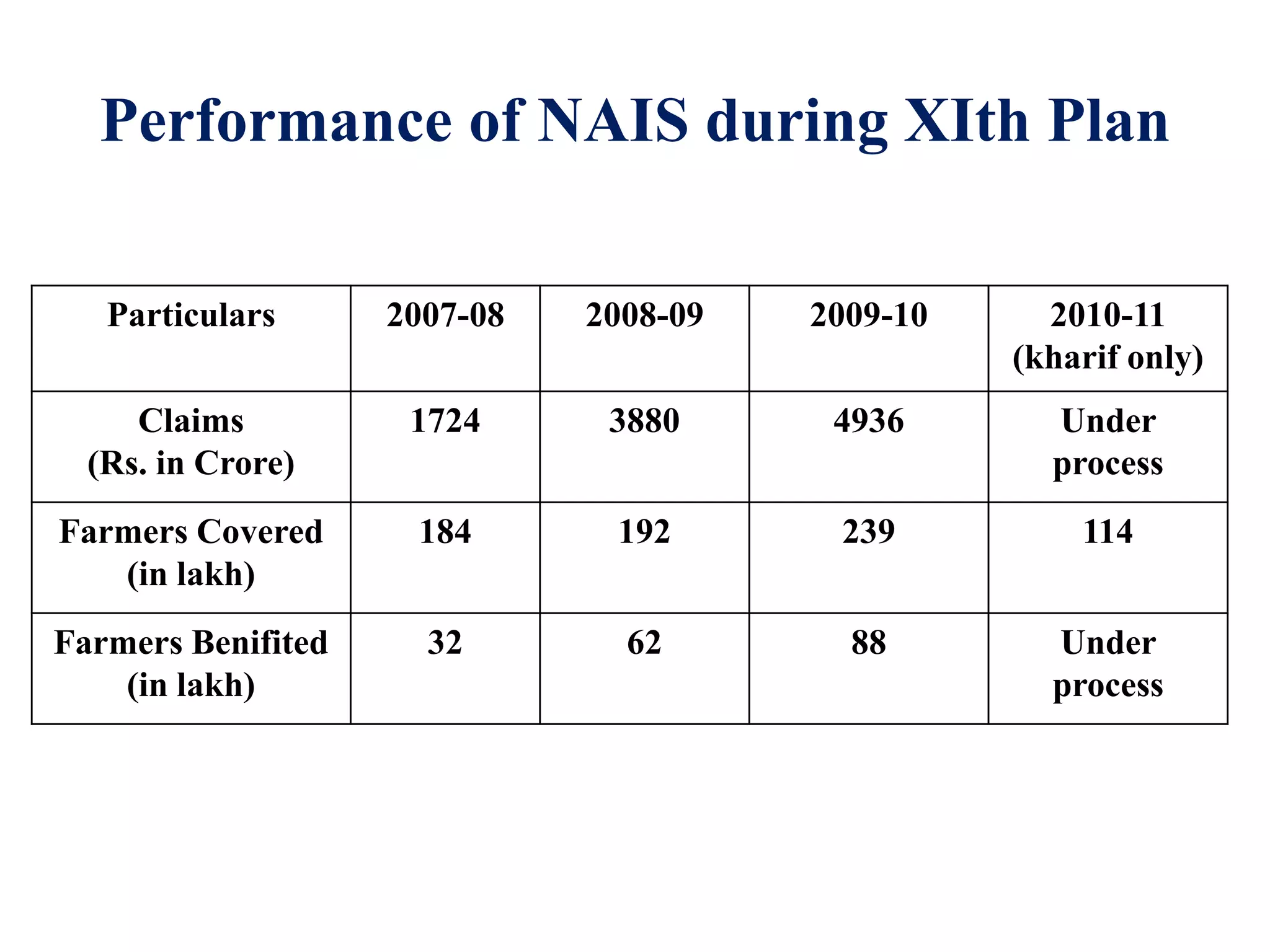

Crop insurance schemes have evolved in India over several decades to protect farmers from risks of crop failure. The current National Agricultural Insurance Scheme (NAIS) was launched in 1999 and makes crop insurance compulsory for loan-taking farmers. It covers lower premiums but has limitations like delayed claims, low compensation levels, and exclusion of certain risks. The Modified NAIS launched in 2010 uses actuarial premiums with government subsidies to make premiums affordable for farmers. It aims to address some issues but challenges remain in accurately designing insurance indices and assessing losses. Improving coverage levels, reducing assessment costs, and faster compensation are suggested to strengthen crop insurance for farmers.