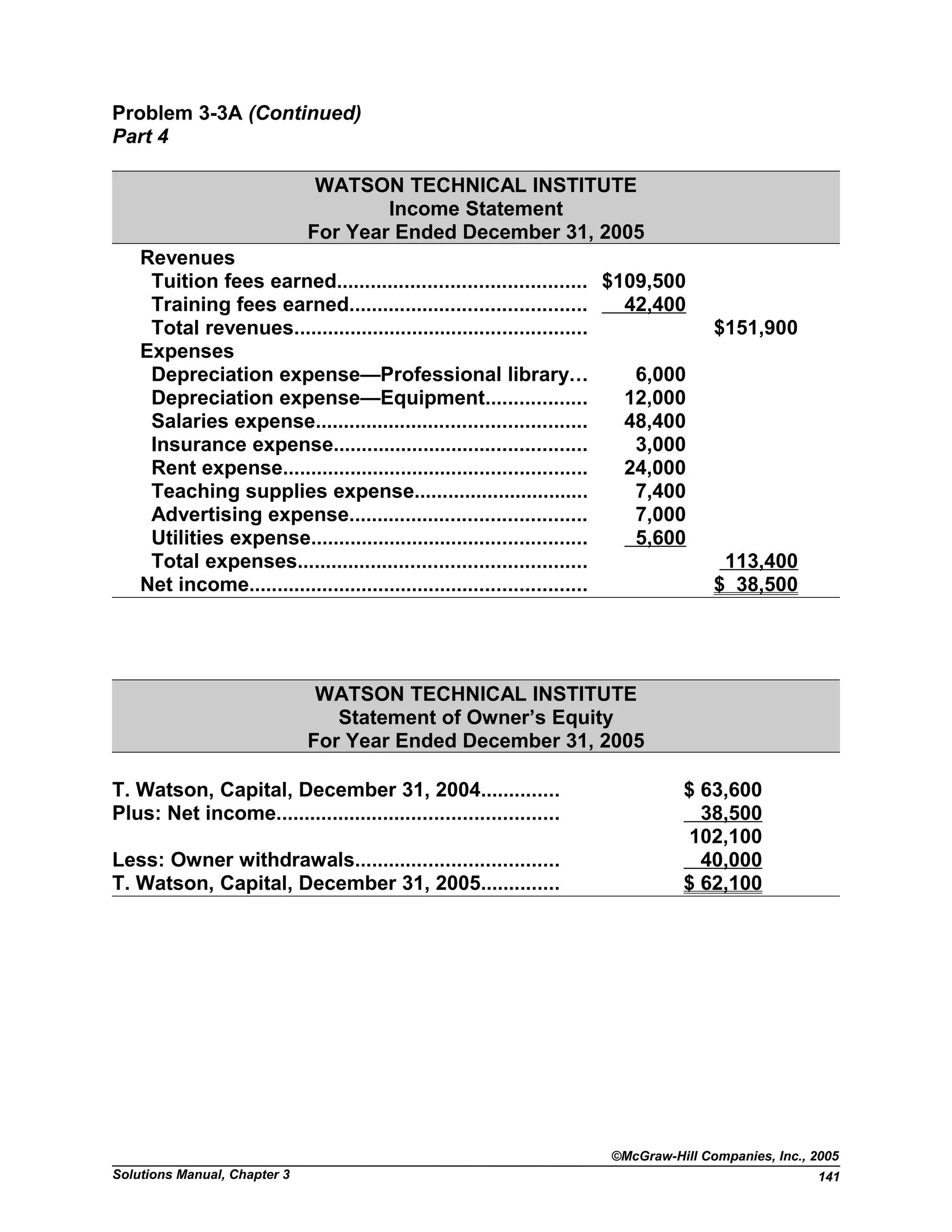

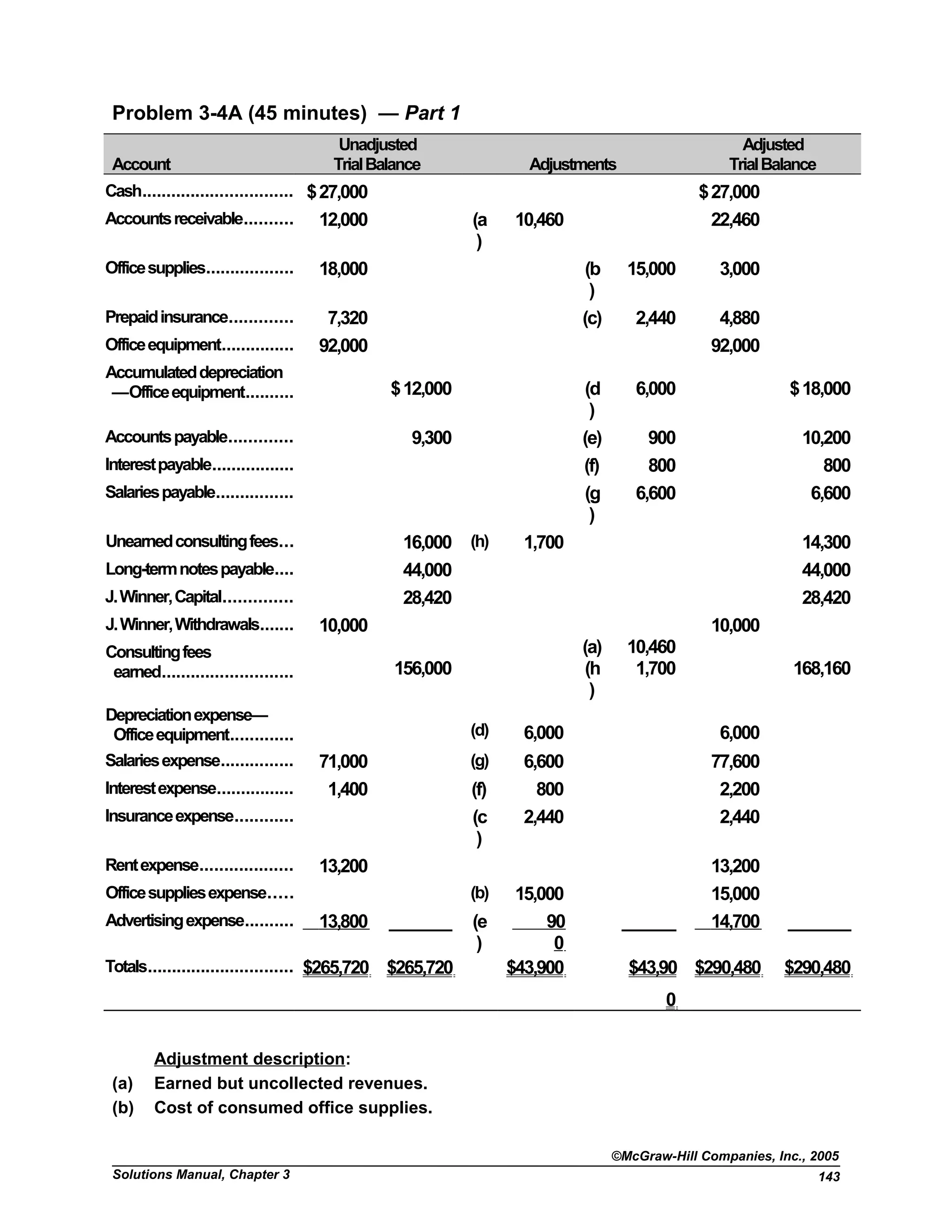

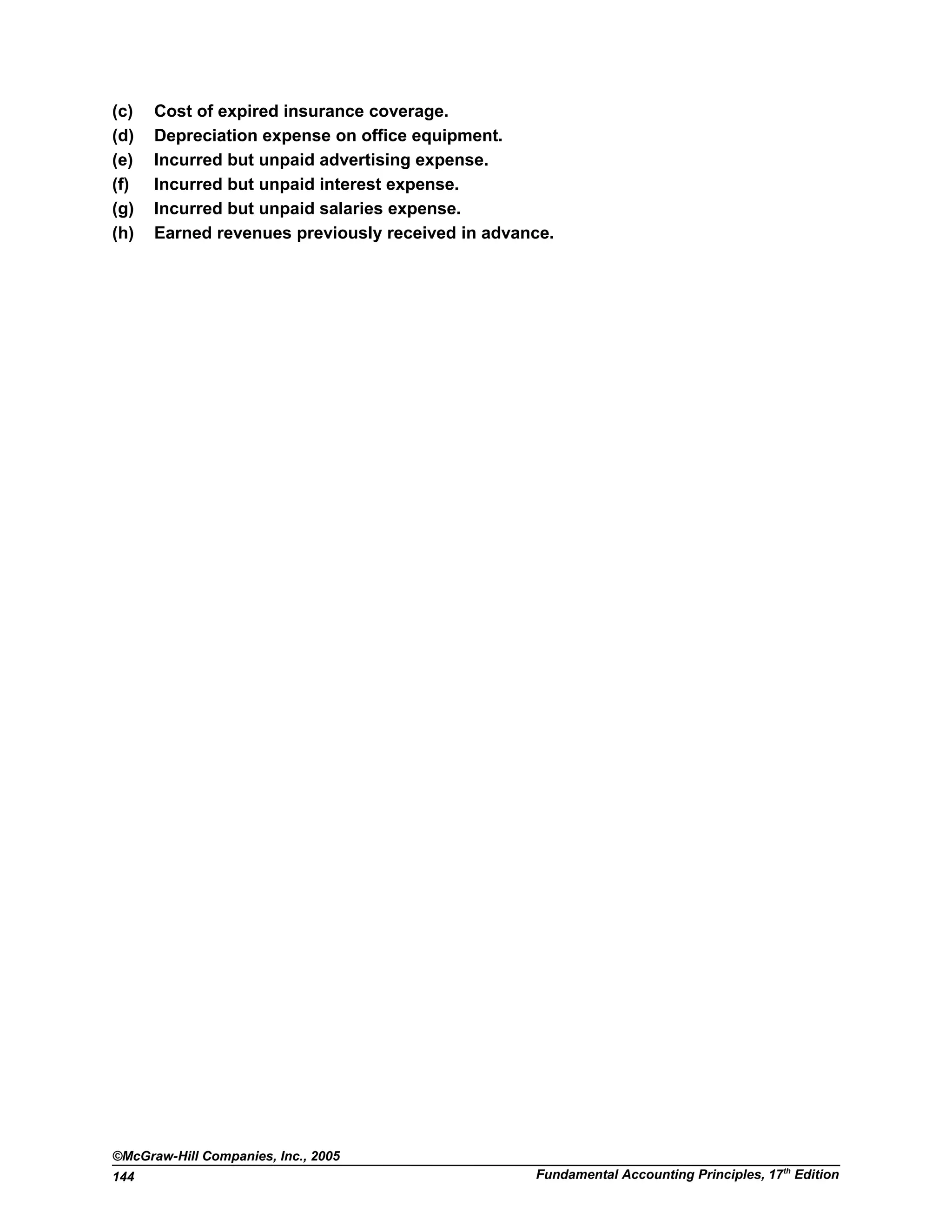

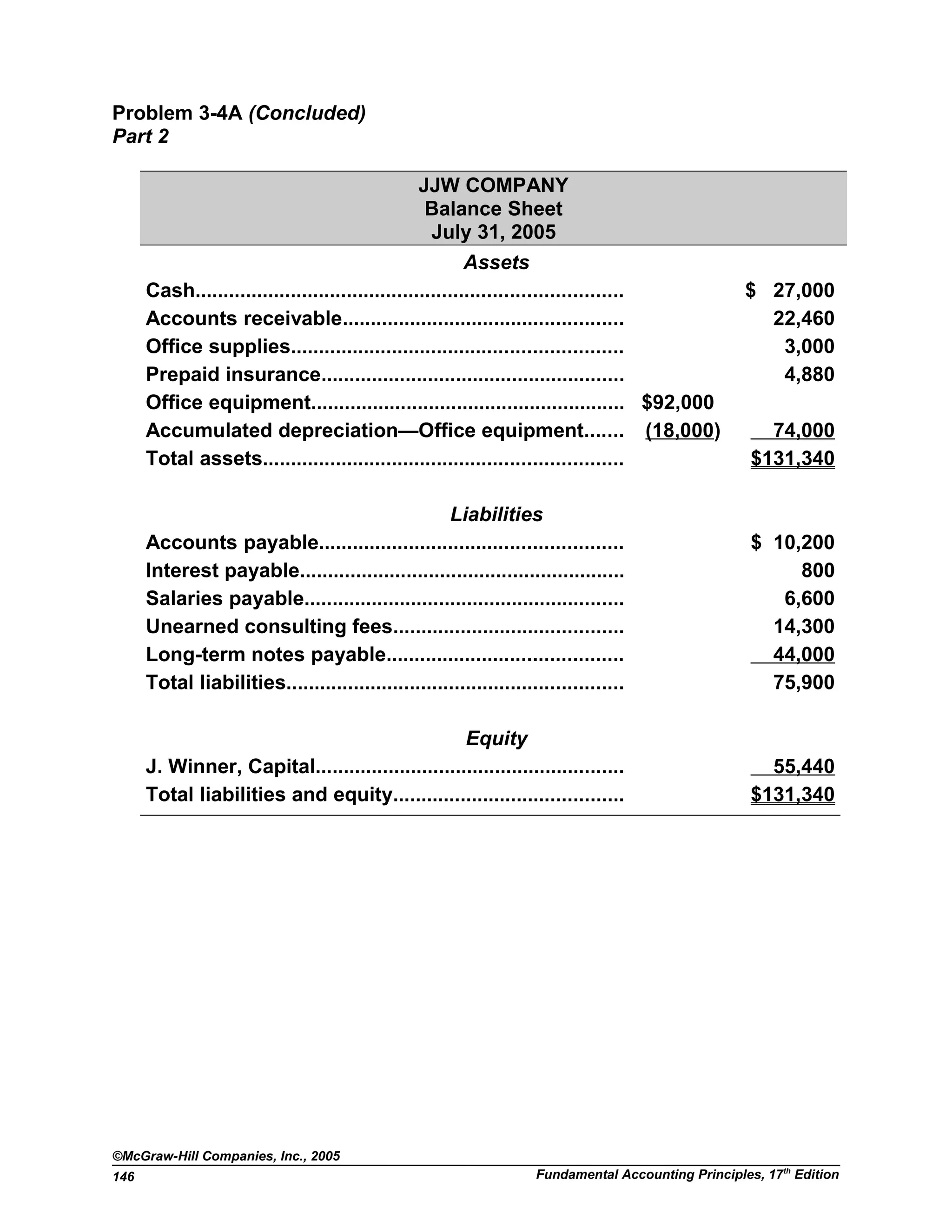

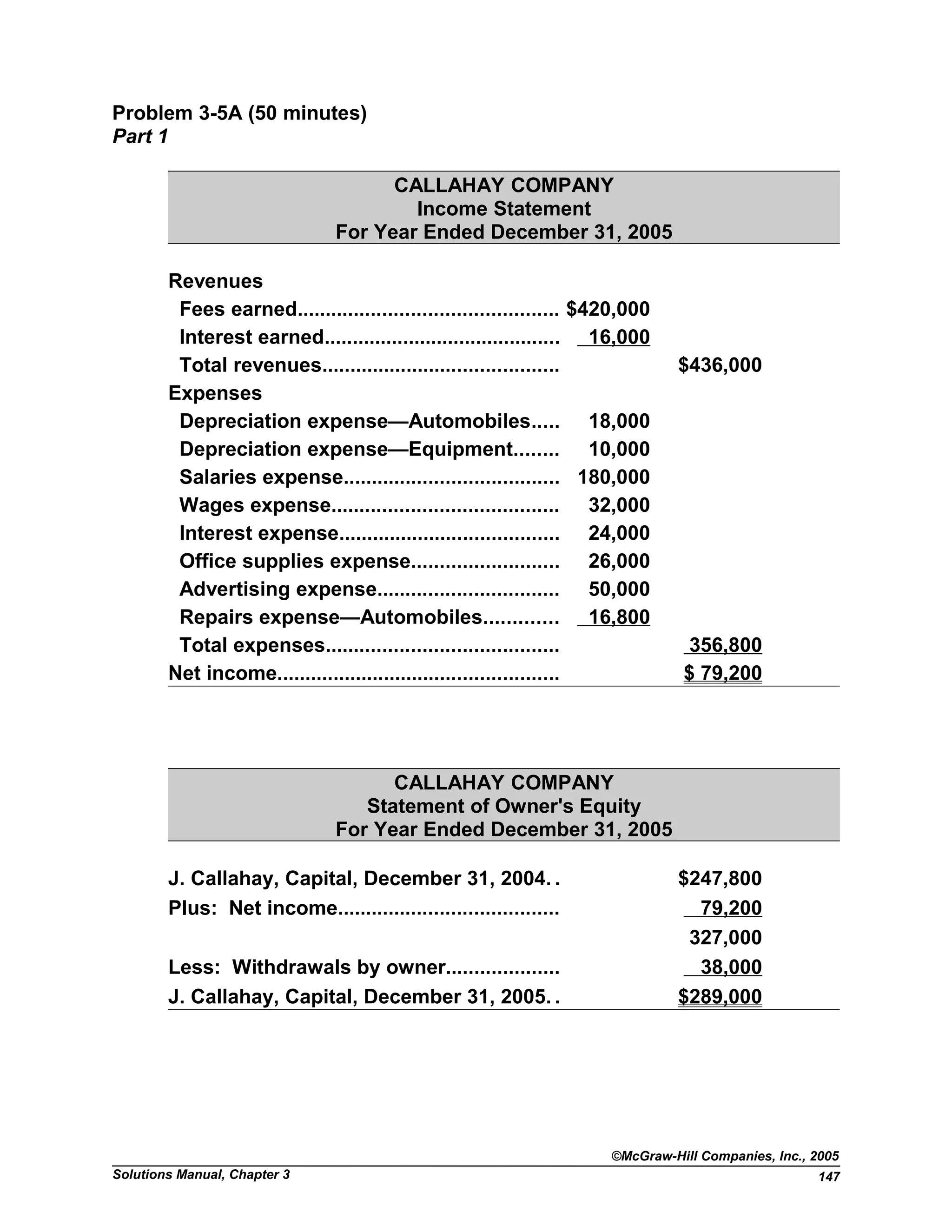

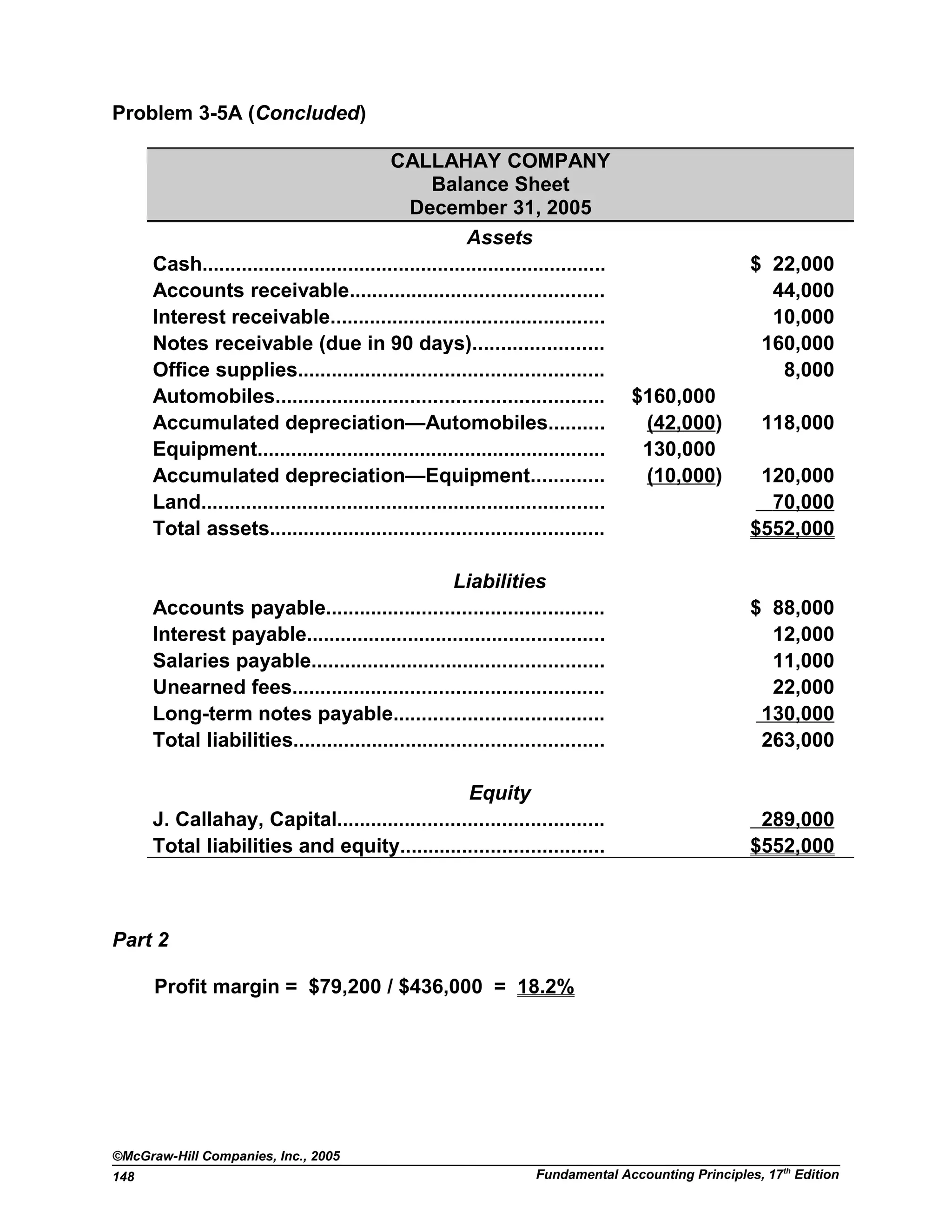

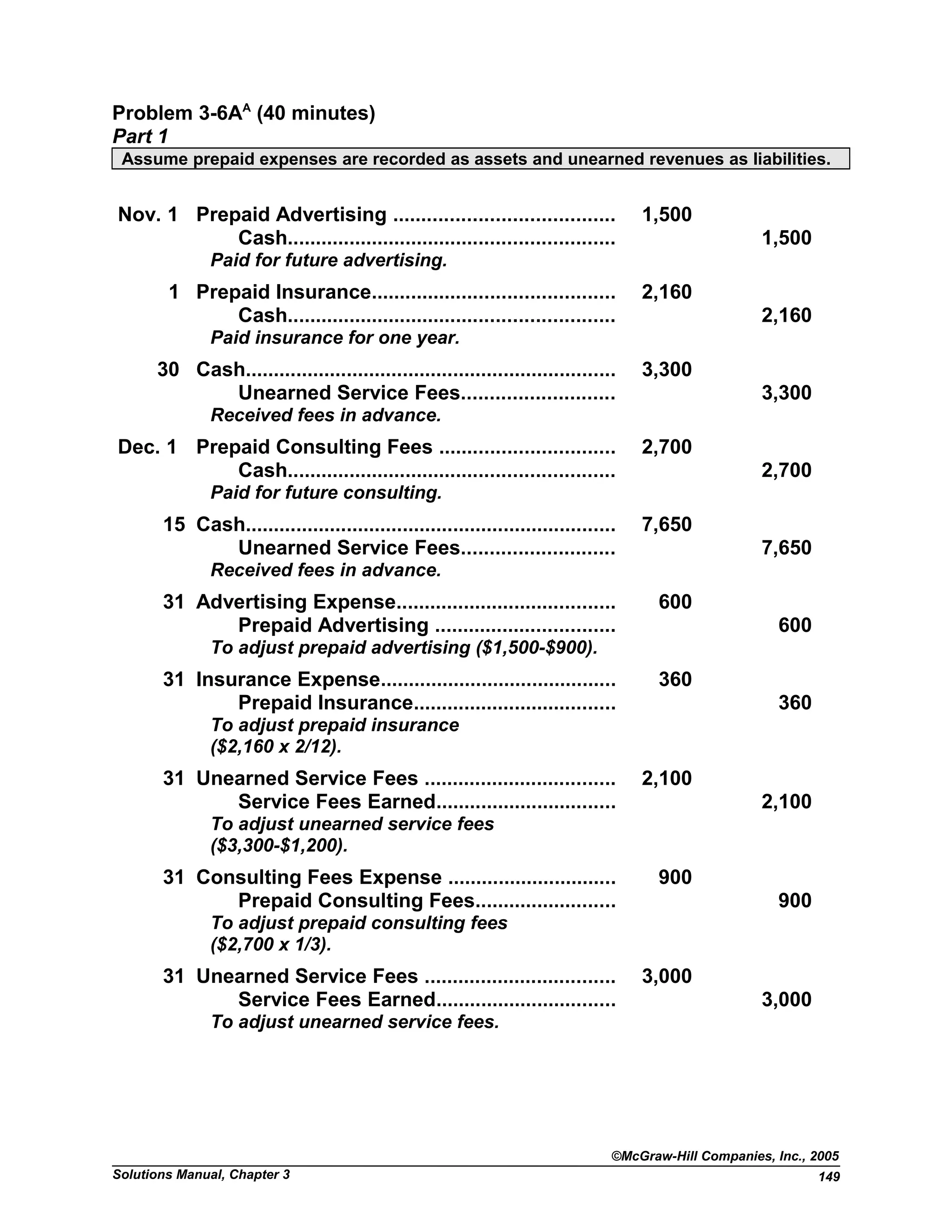

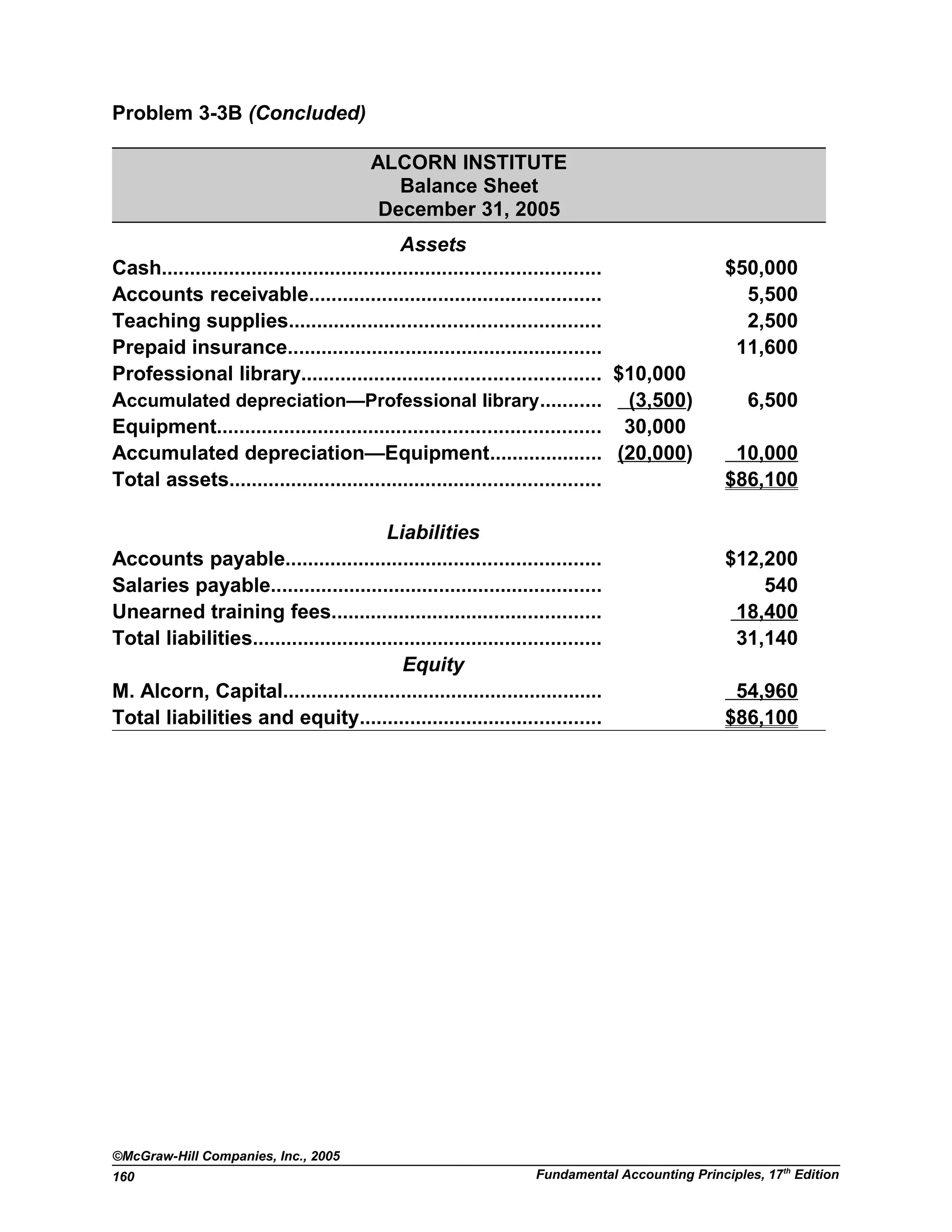

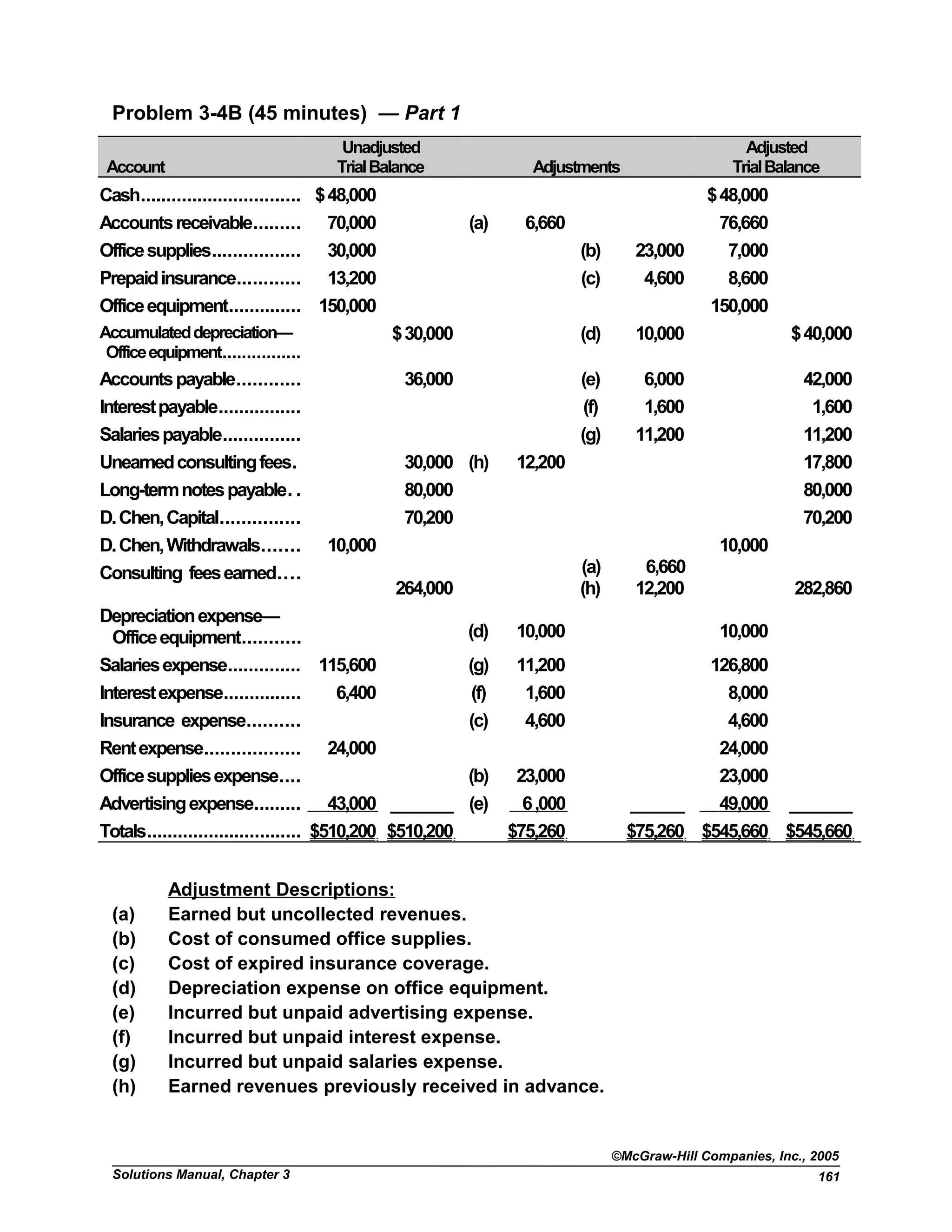

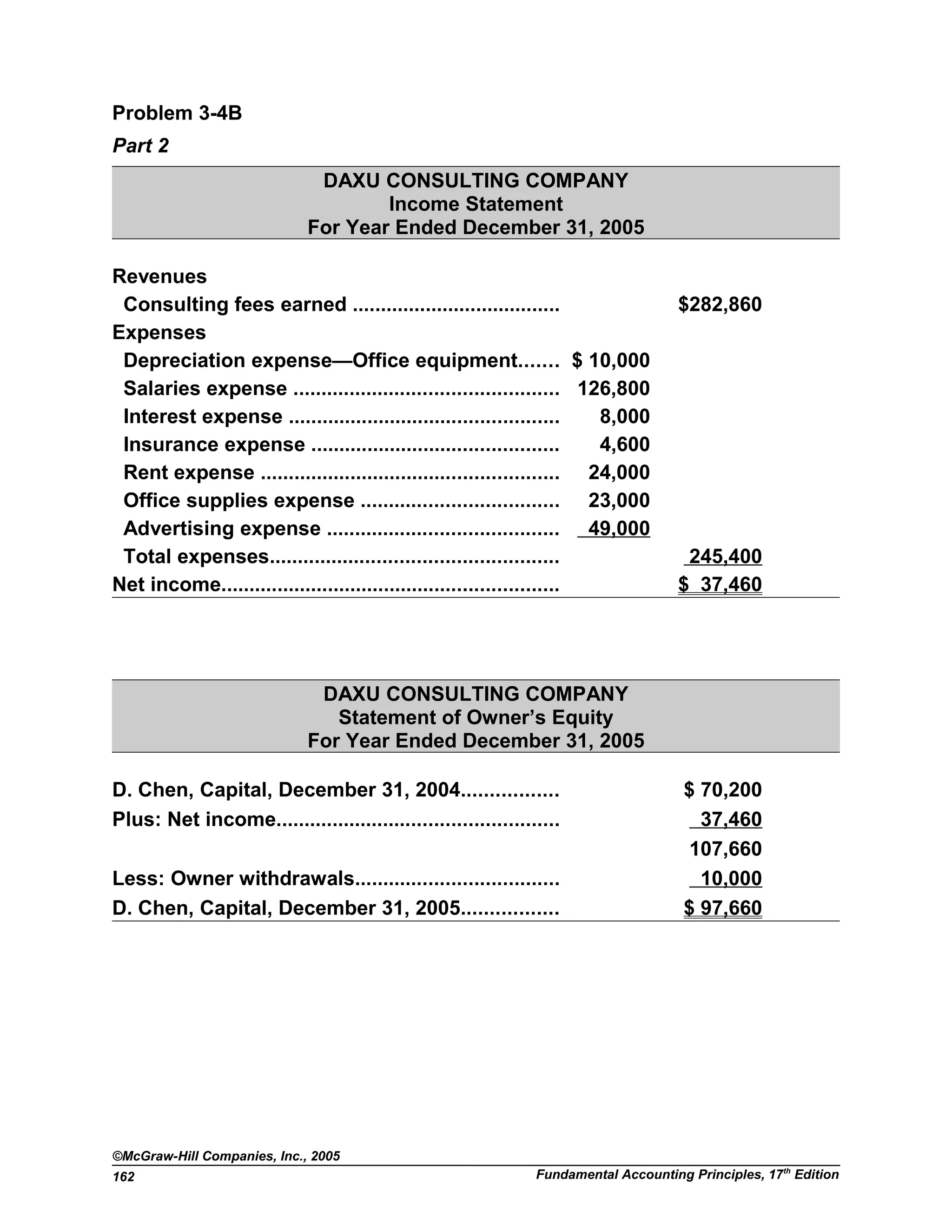

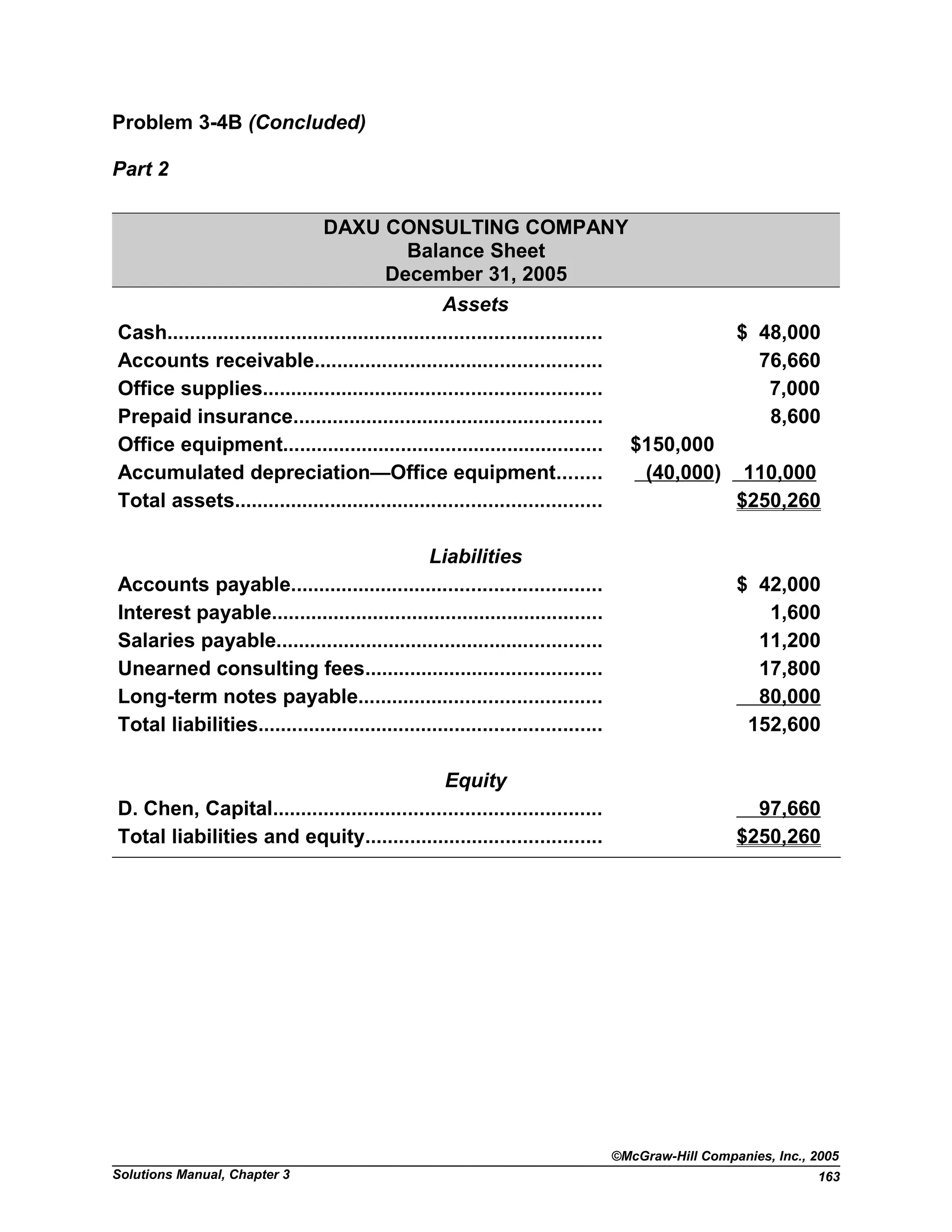

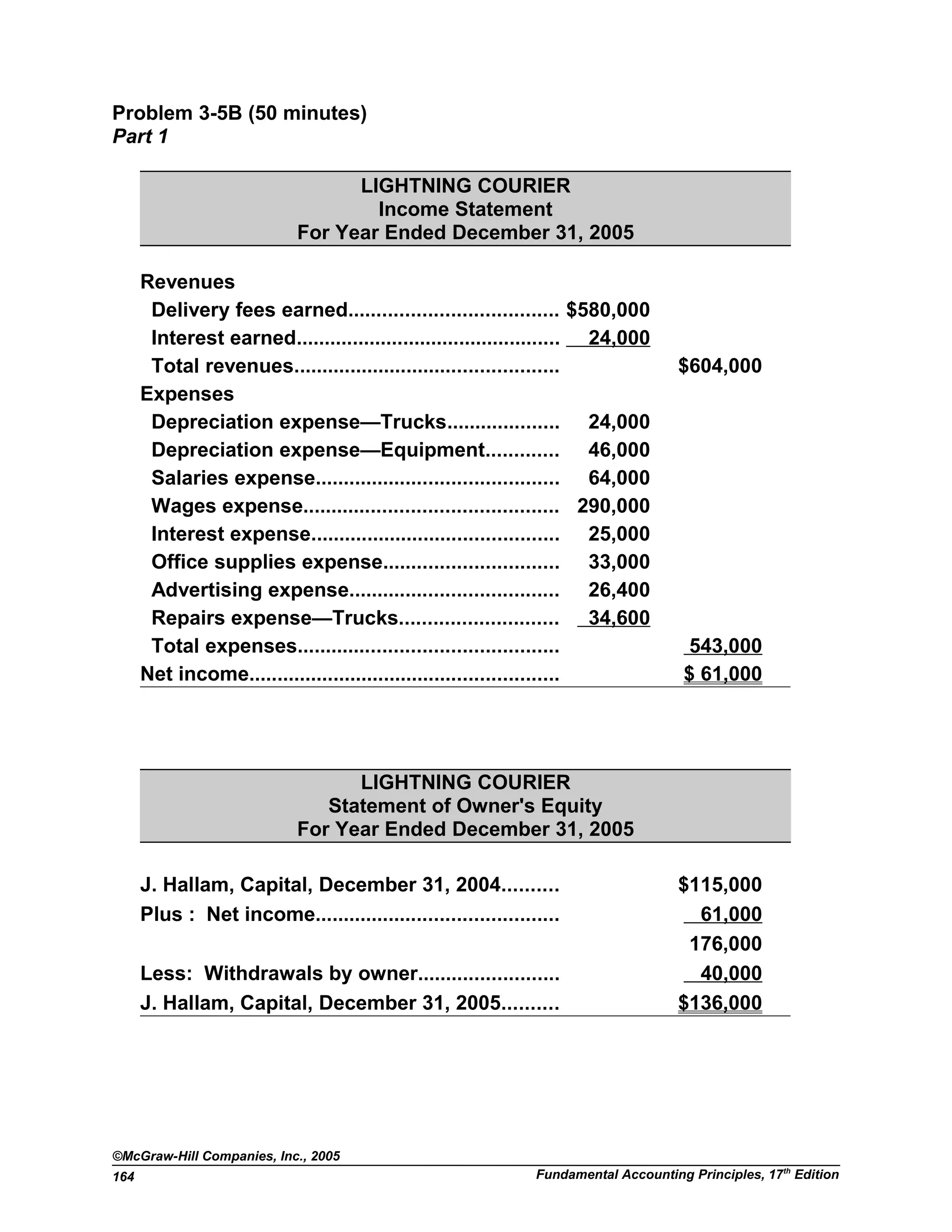

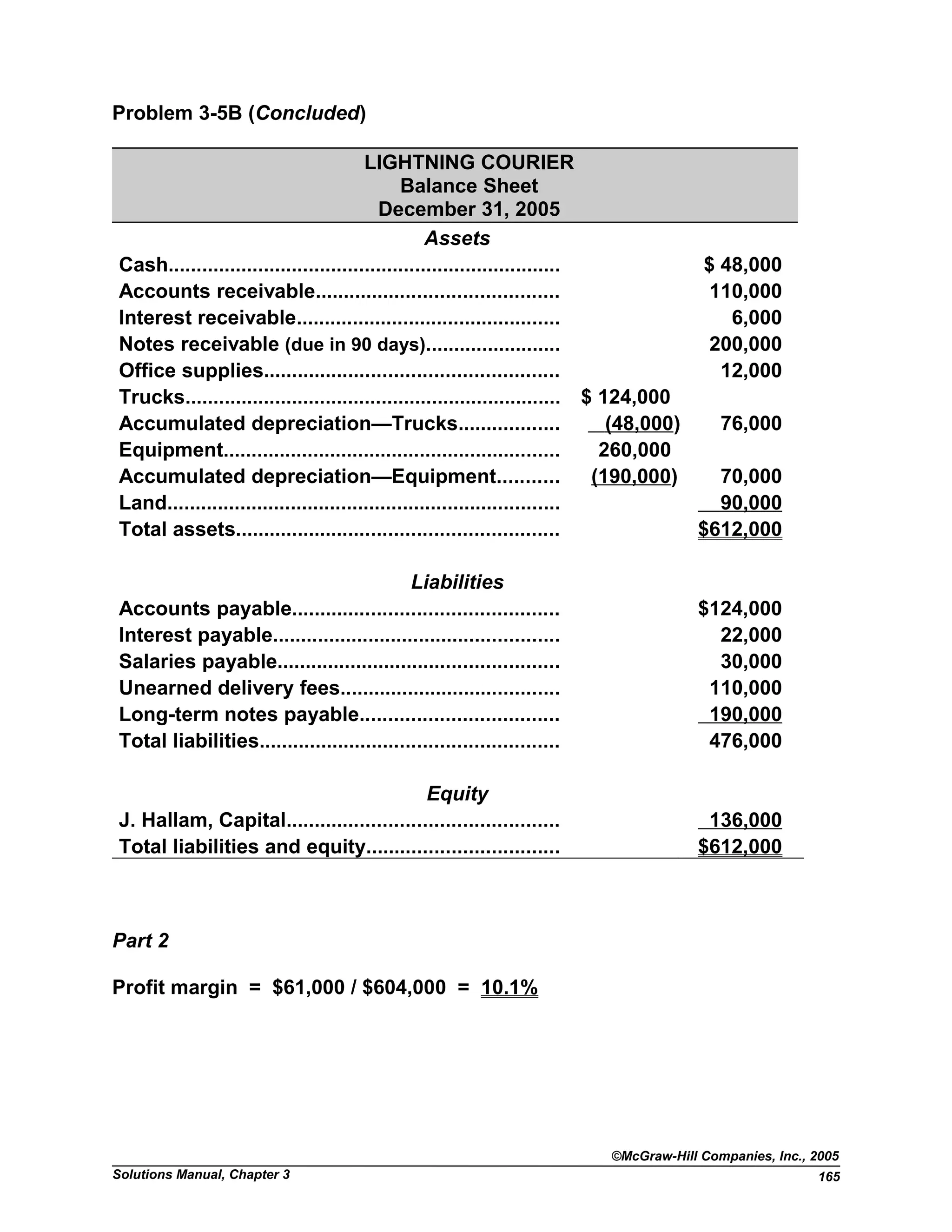

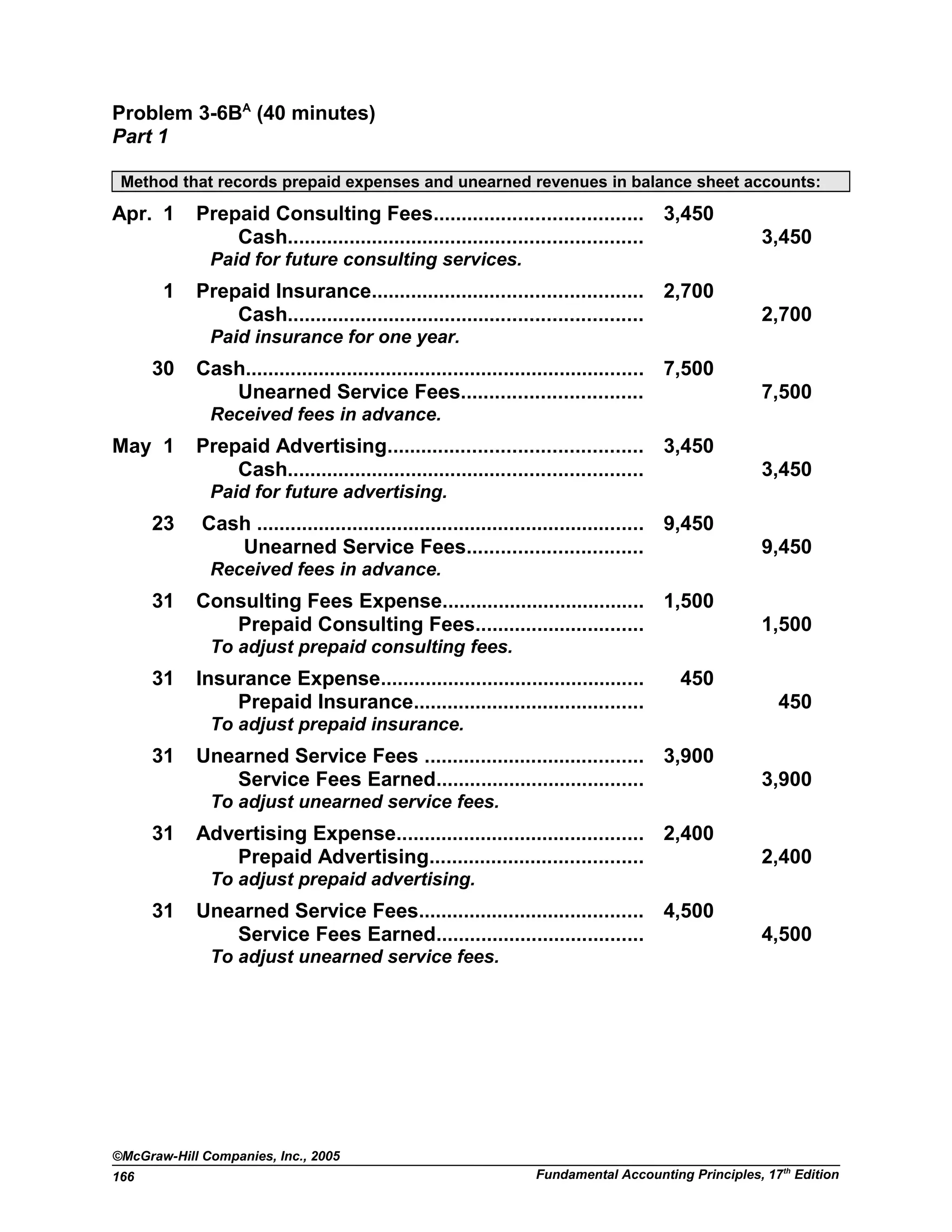

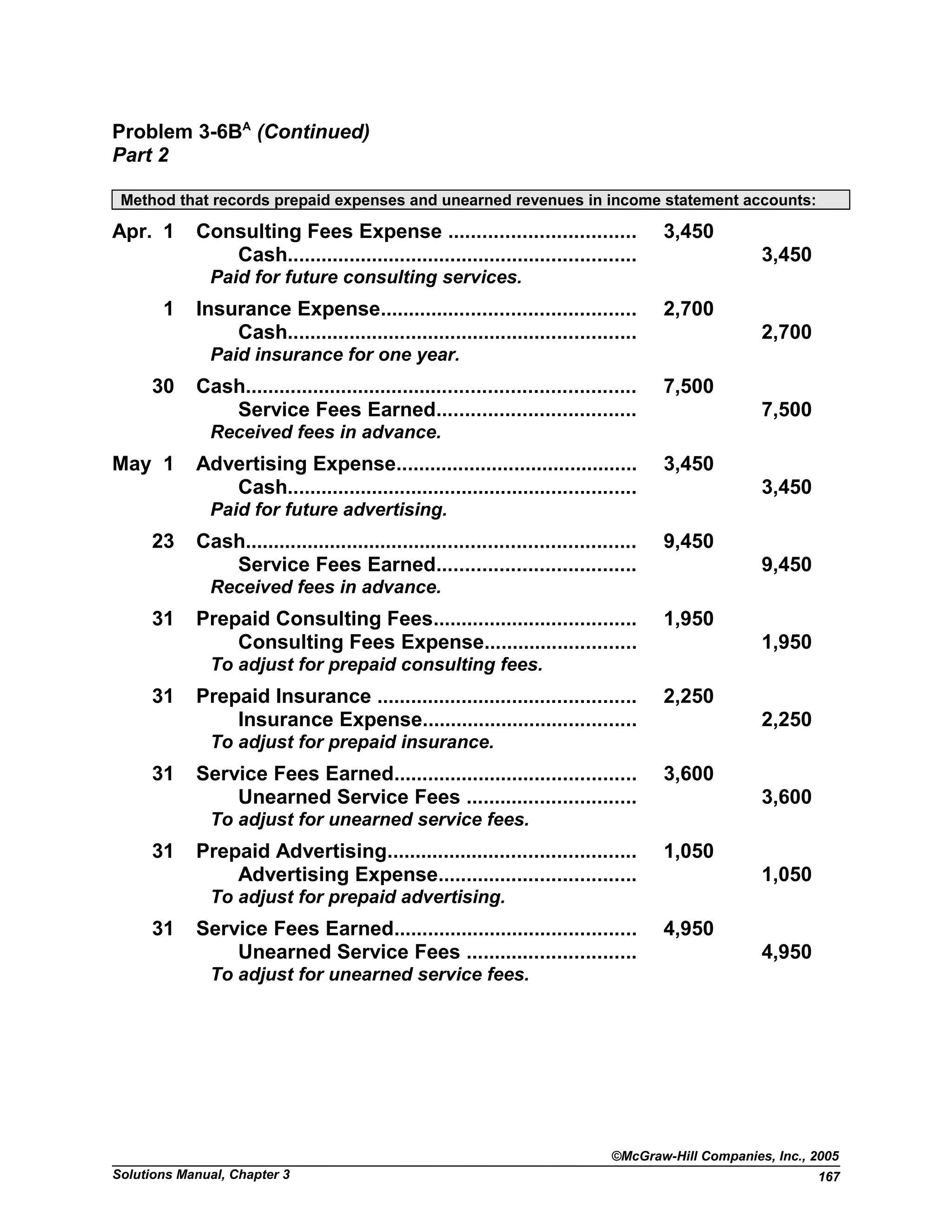

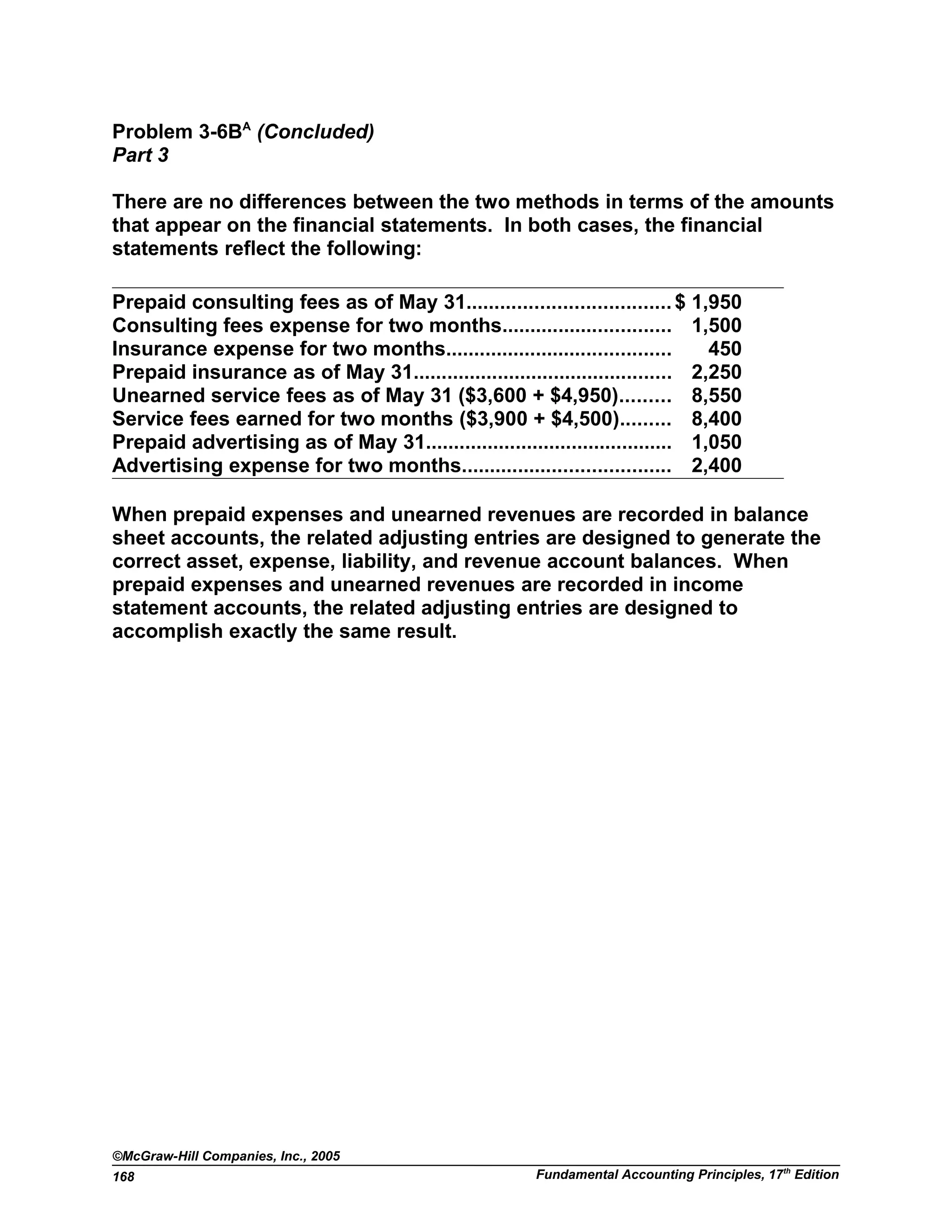

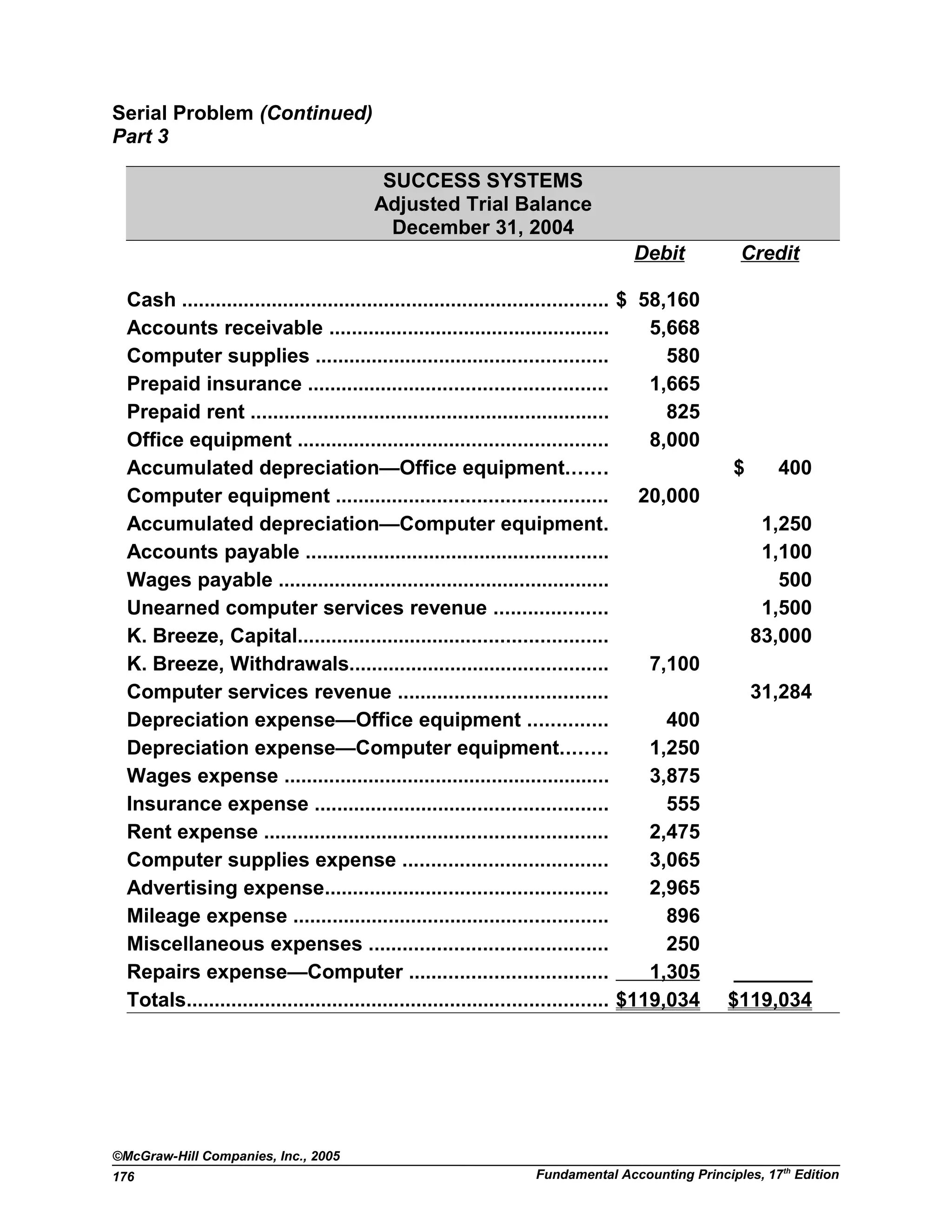

The document discusses various accounting concepts related to adjusting accounts and preparing financial statements. It includes questions about the differences between cash basis and accrual basis accounting, examples of accounts that require adjustment such as prepaid expenses, depreciation, accrued revenues and expenses, and unearned revenues. It also provides examples of adjusting journal entries companies would make.

![11. In addition to prepayments, Tastykake must make adjusting entries to Property,

Plant and Equipment, Deferred Income Taxes, Accrued Payroll and Employee

Benefits, and possibly other assets and liabilities such as Receivables (for bad

debts).

12. The Accrued Wages Expense would be reported as part of “Accrued Expenses and

Other Liabilities” on Harley-Davidson’s balance sheet.

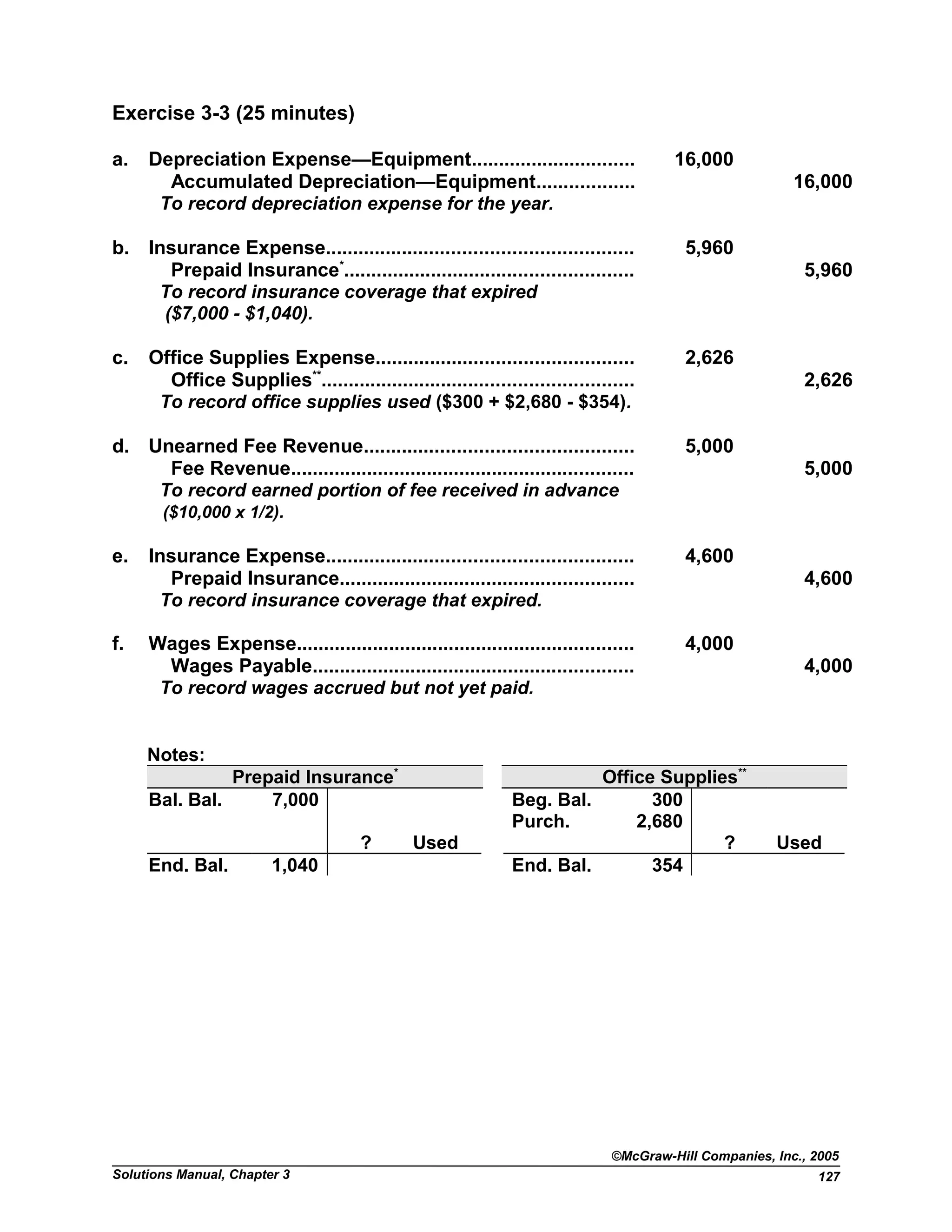

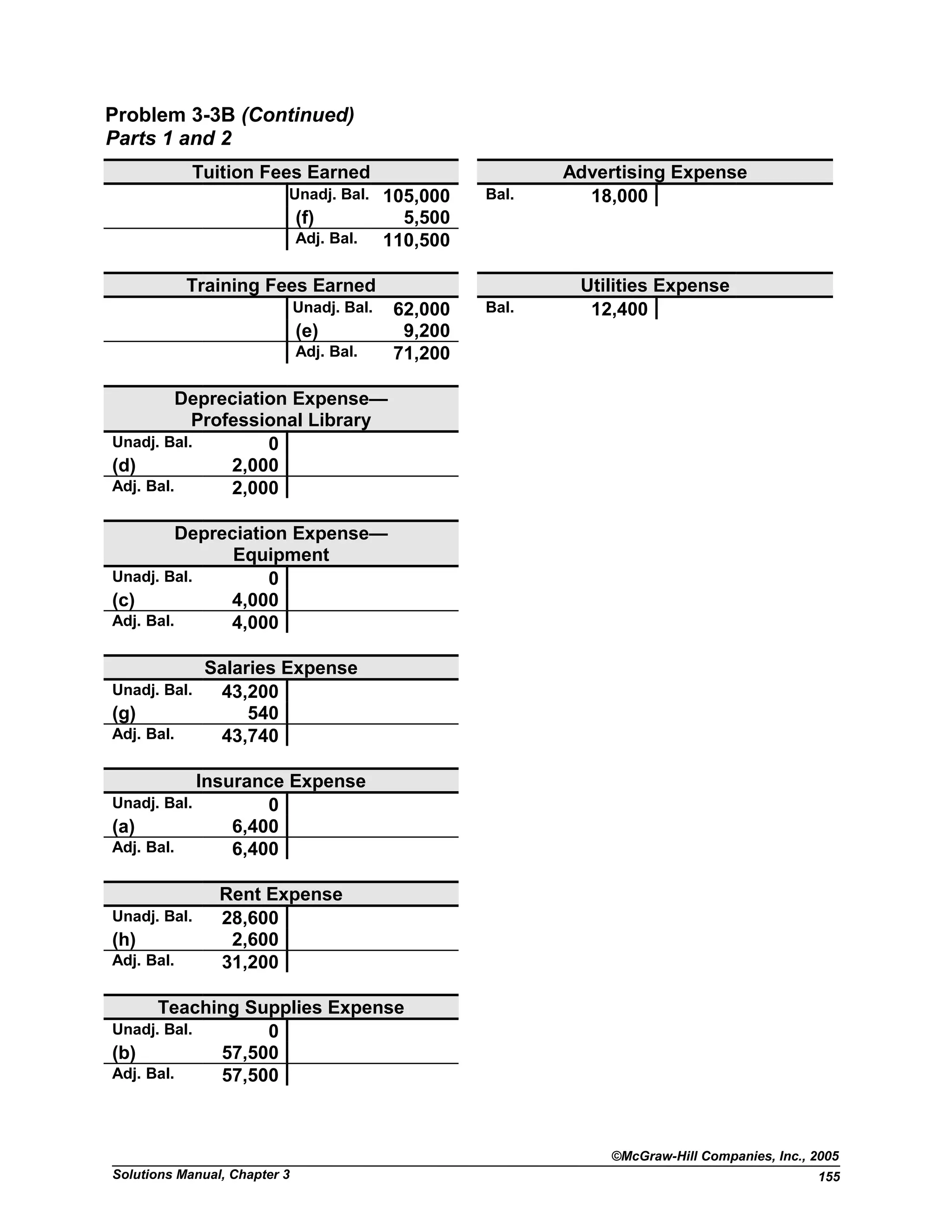

QUICK STUDIES

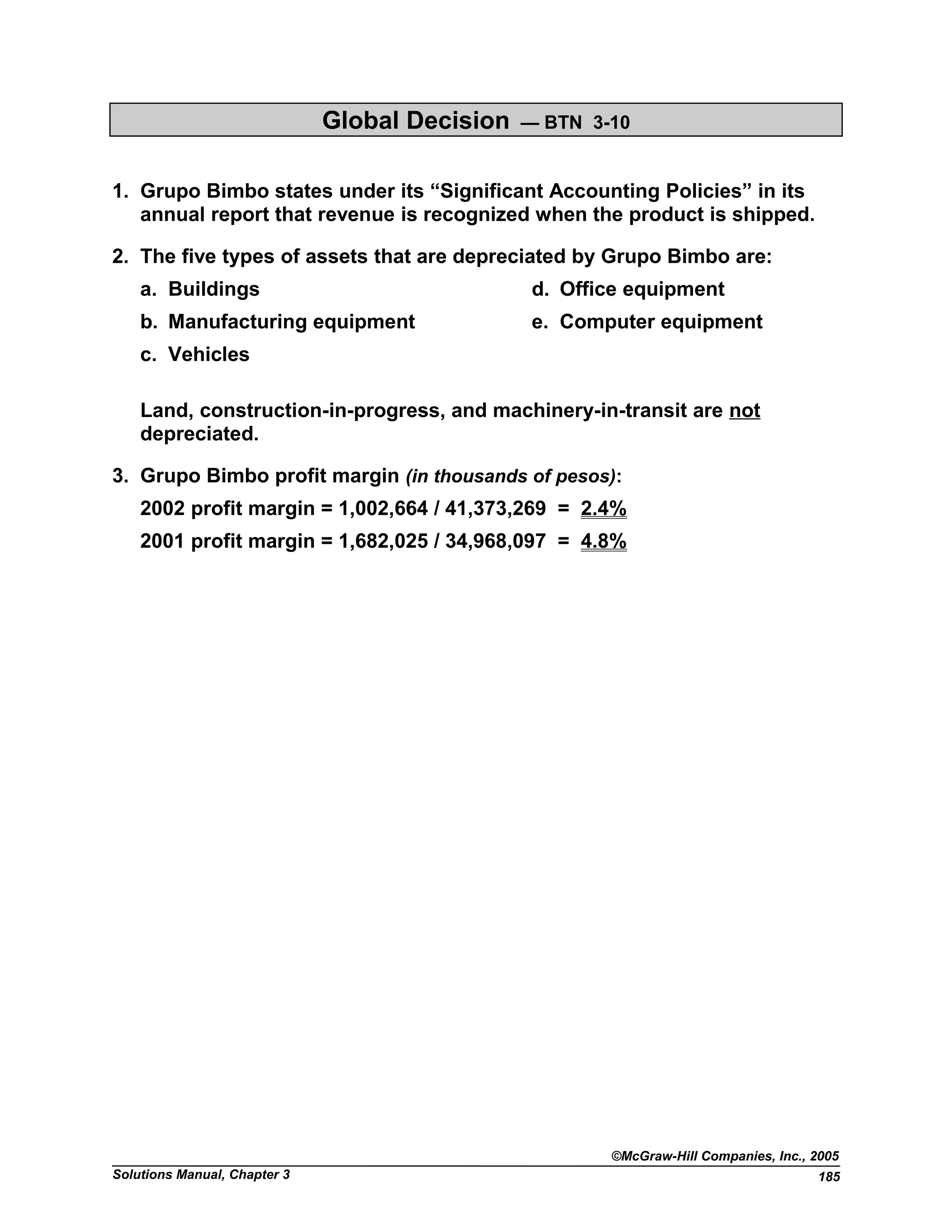

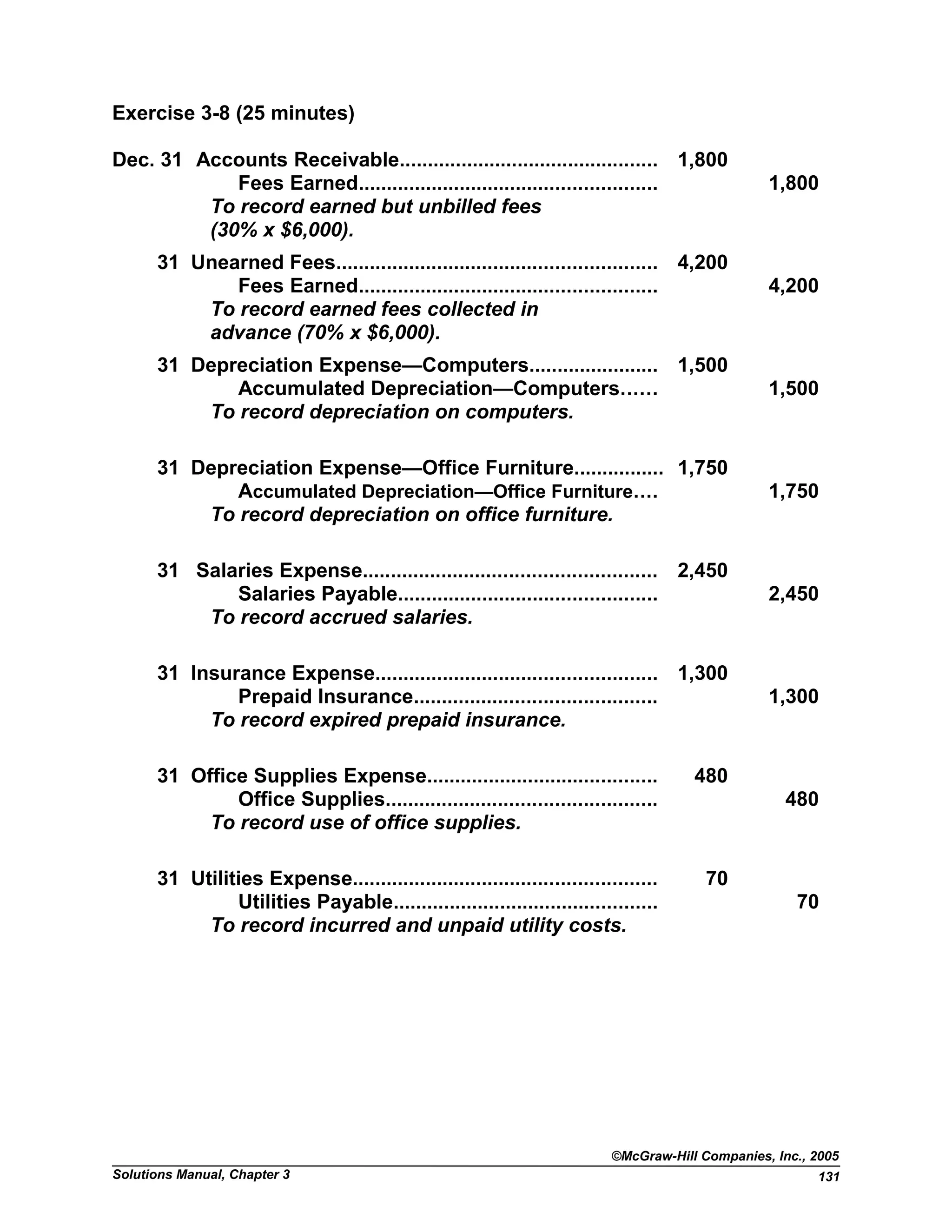

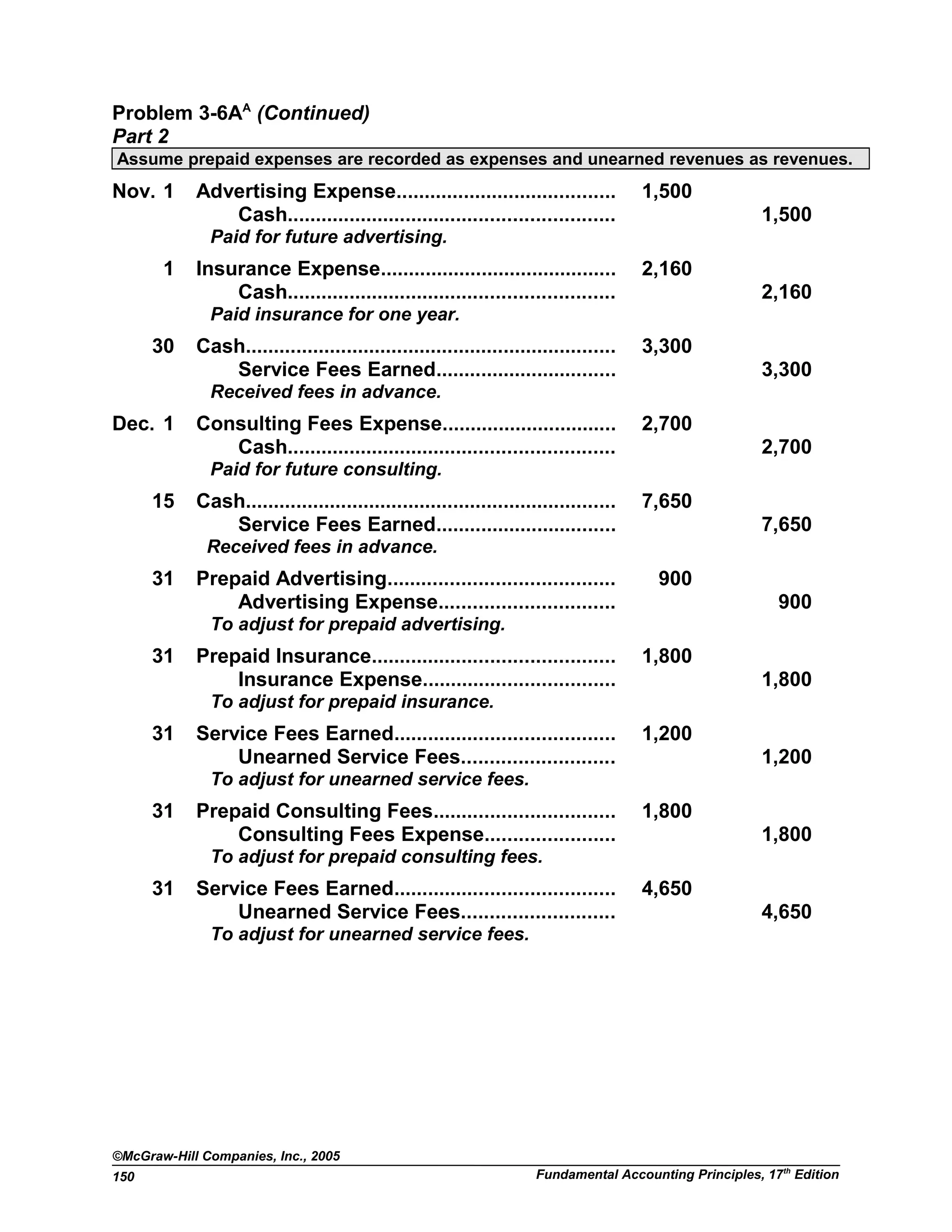

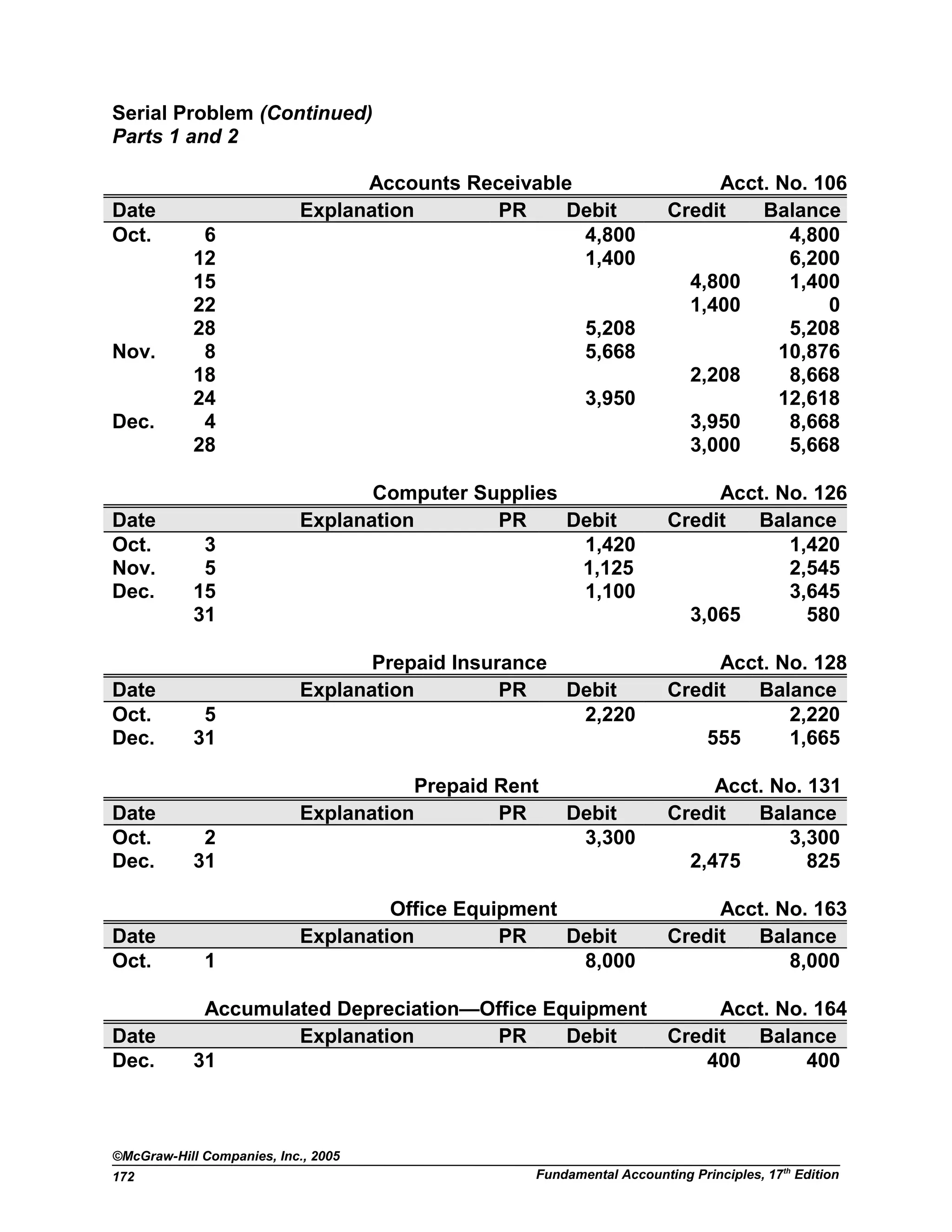

Quick Study 3-1 (10 minutes)

a. UR Unearned revenue

b. PE Prepaid expenses (Depreciation)

c. AE Accrued expenses

d. AR Accrued revenue

e. PE Prepaid expenses

Quick Study 3-2 (10 minutes)

a. Insurance Expense....................................................... 1,800

Prepaid Insurance................................................. 1,800

To record 6-month insurance coverage expired.

b. Supplies Expense......................................................... 2,700

Supplies.................................................................. 2,700

To record supplies used during the year.

($1,000 + $3,000 – [?] = $1,300)

Quick Study 3-3 (10 minutes)

a. Depreciation Expense—Equipment............................ 5,000

Accumulated Depreciation—Equipment............. 5,000

To record depreciation expense for the year.

($30,000 - $5,000) / 5 years = $5,000

b. No depreciation adjustments are made for land as it is expected to last

indefinitely.

©McGraw-Hill Companies, Inc., 2005

Fundamental Accounting Principles, 17th

Edition120](https://image.slidesharecdn.com/solutionmanualchapter3fap-140409230507-phpapp01/75/Solution-manual-chapter-3-fap-2-2048.jpg)

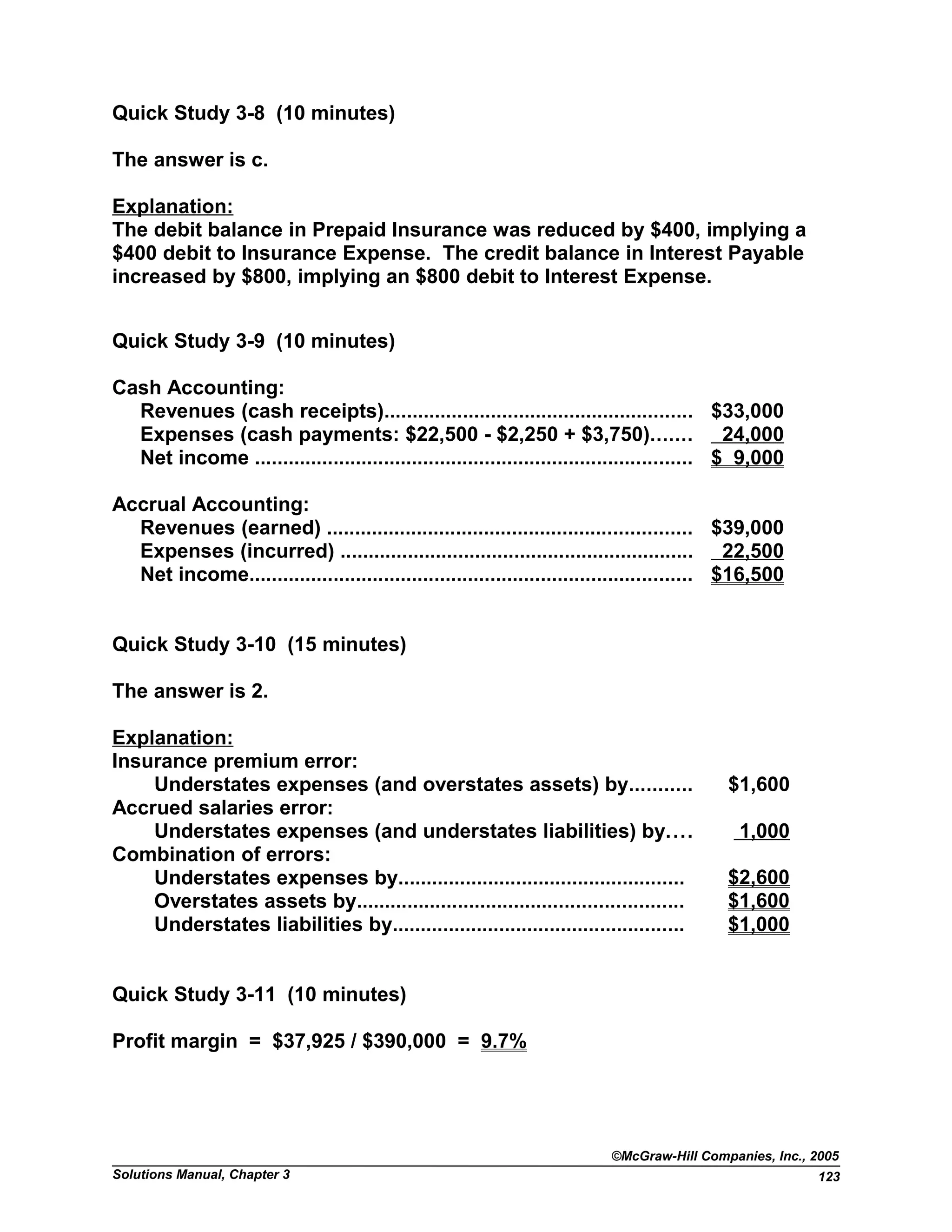

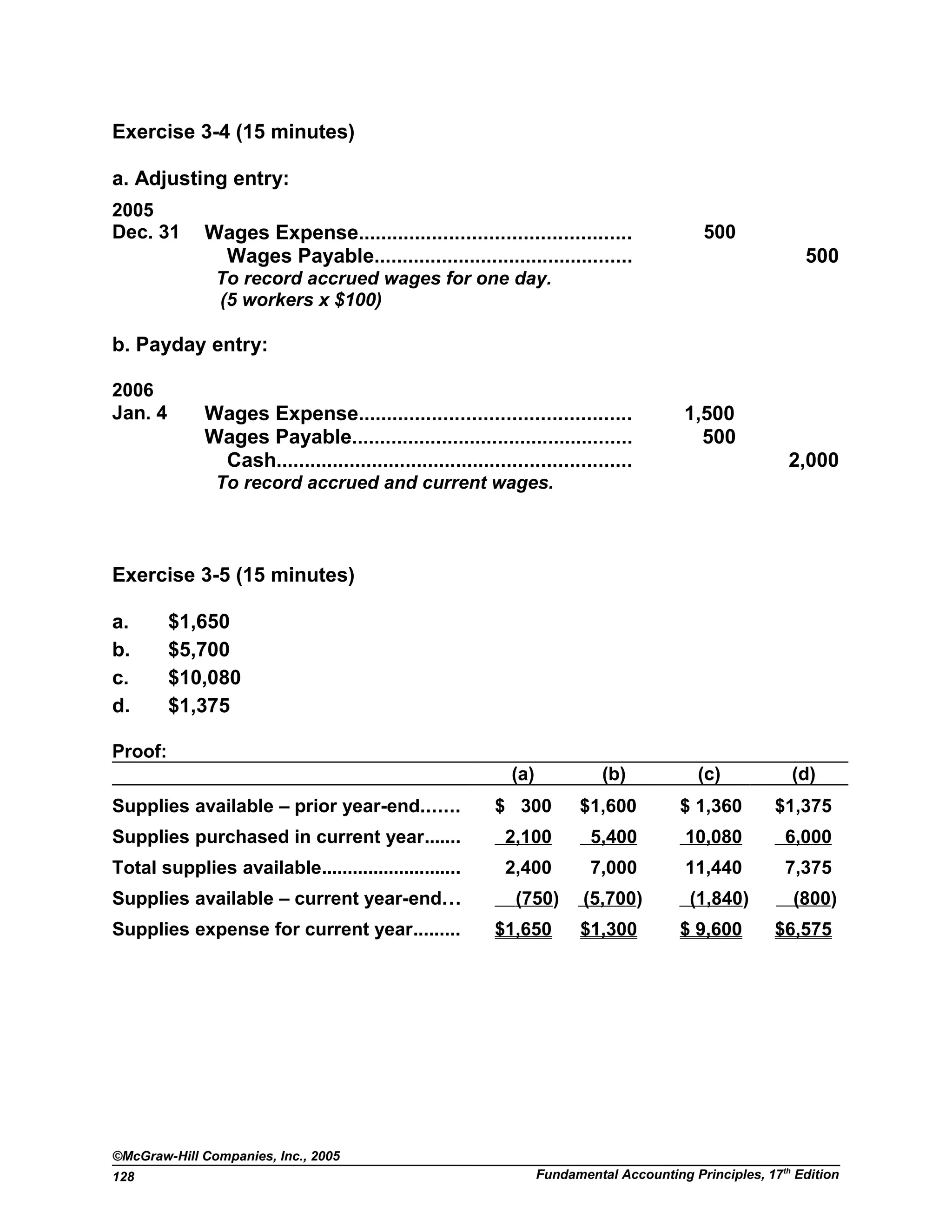

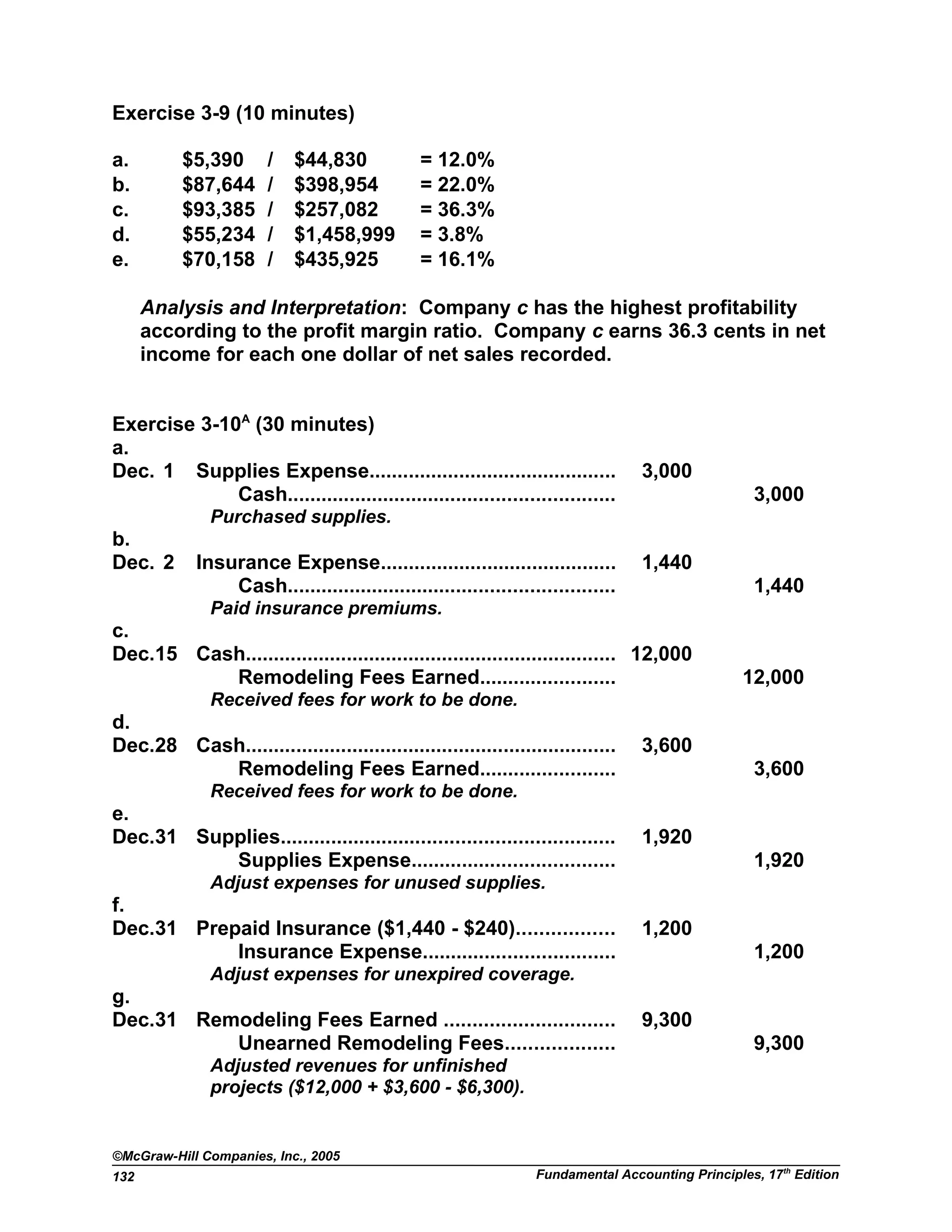

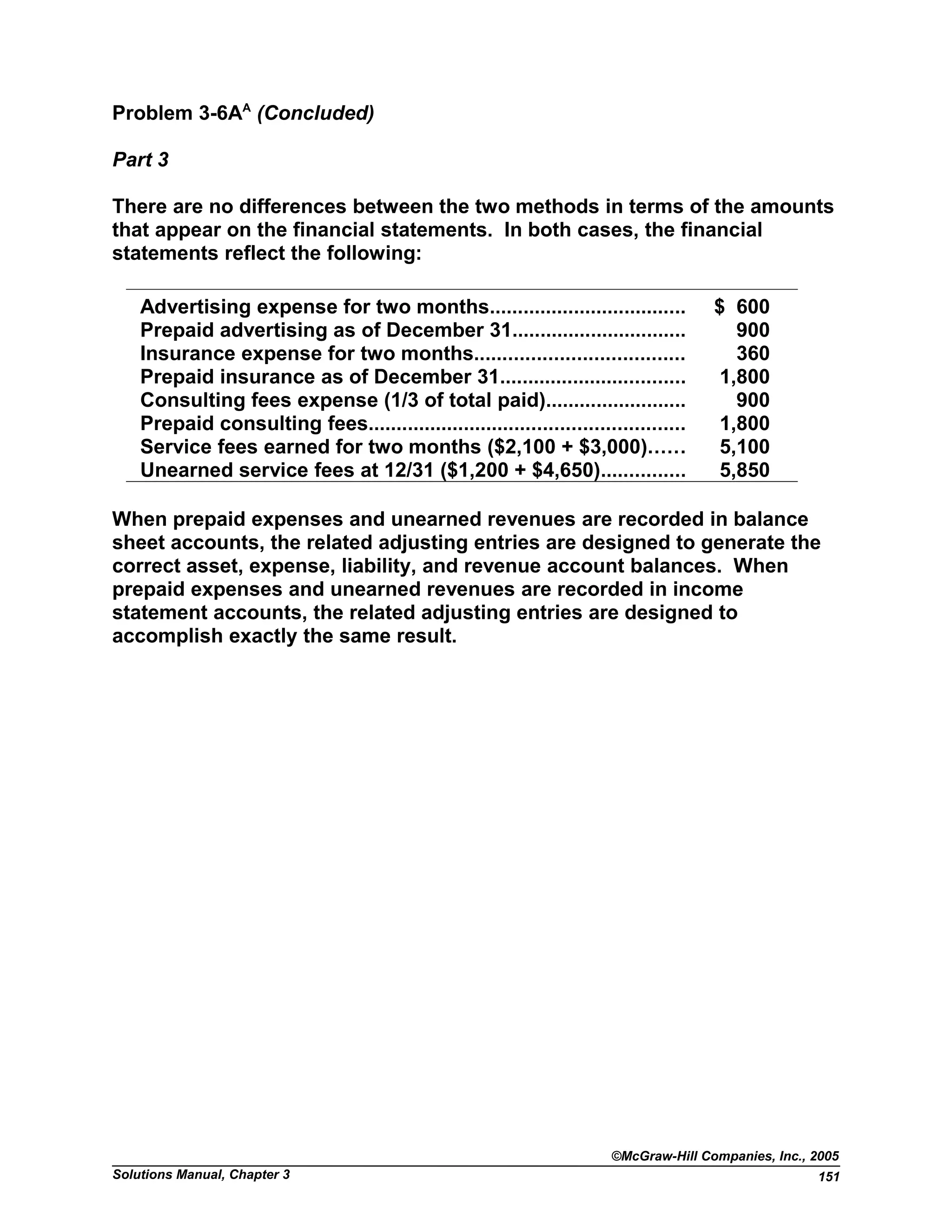

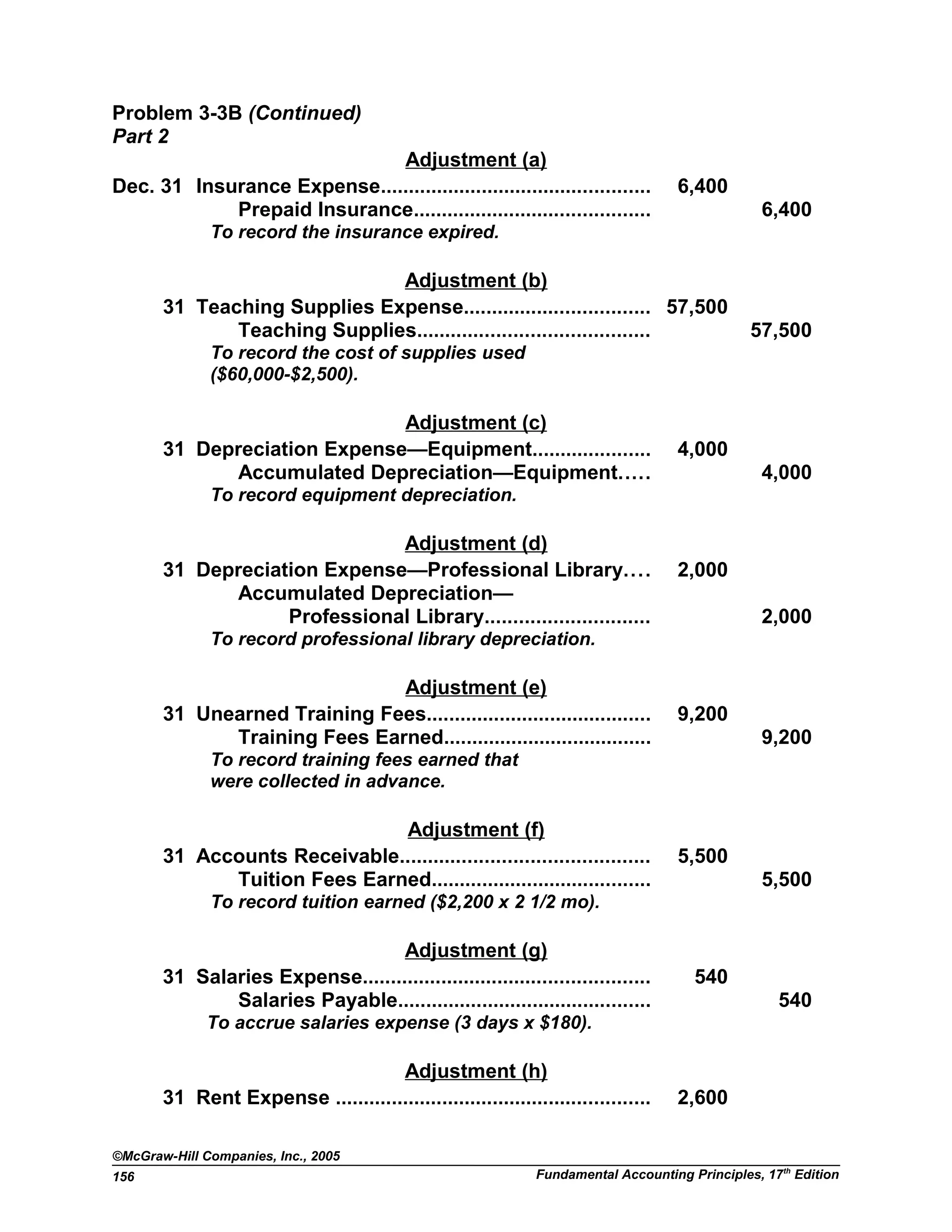

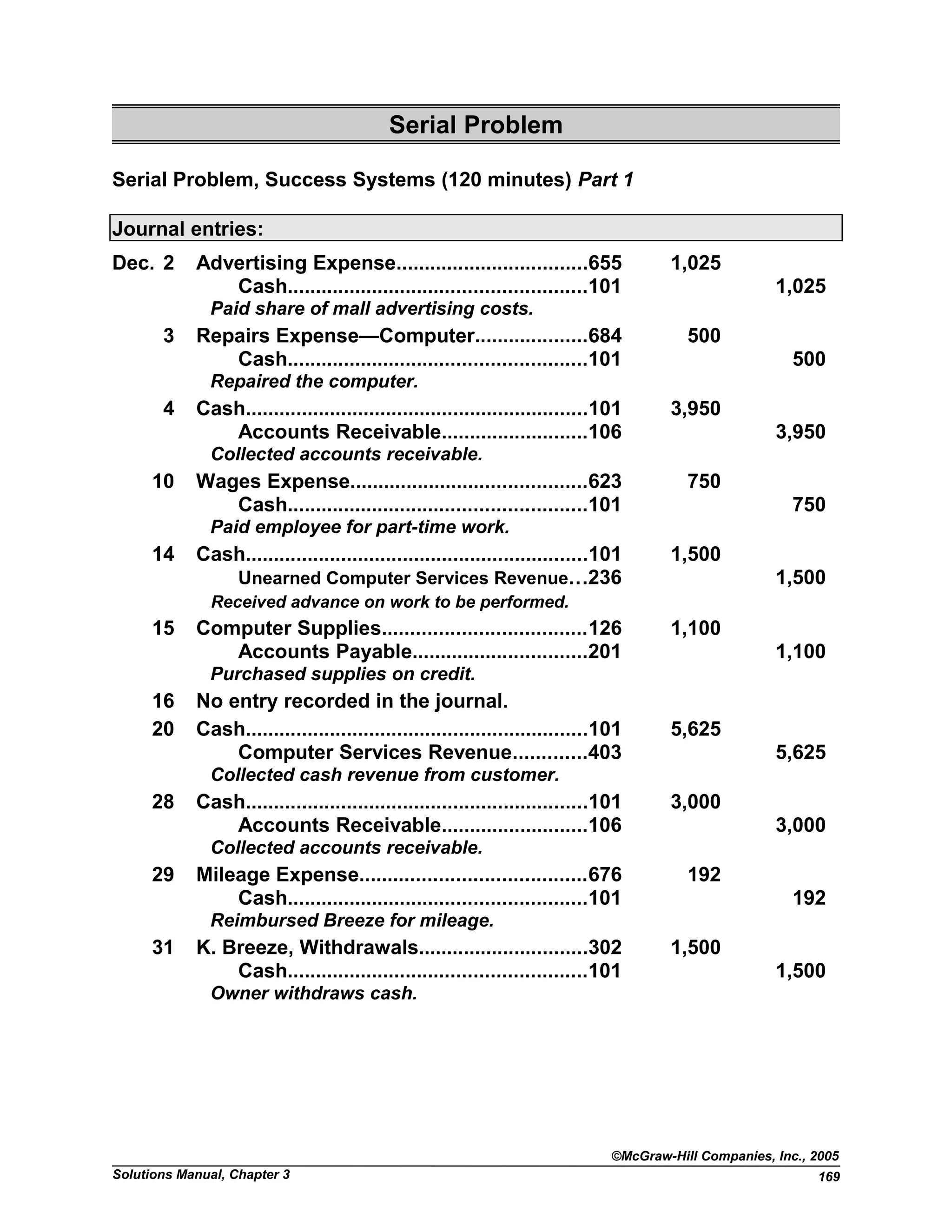

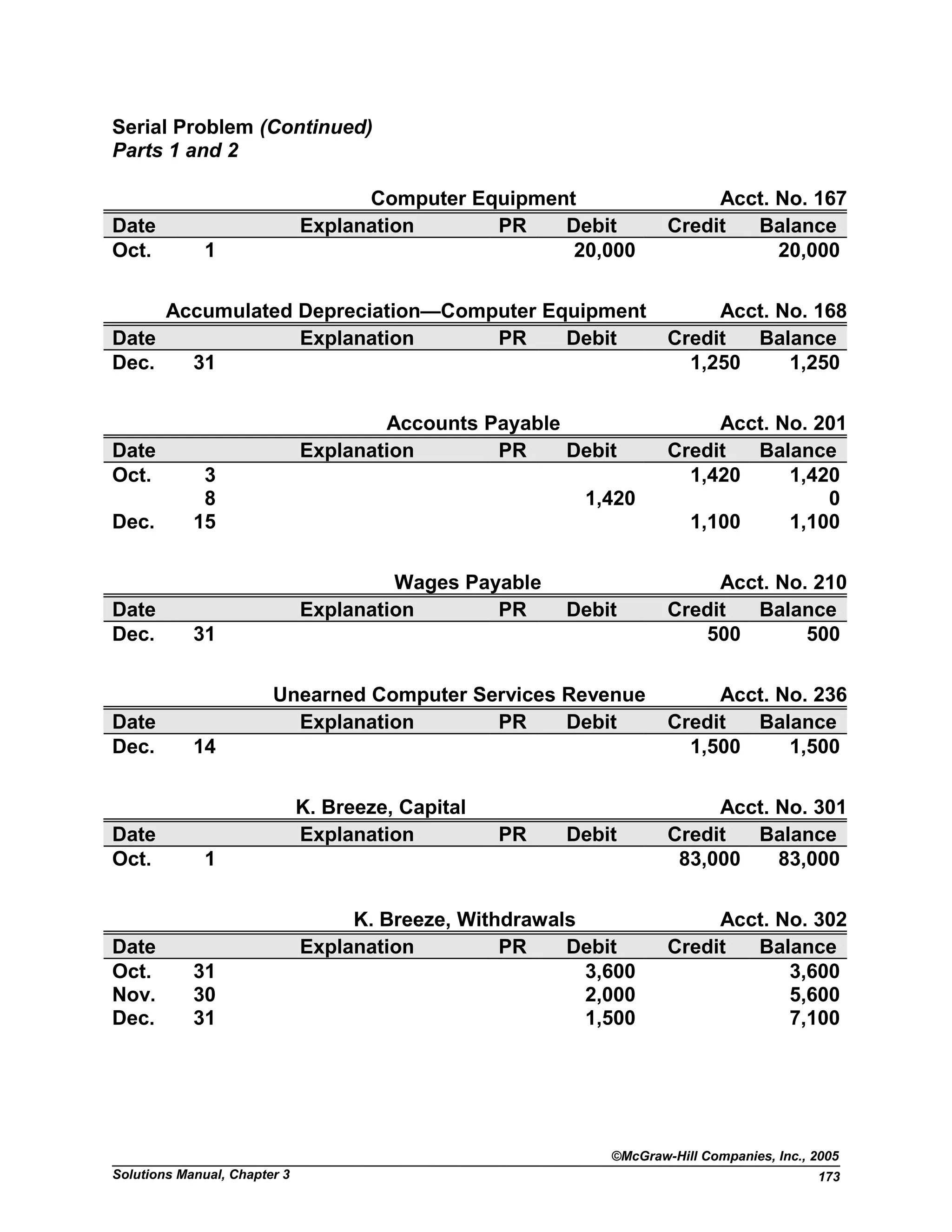

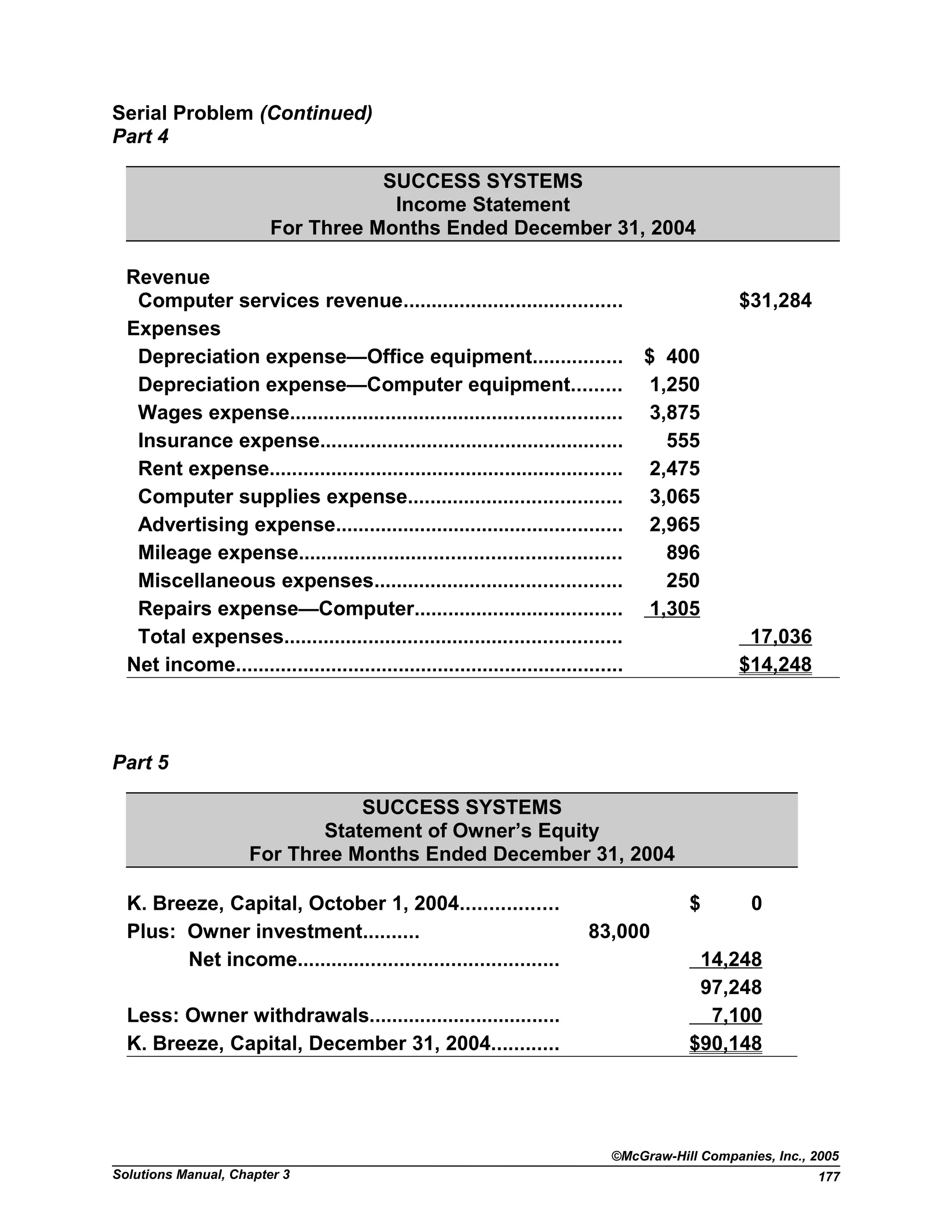

![Quick Study 3-4 (15 minutes)

a. Unearned Revenue........................................................ 15,000

Legal Revenue....................................................... 15,000

To recognize legal revenue earned (20,000 x 3/4).

b. Unearned Subscription Revenue................................ 2,400

Subscription Revenue........................................... 2,400

To recognize subscription revenue earned.

[100 x ($48 / 12 month) x 6 months]

Quick Study 3-5 (10 minutes)

Salaries Expense........................................................... 400

Salaries Payable.................................................... 400

To record salaries incurred but not yet paid.

[One student earns, $100 x 4 days, M-R]

Quick Study 3-6 (15 minutes)

Accounts Debited and Credited Financial Statement

a. Debit Unearned Revenue Balance Sheet

Credit Revenue Earned Income Statement

b. Debit Depreciation Expense Income Statement

Credit Accumulated Depreciation Balance Sheet

c. Debit Wages Expense Income Statement

Credit Wages Payable Balance Sheet

d. Debit Accounts Receivable Balance Sheet

Credit Revenue Earned Income Statement

e. Debit Insurance Expense Income Statement

Credit Prepaid Insurance Balance Sheet

Quick Study 3-7 (10 minutes)

Adjusting entry Debit Credit

1. Accrue salaries expense f d

2. Adjust the Unearned Services Revenue account e g

©McGraw-Hill Companies, Inc., 2005

Solutions Manual, Chapter 3 121](https://image.slidesharecdn.com/solutionmanualchapter3fap-140409230507-phpapp01/75/Solution-manual-chapter-3-fap-3-2048.jpg)

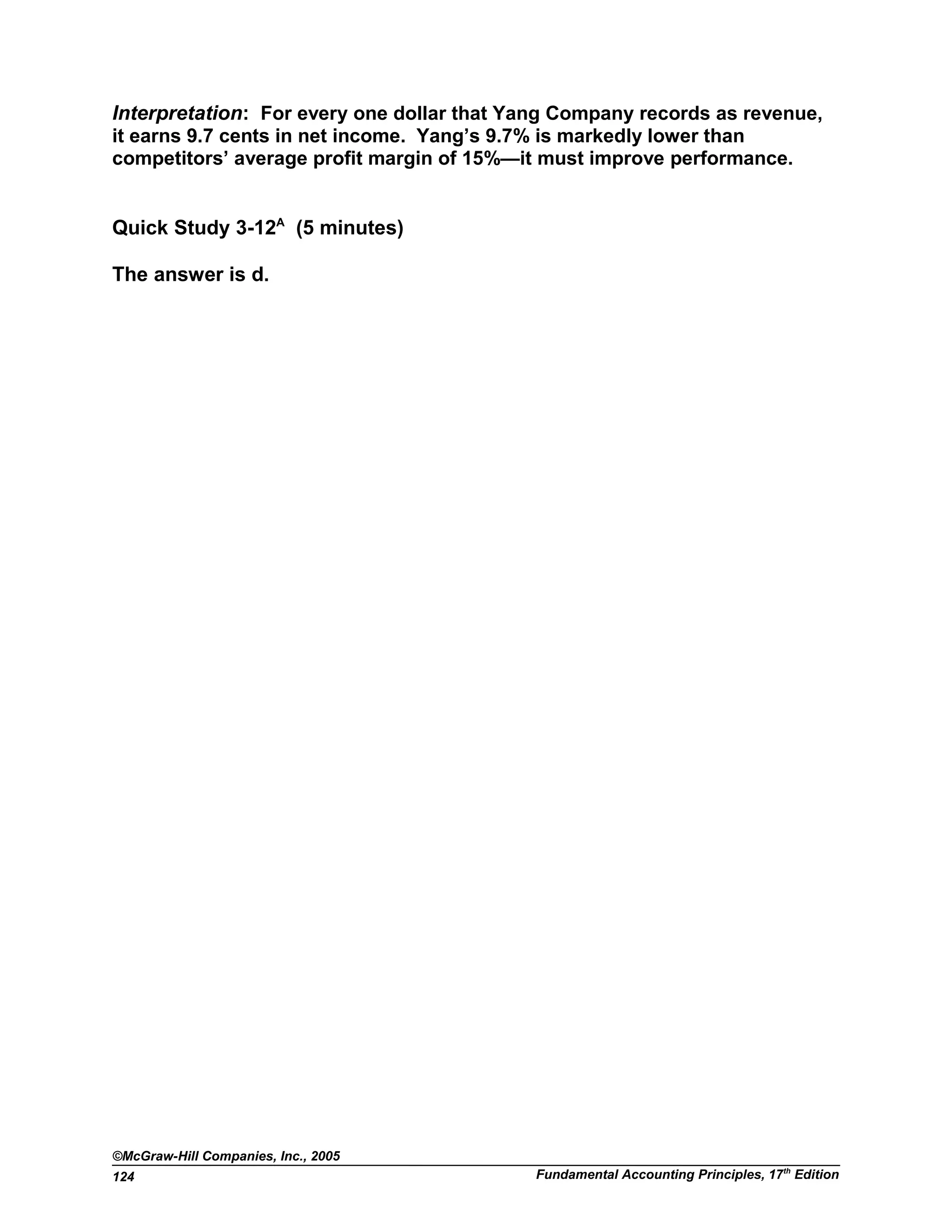

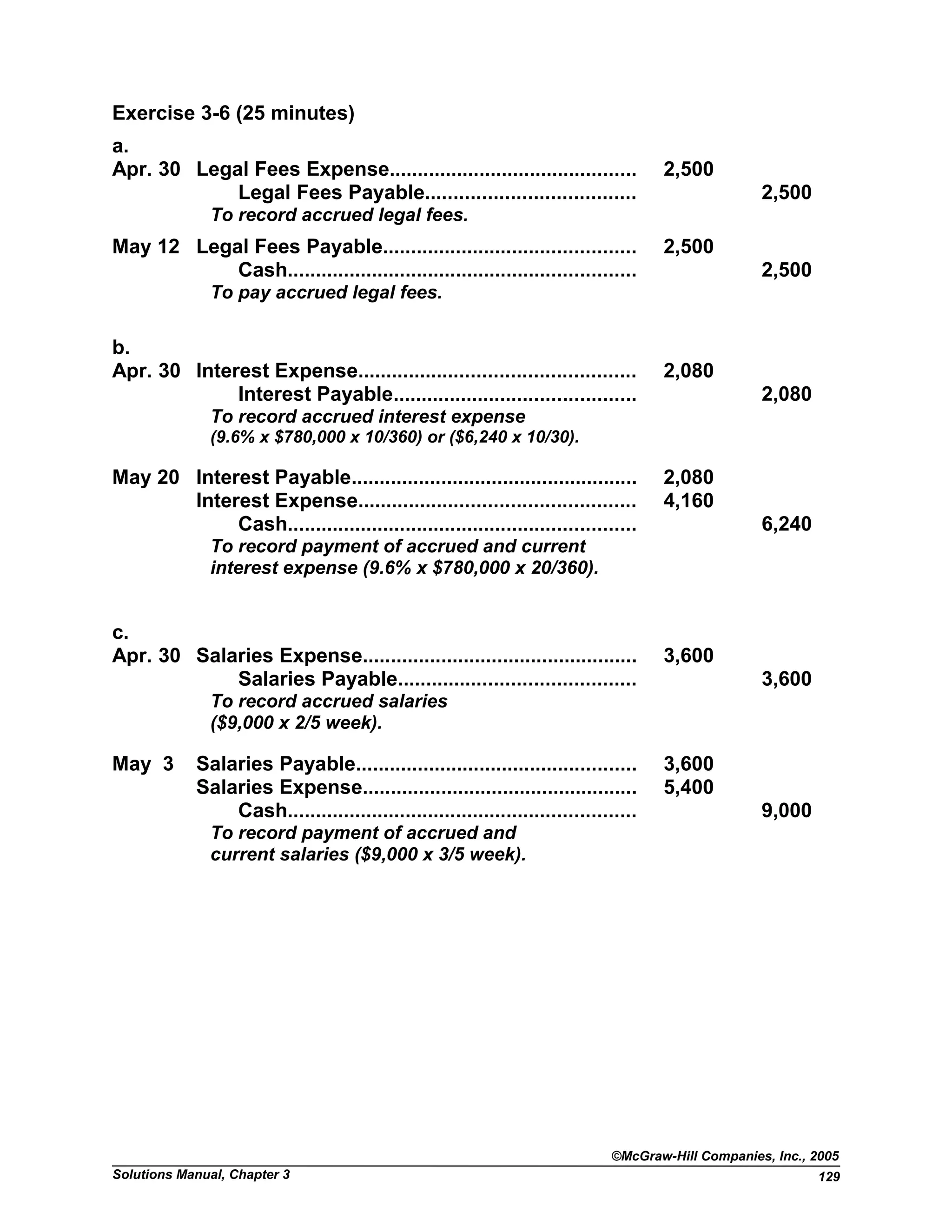

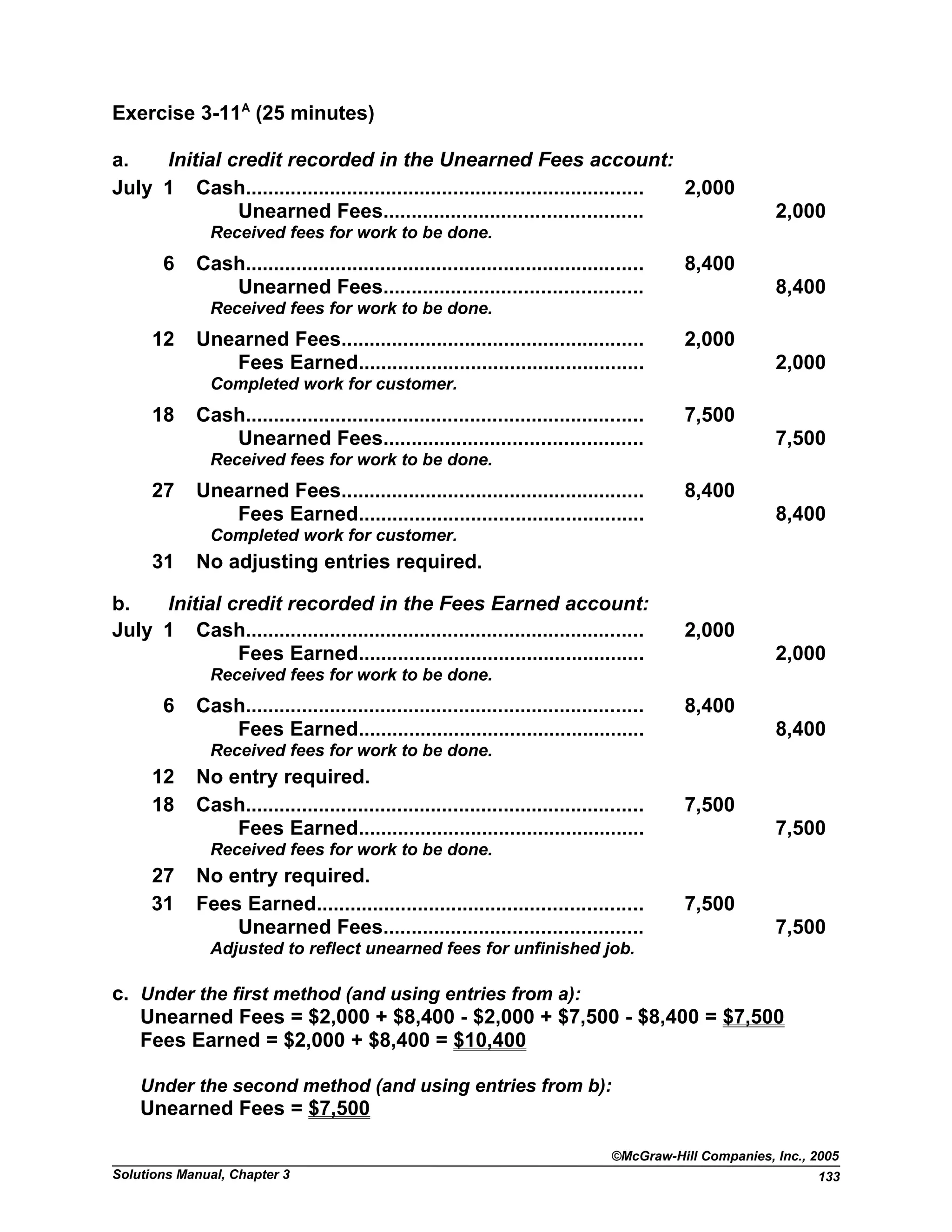

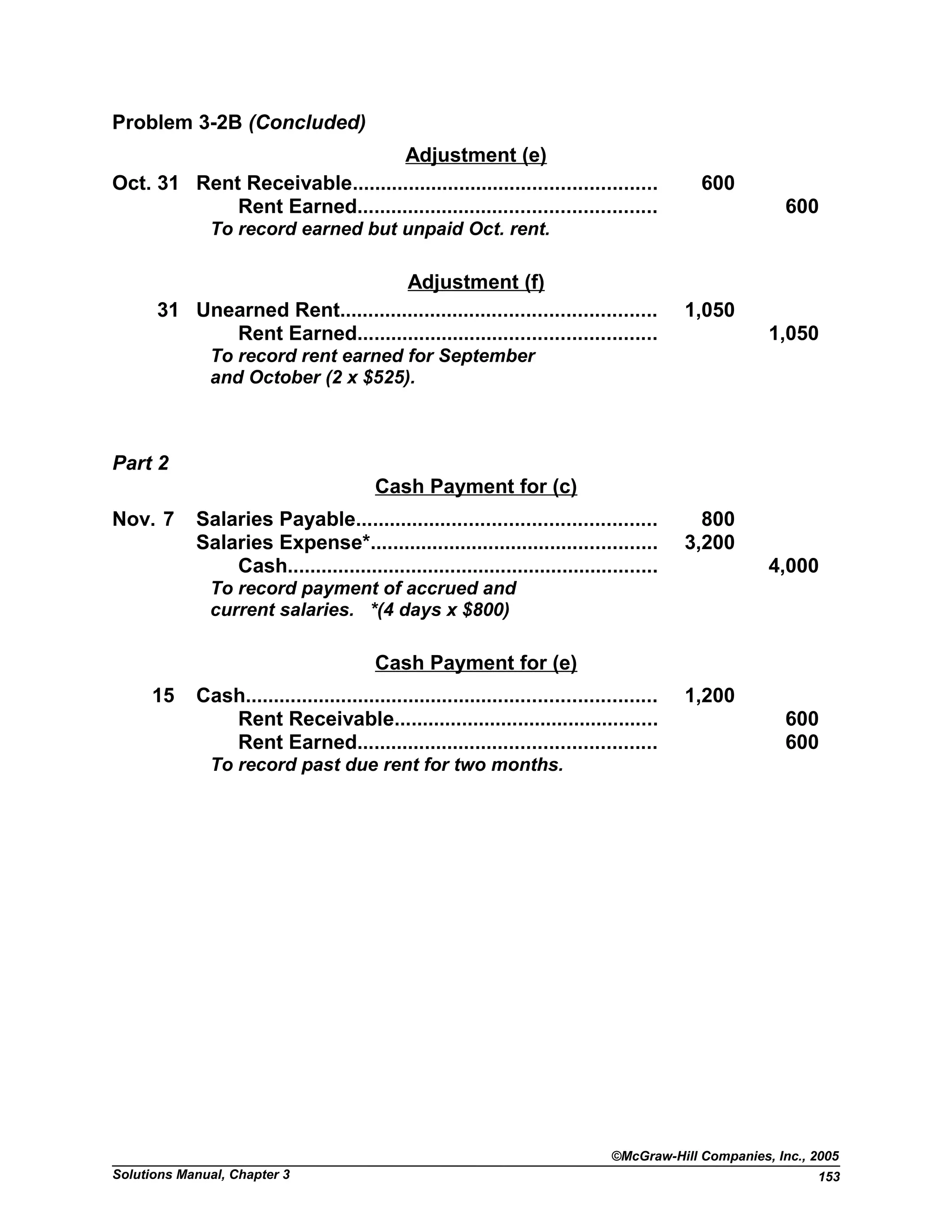

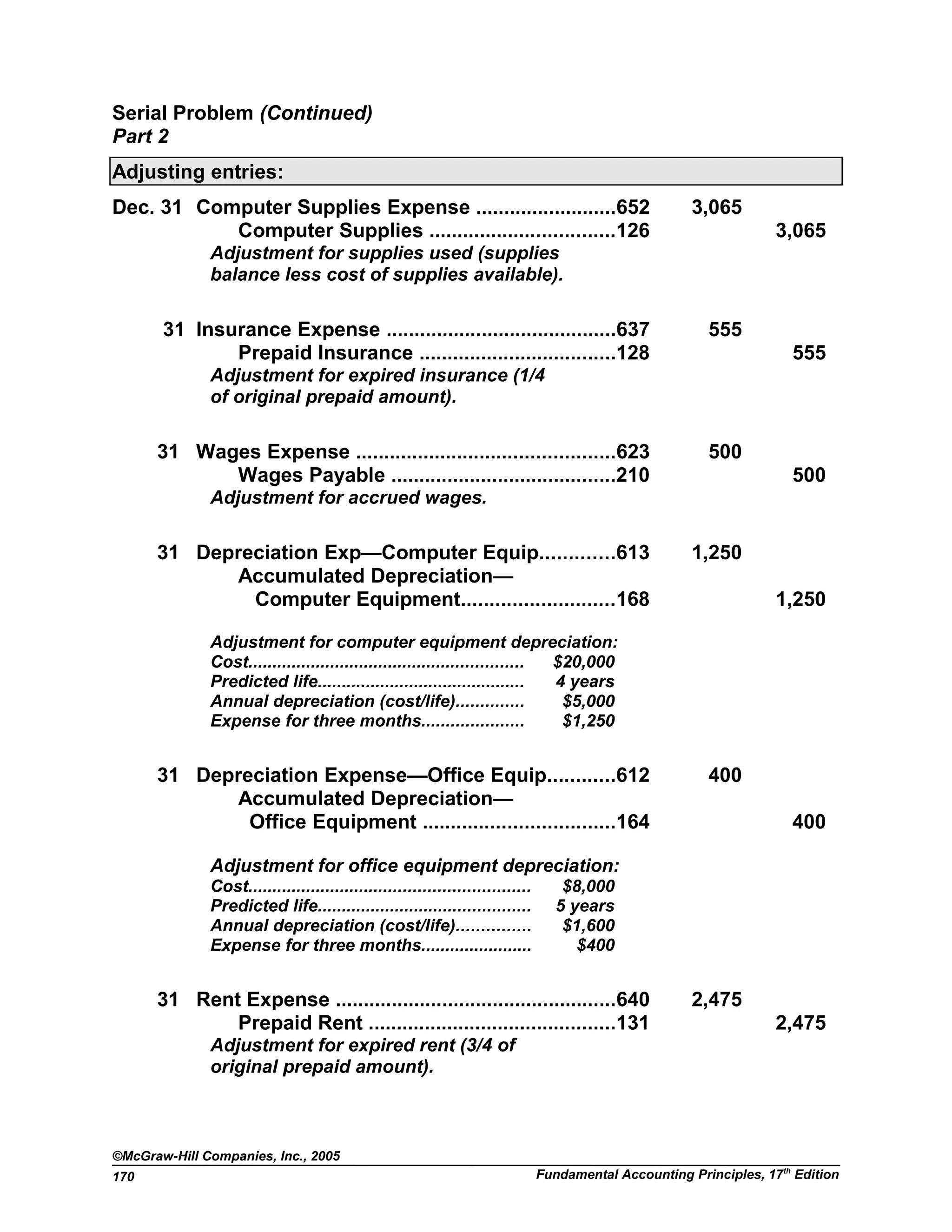

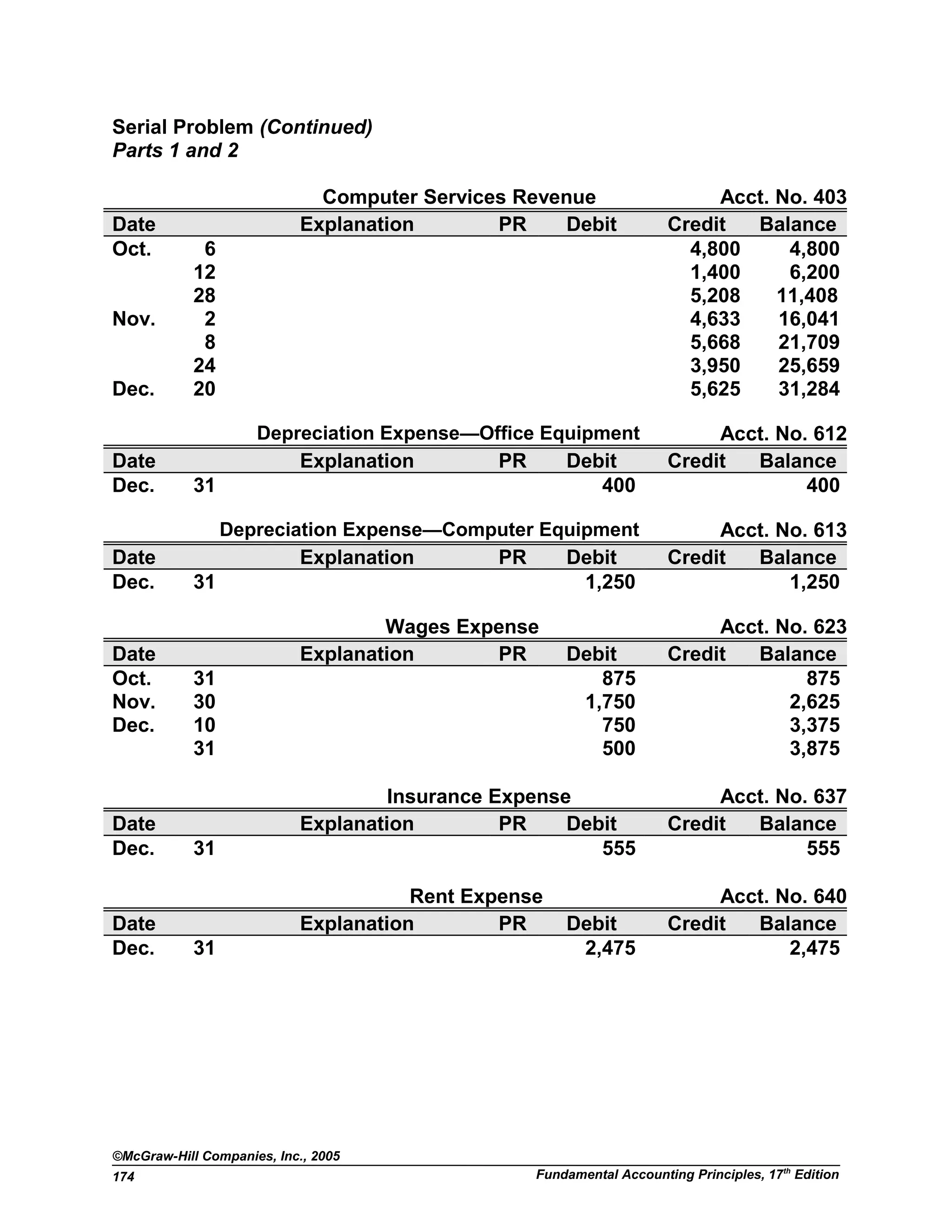

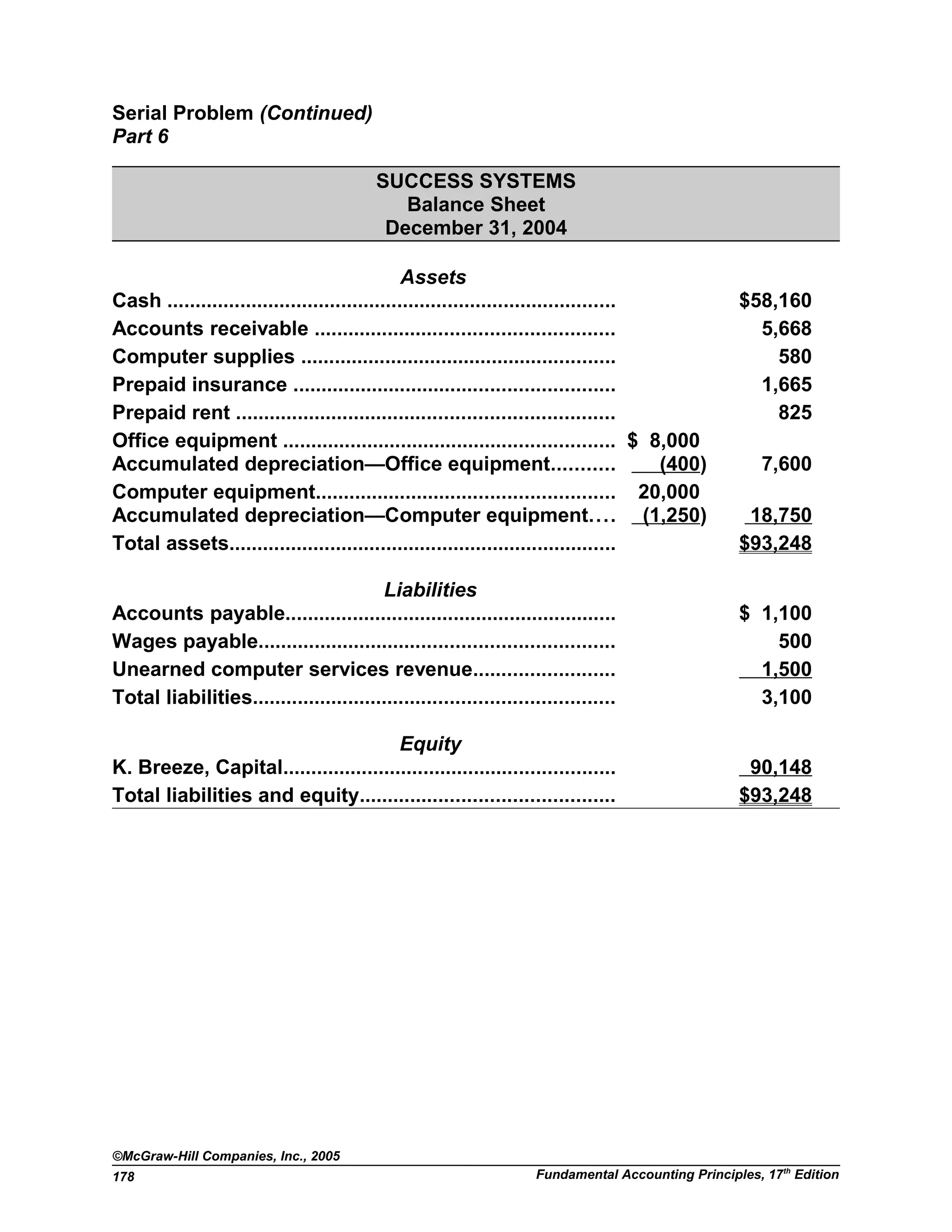

![Fees Earned = $2,000 + $8,400 + $7,500 - $7,500 = $10,400

[Note: Both procedures yield identical results in the financial statements.]

©McGraw-Hill Companies, Inc., 2005

Fundamental Accounting Principles, 17th

Edition134](https://image.slidesharecdn.com/solutionmanualchapter3fap-140409230507-phpapp01/75/Solution-manual-chapter-3-fap-16-2048.jpg)

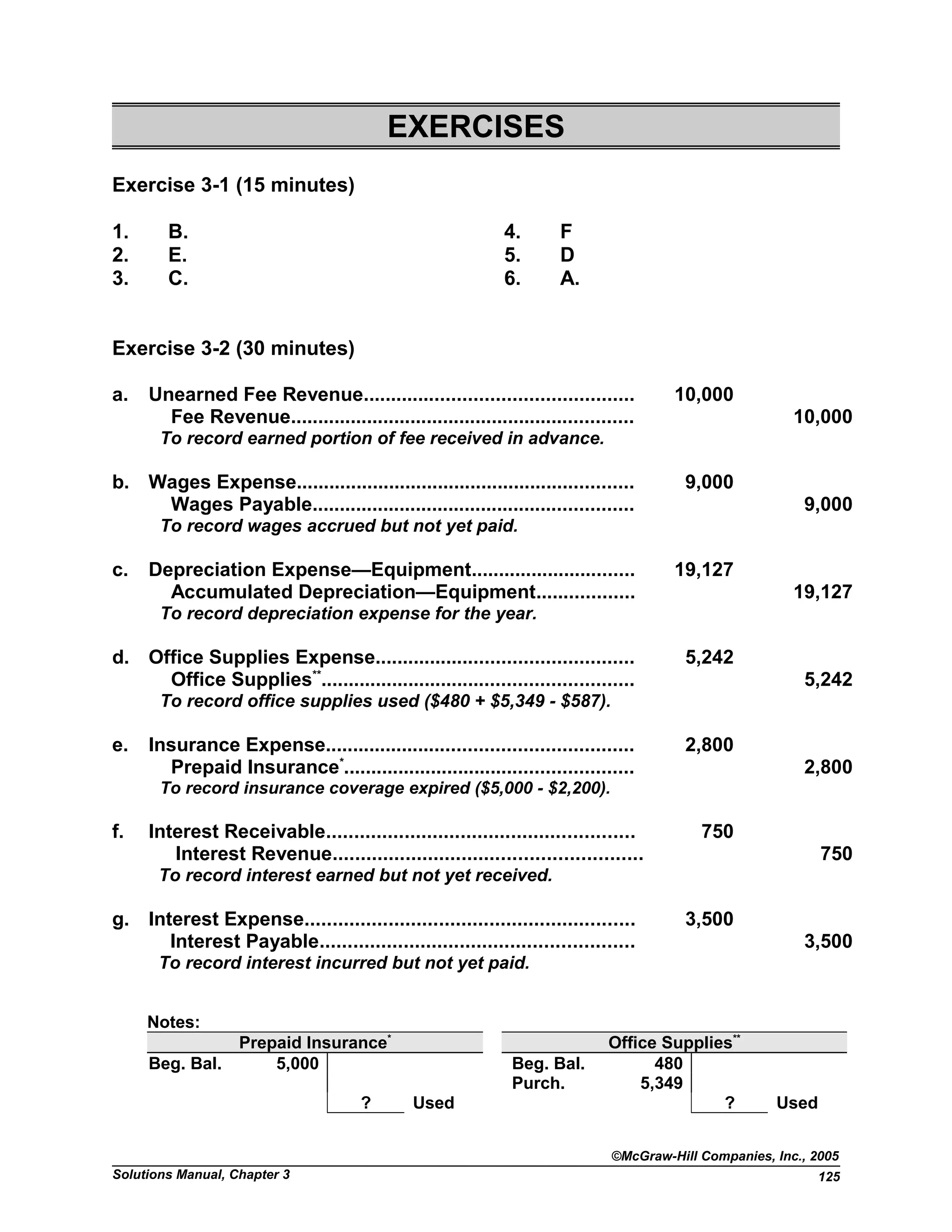

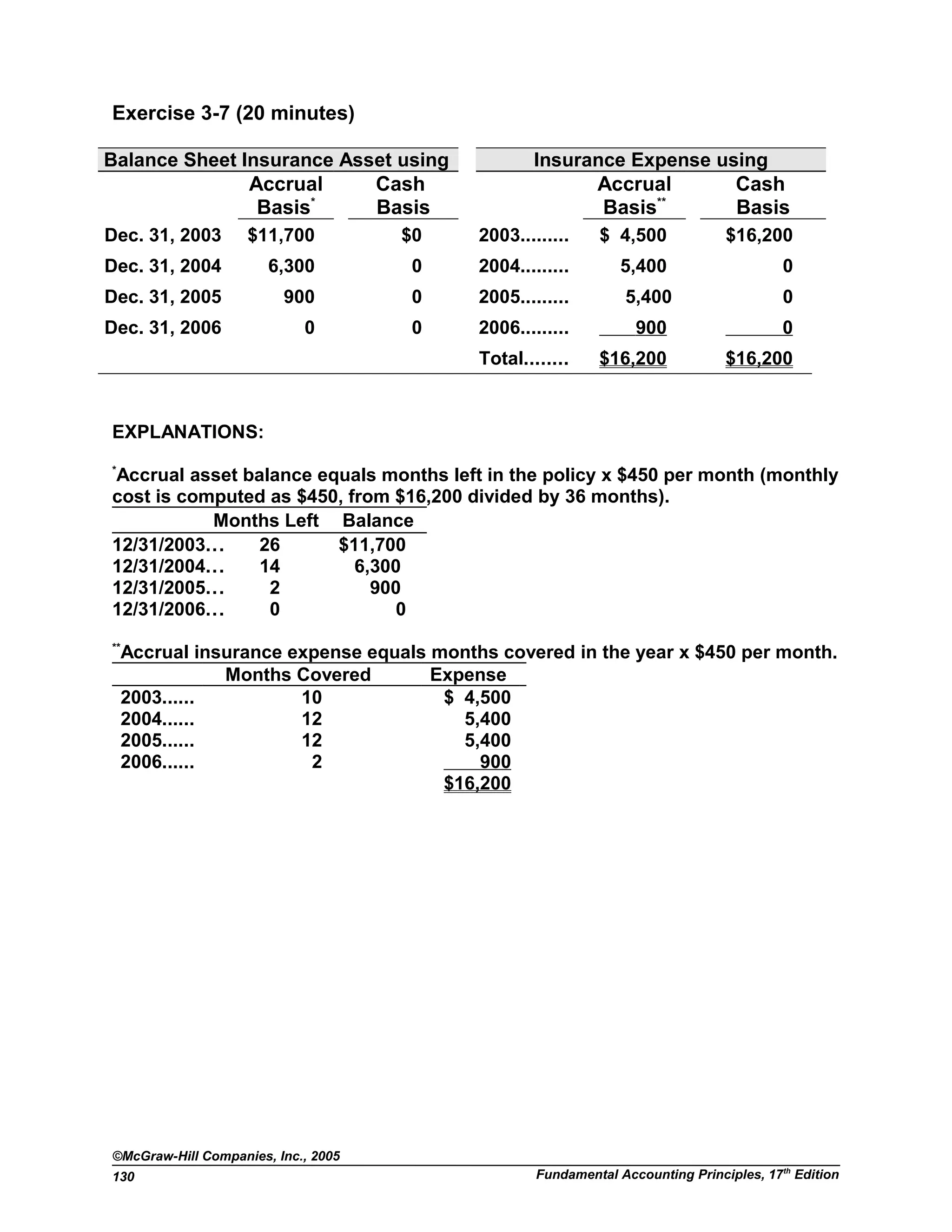

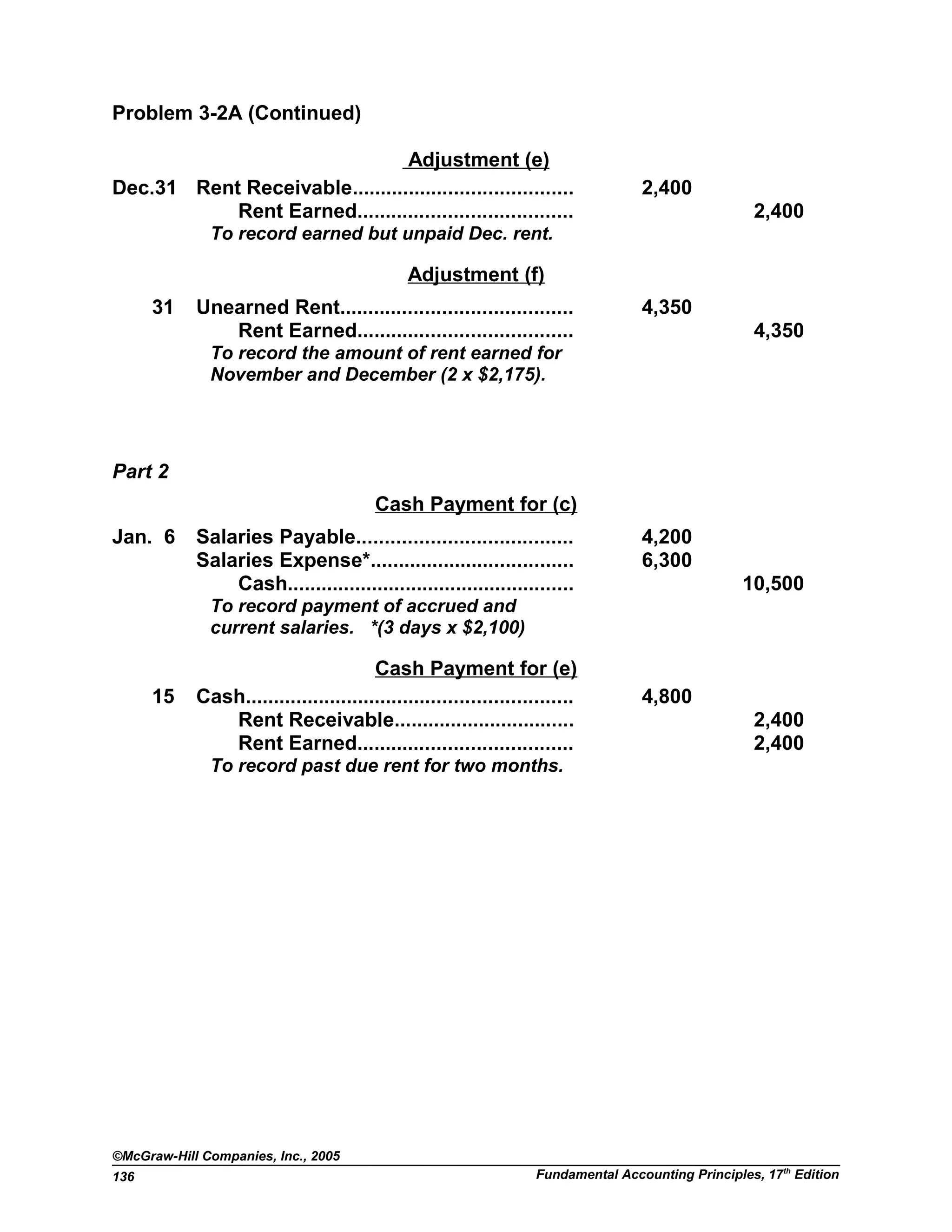

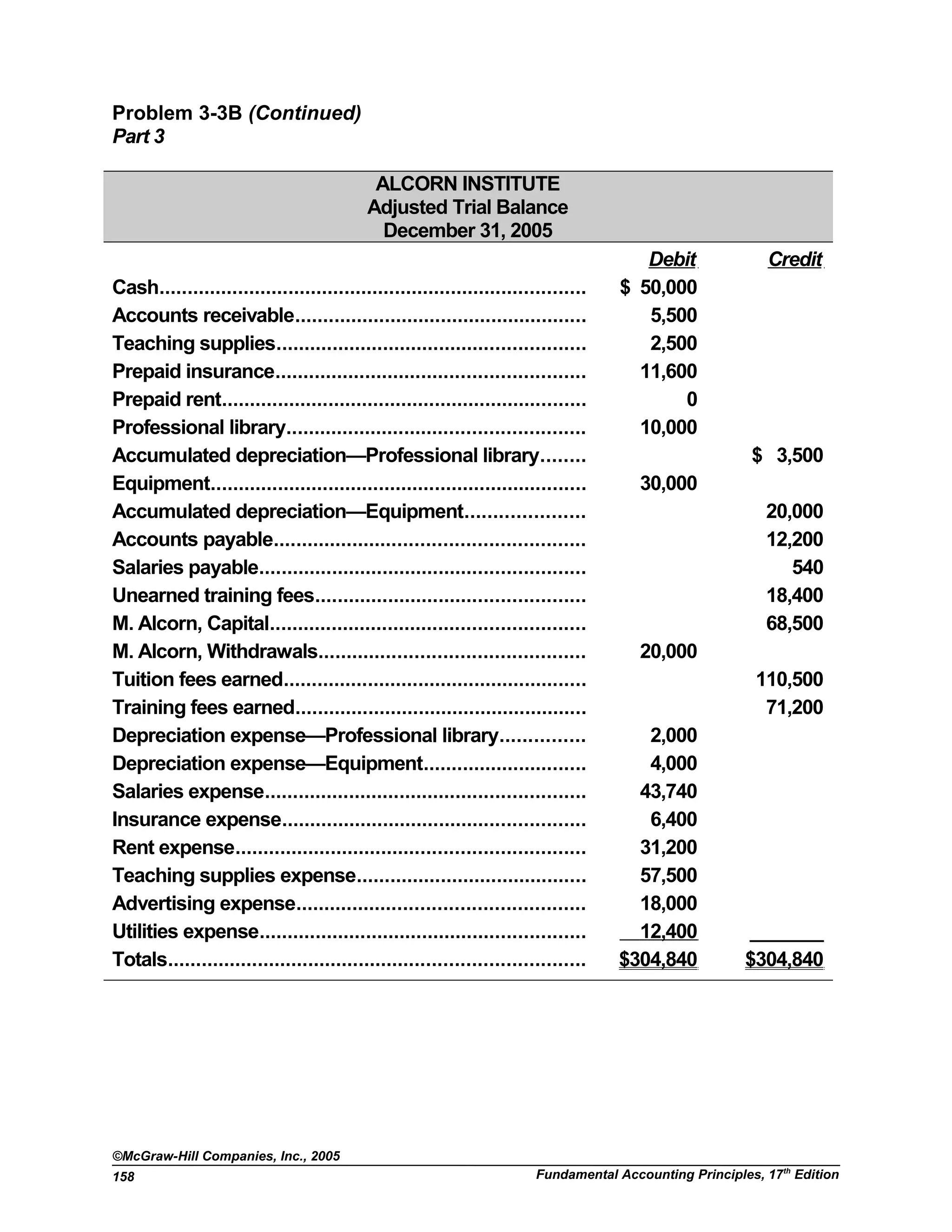

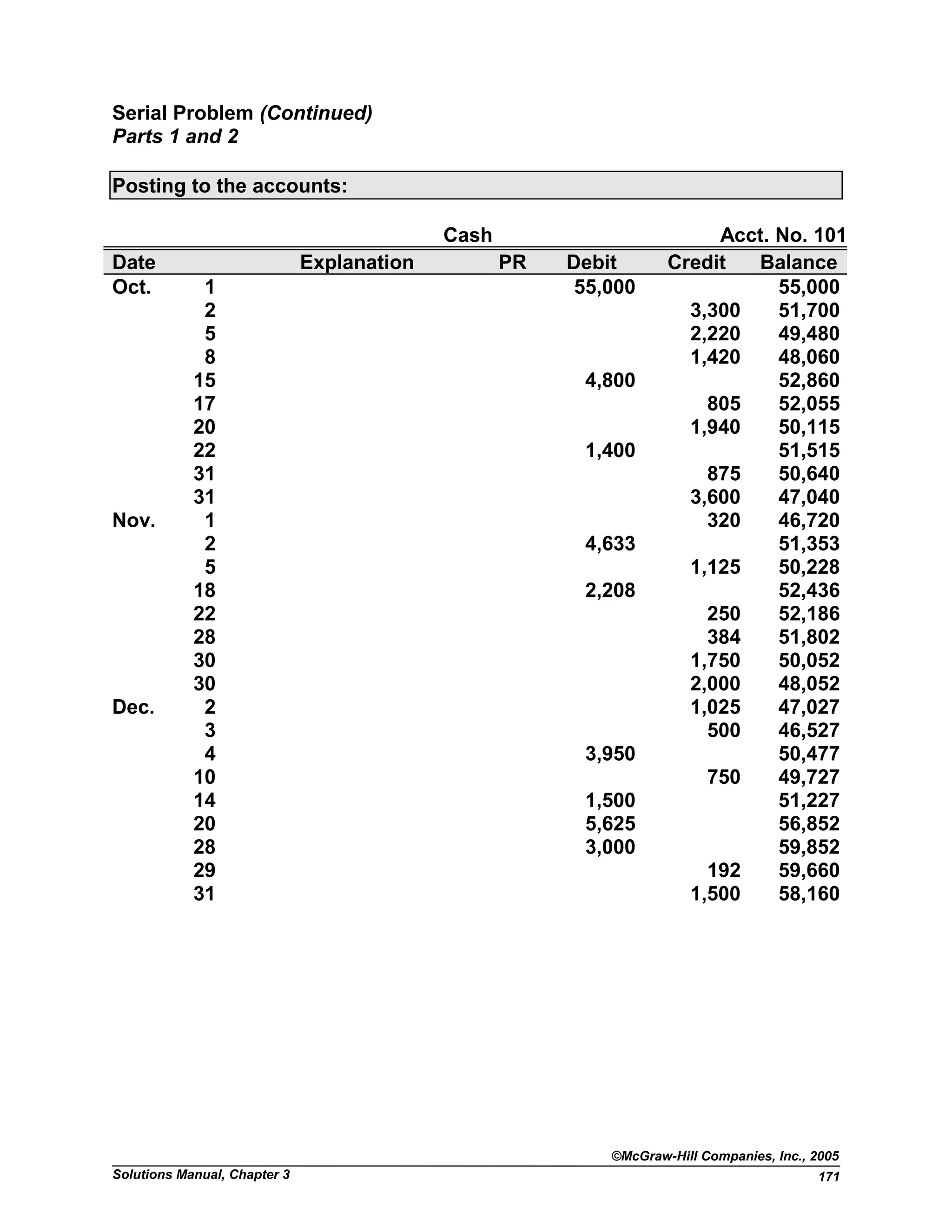

![PROBLEM SET A

Problem 3-1A (15 minutes)

1. G. 4. B. 7. H. 10. D.

2. E. 5. G. 8. E. 11. A.

3. I. 6. C. 9. F. 12. D.

Problem 3-2A (35 minutes)

Part 1

Adjustment (a)

Dec.31 Office Supplies Expense......................... 12,760

Office Supplies................................. 12,760

To record cost of supplies used

($3,000 + $12,400 - $2,640).

Adjustment (b)

31 Insurance Expense.................................. 12,312

Prepaid Insurance............................ 12,312

To record annual insurance coverage cost.

Policy Cost per Month

Months Active

in 2005 2005 Cost

A $660 ($15,840/24 mo.) 12 $ 7,920

B 363 ($13,068/36 mo.) 9 3,267

C 225 ($ 2,700 /12 mo.) 5 1,125

Total $12,312

Adjustment (c)

31 Salaries Expense (2 days x $2,100)........ 4,200

Salaries Payable............................... 4,200

To record accrued but unpaid wages.

Adjustment (d)

31 Depreciation Expense—Building........... 27,000

Accumulated Depreciation—Building 27,000

To record annual depreciation expense

[($855,000 -$45,000) / 30 years = $27,000]

©McGraw-Hill Companies, Inc., 2005

Solutions Manual, Chapter 3 135](https://image.slidesharecdn.com/solutionmanualchapter3fap-140409230507-phpapp01/75/Solution-manual-chapter-3-fap-17-2048.jpg)

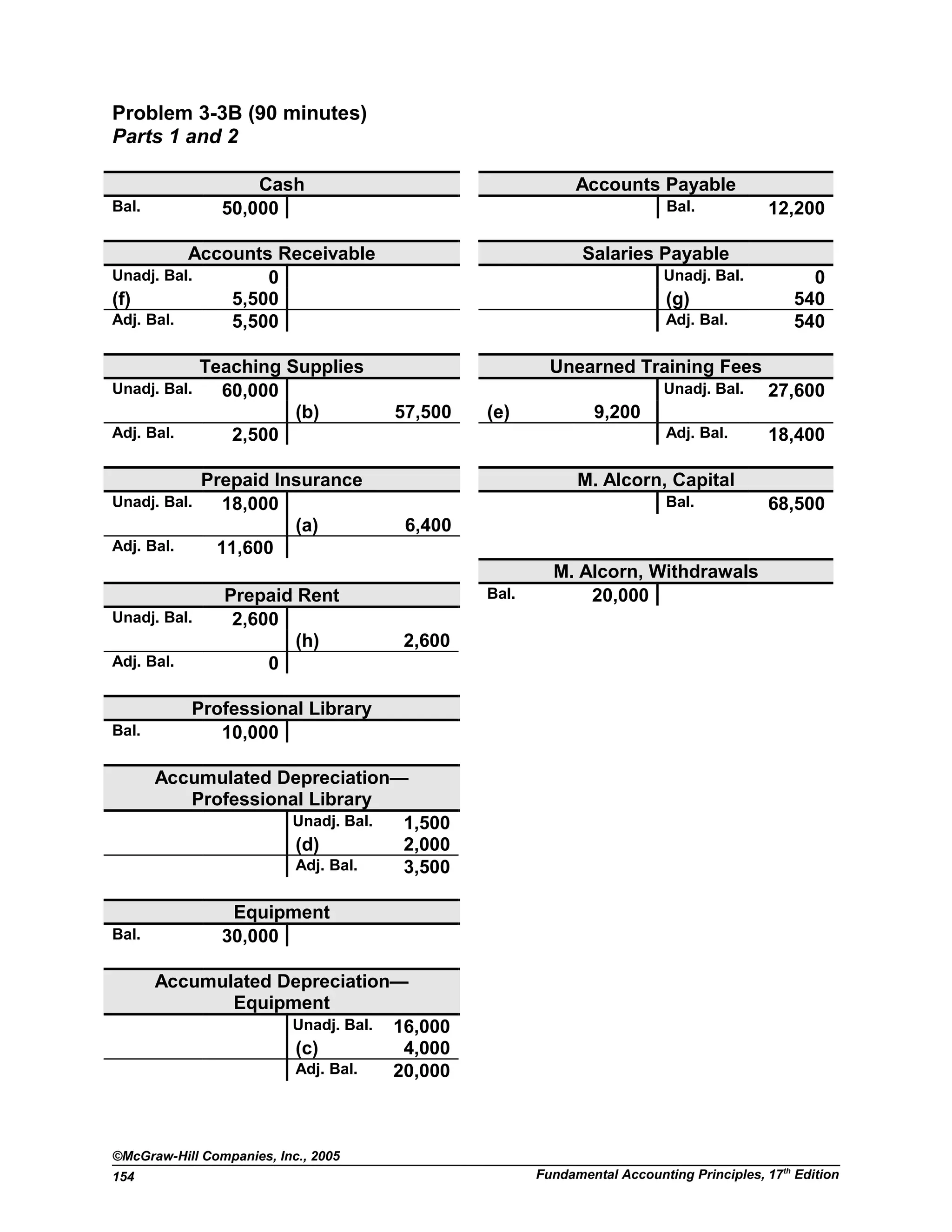

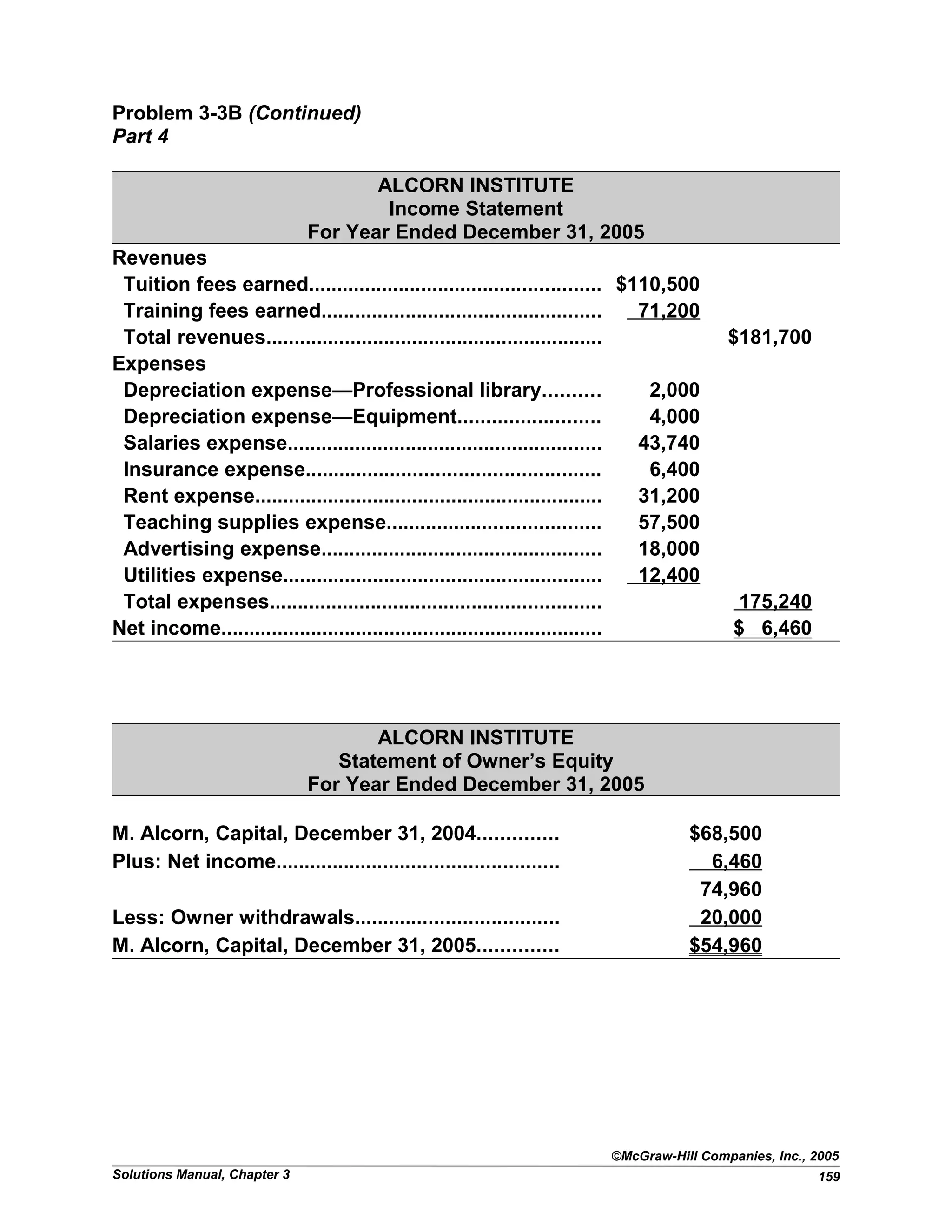

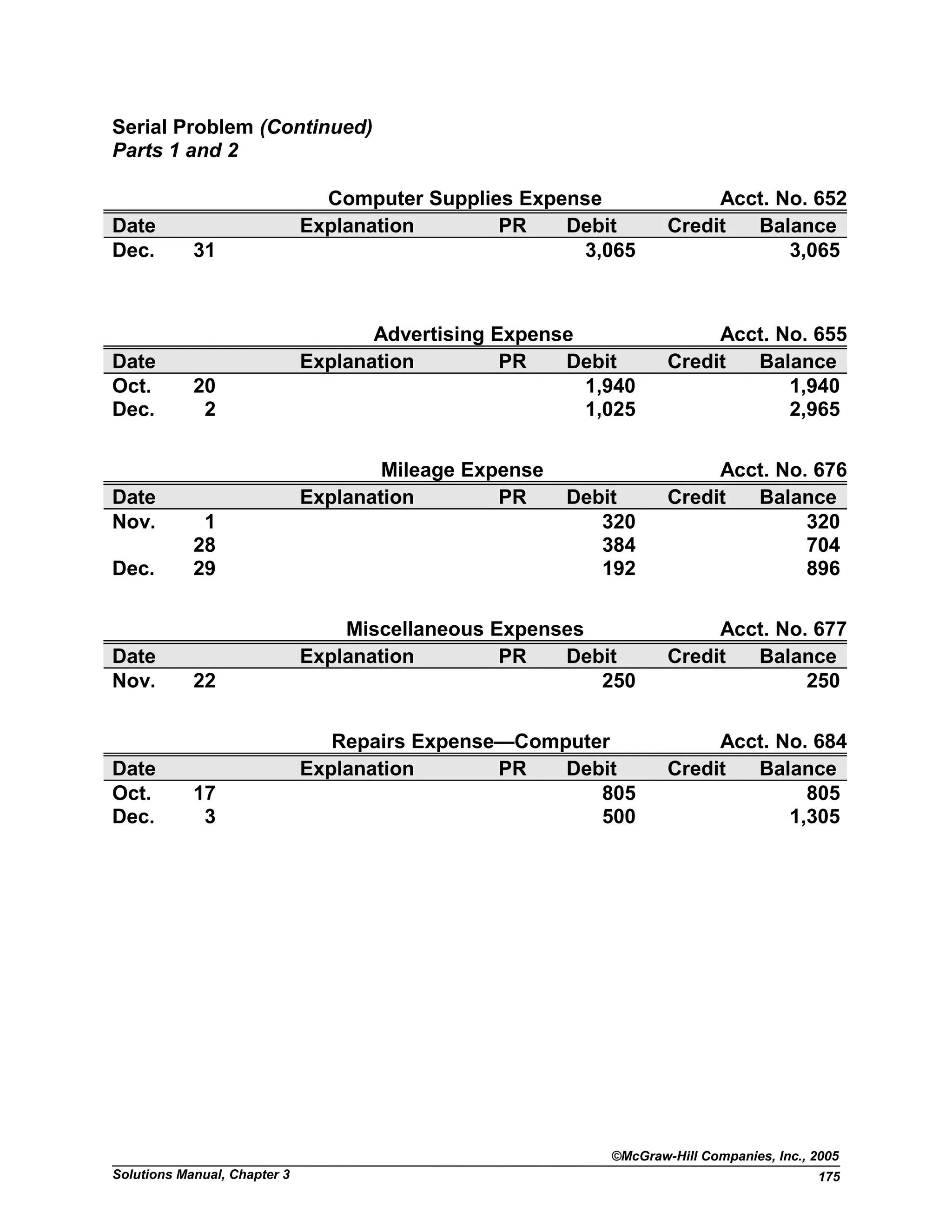

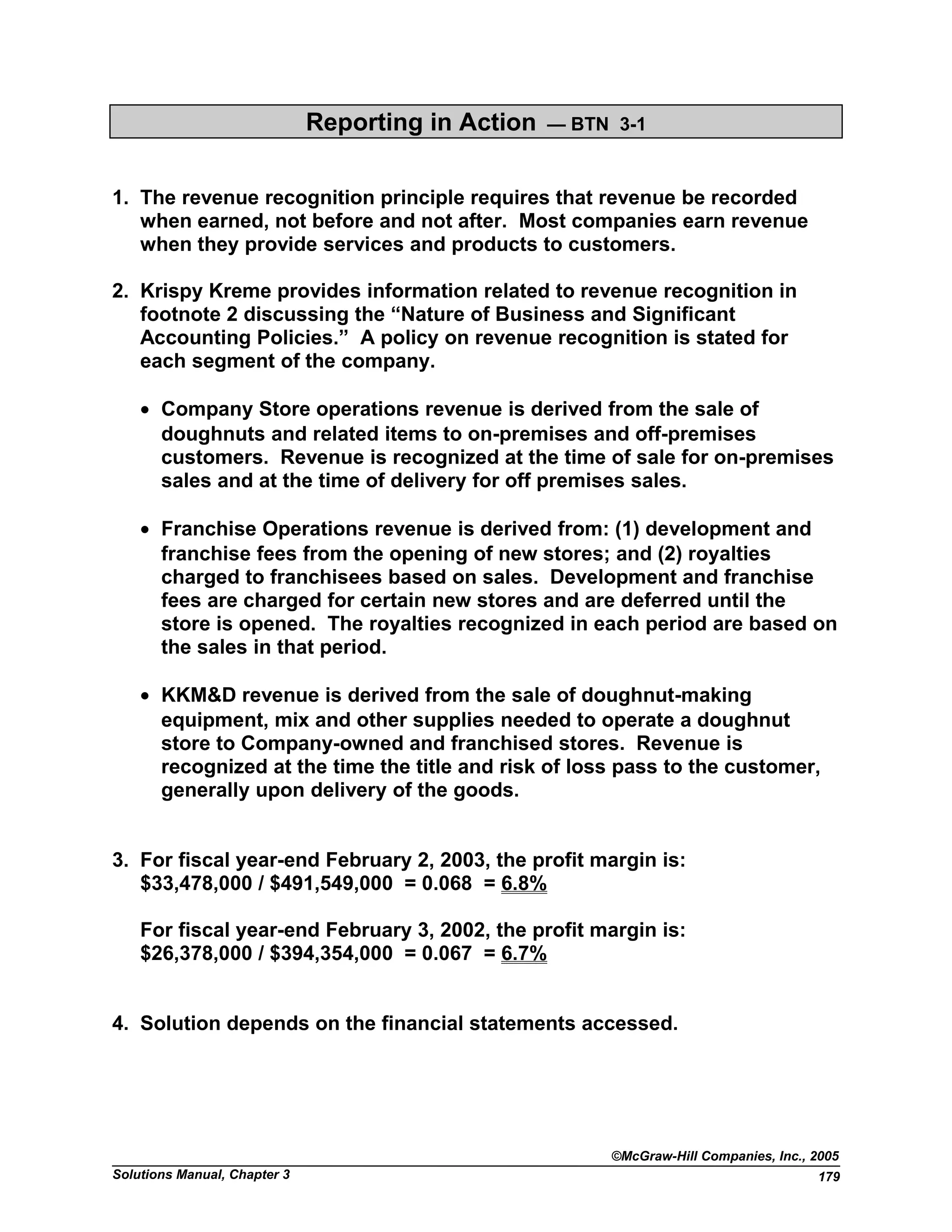

![PROBLEM SET B

Problem 3-1B (15 minutes)

1. E. 4. C. 7. F. 10. I.

2. H. 5. D. 8. I. 11. A.

3. G. 6. B. 9. F. 12. B.

Problem 3-2B (30 minutes)

Part 1

Adjustment (a)

Oct. 31 Office Supplies Expense........................................ 3,450

Office Supplies................................................ 3,450

To record cost of supplies used

($500 + $3,650 - $700).

Adjustment (b)

31 Insurance Expense................................................. 2,365

Prepaid Insurance........................................... 2,365

To record annual insurance coverage cost.

Policy Cost per Month

Months Active

in 2005

2005

Expense

A $125 ($3,000/24 mo.) 12 $1,500

B 100 ($3,600/36 mo.) 7 700

C 55 ( $660 / 12 mo.) 3 165

Total $2,365

Adjustment (c)

31 Salaries Expense.................................................... 800

Salaries Payable.............................................. 800

To record accrued but unpaid wages

(1 day x $800).

Adjustment (d)

31 Depreciation Expense—Building.......................... 5,400

Accumulated Depreciation—Building........... 5,400

To record annual depreciation

[($155,000-$20,000) / 25 years = $5,400].

©McGraw-Hill Companies, Inc., 2005

Fundamental Accounting Principles, 17th

Edition152](https://image.slidesharecdn.com/solutionmanualchapter3fap-140409230507-phpapp01/75/Solution-manual-chapter-3-fap-34-2048.jpg)

![Entrepreneurial Decision — BTN 3-8

1. Many businesses find it cheaper to use outside collection agencies rather

than hire in-house staff to handle past-due account collections.

Additionally, owners of collection agencies are usually experts in the art of

collection and may be able to collect on accounts that the businesses

themselves never would be able to. Although a 50% commission seems

steep, it must be weighed against the possibility that zero collections may

be realized if the account is not turned over.

2. Mellie’s net income = Income x Profit margin = $40,000,000 x 0.08 =

$3,200,000.

3. Current commission expense = $40,000,000 x 0.02 = $800,000.

4. If the commission fee charged can be negotiated down from 50% to 40%,

this will be a 20% reduction in commission expense. This is computed as:

(50% - 40%) / 50% = 20%. Specifically, the commission expense would

change from $800,000 to 80% of $800,000 or $640,000 (also computed as

$40,000,000 x 0.02 x (40%/50%)).

The $160,000 reduction from $800,000 to $640,000 represents a 20% decline

from $800,000.

5. Net income would be $160,000 higher since commission expense would be

reduced by $160,000. Net income would change to $3,360,000 [$3,200,000 +

$160,000].

Profit margin would then equal: $3,360,000/$40,000,000 = 8.4%.

Hitting the Road — BTN 3-9

There is no formal solution to this field activity. The instructor may wish to

tally students’ findings to see what companies were selected, who

responded, what was the response time, etc. The instructor can also

periodically ask students to bring in examples from their selected

companies at certain times, and then compare and contrast them with the

examples in the book.

©McGraw-Hill Companies, Inc., 2005

Fundamental Accounting Principles, 17th

Edition184](https://image.slidesharecdn.com/solutionmanualchapter3fap-140409230507-phpapp01/75/Solution-manual-chapter-3-fap-66-2048.jpg)