1. The document discusses taxation of corporations in the Philippines, defining terms like domestic corporation, foreign corporation, and sources of income.

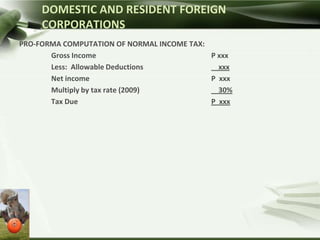

2. It outlines tax rates for business income, passive income, and special rates for proprietary schools, mutual life insurers, and resident/non-resident foreign corporations.

3. Allowable deductions are discussed, including the option for domestic/resident foreign corporations to claim a standard deduction of up to 40% of gross income.