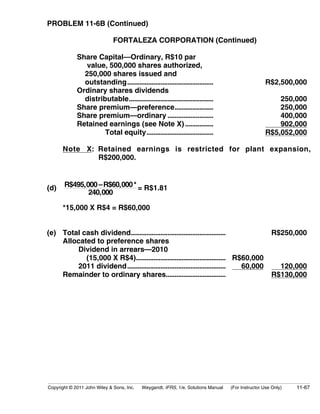

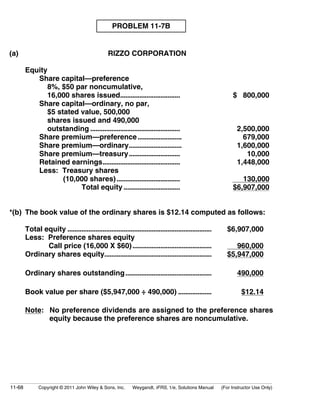

This document provides an assignment classification table and characteristics table for Chapter 11 on corporations. The tables outline the key topics covered in the chapter, including organizing a corporation, issuing and accounting for shares, dividends, retained earnings, and equity analysis. A variety of questions, exercises, and problems are assigned to each objective, with descriptions of their difficulty level and time required.

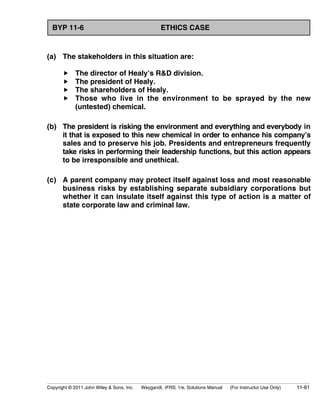

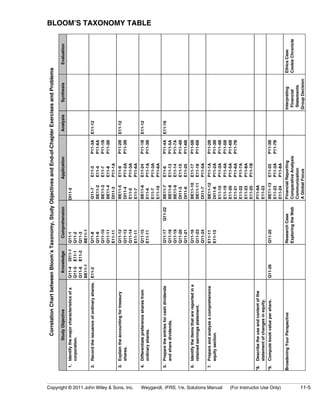

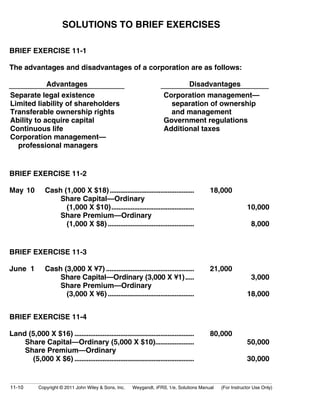

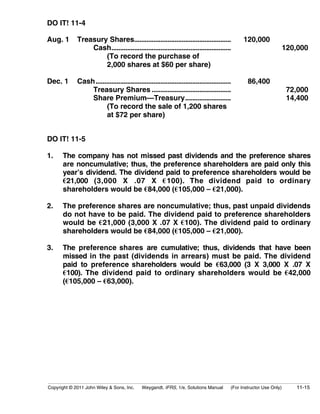

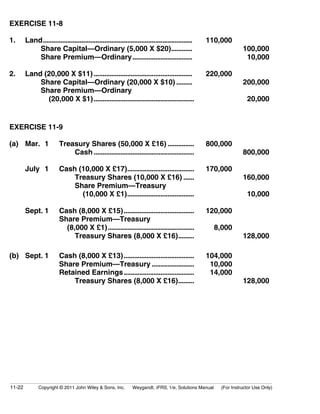

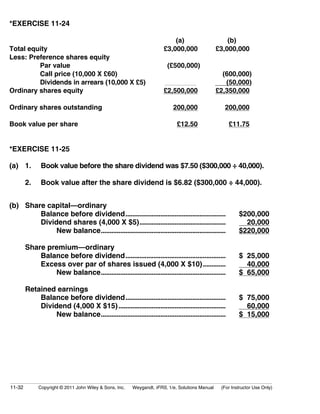

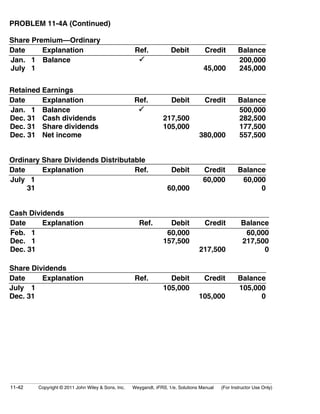

![BRIEF EXERCISE 11-9

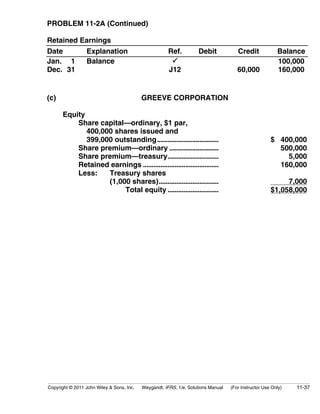

Before

Dividend

After

Dividend

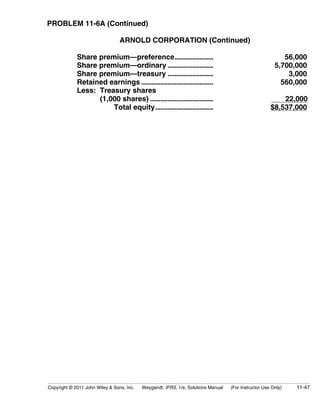

(a) Equity

Share Capital—Ordinary, £10 par £2,000,000 £2,200,000

Share Premium—Ordinary — . 80,000 (1)

Retained earnings 300,000 20,000 (2)

Total equity £2,300,000 £2,300,000

(b) Outstanding shares 200,000 220,000

(1)20,000 X (£14 – £10) (2)[£300,000 – (20,000 X £14)]

BRIEF EXERCISE 11-10

MOUNT INC.

Retained Earnings Statement

For the Year Ended December 31, 2011

Balance, January 1.................................................................... $220,000

Add: Net income ..................................................................... 120,000

340,000

Less: Dividends ........................................................................ 85,000

Balance, December 31 ............................................................. $255,000

11-12 Copyright © 2011 John Wiley & Sons, Inc. Weygandt, IFRS, 1/e, Solutions Manual (For Instructor Use Only)](https://image.slidesharecdn.com/ch11-141109205850-conversion-gate02/85/Ch11-solution-w_kieso_ifrs-1st-edi-12-320.jpg)

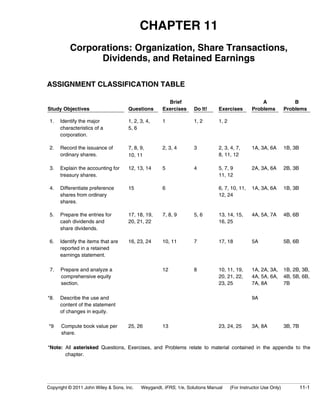

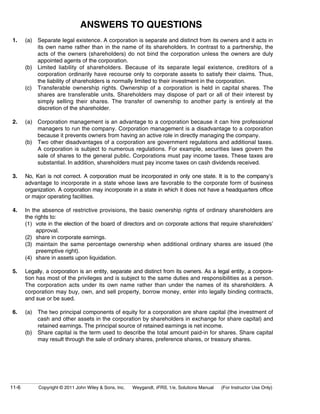

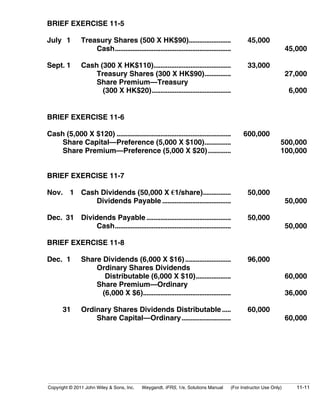

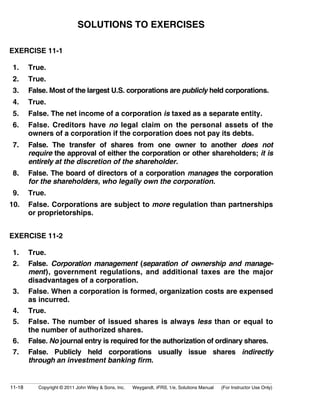

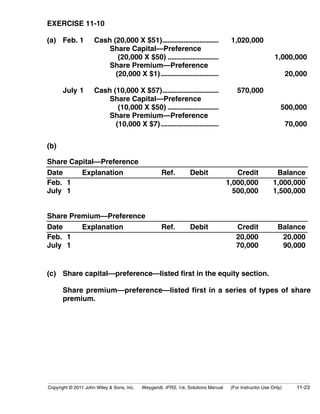

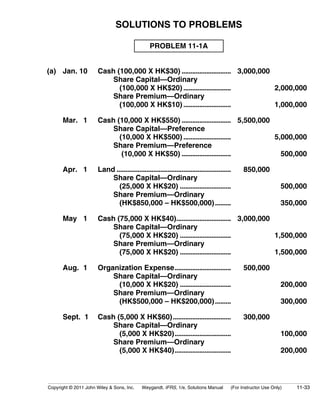

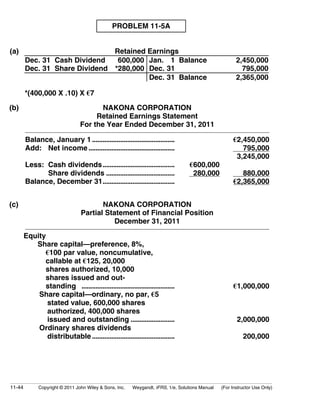

![DO IT! 11-6

(a) 1. The share dividend amount is $3,060,000 [(400,000 X 15%) X $51].

The new balance in retained earnings is $8,940,000 ($12,000,000 –

$3,060,000).

2. The retained earnings after the share split would be the same as it

was before the split: $12,000,000.

(b) (1) and (2) The effects on the equity accounts are as follows:

Original

Balances

After

Dividend After Split

Share capital and share

premium

Retained earnings

Total equity

Shares outstanding

$ 2,400,000

12,000,000

$14,400,000

400,000

$ 5,460,000

8,940,000

$14,400,000

460,000

$ 2,400,000

12,000,000

$14,400,000

800,000

Total equity remains the same under both options.

DO IT! 11-7

ALPHA CENTURI CORPORATION

Retained Earnings Statement

For the Year Ended December 31, 2011

Balance, January 1, as reported ................................... €3,100,000

Correction for understatement of net

income in prior period (depreciation error).......... 110,000

Balance, January 1, as adjusted................................... 3,210,000

Add: Net income .............................................................. 1,200,000

4,410,000

Less: Cash dividends...................................................... 150,000

Balance, December 31...................................................... €4,260,000

11-16 Copyright © 2011 John Wiley & Sons, Inc. Weygandt, IFRS, 1/e, Solutions Manual (For Instructor Use Only)](https://image.slidesharecdn.com/ch11-141109205850-conversion-gate02/85/Ch11-solution-w_kieso_ifrs-1st-edi-16-320.jpg)

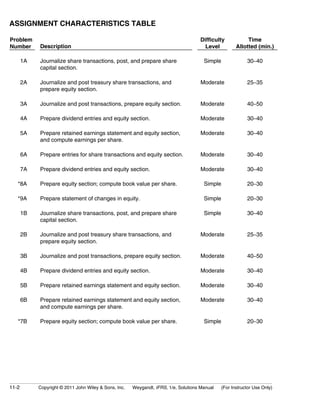

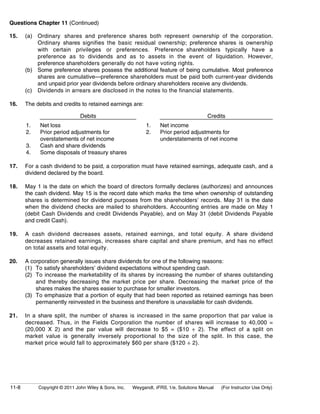

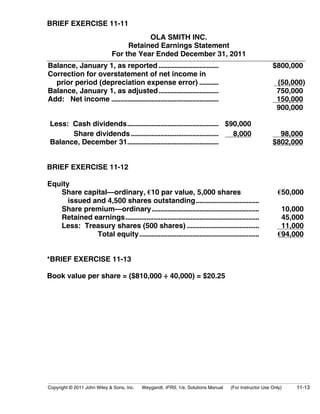

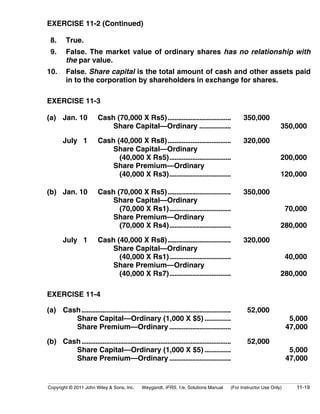

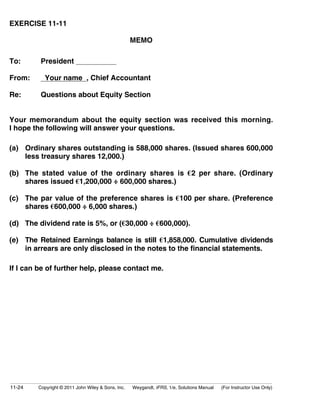

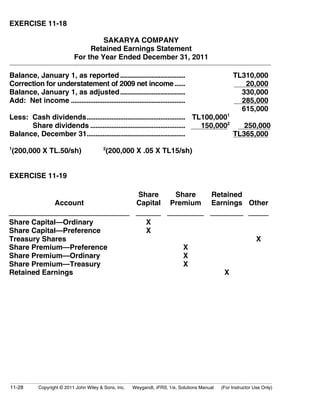

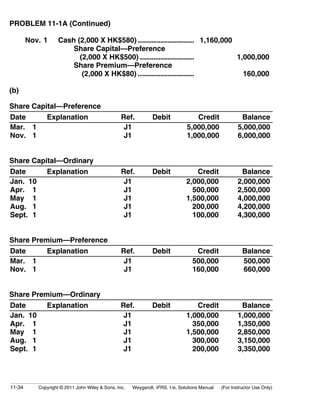

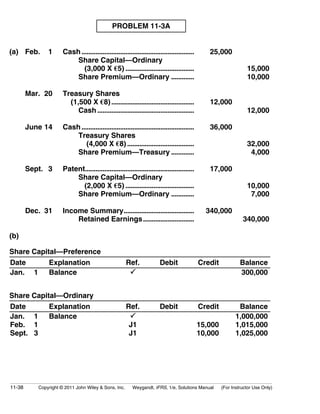

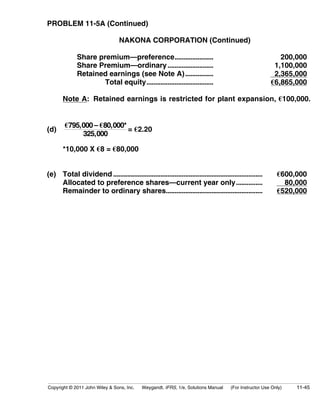

![EXERCISE 11-6

(a) Cash ..................................................................................... 2,100,000

Share Capital—Preference (100,000 X $20) ...... 2,000,000

Share Premium—Preference................................. 100,000

(b) Total Dividend................................................................... $ 500,000

Less: Preference Shares Dividend

($2,000,000 X 8%)................................................ 160,000

Ordinary Shares Dividends .......................................... $ 340,000

(c) Total Dividend................................................................... $ 500,000

Less: Preference Shares Dividend

[($2,000,000 X 8%) X 3] ...................................... 480,000

Ordinary Shares Dividends .......................................... $ 20,000

EXERCISE 11-7

Mar. 2 Organization Expense........................................ 30,000

Share Capital—Ordinary

(5,000 X R$1) ............................................. 5,000

Share Premium—Ordinary....................... 25,000

June 12 Cash ......................................................................... 375,000

Share Capital—Ordinary

(60,000 X R$1)........................................... 60,000

Share Premium—Ordinary....................... 315,000

July 11 Cash (1,000 X R$110).......................................... 110,000

Share Capital—Preference

(1,000 X R$100)......................................... 100,000

Share Premium—Preference

(1,000 X R$10)......................................... 10,000

Nov. 28 Treasury Shares.................................................... 80,000

Cash ................................................................ 80,000

Copyright © 2011 John Wiley & Sons, Inc. Weygandt, IFRS, 1/e, Solutions Manual (For Instructor Use Only) 11-21](https://image.slidesharecdn.com/ch11-141109205850-conversion-gate02/85/Ch11-solution-w_kieso_ifrs-1st-edi-21-320.jpg)

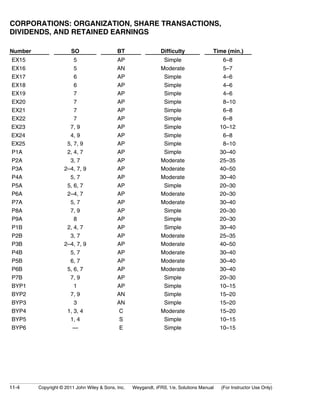

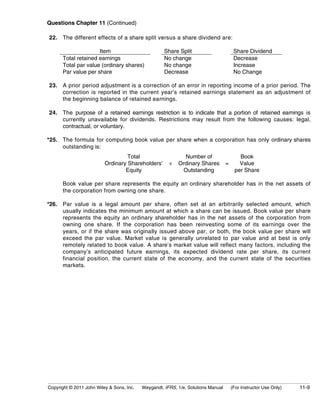

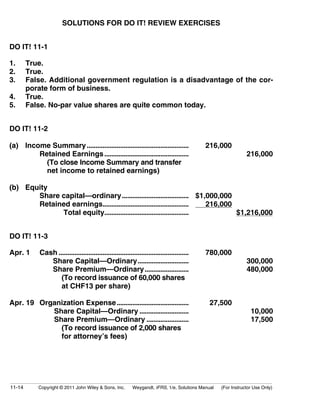

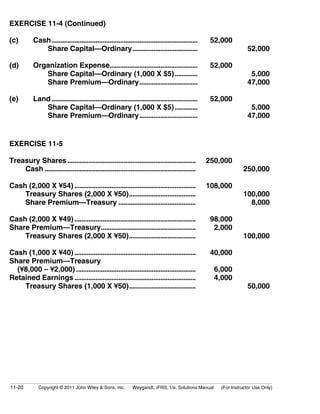

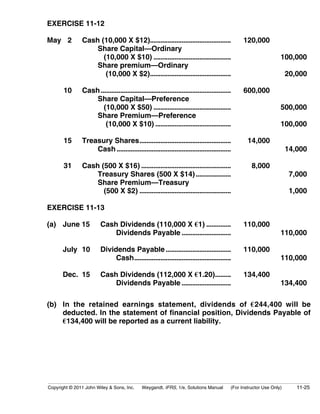

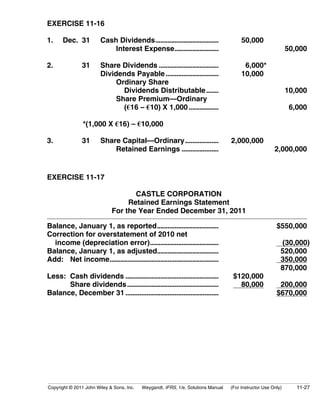

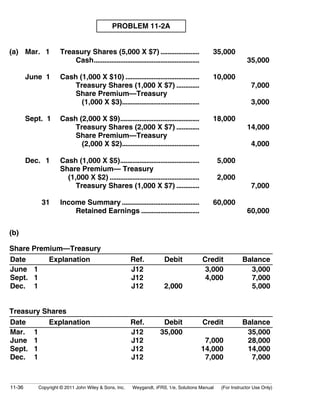

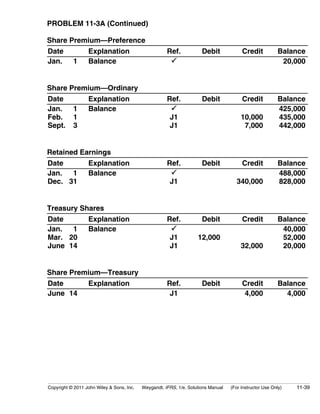

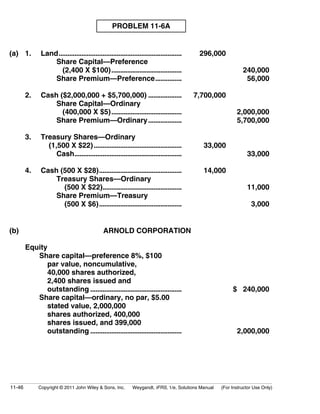

![EXERCISE 11-14

1. Share Dividends (24,000* X $18)................................. 432,000

Ordinary Share Dividends Distributable

(24,000 X $10)....................................................... 240,000

Share Premium—Ordinary

(24,000 X $8)......................................................... 192,000

*[($1,000,000 ÷ $10) + 60,000] X 15%.

2. Share Dividends (39,000* X $20)................................. 780,000

Ordinary Share Dividends Distributable

(39,000 X $5)......................................................... 195,000

Share Premium—Ordinary

(39,000 X $15)....................................................... 585,000

*[($1,000,000 ÷ 5) + 60,000] X 15%.

EXERCISE 11-15

Before

Action

After

Stock

Dividend

After

Stock

Split

Equity

Share capital—ordinary

Share premium—

ordinary

Retained earnings

Total equity

CHF 600,000

0

900,000

CHF1,500,000

CHF 630,000

12,000

858,000

CHF1,500,000

(1)

(2)

CHF 600,000

0

900,000

CHF1,500,000

Outstanding shares 60,000 63,000 120,000

(1)3,000 X (CHF14 – CHF10) (2)CHF900,000 – (3,000 X CHF14)

11-26 Copyright © 2011 John Wiley & Sons, Inc. Weygandt, IFRS, 1/e, Solutions Manual (For Instructor Use Only)](https://image.slidesharecdn.com/ch11-141109205850-conversion-gate02/85/Ch11-solution-w_kieso_ifrs-1st-edi-26-320.jpg)

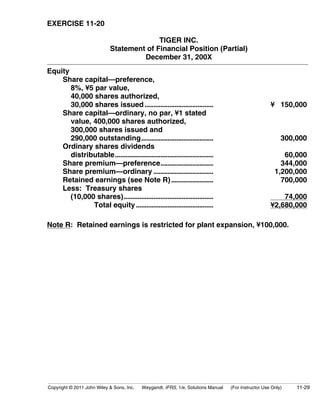

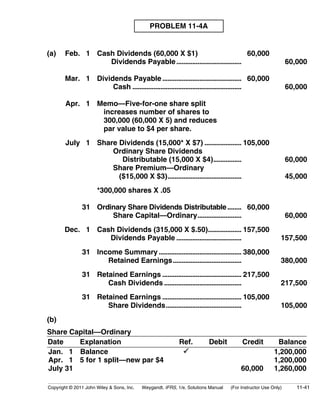

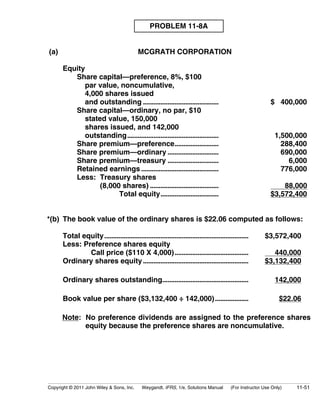

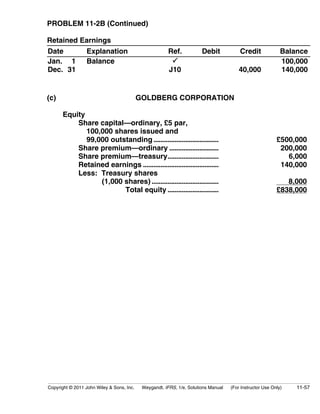

![PROBLEM 11-3B (Continued)

(c) PORT CORPORATION

Equity

Share capital—preference, 8%,

$50 par value, cumulative,

10,000 shares authorized,

8,000 shares issued and

outstanding ................................................... $ 400,000

Share capital—ordinary, no par,

$1 stated value,

2,000,000 shares authorized,

1,030,000 shares issued

and 1,025,000 shares

outstanding ................................................... 1,030,000

Share premium—preference........................ 100,000

Share premium—ordinary............................ 1,550,000

Share premium—treasury............................. 9,000

Retained earnings (see Note X)................... 2,268,000

Less: Treasury shares

(5,000 shares)....................................... 22,000

Total equity ................................ $5,335,000

Note X: Dividends on preference shares totaling $32,000 [8,000 X

(8% X $50)] are in arrears.

11-60 Copyright © 2011 John Wiley Sons, Inc. Weygandt, IFRS, 1/e, Solutions Manual (For Instructor Use Only)](https://image.slidesharecdn.com/ch11-141109205850-conversion-gate02/85/Ch11-solution-w_kieso_ifrs-1st-edi-60-320.jpg)

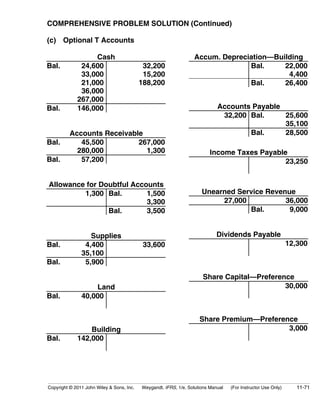

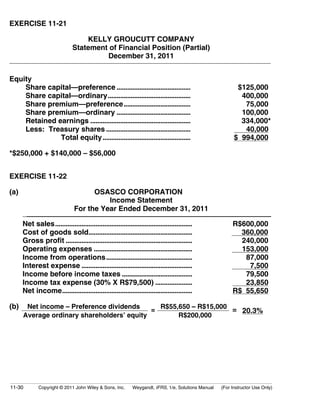

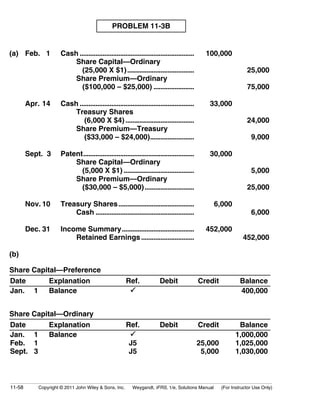

![COMPREHENSIVE PROBLEM SOLUTION

(a) 1. Cash ............................................................................

Share Capital—Preference..........................

Share Premium—Preference......................

33,000

30,000

3,000

2. Cash ............................................................................

Share Capital—Ordinary..............................

Share Premium—Ordinary..........................

21,000

9,000

12,000

3. Accounts Receivable.............................................

Service Revenue.............................................

280,000

280,000

4. Cash ............................................................................

Unearned Service Revenue ........................

36,000

36,000

5. Cash ............................................................................

Accounts Receivable....................................

267,000

267,000

6. Supplies .....................................................................

Account Payable ............................................

35,100

35,100

7. Accounts Payable...................................................

Cash....................................................................

32,200

32,200

8. Treasury Shares ......................................................

Cash....................................................................

15,200

15,200

9. Other Operating Expenses ..................................

Cash....................................................................

188,200

188,200

10. Cash Dividends (£2,100 + £10,200*)..................

Dividends Payable .........................................

12,300

12,300

11. Allowance for Doubtful Accounts .....................

Accounts Receivable....................................

1,300

1,300

*[(£80,000 ÷ £10) + 900 – 400] X £1.20

Copyright © 2011 John Wiley Sons, Inc. Weygandt, IFRS, 1/e, Solutions Manual (For Instructor Use Only) 11-69](https://image.slidesharecdn.com/ch11-141109205850-conversion-gate02/85/Ch11-solution-w_kieso_ifrs-1st-edi-69-320.jpg)

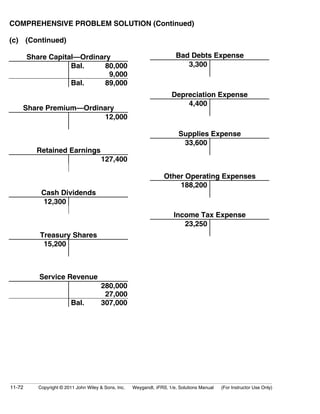

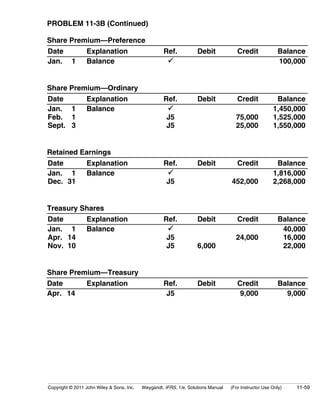

![COMPREHENSIVE PROBLEM SOLUTION (Continued)

Adjusting Entries

1. Supplies Expense (£4,400 + £35,100 – £5,900) ...

Supplies.............................................................

33,600

33,600

2. Unearned Service Revenue..................................

Service Revenue (£36,000 X 9/12).............

27,000

27,000

3. Bad Debts Expense [£3,500 – (£1,500 – £1,300)]......

Allowance for Doubtful Accounts.............

3,300

3,300

4. Depreciation Expense—Building.......................

Accumulated Depreciation—Building

(£142,000 – £10,000) ÷ 30 .........................

4,400

4,400

5. Income Tax Expense..............................................

Income Tax Payable.......................................

23,250

23,250

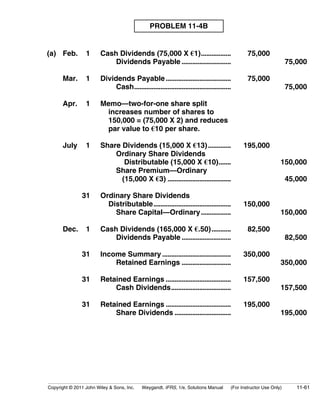

(b) HIATT CORPORATION

Adjusted Trial Balance

12/31/11

Account Debit Credit

Cash.................................................................................. £146,000

Accounts Receivable .................................................. 57,200

Allowance for Doubtful Accounts .......................... £ 3,500

Supplies .......................................................................... 5,900

Land.................................................................................. 40,000

Building ........................................................................... 142,000

Accum. Depreciation—Building.............................. 26,400

Accounts Payable........................................................ 28,500

Income Taxes Payable................................................ 23,250

Unearned Service Revenue ...................................... 9,000

Dividends Payable ....................................................... 12,300

Share Capital—Preference........................................ 30,000

Share Premium—Preference.................................... 3,000

Share Capital—Ordinary............................................ 89,000

Share Premium—Ordinary........................................ 12,000

Retained Earnings ....................................................... 127,400

Cash Dividends............................................................. 12,300

Treasury Shares ........................................................... 15,200

Service Revenue........................................................... 307,000

Bad Debts Expense..................................................... 3,300

Depreciation Expense ................................................ 4,400

Supplies Expense ........................................................ 33,600

Other Operating Expenses........................................ 188,200

Income Tax Expense................................................... 23,250

Total.............................................................................. £671,350 £671,350

11-70 Copyright © 2011 John Wiley Sons, Inc. Weygandt, IFRS, 1/e, Solutions Manual (For Instructor Use Only)](https://image.slidesharecdn.com/ch11-141109205850-conversion-gate02/85/Ch11-solution-w_kieso_ifrs-1st-edi-70-320.jpg)