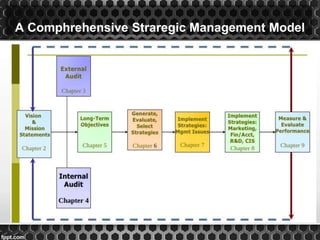

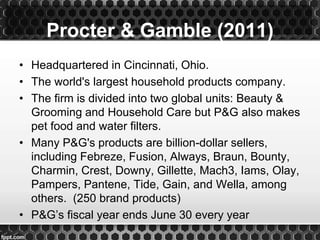

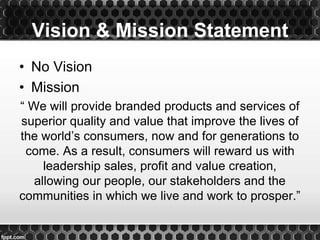

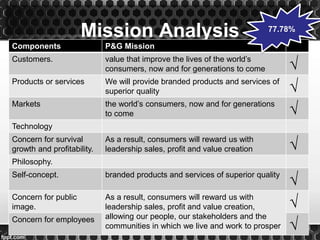

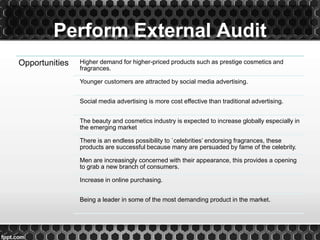

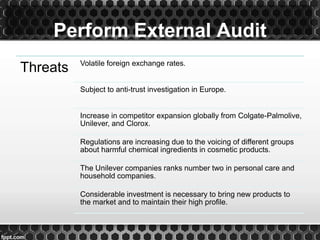

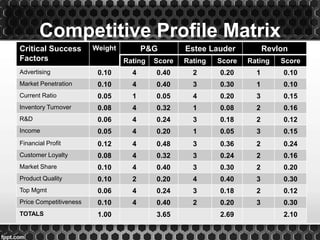

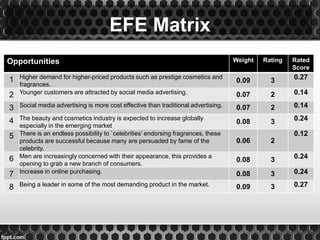

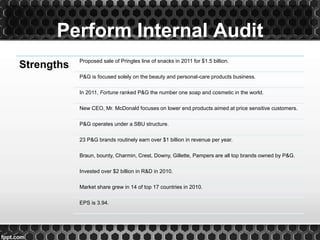

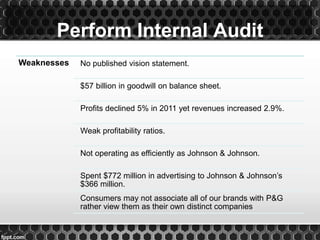

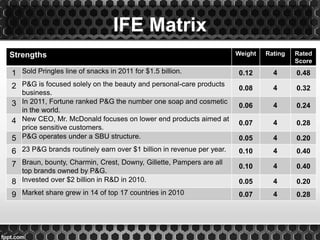

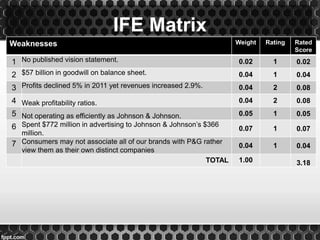

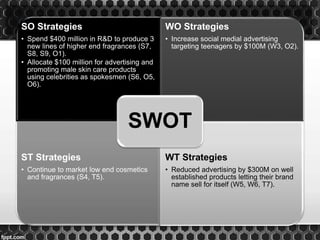

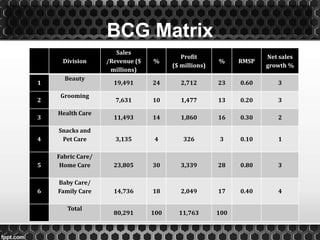

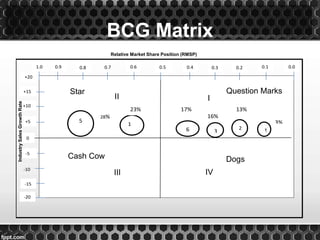

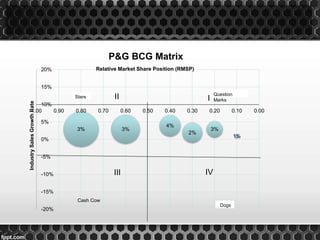

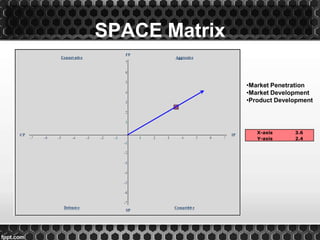

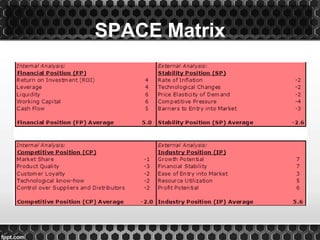

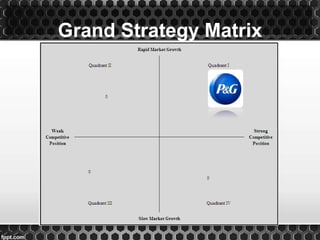

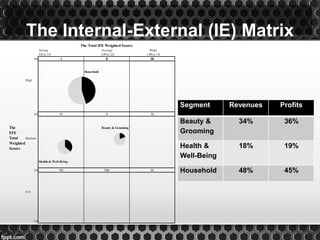

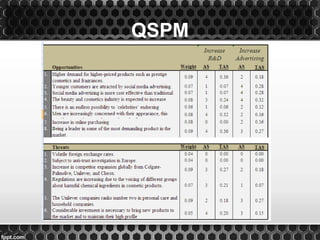

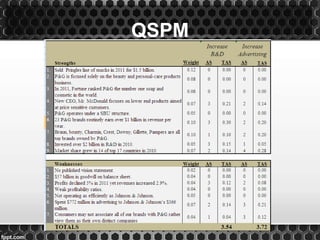

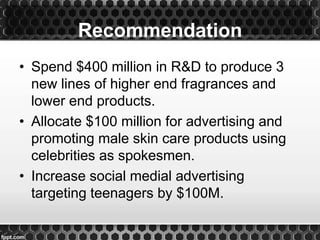

Procter & Gamble is the world's largest consumer goods company, known for brands like Always, Braun, Bounty, Charmin, Crest, Downy, Febreze, Gillette, Olay, Pampers, Pantene, Tide, and Wella. The document analyzes P&G's business in 2011 through external and internal audits, strategic frameworks like BCG matrix and IE matrix, and recommends strategies like increasing investments in R&D, targeting male consumers through celebrity endorsements, and focusing marketing of established brands on their brand recognition. The analyses aim to help P&G accelerate growth, especially in emerging markets