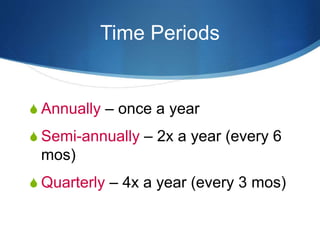

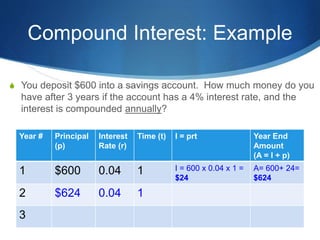

The document contains examples and explanations of compound interest calculations. It defines compound interest as interest earned on deposits that is added to the principal balance periodically, so that interest is earned on interest. The document provides an example of calculating the balance in a savings account over 3 years with annual compounding. It also includes problems calculating balances after a number of years for different principal amounts, interest rates, and compounding periods. The key formulas and steps for setting up compound interest calculation tables are explained.