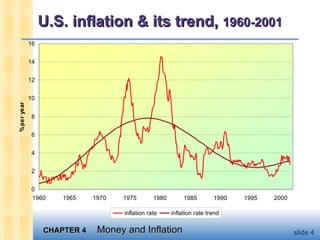

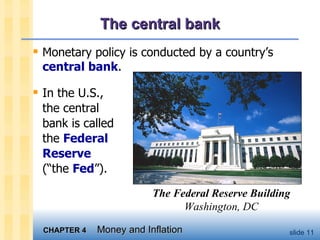

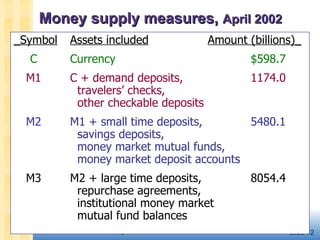

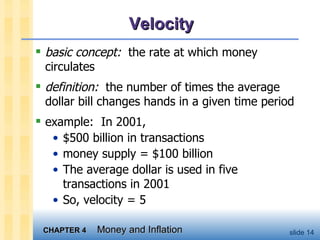

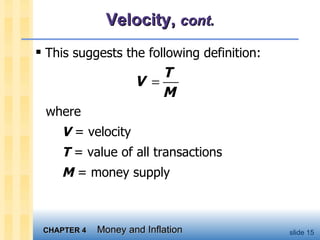

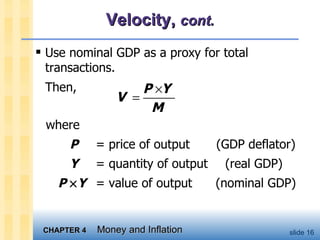

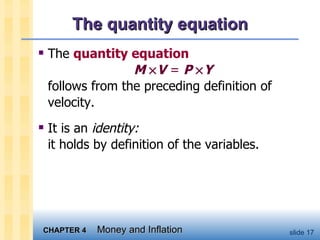

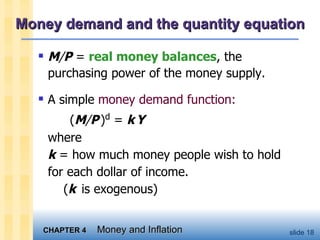

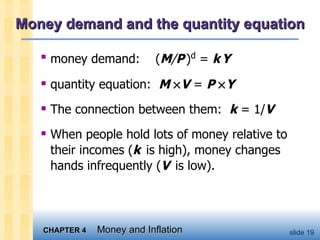

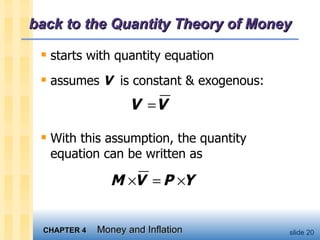

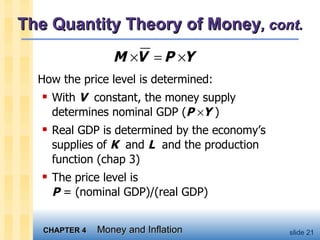

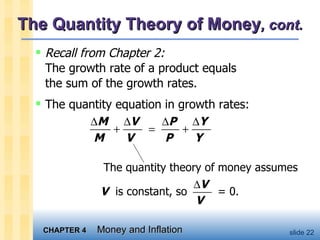

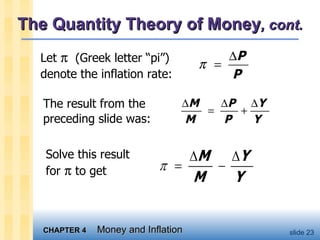

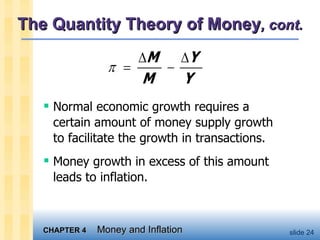

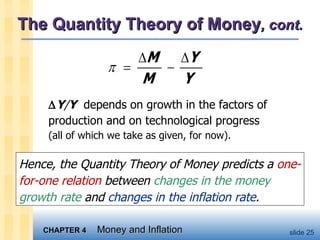

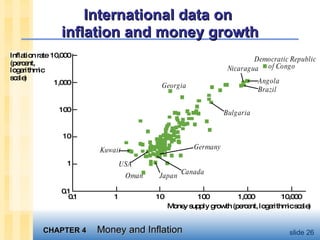

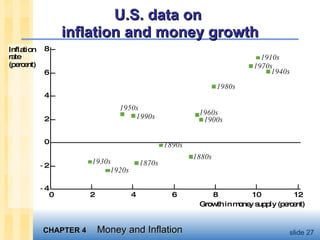

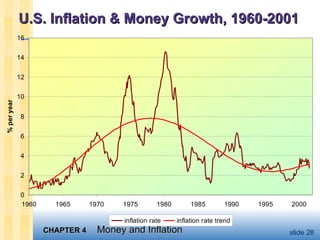

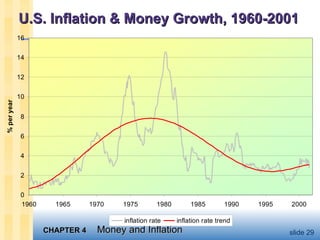

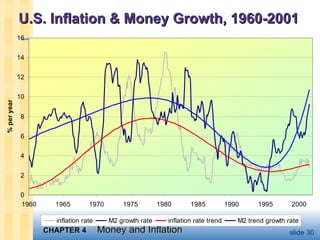

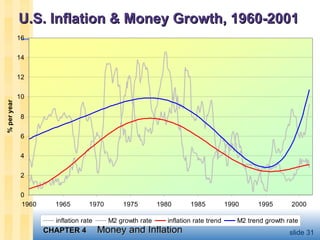

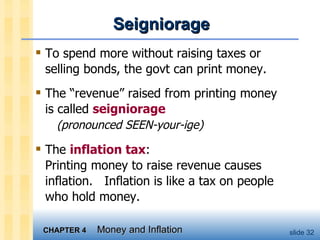

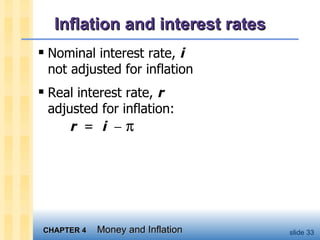

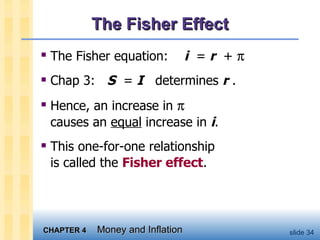

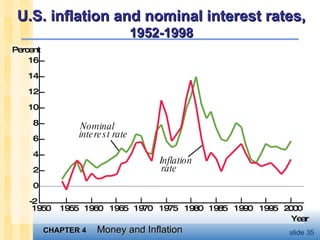

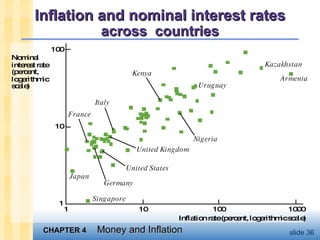

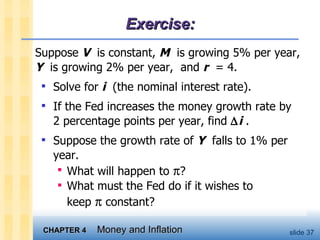

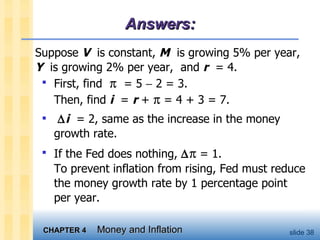

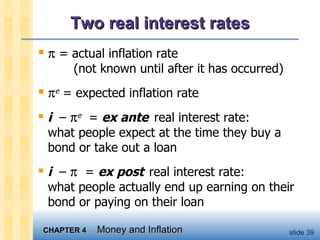

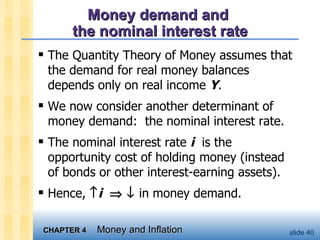

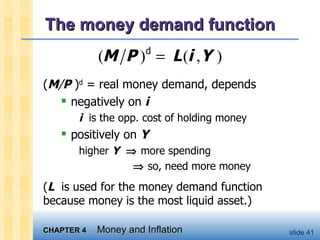

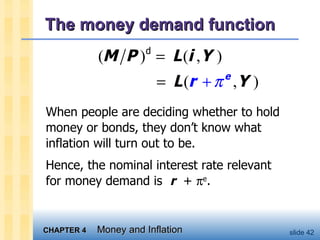

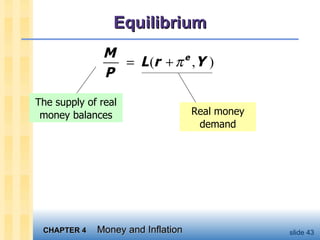

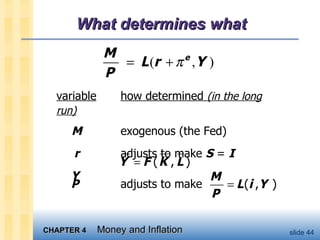

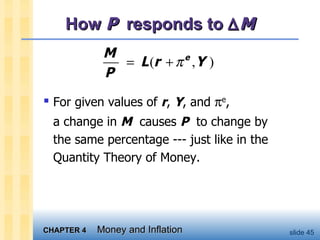

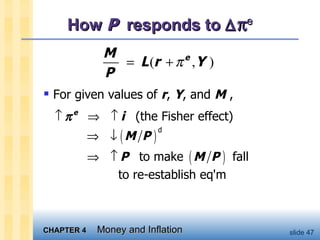

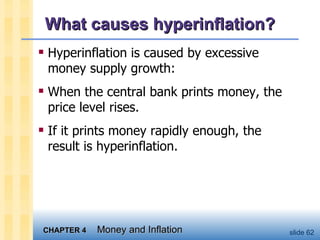

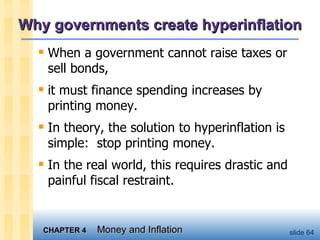

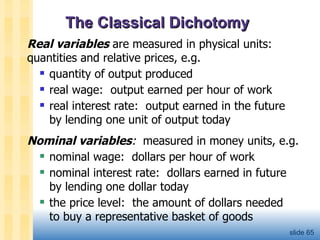

This chapter discusses the relationship between money, inflation, and prices according to the quantity theory of money. It introduces key concepts such as the money supply, monetary policy, the quantity equation, velocity of money, and how the money supply and inflation are connected. The quantity theory predicts a direct relationship between the growth of the money supply and the inflation rate in the long run.