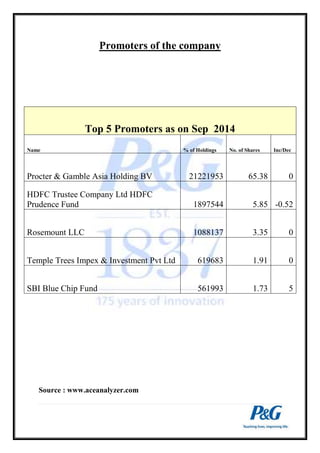

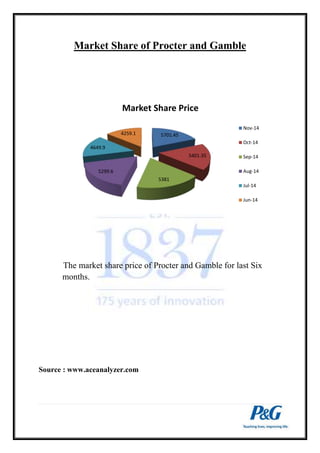

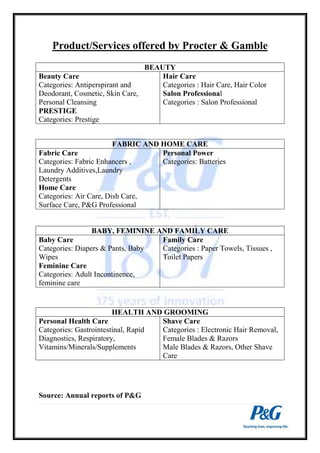

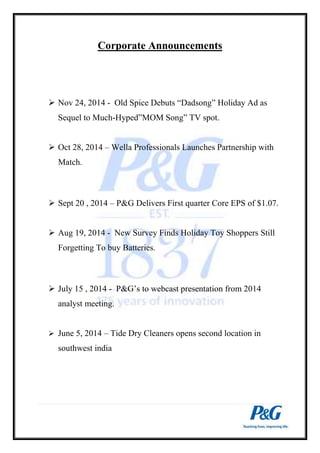

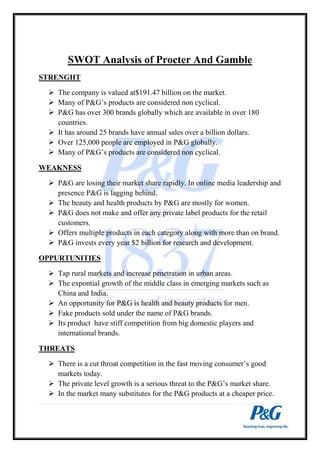

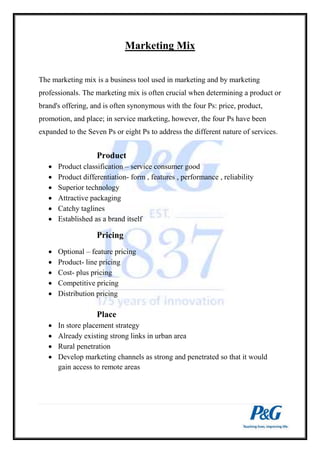

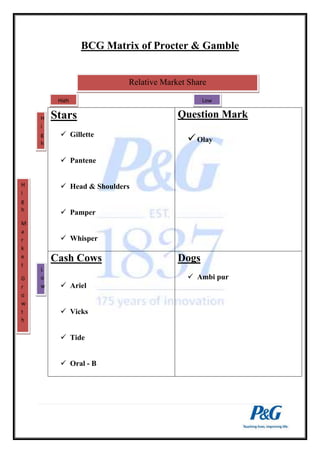

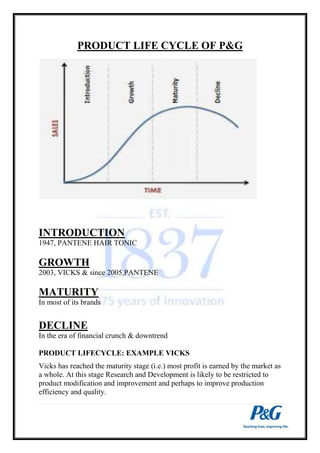

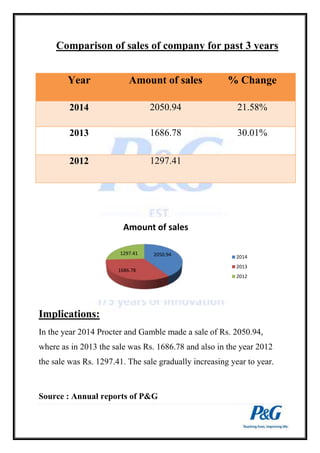

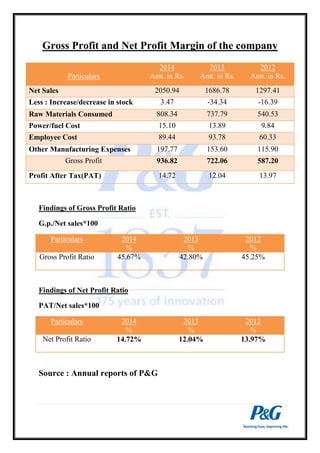

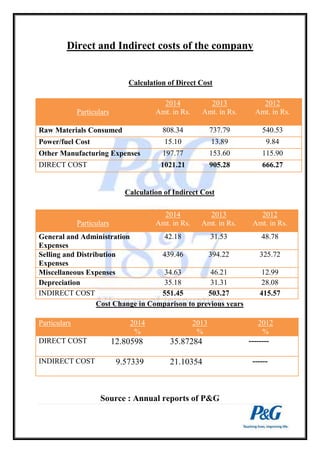

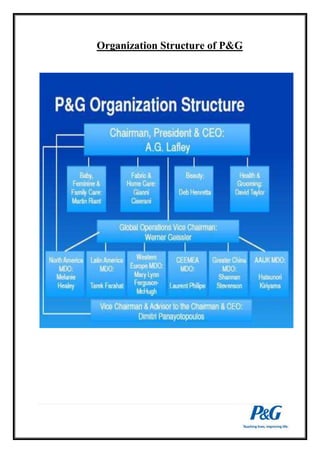

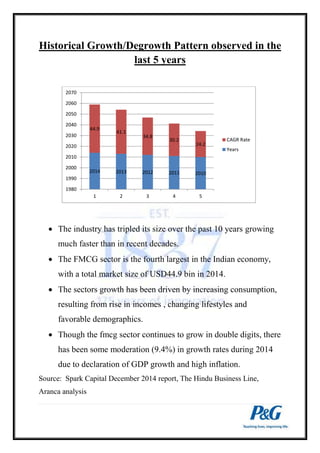

The document is a presentation on Procter & Gamble by Rishiraj Das. It includes an acknowledgement section thanking mentors for their support. The contents section outlines the various topics to be covered in the presentation, including sectoral information, company information, marketing strategy, business finance, human resource management, and a conclusion. Under sectoral information, it provides details on the FMCG sector's contribution to the Indian and world economies, historical growth patterns, and a PEST analysis. Company information includes an overview of P&G's history and promoters, market share, product offerings, and competitor analysis.

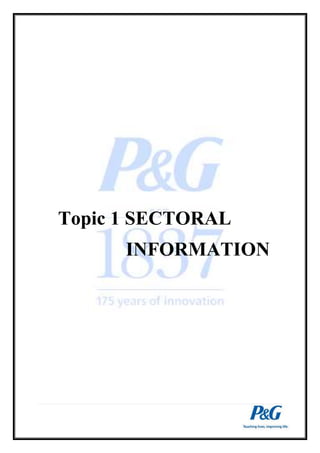

![Snapshot of Procter and Gamble

Company Details

Industry Household & Personal Products

House Procter & Gamble - MNC

Registered

Office Registered Office

Address

P & G Plaza,Cardinal Gracias Road,Chakala Andheri

(East)

Mumbai , 400099 , Maharashtra

BSE Code [500459]

NSE Symbol PGHH

Bloomberg PG IN

ISIN Code INE179A01014

Chairman R A Shah

Managing

Director Shantanu Khosla

Secretary Preeti Bishnoi

Source : www.aceanalyzer.com](https://image.slidesharecdn.com/f1f4fde1-4d19-4d56-9edc-8e98cf72ba53-141215061522-conversion-gate02/85/Final-Presentation-on-Procter-and-Gamble-12-320.jpg)