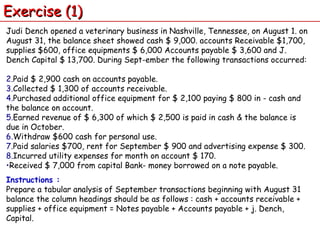

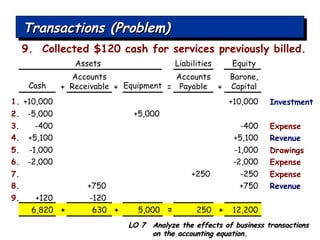

Judi Dench opened a veterinary business and recorded the following transactions in September:

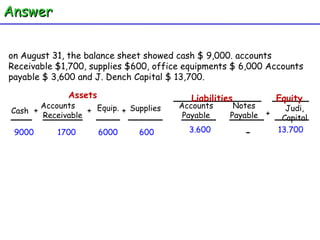

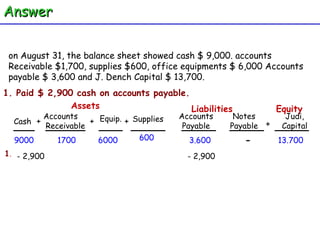

- Paid down accounts payable and collected on receivables.

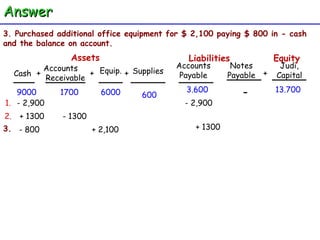

- Purchased new equipment with a mix of cash and credit.

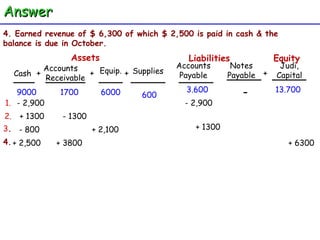

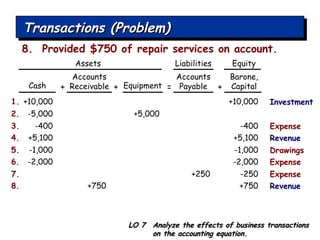

- Earned revenue and was paid in both cash and credit.

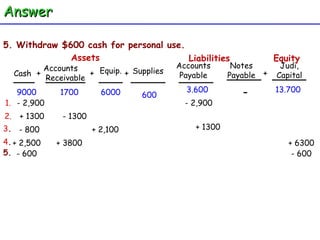

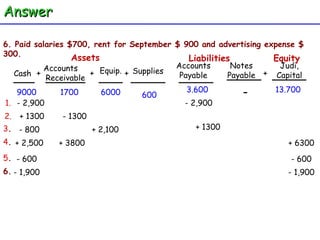

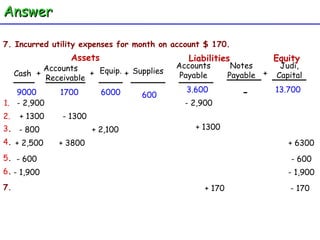

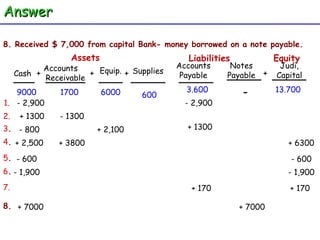

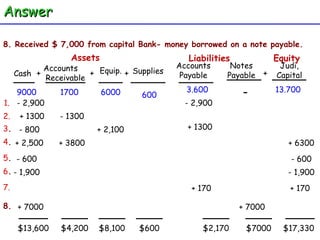

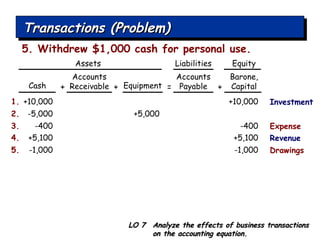

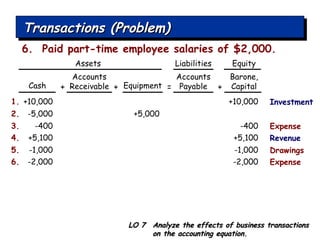

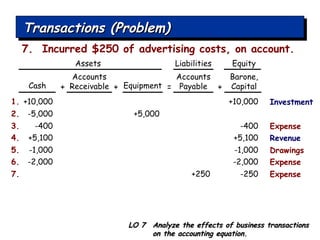

- Withdrew cash, paid expenses, and took out a bank loan.

![Principles Of Accounting (1) Chapter 1 Accounting In Action Mohamed Mahmoud [email_address] Tel: (+202) 33318449](https://image.slidesharecdn.com/section1-110108084753-phpapp02/85/Section-1-2-320.jpg)