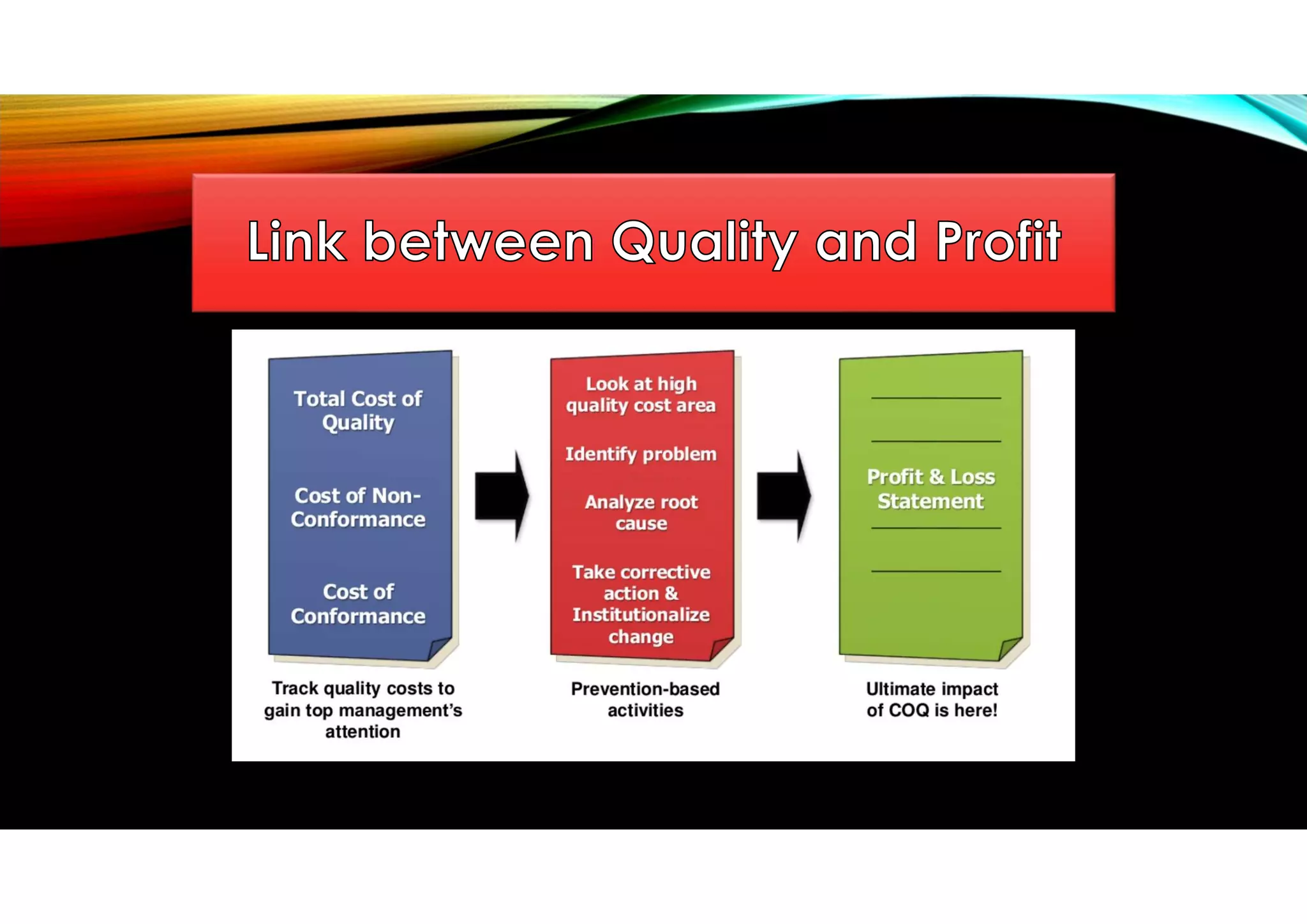

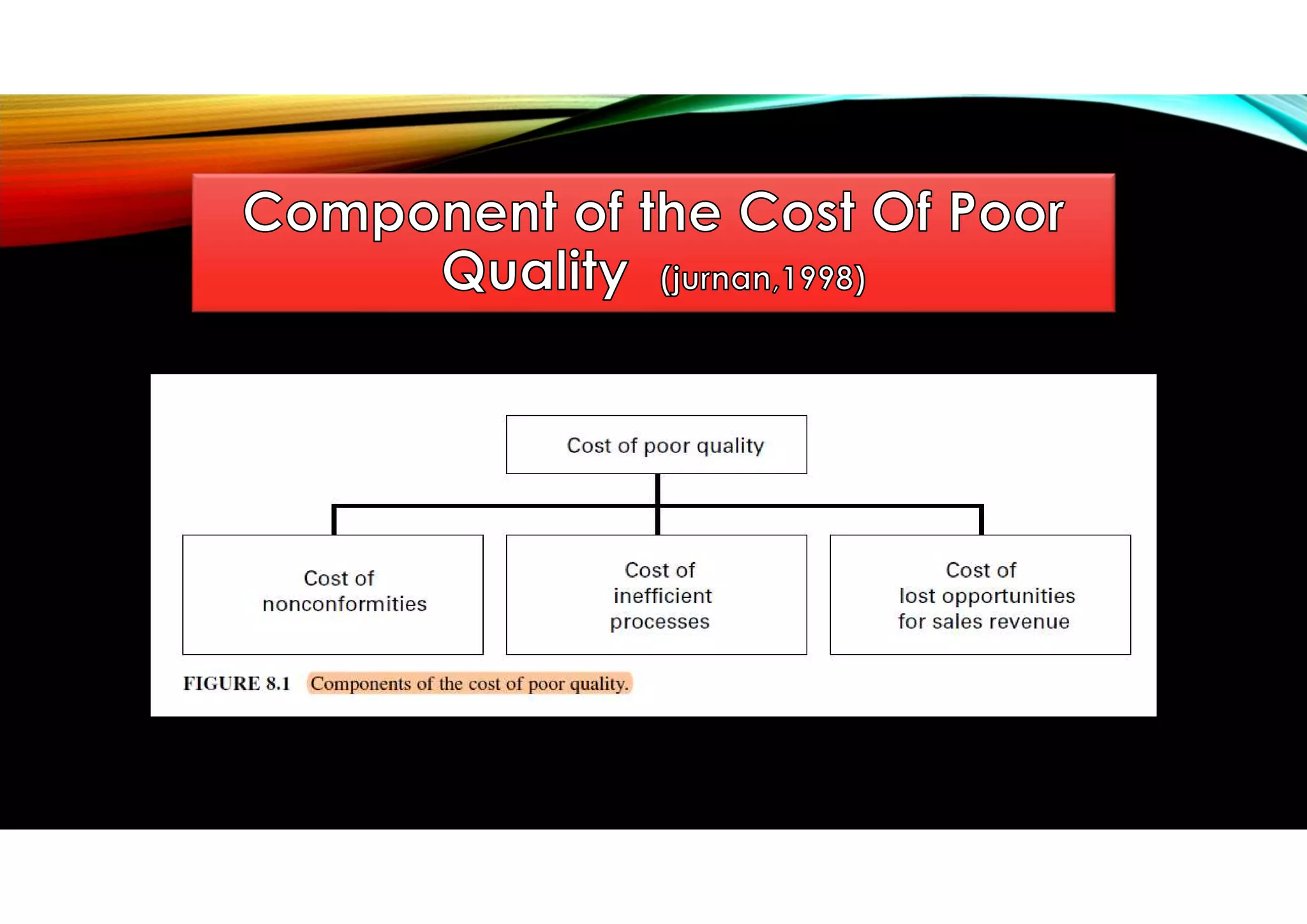

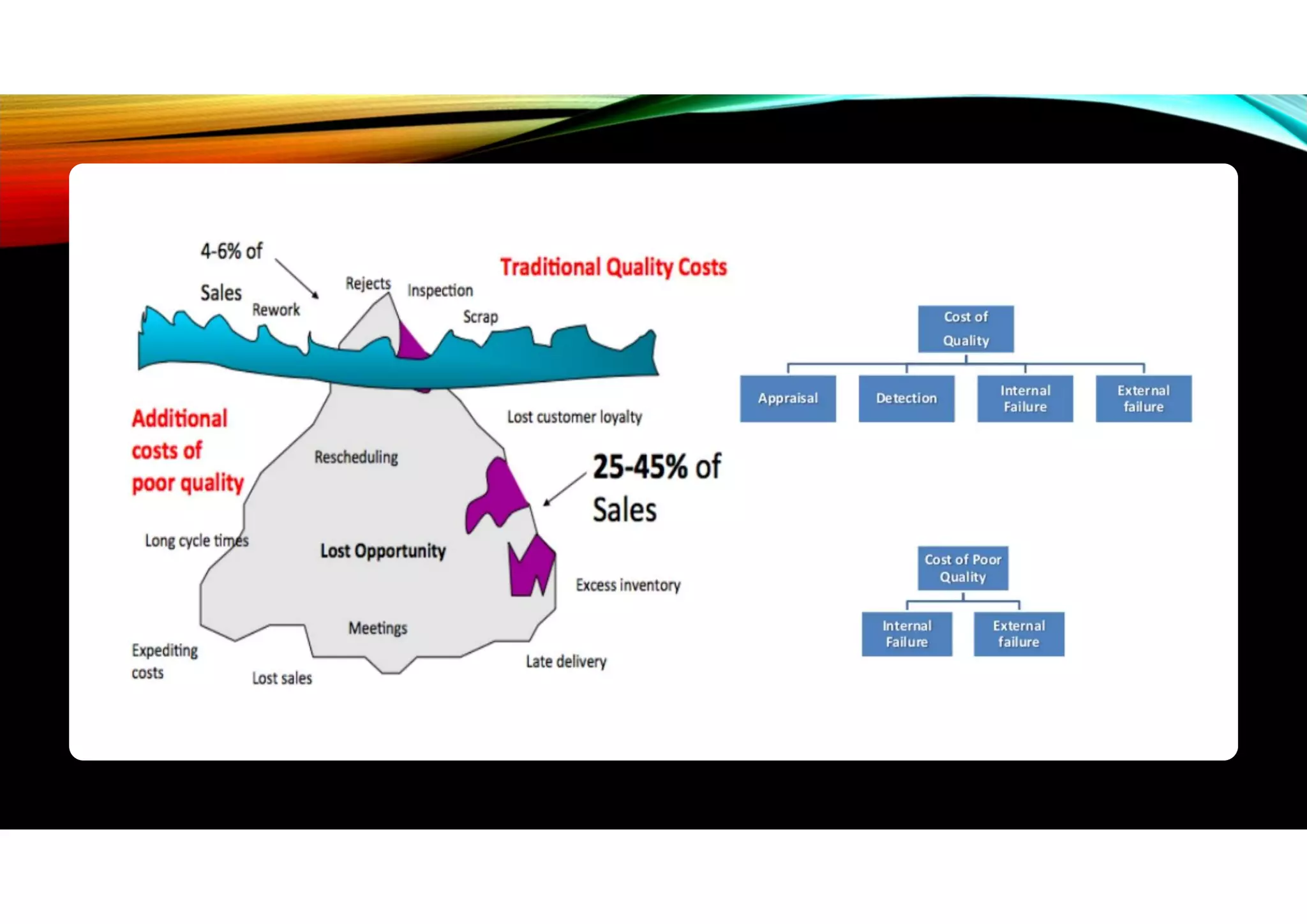

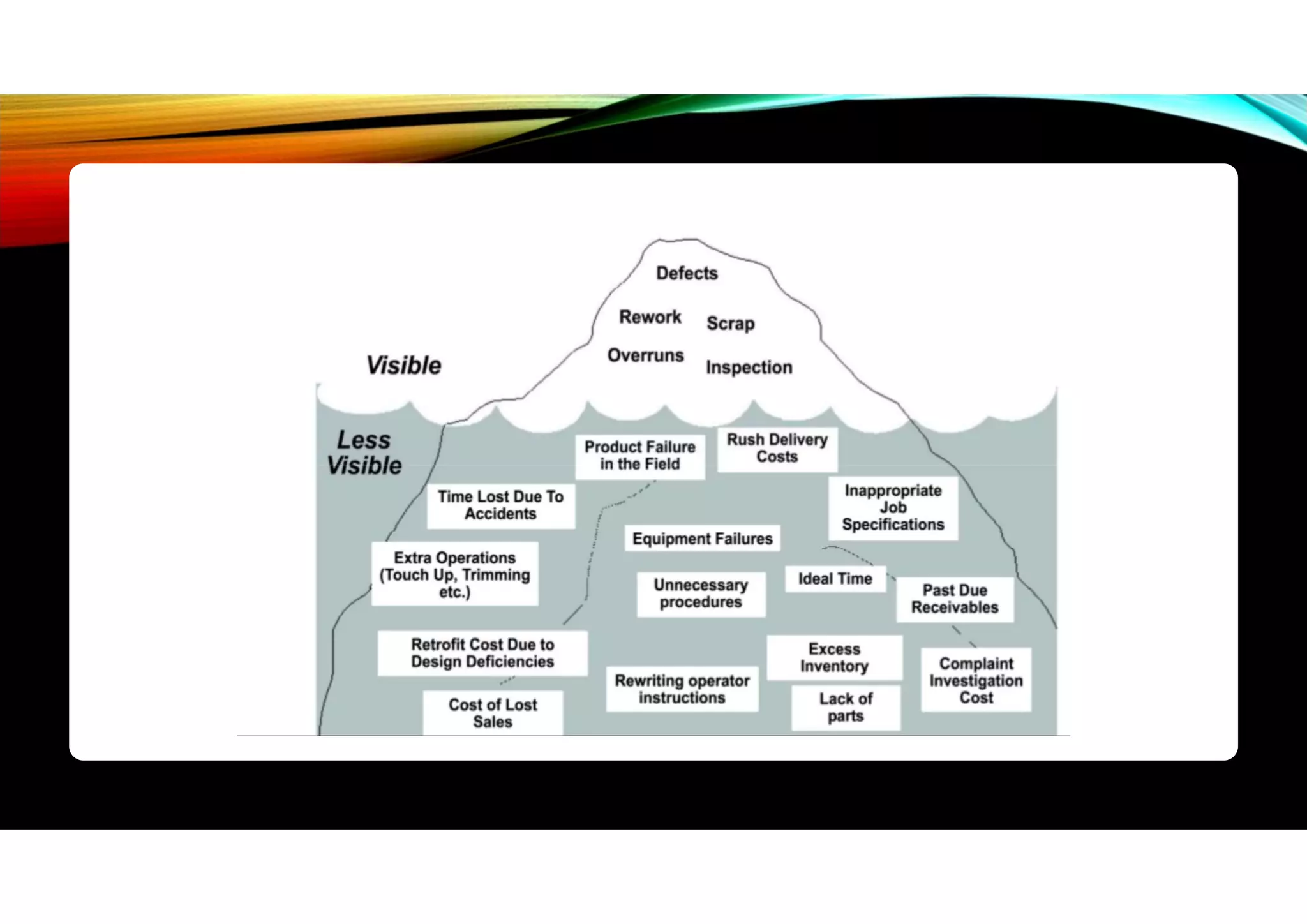

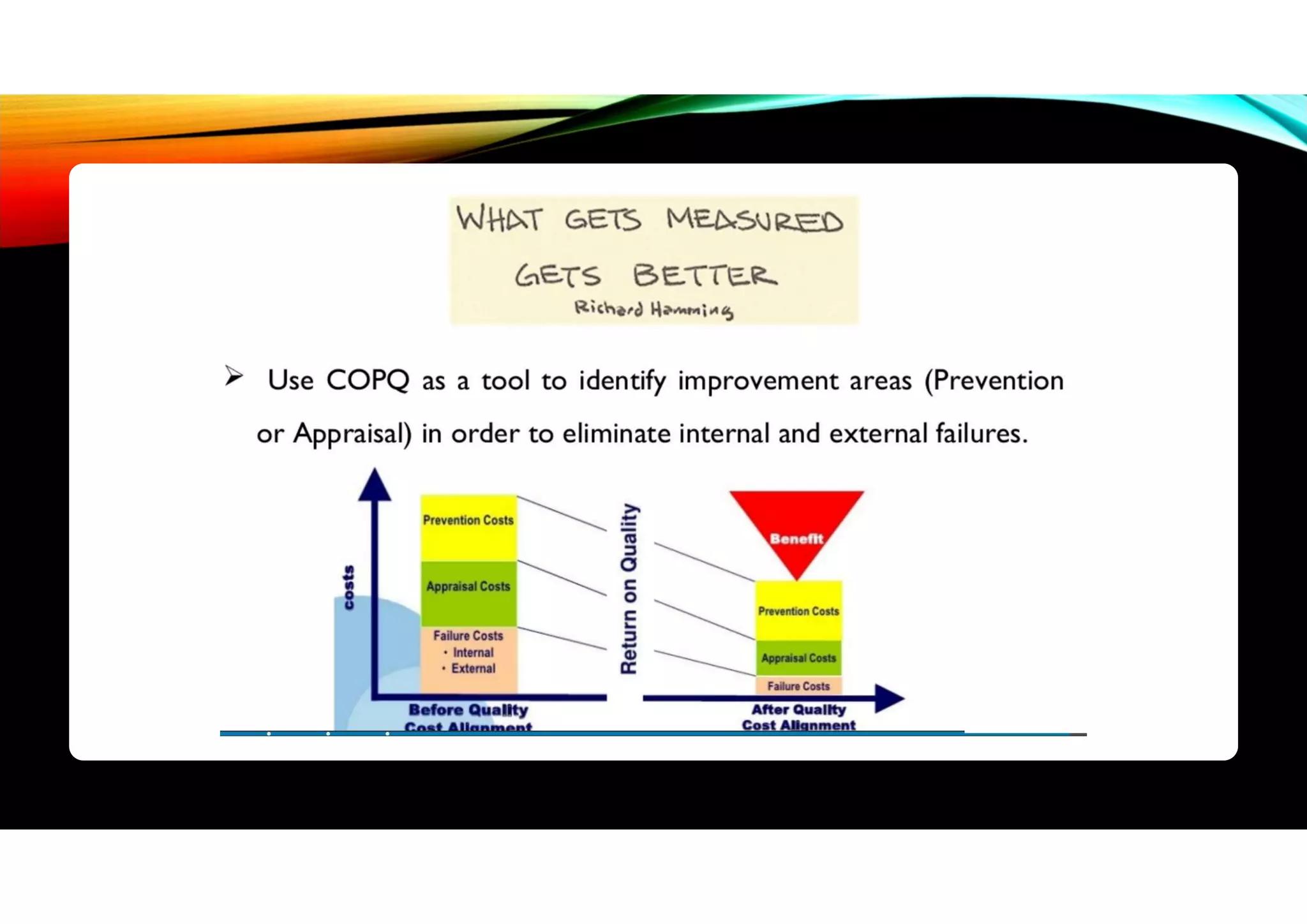

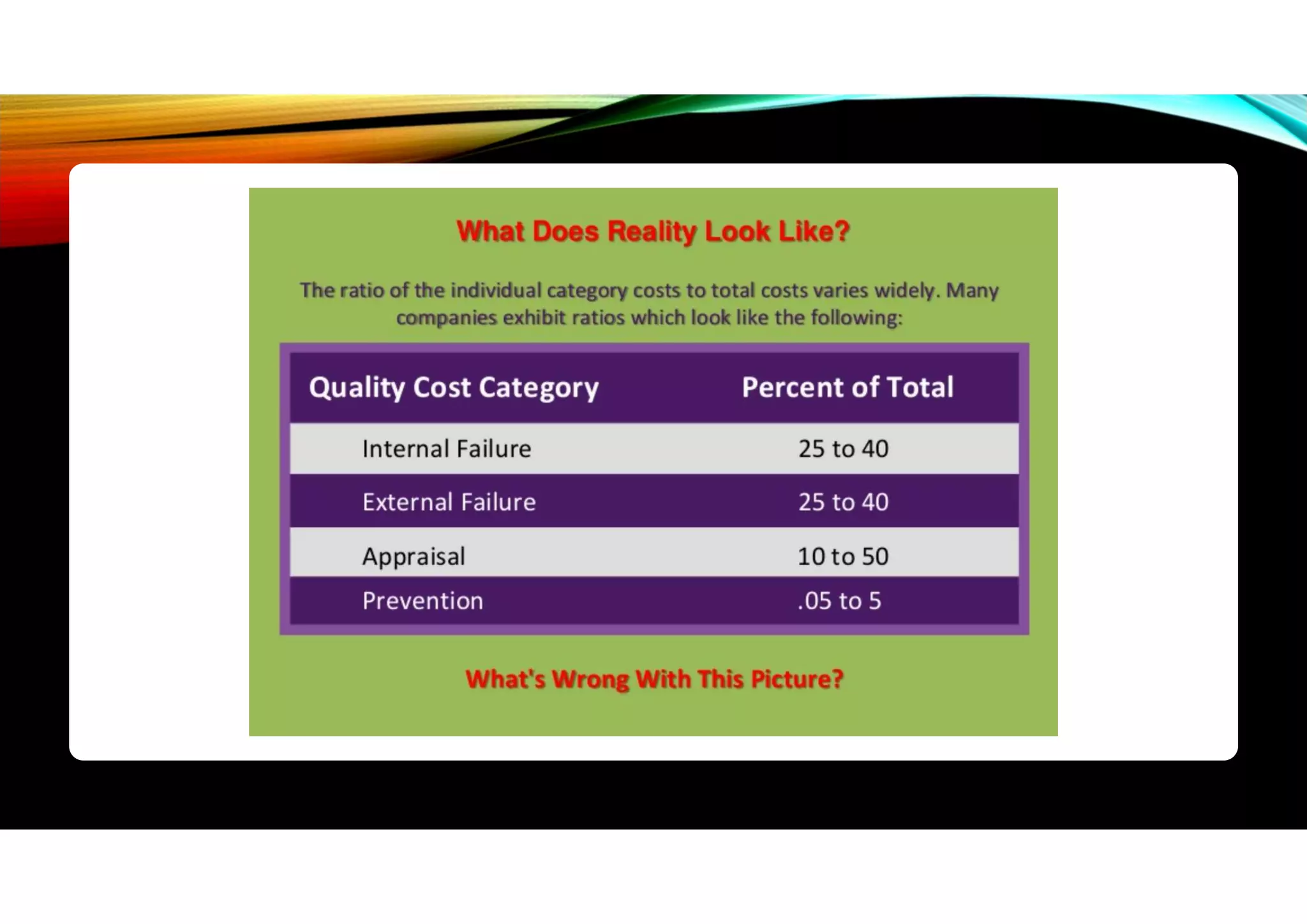

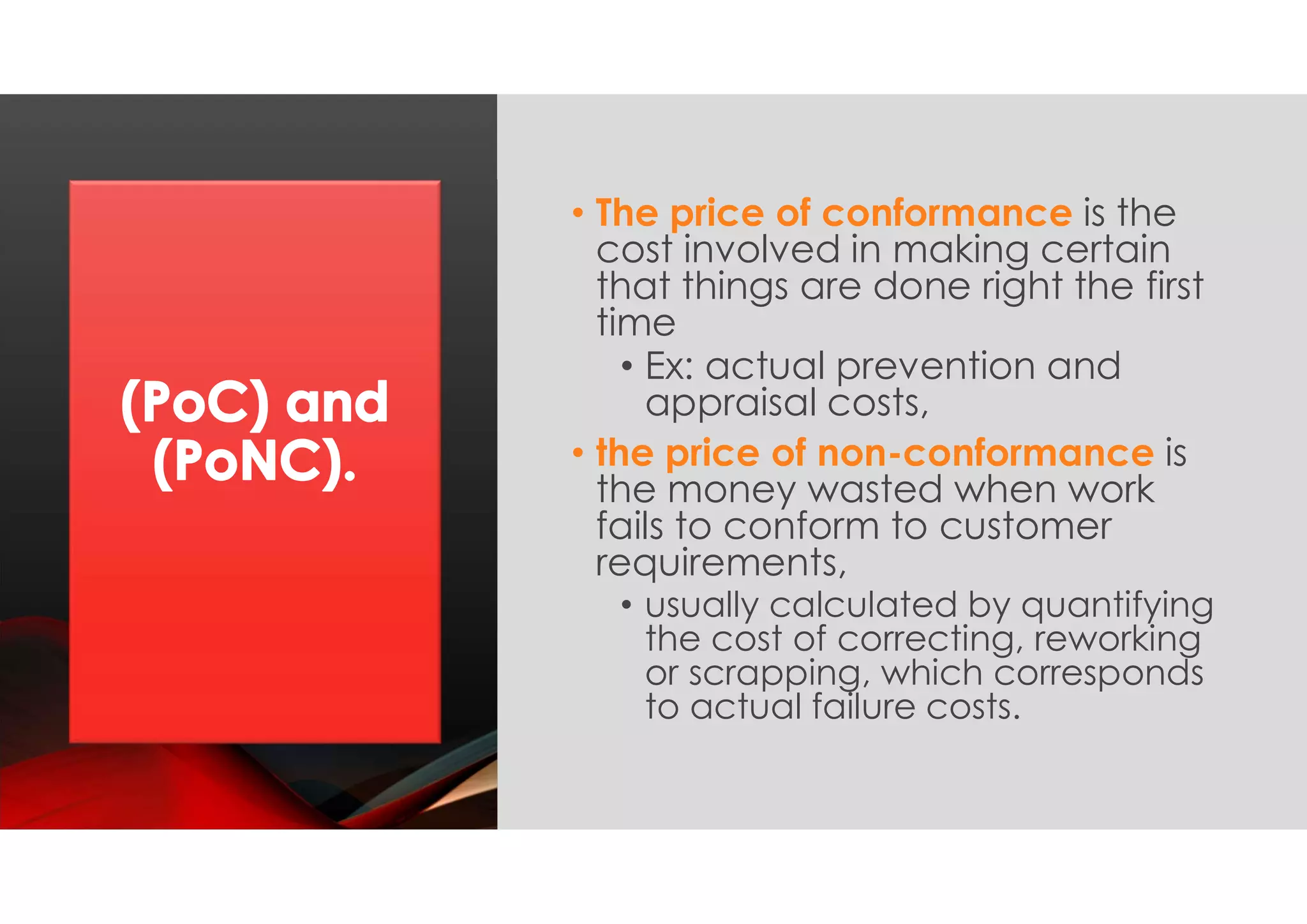

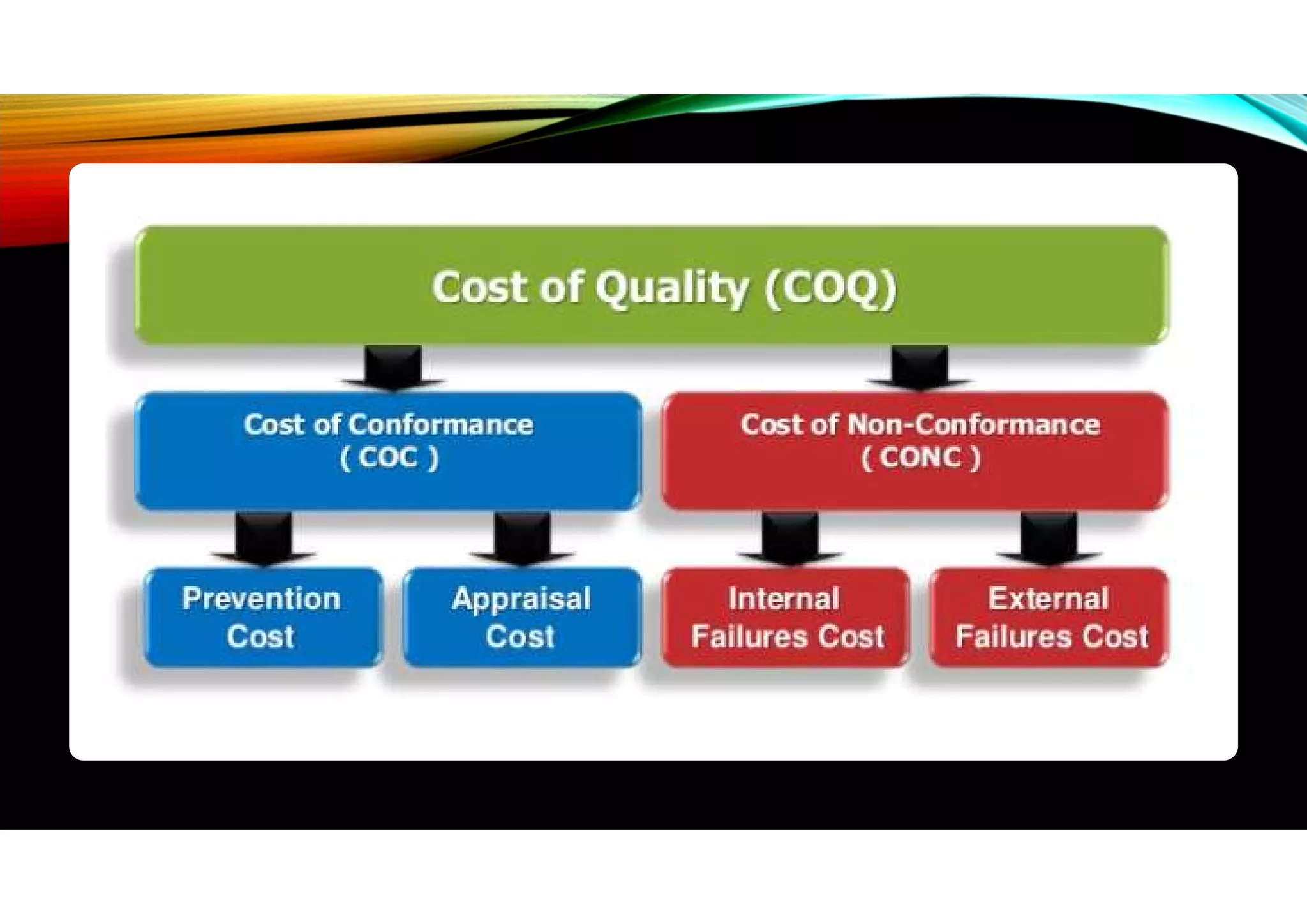

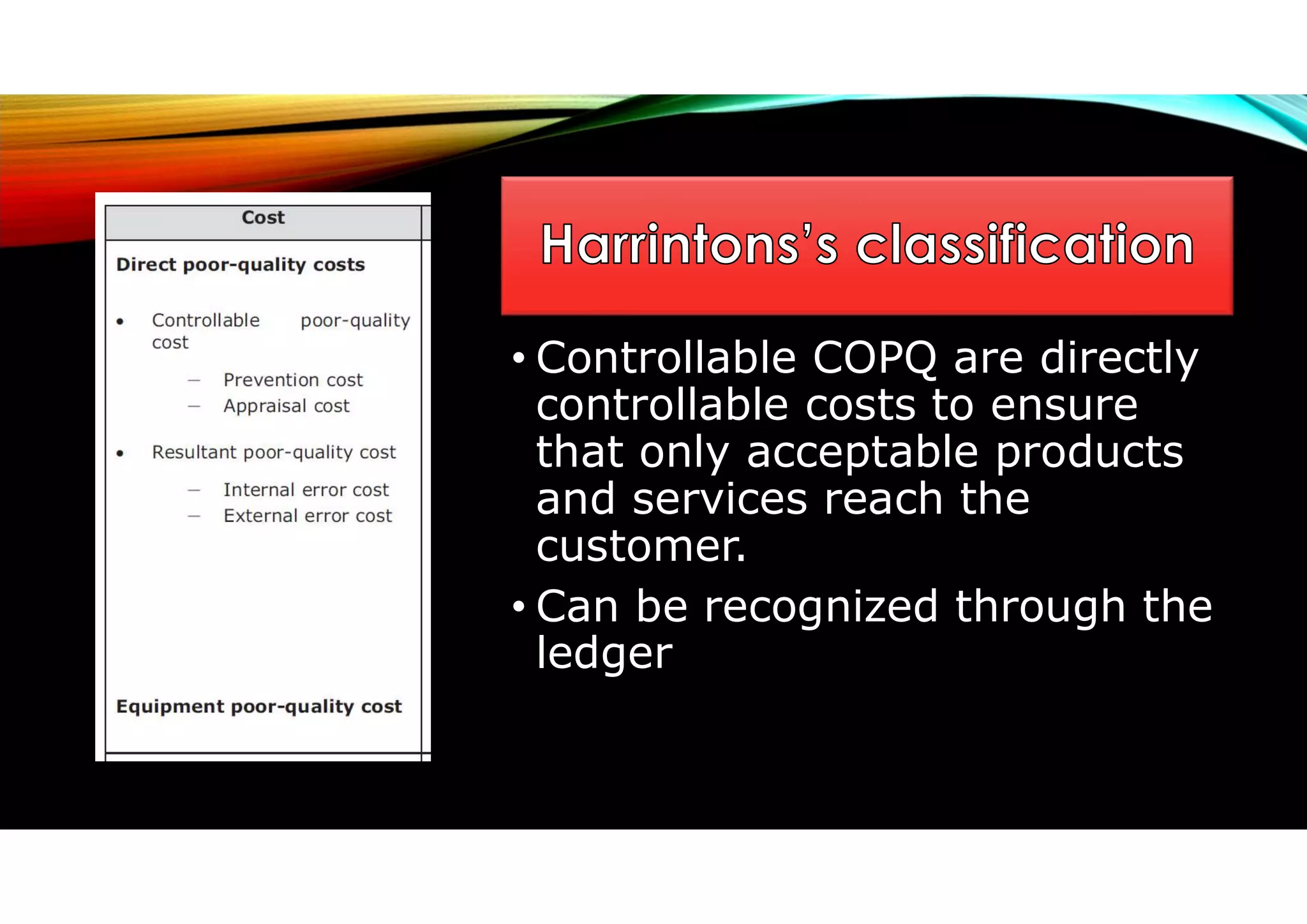

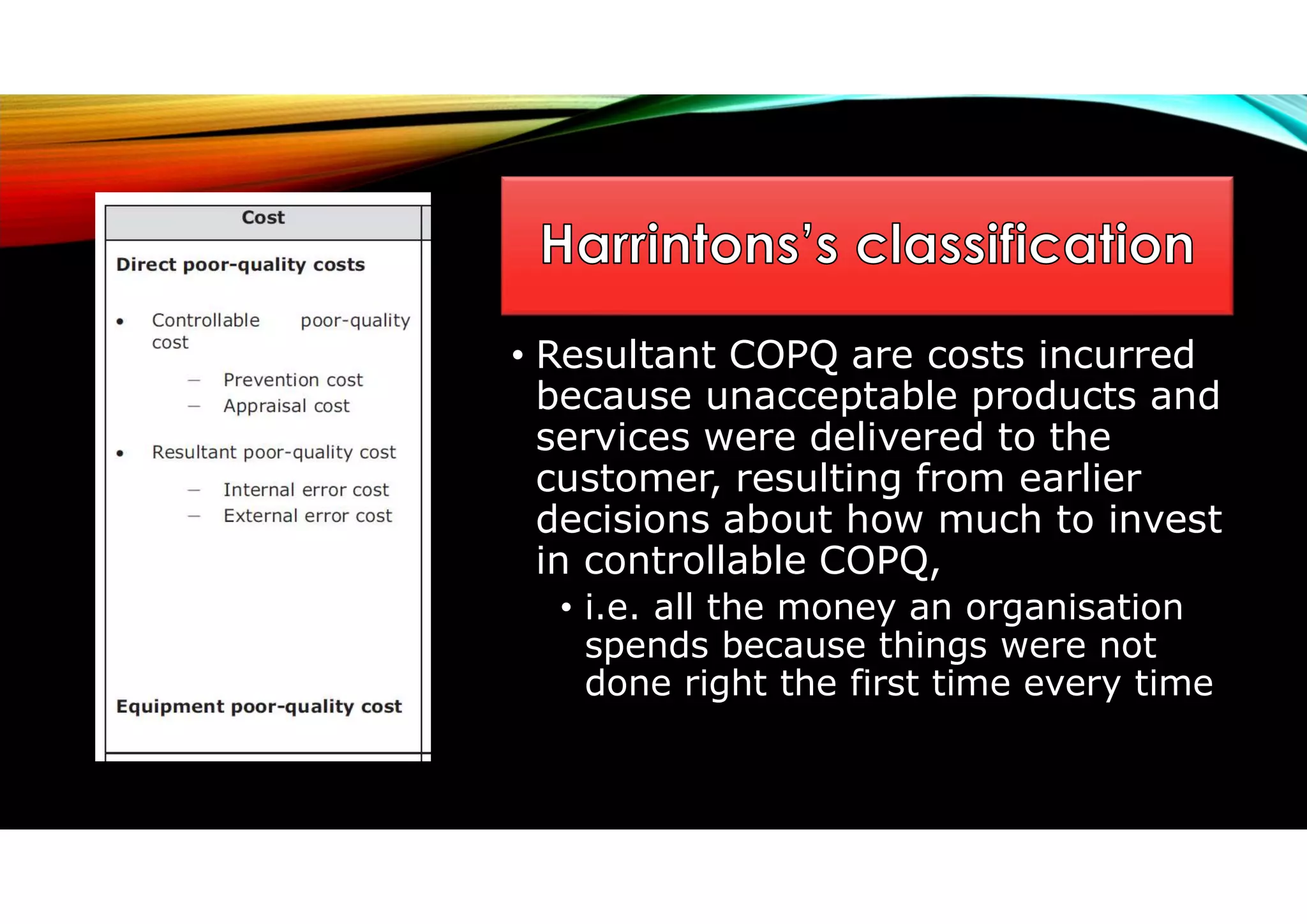

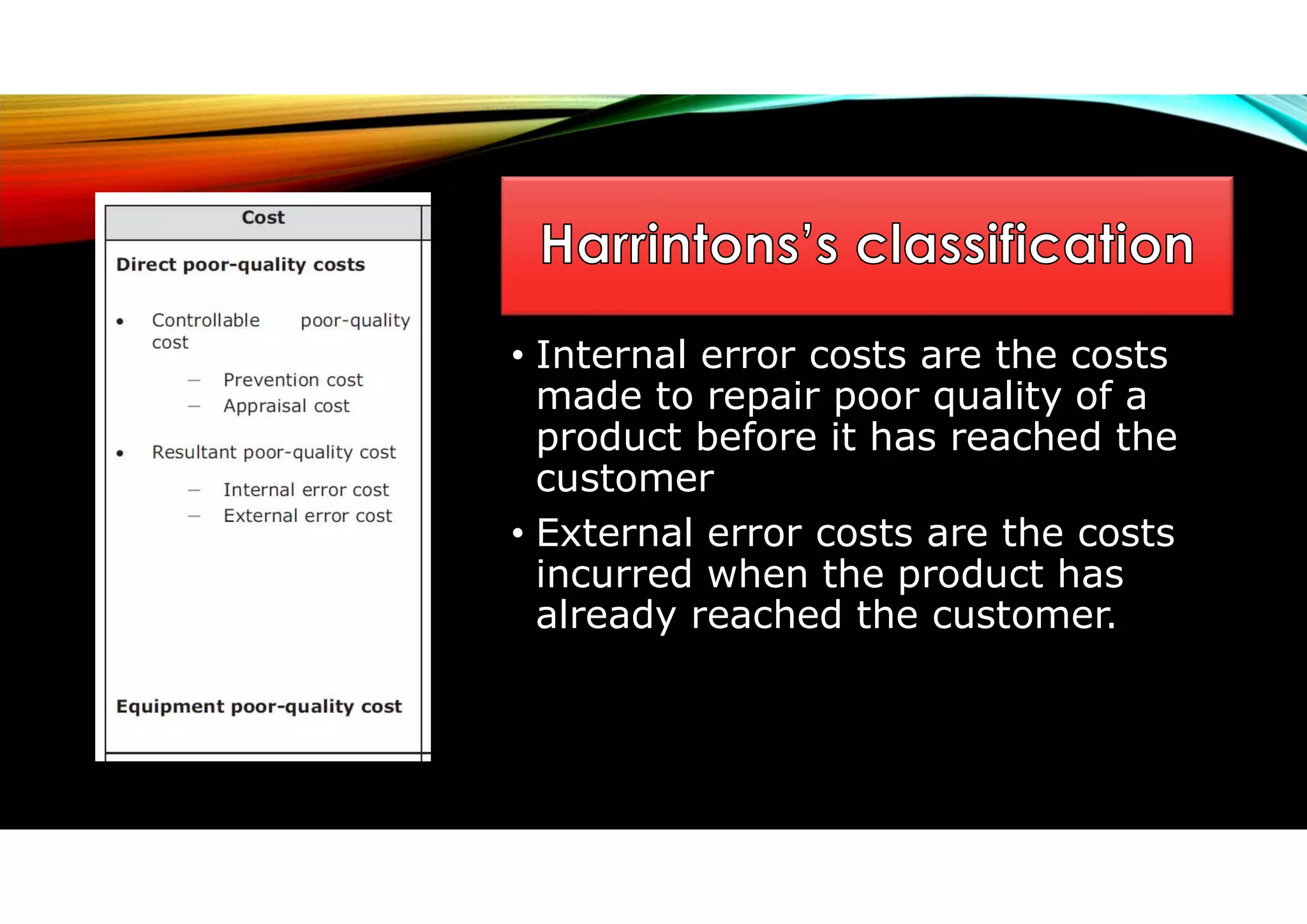

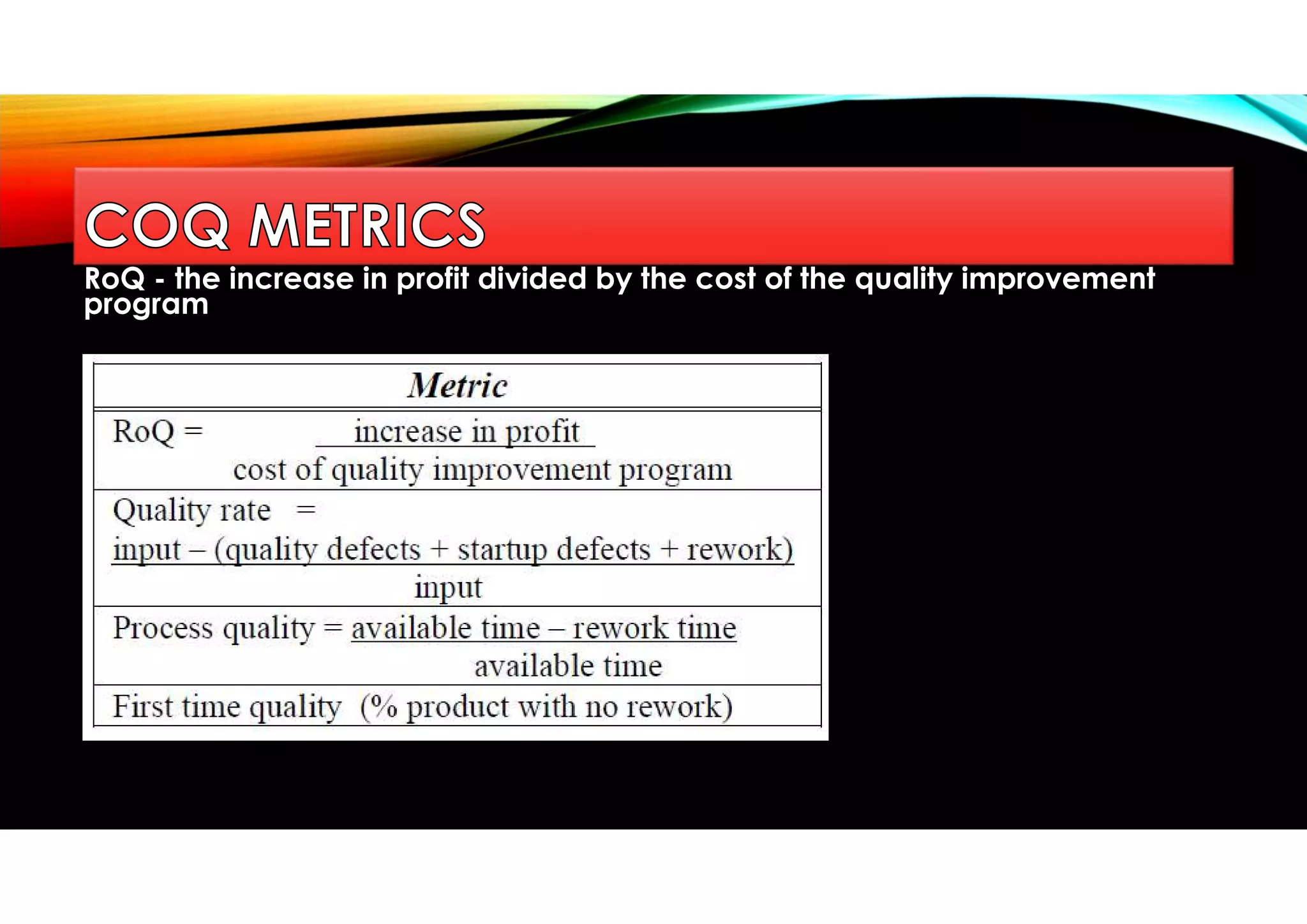

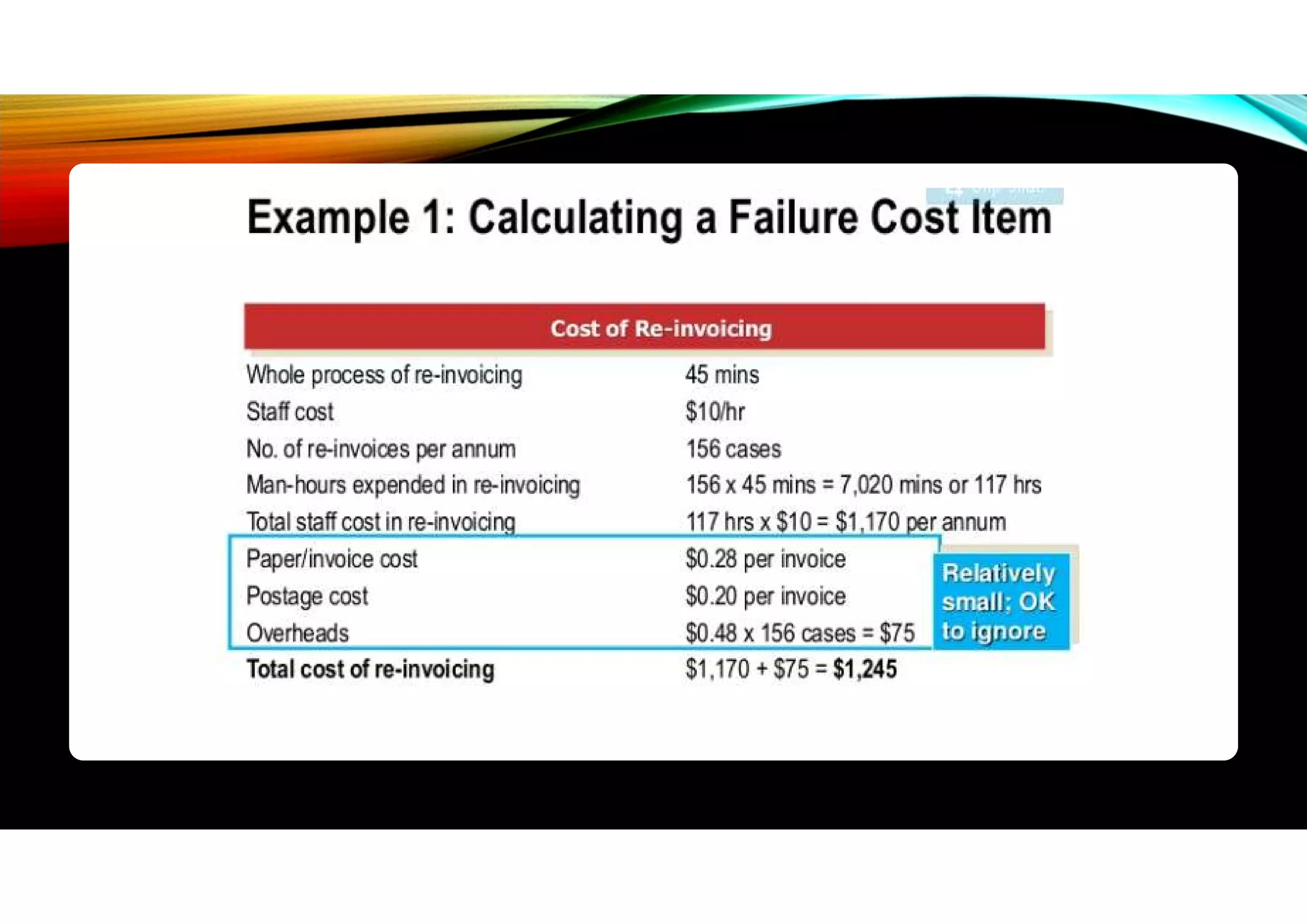

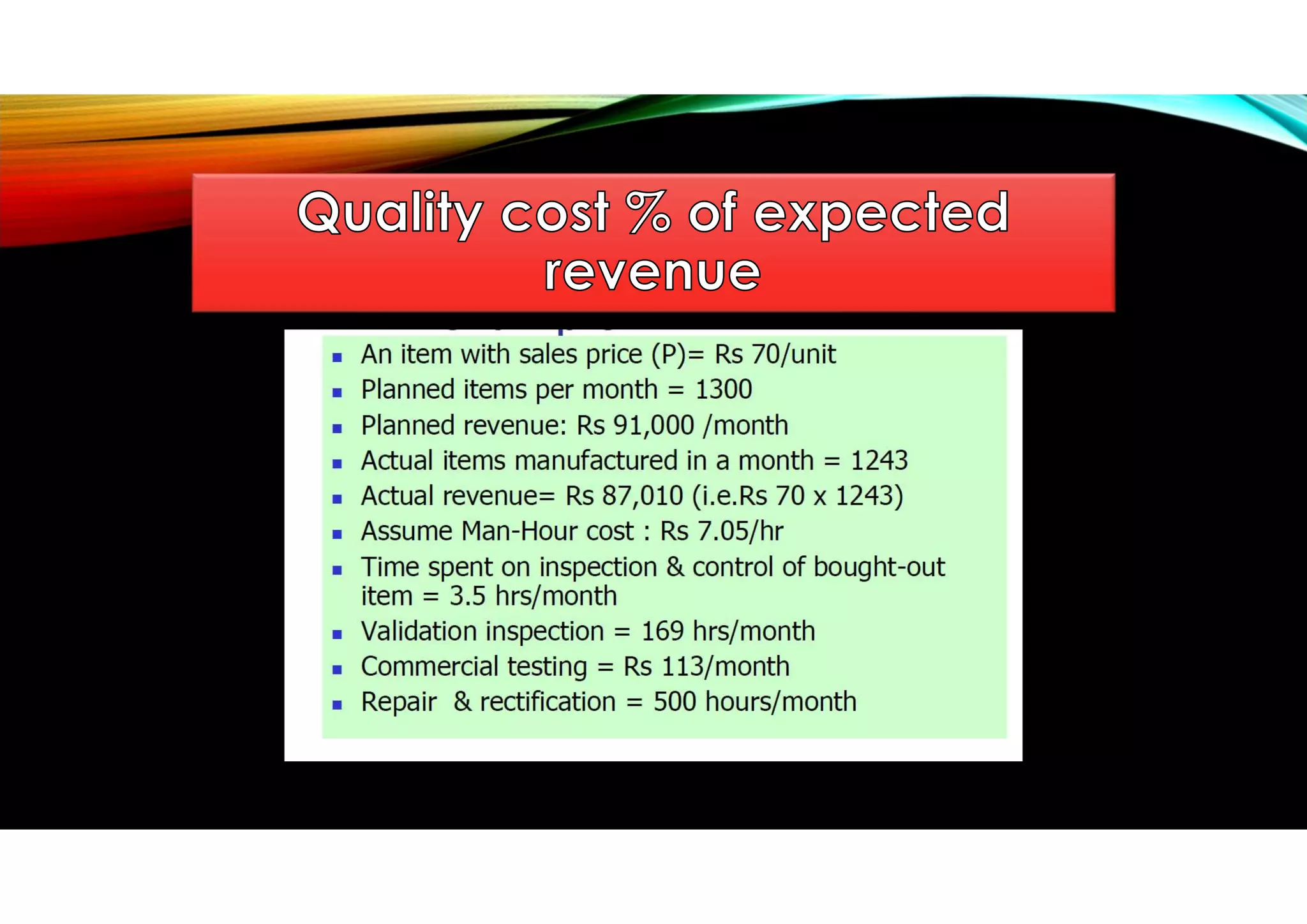

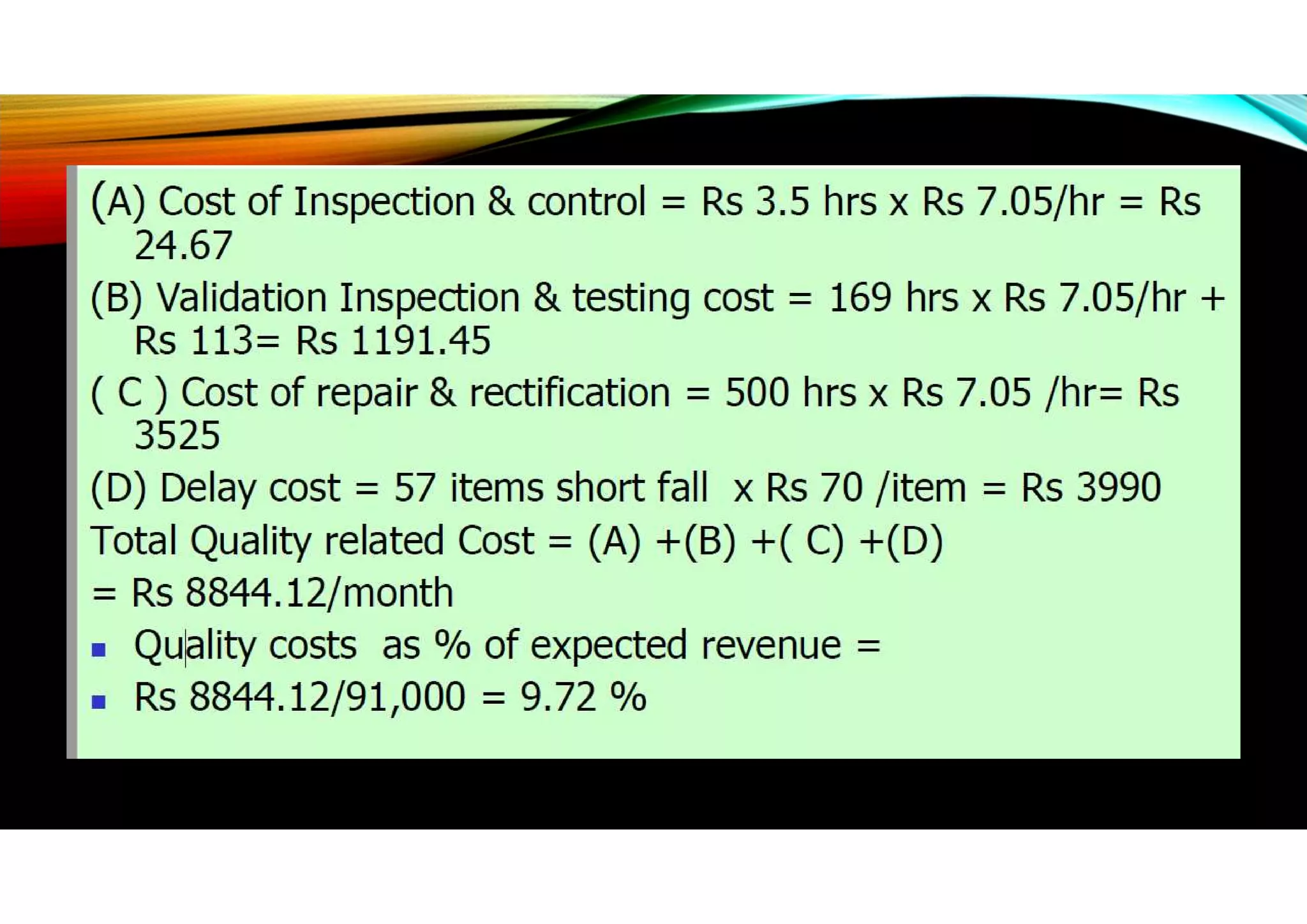

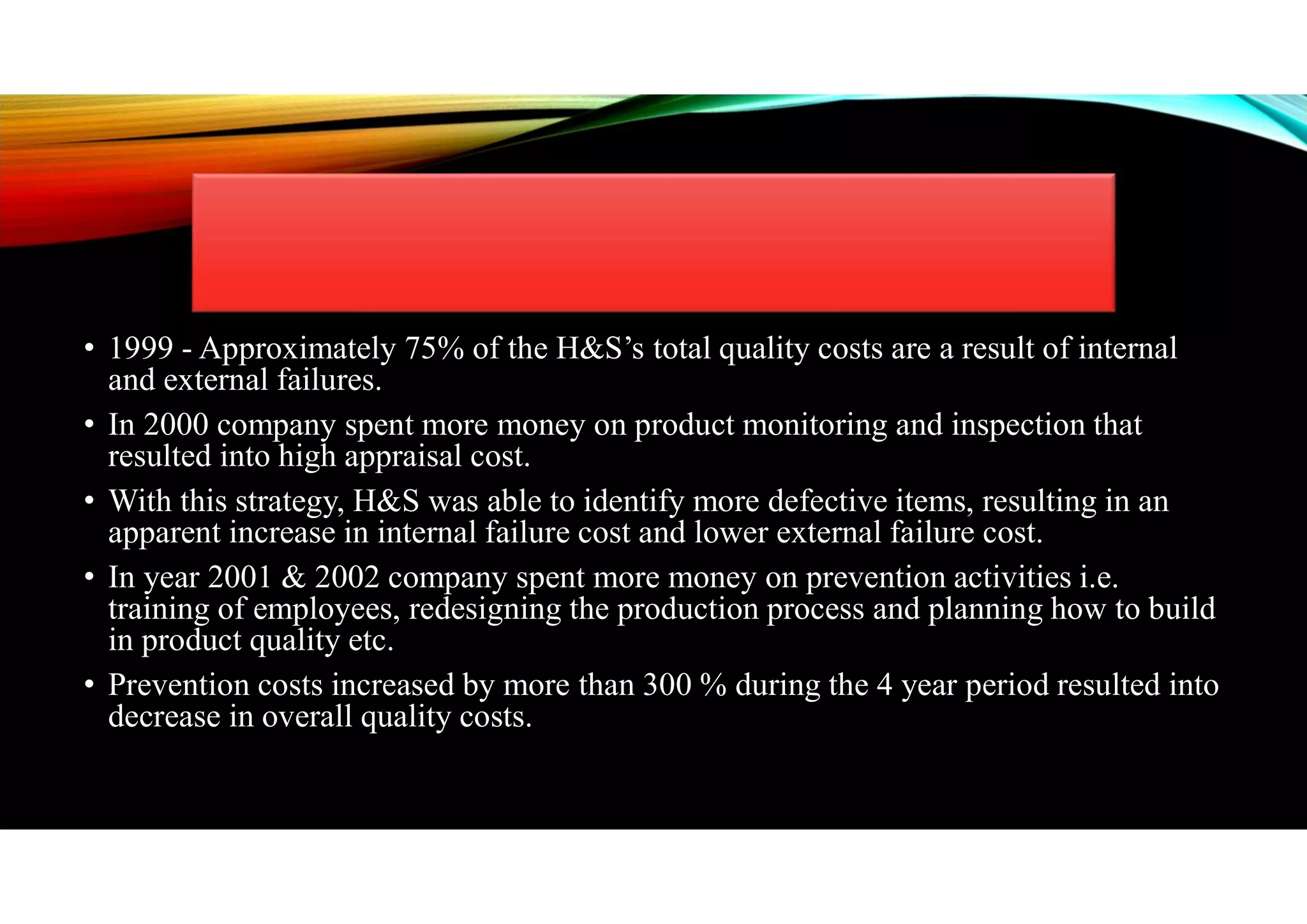

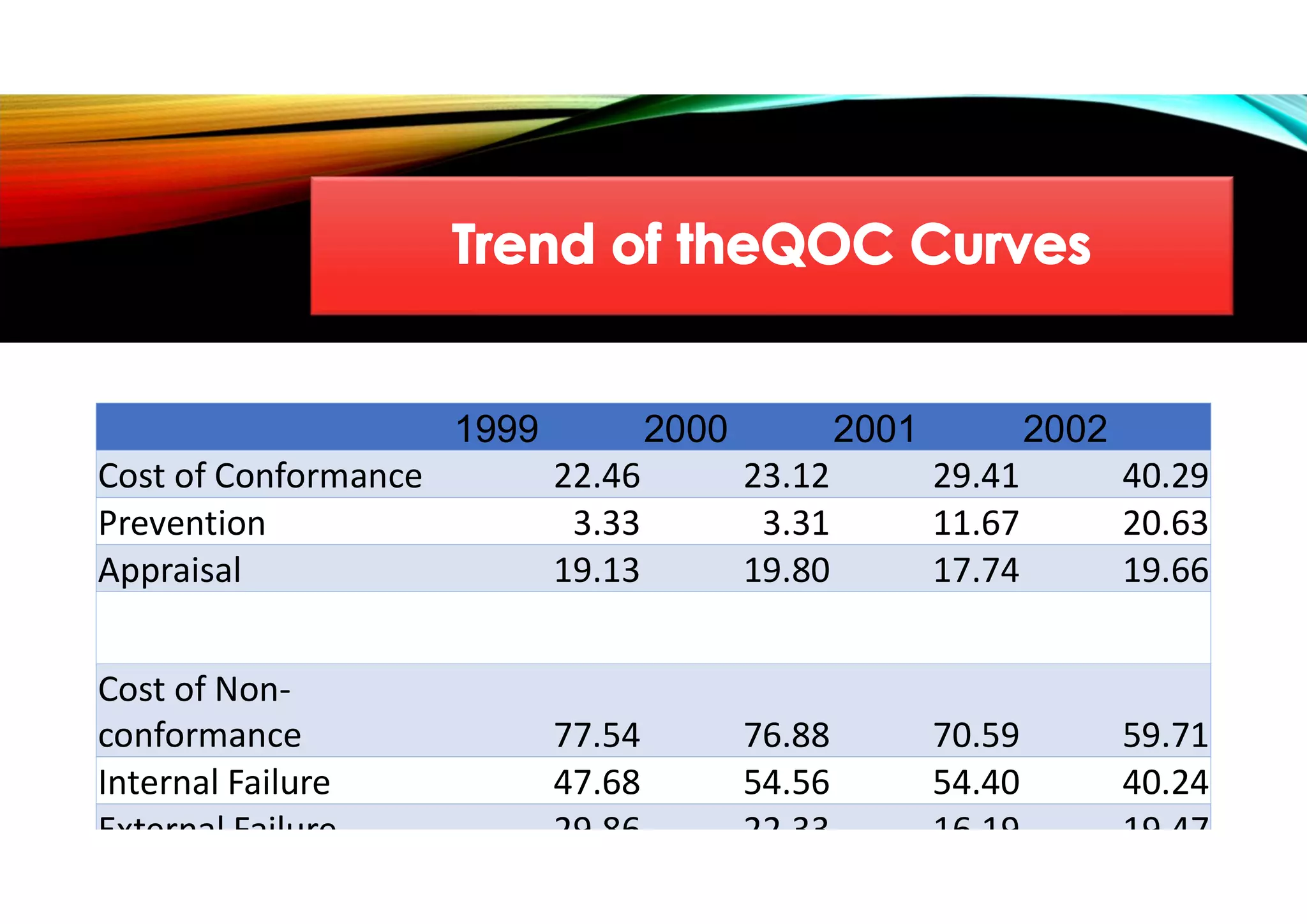

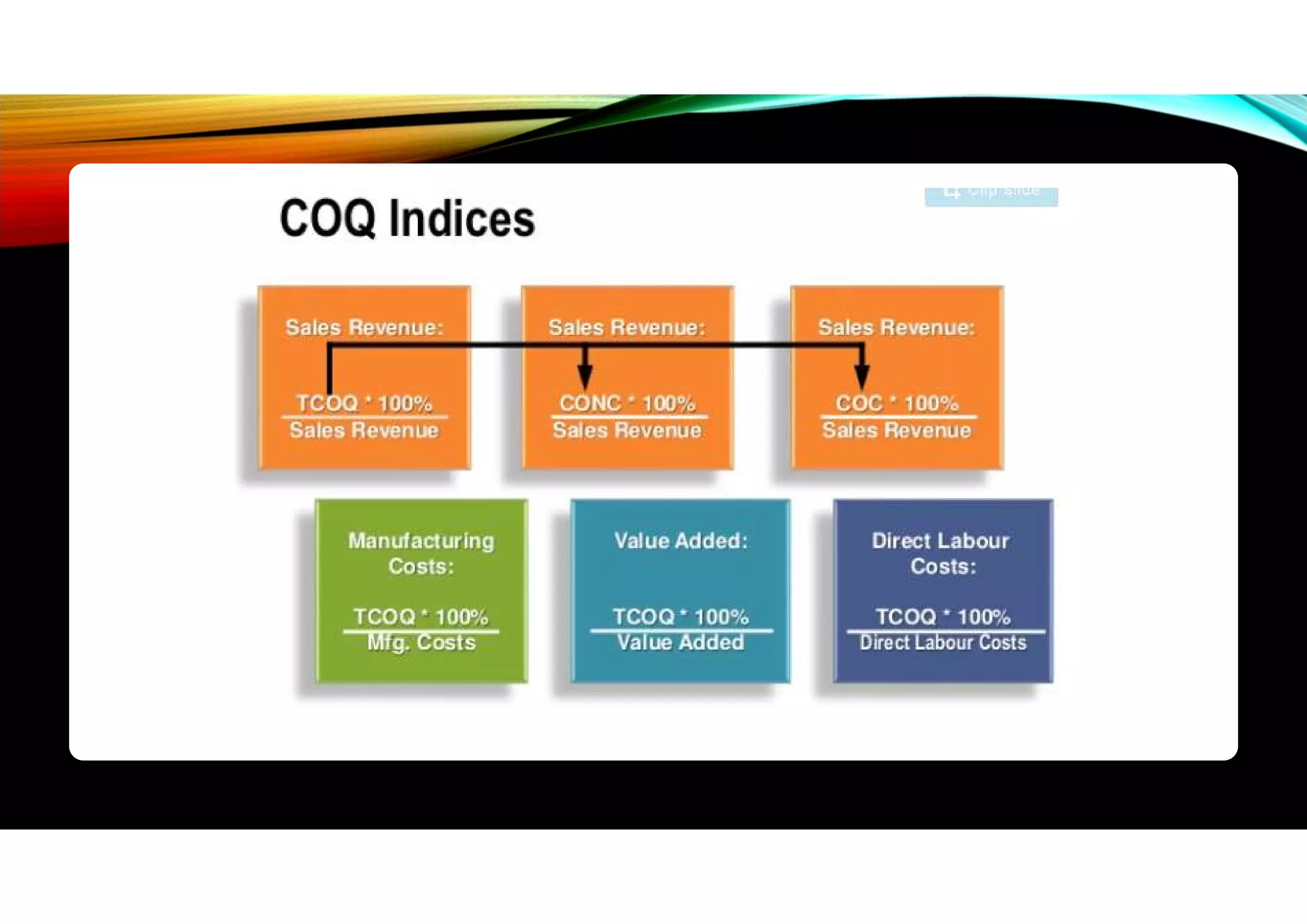

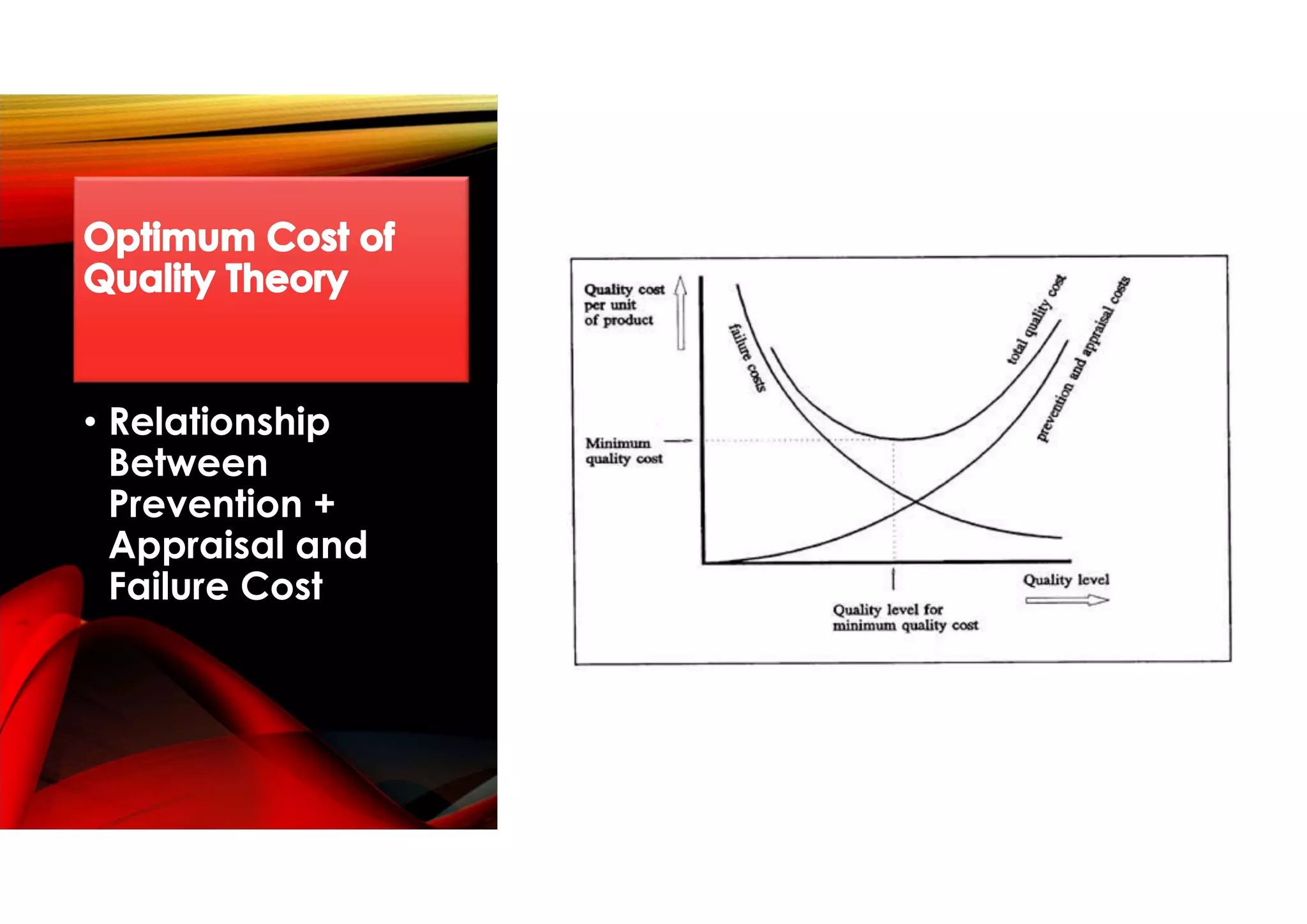

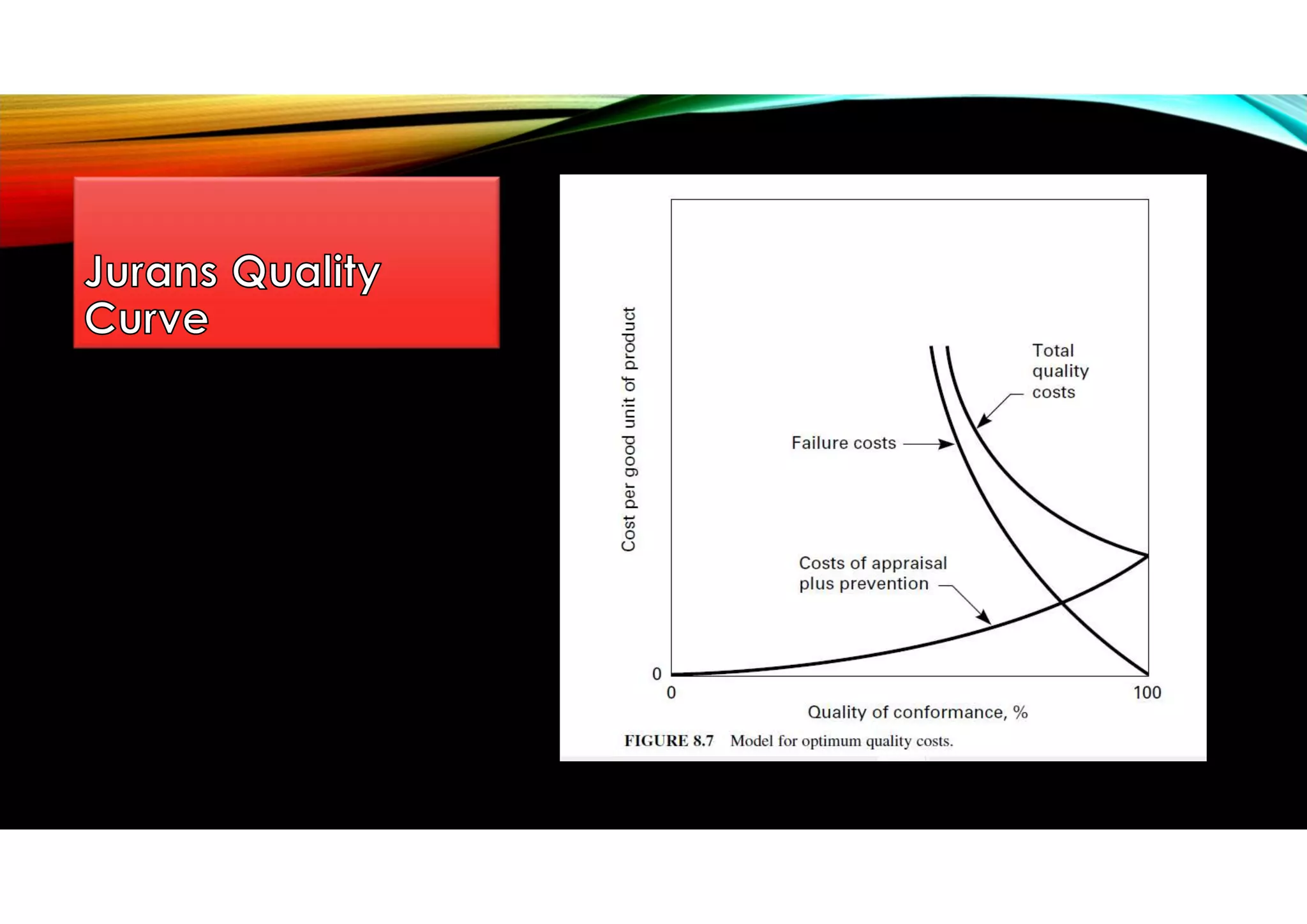

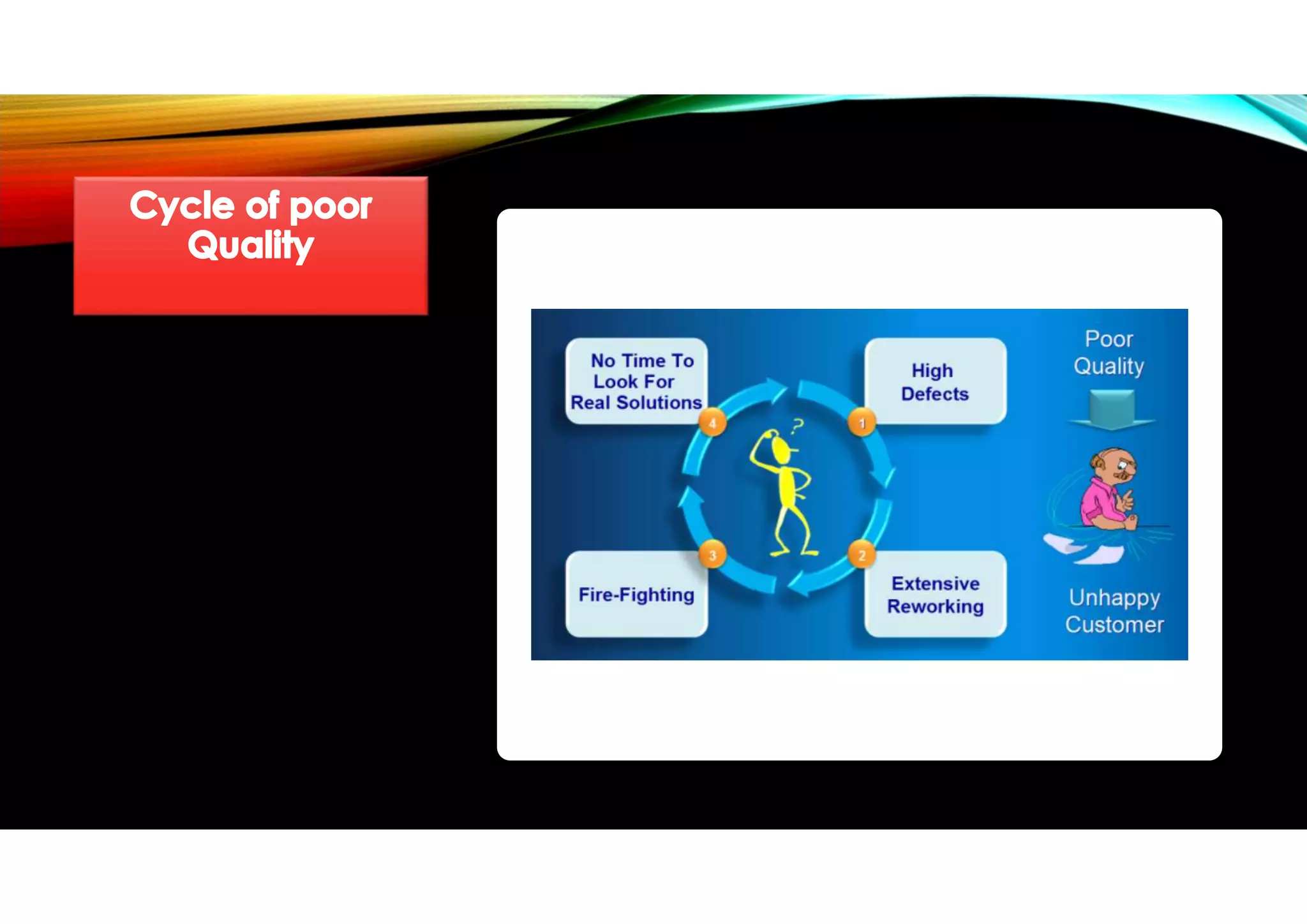

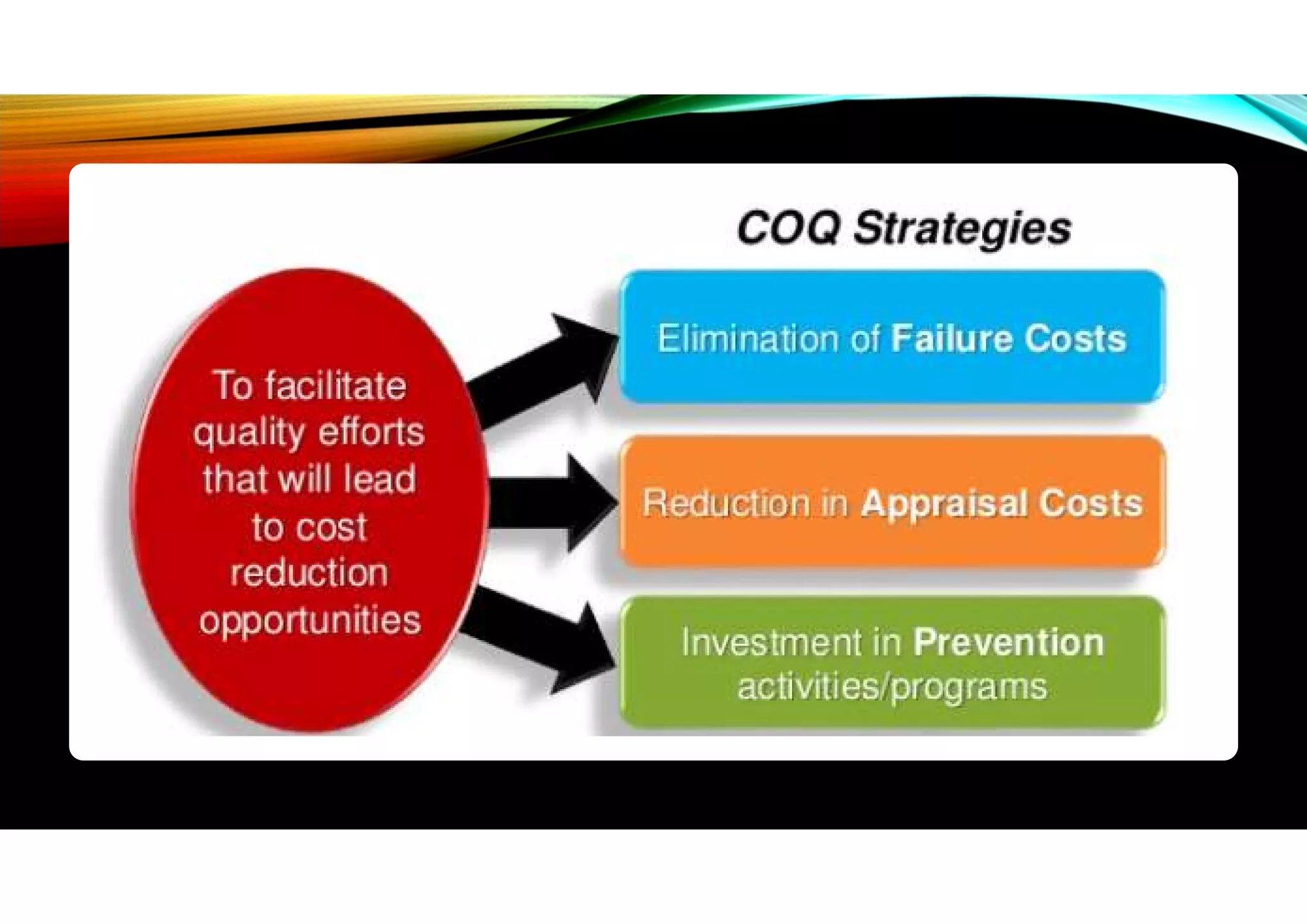

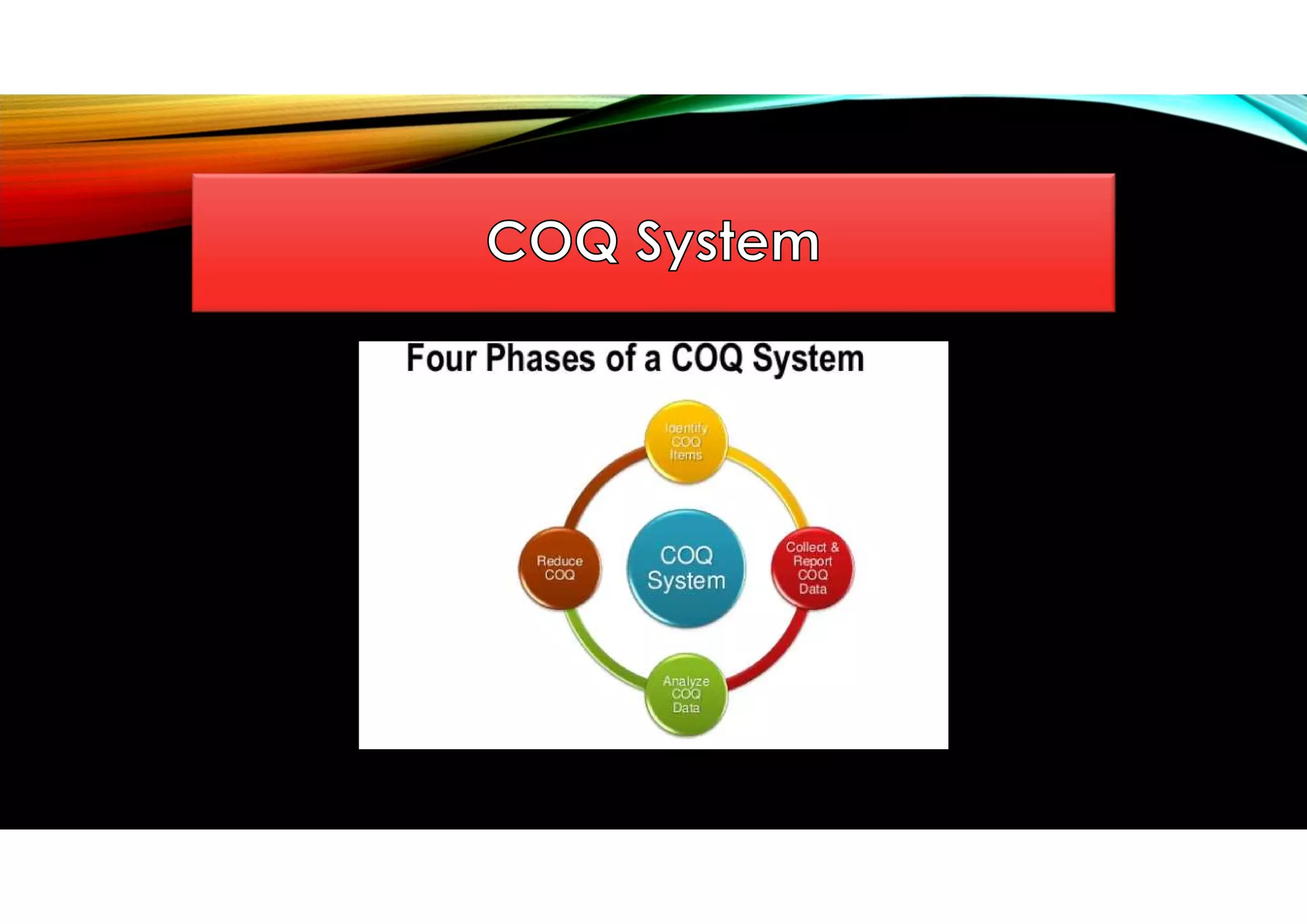

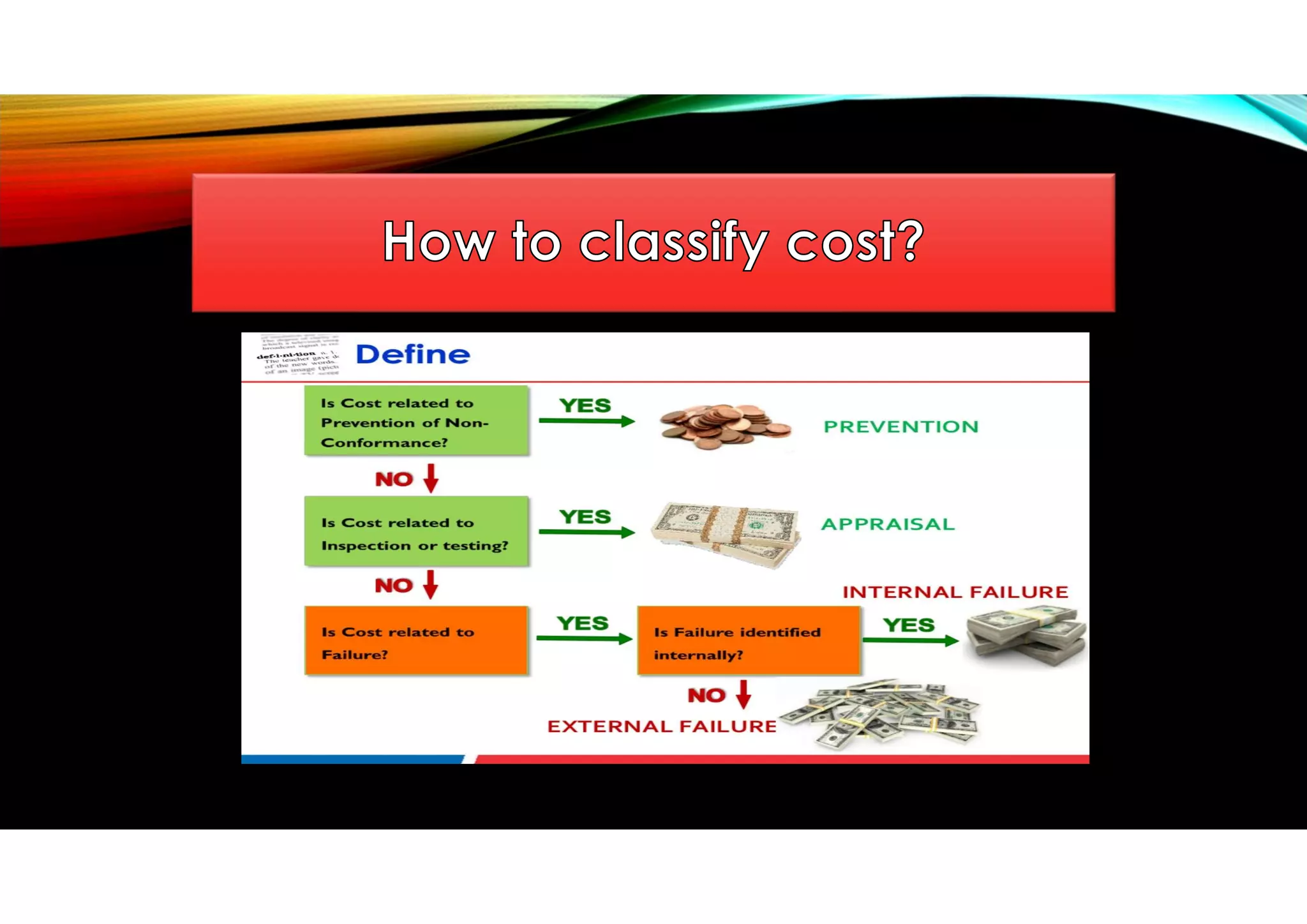

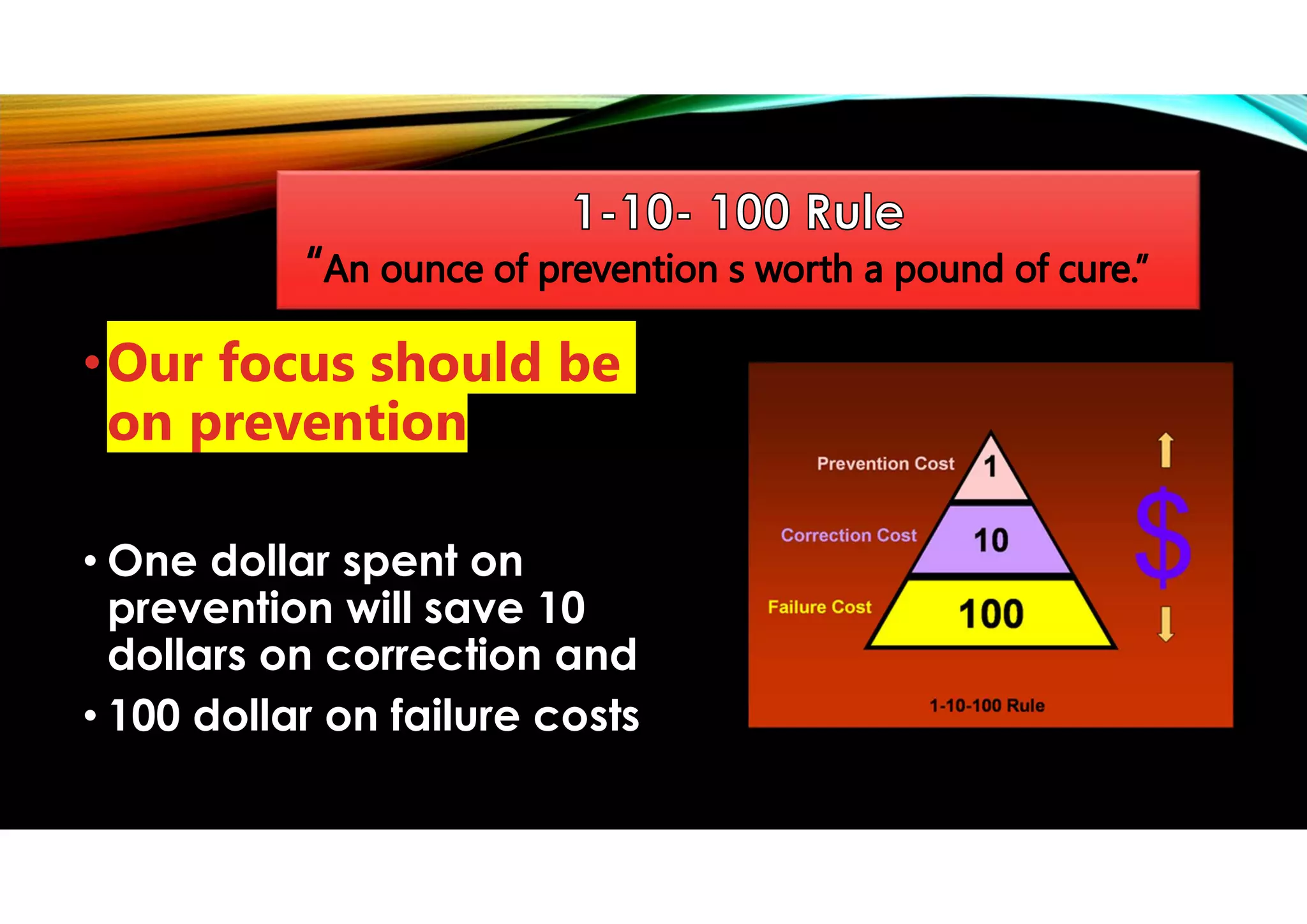

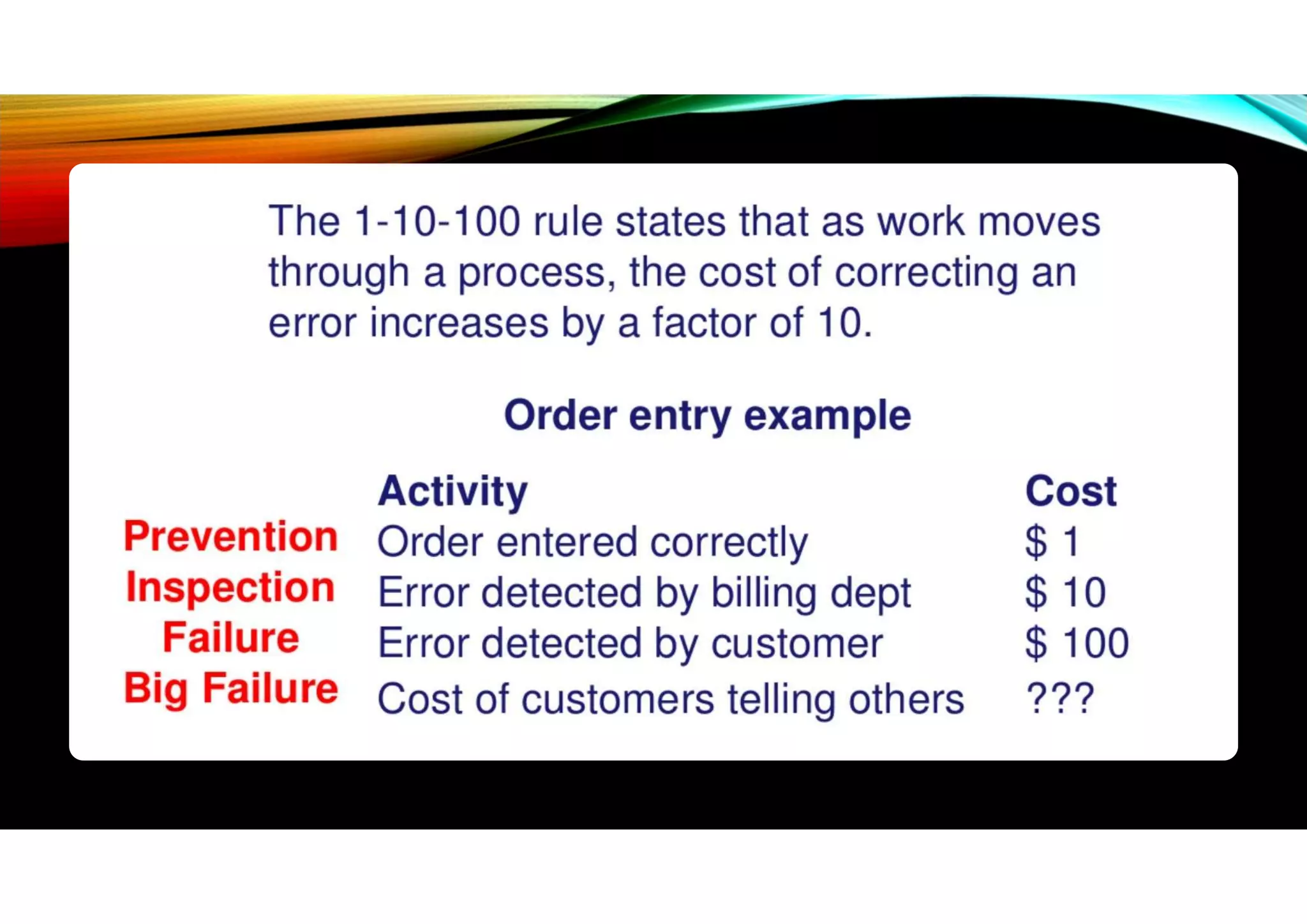

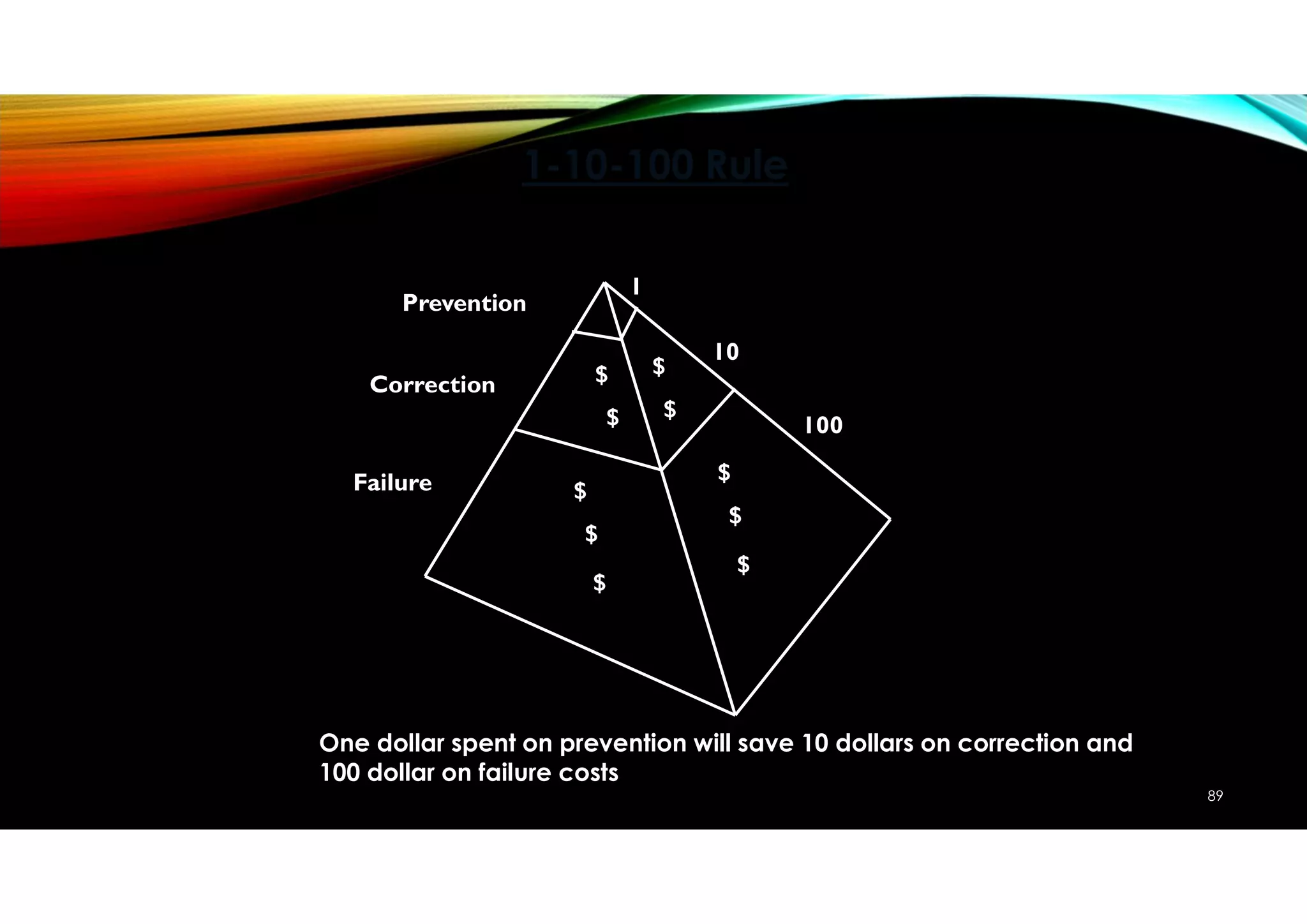

This document discusses cost of quality (CoQ) models and analysis. It begins by outlining the key topics to be covered, including defining CoQ, presenting various CoQ models, analyzing CoQ, and applying CoQ strategy. Several CoQ models are then explained in more detail, such as the Prevention-Appraisal-Failure model, Juran's model, and Harrington's model. The document concludes by discussing the relationship between prevention and appraisal costs and failure costs, with the goal of quality cost reduction through prevention activities.