This document provides an overview of tax deductions available under Sections 80C to 80U of the Indian Income Tax Act. It explains that these deductions are intended to incentivize taxpayers to engage in socially desirable activities and investments. The key deductions covered include those for life insurance premiums (Section 80C), pension contributions (Section 80CCC), medical insurance (Section 80D), treatment of disabled dependents (Section 80DD), tuition fees (Section 80E), interest on education loans (Section 80E), rent payments (Section 80GG), among others. Eligibility conditions and calculation of allowable deductions for each section are described.

![Note:

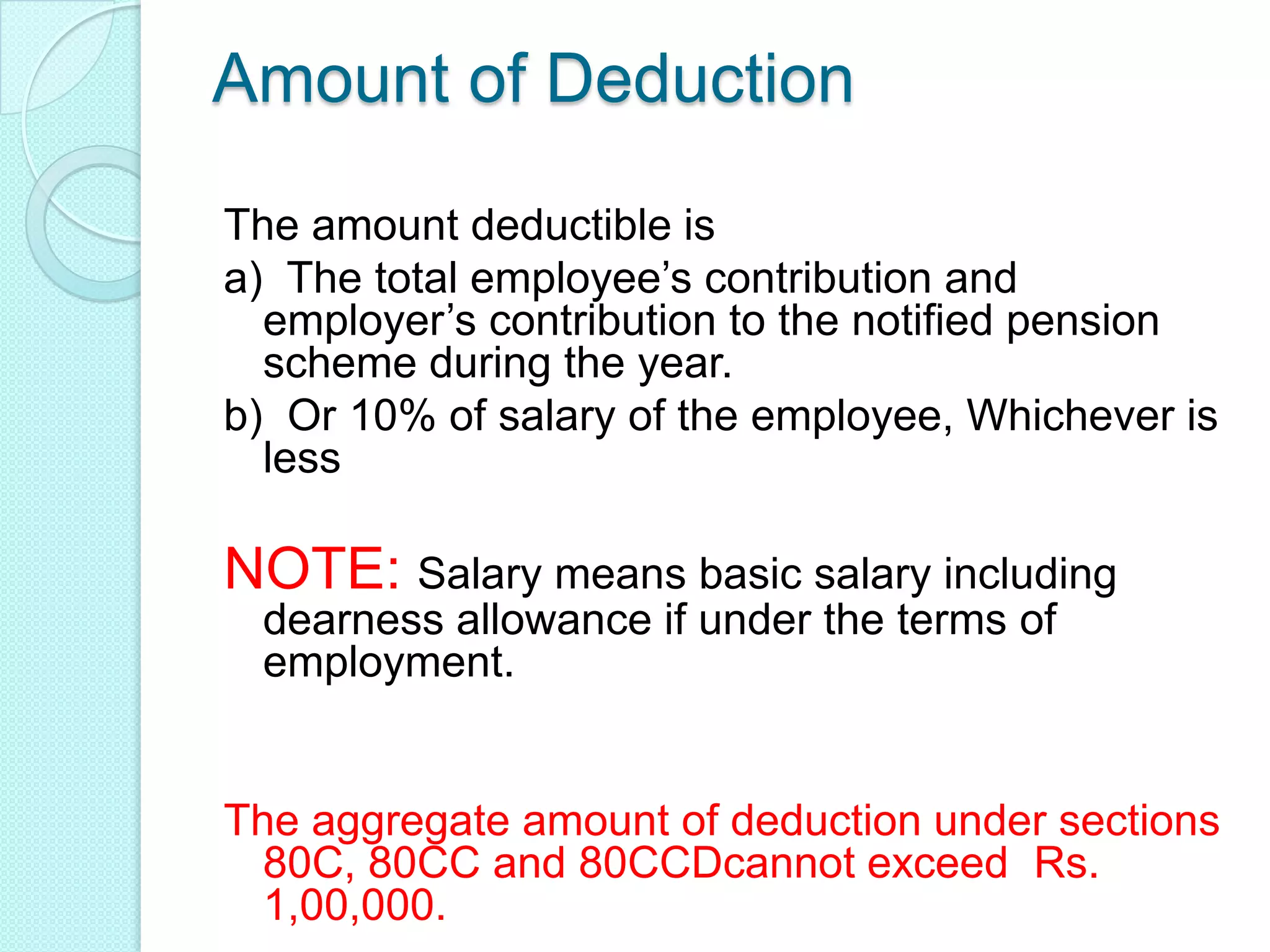

Adj. GTI = Rs [1,80,000 ( GTI) – 9,000 (80D) -12,000

(80C) ] = Rs. 1,59,000

Deductions u/s 80GG will be the least of the following:

i)Rs. 2,000 p.m.

Rs.24,000

ii)Rent paid (Rs 42,000) - 10% of Adj.GTI ( Rs. 1,59,000)

Rs.26,100

iii)25% of Adj. GTI (Rs, 1,59,000)

Rs 39,750

Rs. 24,000 is the least, hence, deductible](https://image.slidesharecdn.com/taxdeductions-130609215404-phpapp01/75/Tax-deductions-u-s-80c-to-80u-48-2048.jpg)