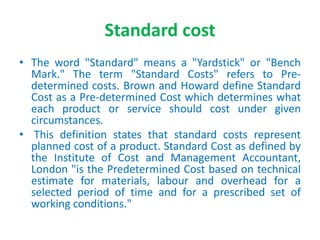

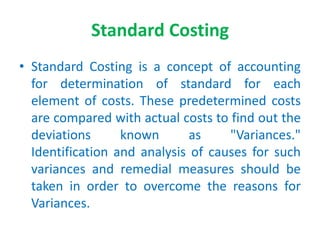

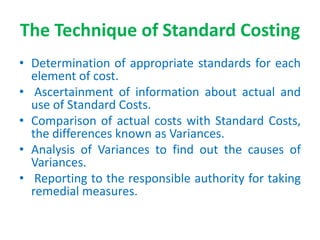

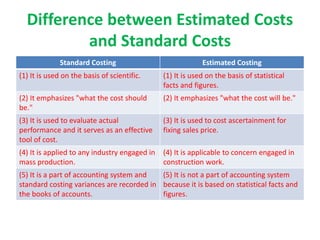

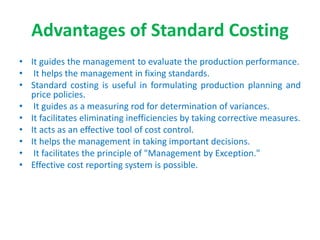

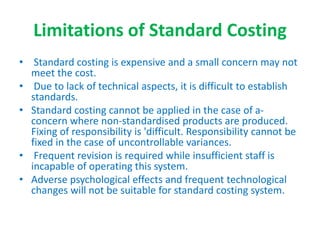

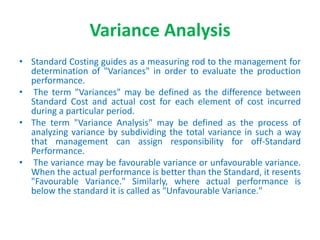

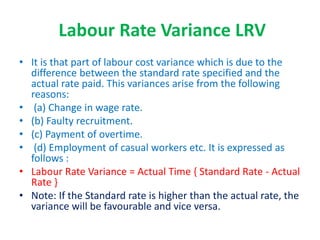

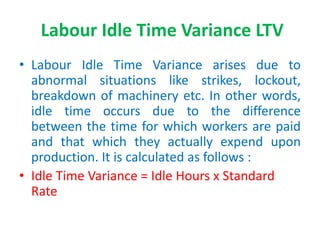

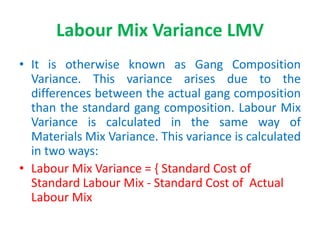

This document discusses standard costing and variance analysis. It defines standard costs as predetermined costs that determine what a product should cost under given circumstances. Standard costing involves setting standards for each cost element and comparing actual costs to standards to calculate variances. Variances are analyzed to identify reasons for differences from standards and take corrective actions. The document outlines different types of cost variances including direct material, direct labor, and overhead variances. It provides formulas to calculate each variance and explains how variances are classified as favorable or unfavorable.

![P. MURUGAN M.Com [CA]., M.Phil., SET., [P.hD]

Assistant Professor in B.Com (CA)

Vivekananda College

Tiruvedakam West

Madurai.](https://image.slidesharecdn.com/standardcostingppt-200423021001/75/Standard-costing-PPT-1-2048.jpg)