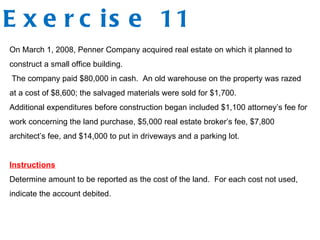

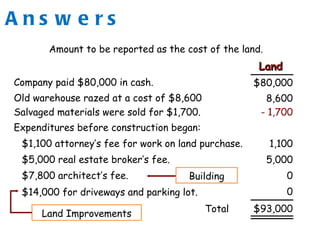

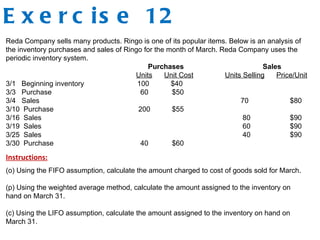

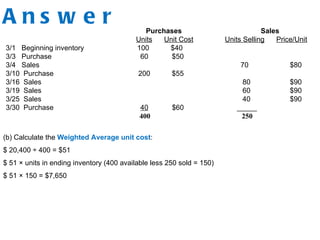

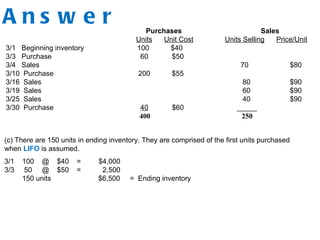

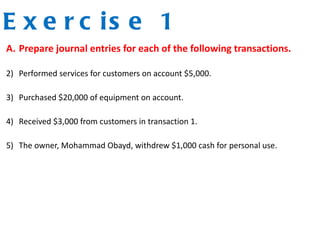

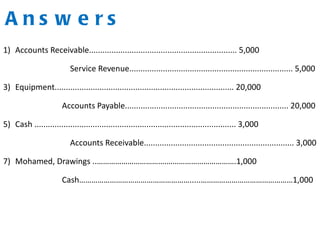

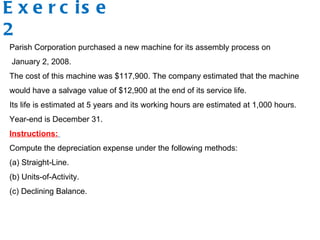

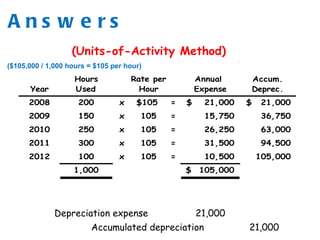

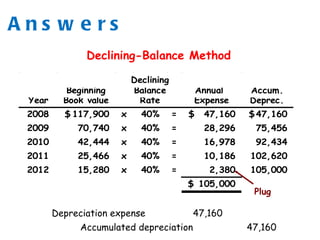

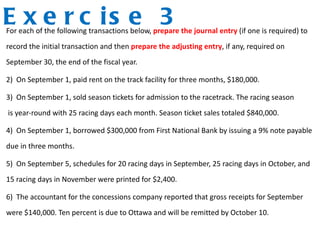

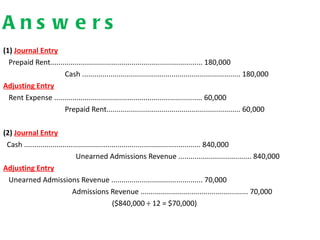

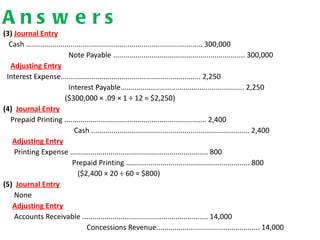

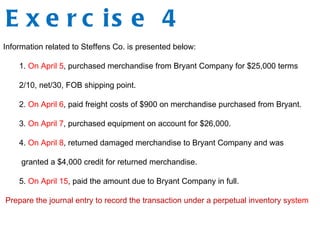

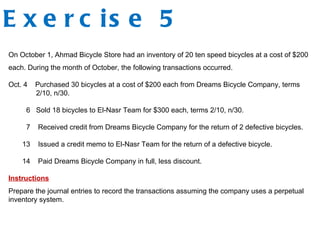

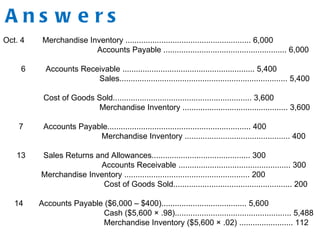

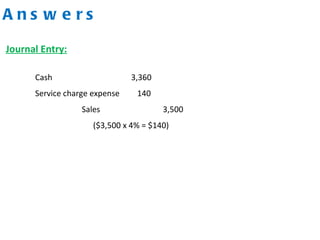

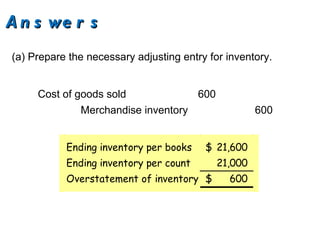

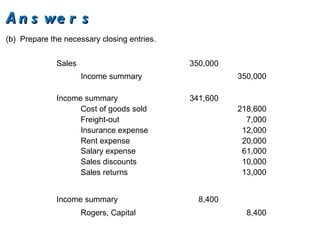

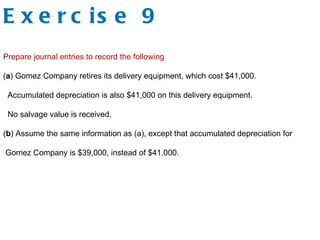

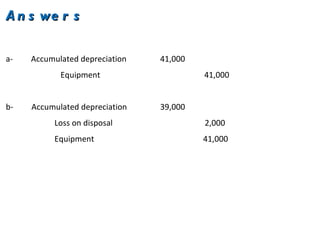

The document contains journal entries and calculations for accounting exercises. It provides solutions to exercises involving journal entries for transactions, depreciation calculations using different methods, adjusting entries at fiscal period-end, inventory calculations, and ratio calculations. Key information includes journal entries to record purchases, sales, expenses and adjusting entries. Calculations show depreciation expense and accumulated depreciation amounts.

![A n s w e r s

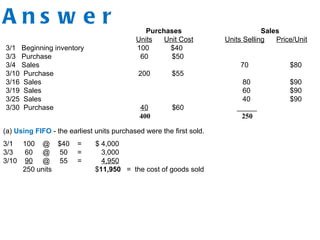

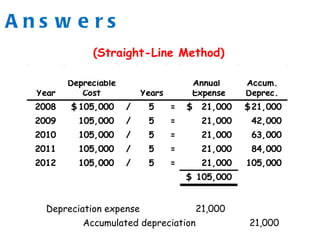

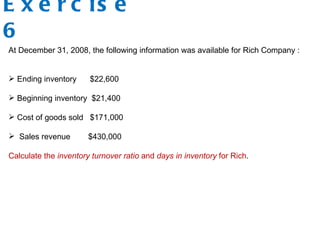

- Inventory Turnover Ratio = $171,000 ÷ [($21,400 + $22,600) ÷ 2]

= 7.8 times

- Days in Inventory = 365 ÷ 7.8 = 46.8 days](https://image.slidesharecdn.com/section11-revision-110110071510-phpapp02/85/Section-11-revision-18-320.jpg)

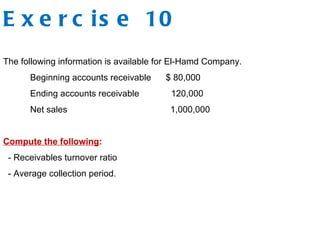

![A n s we rA n s we r

Receivables turnover = $1,000,000 ÷ [($80,000 + $120,000) ÷ 2]

= 10 times

Average collection period = 365 ÷ 10

= 36.5 days](https://image.slidesharecdn.com/section11-revision-110110071510-phpapp02/85/Section-11-revision-27-320.jpg)