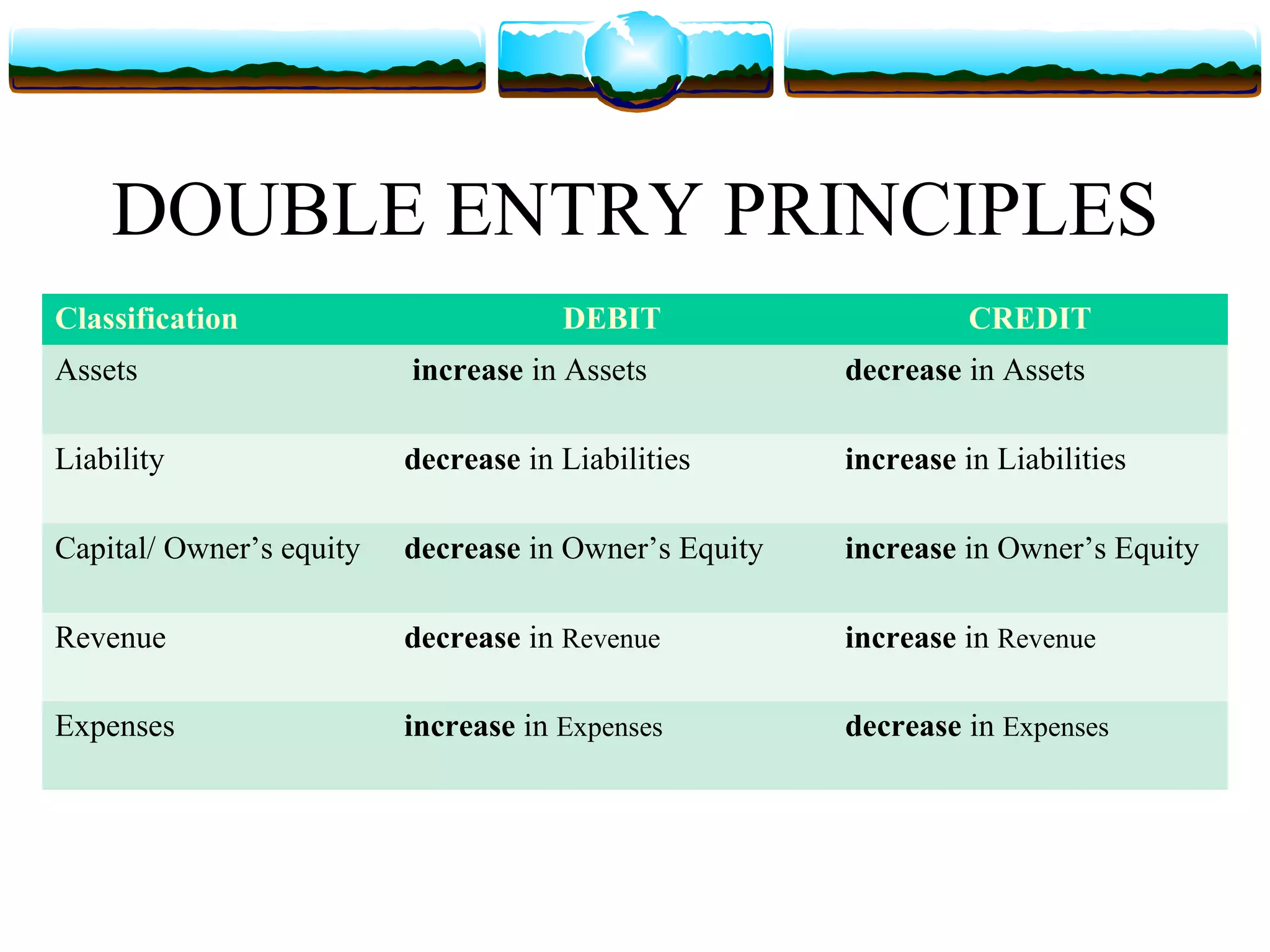

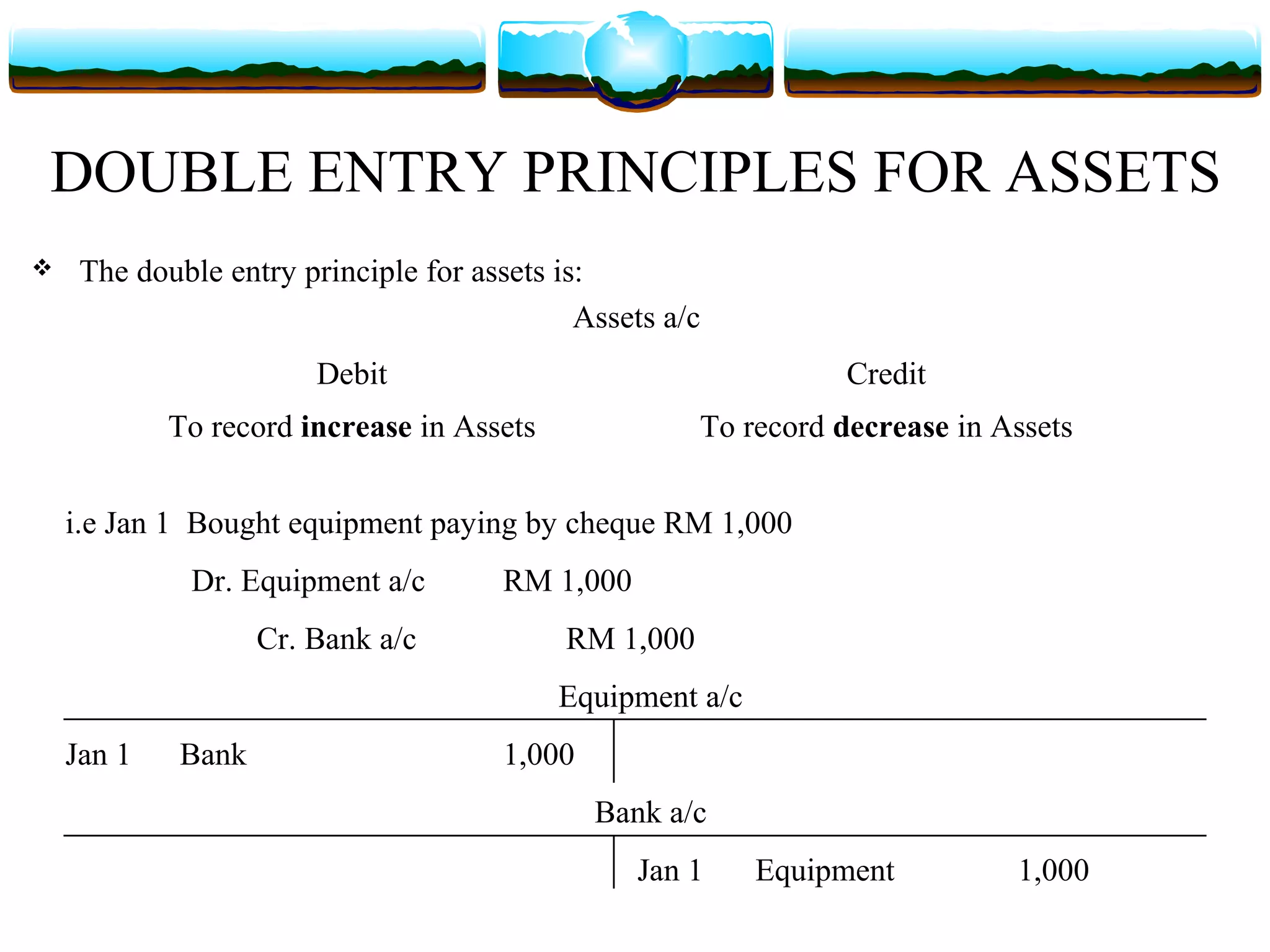

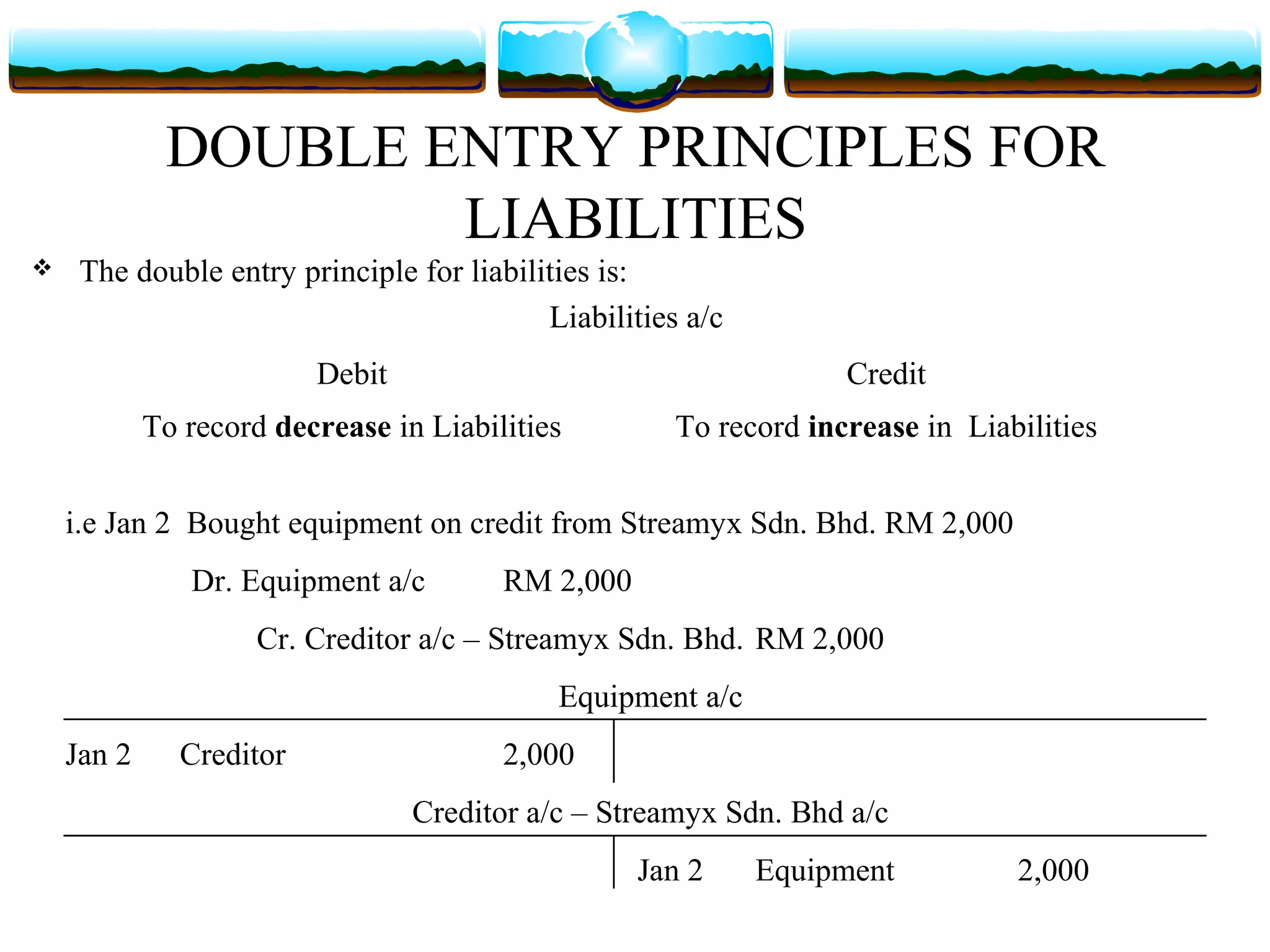

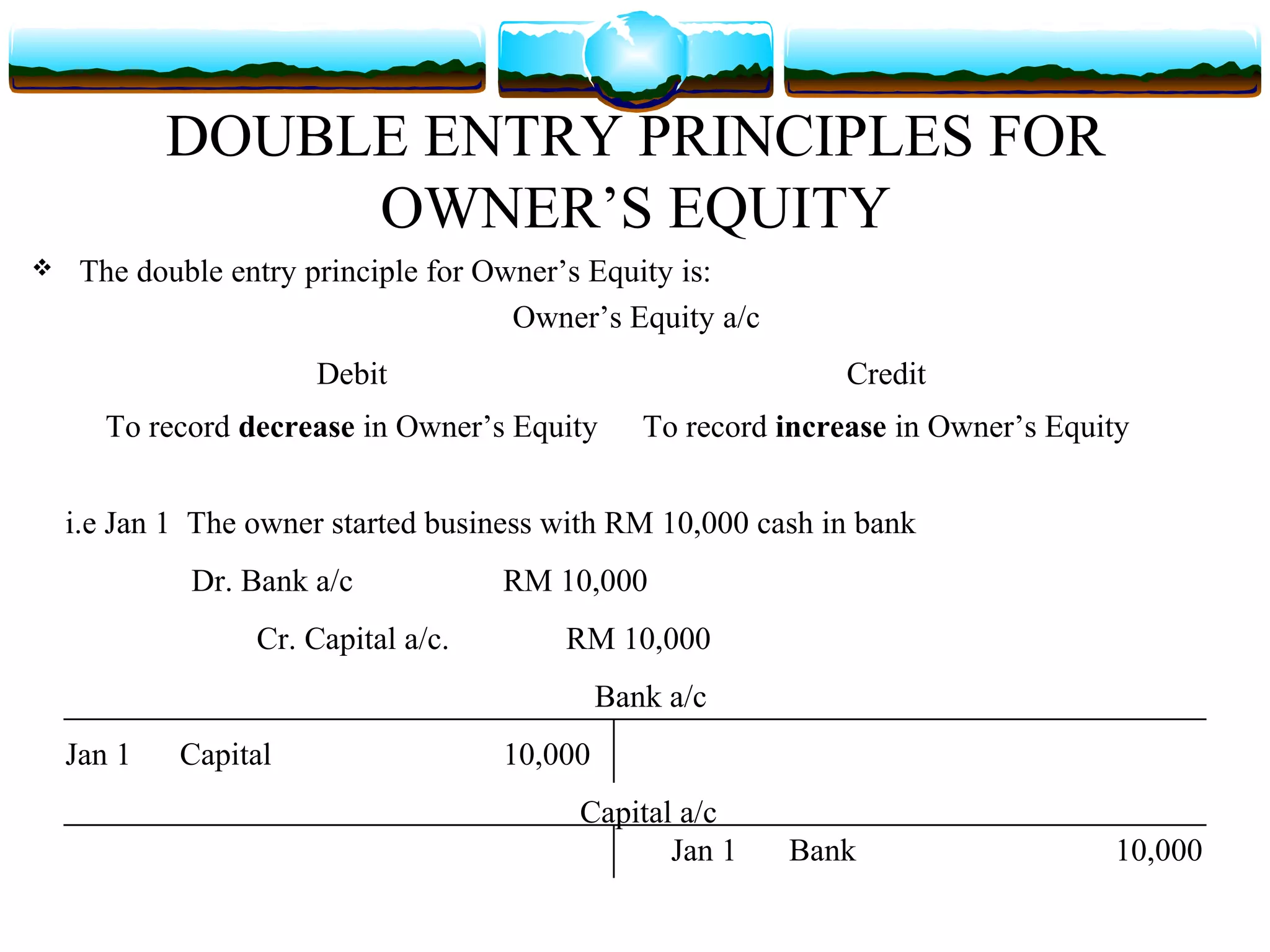

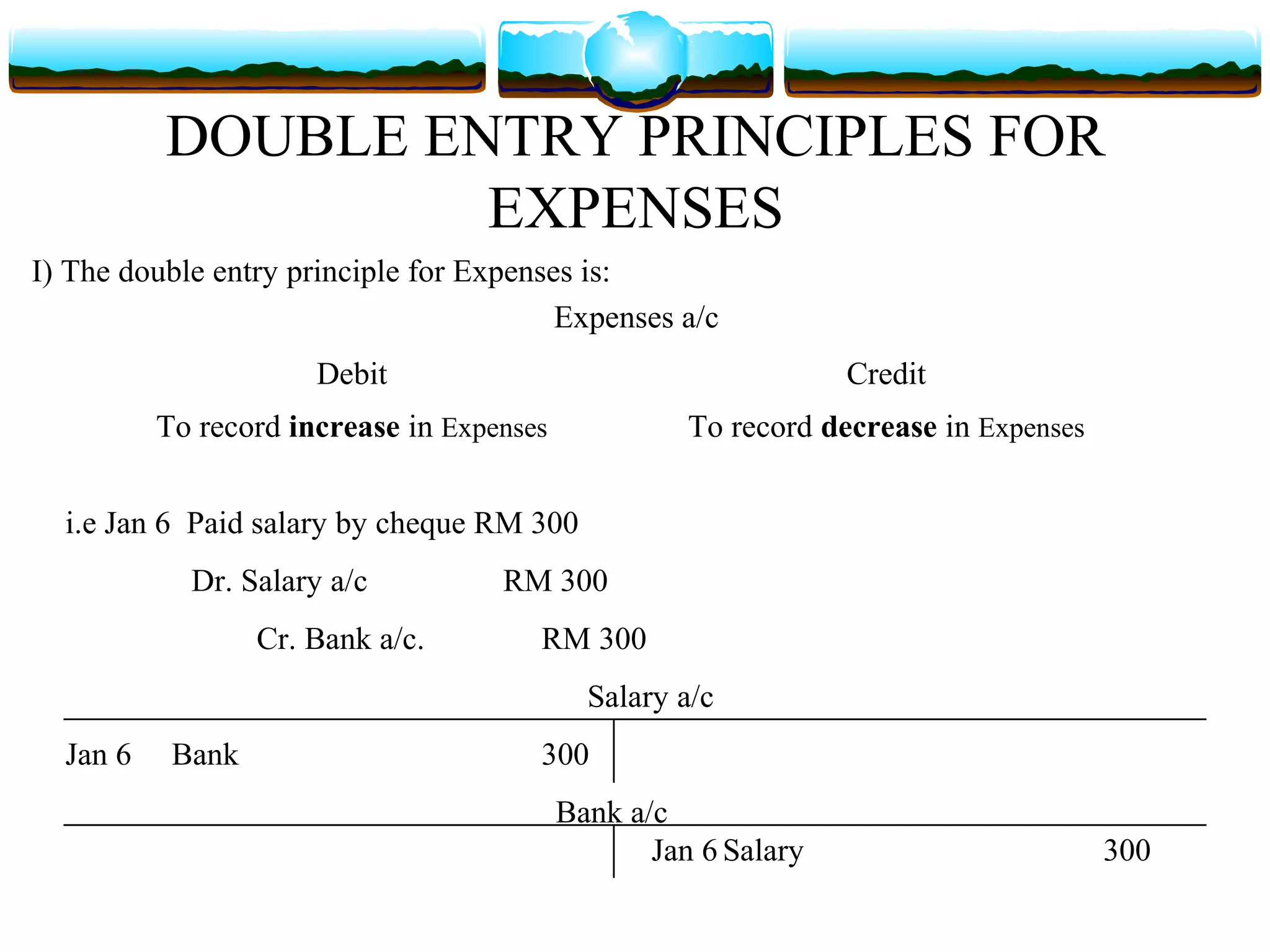

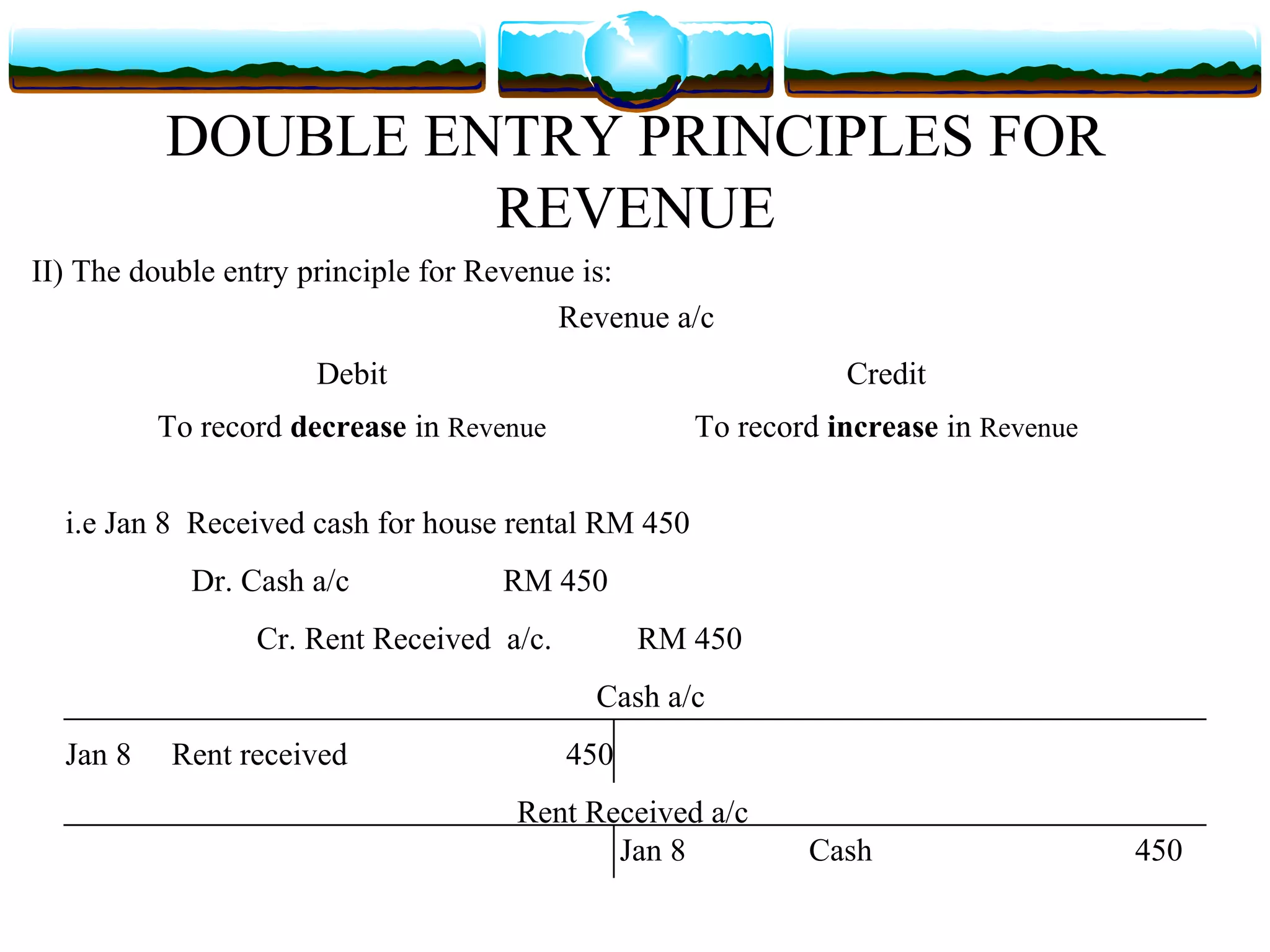

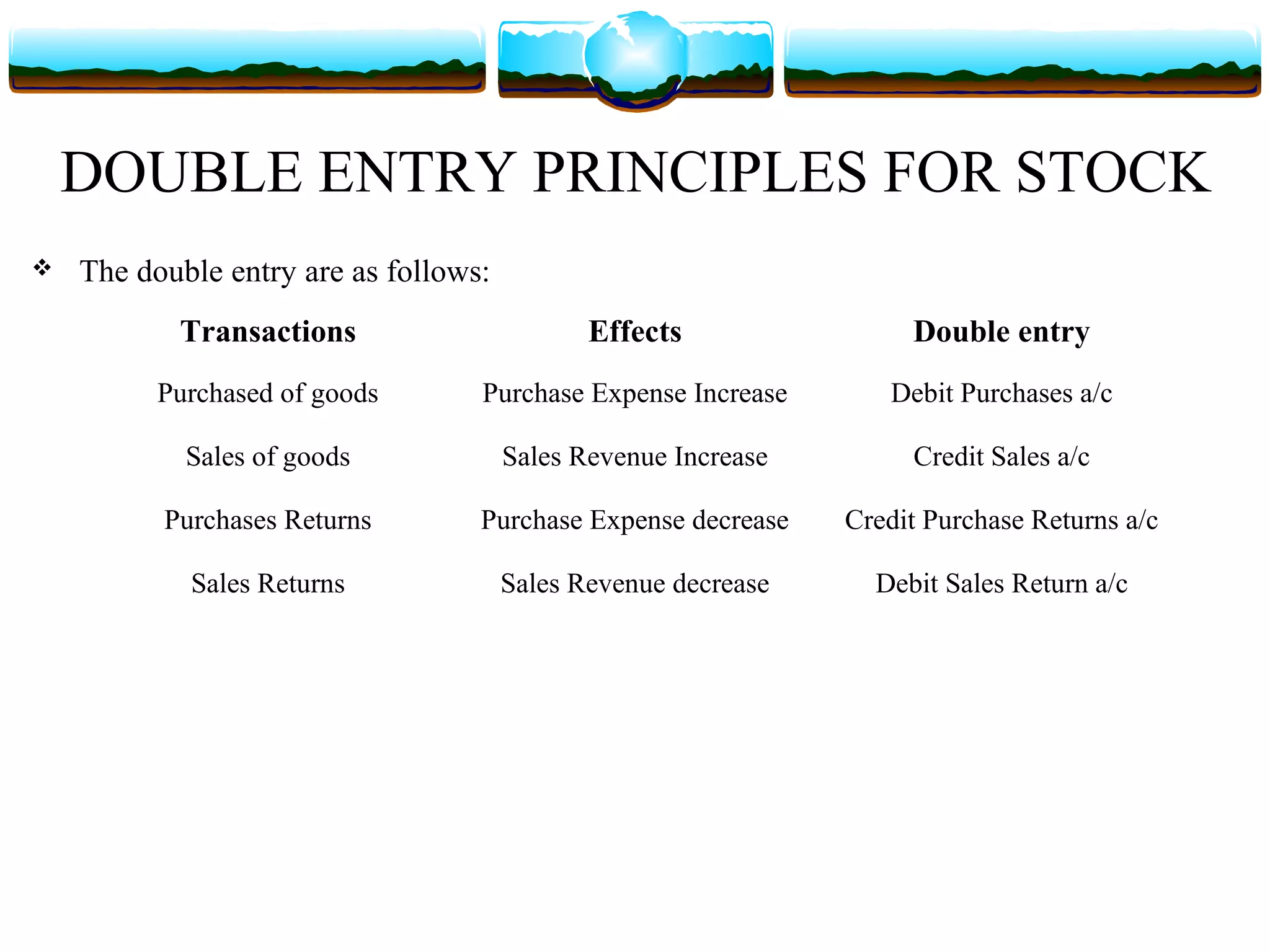

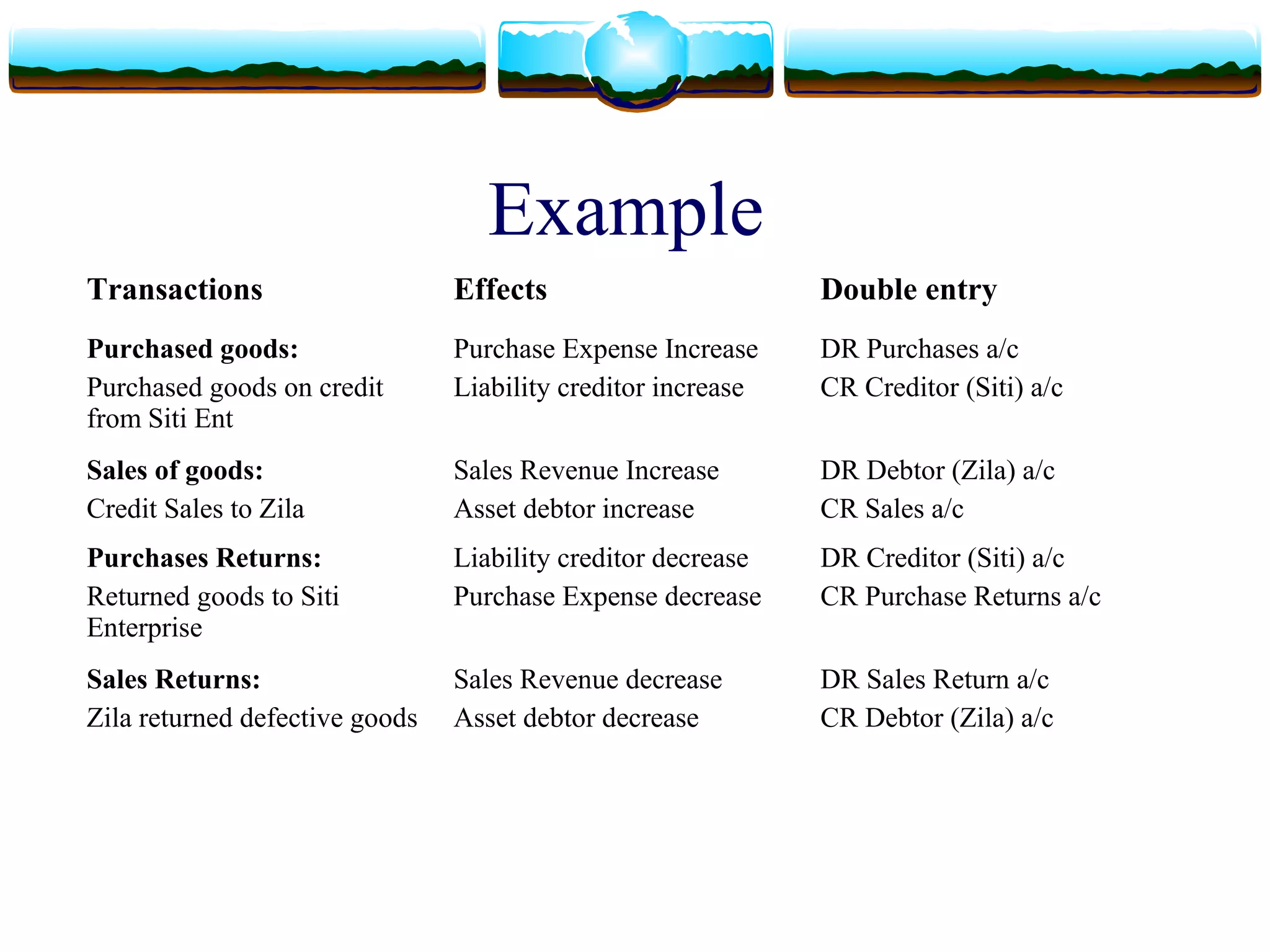

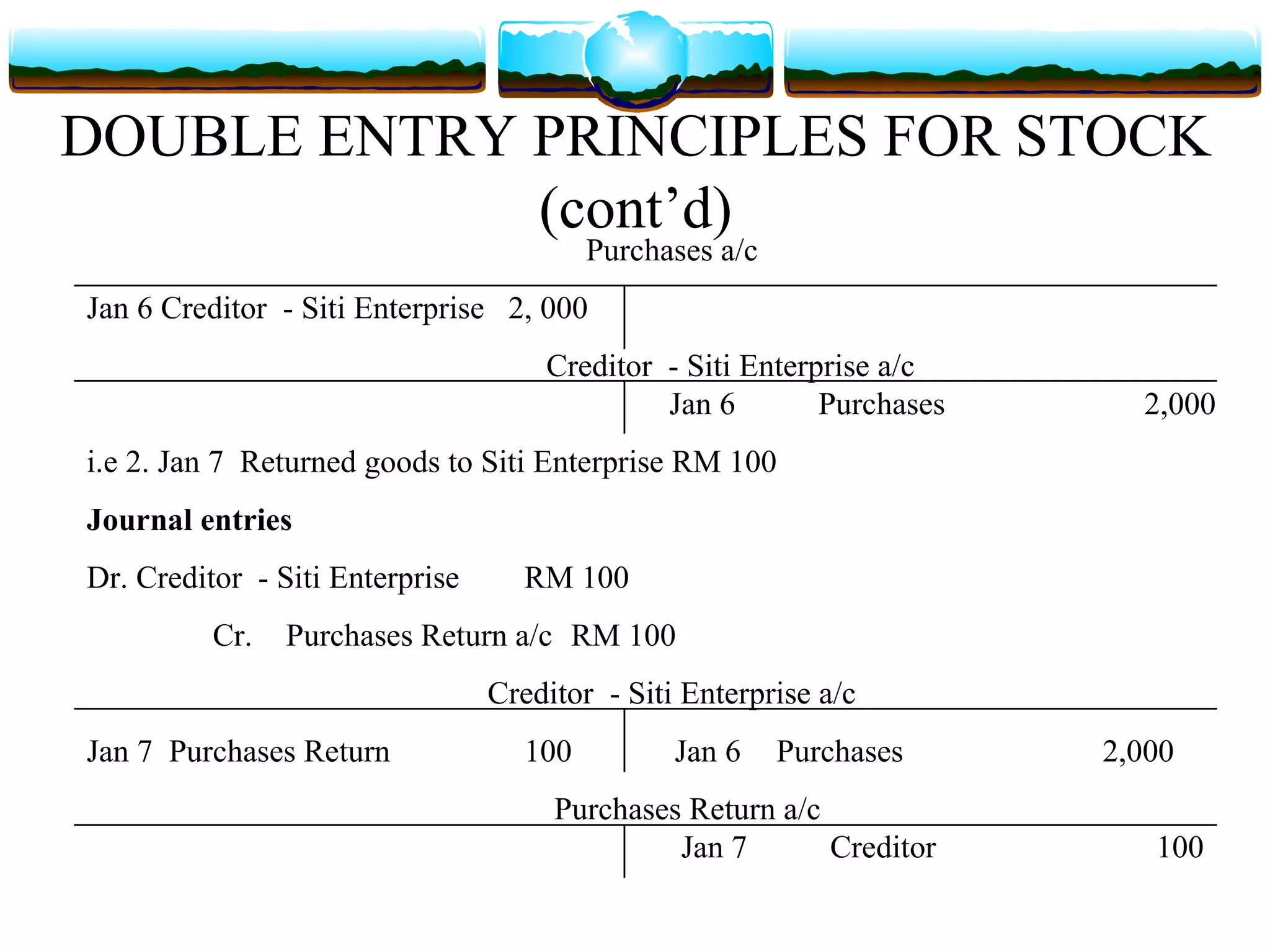

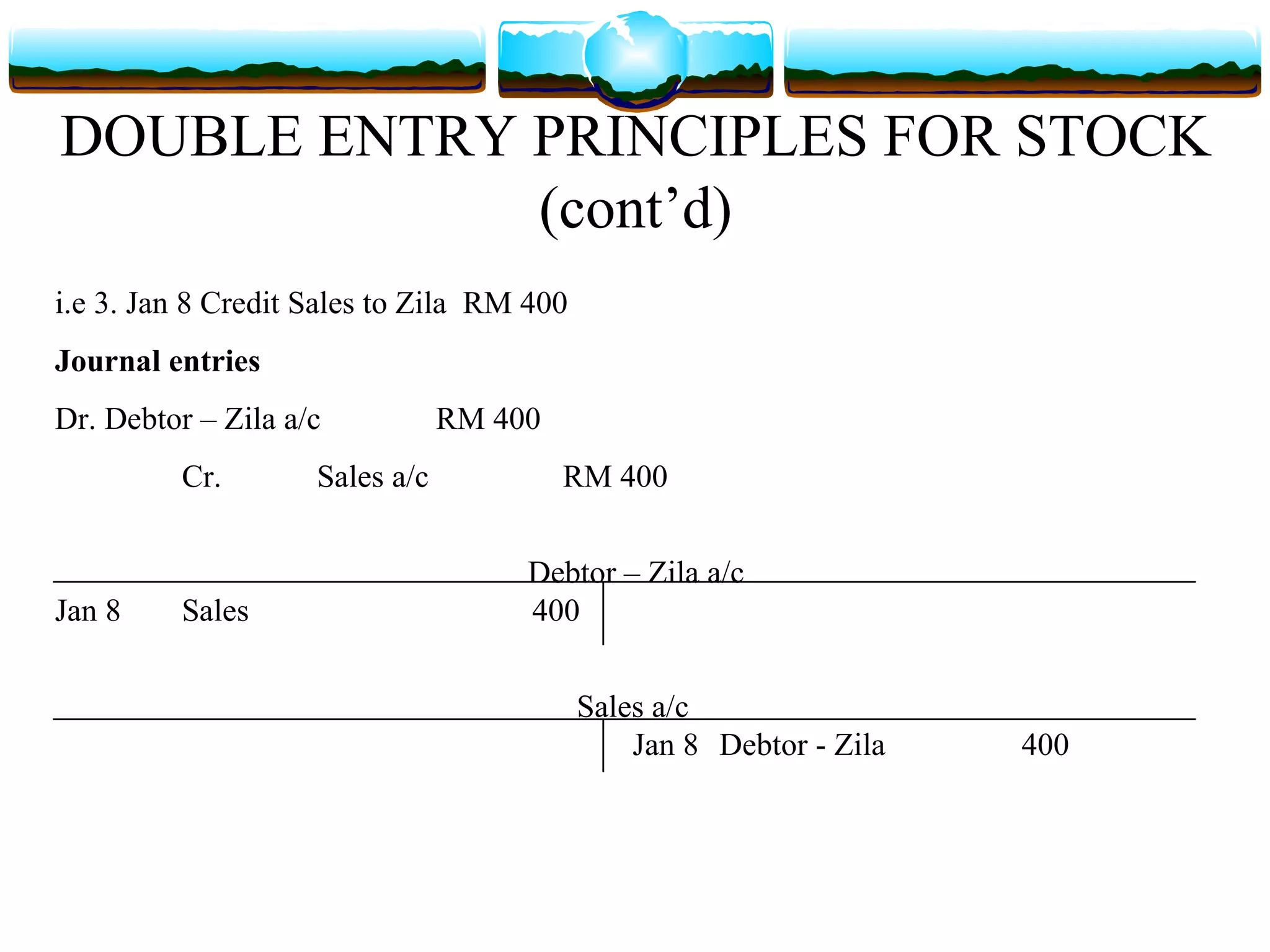

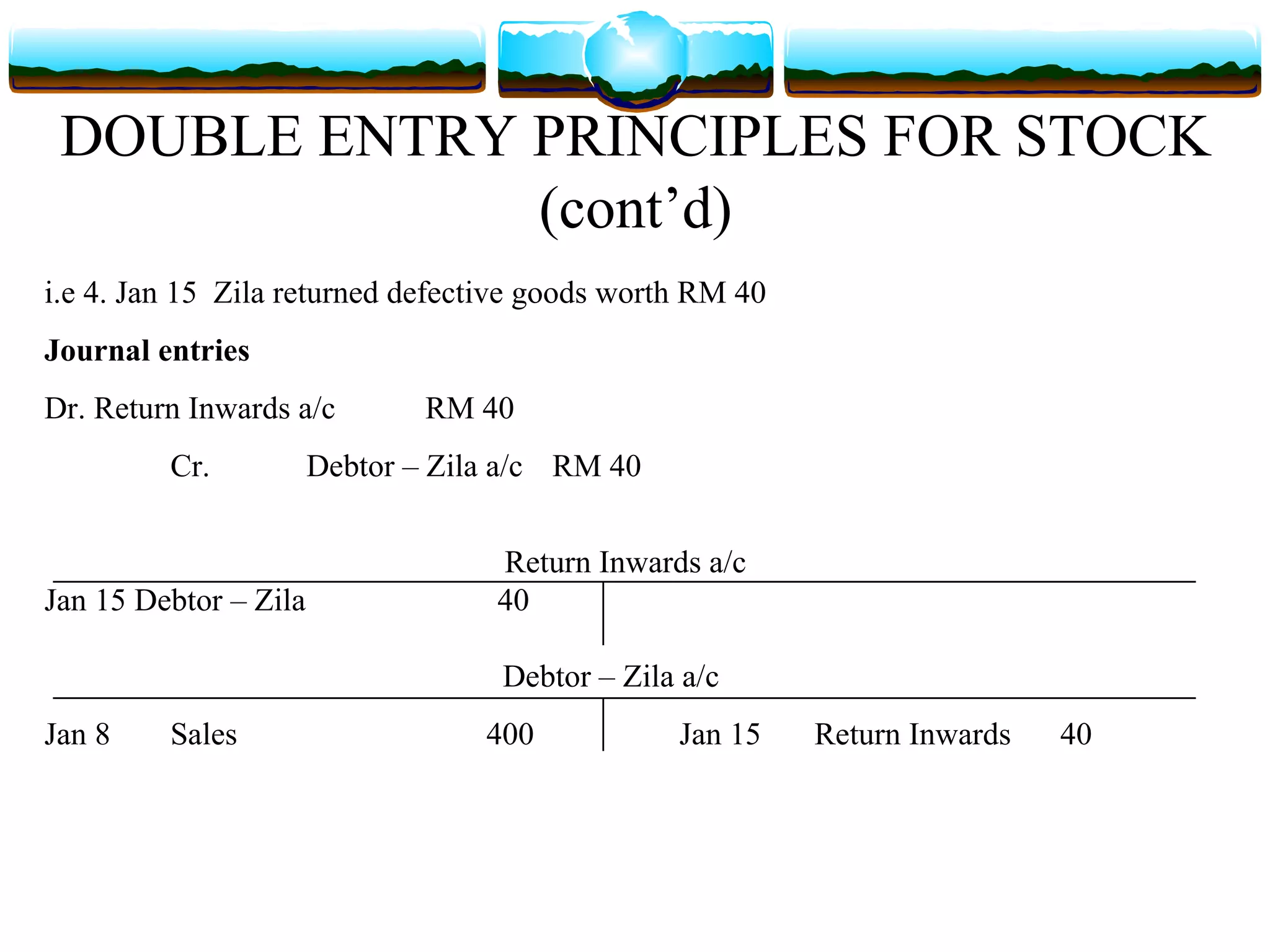

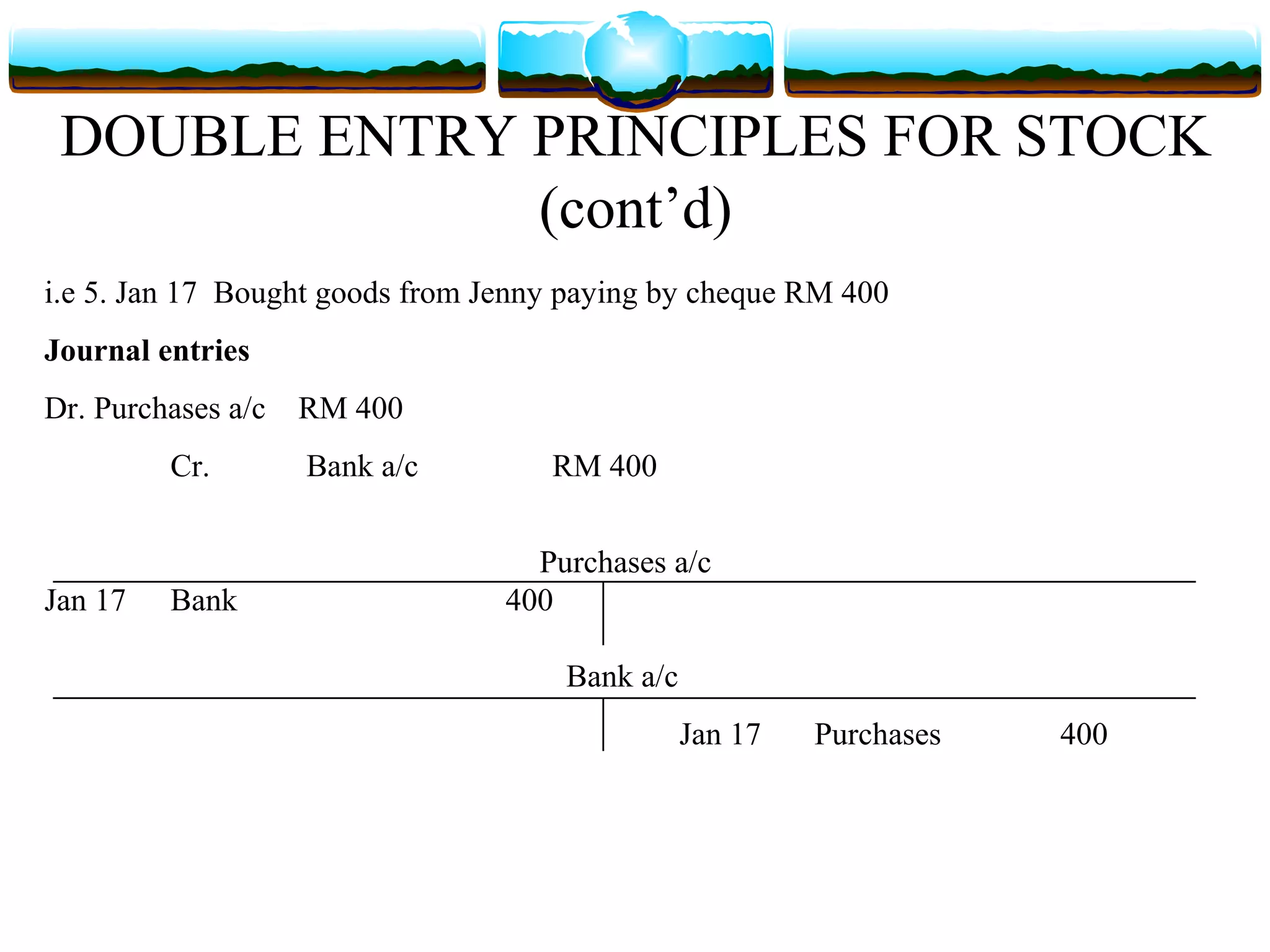

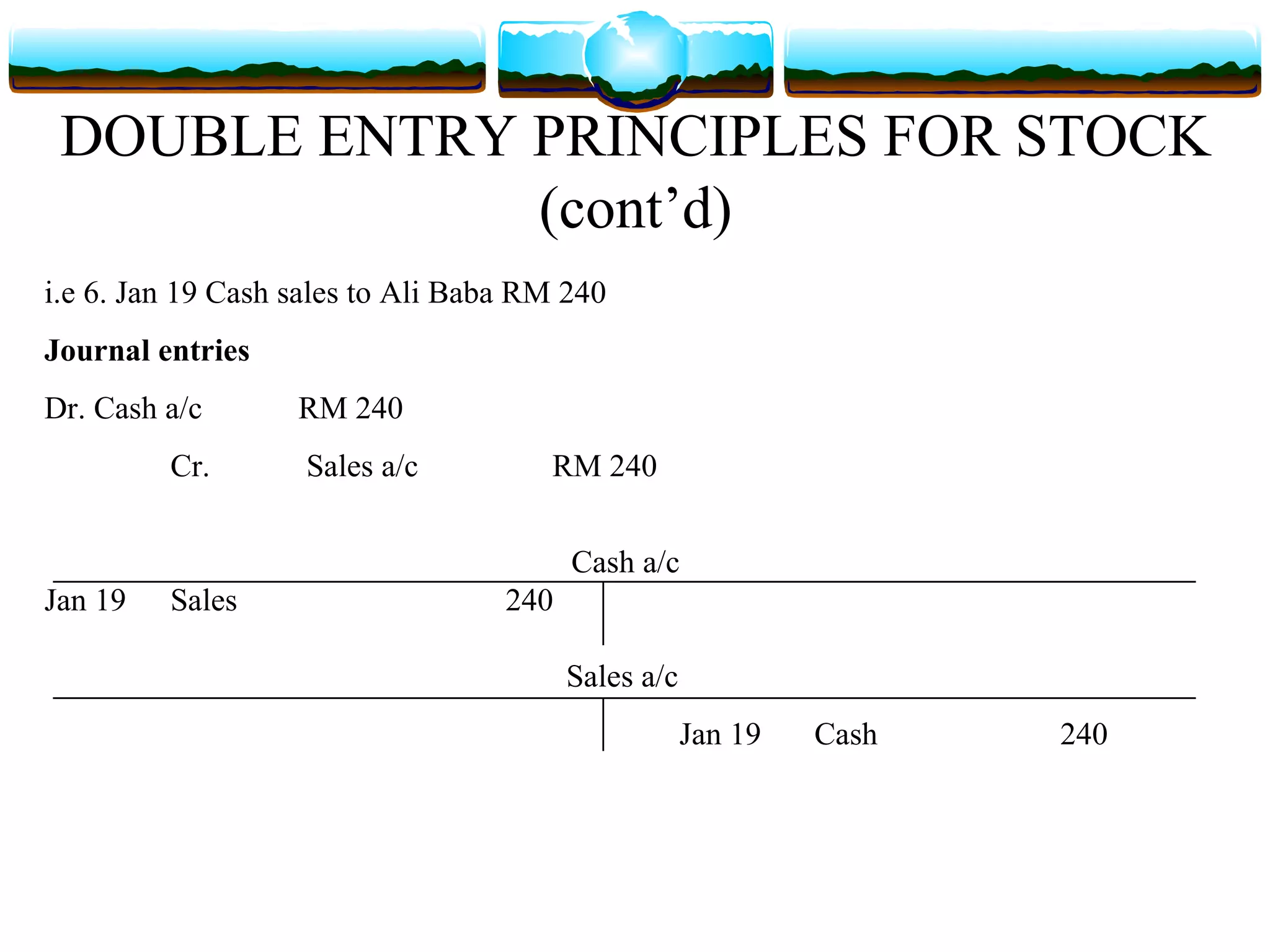

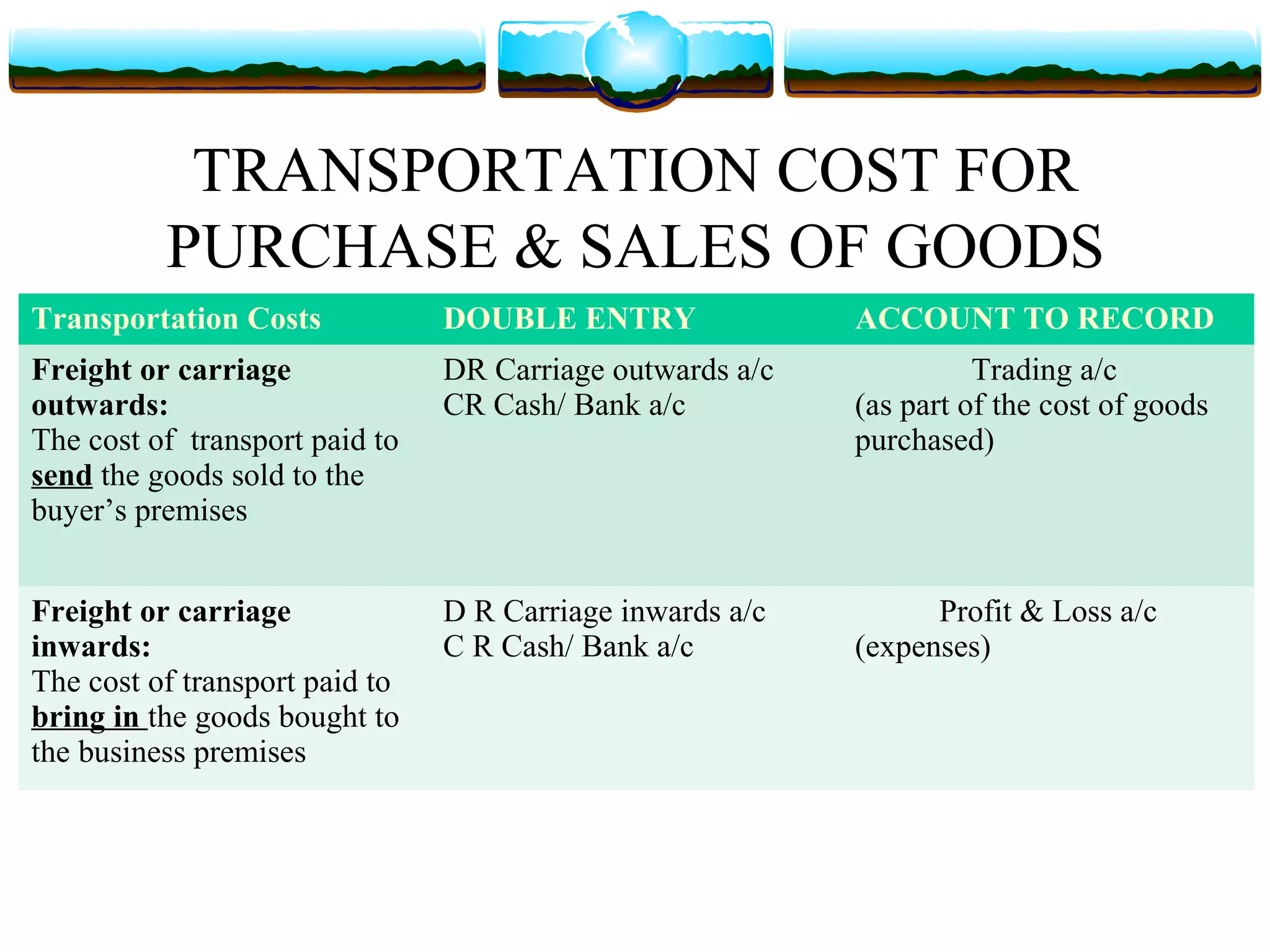

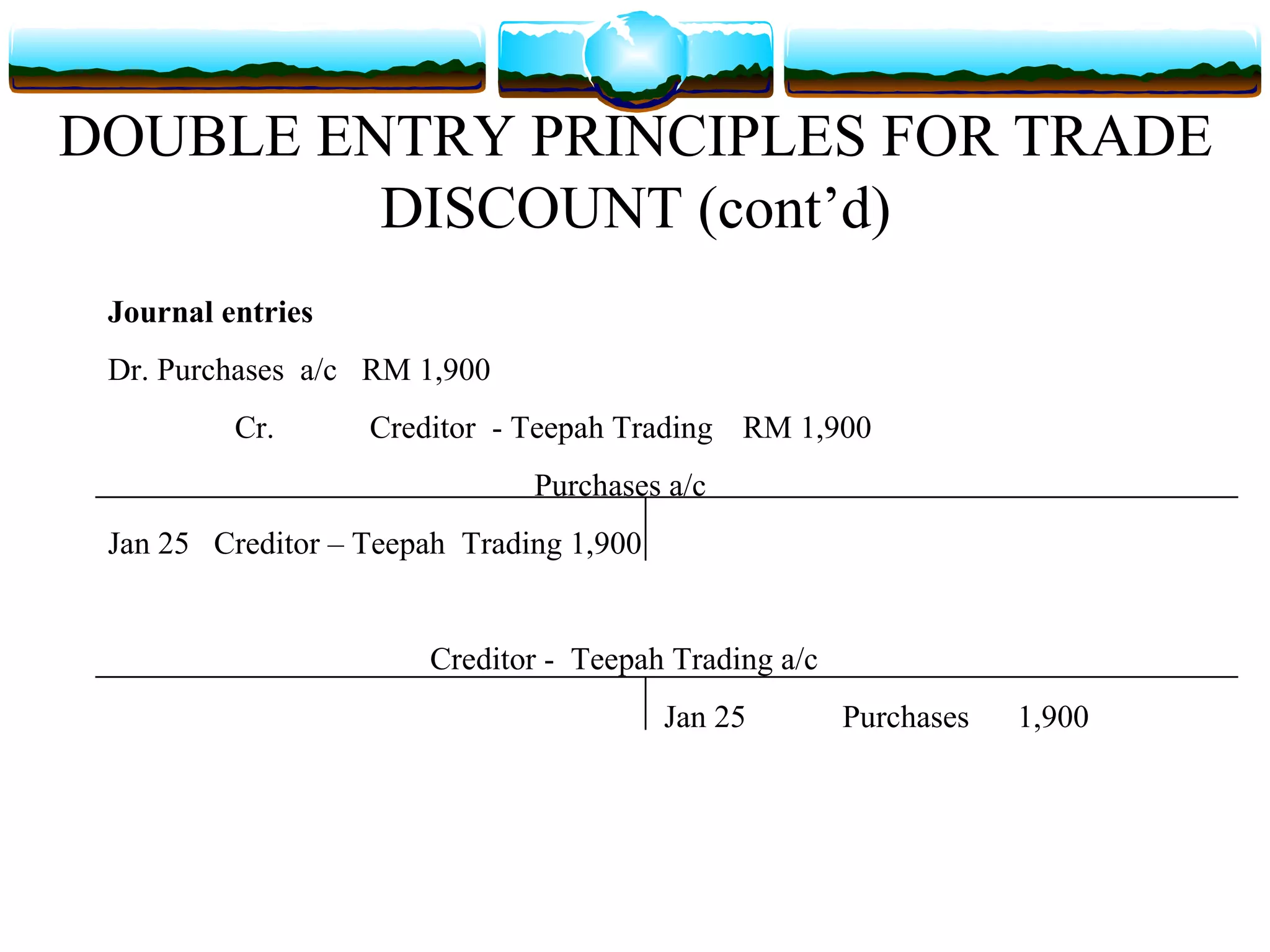

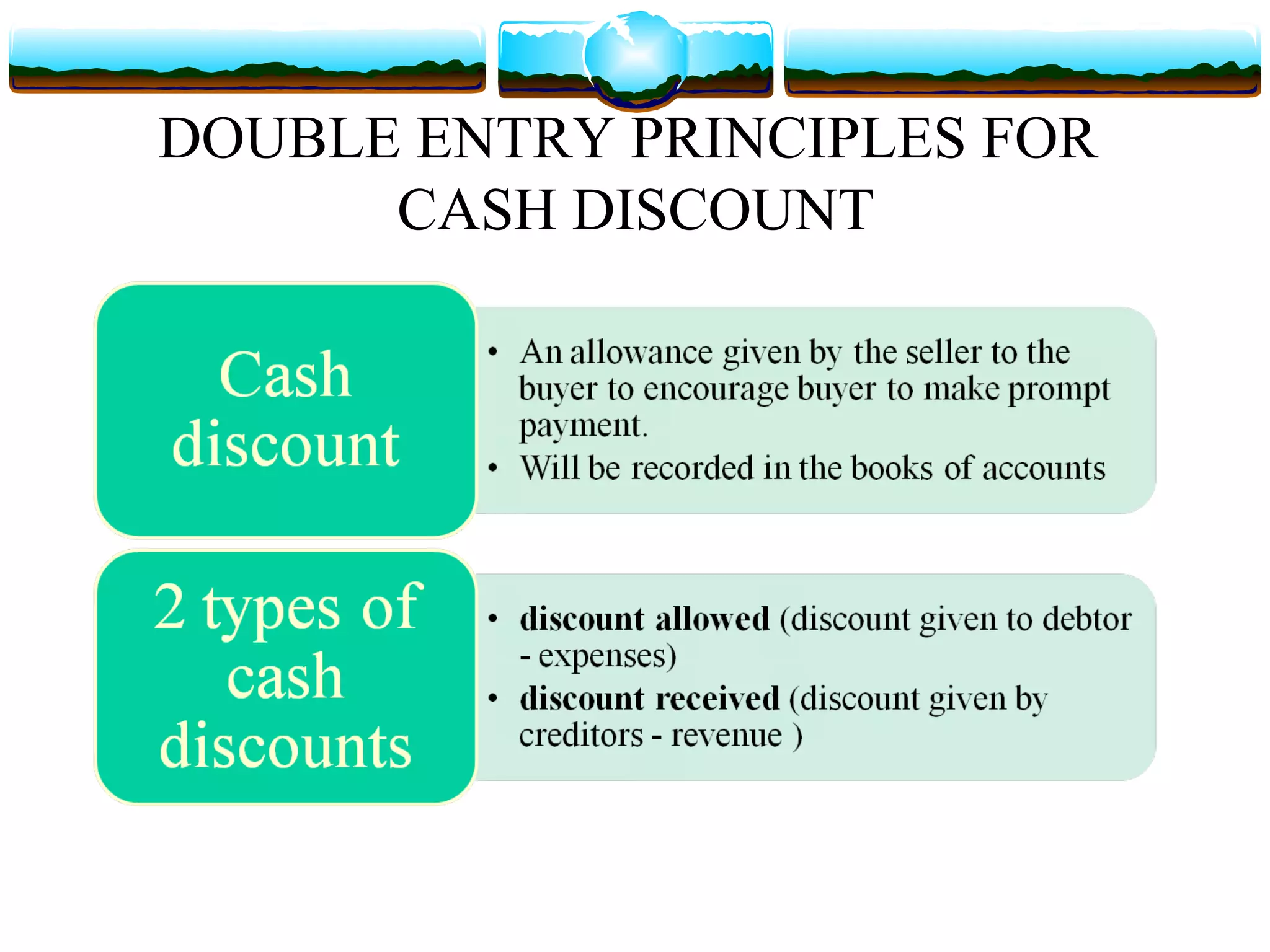

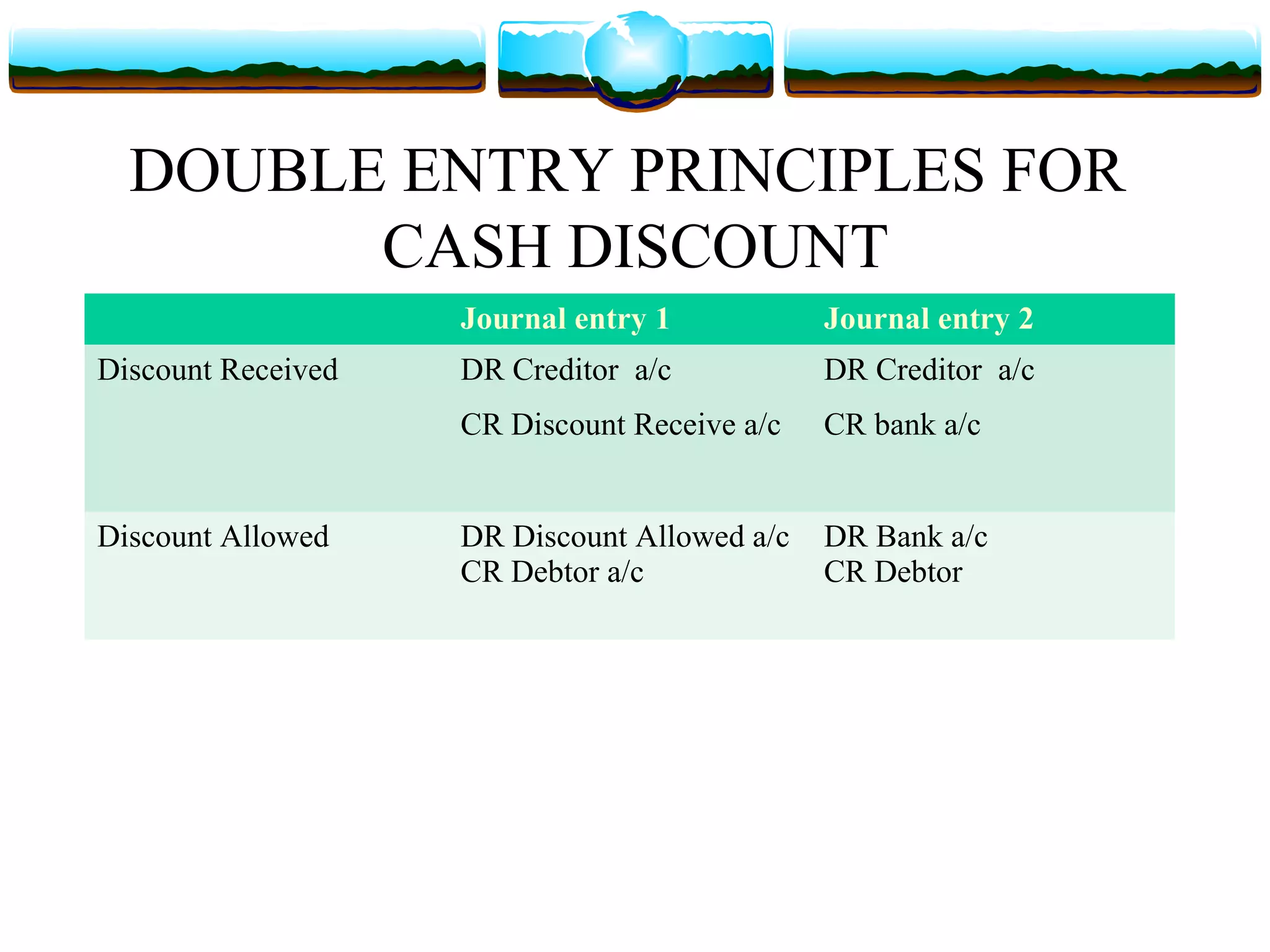

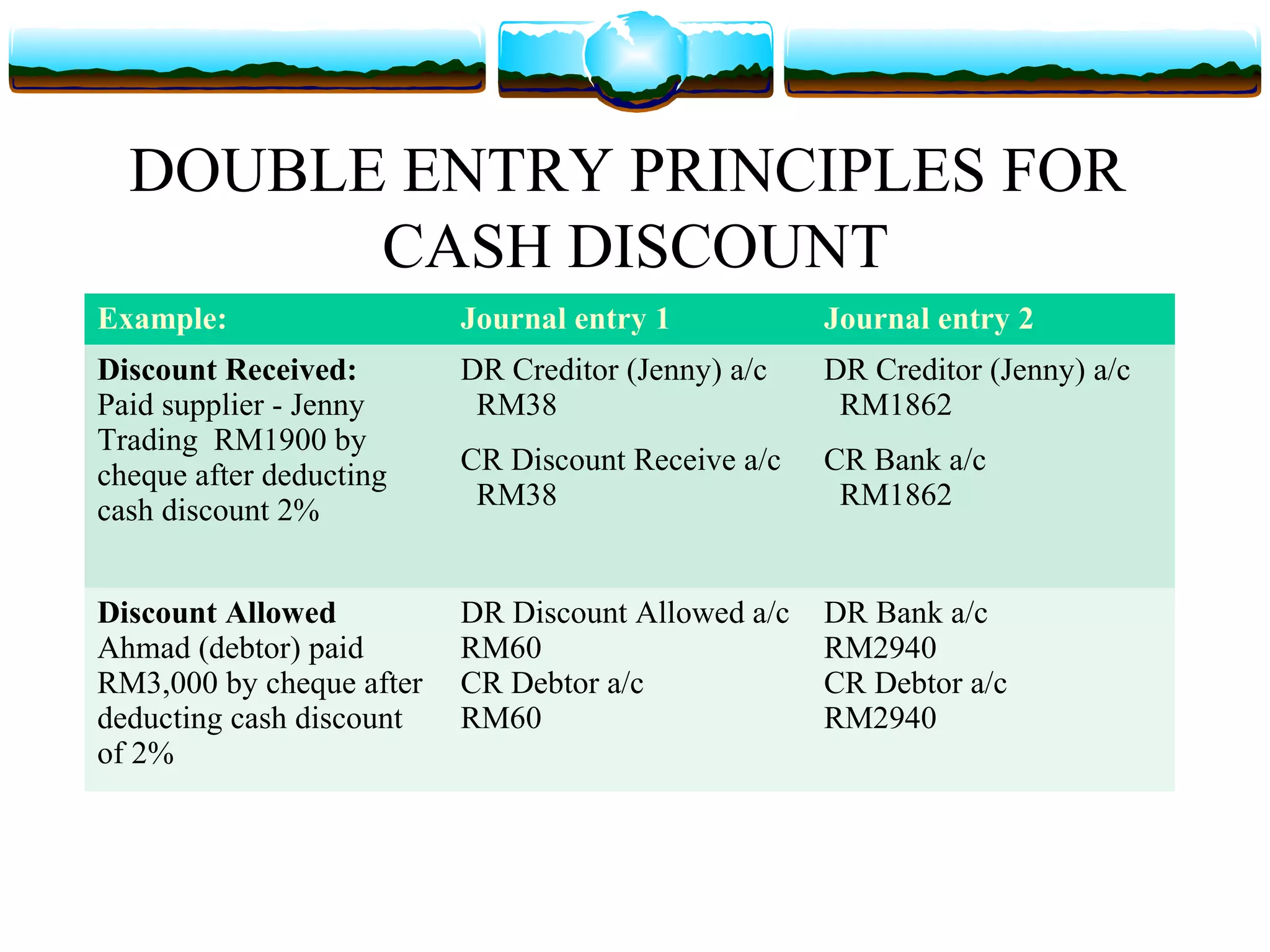

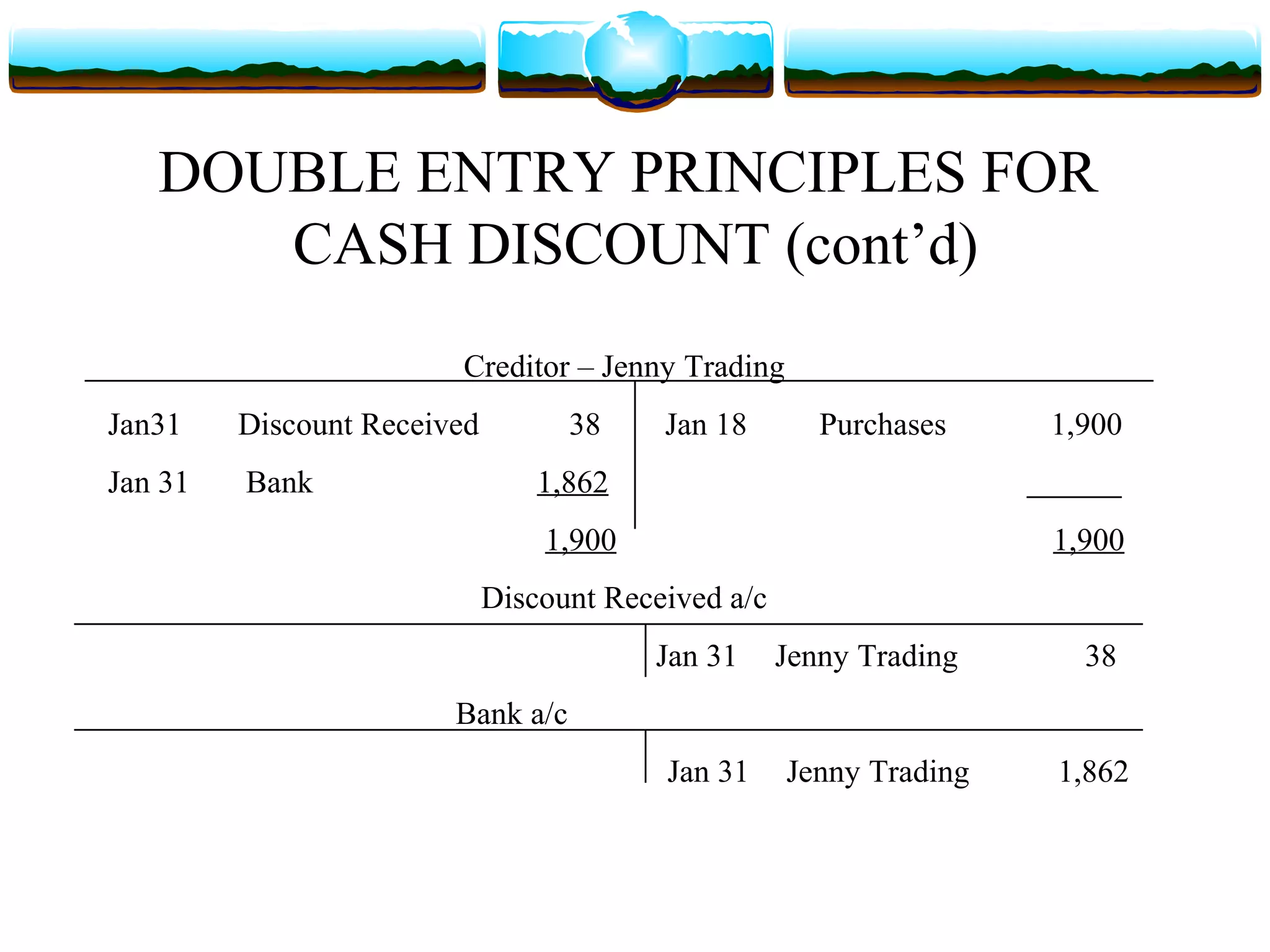

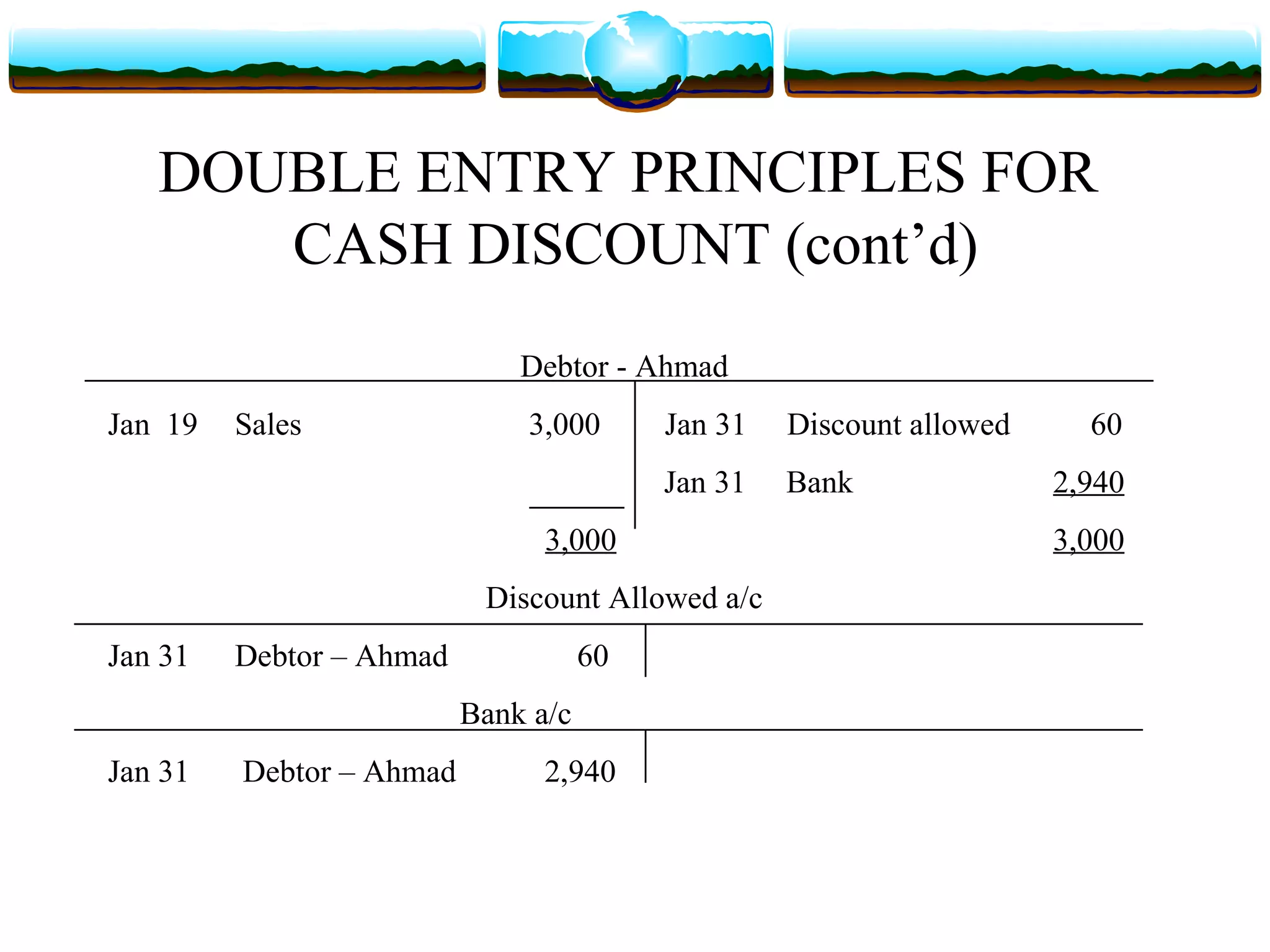

The document discusses the principles of double entry accounting. It explains the debit and credit rules for assets, liabilities, owner's equity, expenses, and revenue. It provides examples of journal entries for transactions involving these accounts. It also covers concepts like stock, transportation costs, trade discounts, and cash discounts.