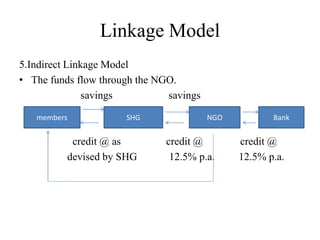

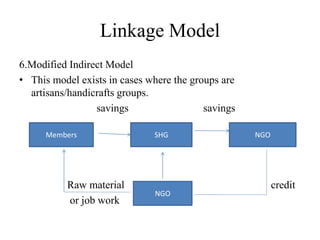

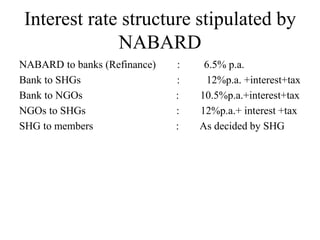

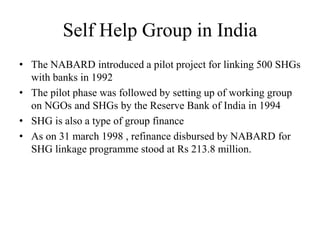

The document provides information about self-help groups (SHGs) in India. It discusses that SHGs are small, voluntary groups of rural poor that come together for savings, credit, and other financial services. It outlines the criteria for SHGs to be linked with banks, including being in existence for 6 months and having successfully undertaken savings and credit operations. It also describes the unique features of SHGs, such as collective decision making, providing financial services locally, and empowering poor individuals. Furthermore, it summarizes the role of NABARD in conceptualizing and piloting the SHG linkage program with banks in India.