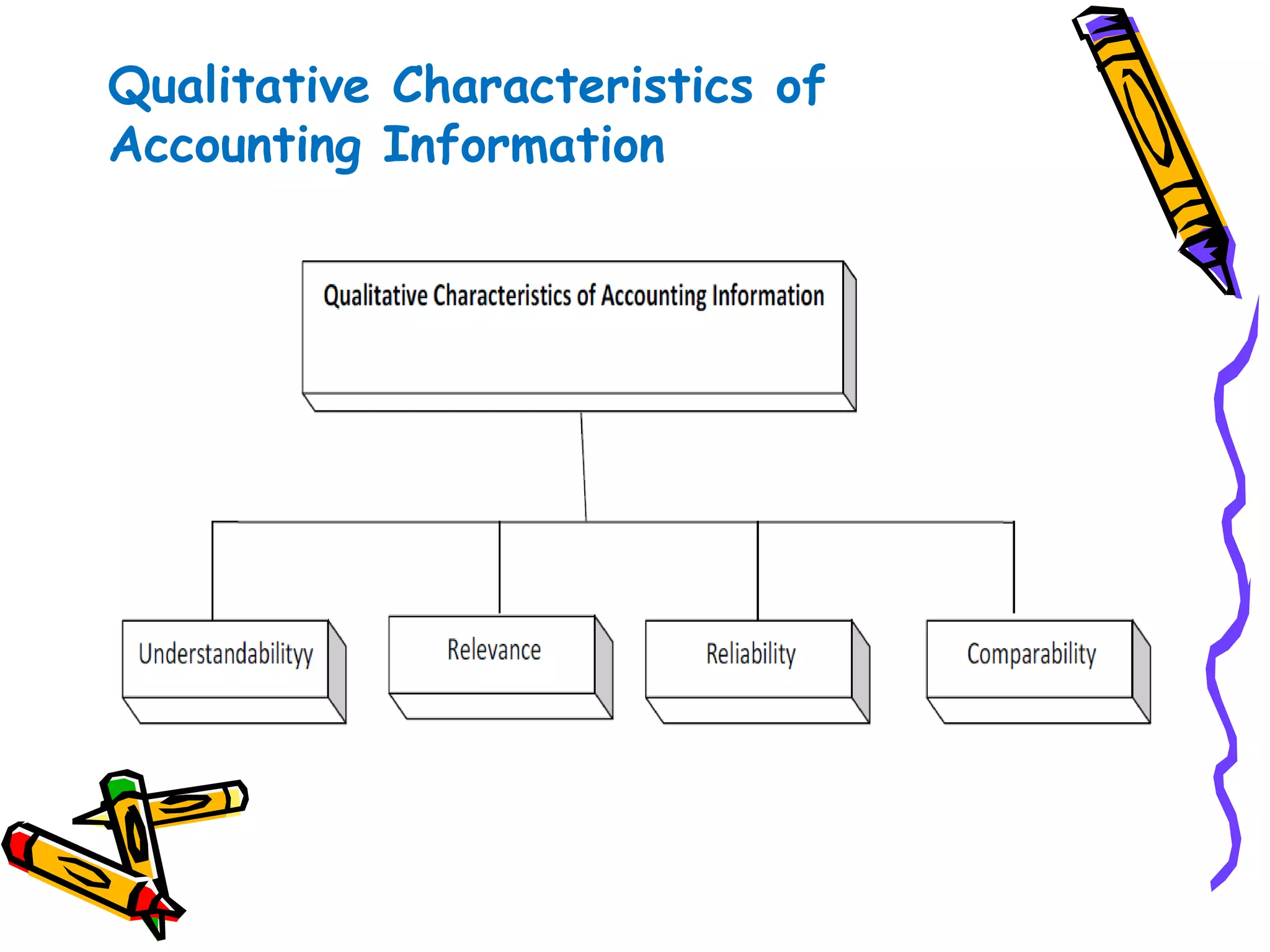

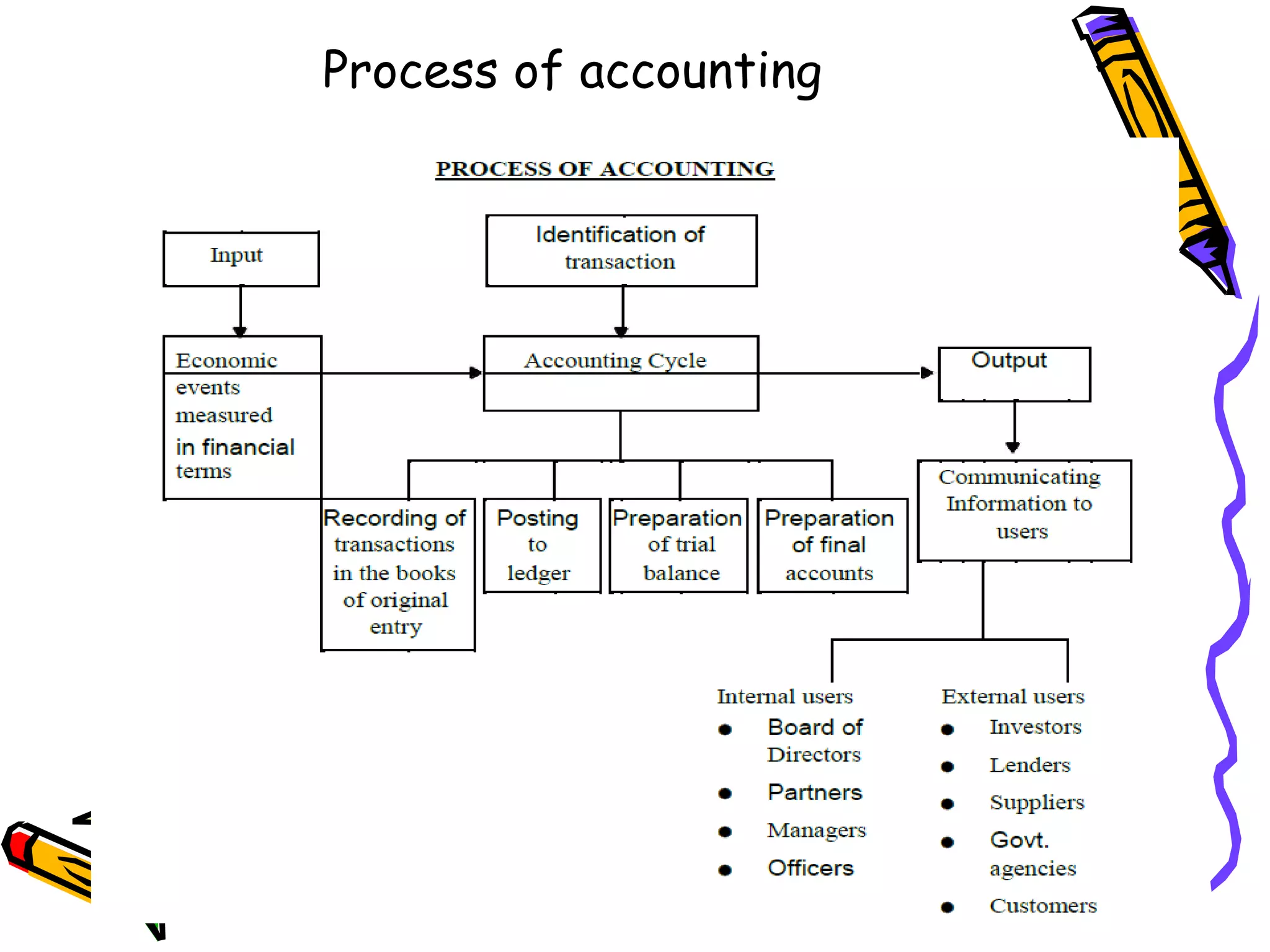

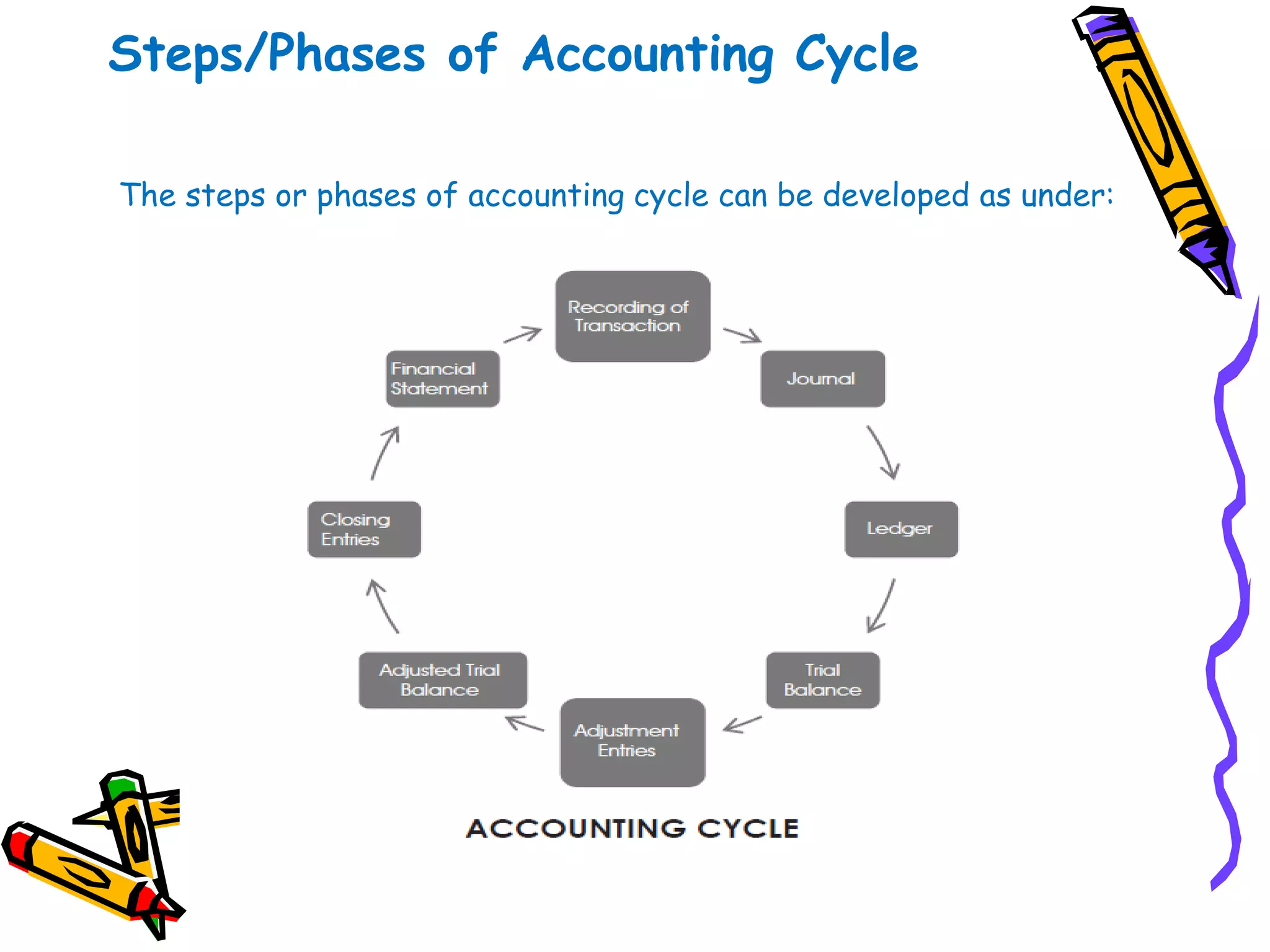

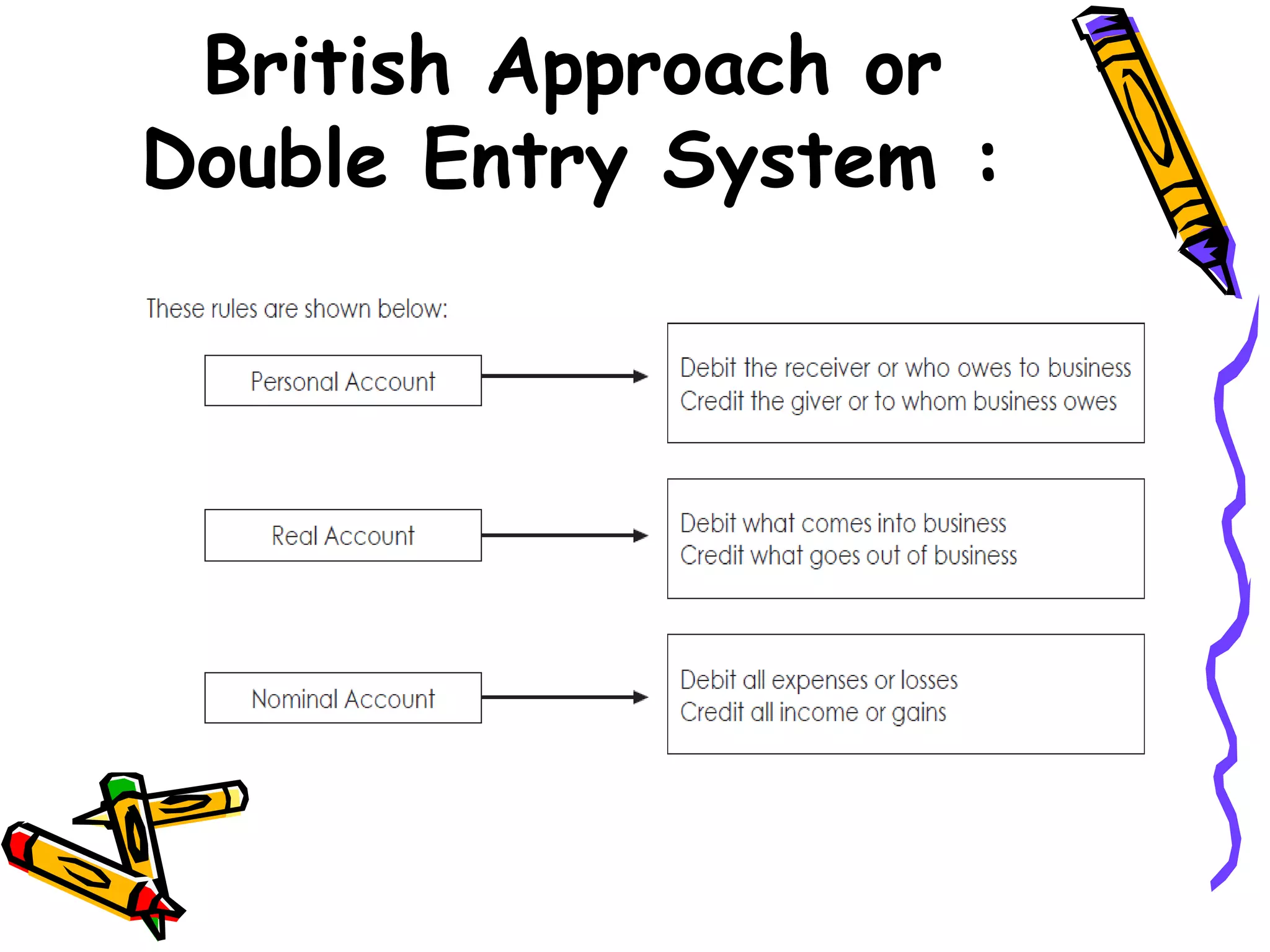

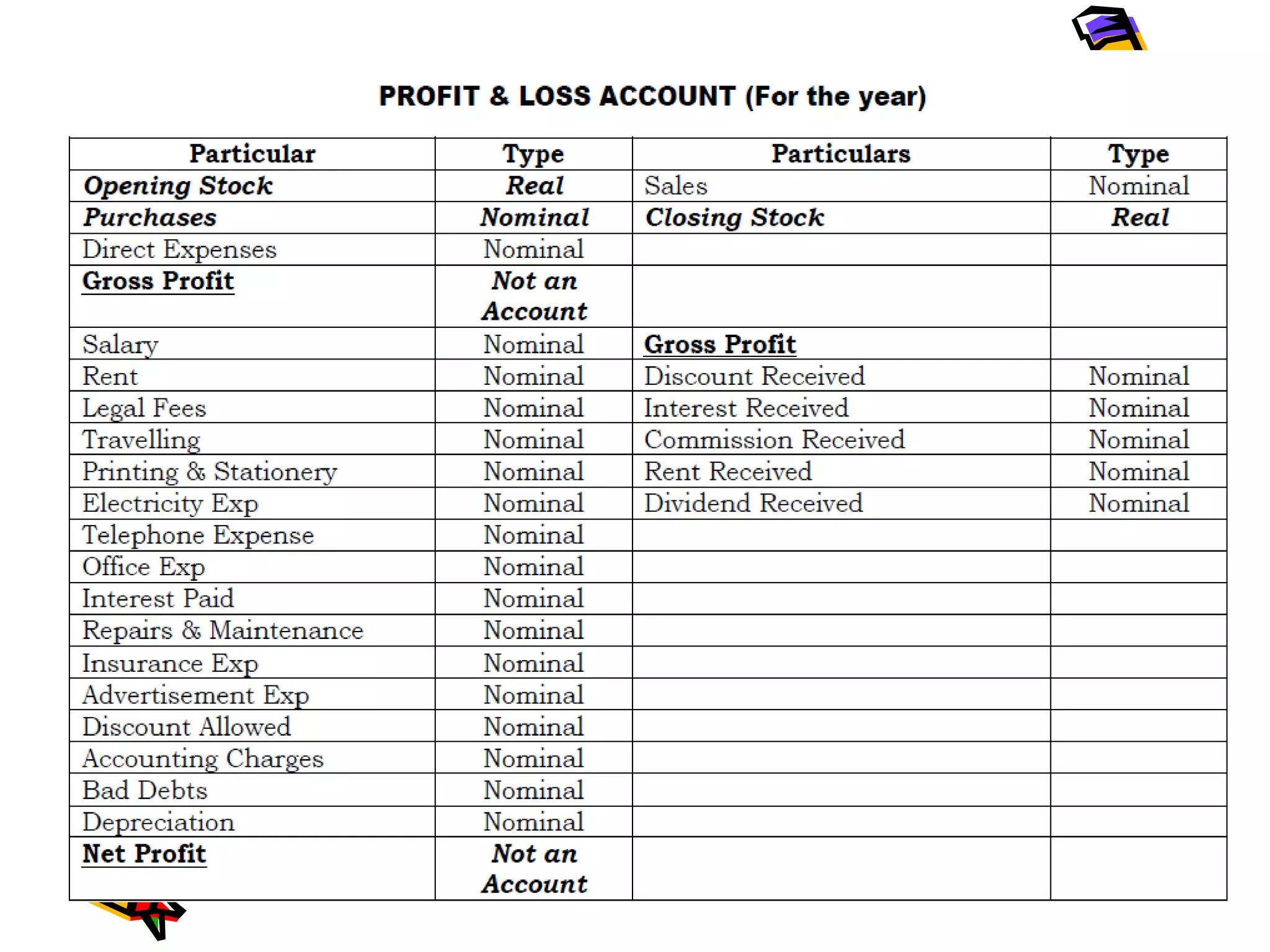

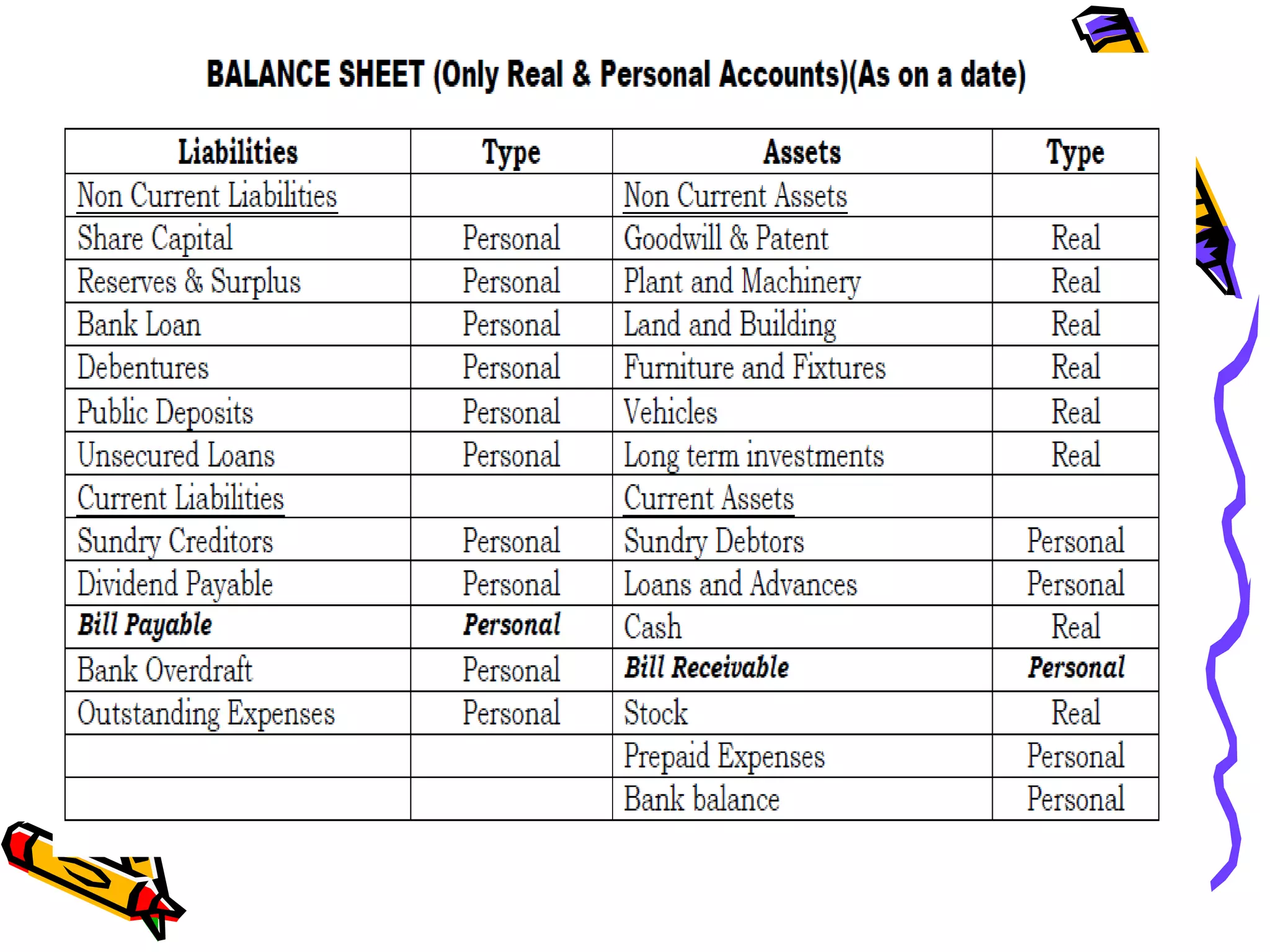

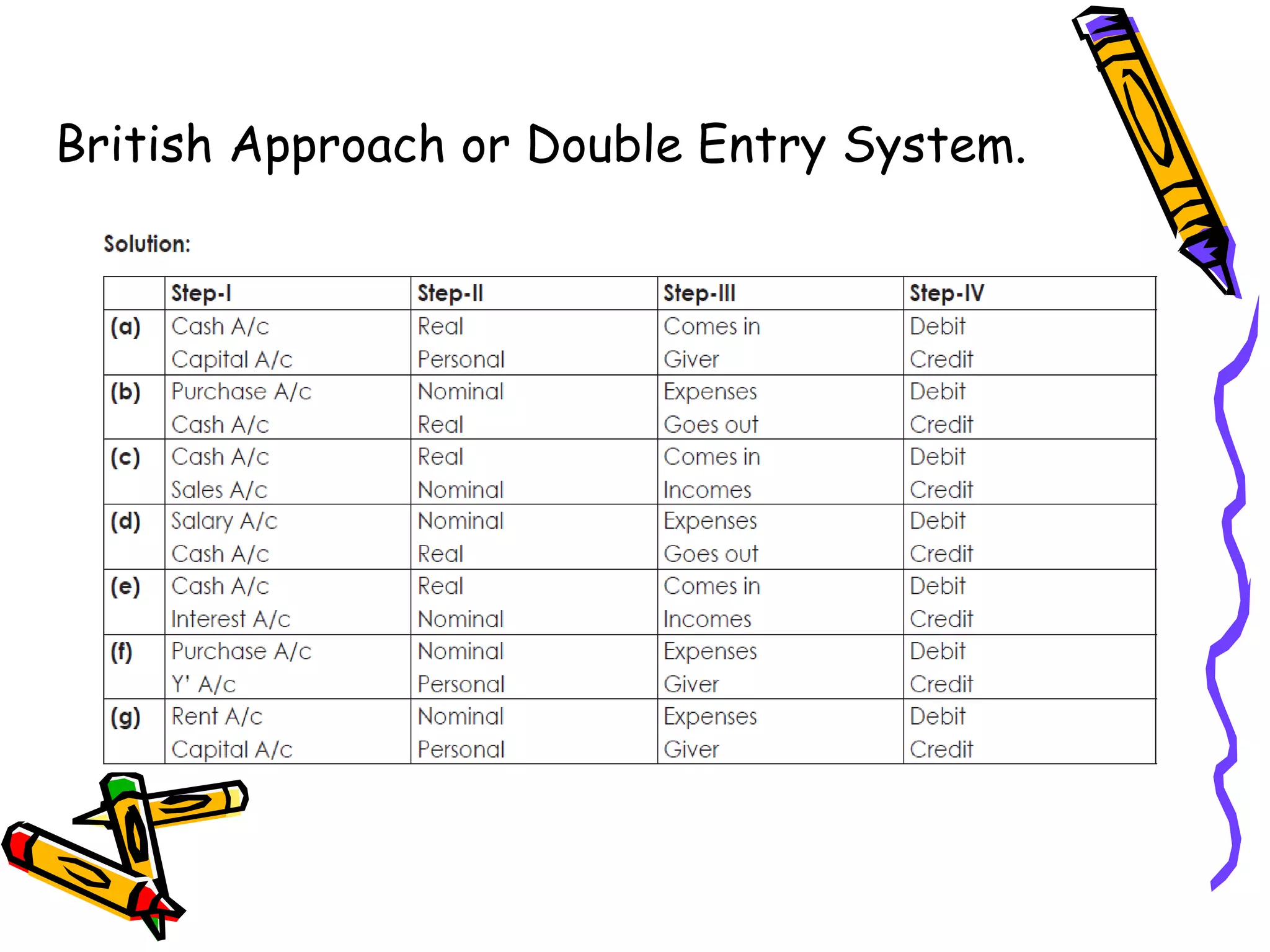

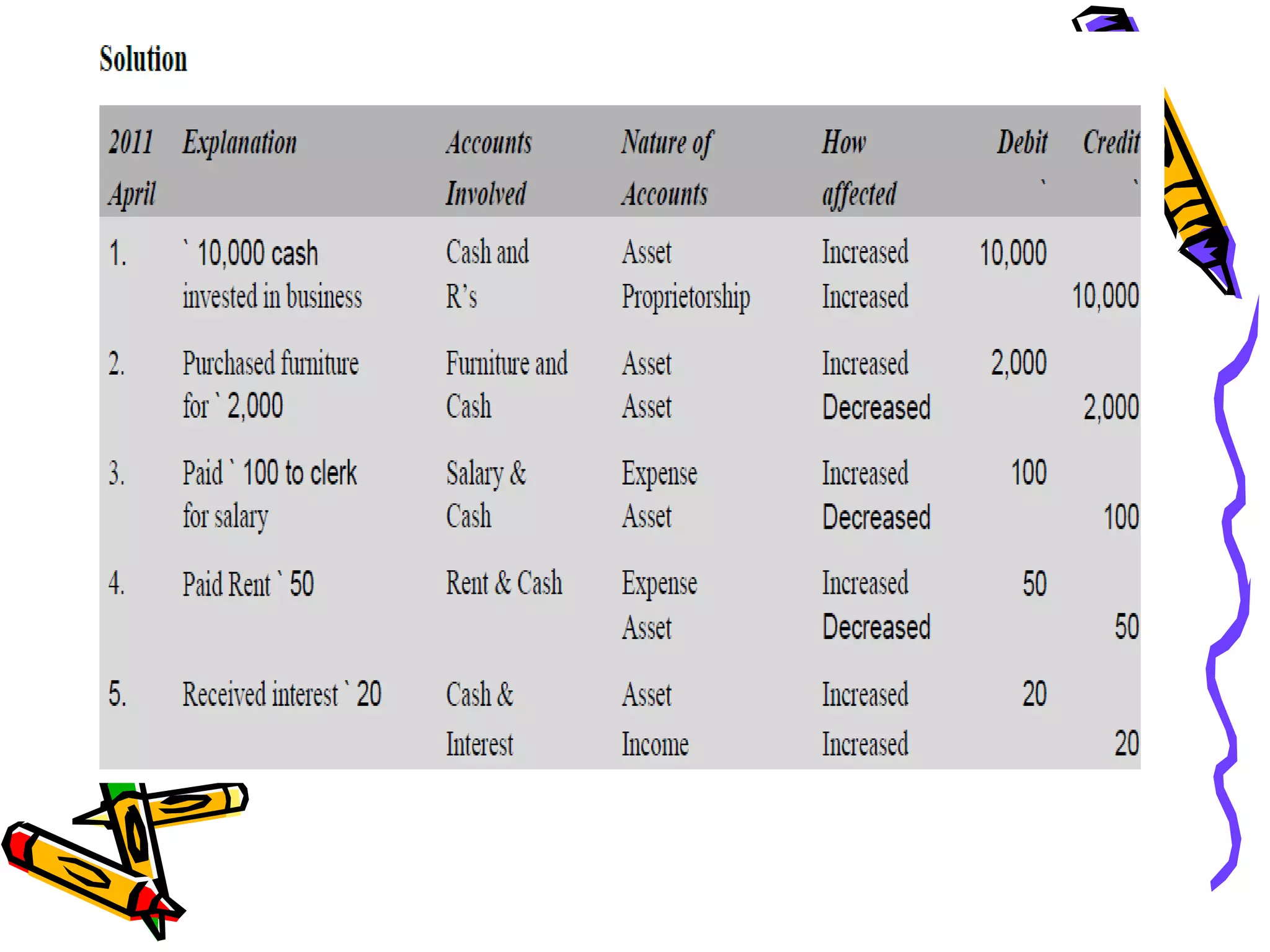

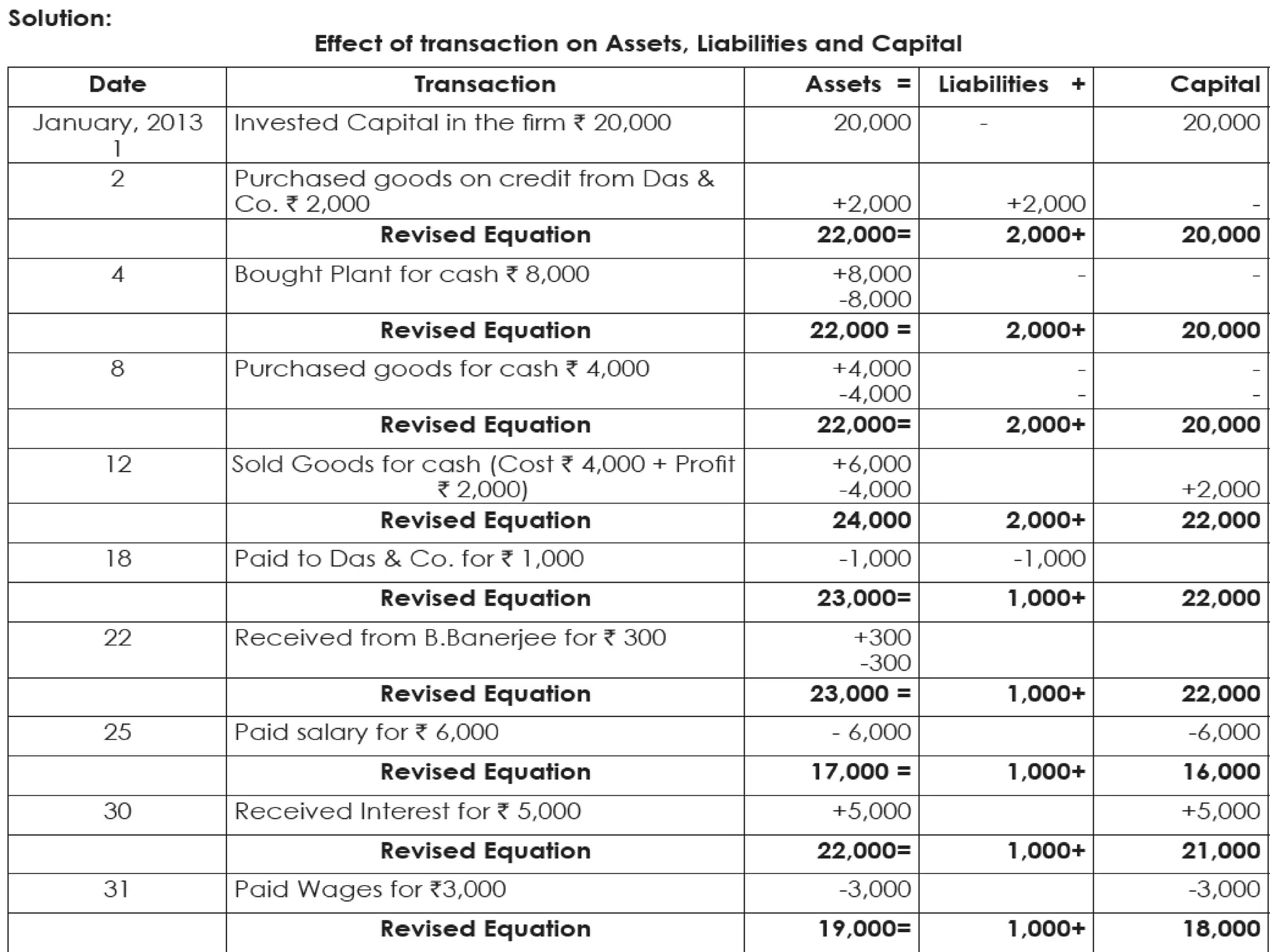

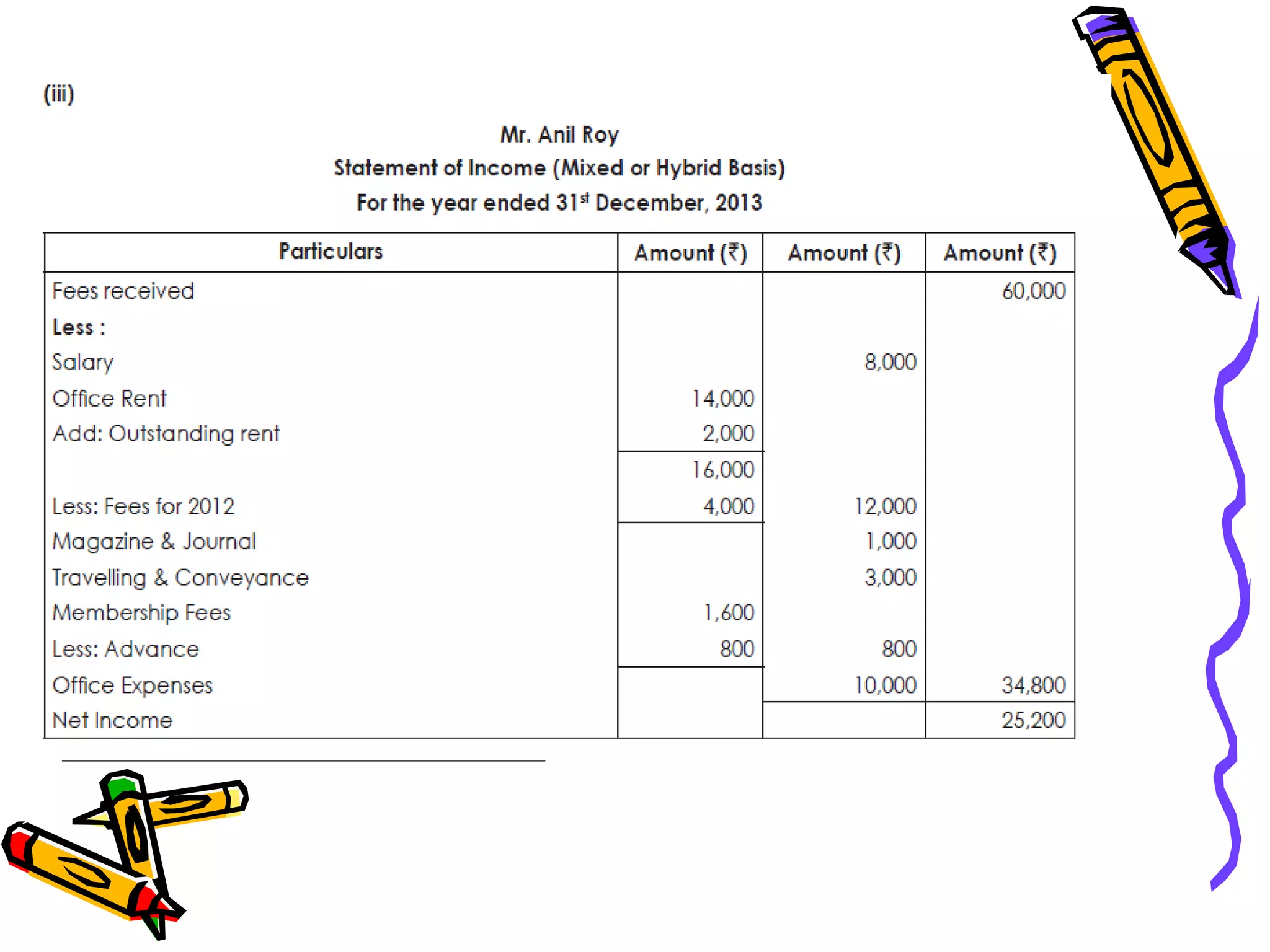

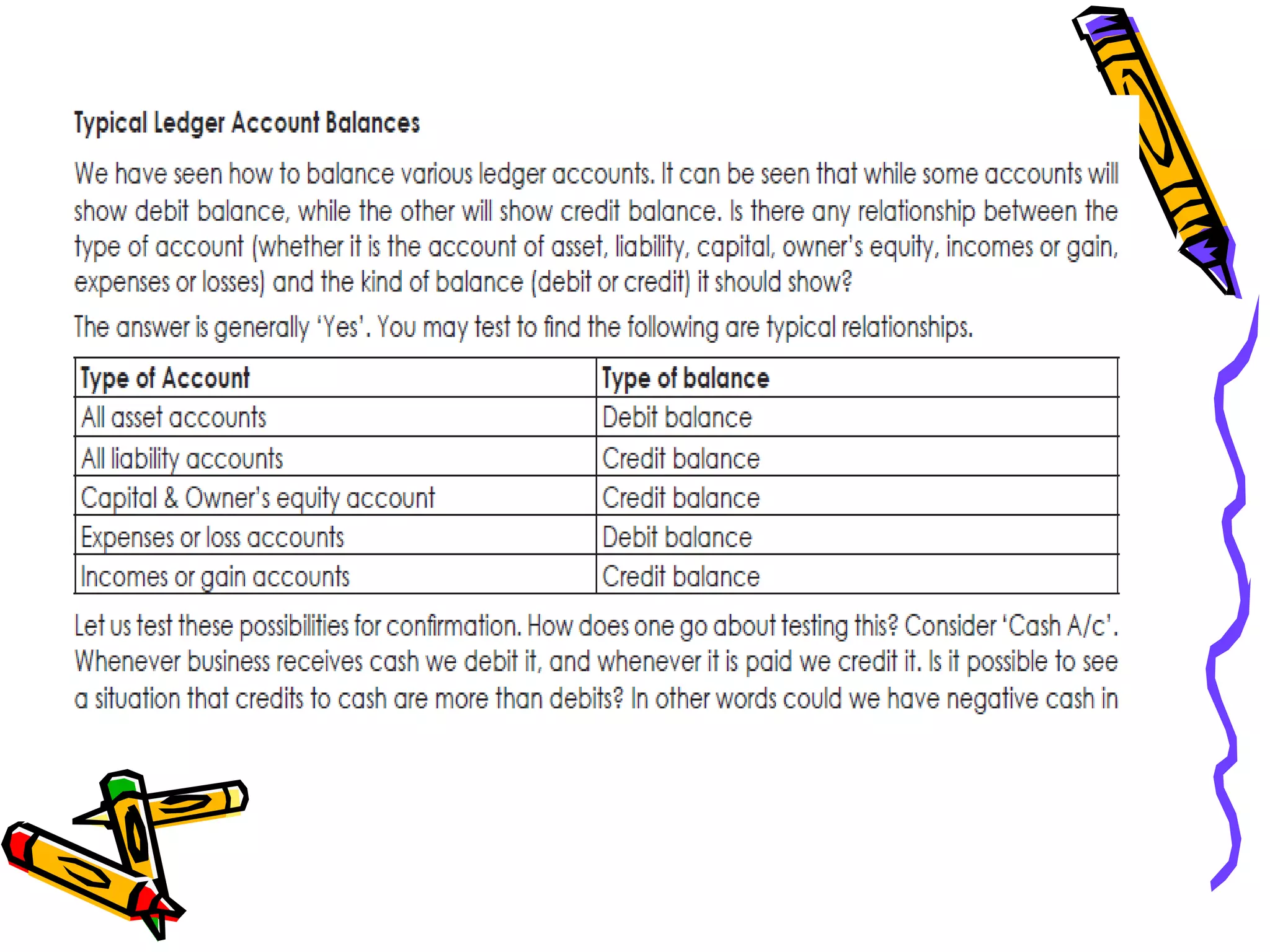

The document provides an overview of financial accounting, including its purpose, fundamental concepts, and processes for recording, classifying, summarizing, and analyzing financial information. It also discusses definitions of accounting, its objectives, and various aspects such as capital and revenue transactions, different types of accounting, and the accounting cycle. Key terms and distinctions between financial accounting, management accounting, and bookkeeping are elaborated upon to highlight their roles in business financial management.