This document provides an assignment classification table for Chapter 3 of Intermediate Accounting. It classifies the chapter's topics, questions, brief exercises, regular exercises, and problems by topic and learning objective. The table also describes the level of difficulty and estimated time to complete for each assignment. It includes 13 topics covered in the chapter and 10 learning objectives. The document provides guidance for instructors on organizing assignments to help students learn the material.

![EXERCISE 3-10 (25–30 minutes)

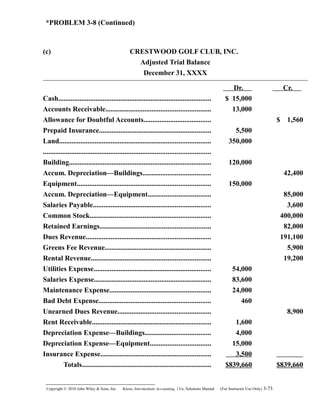

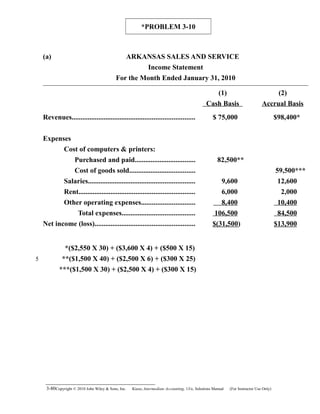

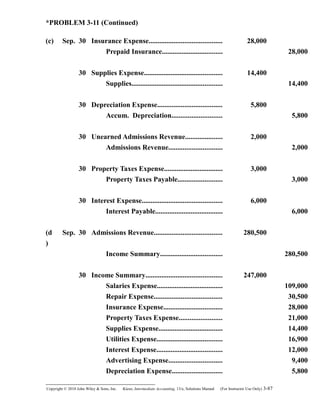

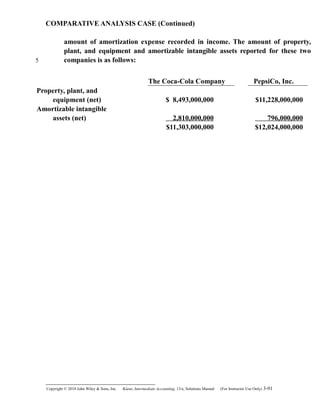

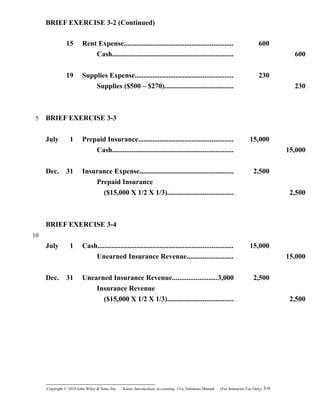

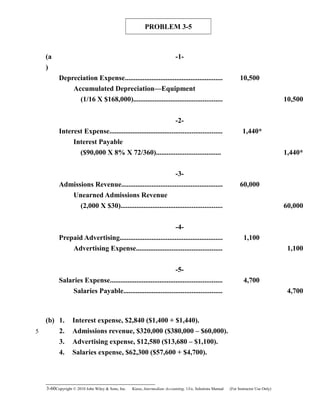

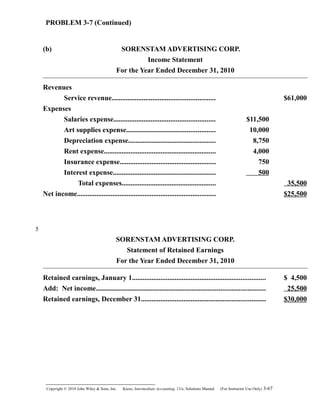

(a

)

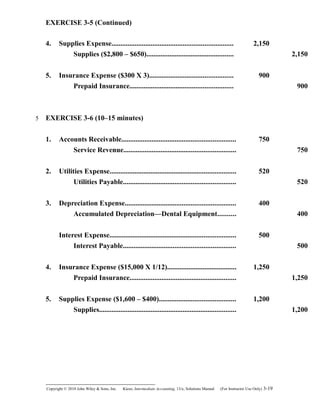

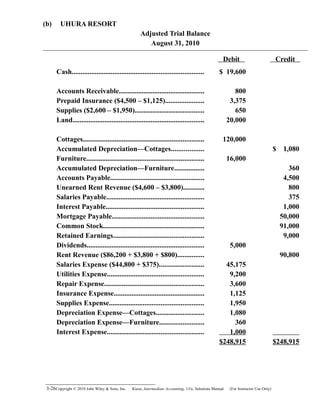

1. Aug. 31 Insurance Expense ($4,500 X 3/12)................ 1,125

Prepaid Insurance................................... 1,125

2. Aug. 31 Supplies Expense ($2,600 – $650)................... 1,950

Supplies..................................................... 1,950

3. Aug. 31 Depreciation Expense—Cottages................... 1,080

Accumulated Depreciation—

Cottages................................................. 1,080

($120,000 – $12,000 = $108,000;

$108,000 X 4% = $4,320 per year;

$4,320 X 3/12 = $1,080)

Aug. 31 Depreciation Expense—Furniture................. 360

Accumulated Depreciation—

Furniture............................................... 360

($16,000 – $1,600 = $14,400;

$14,400 X 10% = $1,440;

$1,440 X 3/12 = $360)

4. Aug. 31 Unearned Rent Revenue................................. 3,800

Rent Revenue........................................... 3,800

5. Aug. 31 Salaries Expense.............................................. 375

Salaries Payable....................................... 375

6. Aug. 31 Accounts Receivable........................................ 800

Rent Revenue........................................... 800

7. Aug. 31 Interest Expense............................................... 1,000

Interest Payable

[($50,000 X 8%) X 3/12]...................... 1,000

3-24Copyright © 2010 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 13/e, Solutions Manual (For Instructor Use Only)](https://image.slidesharecdn.com/ch03-150215110944-conversion-gate01/85/Ch03-24-320.jpg)

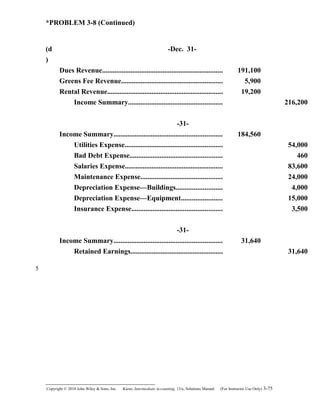

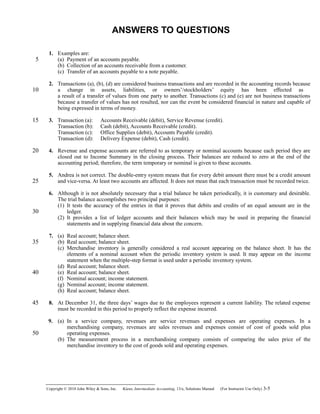

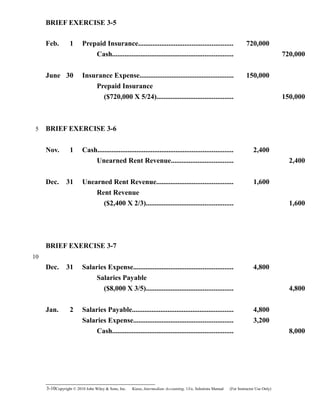

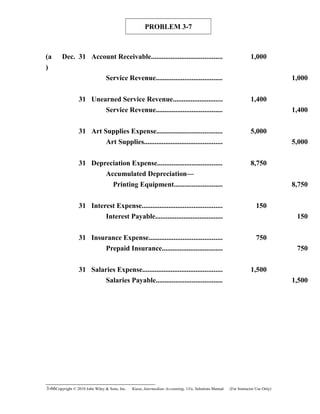

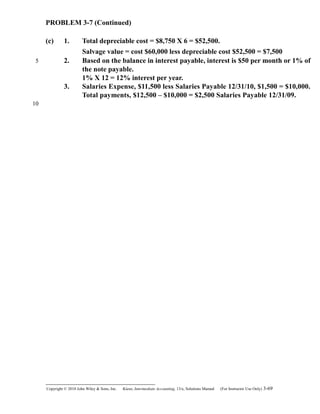

![*PROBLEM 3-8 (Continued)

Salaries Payable Unearned Dues Revenue

Adj. 3,600 Adj. 8,900

Equipment

Bal

.

150,000

(b

)

-1-

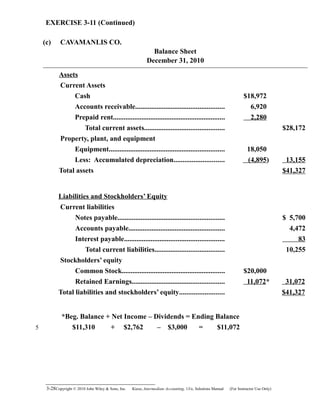

Depreciation Expense—Buildings.................................. 4,000

Accumulated Depreciation—Buildings

(1/30 X $120,000).................................................. 4,000

-2-

Depreciation Expense—Equipment............................... 15,000

Accumulated Depreciation—Equipment

(10% X $150,000)................................................. 15,000

-3-

Insurance Expense........................................................... 3,500

Prepaid Insurance.................................................... 3,500

-4-

Rent Receivable................................................................ 1,600

Rental Revenue

(1/11 X $17,600).................................................... 1,600

-5-

Bad Debt Expense............................................................ 460

Allowance for Doubtful Accounts

[($13,000 X 12%) – $1,100] ................................. 460

-6-

Salaries Expense............................................................... 3,600

Salaries Payable....................................................... 3,600

-7-

Dues Revenue.................................................................... 8,900

Unearned Dues Revenue......................................... 8,900

3-72Copyright © 2010 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 13/e, Solutions Manual (For Instructor Use Only)

5](https://image.slidesharecdn.com/ch03-150215110944-conversion-gate01/85/Ch03-72-320.jpg)