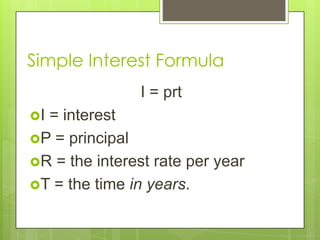

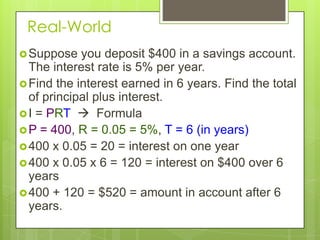

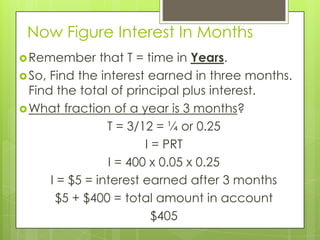

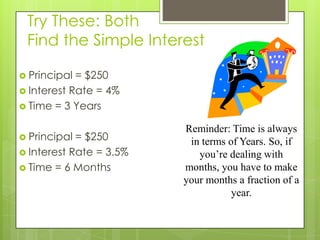

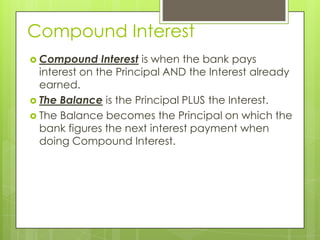

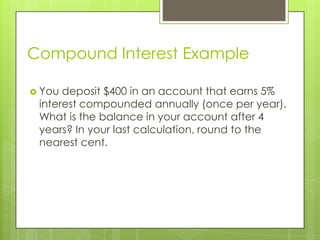

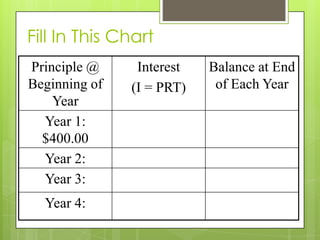

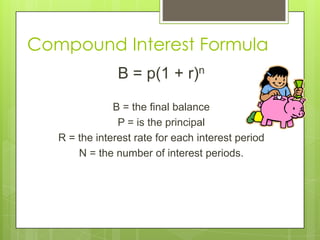

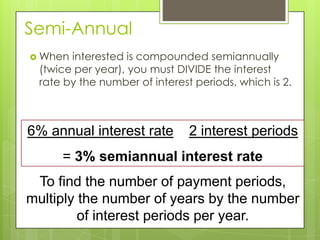

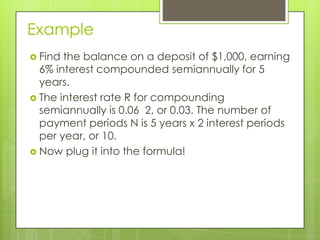

This document discusses simple and compound interest. Simple interest is calculated on the principal only, while compound interest is calculated on the principal and accumulated interest over time. Formulas are provided for calculating simple interest (I=PRT) and compound interest (B=P(1+R)n). Examples are given to demonstrate calculating interest earned over various time periods, such as years, months, and compounding annually vs semiannually. Real-world scenarios help to illustrate applying the concepts of simple and compound interest.

![The Formula!

B = p (1 + R)n

B = $1,000 (1 + 0.03)10

B = $1,000 (1.03)10

B = $1,000 (1.34391638)

B = $1,343.92

Happy? You’ll actually get to use a

calculator for these =]](https://image.slidesharecdn.com/simpleandcompoundintereststudent-140102174013-phpapp01/85/Simple-and-compound-interest-student-15-320.jpg)