The webinar offers practical education on understanding balance sheets, essential for attorneys, accountants, and business professionals seeking insights into financial management. Led by experienced faculty, it covers the basics of balance sheets, their importance, components, and analytical techniques, while emphasizing the significance of knowing financial metrics for business success. The series aims to improve financial literacy among non-finance professionals through accessible language and real-world examples.

![Introduction to the Balance Sheet

"[W]hy is the forgotten financial statement . . . so important for startups? Because they are not

generating profits and free cash flow in their early days. They’re burning through cash and

accumulating losses (negative shareholder equity) in their early days as they seek Product

Market Fit, increasing sales, and cash-flow breakeven. Even if gross margins are high, it is

the very rare startup which generates enough gross margin dollars to cover the entire

startup’s operating expenses.”

9](https://image.slidesharecdn.com/2mbabootcamp2021-howtoreadabalancesheetandwhyyoucare-210326161921/75/How-to-Read-a-Balance-Sheet-And-Why-You-Care-Series-MBA-Boot-Camp-9-2048.jpg)

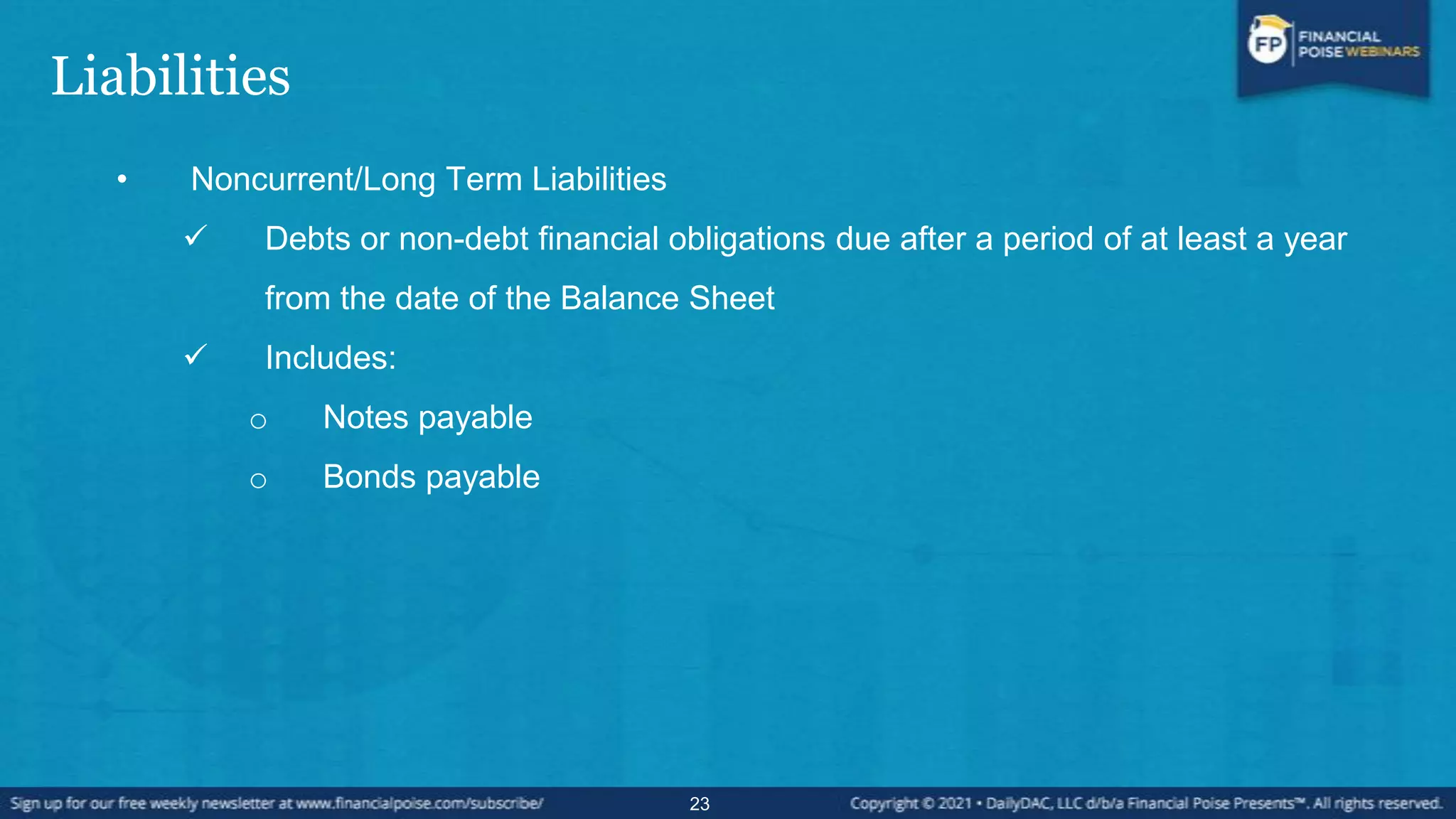

![How is the Balance Sheet Different From Other

Financial Statements?

[Balance Sheet is a snapshot of Company’s financial condition at specific time]

Balance Sheet vs. Income Statement:

• Income statement measures record of company’s revenues matched with costs to

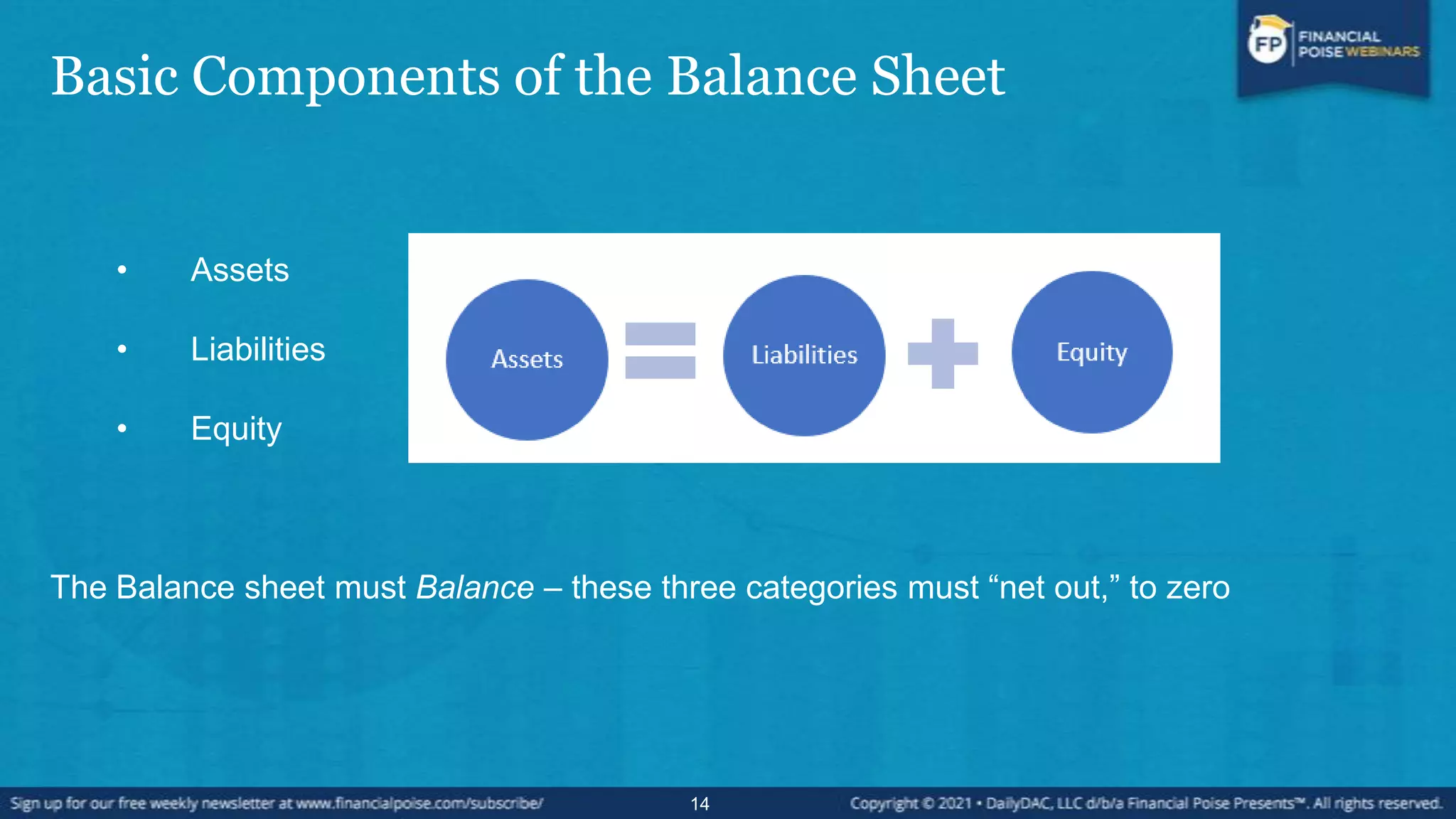

net loss or profitability

Balance Sheet vs. Cash Flow Statement

• Cash flow statement measures actual changes in cash compared to the income

statement, shows where cash is coming in and going out

13](https://image.slidesharecdn.com/2mbabootcamp2021-howtoreadabalancesheetandwhyyoucare-210326161921/75/How-to-Read-a-Balance-Sheet-And-Why-You-Care-Series-MBA-Boot-Camp-13-2048.jpg)