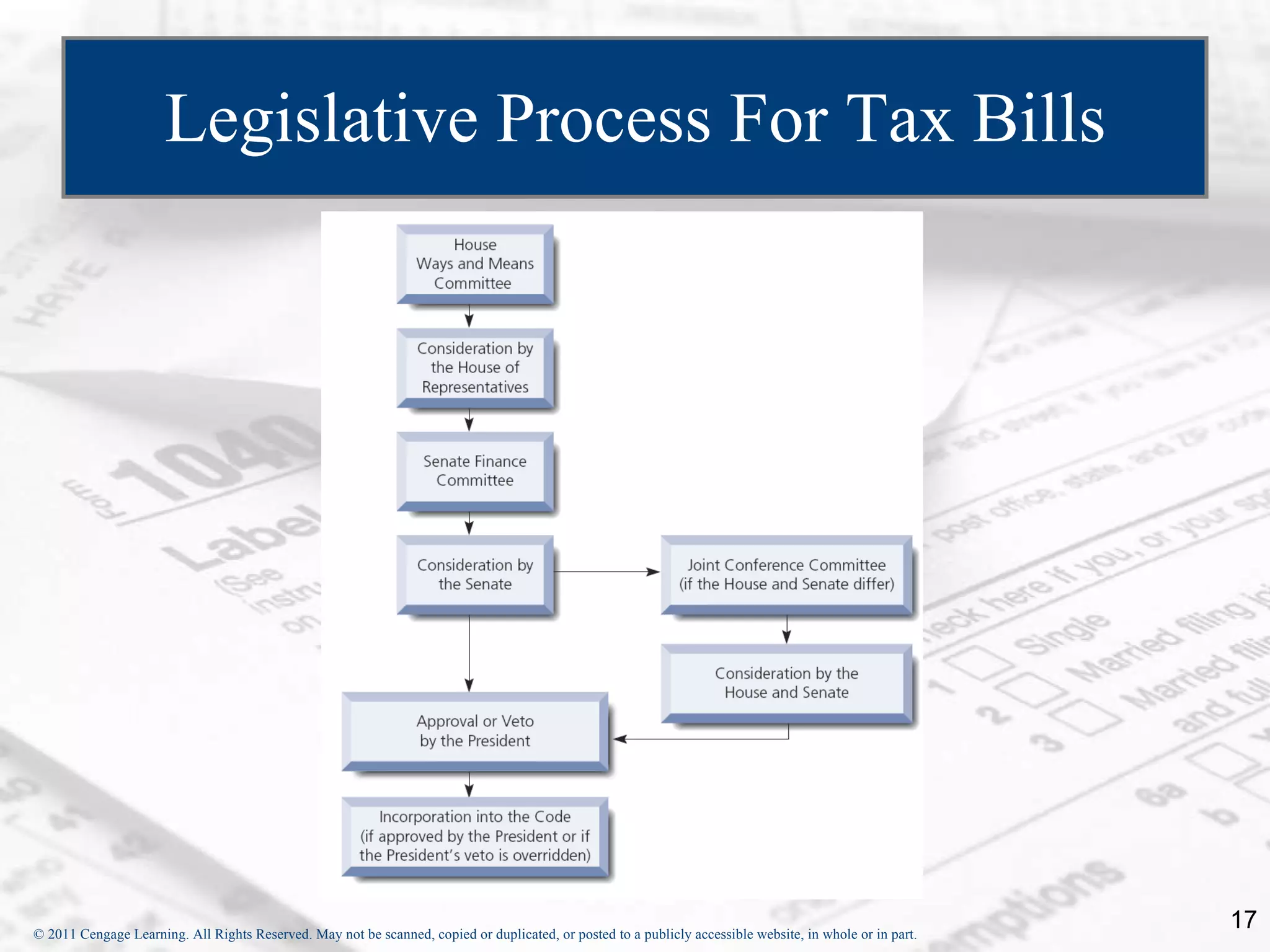

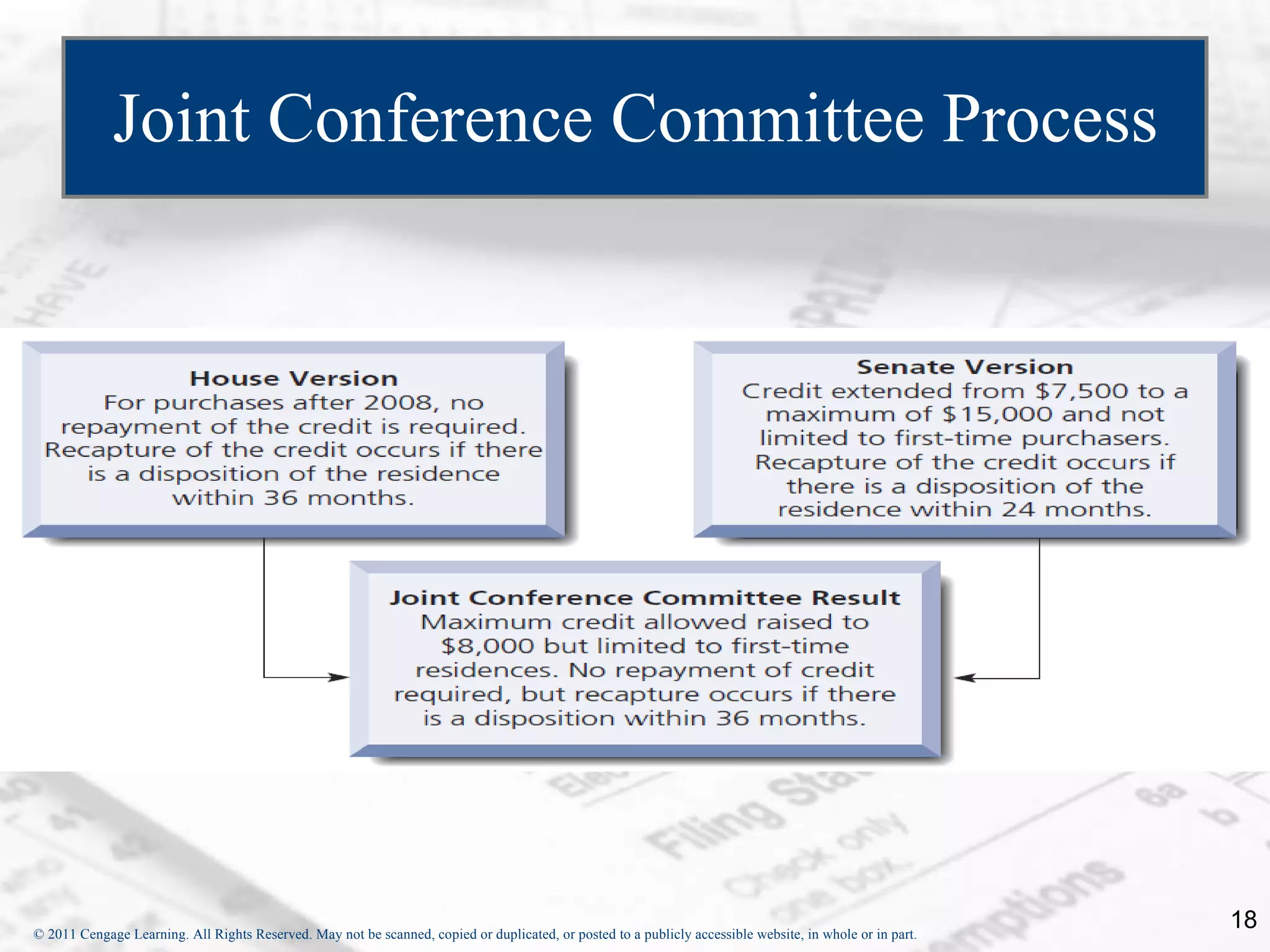

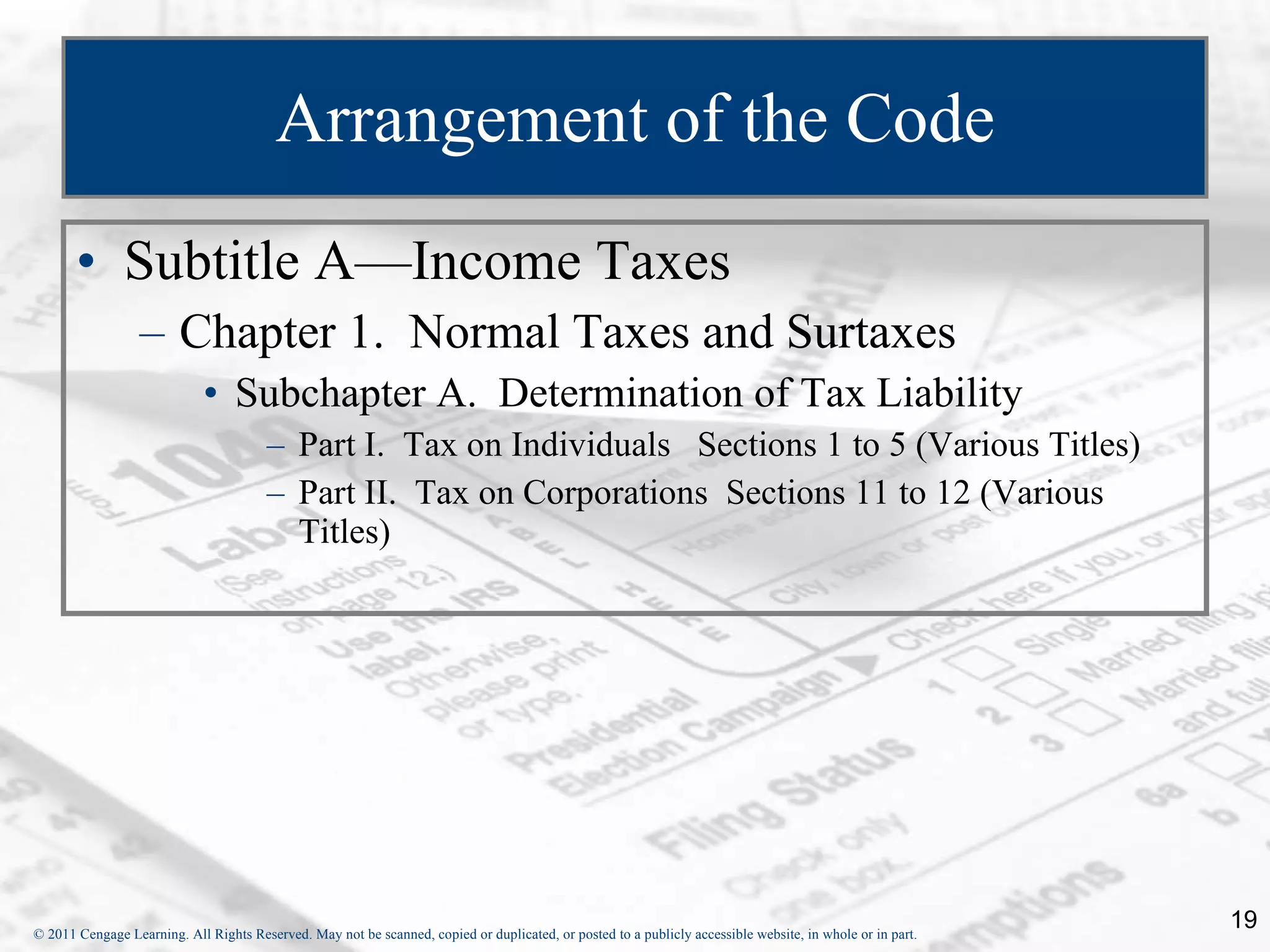

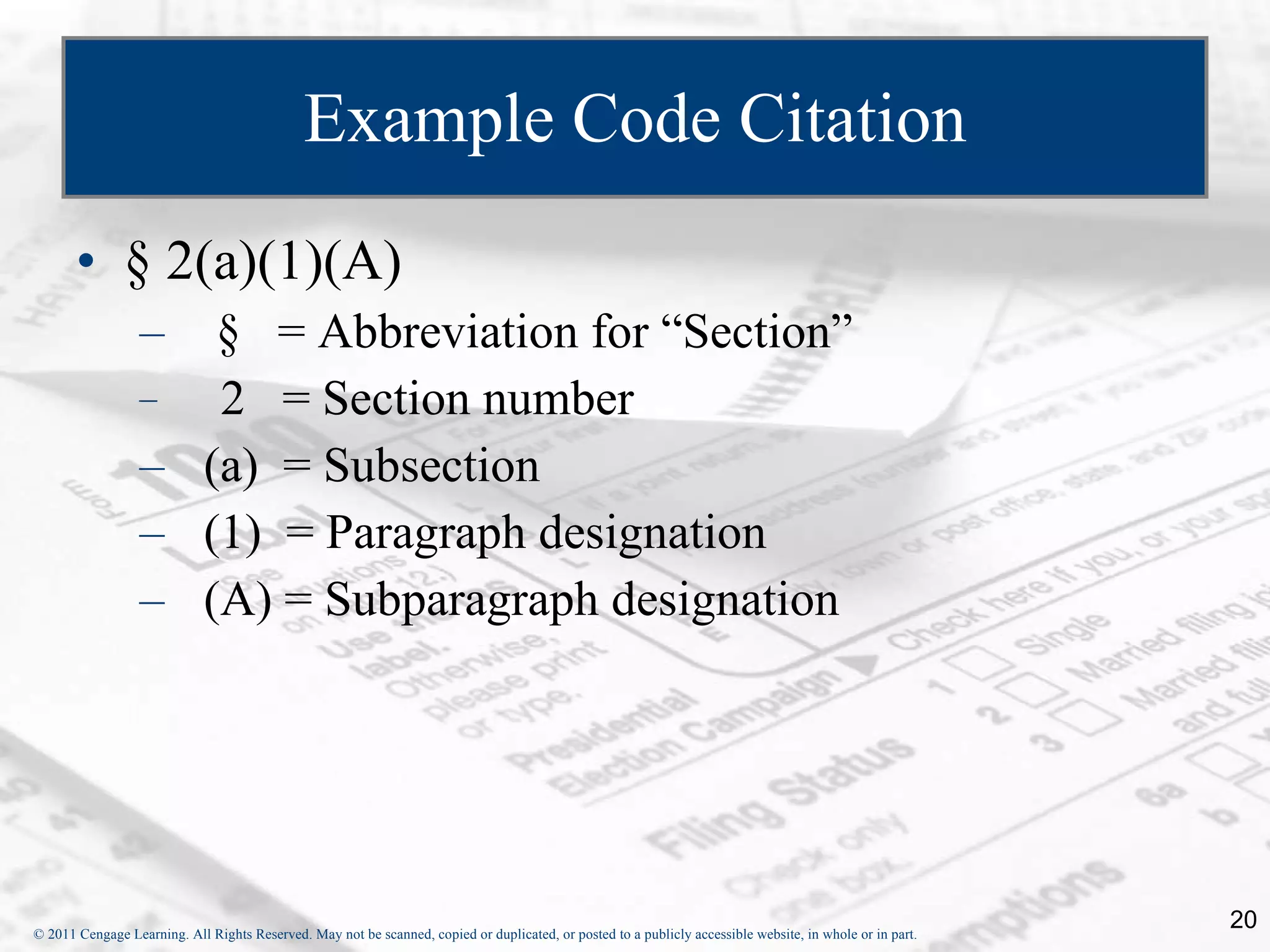

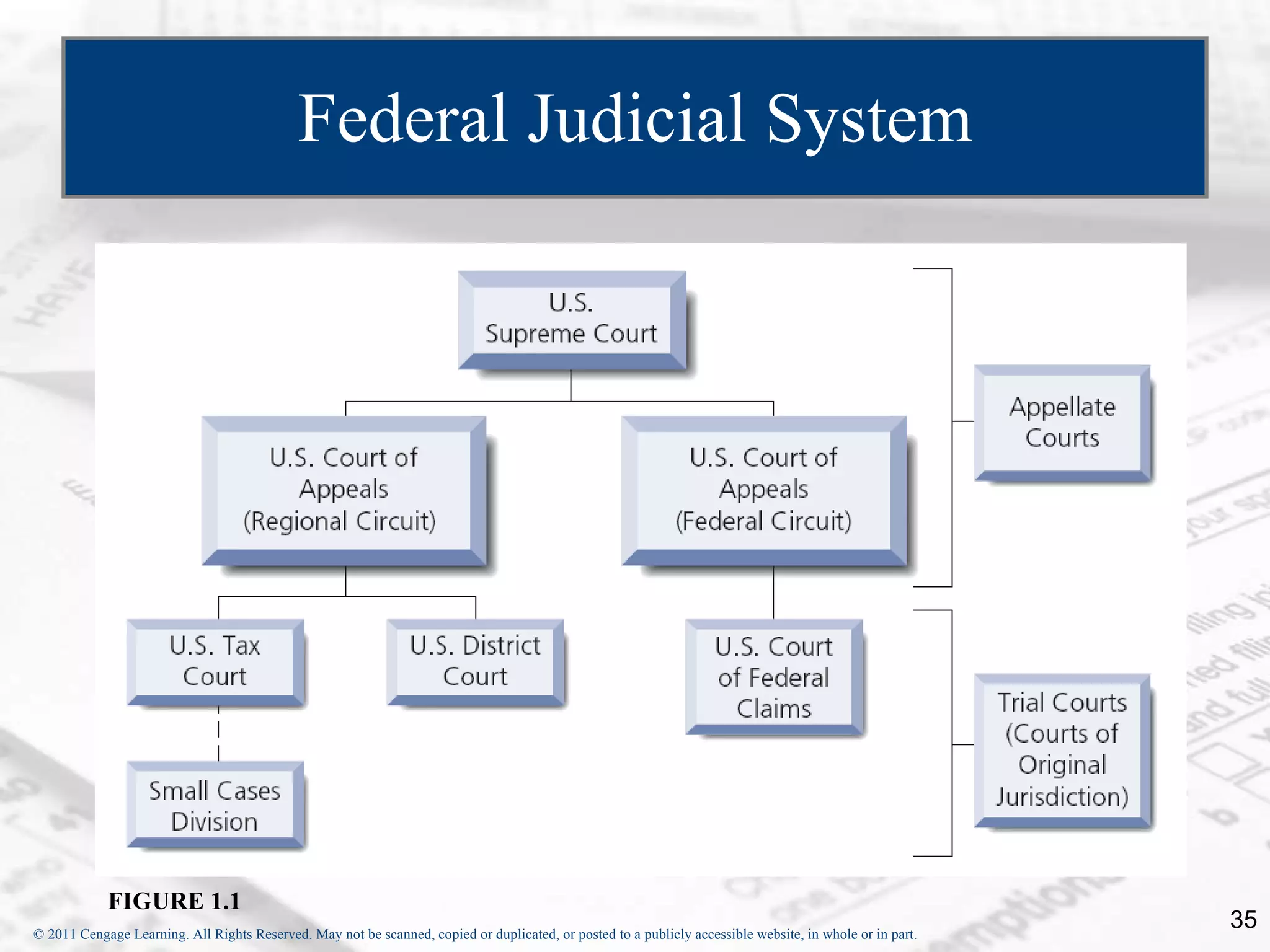

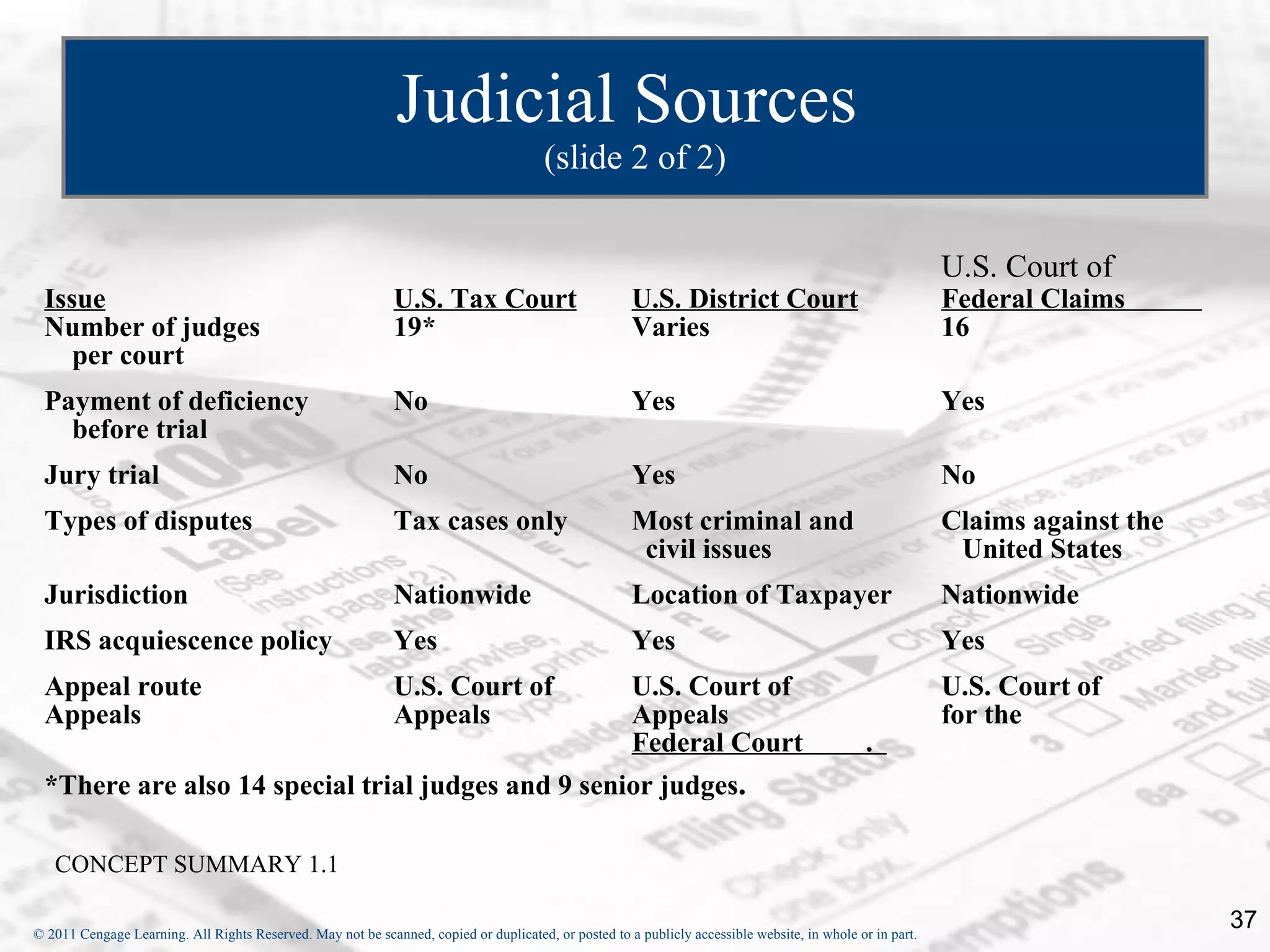

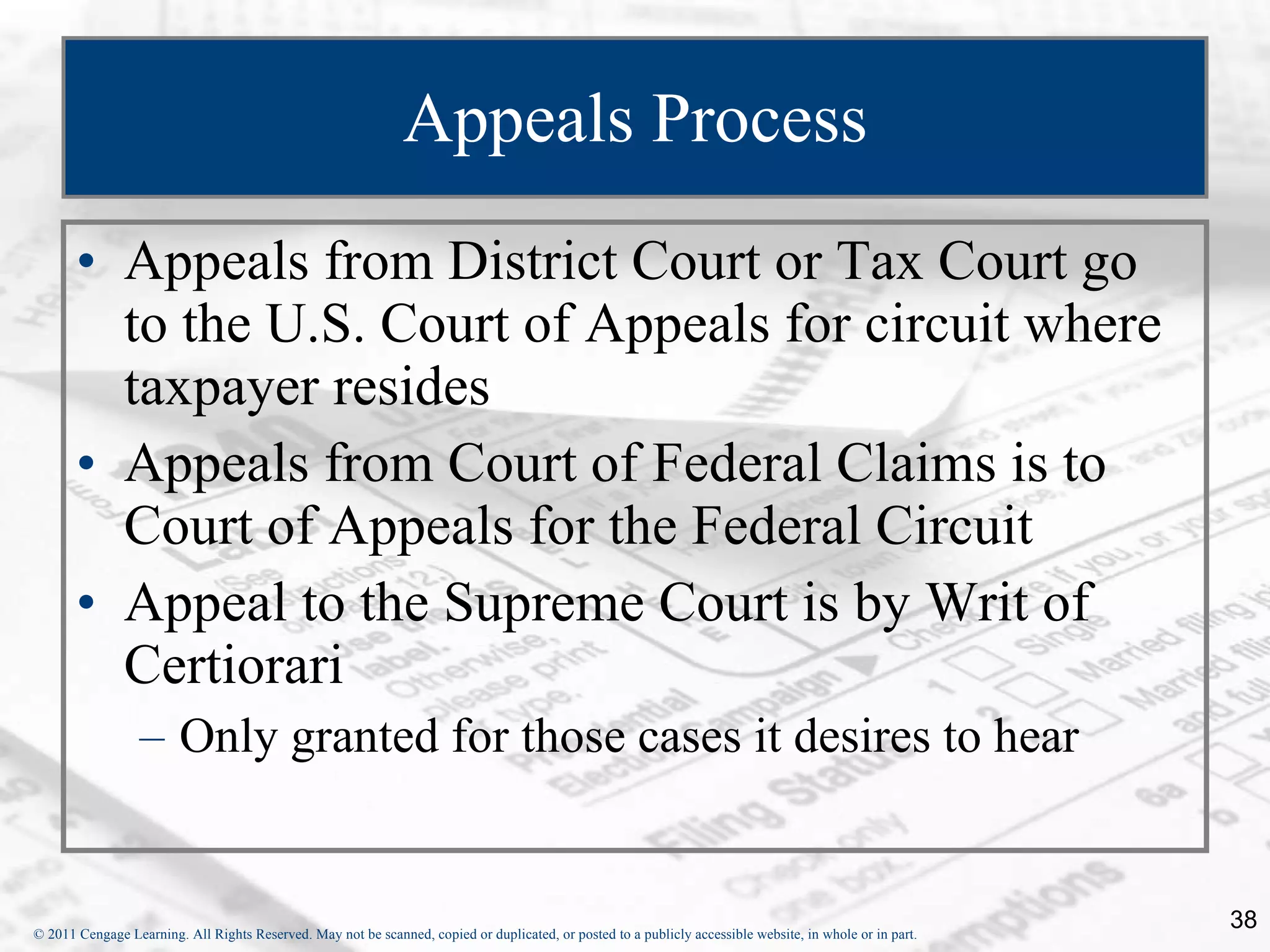

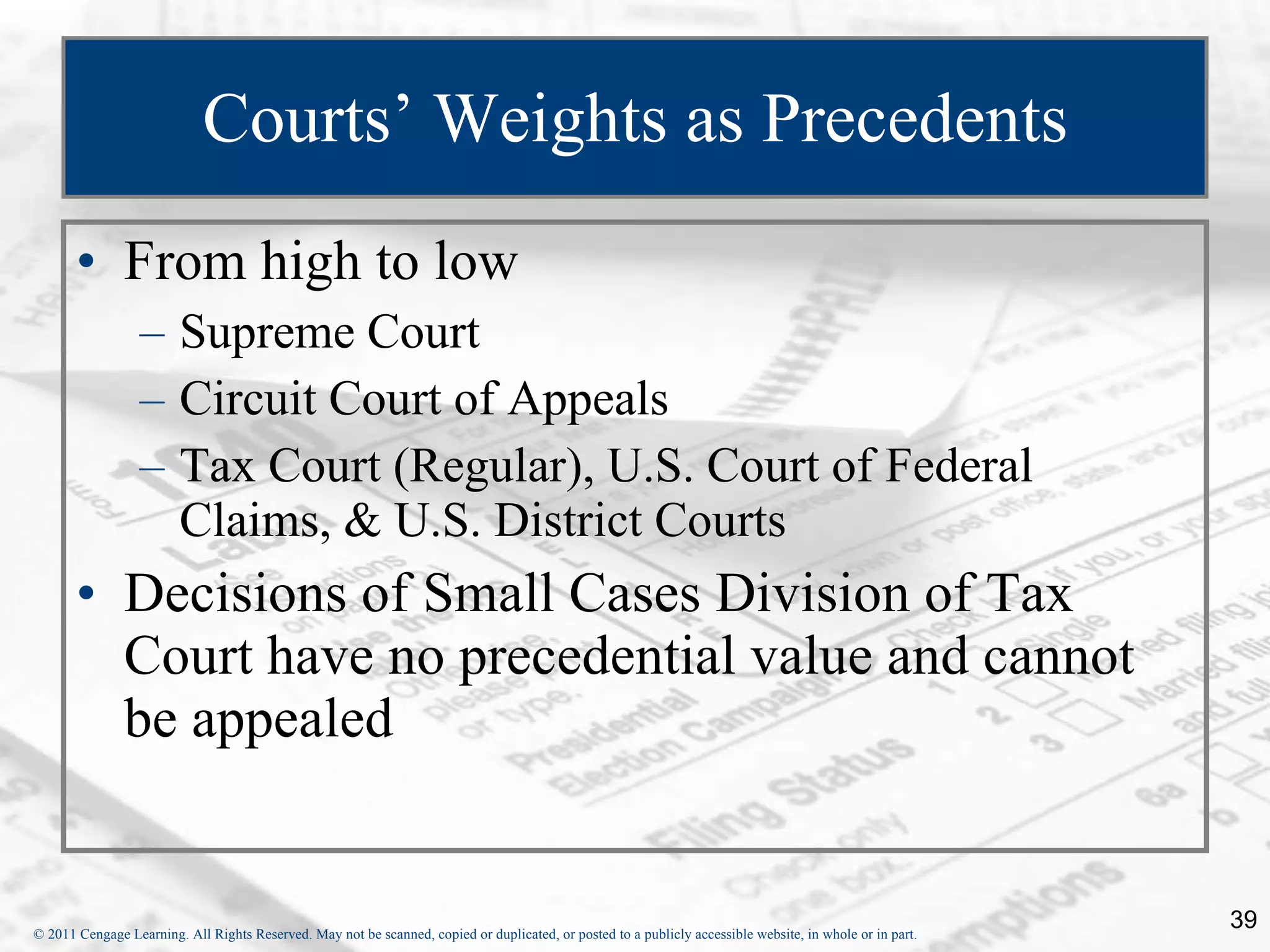

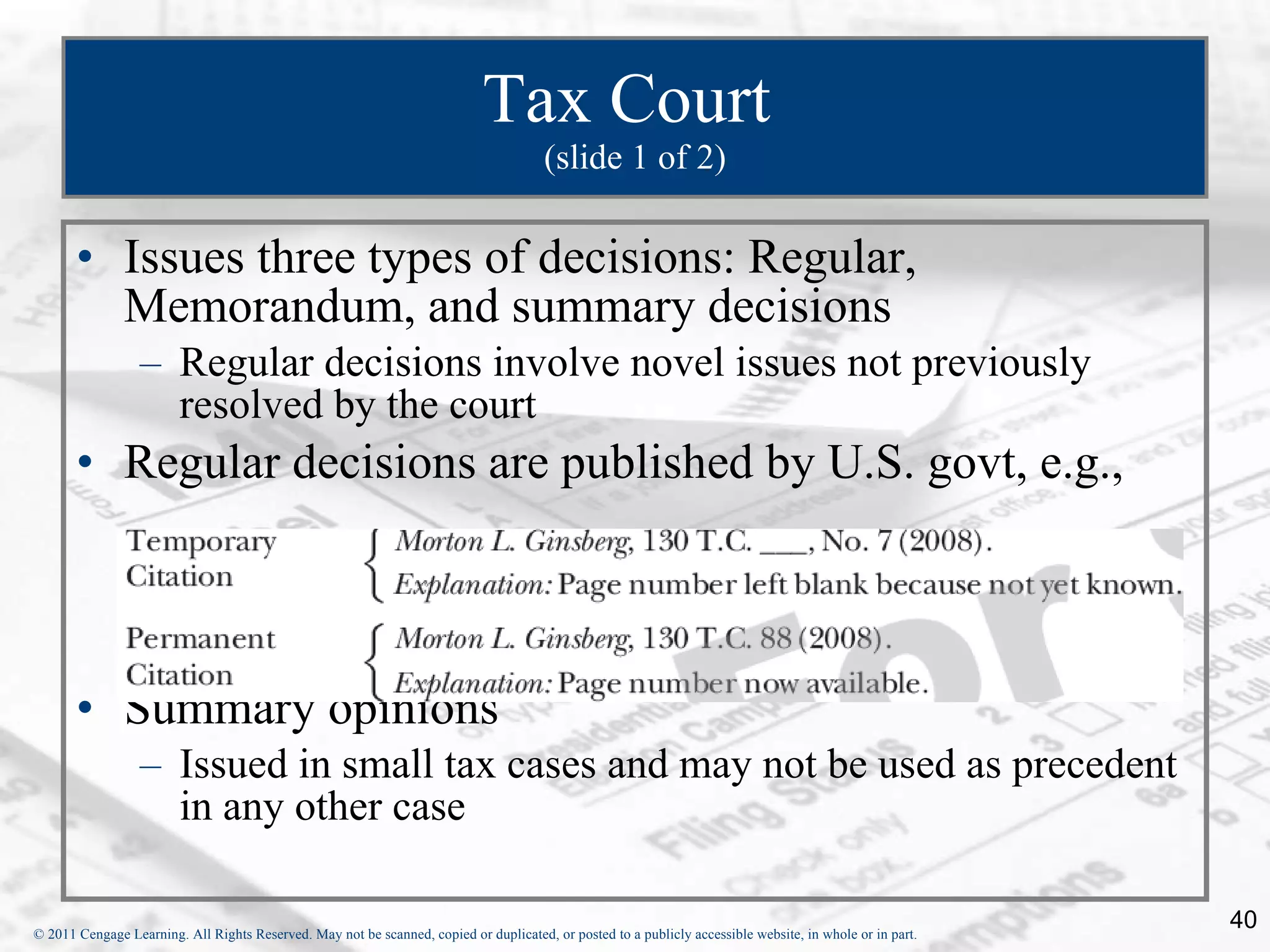

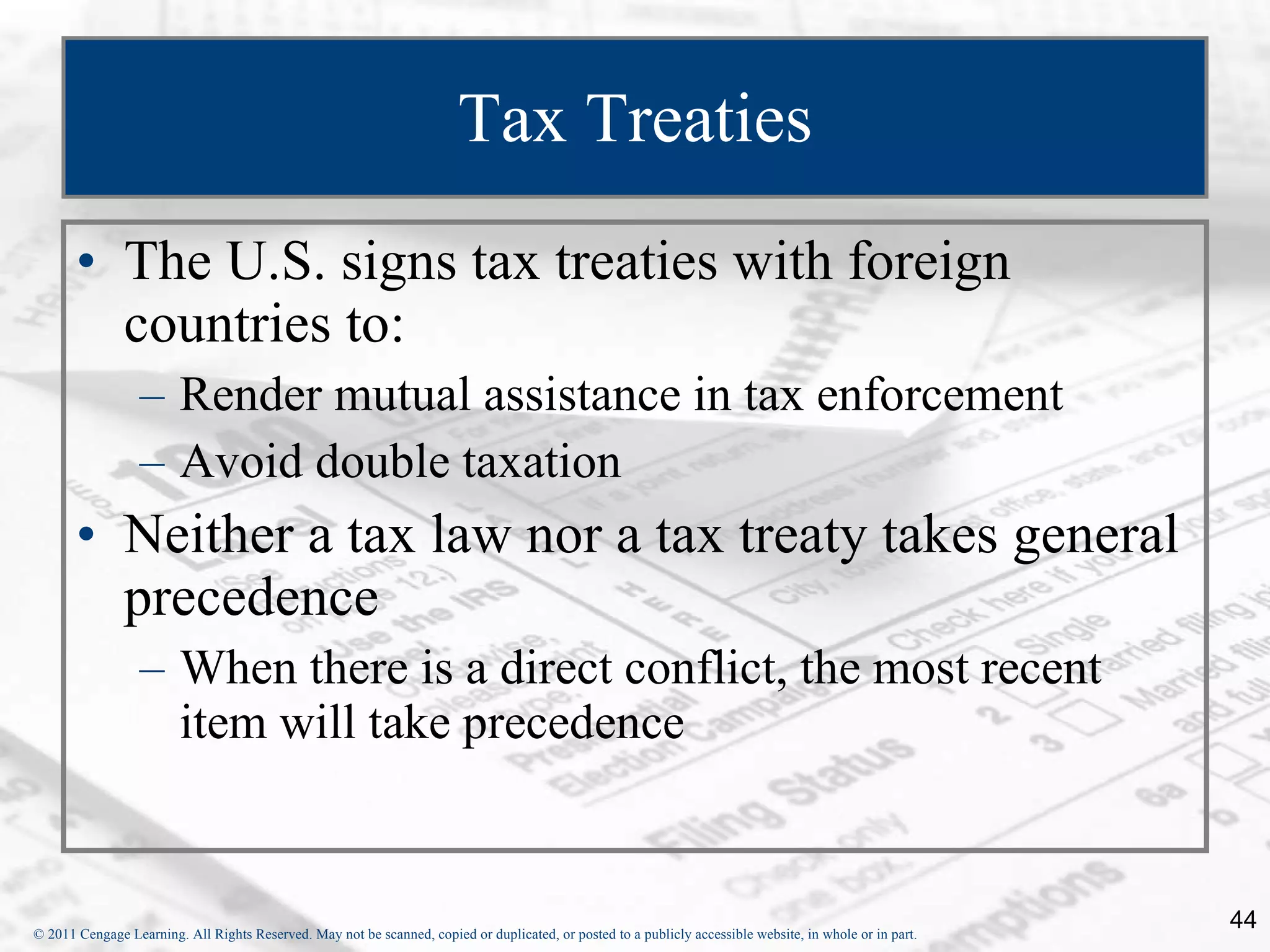

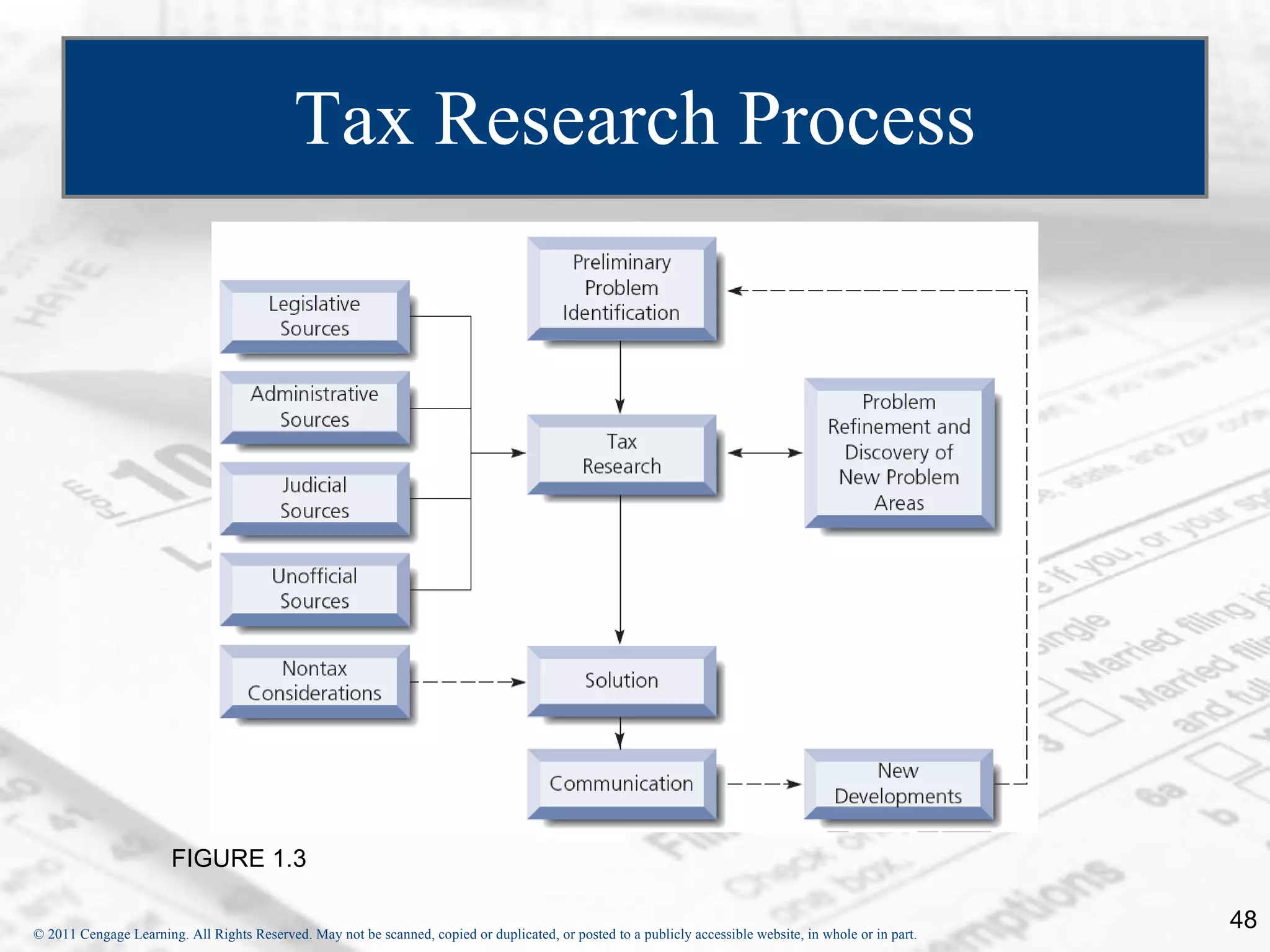

The document discusses the complex structure of the US federal tax law, which results from competing objectives in developing tax policy. It outlines various economic, social, equity and political considerations that influence tax law. It also describes the key agencies and sources that shape tax law, including the IRS, Treasury Department, courts, Internal Revenue Code, regulations, revenue rulings and other administrative pronouncements.

![If you have any comments or suggestions concerning this PowerPoint Presentation for South-Western Federal Taxation, please contact: Dr. Donald R. Trippeer, CPA [email_address] SUNY Oneonta](https://image.slidesharecdn.com/chapter1understandingandworkingwithfederaltaxlaw-110401151254-phpapp01/75/Chapter-1-understanding-and-working-with-federal-tax-law-58-2048.jpg)