This document summarizes several models for understanding customer service and loyalty:

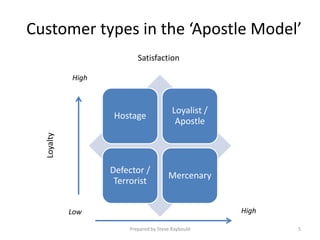

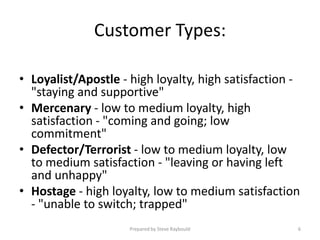

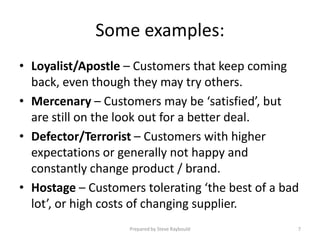

1. The Apostle Model by Jones and Sasser identifies four types of customers based on their satisfaction and loyalty - Loyalists, Mercenaries, Defectors, and Hostages.

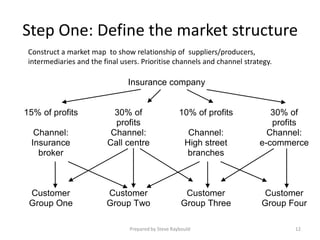

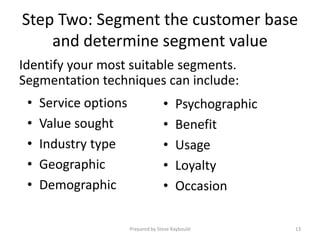

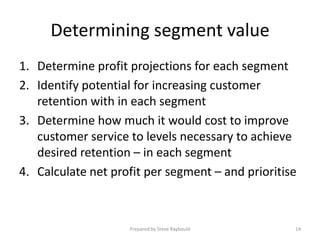

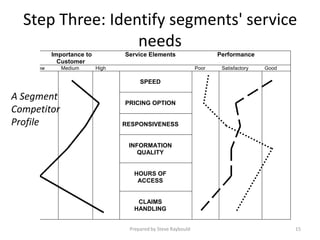

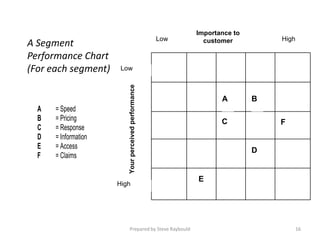

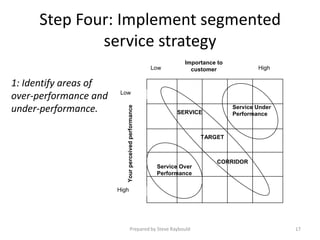

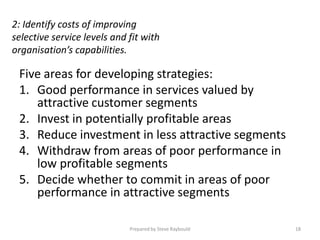

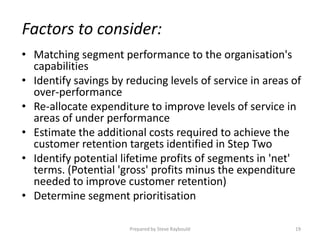

2. The Segmented Service Strategy by Christopher, Payne and Ballantyne involves four steps: defining the market structure, segmenting the customer base, identifying segment needs, and implementing a strategy.

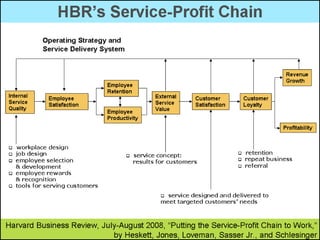

3. The Service-Profit Chain by Heskett et al. emphasizes creating satisfied and productive employees to deliver customer satisfaction and loyalty.