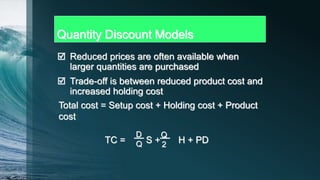

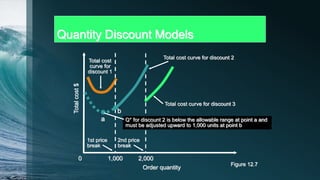

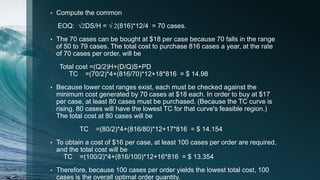

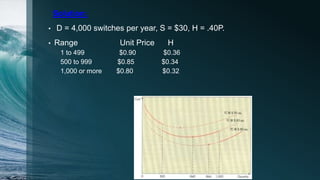

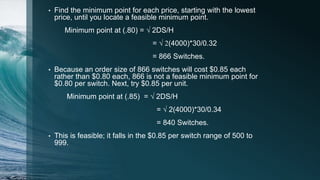

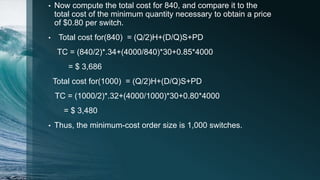

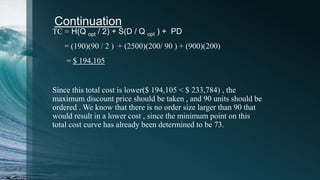

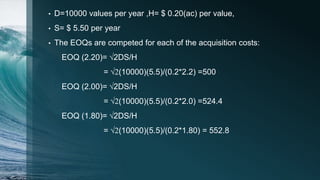

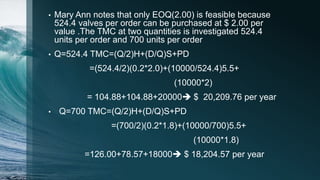

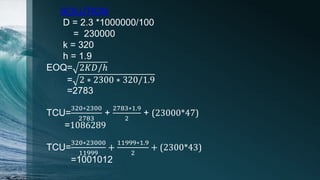

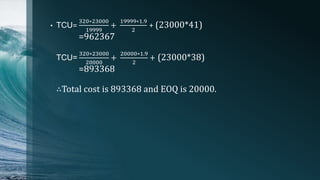

1. The document discusses quantity discount models, including calculating optimal order quantities (Q*) based on setup, holding, and product costs to determine the lowest total cost.

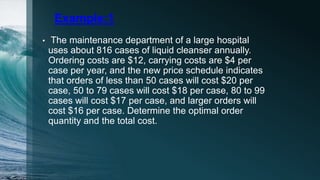

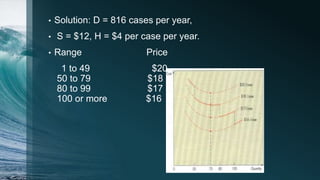

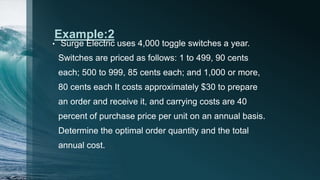

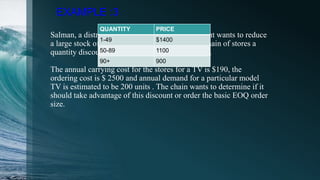

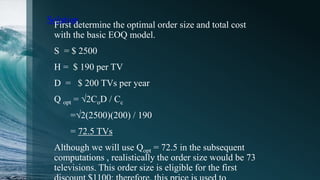

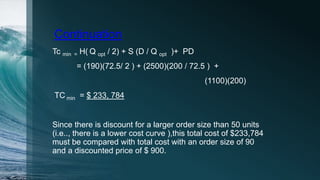

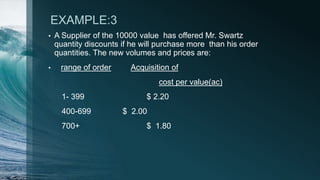

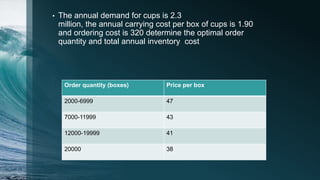

2. It provides examples of applying these models to determine optimal order quantities for various products given annual demand, costs, and discount price structures.

3. The optimal order quantity is the one that results in the lowest total annual cost based on comparing total costs calculated for different possible order sizes.