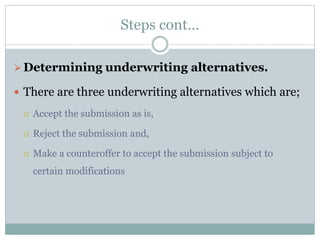

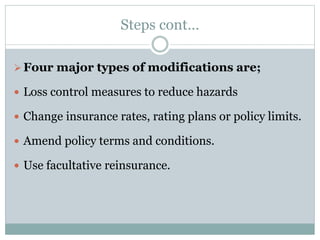

The document discusses the process of insurance underwriting. Underwriting involves evaluating risks to determine whether to issue an insurance policy to an applicant. It aims to select applicants that will likely have claims below assumed losses to ensure a profit. The underwriter considers the applicant's exposure, pricing alternatives like modifying coverage, and monitors policies to maintain satisfactory results for the insurance company. Underwriting balances risks across policyholders and ensures adequate premiums are charged for expected losses.