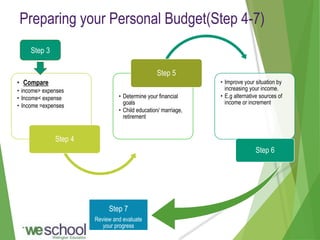

Personal budgeting involves tracking income and expenses to understand how to allocate money and achieve financial goals. It is important to prepare a budget to identify goals, manage money better, increase savings, and prepare for emergencies. A personal budget should determine income sources, average income over 6 months, categorize expenses as fixed, variable or discretionary, average expenses over 2-3 months, compare income to expenses, set financial goals, and regularly review progress. Proper budgeting leads to financial security.