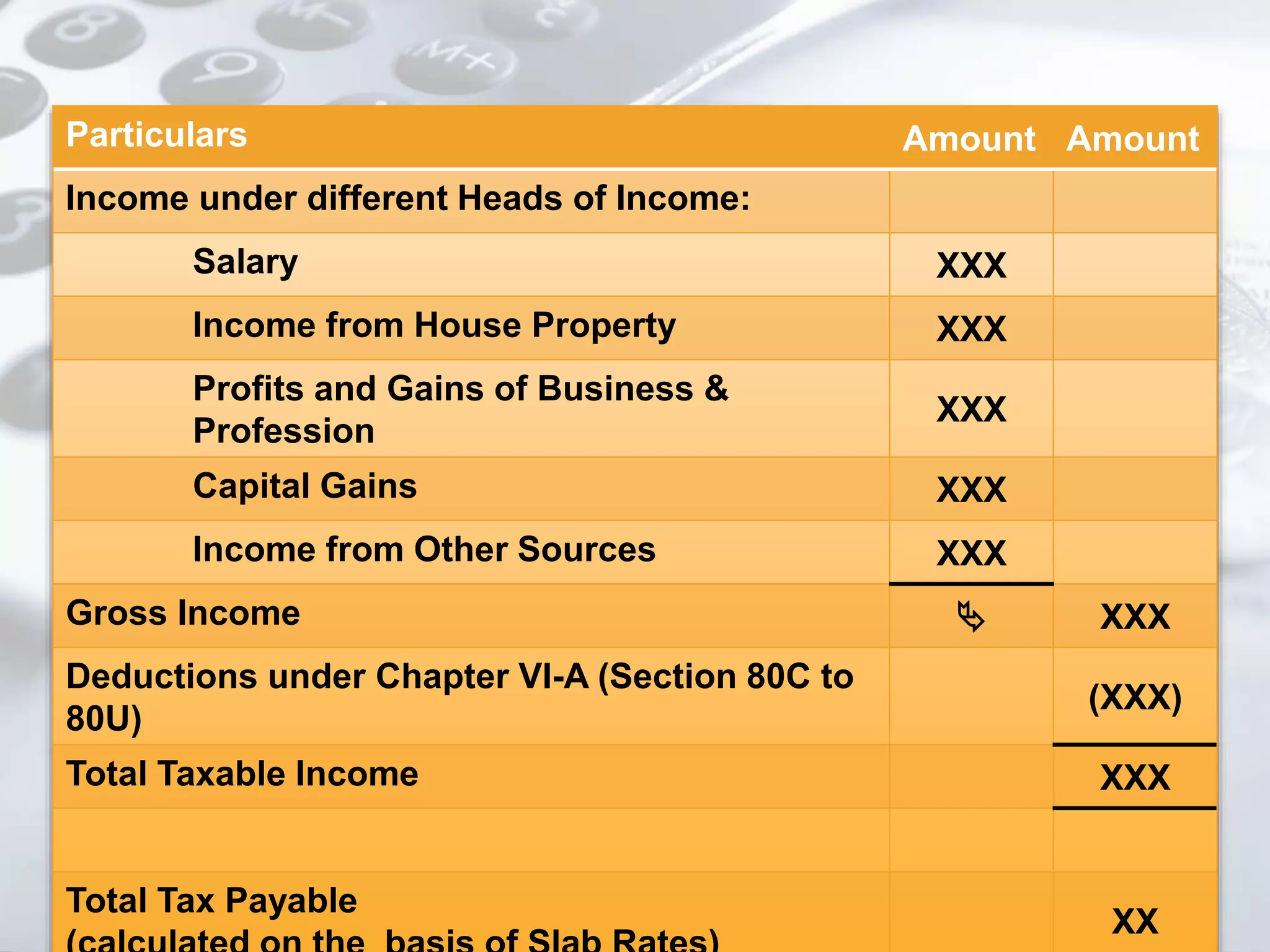

The document outlines key aspects of India's Income Tax Act of 1961, as amended in 2015, including:

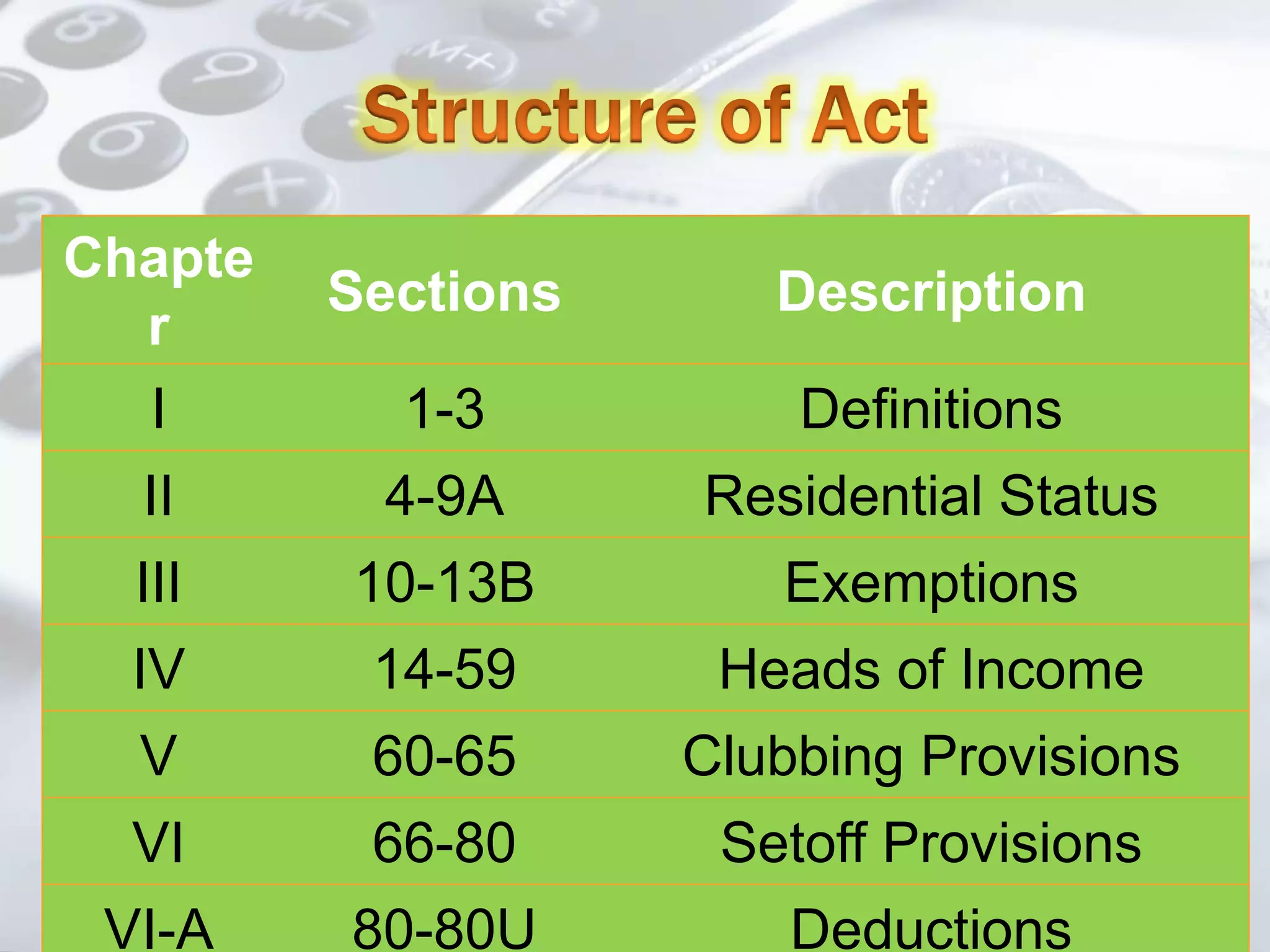

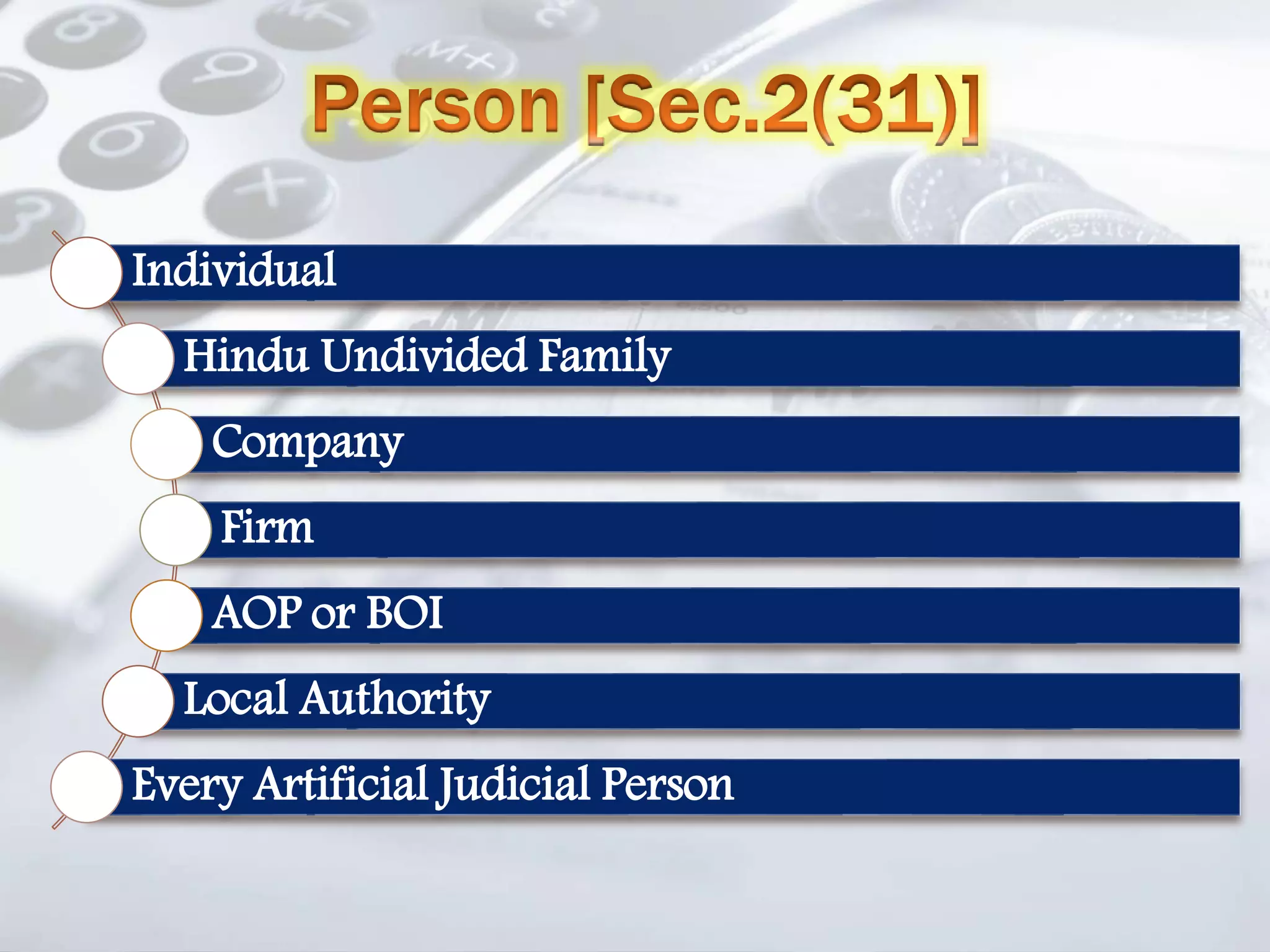

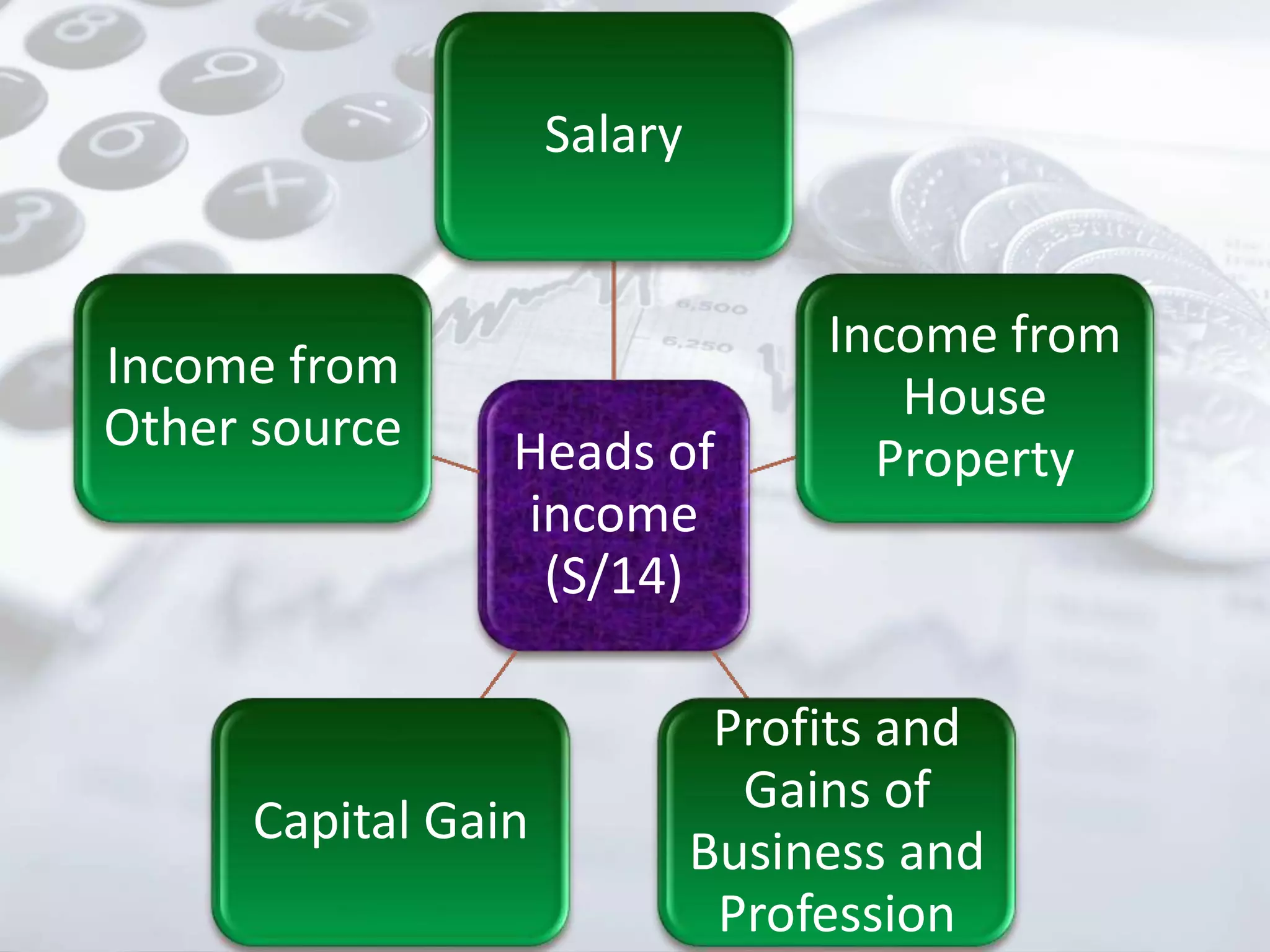

1) It describes the different chapters and sections covering definitions, residential status, exemptions, heads of income, clubbing provisions, setoff provisions, and deductions.

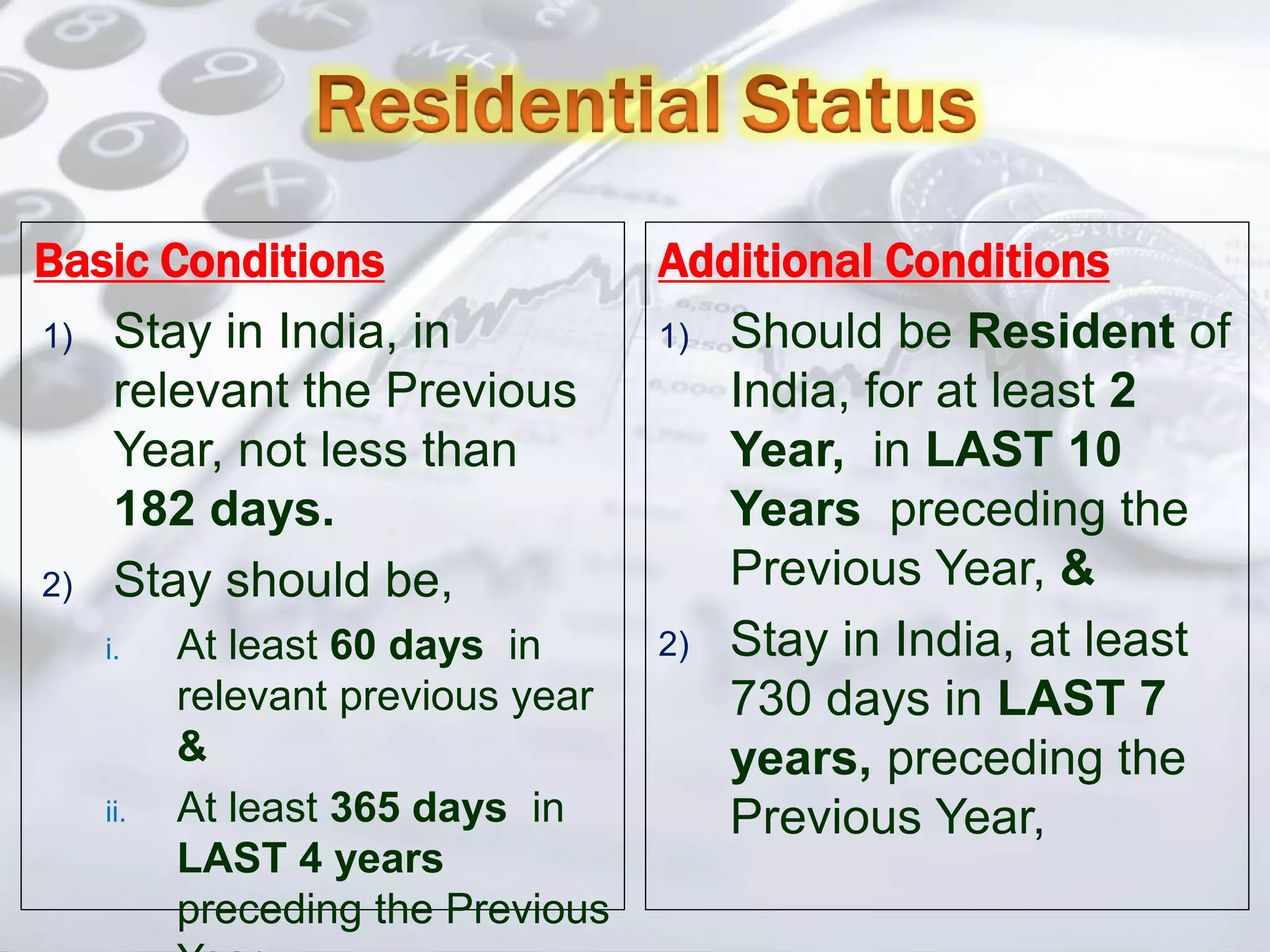

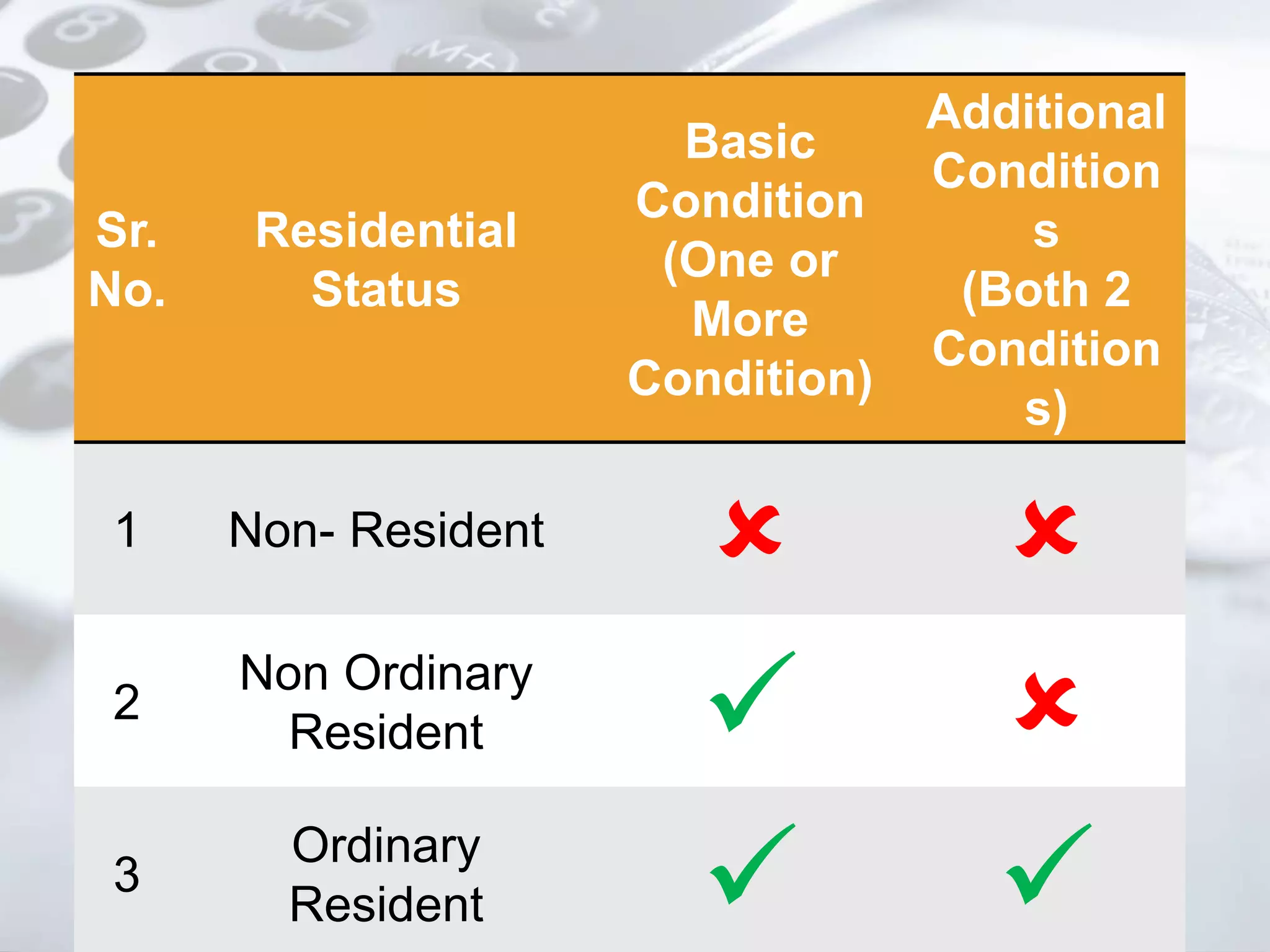

2) It provides details on the residential status criteria for being a non-resident, non-ordinary resident, or ordinary resident.

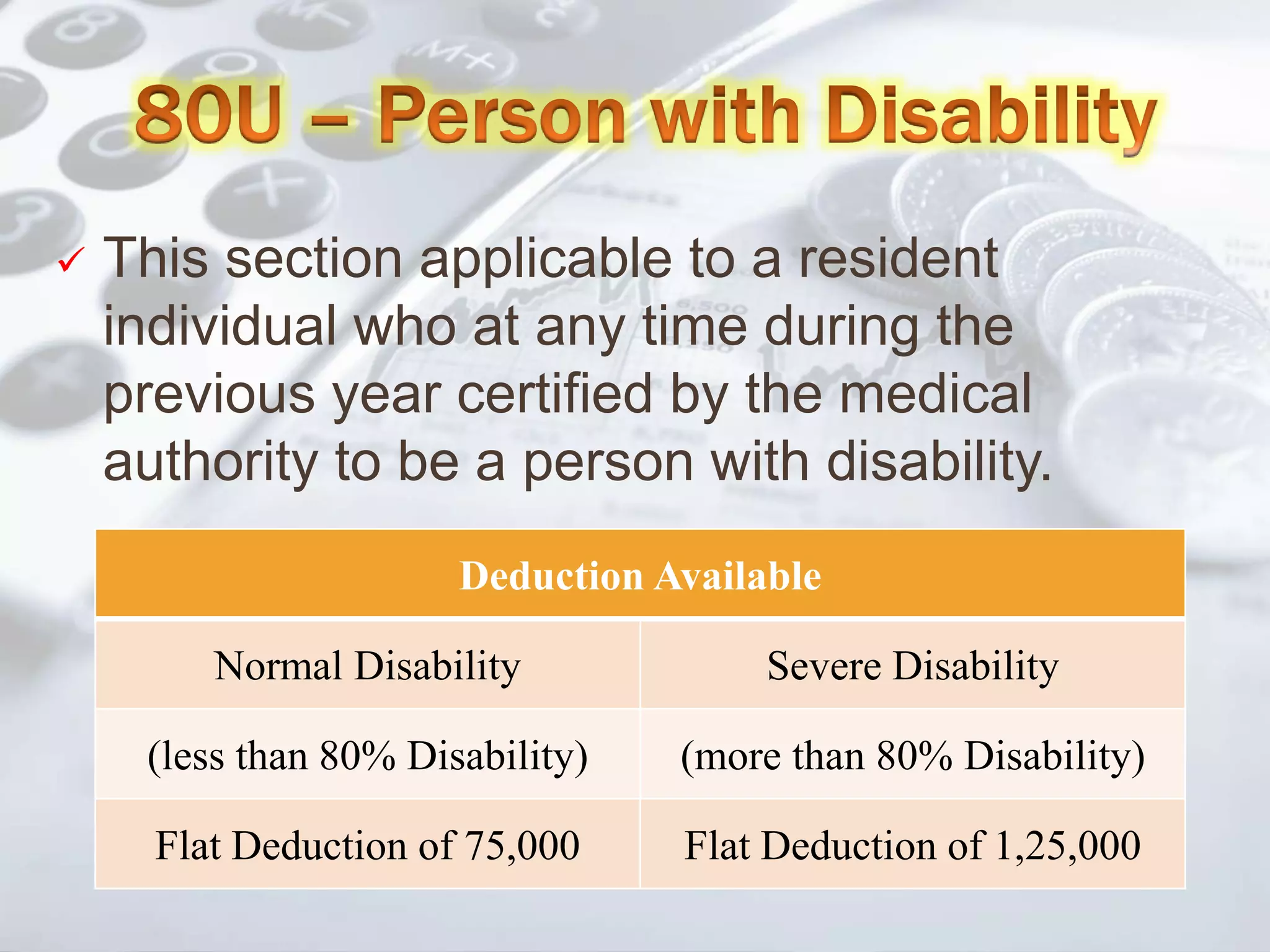

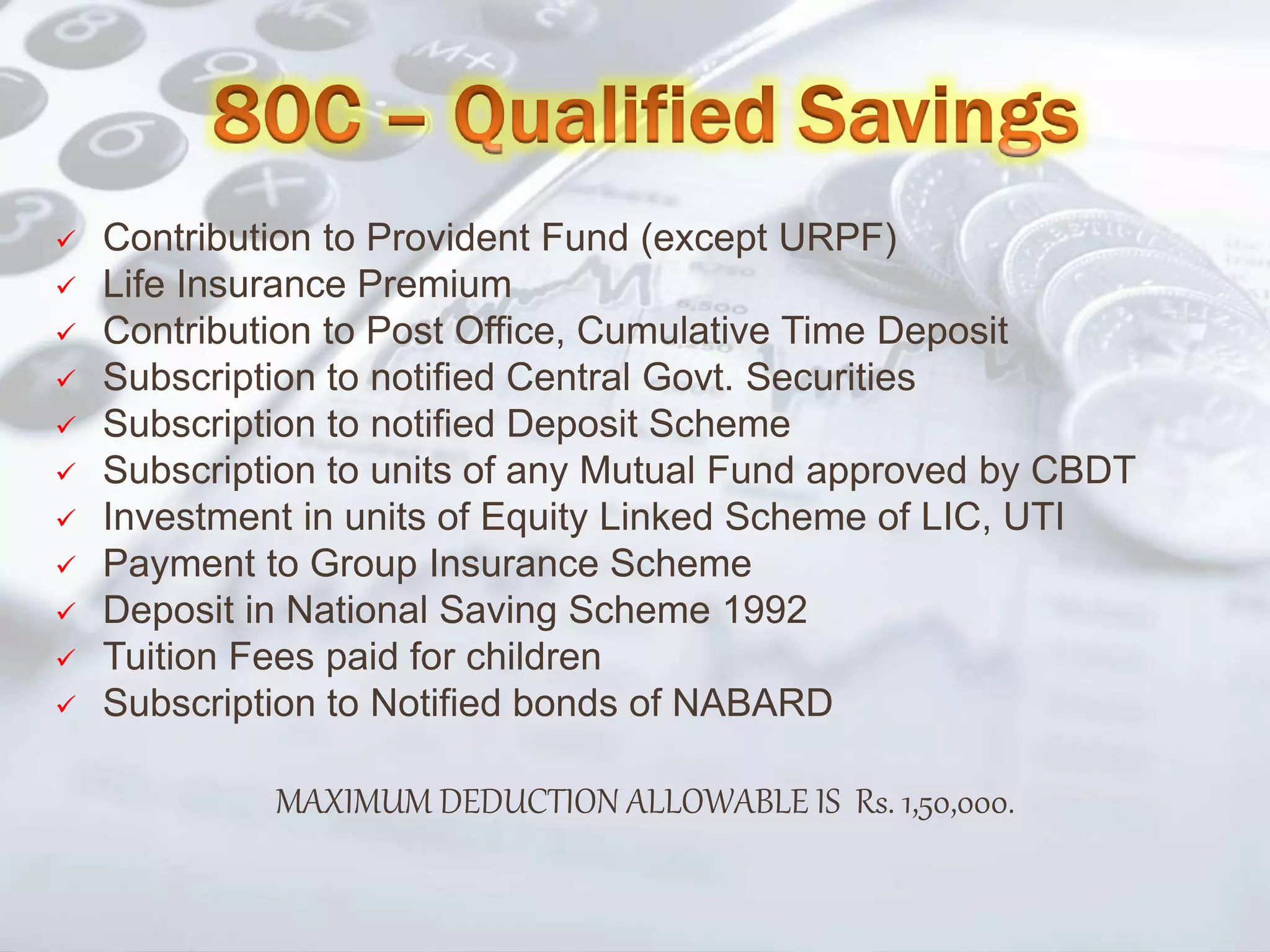

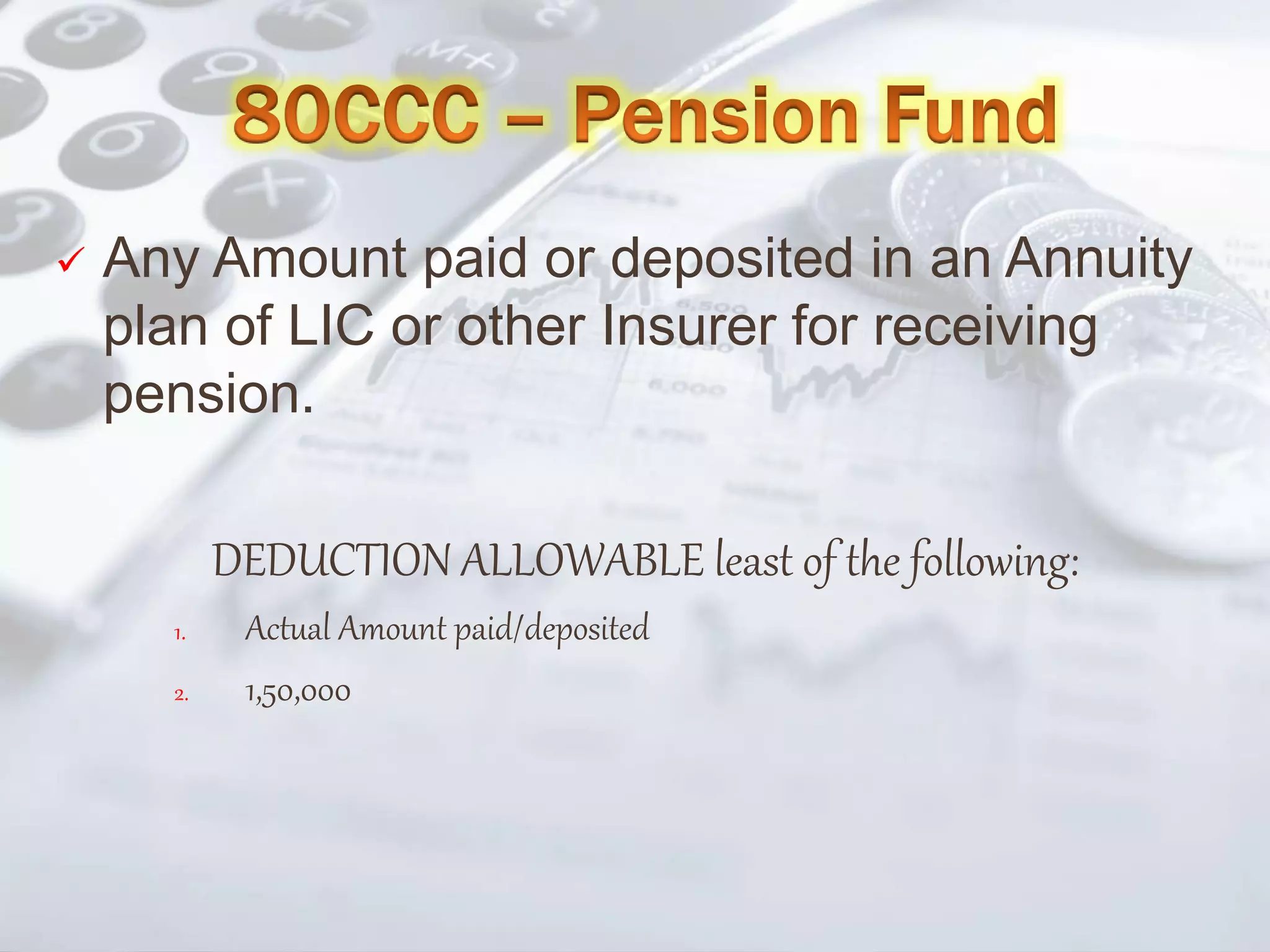

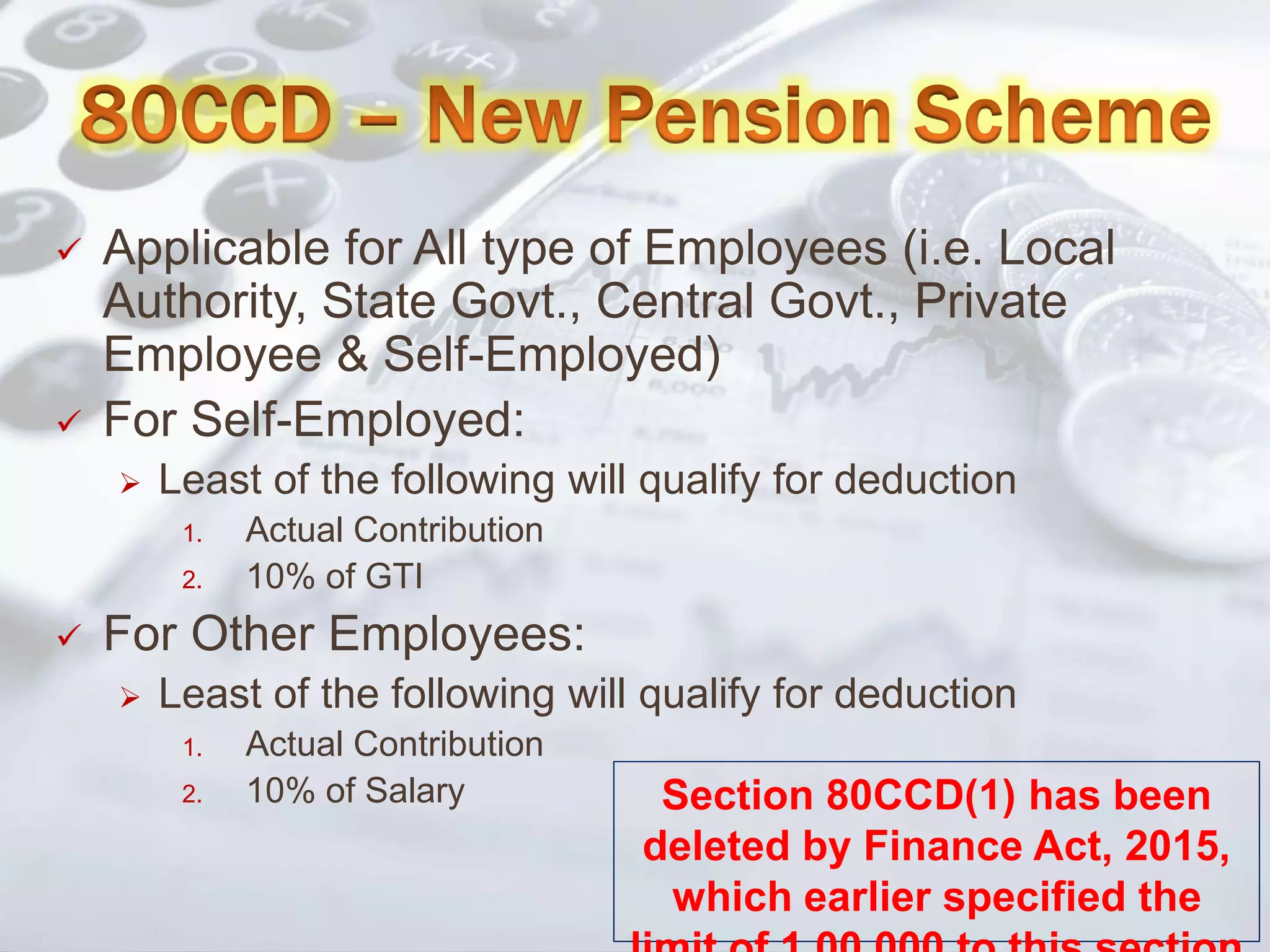

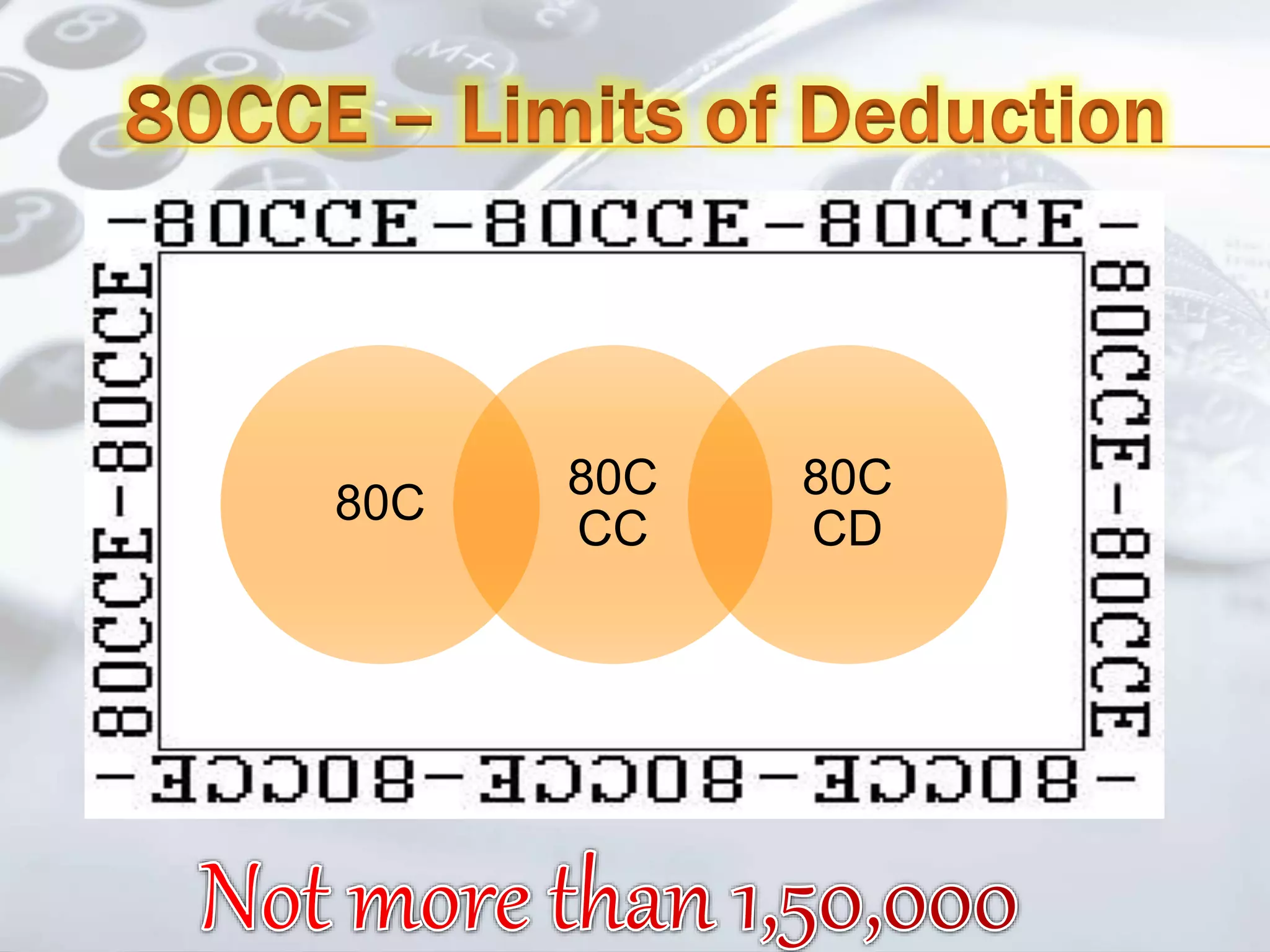

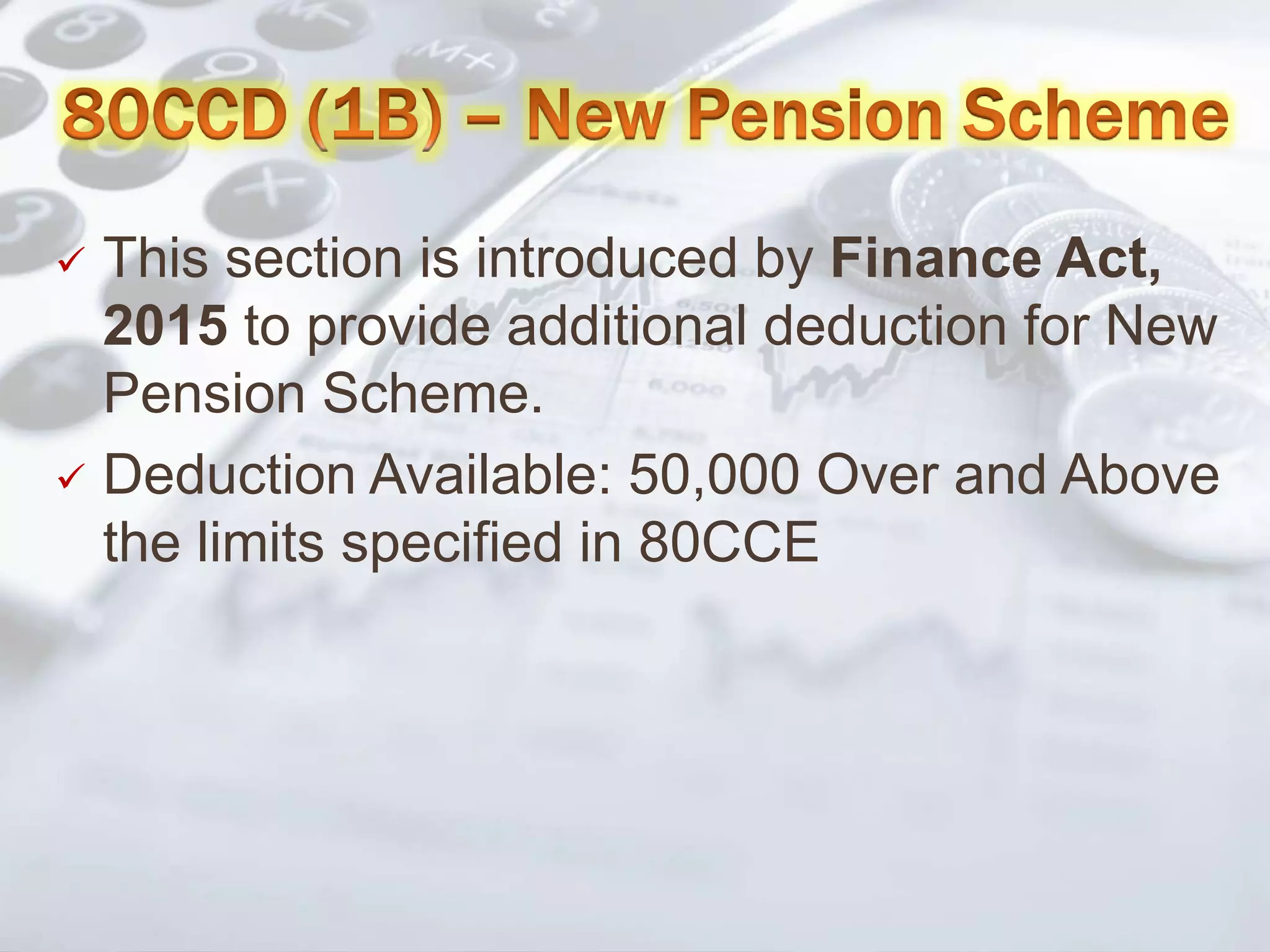

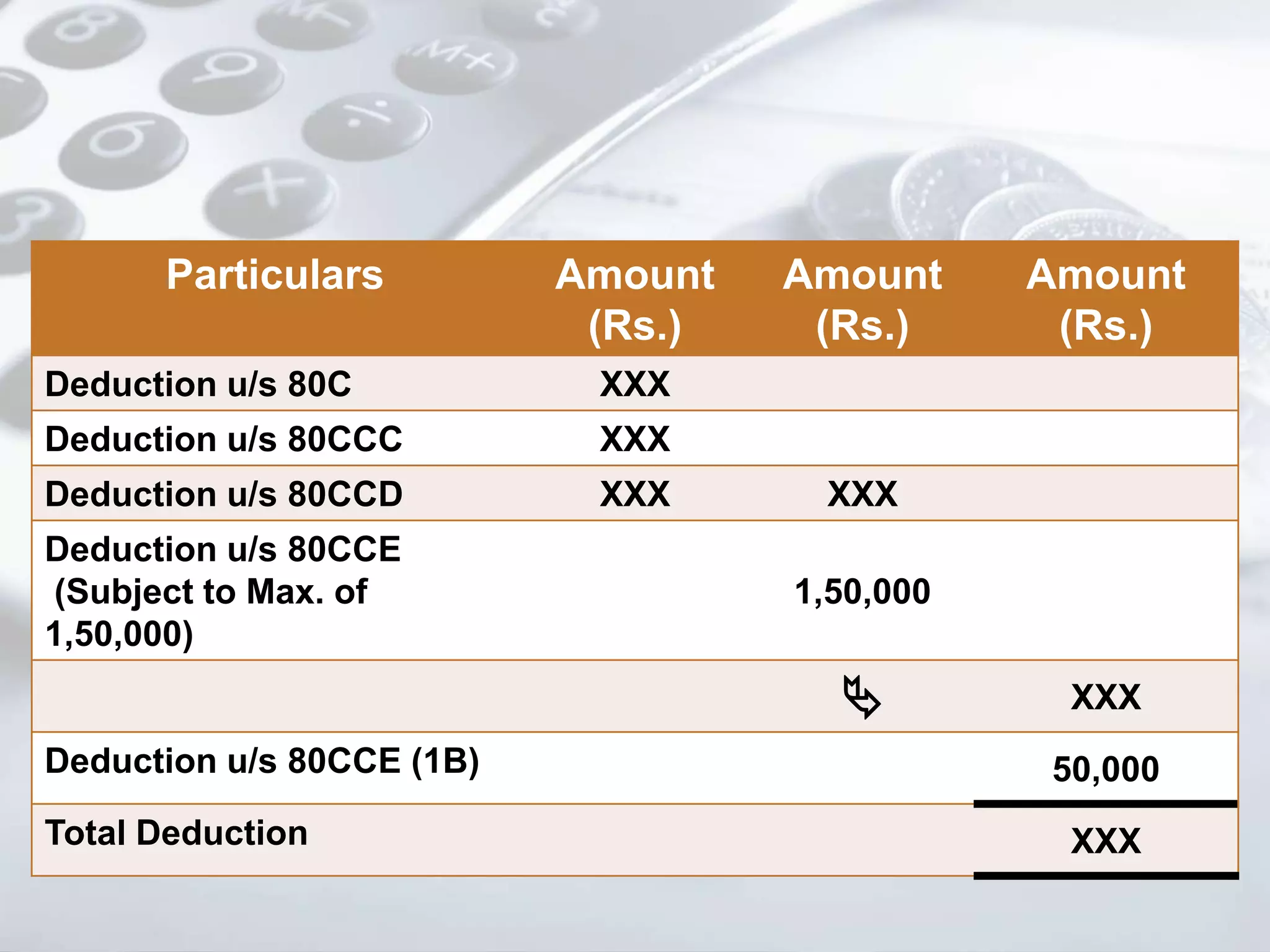

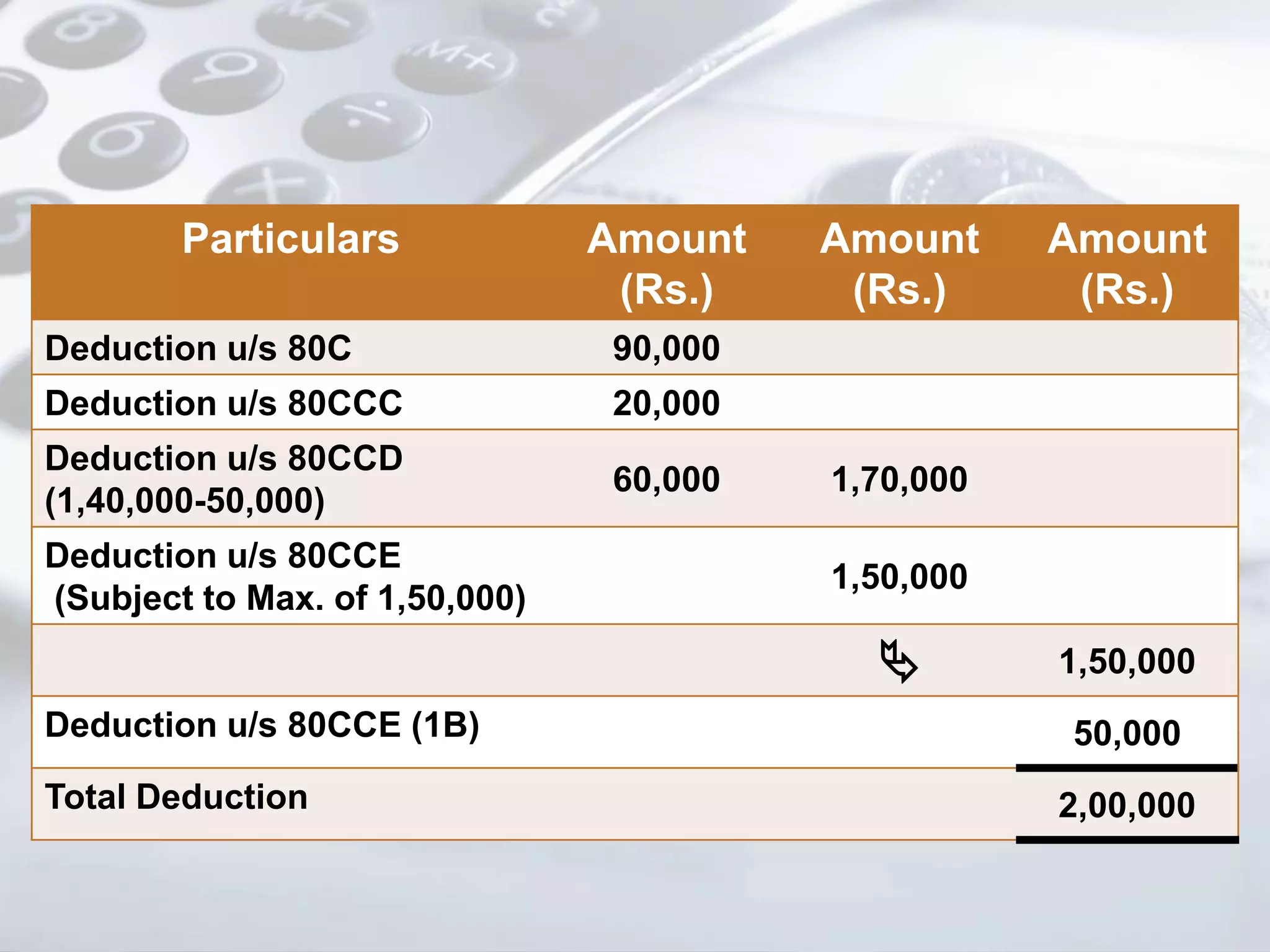

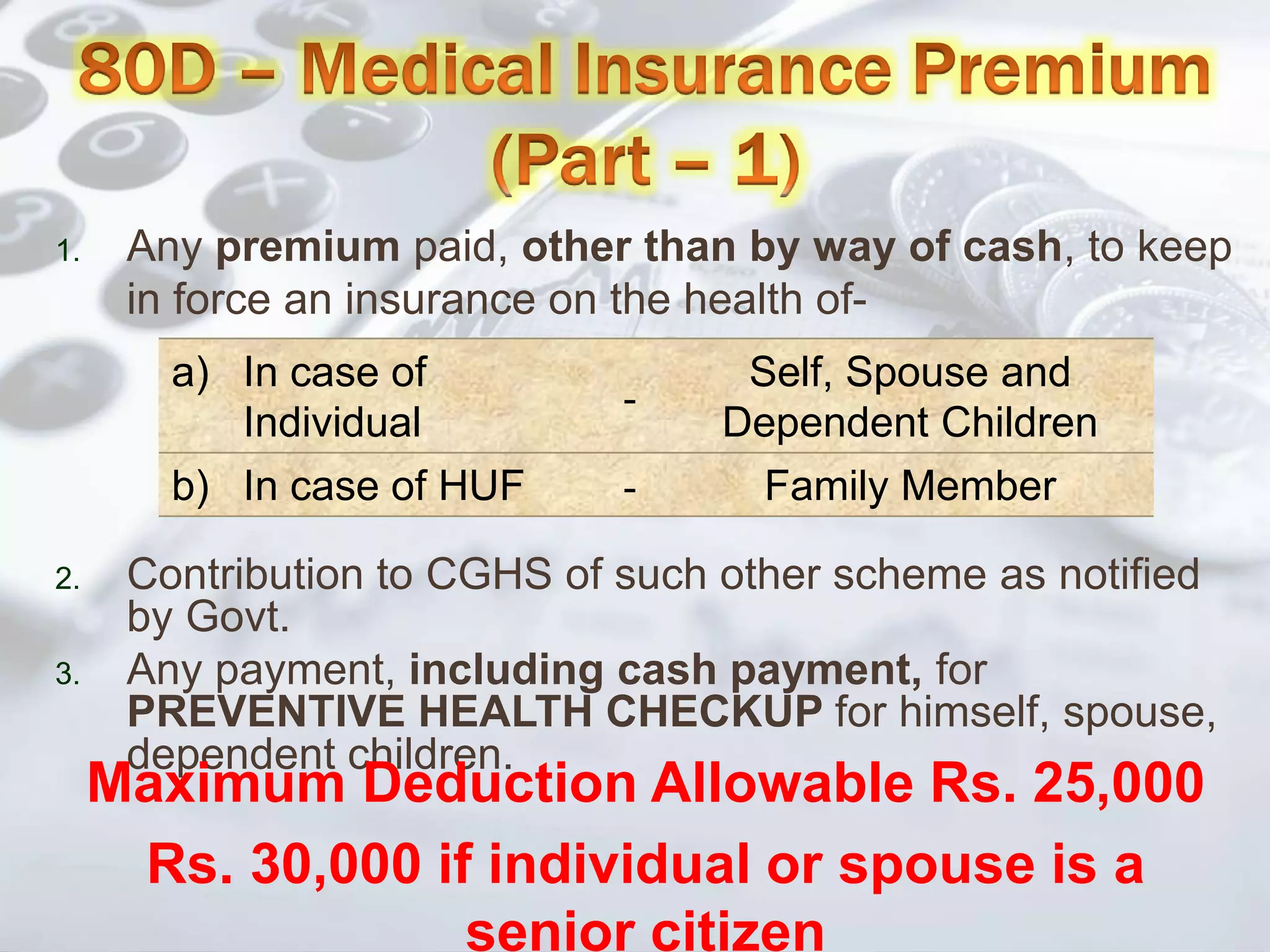

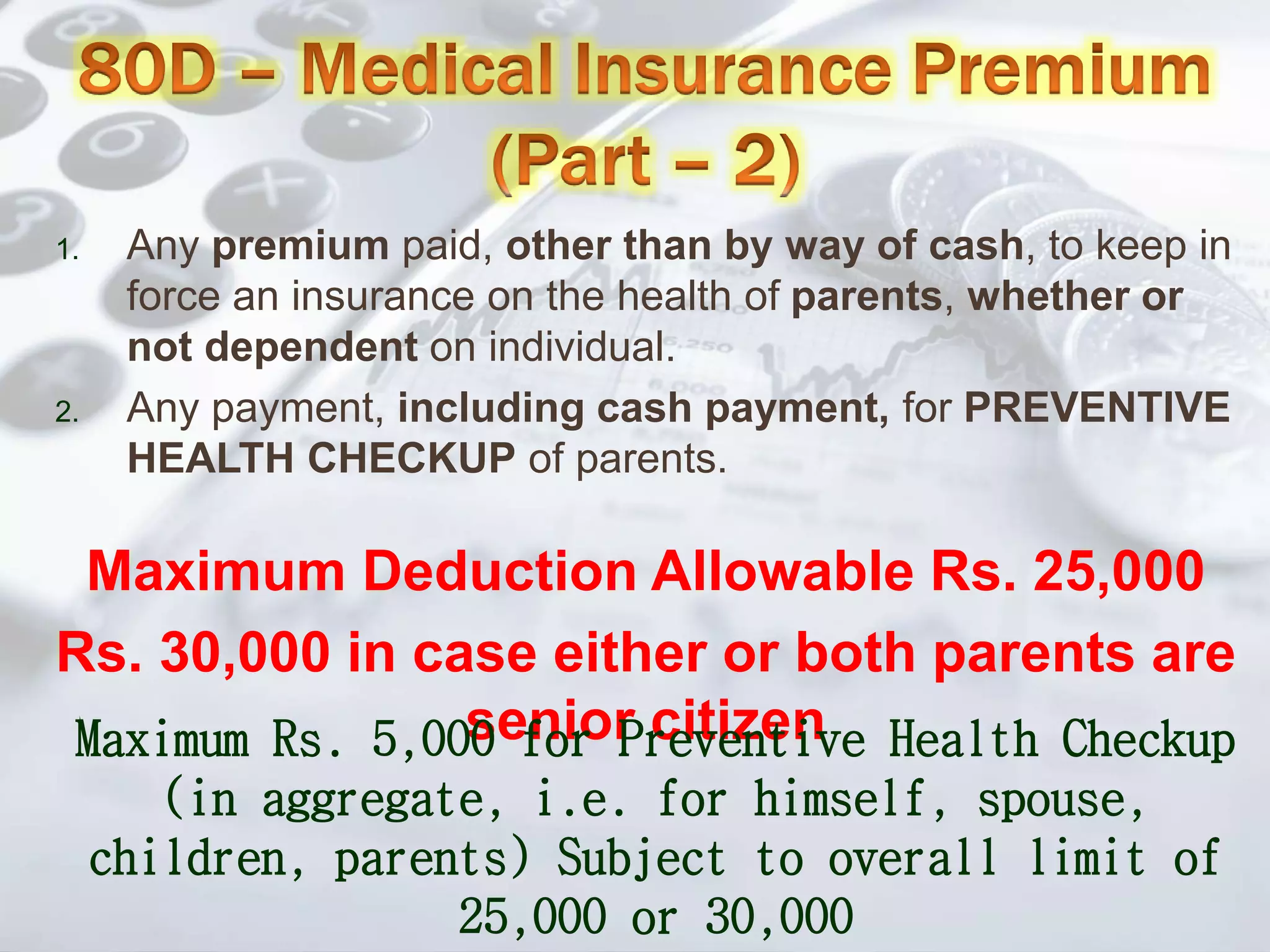

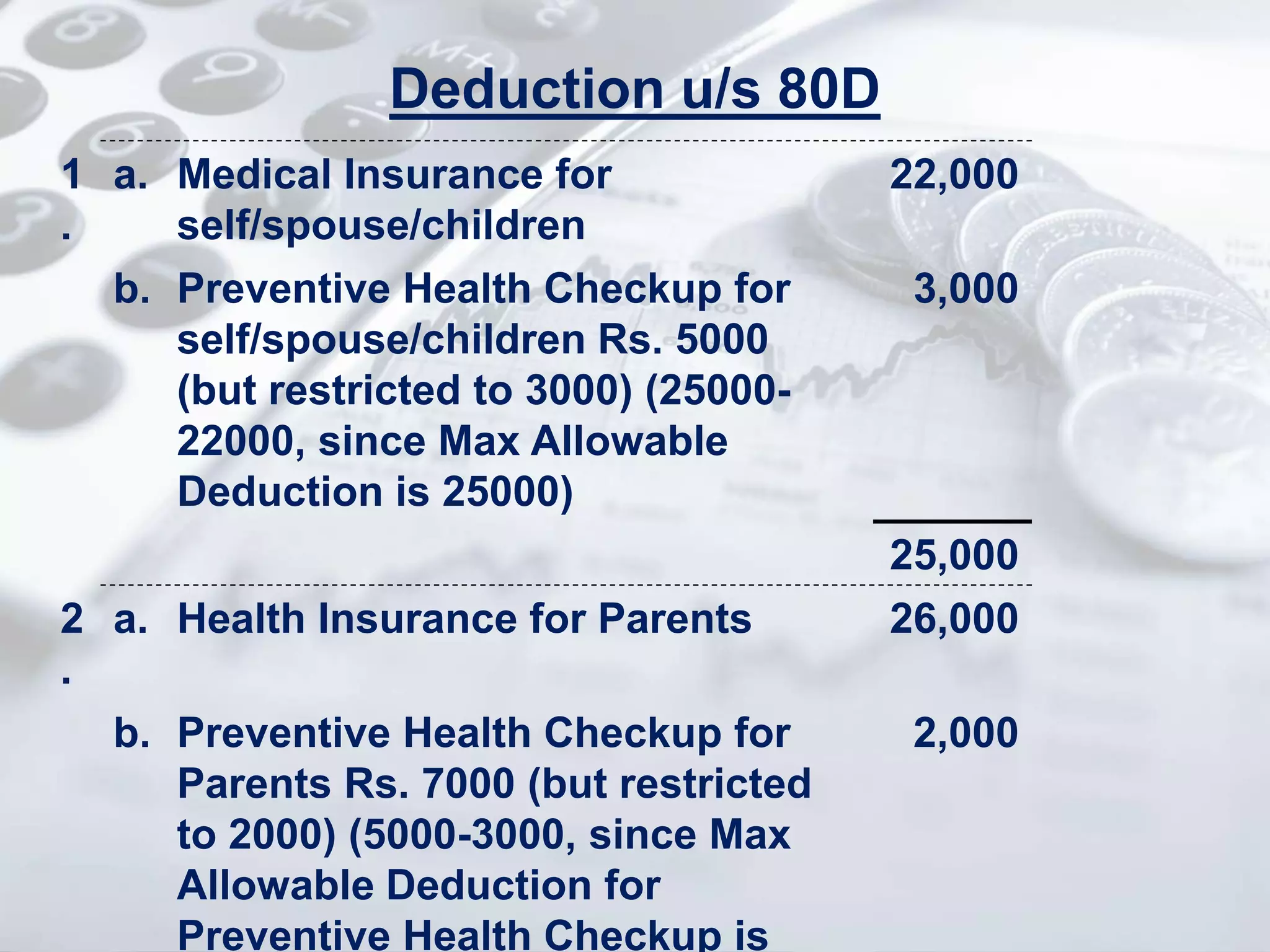

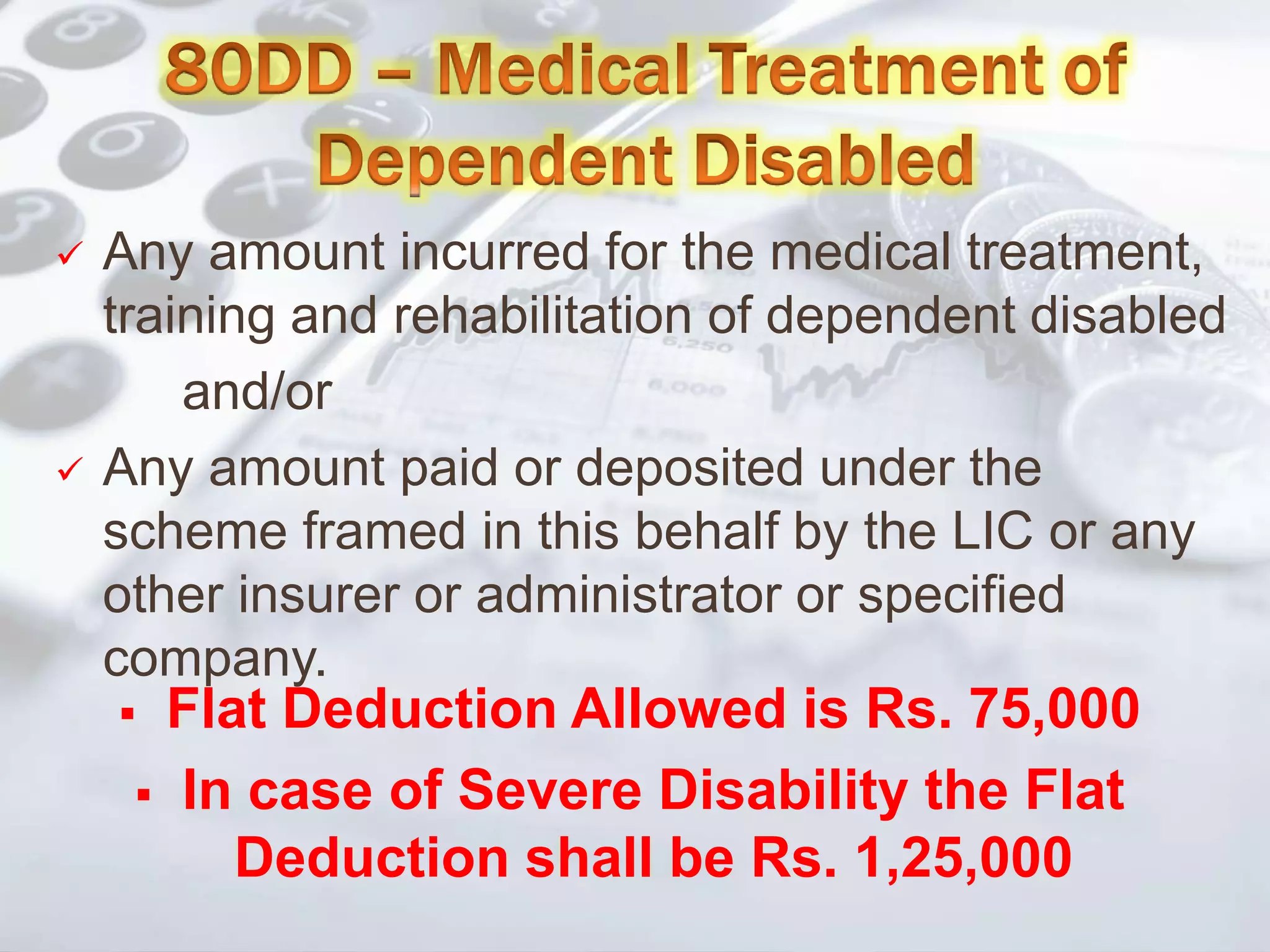

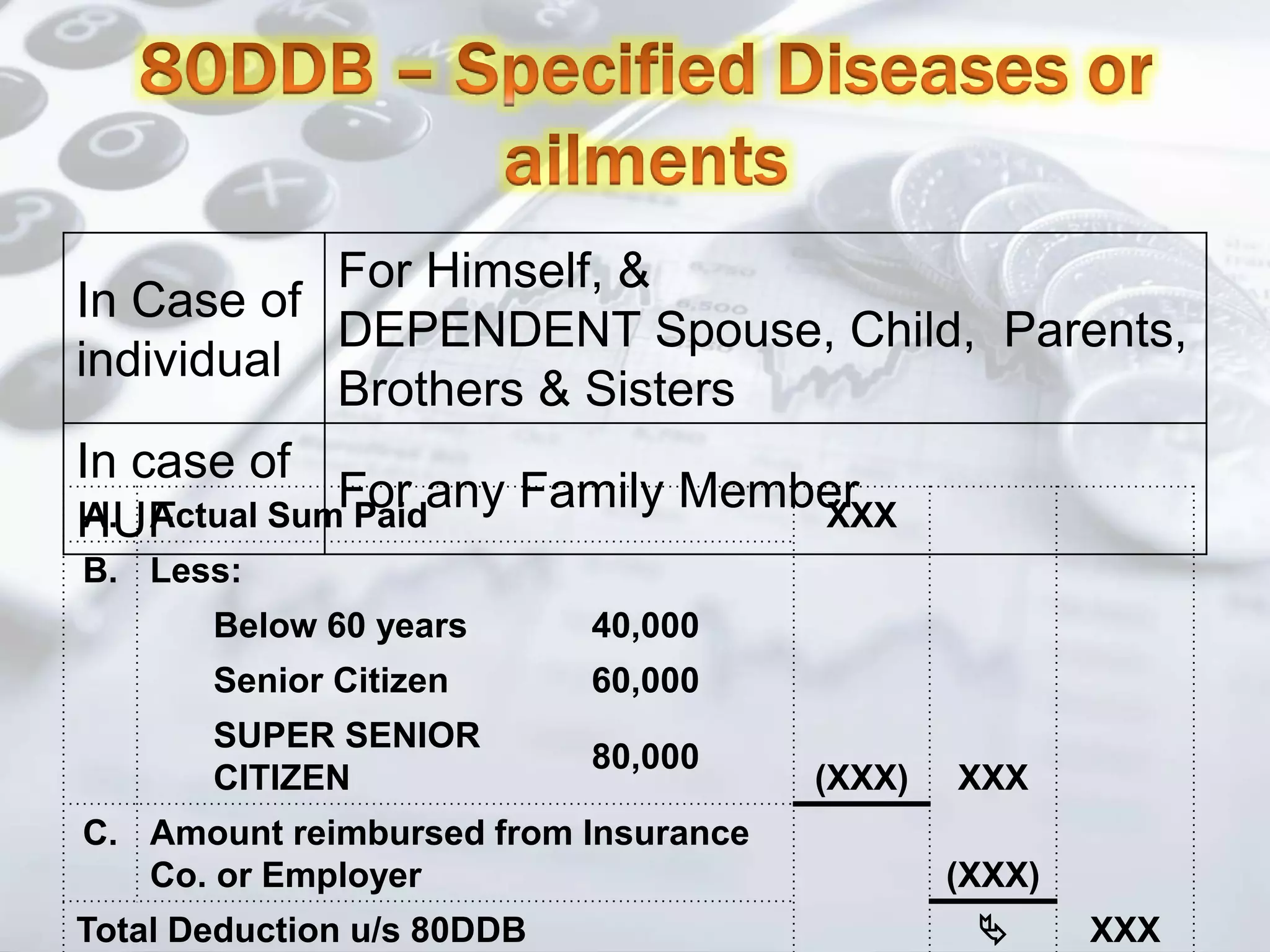

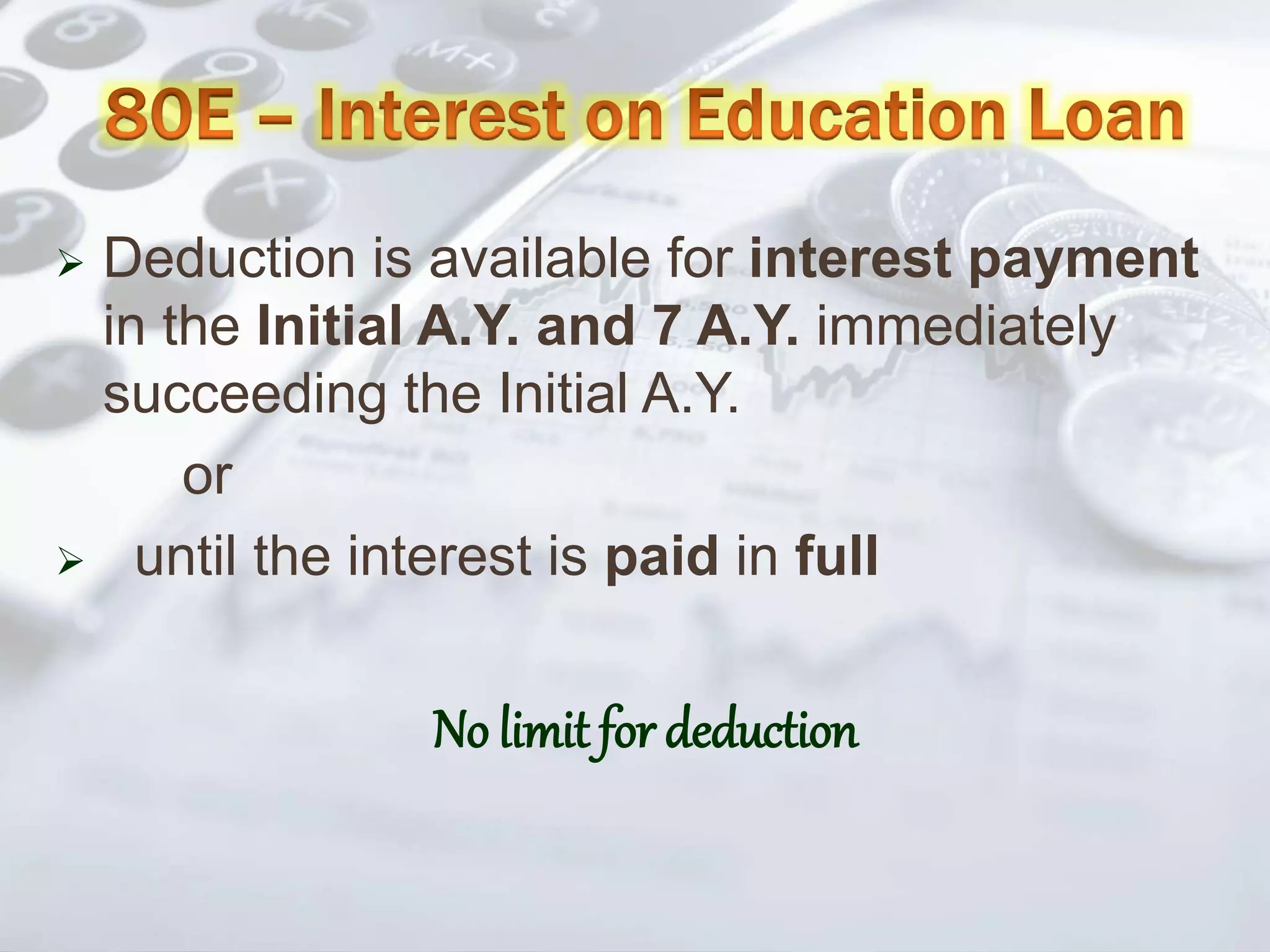

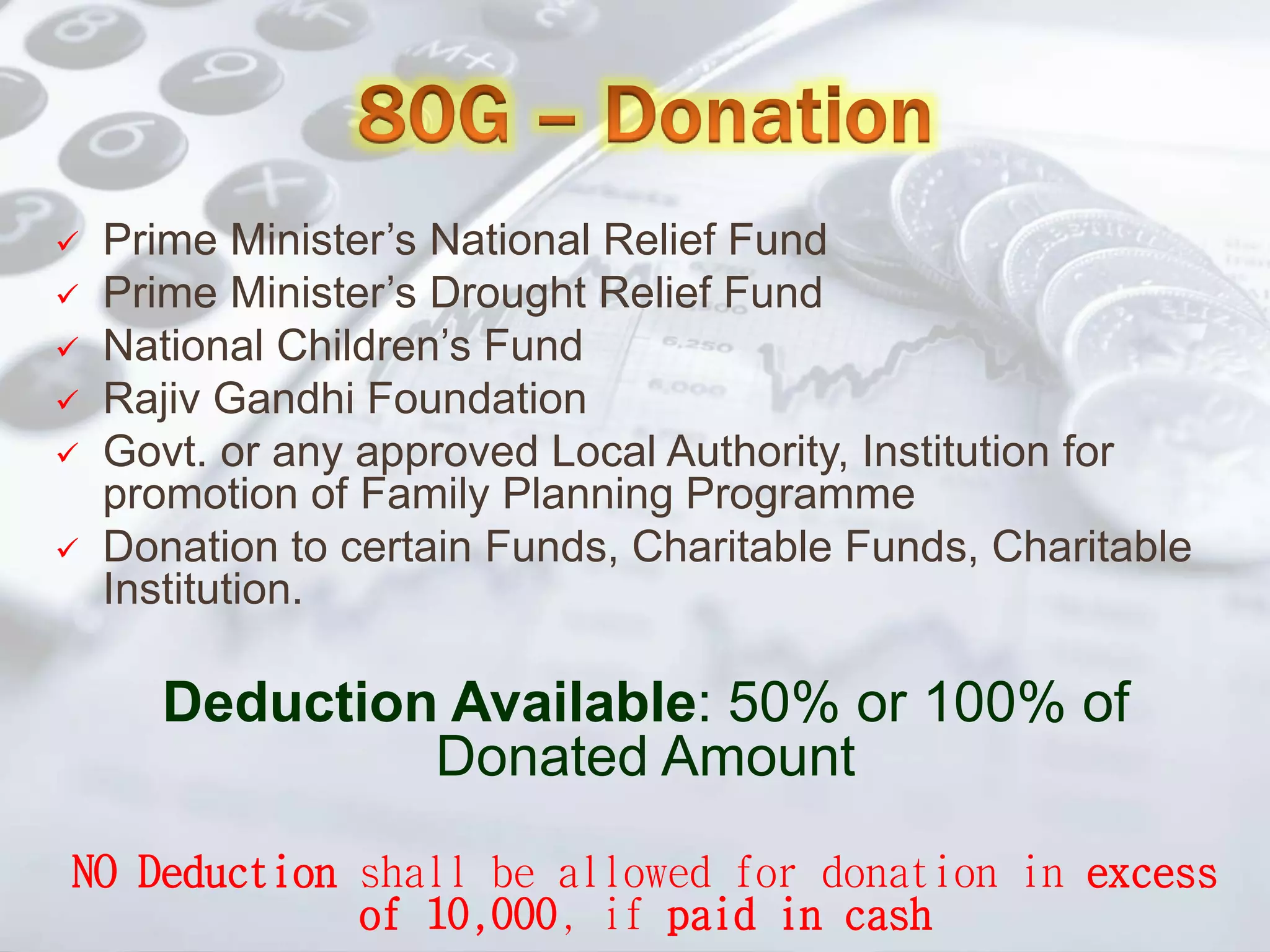

3) It summarizes various deductions that can be claimed under sections 80C to 80U, including for provident funds, life insurance, tuition fees, health insurance, disability, and donations. The maximum aggregate deduction is Rs. 1,50,000.

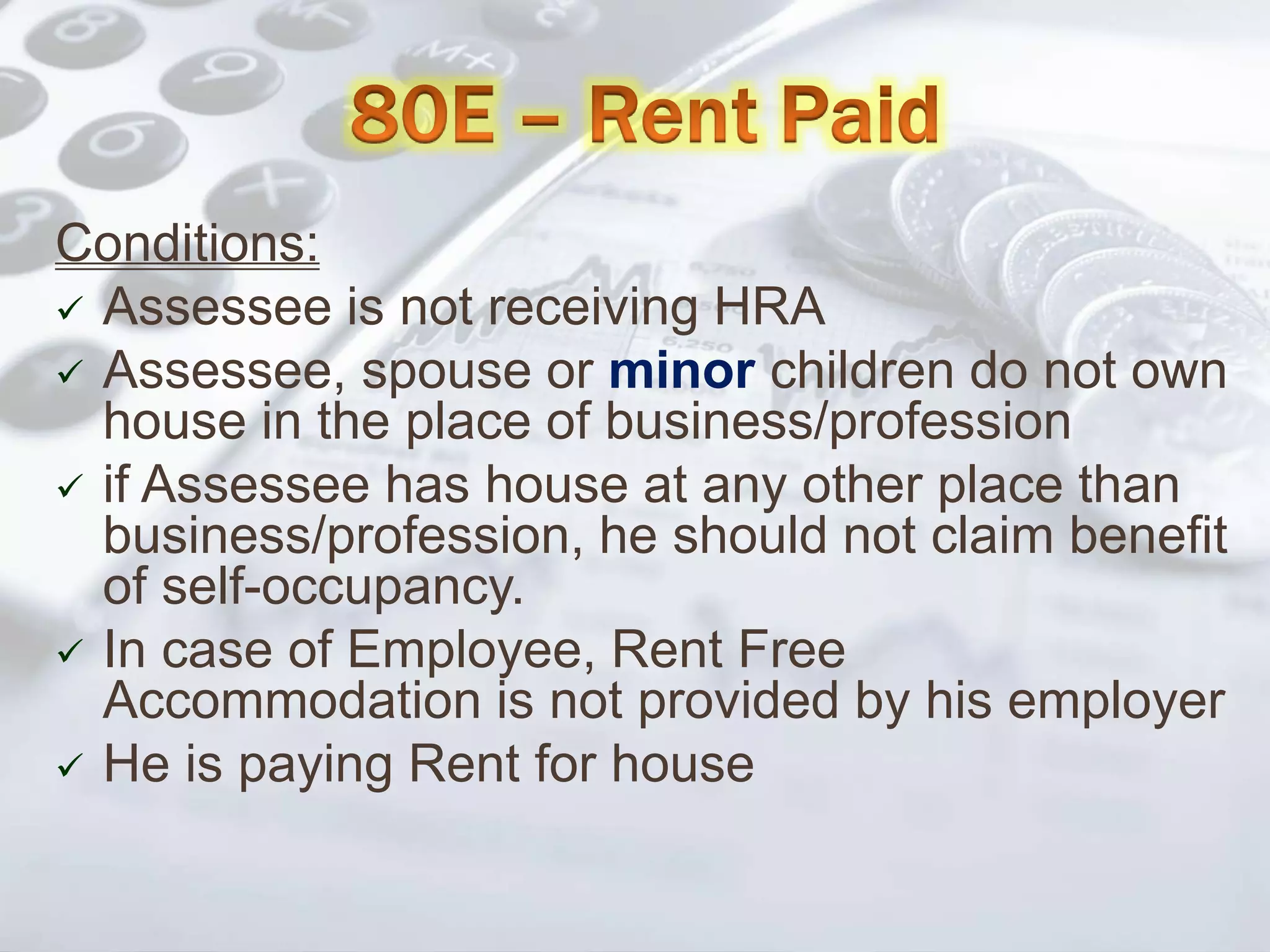

![Least of the following is allowable as deduction

A. Rent Paid (-) 10% of Adjusted GTI

B. 25% of Adjusted GTI

C. 2,000 p.m.

Adjusted GTI = GTI

(–) Long Term Capital Gain

(–) Deduction u/c VI-A[except

u/s 80GG]](https://image.slidesharecdn.com/deductionunderchaptervi-asection80c-80uincometax1961-170226104645/75/Deduction-under-chapter-VI-A-section-80C-80U-income-tax-1961-25-2048.jpg)