Embed presentation

Downloaded 102 times

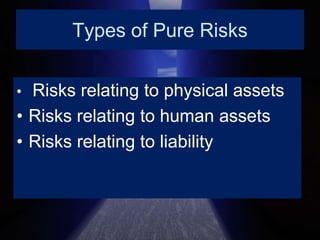

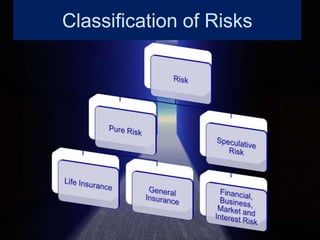

![A] Pure RiskIt is a risk where there is no possibility of profitThere is the expense in the form of insurance premiumThere is a loss when the compensation paid by insurance company is less than the actual lossIt is a method of dividing the risk among those exposed to a particular type of risk](https://image.slidesharecdn.com/riskmanagement-aconceptualframework-100517135317-phpapp01/85/Risk-Management-a-conceptual-framework-B-V-Raghunanadan-4-320.jpg)

![B] Speculative RiskSpeculative risk not only attempts to compensate for the loss, but may also bring in a profitFinancial risk management tools may bring in profit apart from covering the risk](https://image.slidesharecdn.com/riskmanagement-aconceptualframework-100517135317-phpapp01/85/Risk-Management-a-conceptual-framework-B-V-Raghunanadan-5-320.jpg)

![A] Pure Risk ManagementLife Insurance and General InsuranceLife Insurance Principles: Utmost Good faith, and Insurable InterestGeneral Insurance Principles: - Utmost Goodfaith -Insurable Interest -Indemnity -Subrogation -Contribution](https://image.slidesharecdn.com/riskmanagement-aconceptualframework-100517135317-phpapp01/85/Risk-Management-a-conceptual-framework-B-V-Raghunanadan-6-320.jpg)

![B] Speculative RisksBusiness RiskDefault RiskMarket RiskLiquidity RiskCredit RiskExchange RiskFinancial RiskExternal Environment RiskEnvironment RiskAttrition RiskManufacturing RiskRisk of Natural Calamity](https://image.slidesharecdn.com/riskmanagement-aconceptualframework-100517135317-phpapp01/85/Risk-Management-a-conceptual-framework-B-V-Raghunanadan-8-320.jpg)

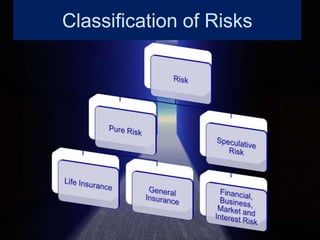

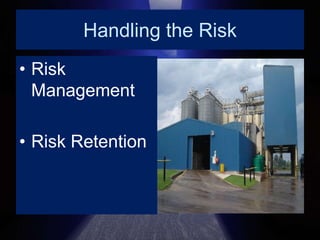

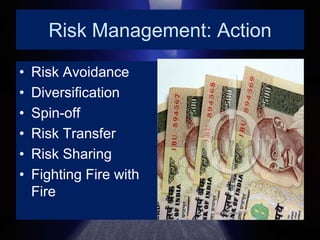

This document provides an overview of risk management concepts. It defines risk as the possibility of loss or uncertainty of return. Risks are classified as either pure risks, where there is no possibility of profit only loss, or speculative risks, which can result in either profits or losses. Pure risks can be managed through insurance principles like indemnity and subrogation. Speculative risks include business, market, credit, and environmental risks. The key aspects of risk management are risk avoidance, diversification, risk transfer, and risk sharing. The risk management process involves identifying objectives, risks, evaluation, selection of policies, development of strategies, and organizational control.

![A] Pure RiskIt is a risk where there is no possibility of profitThere is the expense in the form of insurance premiumThere is a loss when the compensation paid by insurance company is less than the actual lossIt is a method of dividing the risk among those exposed to a particular type of risk](https://image.slidesharecdn.com/riskmanagement-aconceptualframework-100517135317-phpapp01/85/Risk-Management-a-conceptual-framework-B-V-Raghunanadan-4-320.jpg)

![B] Speculative RiskSpeculative risk not only attempts to compensate for the loss, but may also bring in a profitFinancial risk management tools may bring in profit apart from covering the risk](https://image.slidesharecdn.com/riskmanagement-aconceptualframework-100517135317-phpapp01/85/Risk-Management-a-conceptual-framework-B-V-Raghunanadan-5-320.jpg)

![A] Pure Risk ManagementLife Insurance and General InsuranceLife Insurance Principles: Utmost Good faith, and Insurable InterestGeneral Insurance Principles: - Utmost Goodfaith -Insurable Interest -Indemnity -Subrogation -Contribution](https://image.slidesharecdn.com/riskmanagement-aconceptualframework-100517135317-phpapp01/85/Risk-Management-a-conceptual-framework-B-V-Raghunanadan-6-320.jpg)

![B] Speculative RisksBusiness RiskDefault RiskMarket RiskLiquidity RiskCredit RiskExchange RiskFinancial RiskExternal Environment RiskEnvironment RiskAttrition RiskManufacturing RiskRisk of Natural Calamity](https://image.slidesharecdn.com/riskmanagement-aconceptualframework-100517135317-phpapp01/85/Risk-Management-a-conceptual-framework-B-V-Raghunanadan-8-320.jpg)