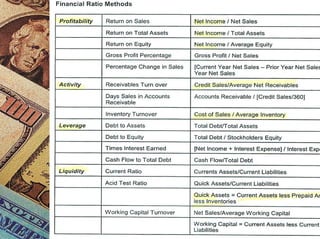

Financial ratio analysis can serve as an early warning system by measuring a company's performance across key financial metrics. Ratio analysis assumes accurate accounting information and compares a company's ratios to industry standards. Conducting regular ratio analysis can improve a company's profitability and chances of survival by identifying areas for improvement. Key ratios to examine include current assets to current liabilities, accounts receivable to working capital, inventory turnover, net profit to net worth, and net sales to working capital. Comparing ratios to competitors helps pinpoint where a company can enhance efficiency.