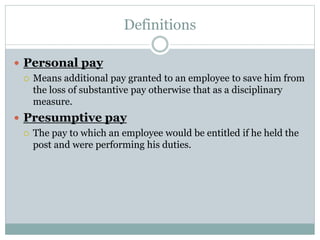

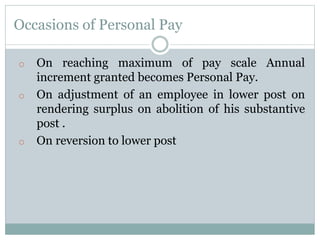

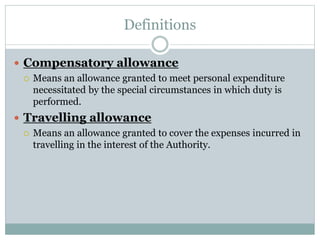

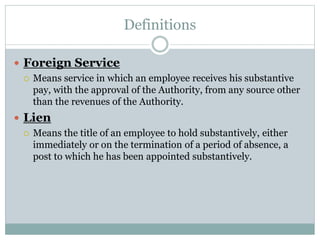

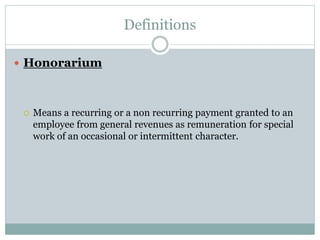

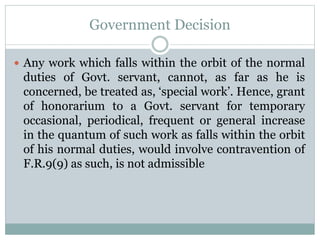

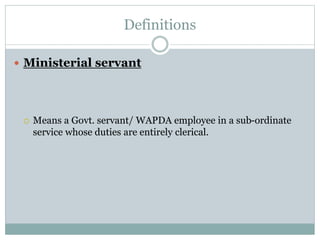

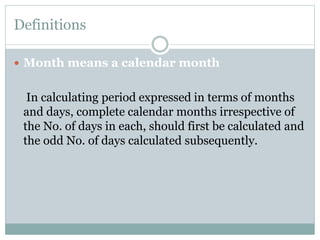

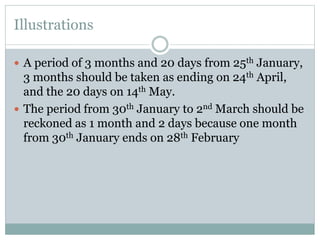

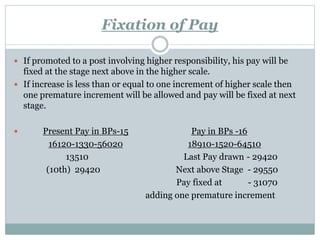

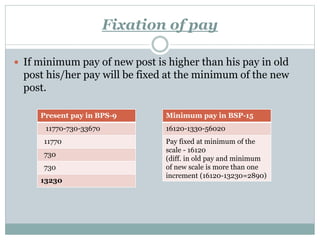

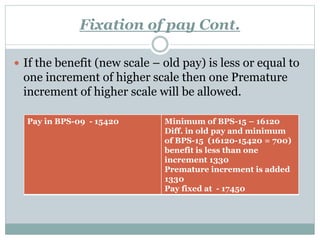

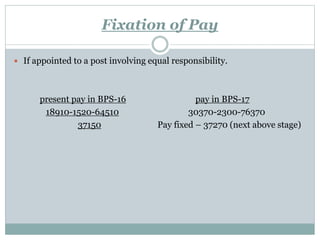

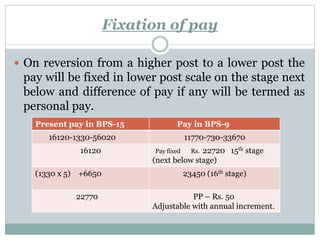

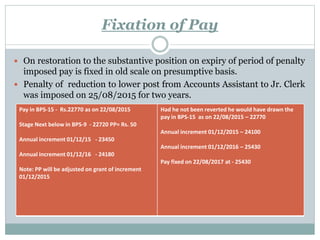

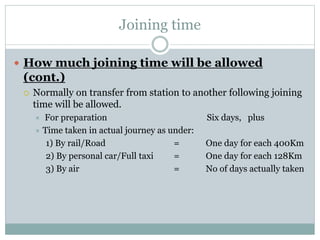

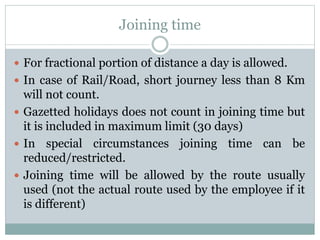

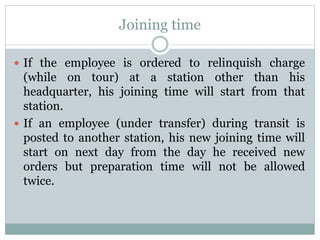

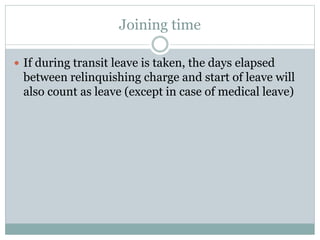

The document defines key terms related to pay rules such as substantive pay, special pay, personal pay, presumptive pay, cadre, honorarium, and joining time. It provides details on fixation of pay on promotion, reversion, restoration, and surplus. Joining time allowed is up to 30 days depending on distance traveled, with preparation time of 6 days and travel time calculated based on mode of transportation. Exceptions to joining time rules are also outlined.