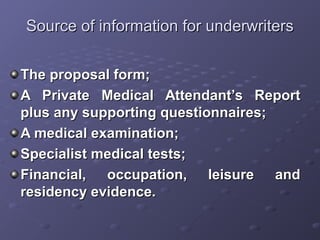

This document provides an overview of life insurance underwriting. It defines life insurance and explains that underwriters assess risks, decide whether to accept risks, determine coverage terms and calculate premiums. Underwriters consider factors like medical history, occupation, habits and family history. They make decisions to accept risks at standard or substandard rates, call for more information or decline coverage. Risks are evaluated based on criteria like age, sex, weight and medical impairments. Extra risks may be rated using methods like fixed monetary extras, age additions or temporary/permanent rating combinations.