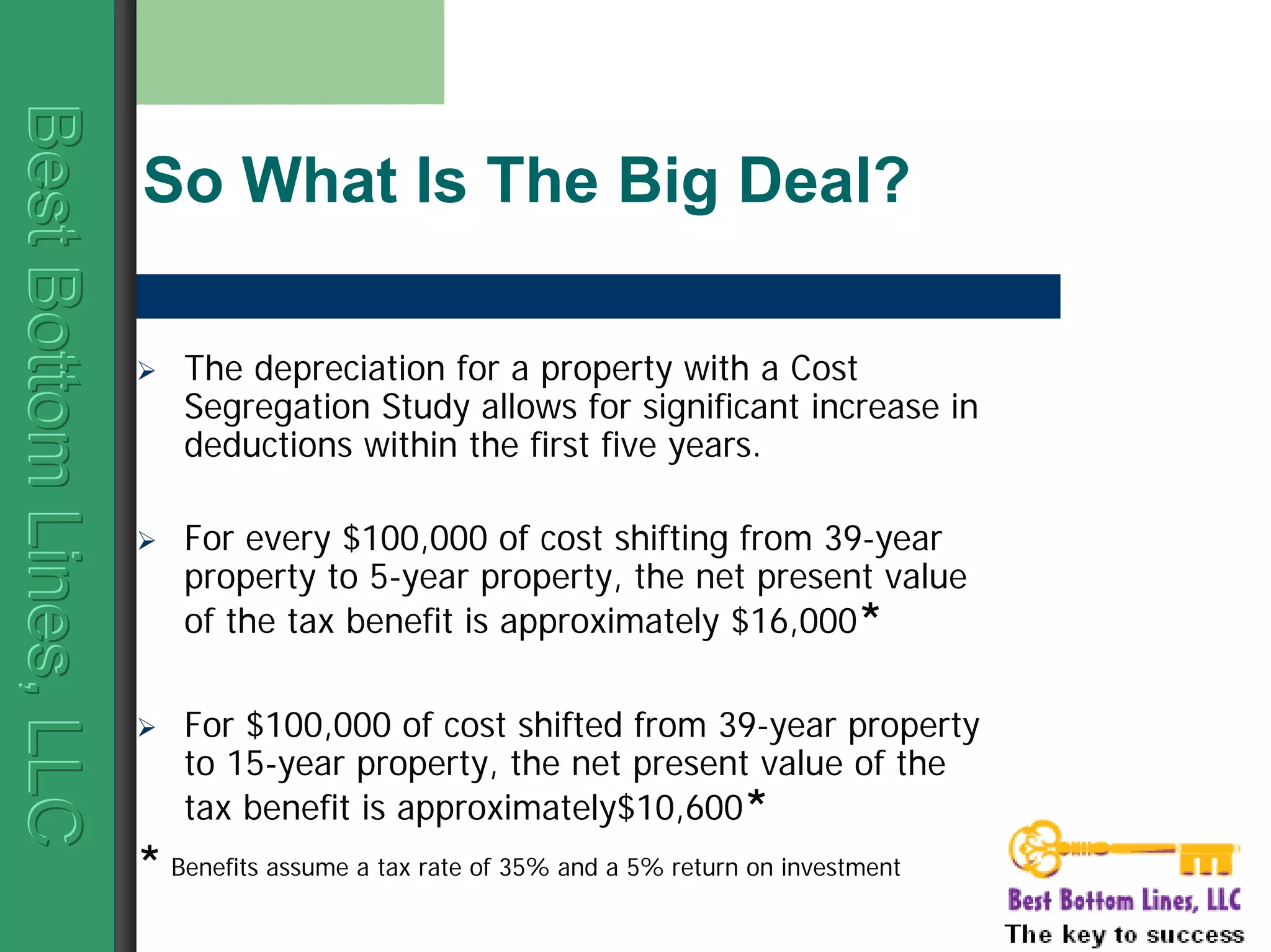

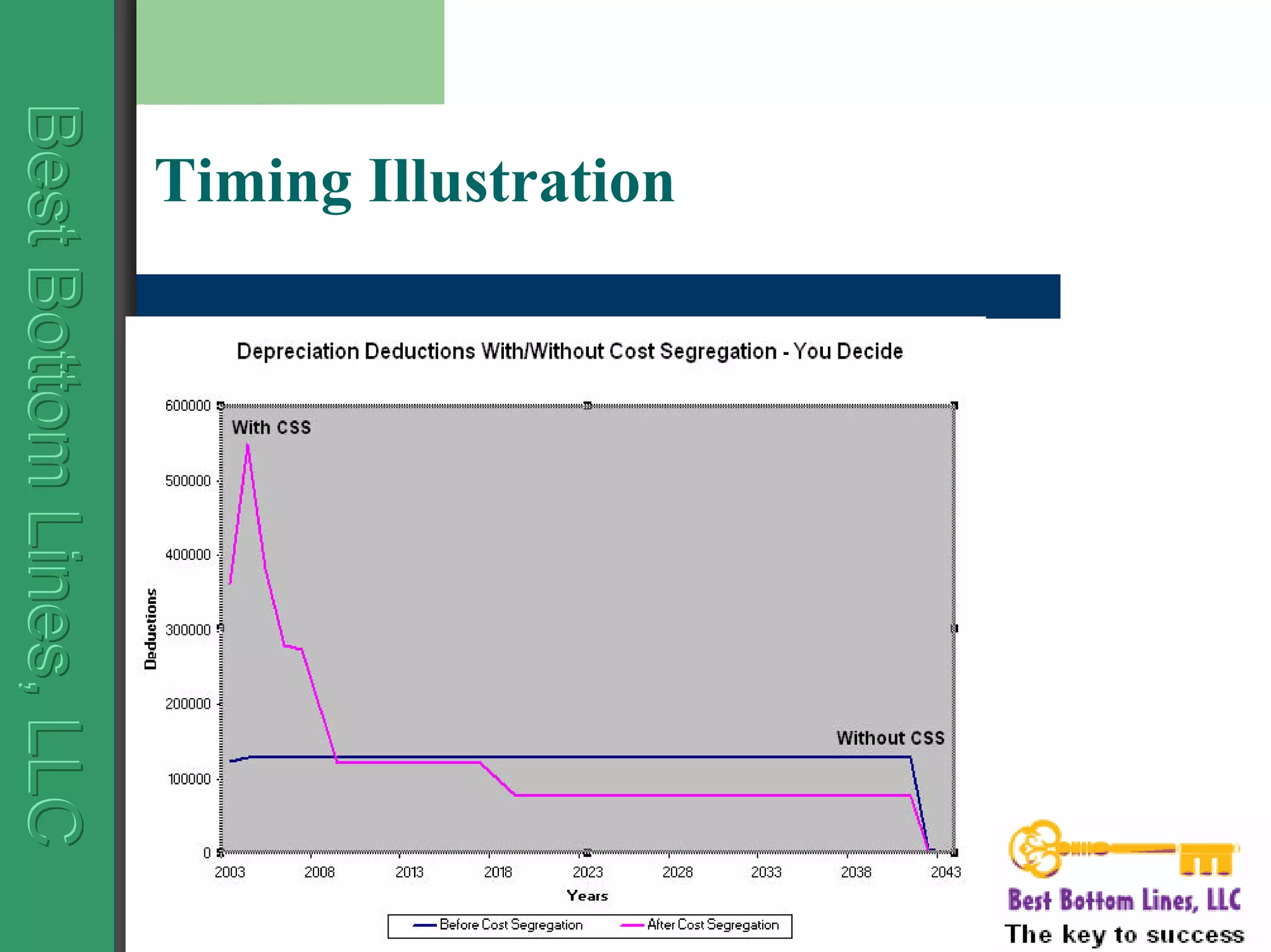

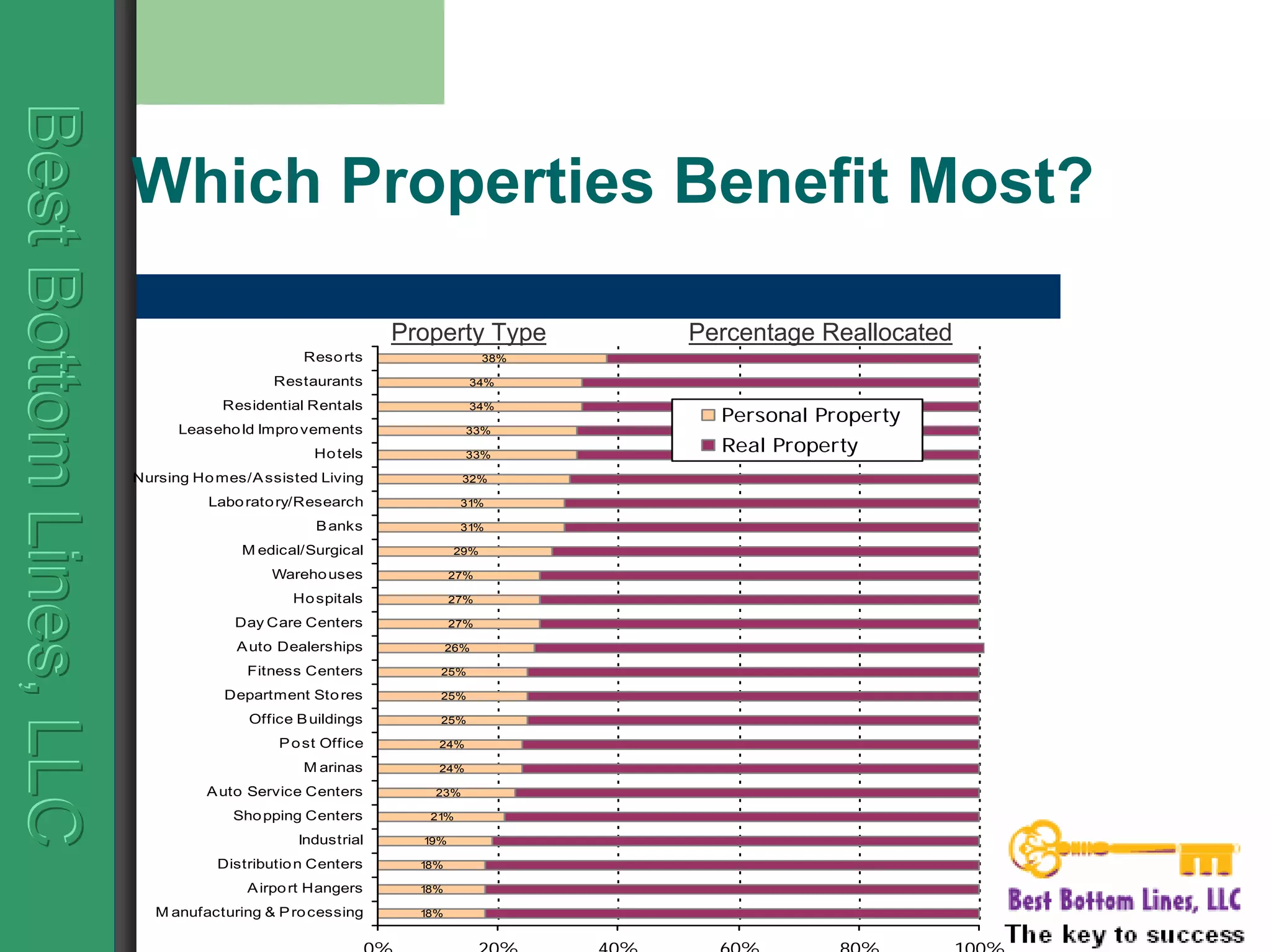

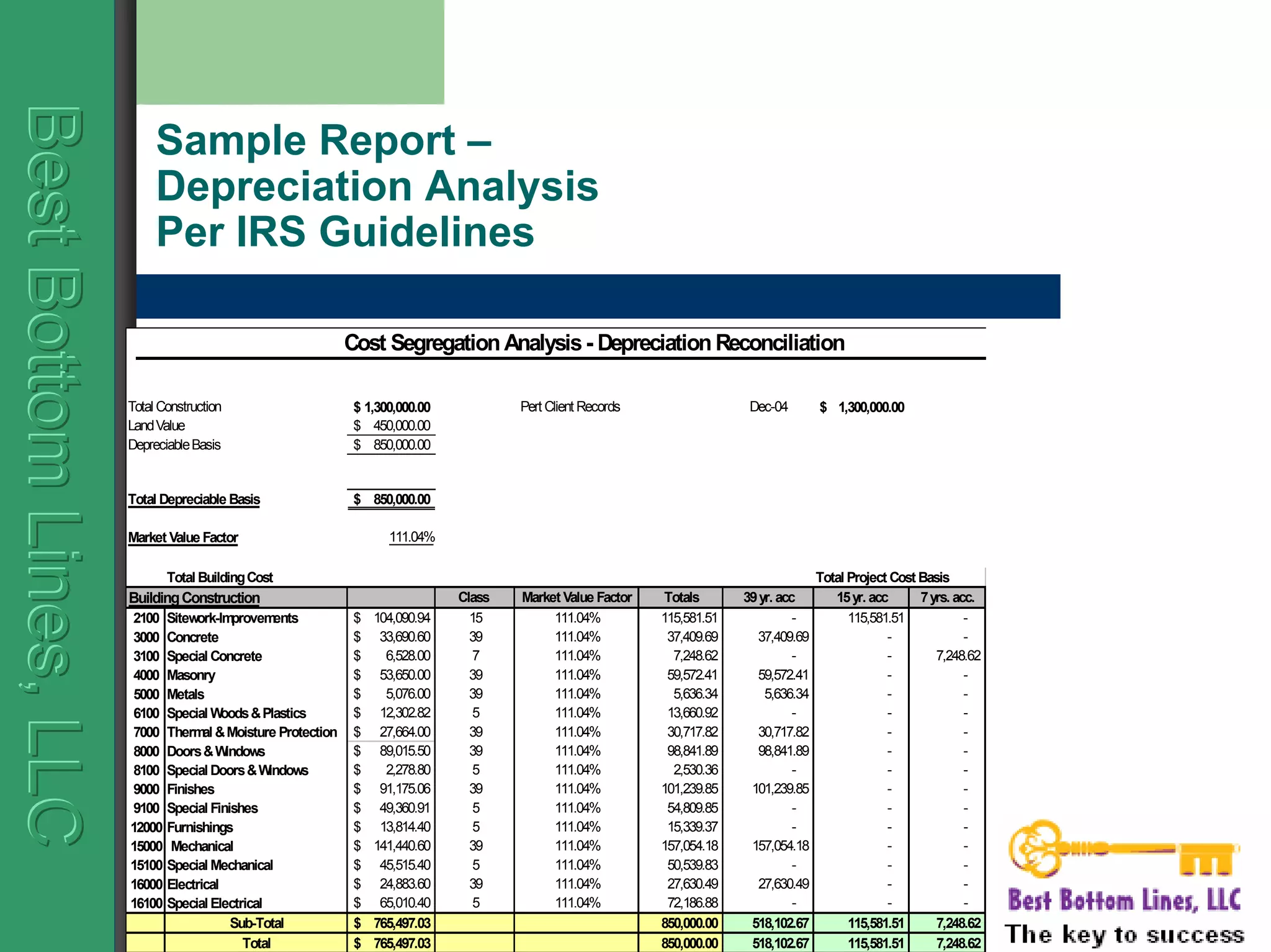

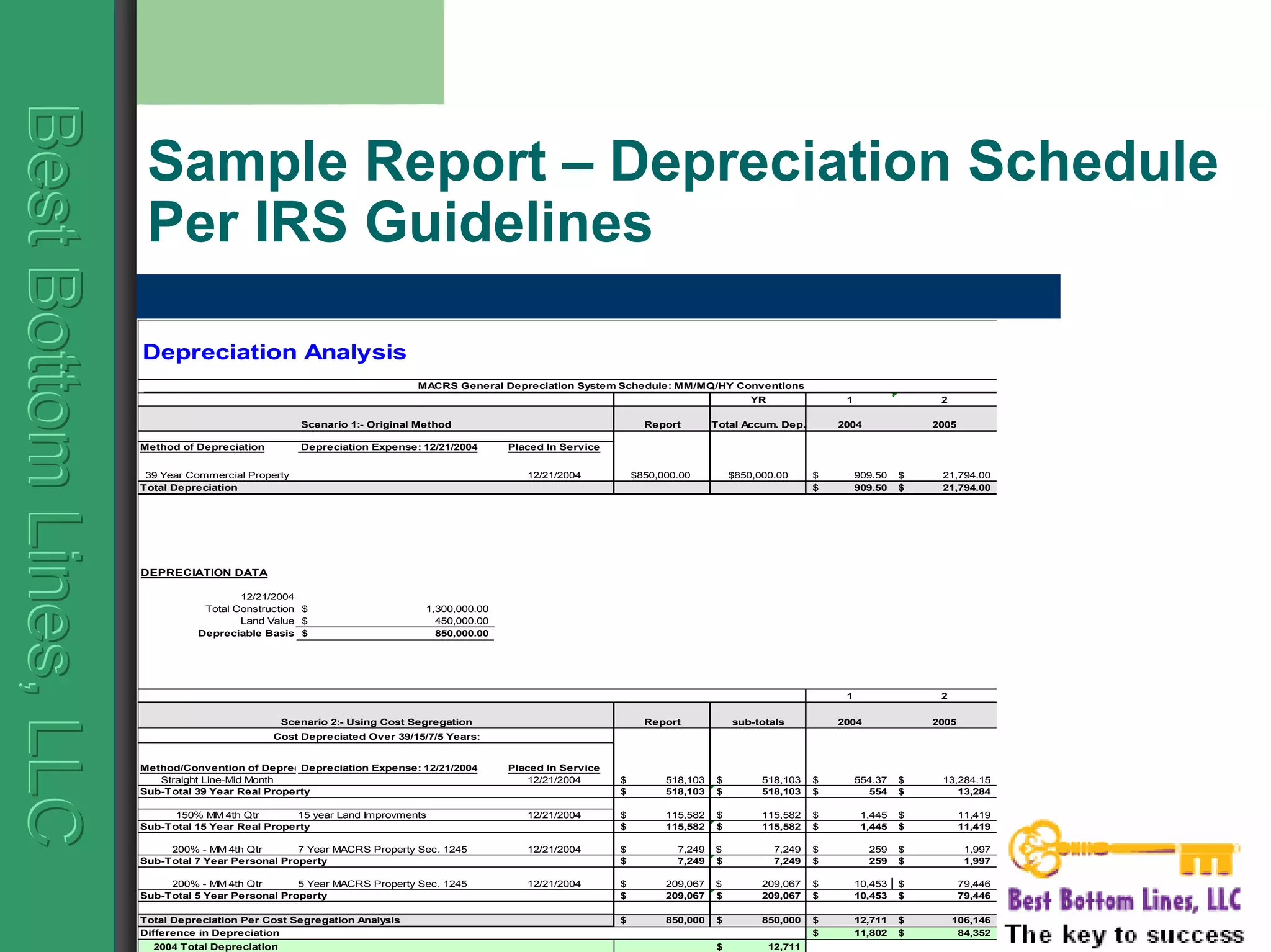

This document provides information about cost segregation studies and their tax benefits. A cost segregation study identifies construction-related costs that can be accelerated from 39, 27.5, and 15 year depreciation schedules to 5, 7, and 15 year schedules. This results in increased tax deductions and cash flow in early years. On average, 20-40% of total costs can be shifted, providing present value tax benefits of $16,000-$10,600 per $100,000 shifted to shorter schedules. Cost segregation studies provide significant cash flow benefits and apply to both new and existing commercial and investment properties.