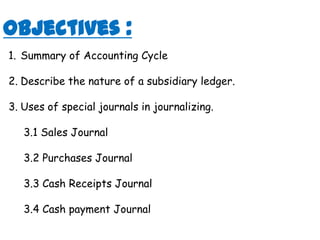

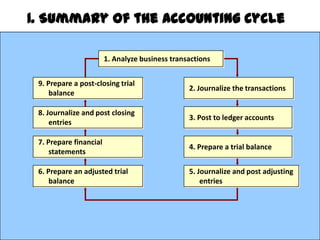

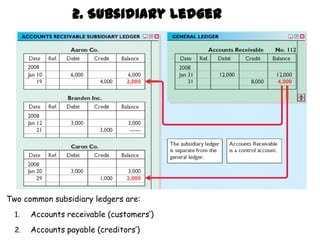

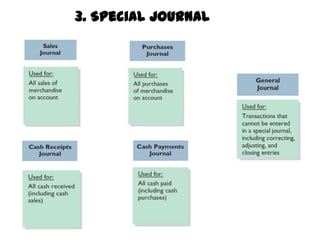

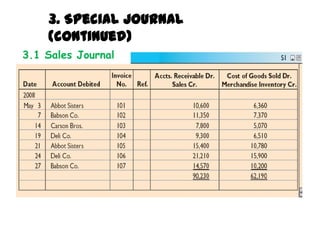

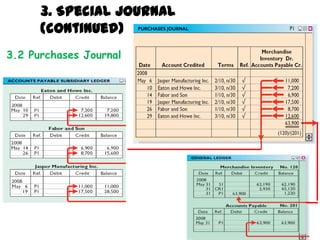

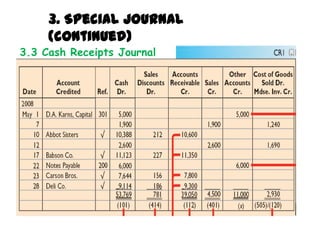

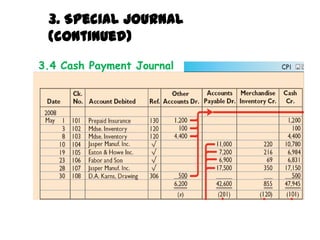

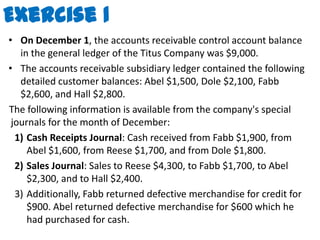

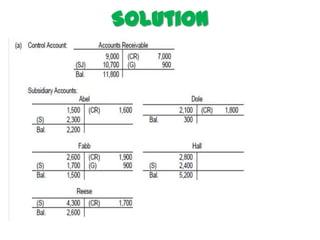

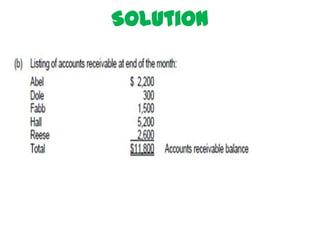

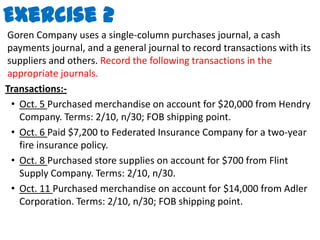

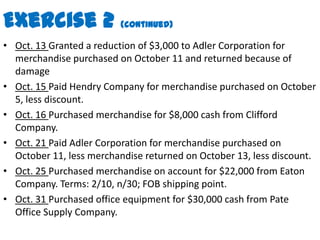

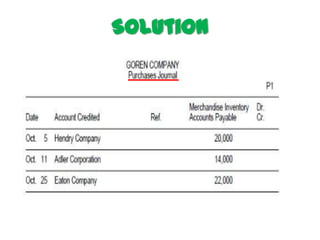

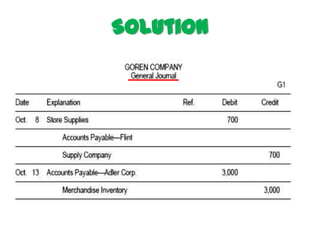

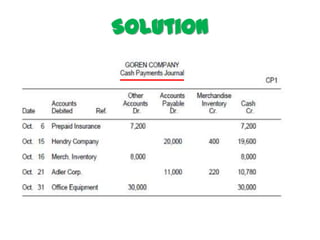

The document summarizes key aspects of the accounting cycle and special journals. It outlines the 9 steps of the accounting cycle, including analyzing transactions, journalizing, posting to ledgers, preparing trial balances, adjusting entries, closing entries, and financial statements. It describes subsidiary ledgers for accounts receivable and payable. Finally, it discusses the uses of special journals like sales, purchases, cash receipts and cash payments journals.