This document provides an overview of key topics related to partnerships covered in Chapter 16, including:

1) The definition of a partnership as an unincorporated association with two or more persons who associate for profit.

2) Partnerships are generally treated as pass-through entities where income/loss and separately stated items are allocated to partners.

3) Separately stated items such as capital gains/losses must be stated separately since tax treatment may vary between partners.

![Types of Partnerships

General partnership [GP]. A GP has one or more general partners

who is personally liable for partnership debts; a general partner can

be bankrupted by a malpractice judgment brought against the

partnership, even though the partner was not personally involved in

the malpractice.

Limited liability partnership [LLP]. An LLP is similar to a general

partnership, except that an LLP partner is not liable for any

malpractice committed by the other LLP partners.

Chapter 16, Exhibit 2a CCH Federal Taxation Basic Principles5 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-5-320.jpg)

![Types of Partnerships

Limited partnership [LP]. An LP is comprised of at least one general

partner and often many limited partners. Limited partners may not

participate in the management of the LP, and their risks of loss are

restricted to their equity investments in the LP.

Limited liability company [“LLC”]. An LLC is a state-registered

association generally taxed as a partnership if it “checks the box.”

LLC members, like corporate shareholders, are not personally

liable. Unlike limited partners, LLC members may participate in

management without risking personal liability. However,

guaranteed payments are subject to self-employment tax, along with

the members’ share of ordinary income or loss from the LLC.

Chapter 16, Exhibit 2b CCH Federal Taxation Basic Principles6 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-6-320.jpg)

![Tax Formula

[Taxation at Owner Level]

Ordinary Income “From Whatever Source Derived”

(including Code Sec. 1245 recapture)

– Exclusions and Cost of Goods Sold

= Gross Income from Business Operations

- Operating Expenses

– Code Sec. 702(a)(8) Ordinary Income

+ or - Separately Stated Items (These are items that may result in

different tax treatment by different partners. Examples include

capital gain or loss and charitable contributions.)

Chapter 16, Exhibit 5 CCH Federal Taxation Basic Principles9 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-9-320.jpg)

![Formation of Partnerships—

Overview of Code Section 721

What is “property”?

“Property” includes just about everything except services. (i.e.,

cash, inventory, receivables, land, other tangible assets,

nonexclusive licenses and industry know-how.)

[Note: Since neither Congress nor the Treasury Dept. have offered

a definition of property, the courts have been guided by analogous

interpretations under Code Sec. 351. Recall that Code Sec. 351

provides for nonrecognition treatment on the transfer of “property”

to an 80% controlled corporation in exchange for stock.]

Chapter 16, Exhibit 8i CCH Federal Taxation Basic Principles24 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-24-320.jpg)

![Formation of Partnerships—

Overview of Code Section 721

Why are “services” NOT “property’?

Reg. §1.721-1(b)(1) provides that services are NOT property to ensure

that a person who provides services to a partnership will be taxed either:

1. Immediately, on the FMV of the P/S capital interest received:

With a contribution of services, the FMV of the P/S capital interest

received is taxed to the partner as compensation (i.e., OI). [Recall that a

shareholder’s contribution of services gets similar ordinary treatment.]

2. Eventually, on the receipt of income from an income only P/S

interest:

If services are performed in exchange for an income interest, (not a

capital interest), then income recognition is DEFERRED until income is

received. The reason for deferring the recognition of income is because

of the difficulty in determining a market value of the speculative future

profits.

Chapter 16, Exhibit 8j CCH Federal Taxation Basic Principles25 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-25-320.jpg)

![Part Property/ Part Services—Example

FACTS

“A” transfers the following items to XYZ Partnership in exchange for a capital

interest:

Asset FMV Basis

Land $50,000 $10,000

Services $35,000 $0

QUESTION: How much income is recognized on the transfer?

SOLUTION

Services: $35,000 OI as compensation.

Land: $0. The $40,000 [50,000 - 10,000 = 40,000] realized gain on transfer of

land is NOT recognized, consistent with Code Sec. 721; rather, it is a built-in

gain.

Chapter 16, Exhibit 10 CCH Federal Taxation Basic Principles27 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-27-320.jpg)

![Disguised Sales—General Rules

The P/S sold the distributed property to an unrelated 3rd party.

Gains or losses are recognized by partners and

partnerships on disguised sales, based on the difference between

fair market value (FMV) and adjusted basis (AB). However,

recognition of losses depends on the partner’s % ownership

interest. If the partner has a “ > 50% capital interest,” NEITHER

may recognized losses. Instead, the related party rules must be

applied. Code Sec. 707(b)(1).

[Compare these rules with the rules for corporations. C

corporations recognize gain but NEVER LOSS on transfers of

nonstock property to any shareholder, regardless of ownership

%.]

Chapter 16, Exhibit 11b CCH Federal Taxation Basic Principles29 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-29-320.jpg)

![Disguised Sales—General Rules

If a disguised sale involves the transfer by a partnership of a

capital interest, does part of the transaction qualify for Code Sec.

721 nonrecognition treatment? If so, how much?

Yes, % of total transfers that get Code Sec. 721 nonrecognition

treatment, are: [(a) – (b)] ÷ (a), where:

(a) = FMV of property contributed by the partner to the P/S; and

(b) = FMV of property other than a capital interest distributed by

the P/S to the partner.

Chapter 16, Exhibit 11c CCH Federal Taxation Basic Principles30 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-30-320.jpg)

![Disguised Sales—Example

FACTS: Fred transfers land [$400 fair market value (FMV),

$120 adjusted basis (AB), held long-term for investment

purposes] to a partnership (P/S) in exchange for:

1. A capital interest worth $100;

2. $300 cash.

QUESTIONS:

A. What portion of the exchange represents a disguised sale?

B. What portion of the exchange represents a Code Sec. 721

contribution?

C. What is the tax treatment to Fred?

D. What is the tax treatment to P/S?

Chapter 16, Exhibit 12a CCH Federal Taxation Basic Principles31 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-31-320.jpg)

![Disguised Sales—Example

SOLUTION

The transfer is treated as a partial disguised sale and a partial partnership contribution:

Total Disguised Sale (75%): Contribution (25%):

FMV of cap. int. 100 75 25

Cash 300 225 75

Amount realized 400 300 100

Basis in land 120 90 [75%] 30 [25%]

Realized gain 280 210 70

Recognized gain 210 0

Character of gain LTCG Not recognized

Computation 100% - 25% = 75% (400 - 300) ÷ 400) = 25%

Reason for tax Reg. §1.707-3(a) Code Sec. 721

treatment: Recognition of realized gain Nonrecognition on transfer of

from disguised sale. property for a P/S interest.

Chapter 16, Exhibit 12b CCH Federal Taxation Basic Principles32 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-32-320.jpg)

![Disguised Sales—Example

SOLUTION

Fred’s basis in the partnership interest: $30 [25% of the basis of

land is attributable to a “contribution.”

P/S’ basis in the land: $330 [Fred’s 30 basis of land

“contributed” + 300 “sale” price.]

COMMENTS

Even if Fred had received the $300 cash 2 years after receipt of a

P/S interest, the IRS would still presume that Fred’s contribution

was partially a disguised sale as per above. Fred would have to

prove otherwise.

Chapter 16, Exhibit 12c CCH Federal Taxation Basic Principles33 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-33-320.jpg)

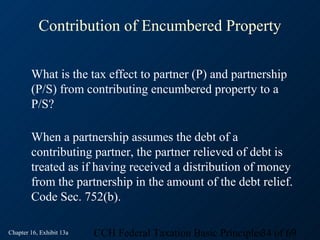

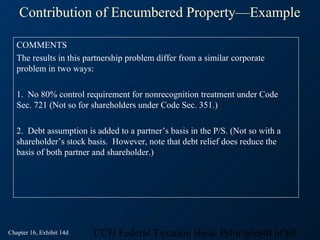

![Contribution of Encumbered Property—Example

FACTS:

Ann, Bob and Cal decide to pool their efforts and form a partnership. They make the

following contributions to the partnership:

C

Partner FMV AB to P P’s % int. in P/S:

ontribution

Ann Services $ 30,000 $ 0 30%

Bob Land 70,000 20,000 60%

Cal Equipment 10,000 11,000 10%

TOTALS $110,000 100%

Bob’s land is subject to a $10,000 mortgage that the partnership assumes.

The FMV of the P/S is $100,000 [$110,000 FMV assets - $10,000 debt assumed.]

Does this transfer of assets qualify for Code Sec. 721 treatment?

What is each partner’s gain or loss on contributions to the partnership?

What is the resulting basis of each partner in the P/S (“outside basis”)?

What is the P/S’s basis in the assets received (“inside basis”)?

Chapter 16, Exhibit 14a CCH Federal Taxation Basic Principles37 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-37-320.jpg)

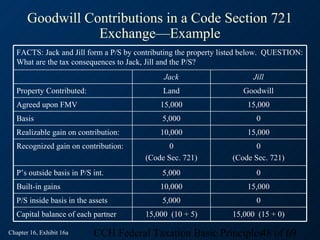

![Goodwill Contributions in a Code Section 721

Exchange—Example

SOLUTION:

If both Jack and Jill were to sell their partnership interests for $15,000 each,

assuming no other transactions, the partnership would have no distributive gain,

[since post-contribution-date values do not change] but Jack and Jill would

recognize their respective built-in gains:

Jack: $10,000 capital gain [15,000 FMV at contribution -

5,000 basis at contribution]

Jill: $15,000 capital gain [15,000 FMV at contribution - 0

basis at contribution].

Chapter 16, Exhibit 16b CCH Federal Taxation Basic Principles49 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-49-320.jpg)

![What Is a Partner’s Holding Period (HP) in the

Outside Basis?

The HP depends on the type of property contributed by the partner:

Type of Contribution HP of Partnership Interest

Investment or business property Tacks on to property contributed.

Other property (e.g., receivables and Begins on day after contribution.

inventory)

Services Begins on day after contribution.

[Note that an outside basis can have a split holding period if multiple assets are

contributed.]

Chapter 16, Exhibit 20 CCH Federal Taxation Basic Principles53 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-53-320.jpg)

![Outside Basis Computations—Example

(A): $25,000 [10,000 capital account + (1/2 x 30,000 P/S debt)]

(B): $41,275 [see below]

(C): $29,275 [see below]

+ MARY’S BEGINNING BASIS (A)

+ Share of P/S’s TI under Sec. 702(a)(8) 24,000 =[1/2 x 48,000]

+ Share of “separately stated items” 5,275 =[1/2 x (5 + 6.2 + .5 - .1 - .25 - .8)]

– Share of debt relief (3,000) =[1/2 x (30,000 - 24,000)]

– Basis of land distributions to Mary (10,000) = [100% x 10,000]

MARY’S ENDING BASIS (B) 41,275

MARY’S ENDING CAPITAL ACCT 29,275 =[41,275 - (1/2 x 24,000 debt]

BAL. (C)

Note: The Code Sec. 1245 gain was a “smoke screen” because it is already included in Code Sec.

702(a)(8) taxable income. Recall that Code Sec. 1245 gain gets ordinary treatment and is not part of

the netting process. With its “automatic” ordinary treatment, there is no need for it to be “separately

stated.” Doing so in this problem would have resulted in its being counted twice.

Chapter 16, Exhibit 21c CCH Federal Taxation Basic Principles56 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-56-320.jpg)

![Code Section 465 At-Risk Rules

(d) What about alimony paid, charitable contributions and

other nonbusiness/noninvestment expenses? Prop. Reg.

§1.465-13 addresses this question by providing that,

“ ...allowable deductions allocable to an [passive] activity are

those otherwise allowable deductions incurred in a trade or

business or for the production of income from the activity.”

(In other words, alimony and charitable contributions paid by a

partnership are generally NOT subject to the at-risk rules since

they do not ordinarily serve a business or investment purpose to

the passive activity incurring these expenses. However, facts

and circumstances govern “purpose”.)

Chapter 16, Exhibit 22c CCH Federal Taxation Basic Principles59 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-59-320.jpg)

![Code Section 469 Passive Activity Loss Rules

As with the at-risk rules, the passive activity loss (PAL) rules are

applied on a partner-by-partner basis, not at the partnership level.

However, unlike the at-risk rules, the PAL rules apply only to

business income and losses [i.e., Code Sec. 702(a)(8) taxable

income or loss.] PALs are deductible (i.e., allowed to “jump Hurdle

2”) to the extent of Code Sec. 702(a)(8) income from all passive

activities in the aggregate.

“Portfolio income” (interest, dividends, annuities, royalties not

derived from the ordinary course of business and gains or losses

from assets that produce such income, less related expenses) shall

not be considered as arising from a passive activity. Code Sec.

469(e)(1).

Partnership ordinary loss is generally passive to a partner unless the

partner materially participates in the partnership activity.

Chapter 16, Exhibit 23 CCH Federal Taxation Basic Principles60 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-60-320.jpg)

![At-Risk and Passive Activity Loss Rules—Example

At-Risk Hurdle (H1)

Yr Beg. At- Passive Passive Contrib. Amt. of Loss “Jumping” H1 Loss “Blocked” By

Risk Basis Income (Loss) (Distr.) H1

(a) = (i) (b) (c) (d) (e) = (f) =

from prior Lesser of: [(c) + (f) from prior

yr. period] - (e)

[(c) + (f) from prior yr.] or

[(a)+(b)+/-(d)], expressed as a

negative number.

x1 24 (25) 0 (24) (1)

Lesser of: (25) + 0 - (24) = (1)

[(25) + 0 = (25)]; or neg. [24 + 0

+ /- 0] = (24); Lesser = (24).

x2 0 3 0 (3) (21)

Lesser of: 0 + (24) - (3) = (21)

[0 + (24) = (24)]; or neg. [0 + 3 + /-

0] = (2); Lesser = (2).

Chapter 16, Exhibit 24b CCH Federal Taxation Basic Principles62 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-62-320.jpg)

![At-Risk and Passive Activity Loss Rules—Example

Passive Hurdle (H2)

Yr Amt. of Loss Loss “Blocked” Ending At-Risk Income Deduct

“Jumping” H2 By H2 Basis

(g) = (h) = (i) = (j) = (k) = (g)

Lesser of: [(e) + (h) from (a) + (b) +/- (d) + (b) from all

[(e) + (h) from prior prior period] - (e) passive activities

yr.]; or (g)

[(b) from all passive

activities, expressed

as a neg. number.

x1 0 (24) 0 0

[(24) + 0 - 0 = [24 + 0 + 0 + (24) (b) = 0 (g) = 0

(24)] = 0]

x2 (3) (24) 0 3 (3)

[(3) + (24) = (27]; [(3) + (24) - (3) [0 + 3 + 0 + (2) =

neg. 3 = (3); = (24)] 0]

Lesser = (3)

Chapter 16, Exhibit 24c CCH Federal Taxation Basic Principles63 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-63-320.jpg)

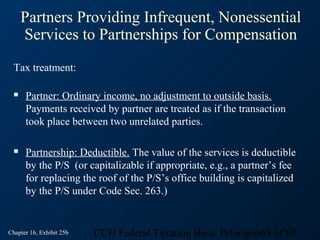

![Partners Providing Infrequent, Nonessential

Services to Partnerships for Compensation

What rules govern transactions between partners and

partnerships (P/Ss)?

Infrequent, nonessential services. Code Sec. 707(a)(1) allows

nonpartner status when a partner acts in an independent

capacity, rendering services that are neither ongoing nor

integral to the operations of the partnership. [For example, a

partner who is a licensed CPA prepares the partnership’s tax

returns for his customary fee.] Code Sec. 707(a)(1)

encompasses both “outbound” (partnership pays partner) and

“inbound” (partner pays partnership) payments. The payments

may be for services, interest on loans, leases or purchase of

property.

Chapter 16, Exhibit 25a CCH Federal Taxation Basic Principles64 of 69](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pii-120911125342-phpapp02/85/2013-cch-basic-principles-ch16-pii-64-320.jpg)