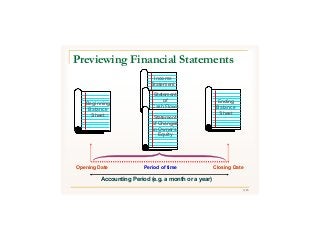

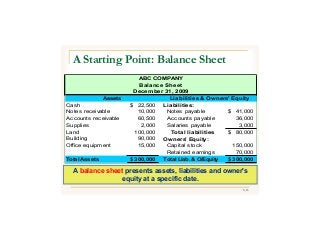

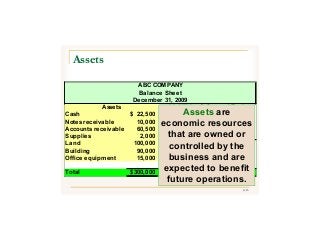

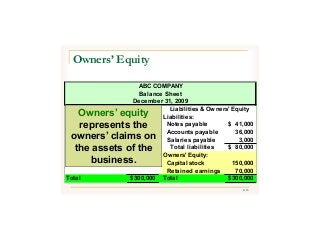

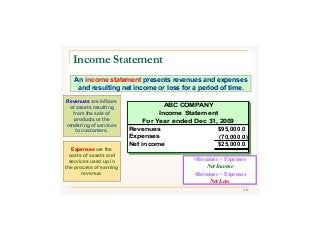

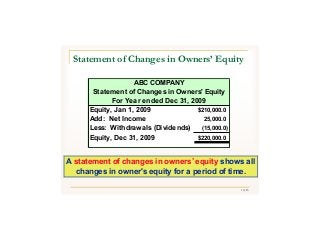

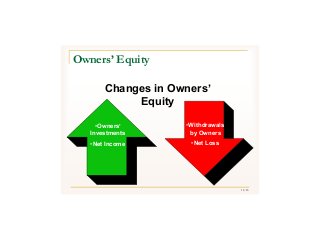

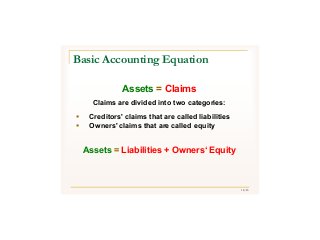

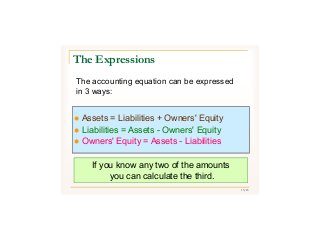

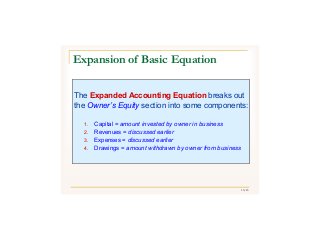

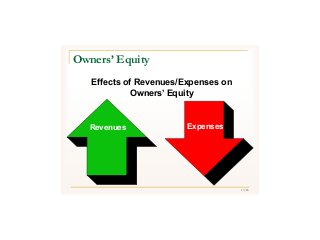

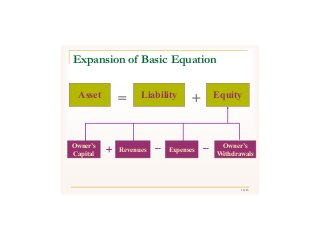

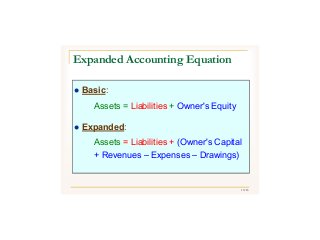

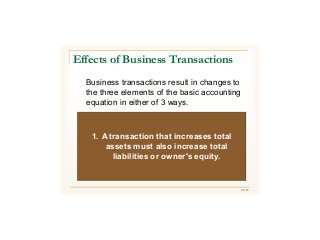

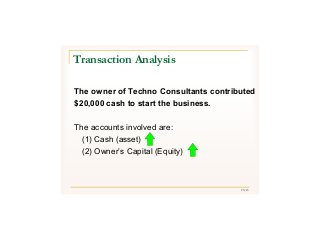

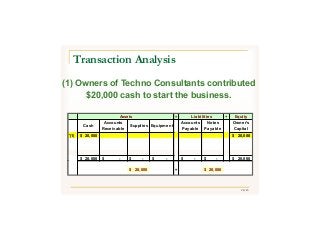

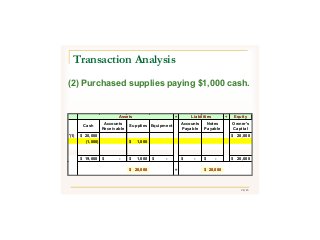

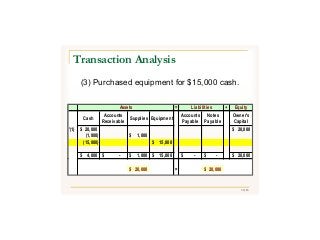

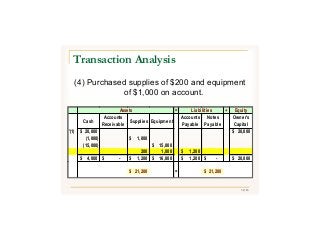

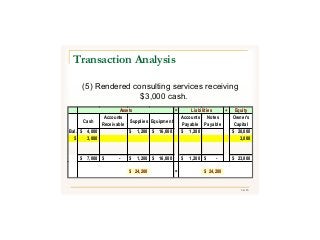

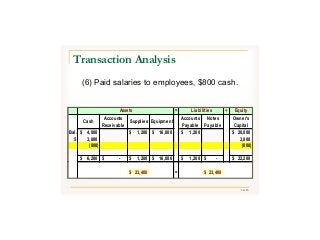

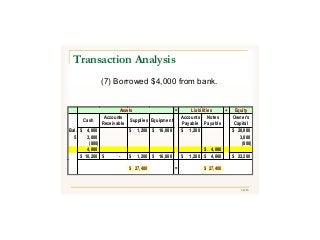

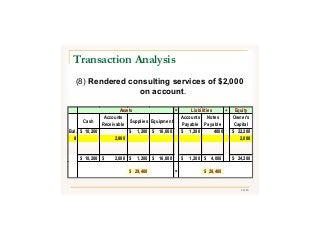

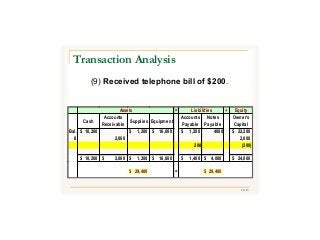

The document provides an overview of financial and managerial accounting, focusing on the importance of financial statements such as balance sheets, income statements, and statements of changes in owners' equity. It discusses the basic accounting equation and the nature of business transactions, emphasizing their impact on assets, liabilities, and owners' equity. Additionally, the document includes examples of transaction analysis to illustrate how different transactions affect the accounting equation.