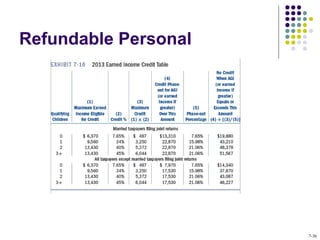

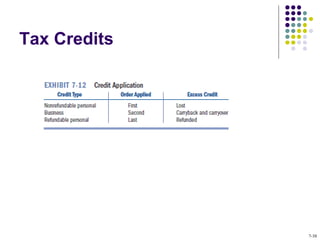

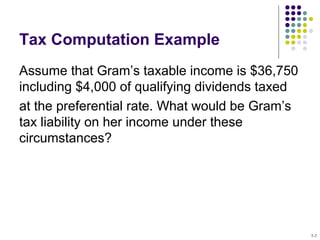

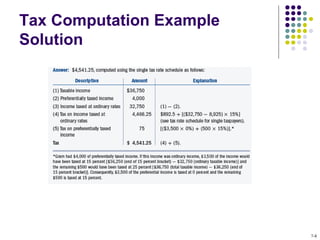

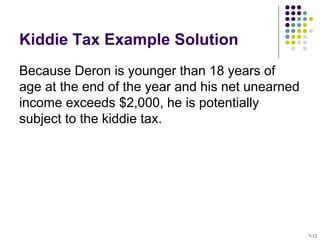

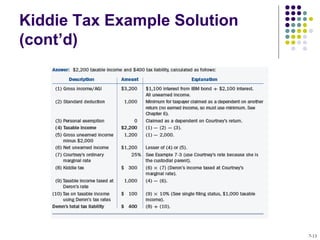

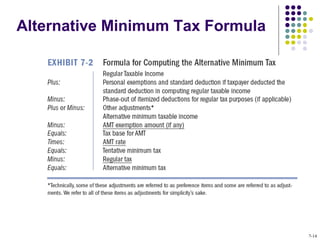

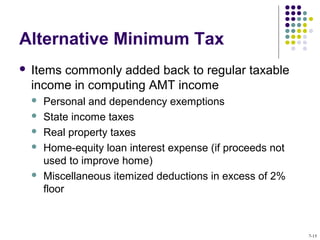

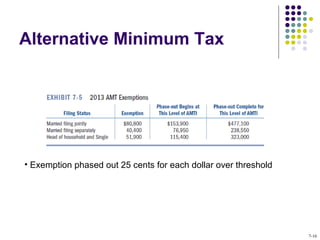

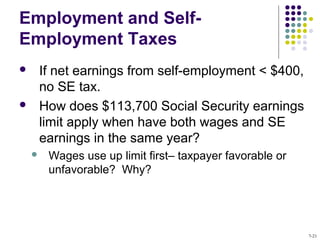

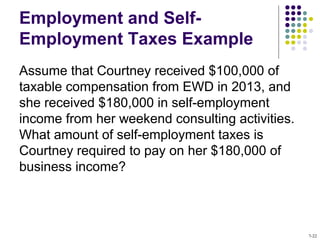

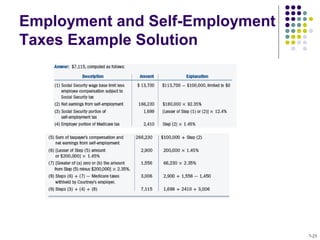

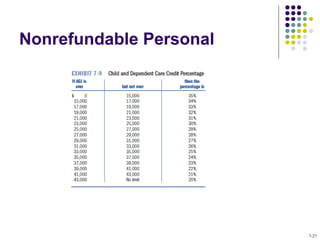

This document provides learning objectives and content about individual income tax computation and tax credits. It covers determining regular and alternative minimum tax liability, computing employment and self-employment taxes, describing types of tax credits including refundable and nonrefundable personal and business credits, and explaining taxpayer filing requirements and penalties. Examples are provided to illustrate concepts like kiddie tax, education credits, and late payment penalties.

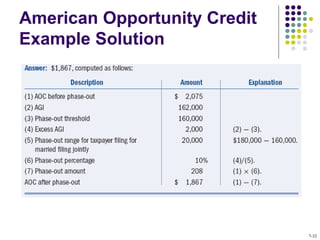

![American Opportunity Credit

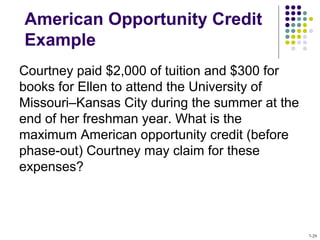

Example Solution

Answer: $2,075.

Because the cost of tuition and books are

eligible expenses, Courtney may claim a

maximum American opportunity credit before

phase-out of $2,075 [($2,000 × 100%) +

($2,300 - $2,000) × 25%].

7-30](https://image.slidesharecdn.com/acct-321-chapter7-140523090303-phpapp02/85/ACCT321-Chapter-07-30-320.jpg)