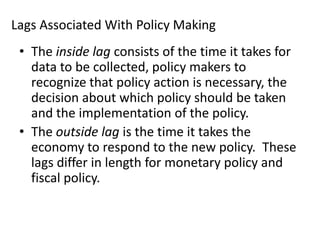

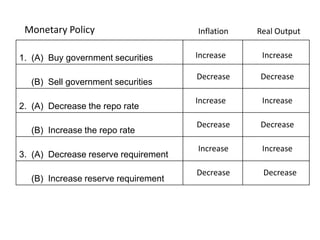

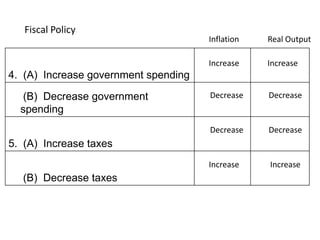

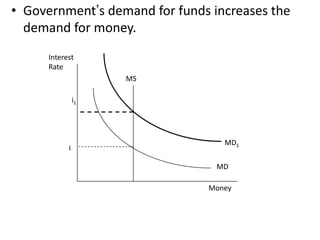

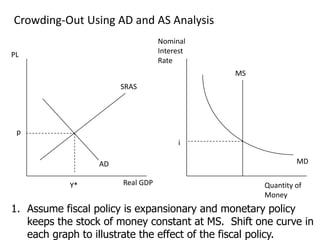

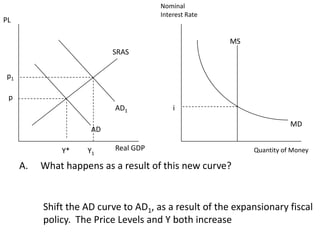

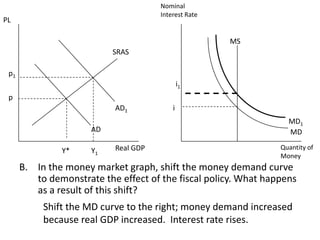

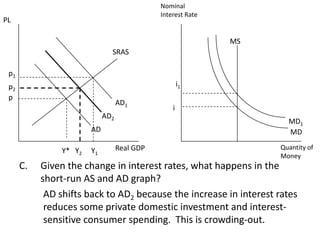

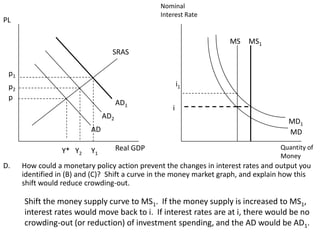

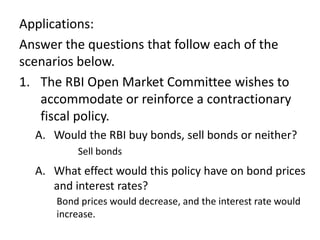

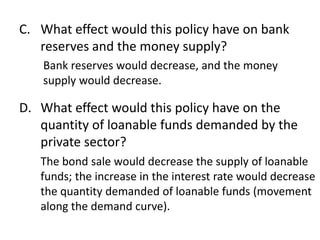

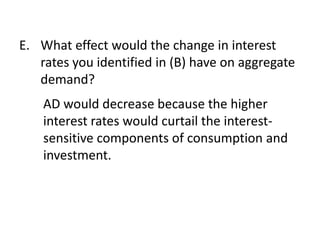

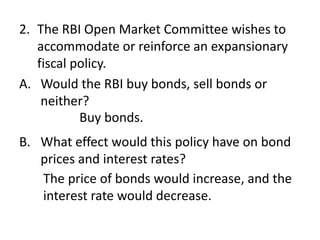

This document discusses policy lags, the crowding-out effect, and how monetary and fiscal policy tools can impact inflation and real output in the short-run. It defines inside lags as the time for policymakers to recognize the need for and implement policy changes, and outside lags as the time for an economy to respond to policy. Crowding-out refers to how increased government borrowing to finance deficits can increase interest rates and crowd-out private borrowing and investment. The document uses aggregate demand and supply models to illustrate these concepts and how monetary policy actions like changing the money supply can lessen or reinforce the crowding-out effect of fiscal policy.