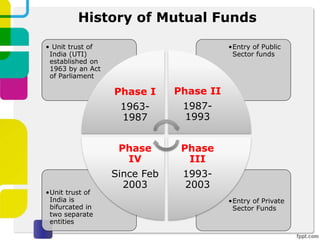

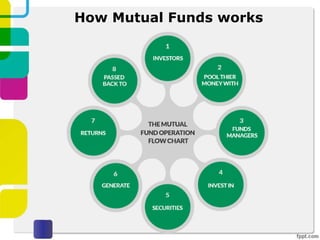

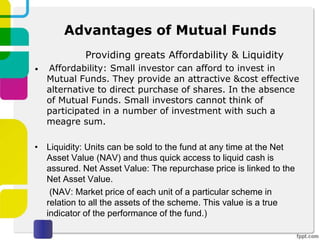

The document discusses the history and functioning of mutual funds, highlighting their advantages such as affordability and liquidity for small investors. It explains the importance of understanding net asset value (NAV) and cautions against blindly chasing high-performing funds without considering consistency and associated risks. The moral emphasizes that consistent performance is more valuable than high but volatile returns.