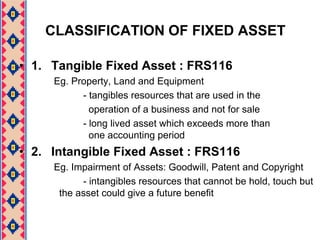

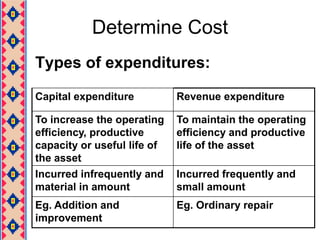

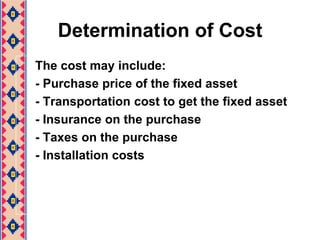

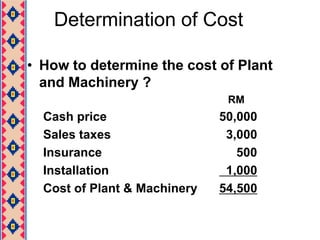

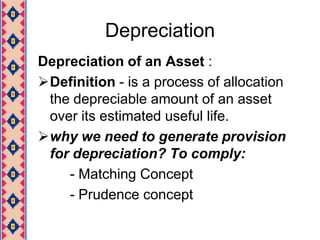

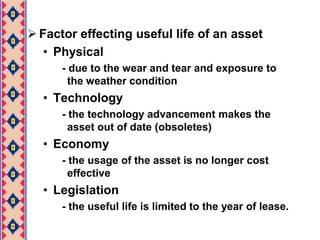

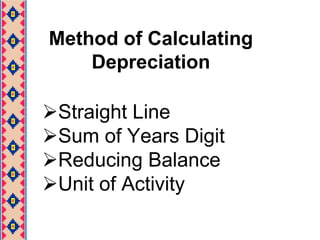

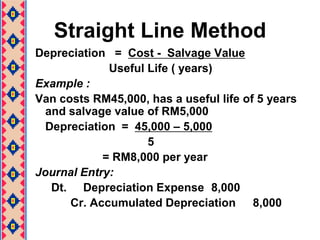

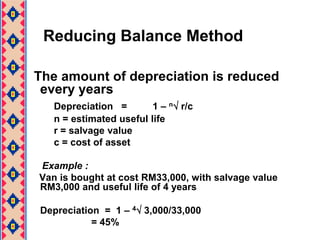

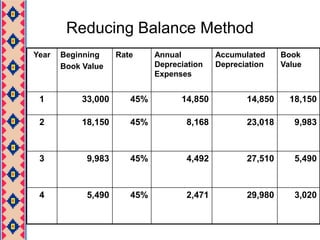

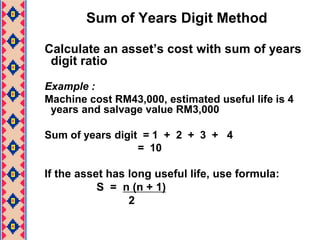

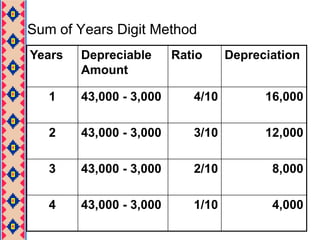

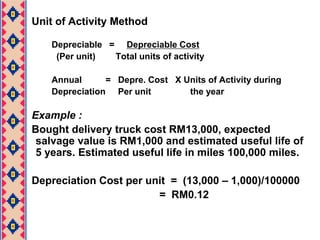

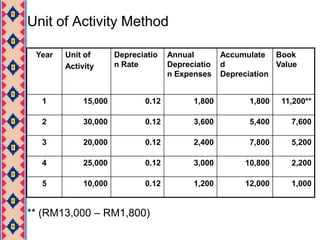

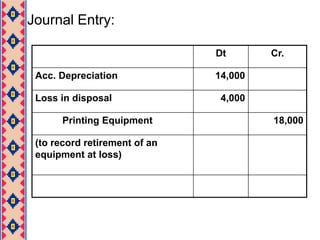

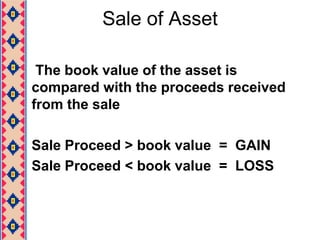

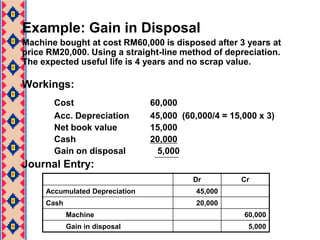

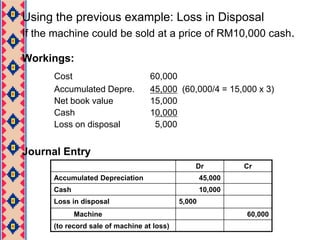

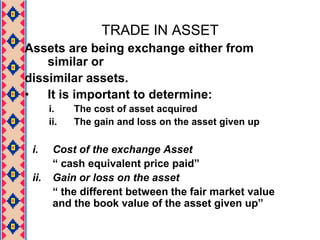

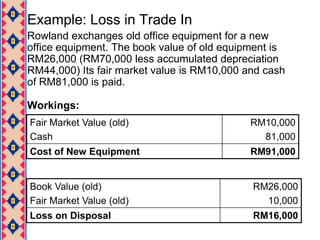

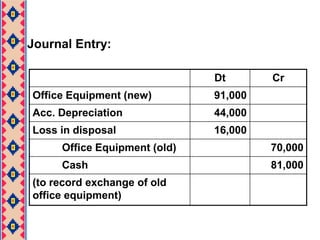

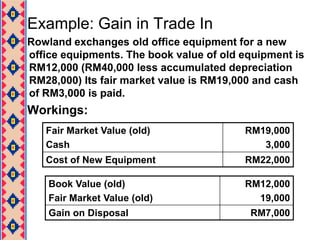

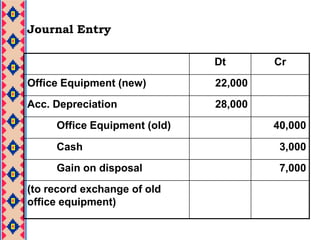

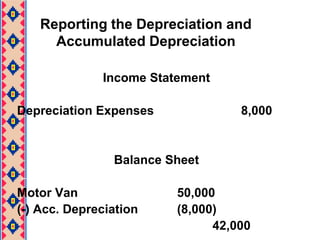

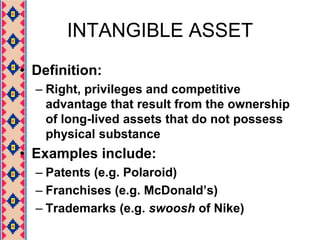

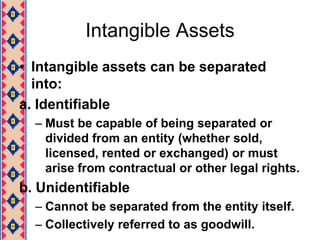

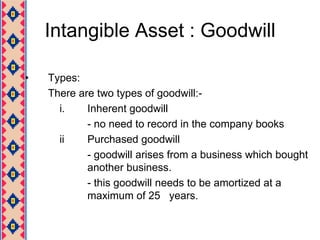

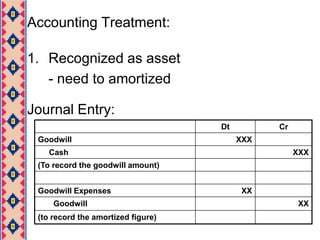

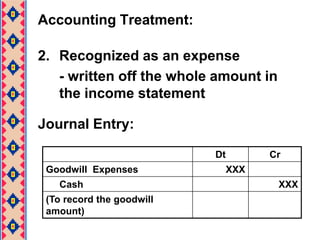

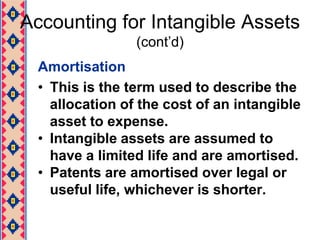

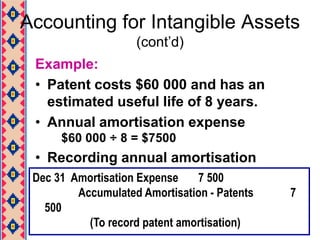

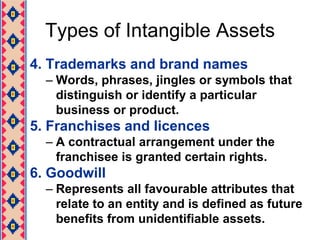

This document discusses the classification, cost determination, depreciation, and disposal of non-current assets. It covers the classification of tangible and intangible fixed assets. It discusses how to determine the cost of an asset and various depreciation methods like straight-line, reducing balance, and sum of years digit. The document also discusses disposal methods like retirement, sale, and trade-in of assets. It provides examples of calculating gains and losses on disposal. Finally, it discusses the accounting treatment and types of intangible assets like patents, goodwill, trademarks, and franchises.