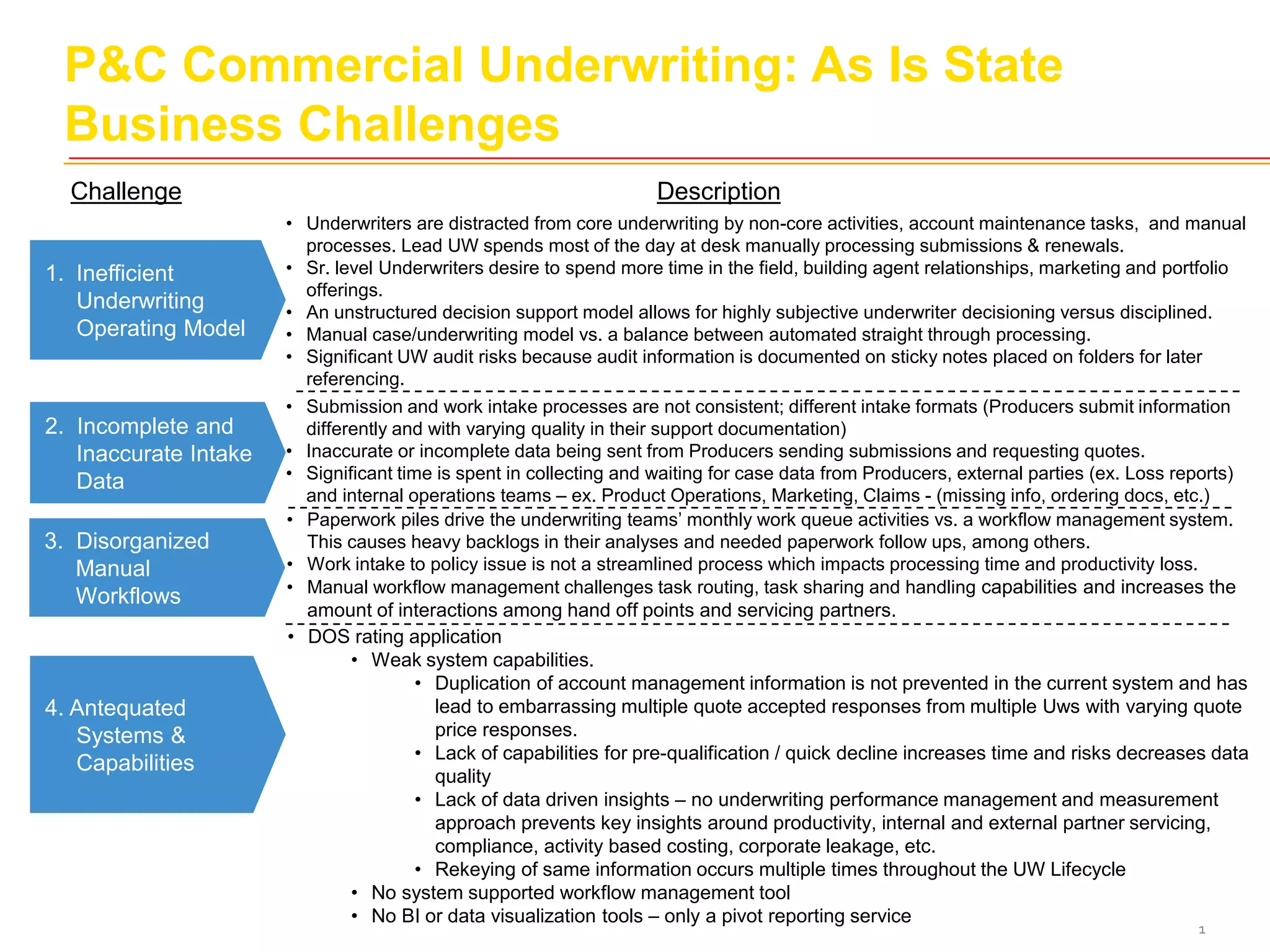

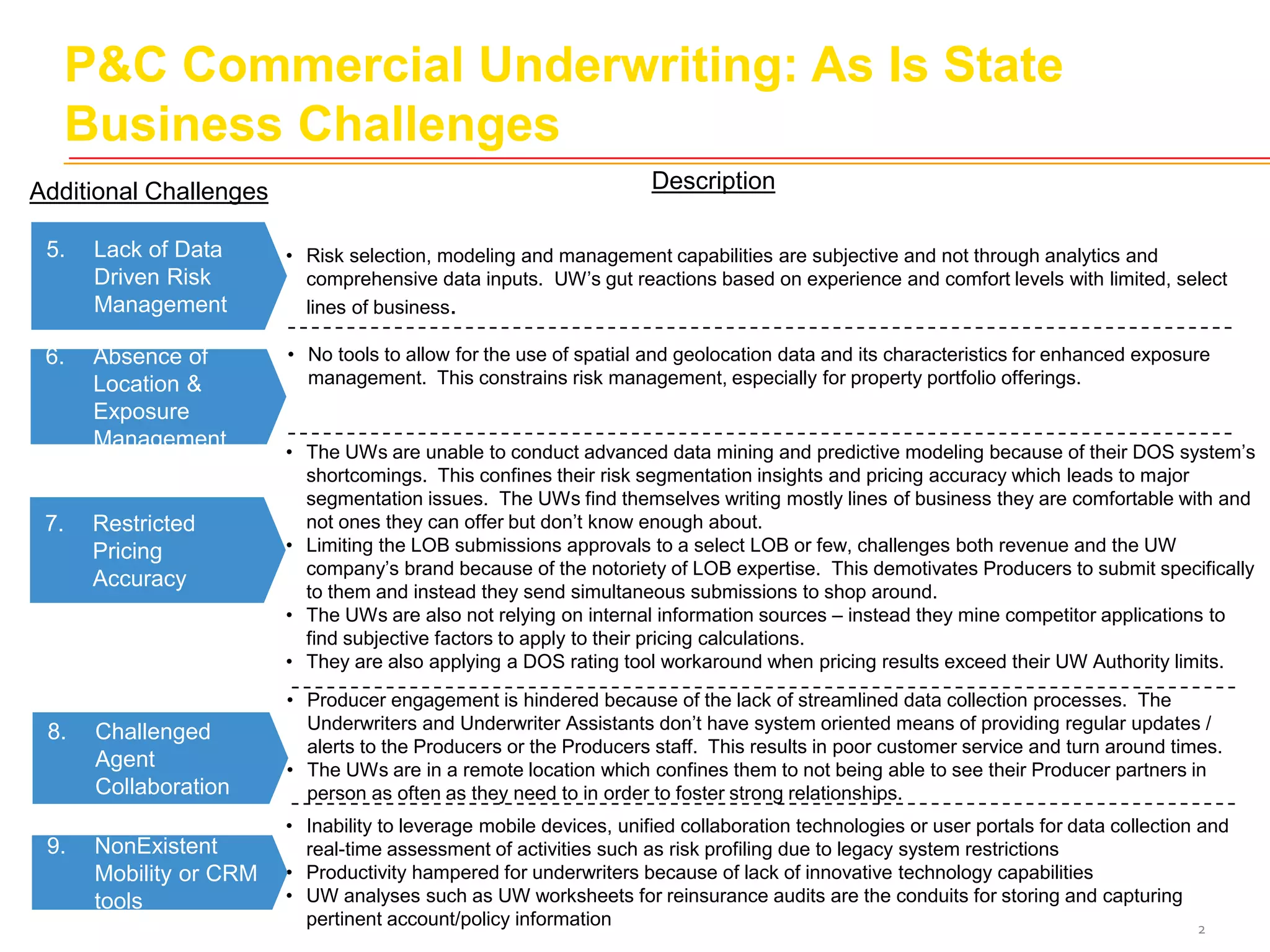

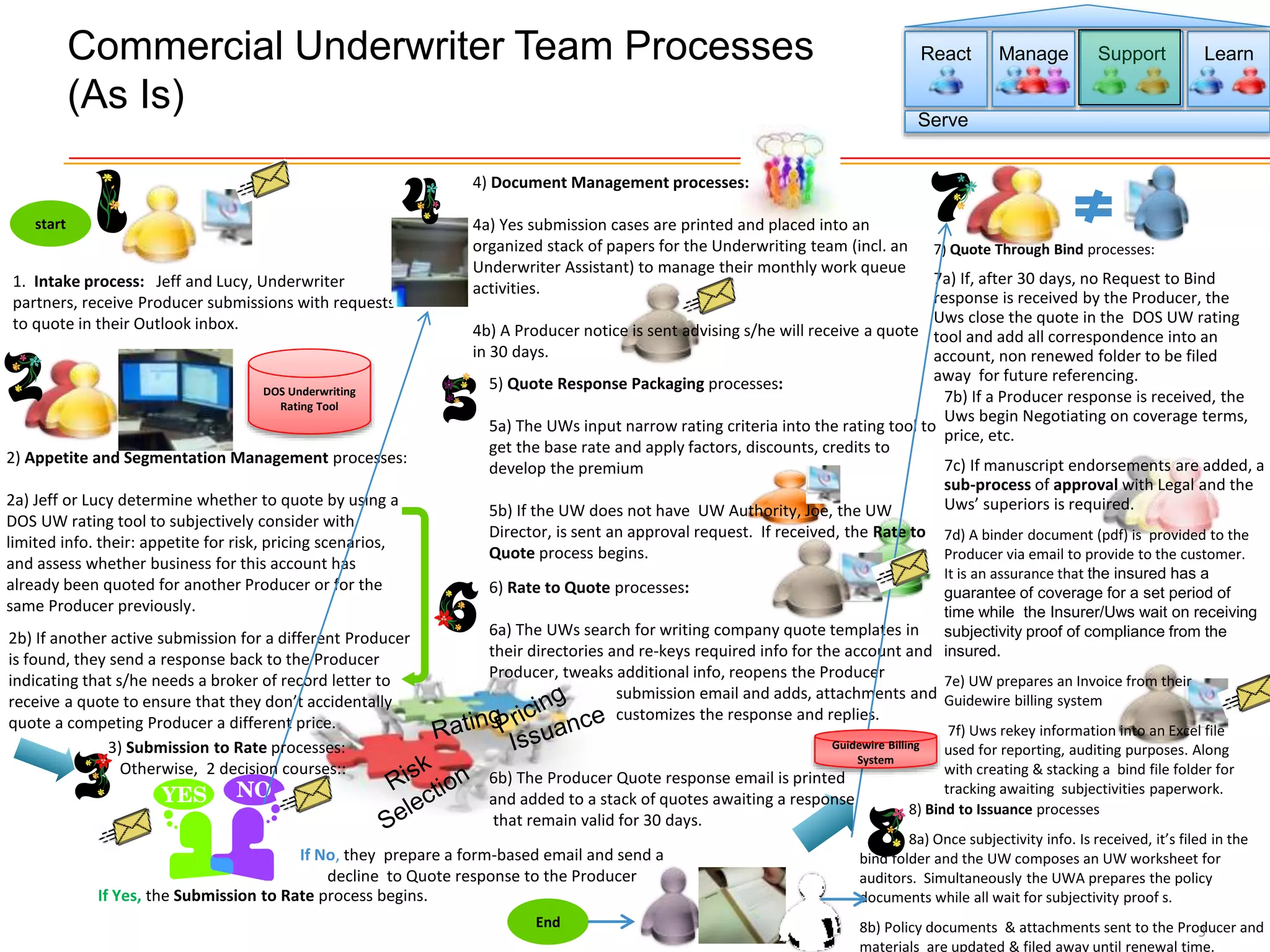

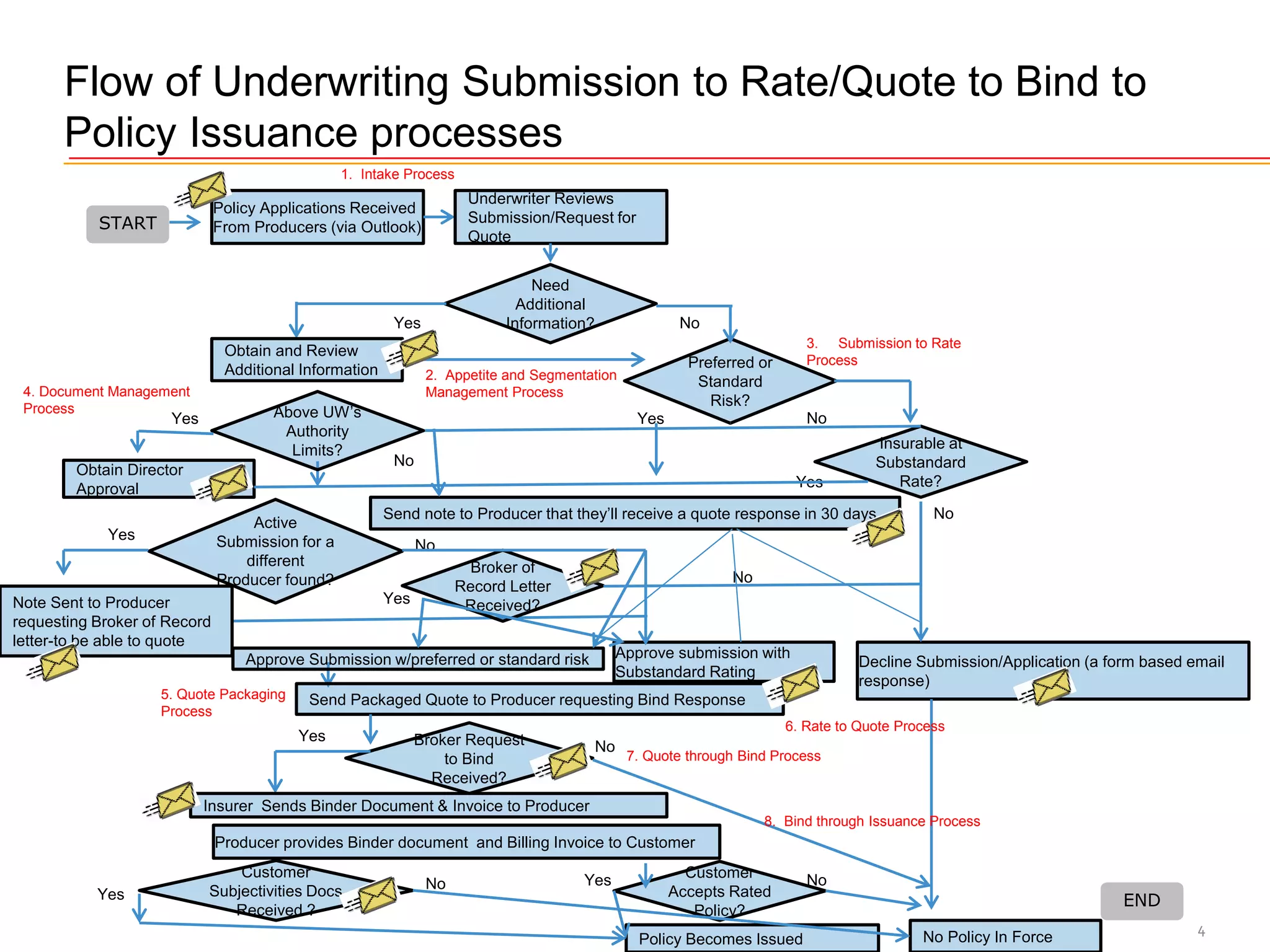

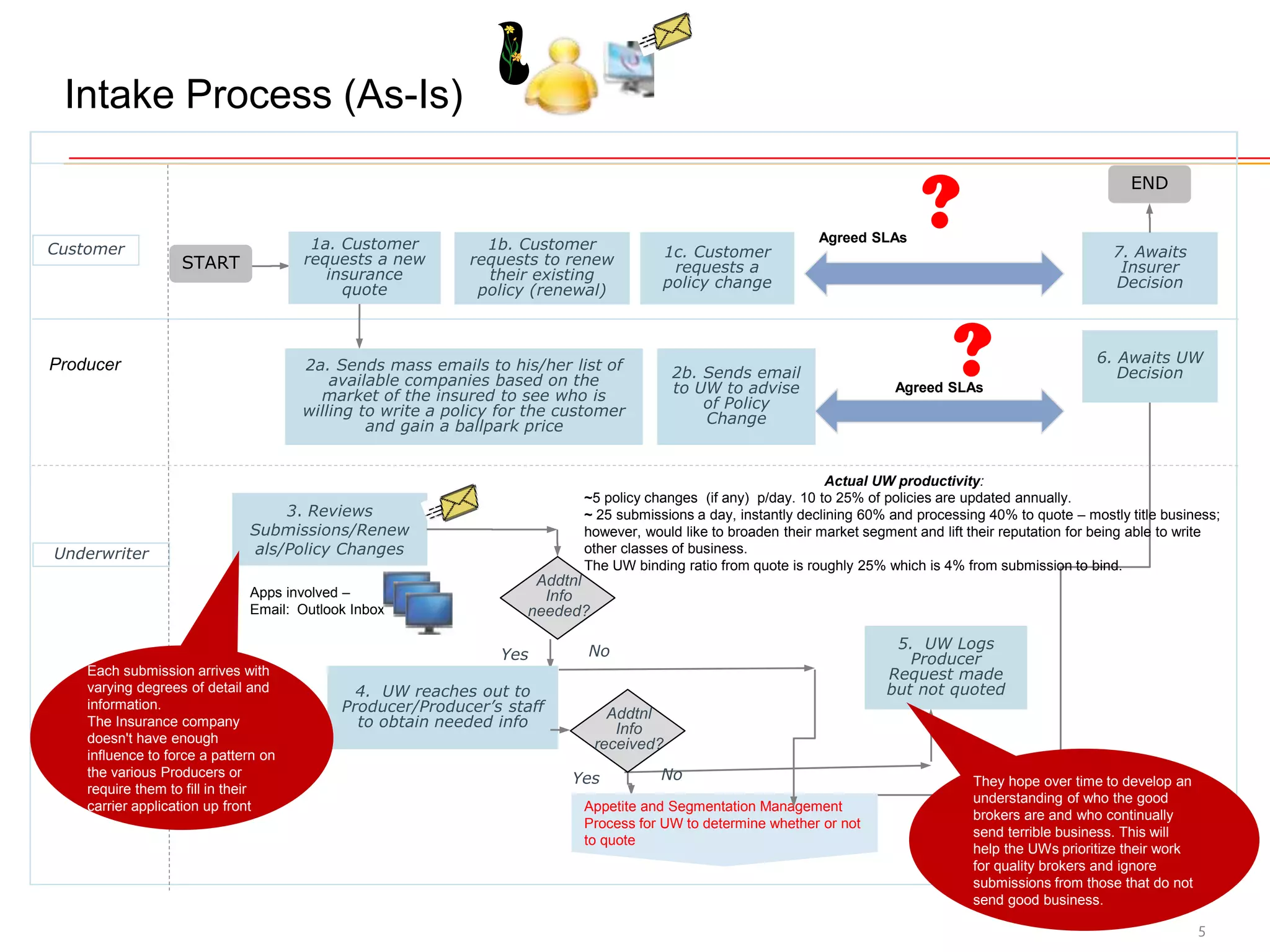

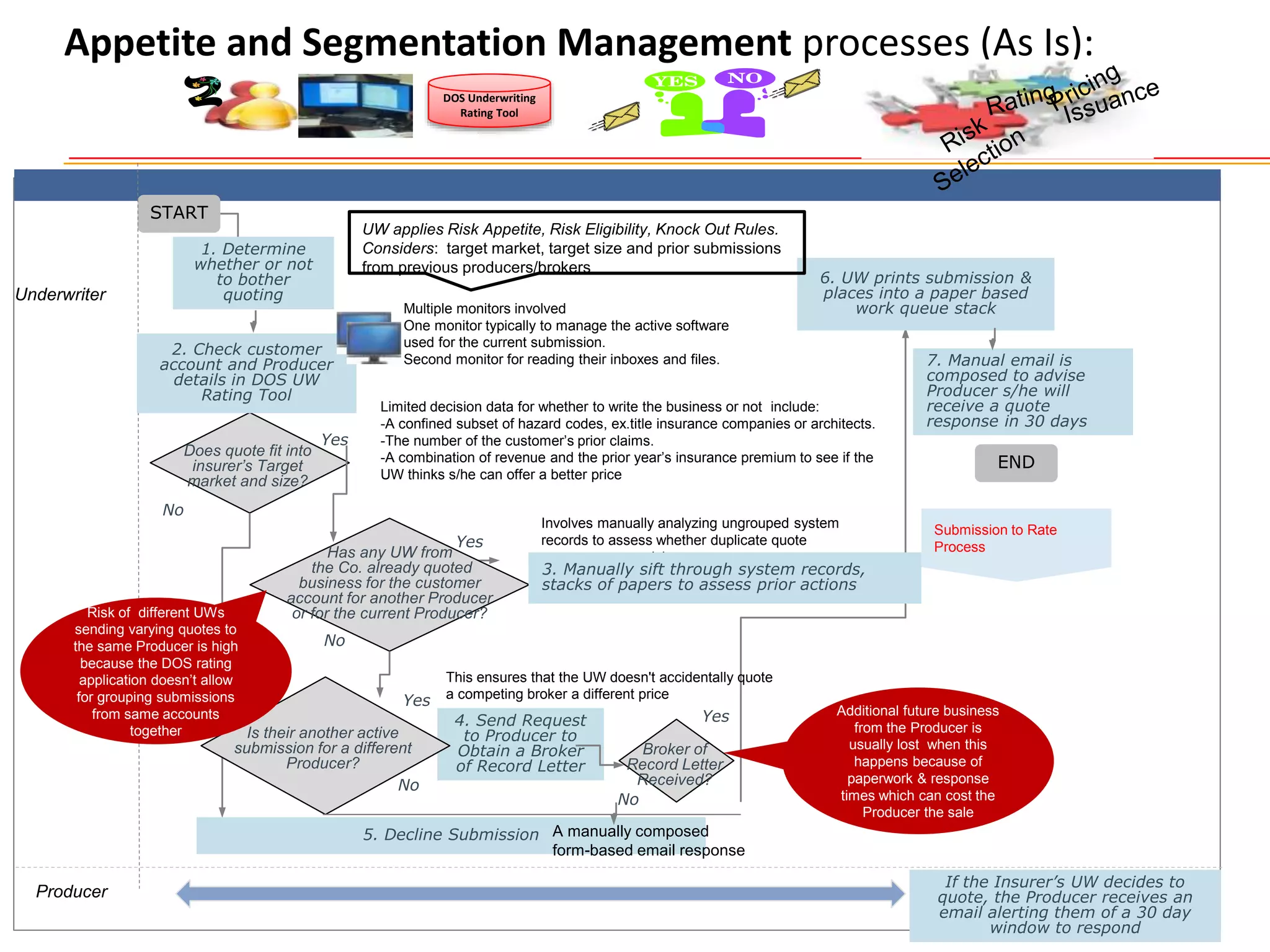

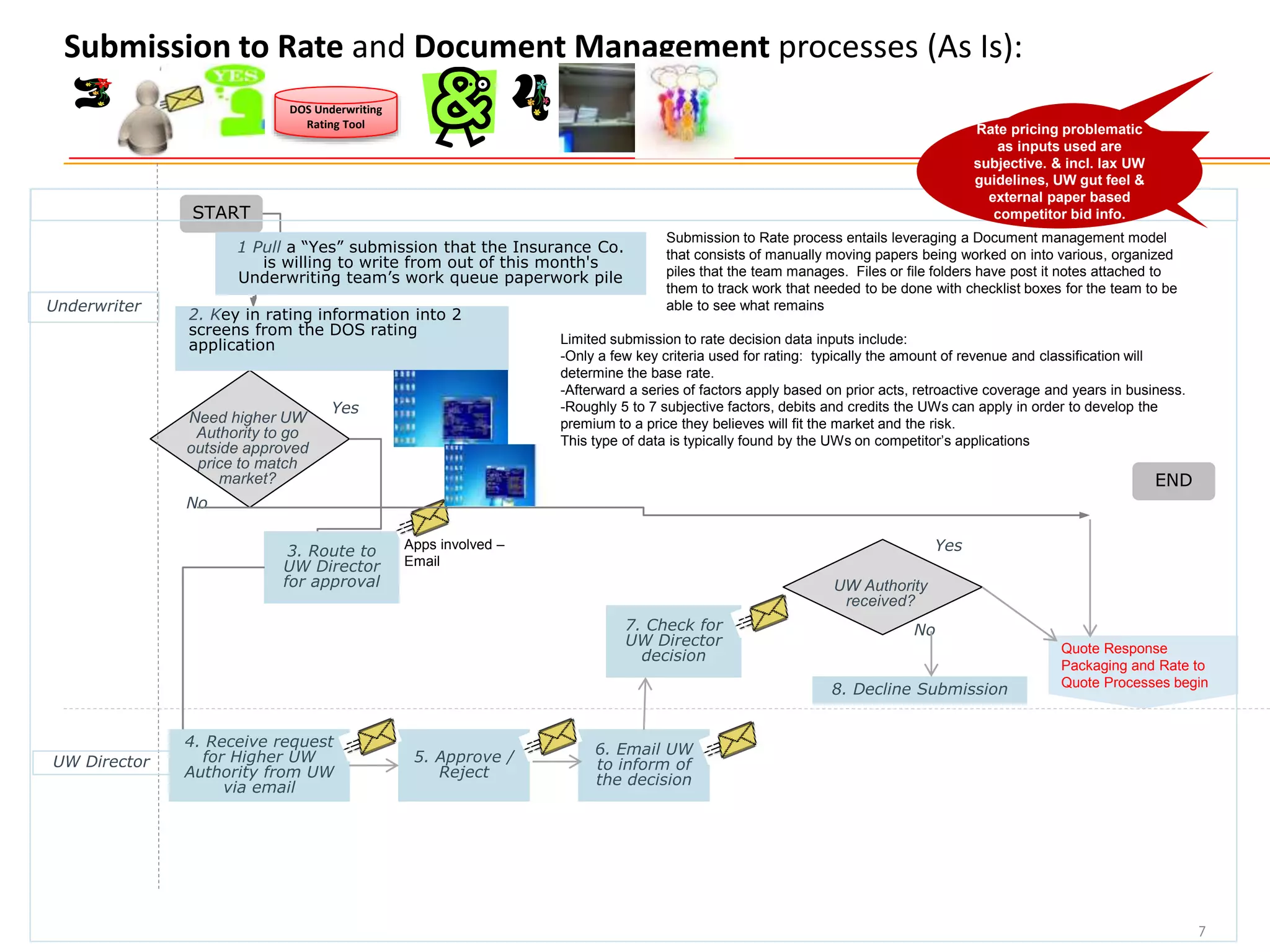

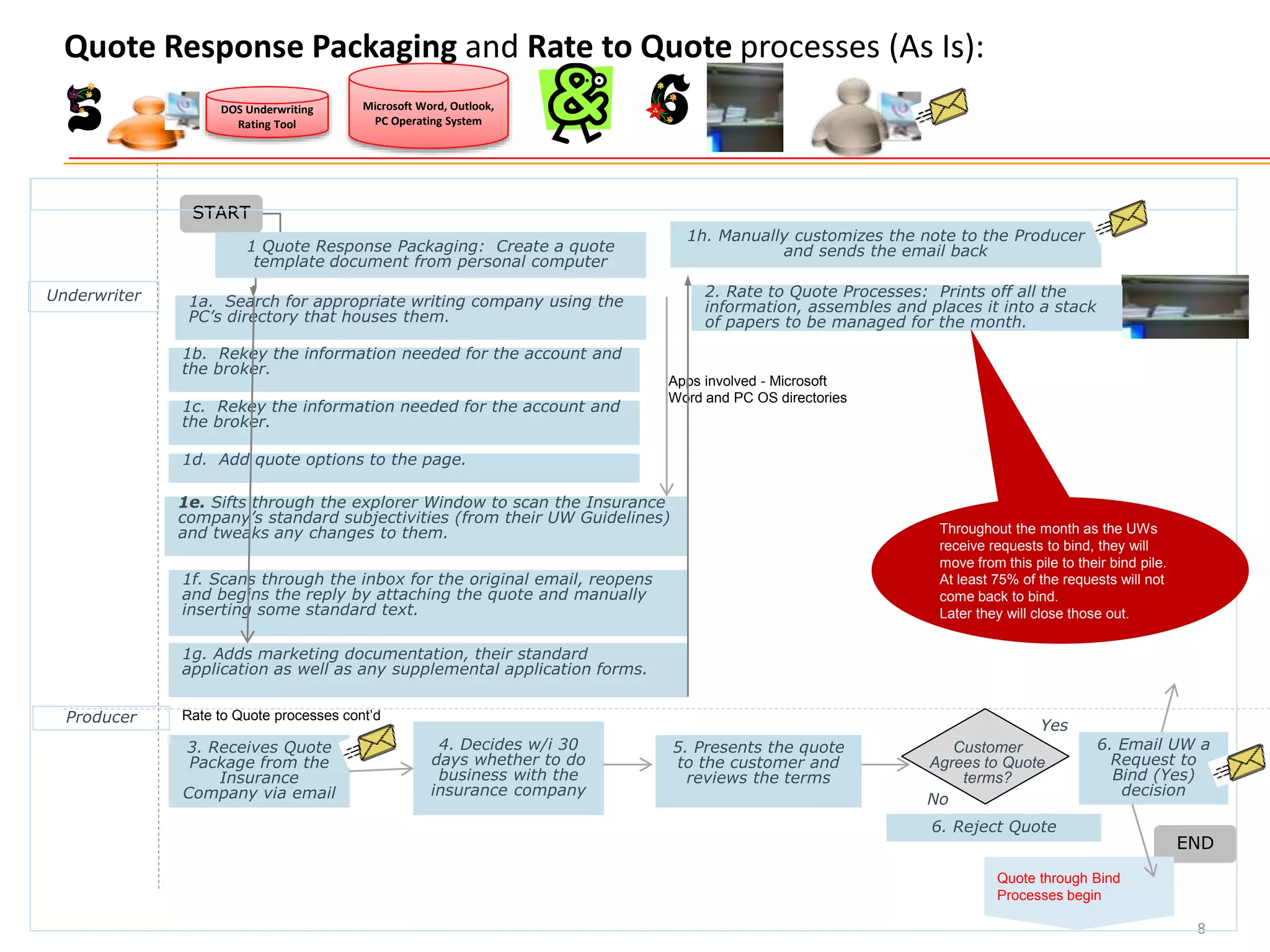

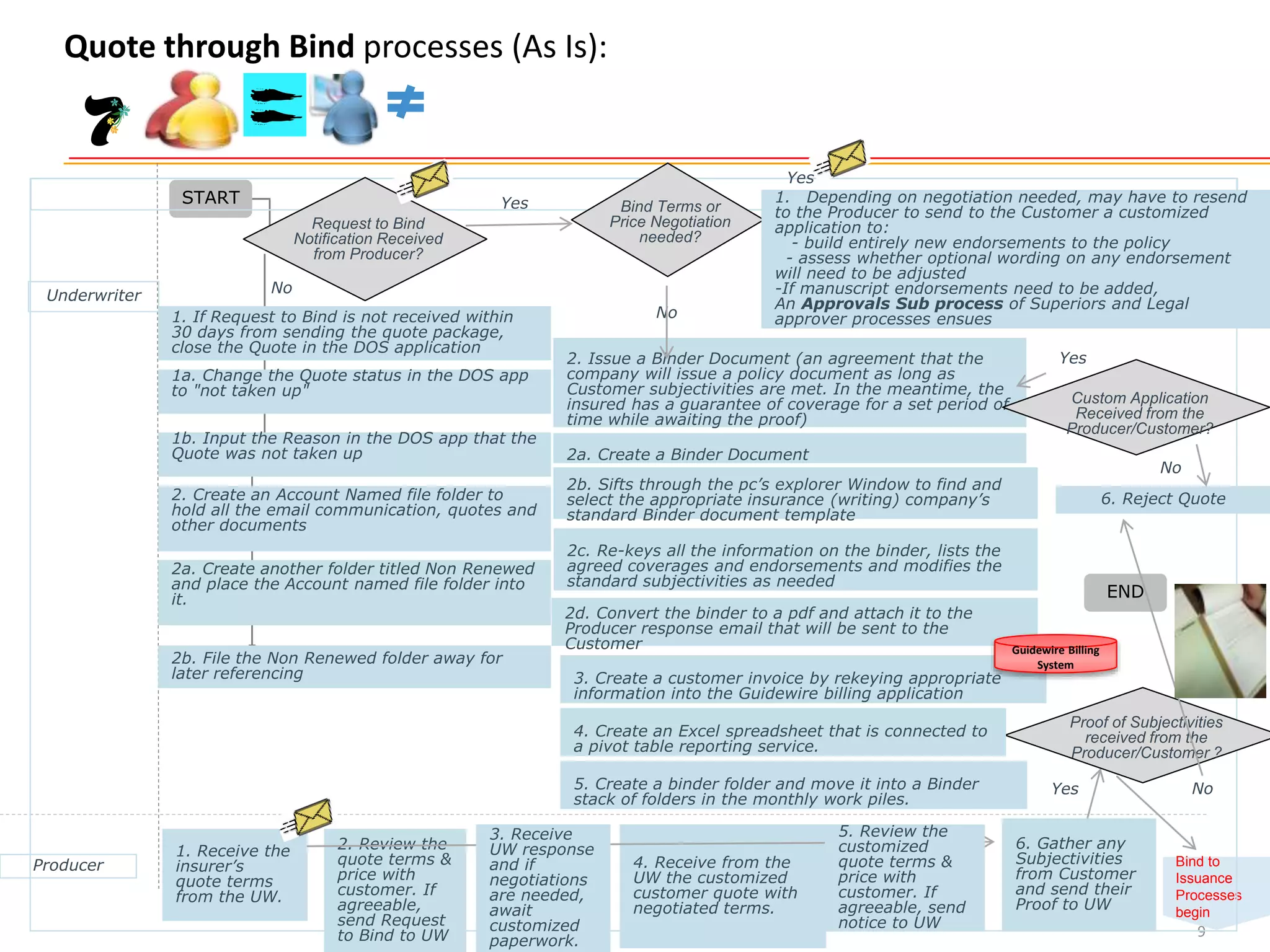

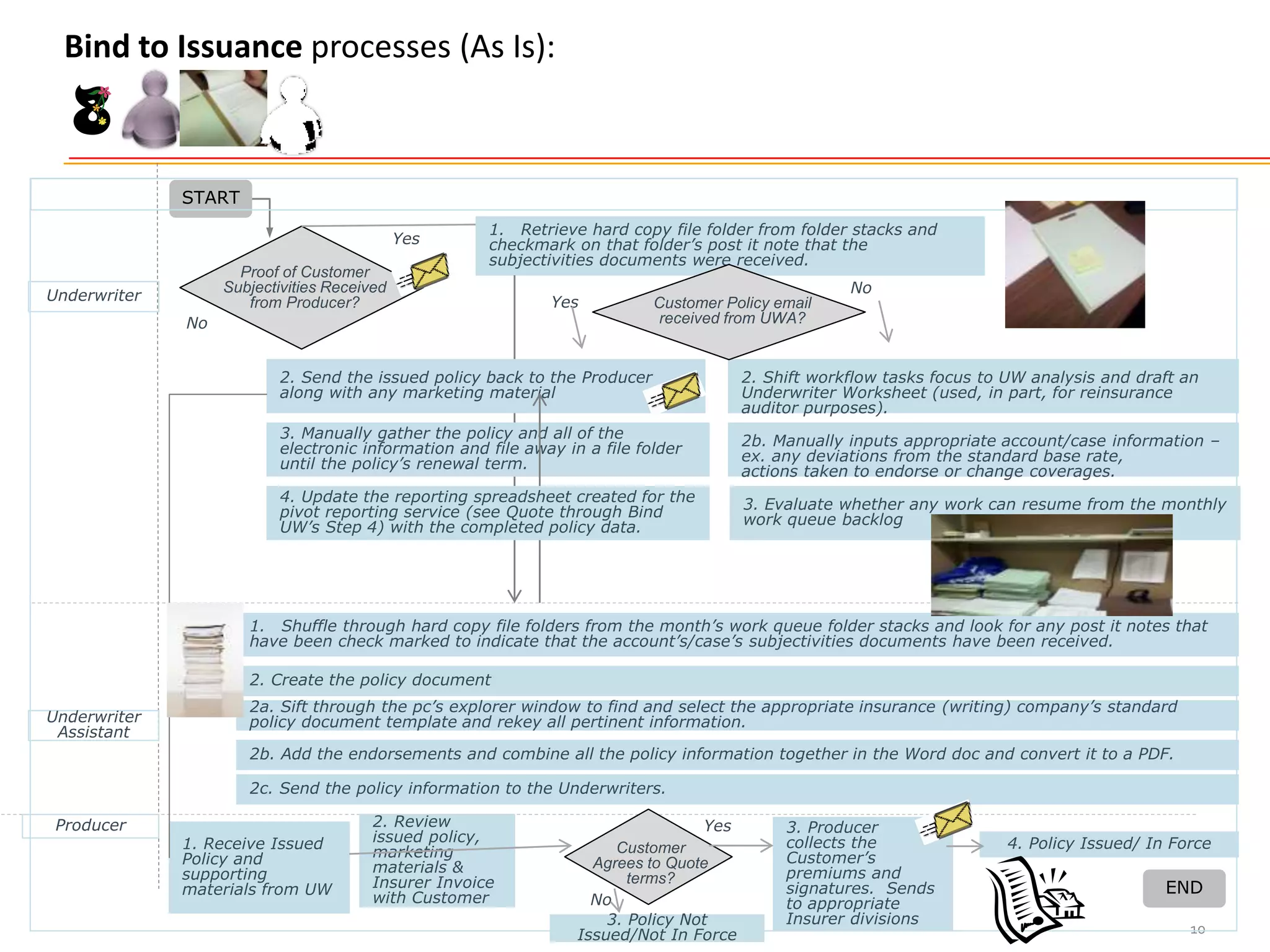

The commercial underwriting process at an insurance company is highly manual and inefficient. Underwriters spend much of their time on non-core tasks due to outdated systems, incomplete data intake, and disorganized workflows. Key challenges include distracting manual processes, lack of data-driven risk management capabilities, and producer engagement issues due to unstructured communication methods. The underwriting cycle lacks consistency and relies heavily on paper files, multiple data re-entry steps, and subjective underwriter decisions. There is an opportunity to modernize systems and processes to allow underwriters to focus more on strategic tasks and decision-making.