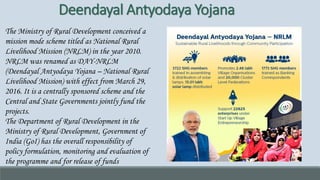

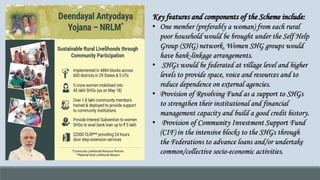

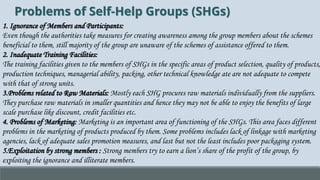

Self help groups are informal associations of financially weak individuals that are created to benefit group members. They are typically formed with 10-20 local people from similar backgrounds. The main purpose is to develop the socio-economic conditions of members. Government programs aim to empower women and support economic development through self help groups. Key features include small member size, common interests, equal rights, and maintaining monthly thrift savings. Self help groups provide important advantages like capacity building, mutual support, increased confidence and skills. Government schemes like DAY-NRLM provide funds and support to strengthen self help groups.