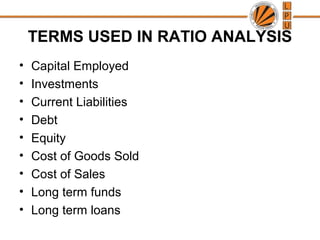

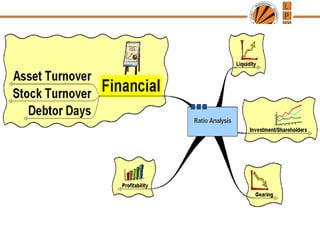

Ratio analysis measures relationships between financial variables to show how a firm's situation compares to its past, other firms, and the industry. Ratios are used to identify performance, standardize information, provide early warnings, and enable trend spotting. Key types of ratios include liquidity, activity, debt, and profitability. Liquidity ratios measure a firm's ability to pay obligations and include current, quick, and cash ratios. Activity ratios evaluate efficiency through measures like inventory turnover, accounts receivable period, and asset turnover.

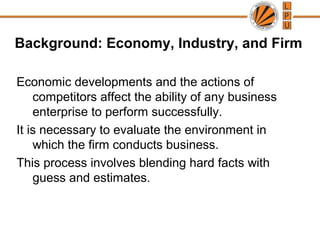

![LIABILITIES ASSETS

Capital + Reserves 355 Net Fixed Assets 265

P & L Credit Balance 7 Cash 1

Loan From S F C 100 Receivables 125

Bank Overdraft 38 Stocks 128

Creditors 26 Prepaid Expenses 1

Provision of Tax 9 Intangible Assets 30

Proposed Dividend 15

550 550

Q . What is the Proprietary Ratio ? Ans : (T NW / Tangible Assets) x 100

[ (362 - 30 ) / (550 – 30)] x 100

(332 / 520) x 100 = 64%

Q . What is the Net Working Capital ?

Ans : C. A - C L. = 255 - 88 = 167

Q . If Net Sales is Rs.15 Lac, then What would be the Stock Turnover

Ratio in Times ? Ans : Net Sales / Average Inventories/Stock

1500 / 128 = 12 times approximately

Exercise 4. contd…](https://image.slidesharecdn.com/ratioanalysis-140514135724-phpapp01/85/Ratio-analysis-99-320.jpg)