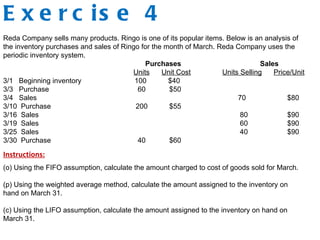

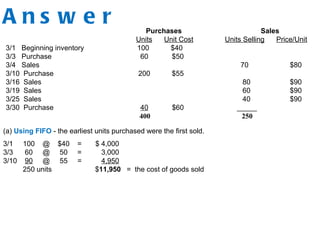

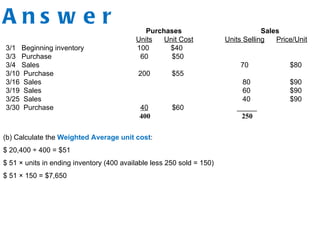

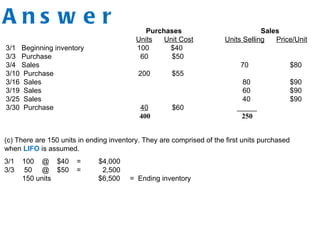

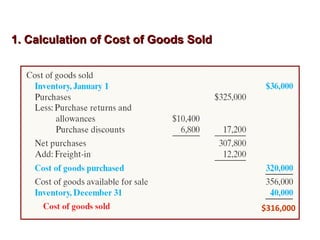

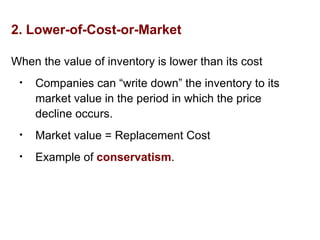

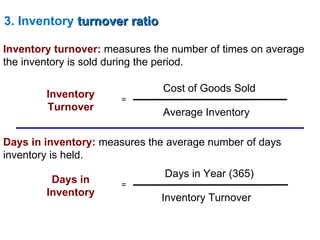

- The document discusses accounting principles related to inventories, including calculating cost of goods sold, lower-of-cost-or-market valuation, inventory turnover ratio, and inventory cost flow methods.

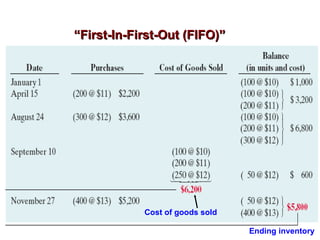

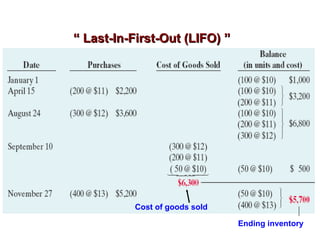

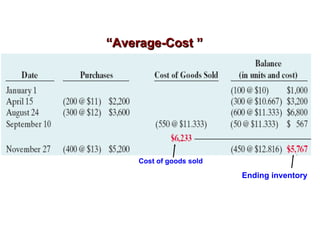

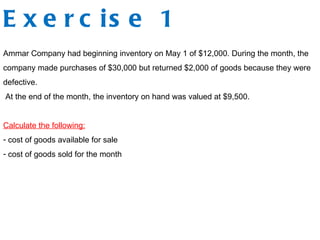

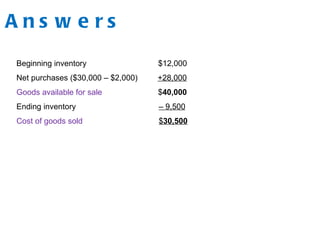

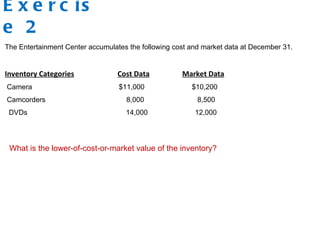

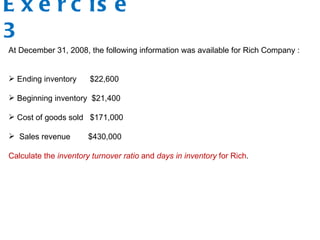

- Several exercises are provided to demonstrate calculating cost of goods sold, applying the lower-of-cost-or-market rule, computing inventory turnover and days in inventory, and using different inventory cost flow methods like FIFO, weighted average, and LIFO.

- The answers explain step-by-step how to apply the inventory accounting concepts introduced to solve the numerical problems.

![A n s w e r s

- Inventory Turnover Ratio = $171,000 ÷ [($21,400 + $22,600) ÷ 2]

= 7.8 times

- Days in Inventory = 365 ÷ 7.8 = 46.8 days](https://image.slidesharecdn.com/section8-110110071333-phpapp02/85/Section-8-14-320.jpg)