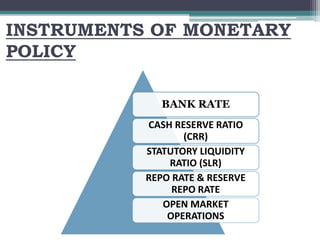

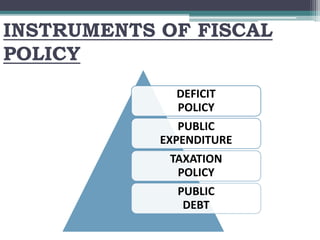

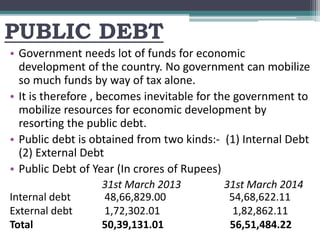

This document discusses monetary and fiscal policy in India. It defines monetary policy as the central bank's use of tools like interest rates, reserve requirements, open market operations etc. to regulate money supply and achieve objectives like full employment and price stability. The key monetary policy tools discussed are bank rate, cash reserve ratio, statutory liquidity ratio, repo rate, and open market operations. Fiscal policy refers to the government's use of taxing and spending tools to impact the economy. The major fiscal policy tools covered are the deficit, public expenditure, taxation, and public debt.