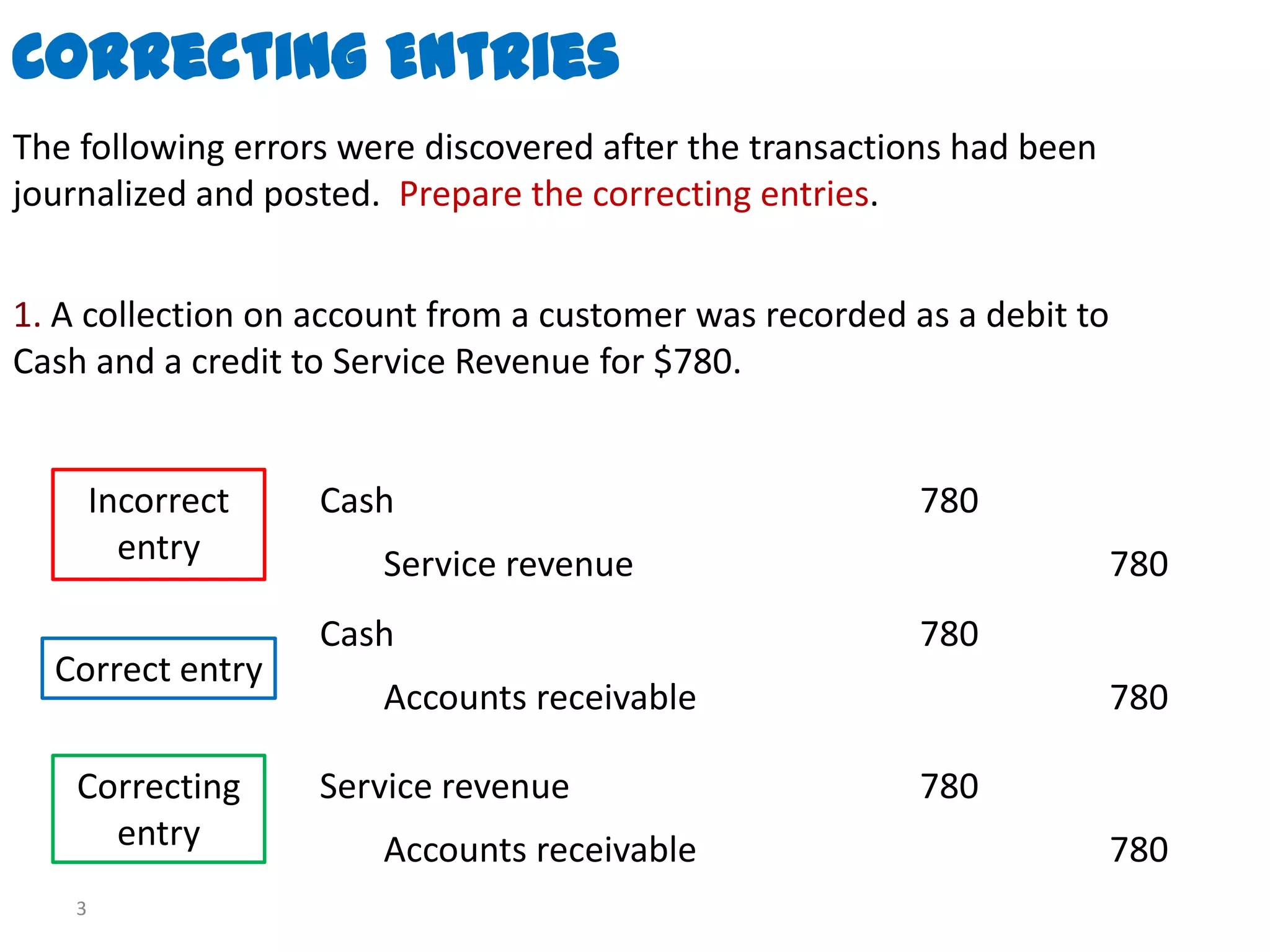

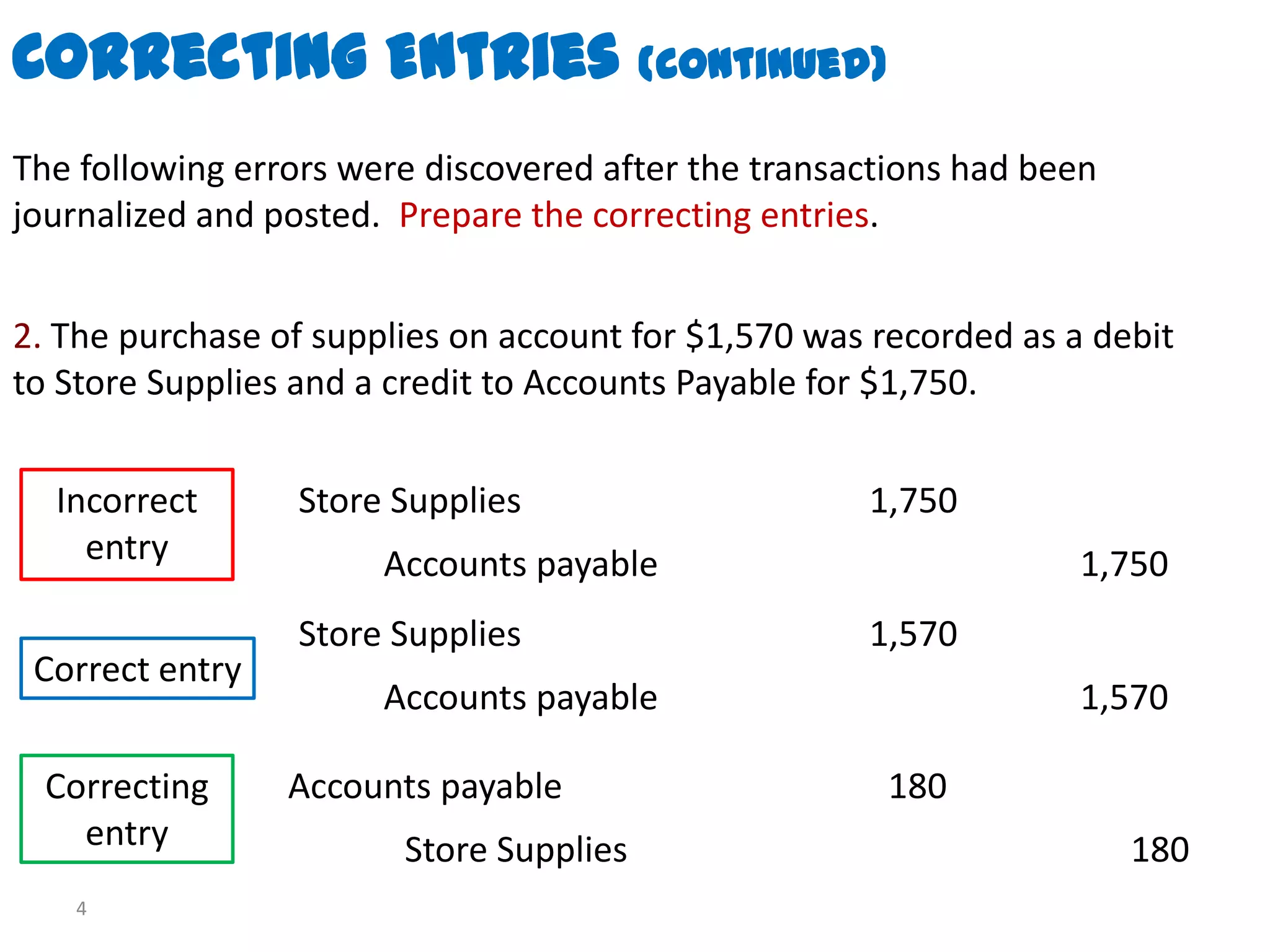

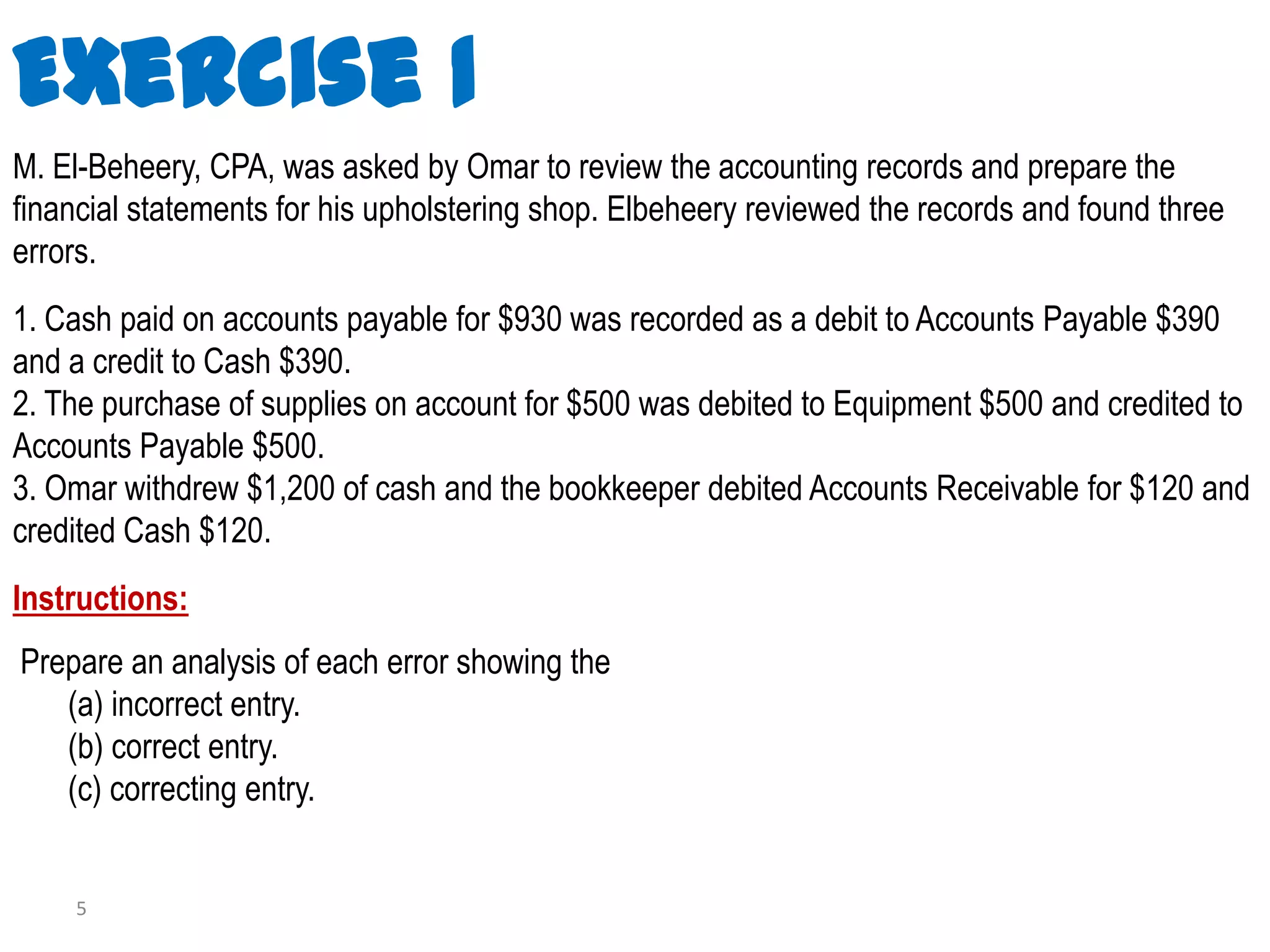

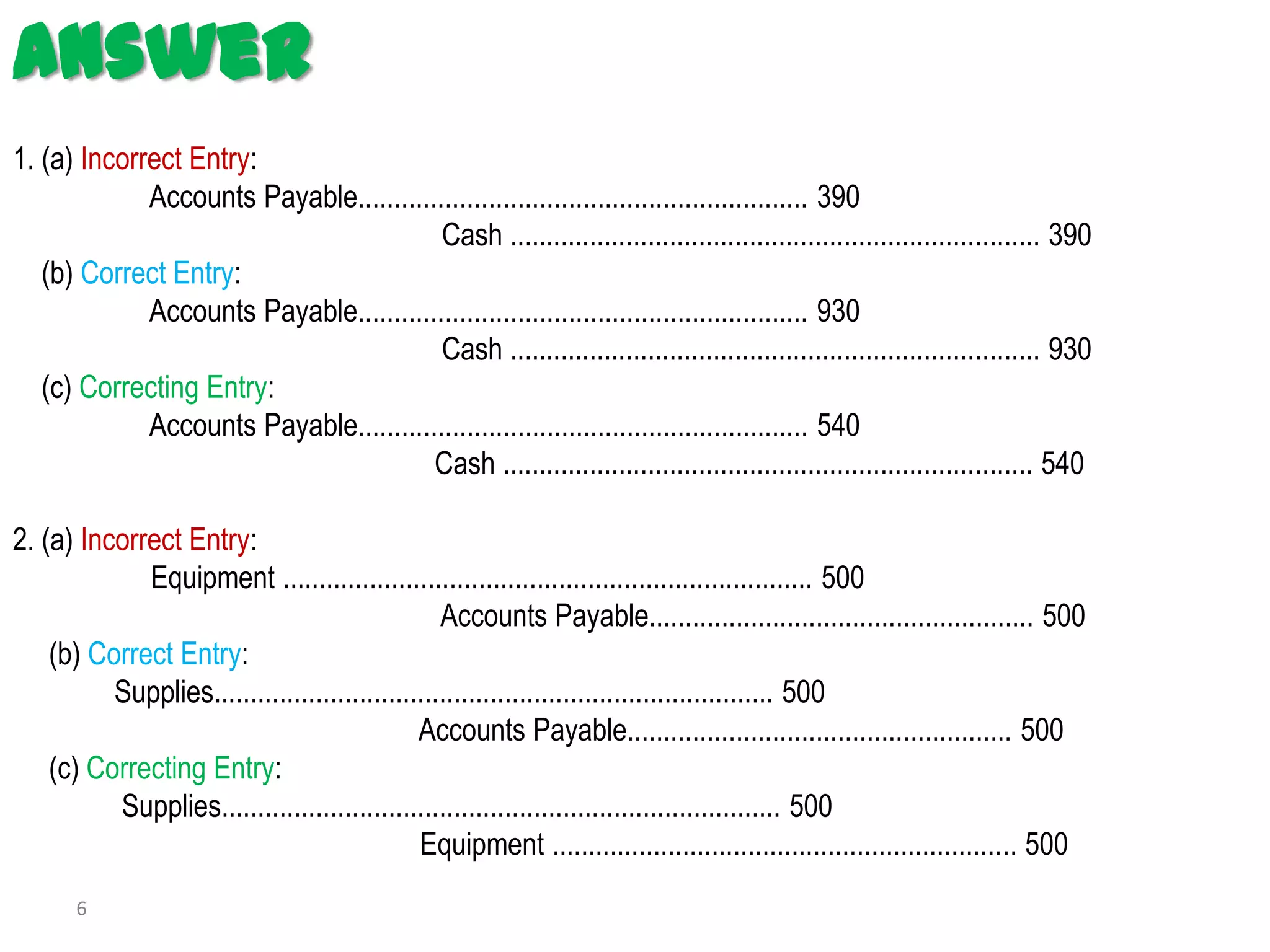

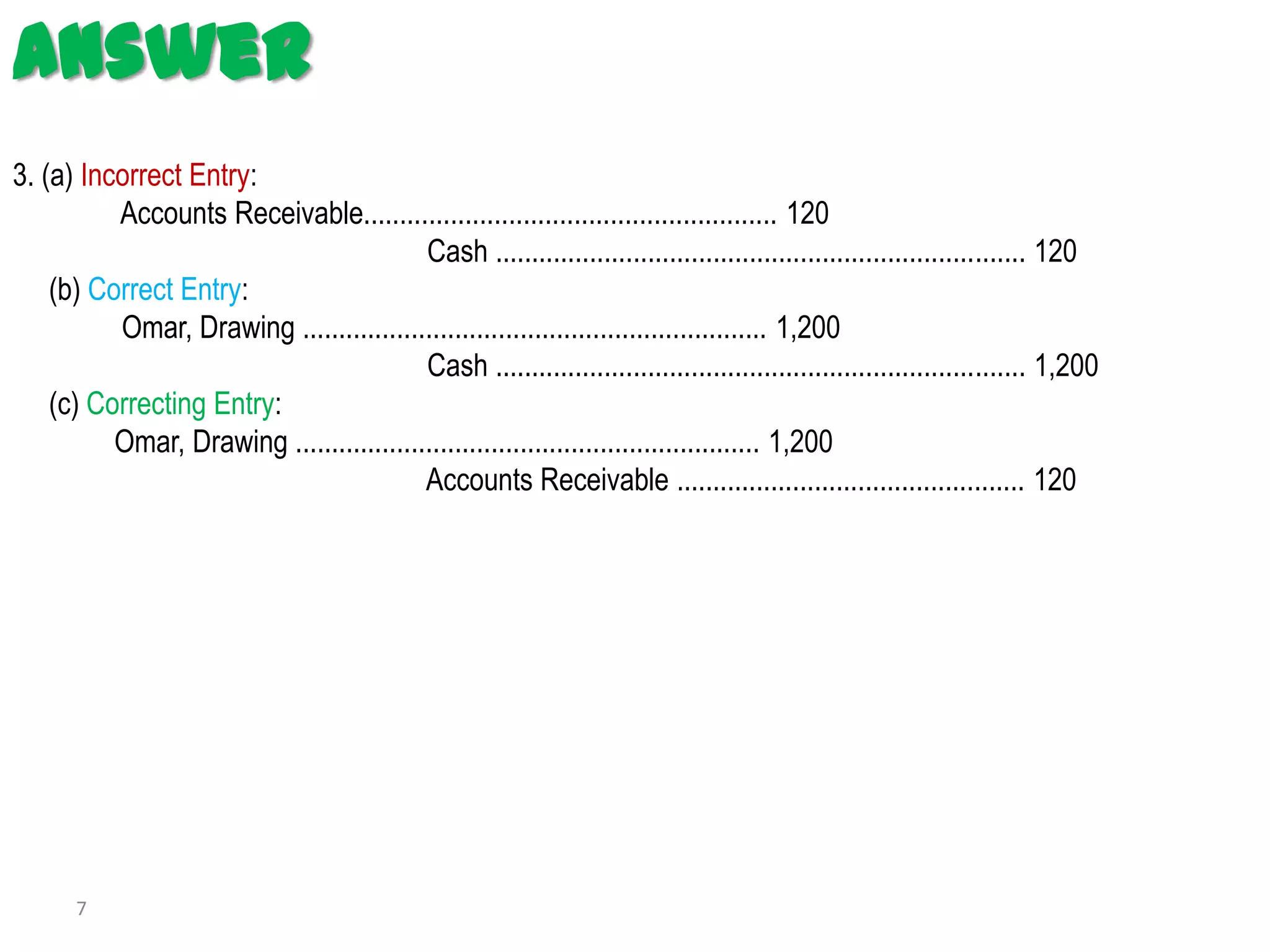

This document contains examples of correcting entries for accounting errors. The first error was a collection that was incorrectly recorded as a debit to cash and credit to service revenue, when it should have been a debit to accounts receivable and credit to service revenue. The second error was a purchase of supplies that was incorrectly recorded as a debit to supplies and credit to accounts payable for the wrong amount. The document provides the incorrect entry, correct entry, and correcting entry for each error.