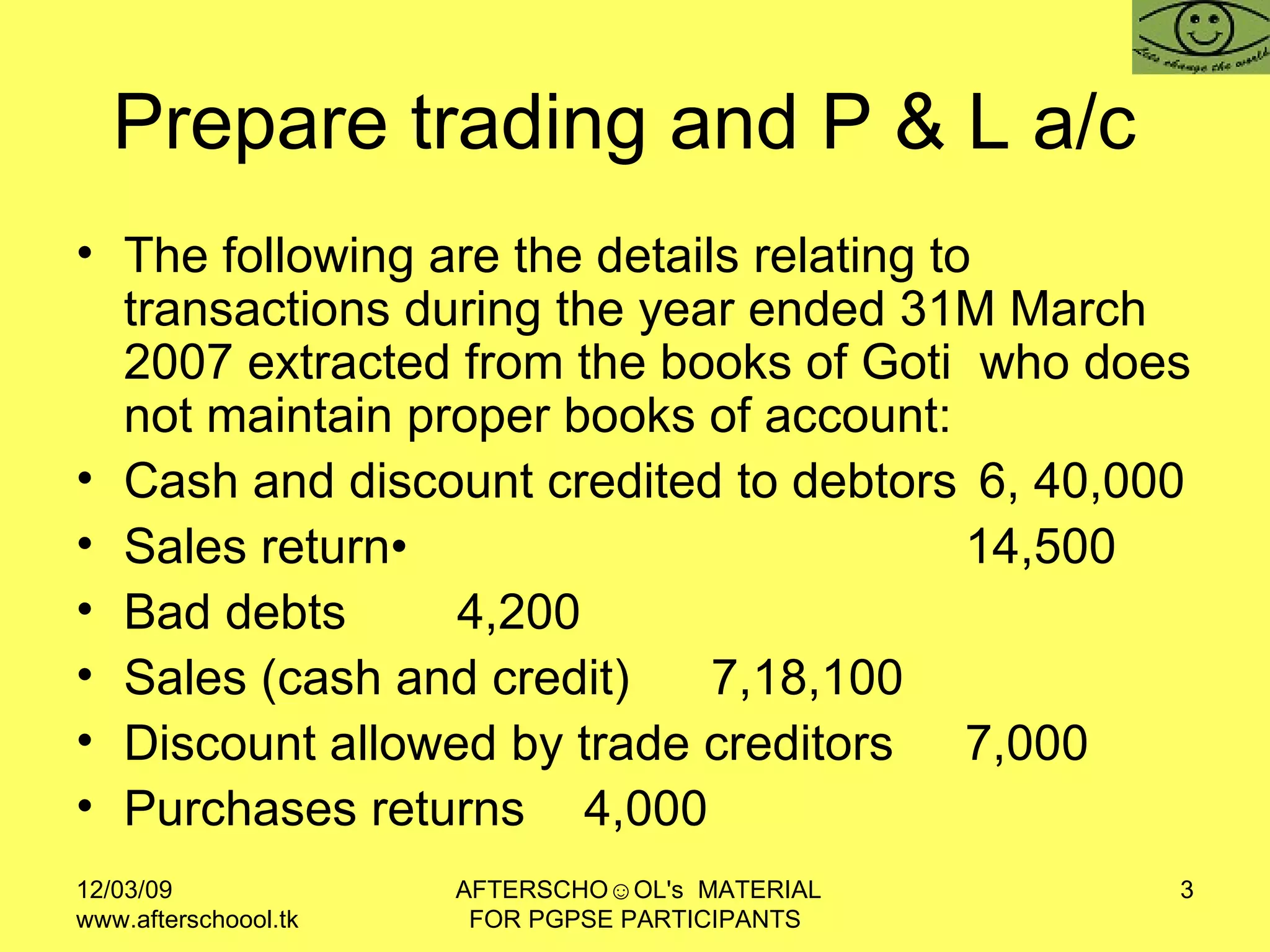

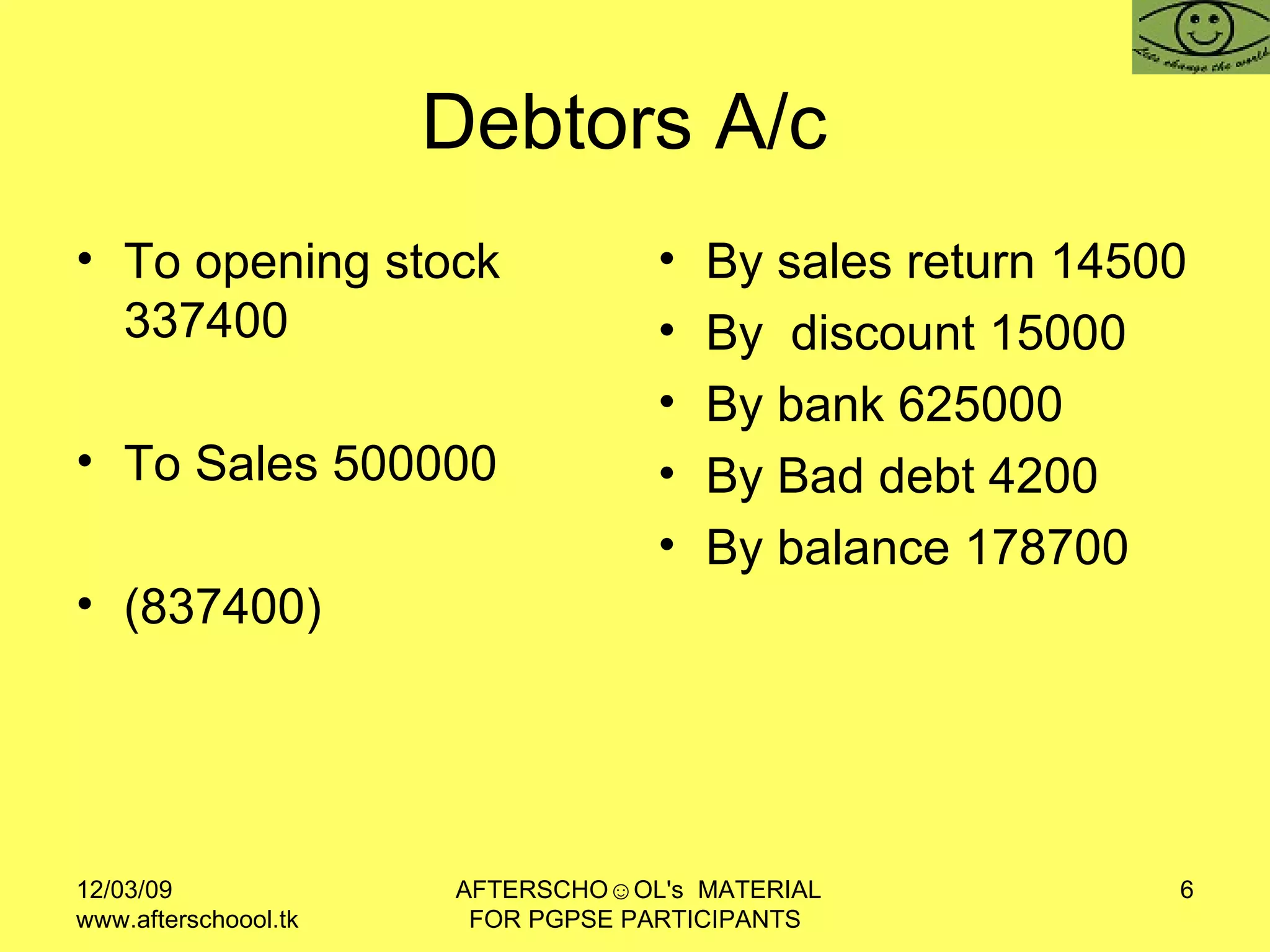

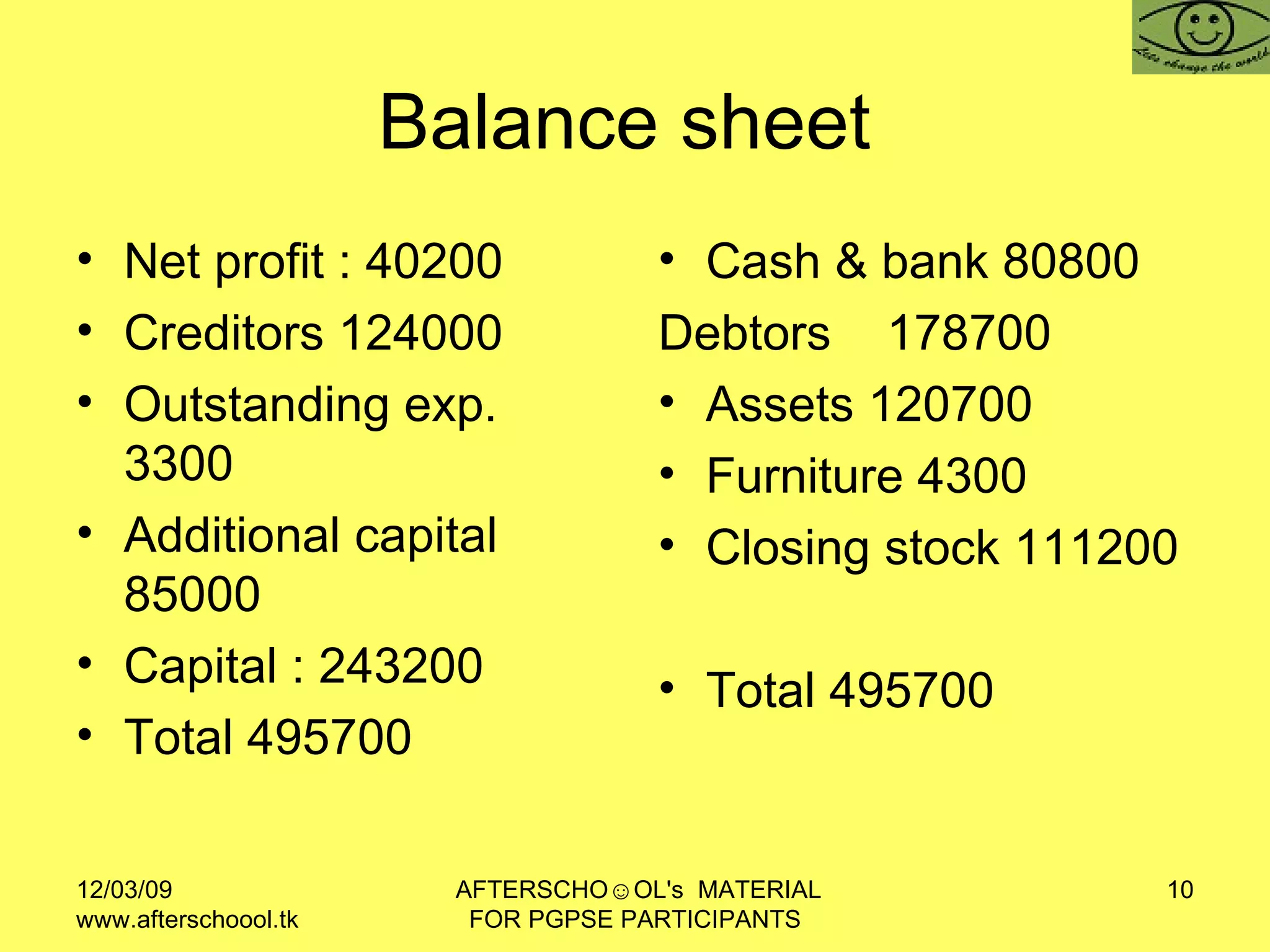

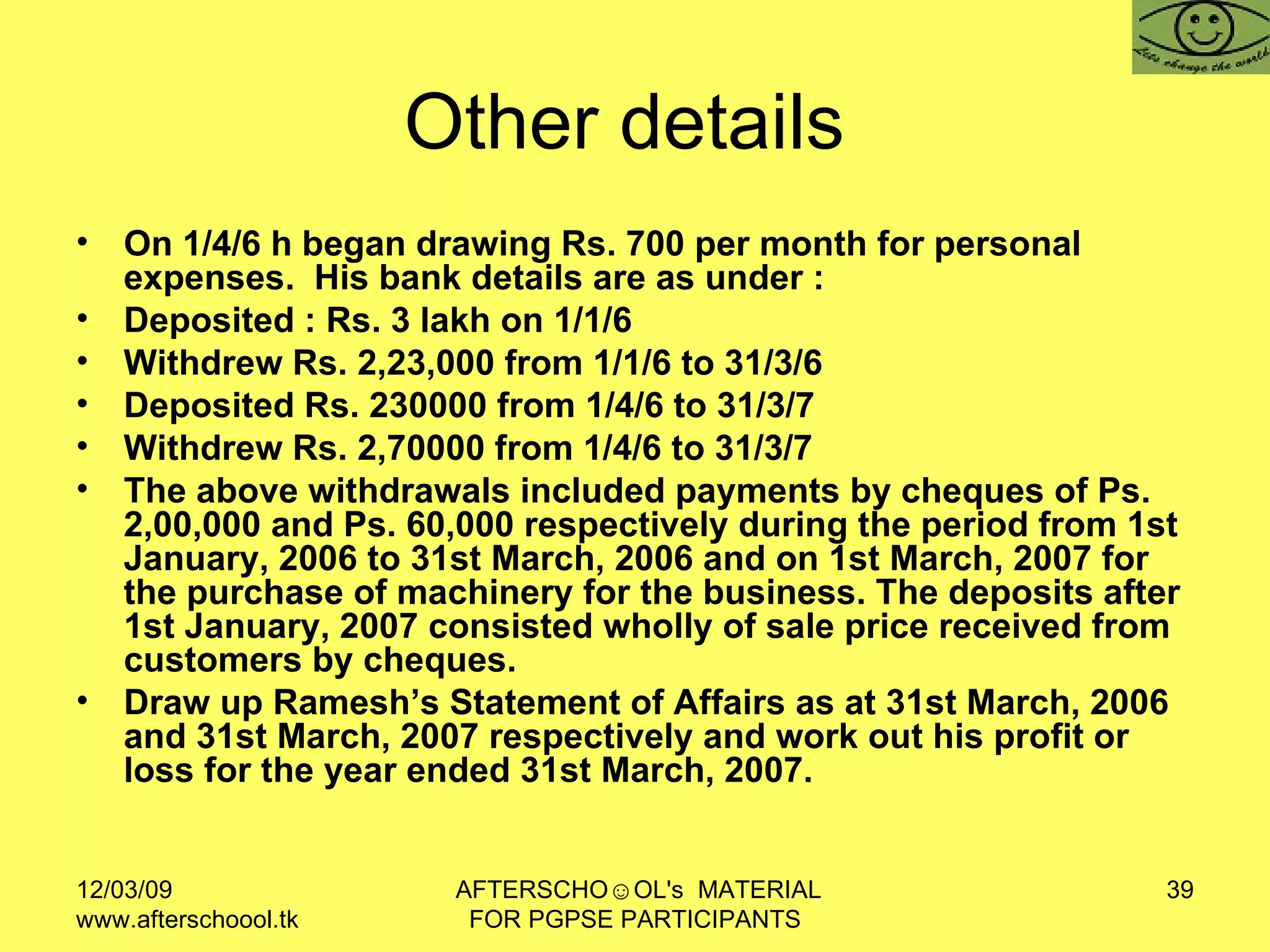

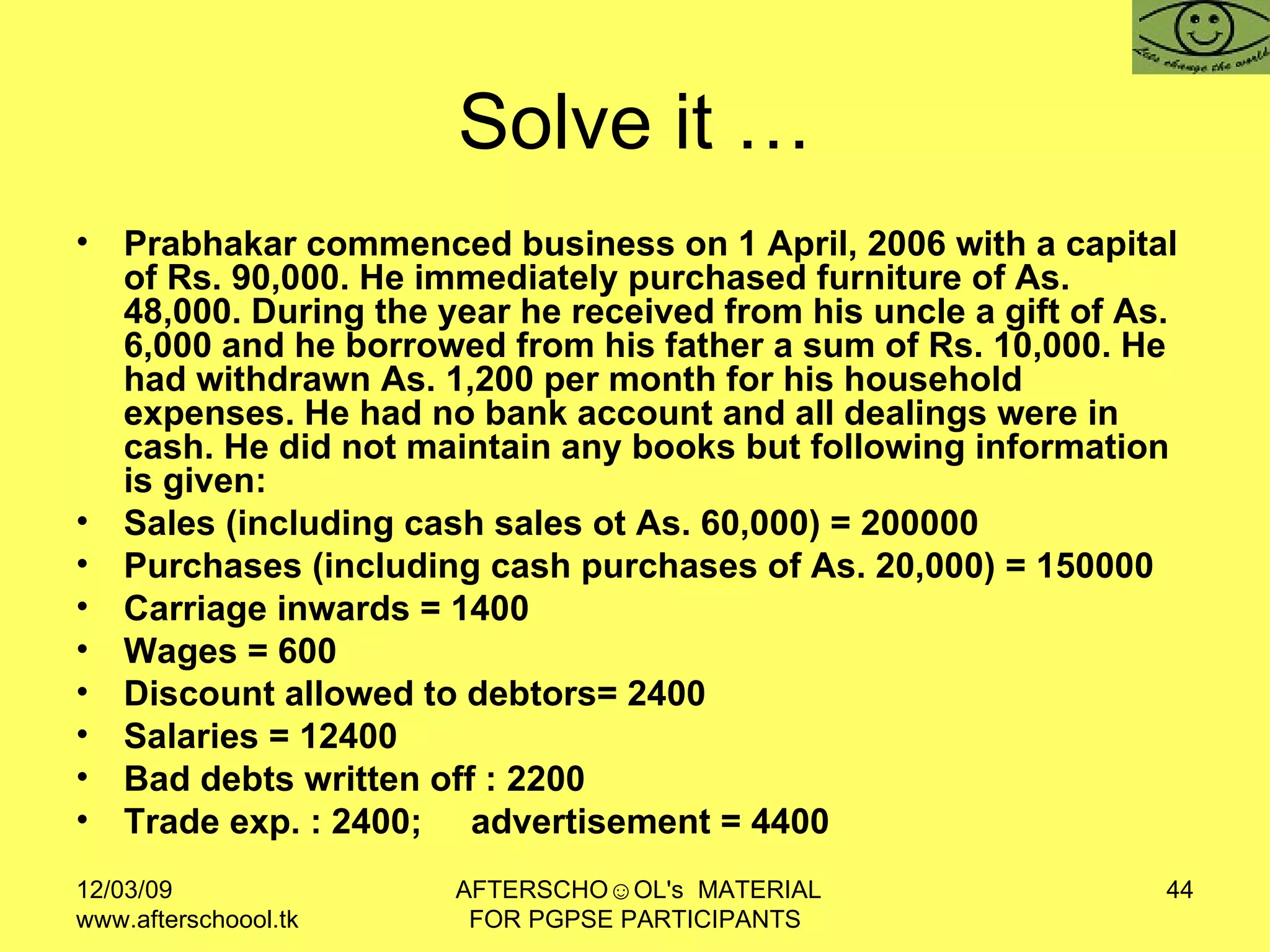

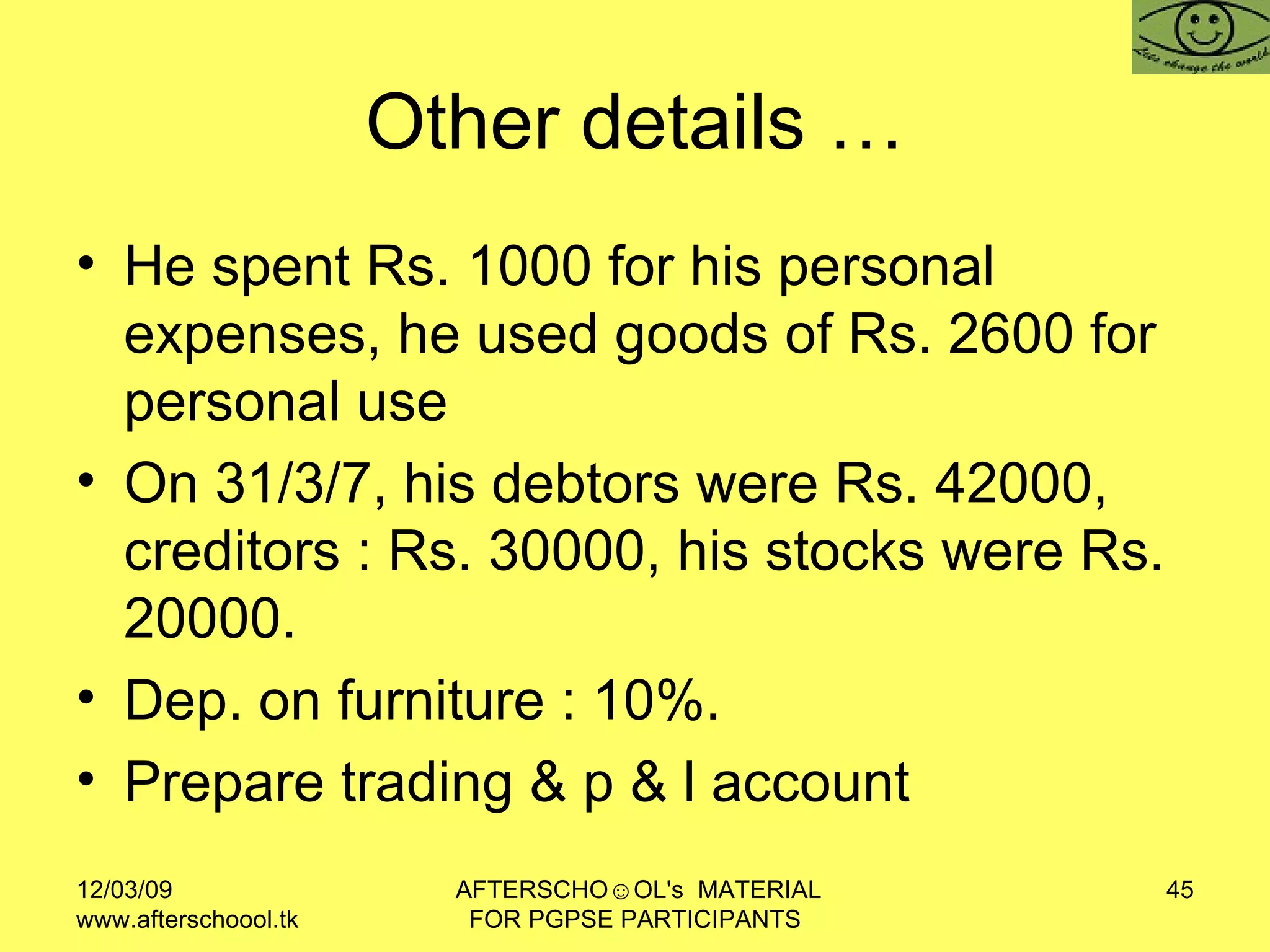

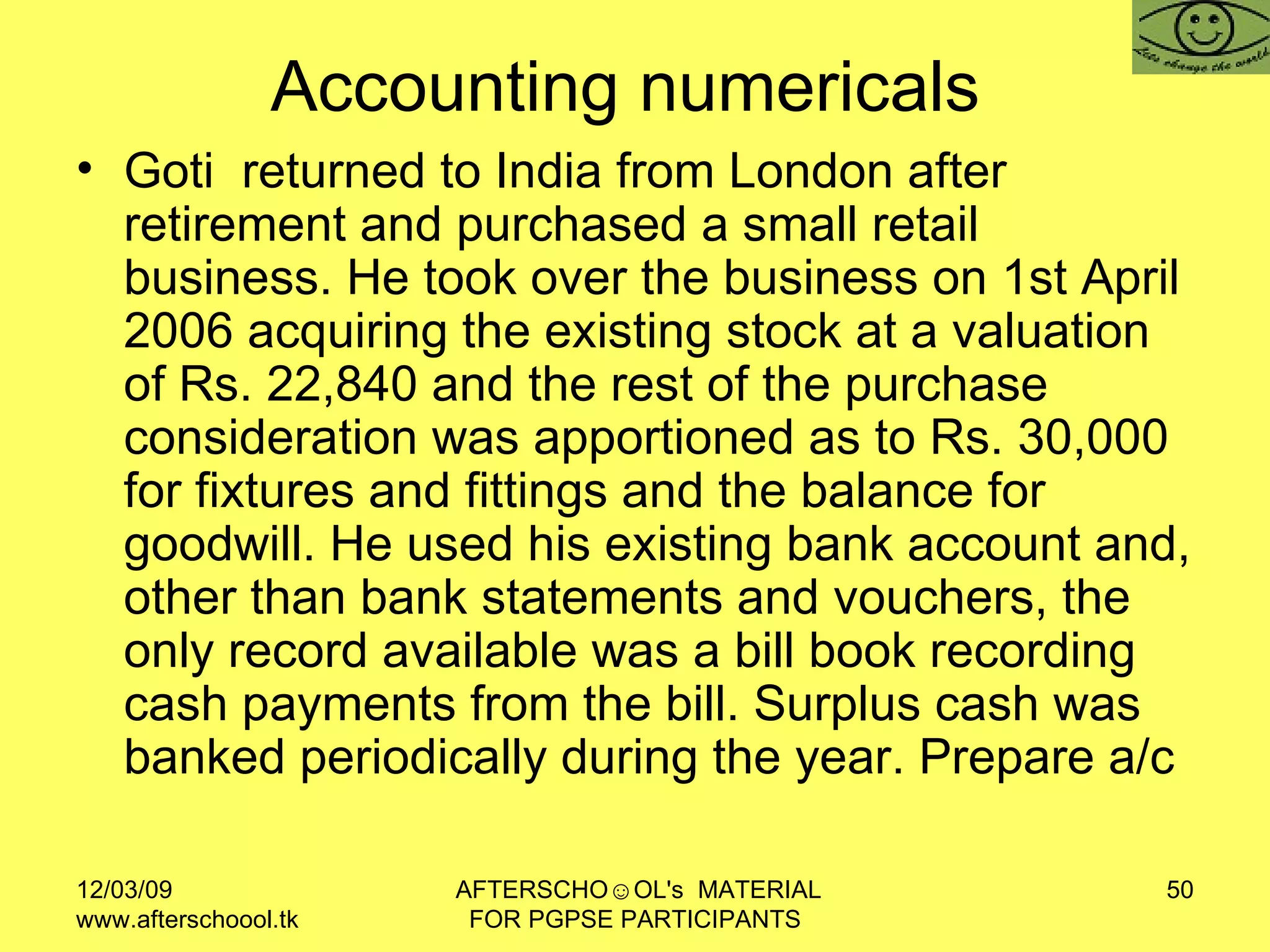

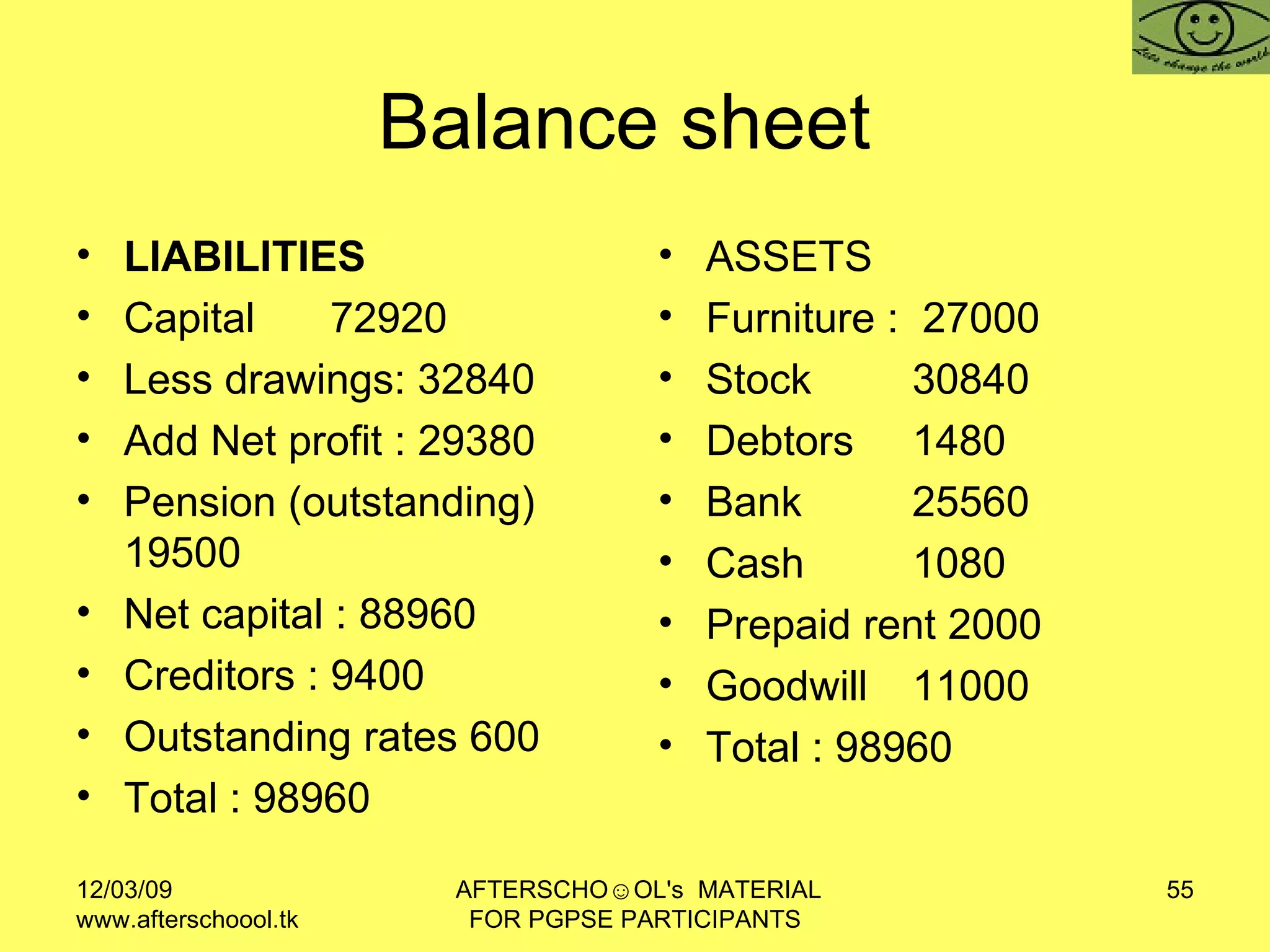

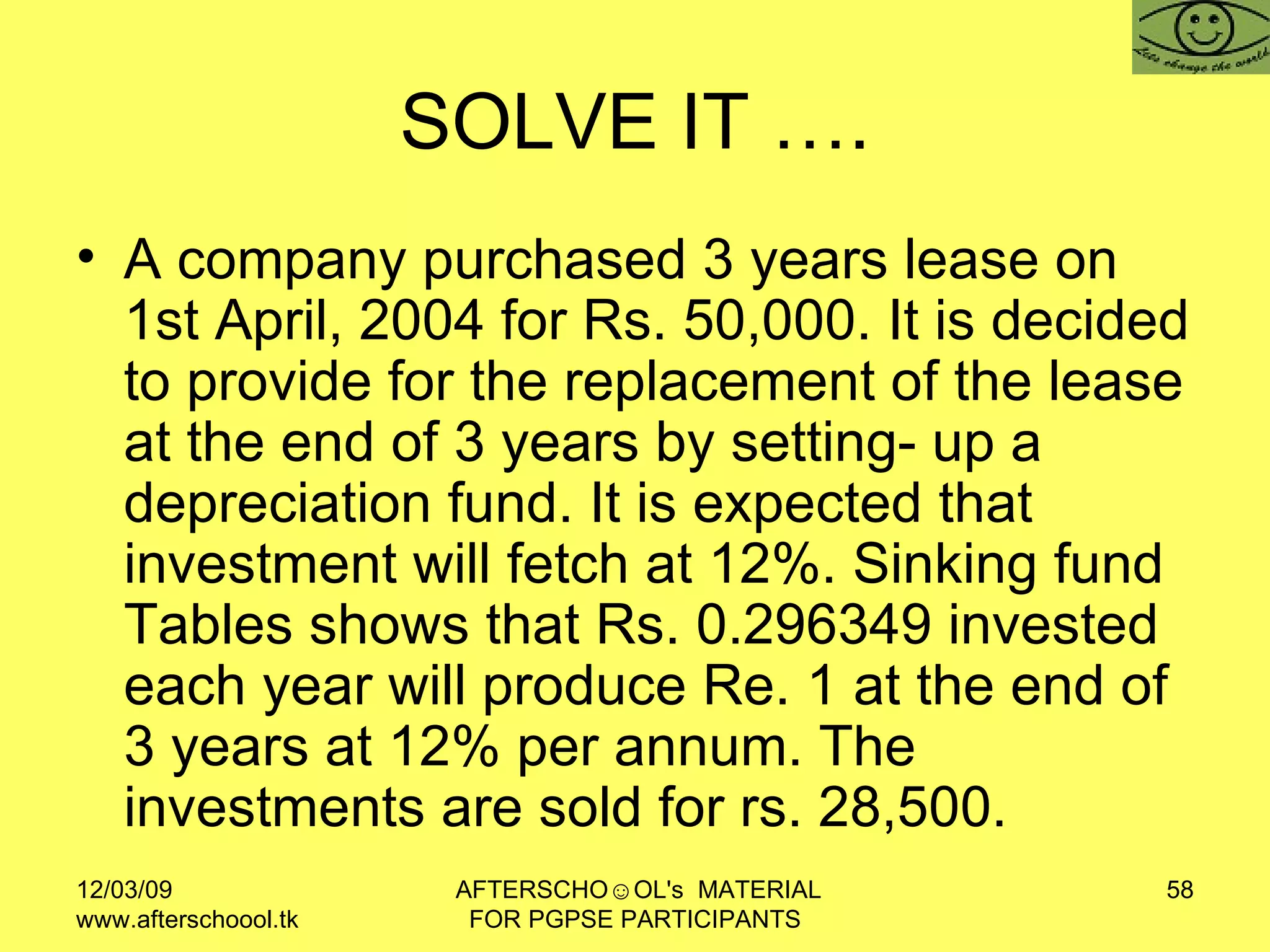

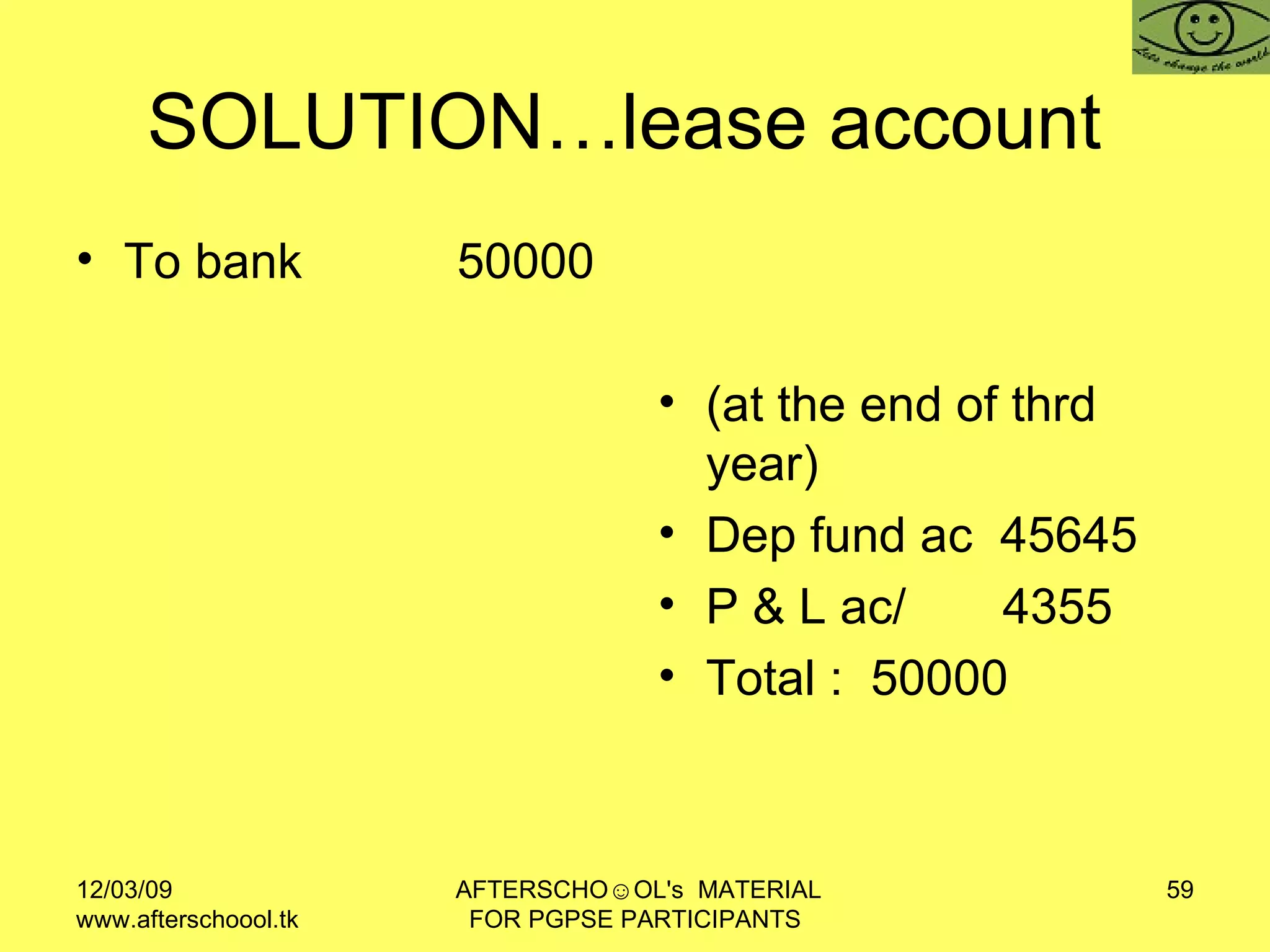

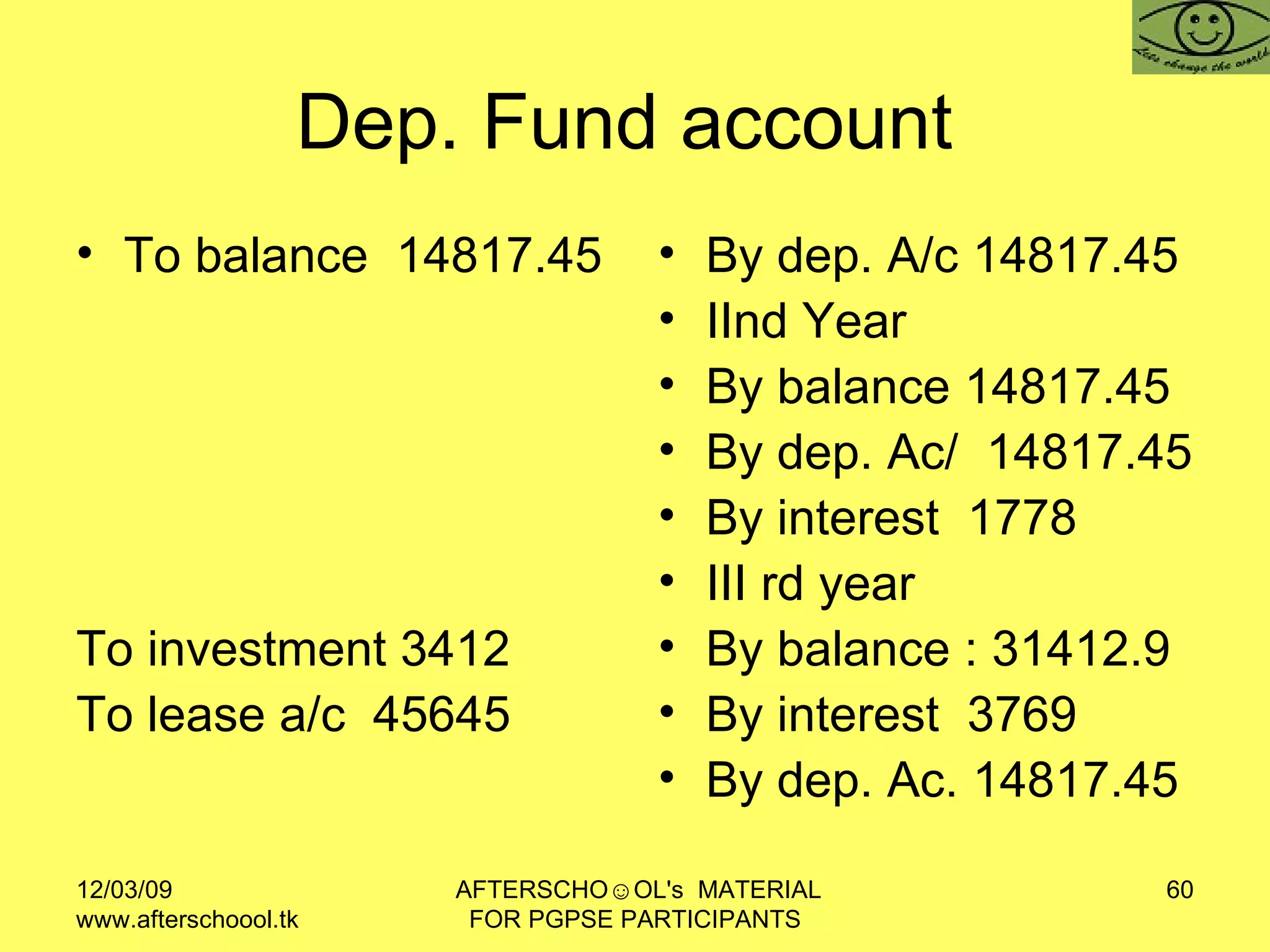

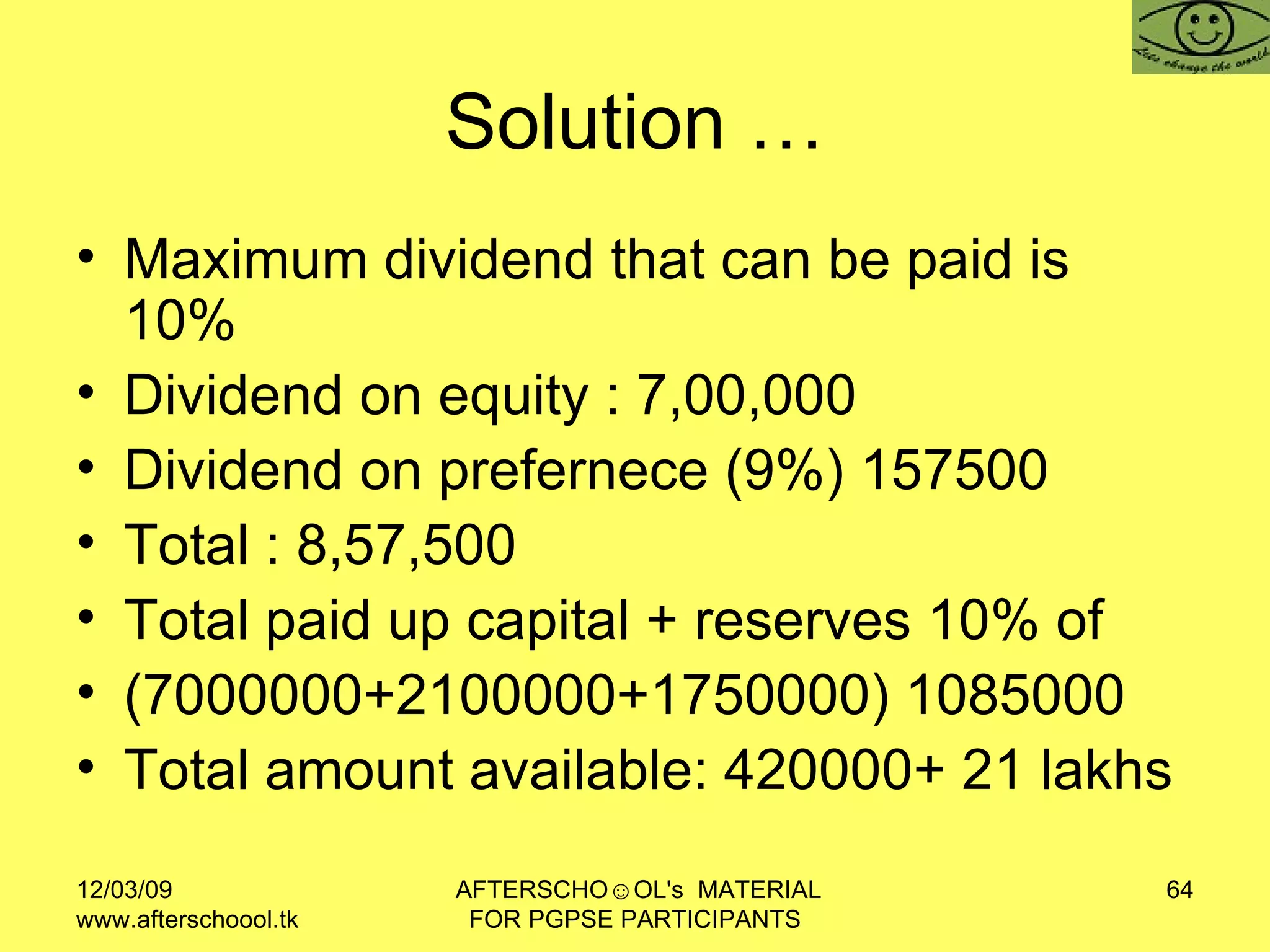

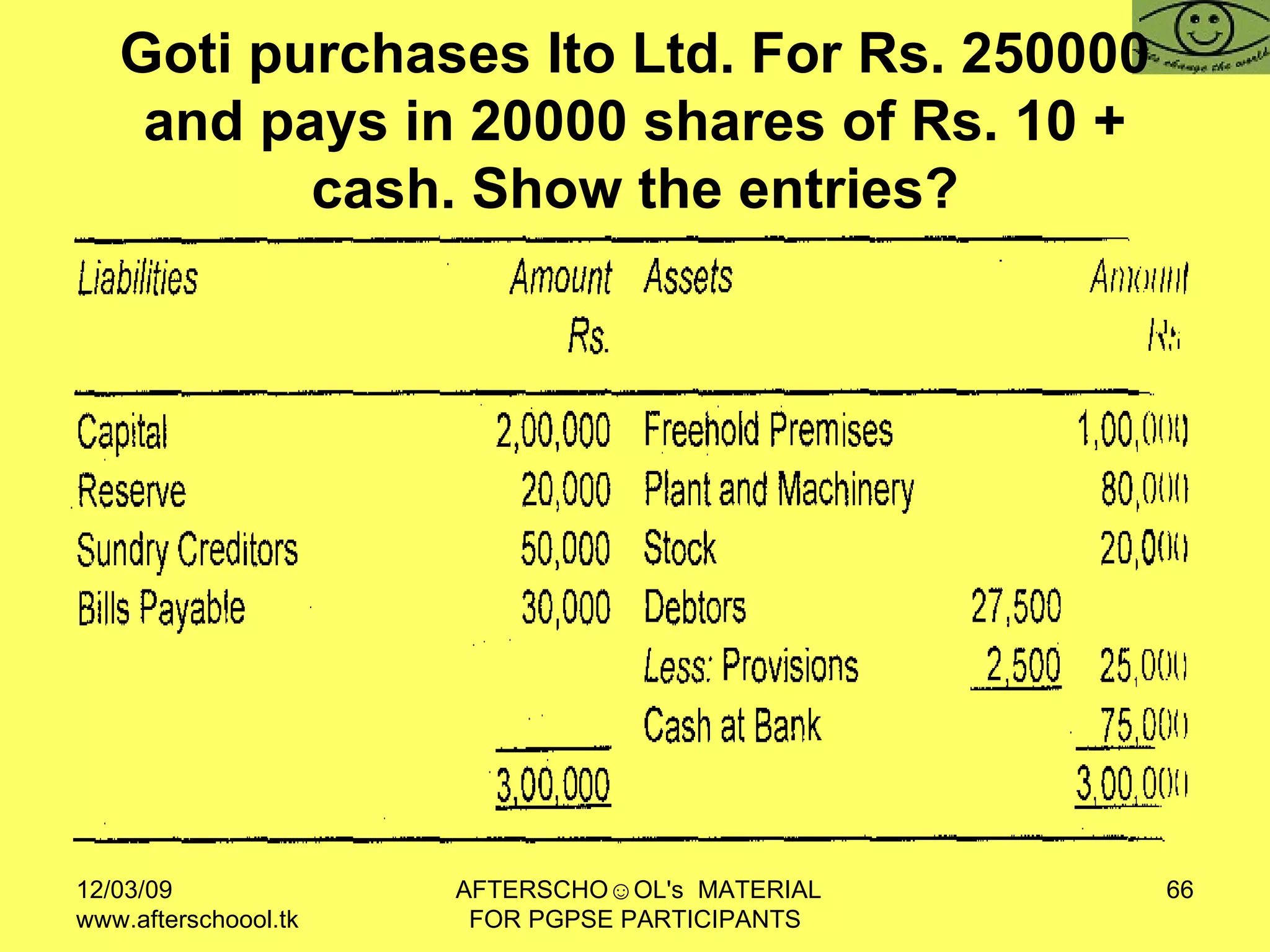

The document provides details about an accounting for business program by Afterscho☺ol Centre for Social Entrepreneurship. It includes instructions for participants to prepare trading and profit and loss accounts based on transaction details provided for a business owner named Goti for the year ended 31 March 2007. It also provides an additional information and asks participants to prepare a balance sheet as on that date.

![ACCOUNTING FOR BUSINESS Dr. T.K. Jain. AFTERSCHO☺OL Centre for social entrepreneurship Bikaner M: 9414430763 [email_address] www.afterschool.tk , www.afterschoool.tk www.afterschoool.tk AFTERSCHO☺OL's MATERIAL FOR PGPSE PARTICIPANTS](https://image.slidesharecdn.com/accounting-for-business-1233032566209043-2/75/Ac-Counting-For-Business-2-2048.jpg)