1) Compound interest occurs when interest is added to the principal amount each period, so that interest is earned on interest.

2) The compound interest formula is Amount = Principal × (1 + Rate/Period)^(Periods × Time), where the rate is divided by the number of compounding periods in a year.

3) More frequent compounding results in a higher effective interest rate compared to the nominal annual rate, even though the nominal rate stays the same.

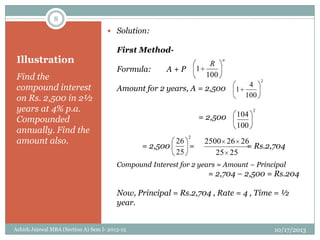

![Simple Interest = = = Rs. 54.08

Compound Interest for 2½ years = 204 + 54.08 = Rs.258.08

and Amount = P + C.I

= 2,500 + 258.08 = Rs.2,758.08

Second Method-

Formula: A + P

Where k = number of whole years = 2

t = fraction of the fractional year = ½

A = 2,500

= 2,500

= antilog [log 2,500 + 2 log (1.04) + log 1.02]

= antilog [3.3979 + 2(.0170) + .0086]

100

PRT

100

2/142704

100

1

100

1

RtR

k

100

2/14

1

100

4

1

2

02.104.1

2

10/17/2013Ashish Jaiswal MBA (Section A) Sem I- 2013-15 9](https://image.slidesharecdn.com/compoundinterest-140426060102-phpapp01/85/Compound-Interest-9-320.jpg)

![= antilog [3.3979 + .0340 + .0086]

A = antilog [3.4405] = 2,757

Compound Interest = A – P = 2,757 – 2,500 = Rs. 257

Third Method:

Formula: A = P

where P = 2,500 , R = 4 , n = 2½ = 5/2

=> A = 2,500 = 2,500

Taking logarithm on both sides,

log A = log 2,500 + 5/2 ( log 104 – log 100)

= 3.3979 + 5/2 (2.0170 – 2.0000)

= 3.3979 +

n

R

100

1

2/5

100

4

1

2/5

100

104

2

0170.5

10/17/2013Ashish Jaiswal MBA (Section A) Sem I- 2013-15 10](https://image.slidesharecdn.com/compoundinterest-140426060102-phpapp01/85/Compound-Interest-10-320.jpg)

![Illustration

Find the compound

Interest on Rs.1,200

@ 8% annually for

two years if:

1) the interest is

calculated

annually.

2)the interest is

calculated half-

yearly.

3) the interest is

calculated

quarterly.

4) the interest is

calculated monthly.

Solution:

1) Interest is compounded annually:

A = P , where P = 1,200 , R = 8, n = 2

= 1,200

= 1,200 × = 1,200 ×

Using logarithm table,

log A = log 1,200 + (log 27 – log 25)

= 3.0792 + 2[1.4314 – 1.3979]

= 3.0792 + 2(.0335)

= 3.0792 + .0670 = 3.1462

A = antilog (3.1462) = Rs. 1,401

that is, Compound Interest = A – P = 1,401 – 1,200

= Rs. 201

n

R

100

1

2

100

8

1

2

100

108

2

25

27

10/17/2013Ashish Jaiswal MBA (Section A) Sem I- 2013-15

13](https://image.slidesharecdn.com/compoundinterest-140426060102-phpapp01/85/Compound-Interest-13-320.jpg)

![2) Interest is compounded half-yearly:

A = P , where Rate = R/2 = 8/2 = 4

Conversion Period = 2n = 2×2 = 4

=> A = 1,200

= 1,200

= 1,200

log A = log 1,200 + 4 log (1.04)1,200 =

= 3.0792 + 4(.0170)

= 3.0792 + .0680 = 3.1472

A = antilog (3.1472) = Rs. 1,404

Compound Interest = 1,404 – 1,200 = Rs.204

[ if = 1.16985865 then

A = 1,403.830272 = Rs. 1,403.83]

n

R

2

100

2/

1

4

100

4

1

4

04.1

4

04.1

4

04.1

10/17/2013Ashish Jaiswal MBA (Section A) Sem I- 2013-15 14](https://image.slidesharecdn.com/compoundinterest-140426060102-phpapp01/85/Compound-Interest-14-320.jpg)

![4) Interest is compounded monthly:

A = P , where Rate = R/12 = 8/12

Conversion Period = 12n = 12 × 2 = 24

=> A = 1,200

= 1,200

= 1,200 = 1,200

log A = log 1,200 + 24 [log 302 – log 300]

= 3.0792 + 24 [2.4800 = 2.4771]

A = 3.0792 + 24 [0.0029]

= 3.0792 + .0696 = 3.1488

A = antilog (3.1488) = Rs. 1,409

Compound Interest = A – P = 1,409 – 1,200 = Rs. 209

n

R

12

100

12/

1

24

100

12/8

1

24

10012

8

1

24

300

2

1

24

300

302

10/17/2013Ashish Jaiswal MBA (Section A) Sem I- 2013-15 16](https://image.slidesharecdn.com/compoundinterest-140426060102-phpapp01/85/Compound-Interest-16-320.jpg)

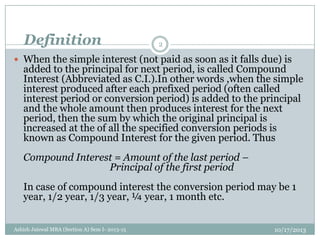

![Illustration

Find Compound

Interest of Rs.

10,000 for 2 years

@ 8% per annum

compounding

monthly.

Solution:

Formula: Amount = Principal

Here Principal = 10,000

Time = 2 years = 2 × 12 months = 24 months

Rate = 8/12 per month

Amount, A = 10,000

= 10,000

= 10,000

log A = log (10,000) + 24 [log 151 – log 150]

= 4.0000 + 24[2.1790 – 2.1761]

time

Rate

100

1

24

100

12/8

1

24

100

12/8

1

24

150

151

10/17/2013Ashish Jaiswal MBA (Section A) Sem I- 2013-15

17](https://image.slidesharecdn.com/compoundinterest-140426060102-phpapp01/85/Compound-Interest-17-320.jpg)