Embed presentation

Downloaded 45 times

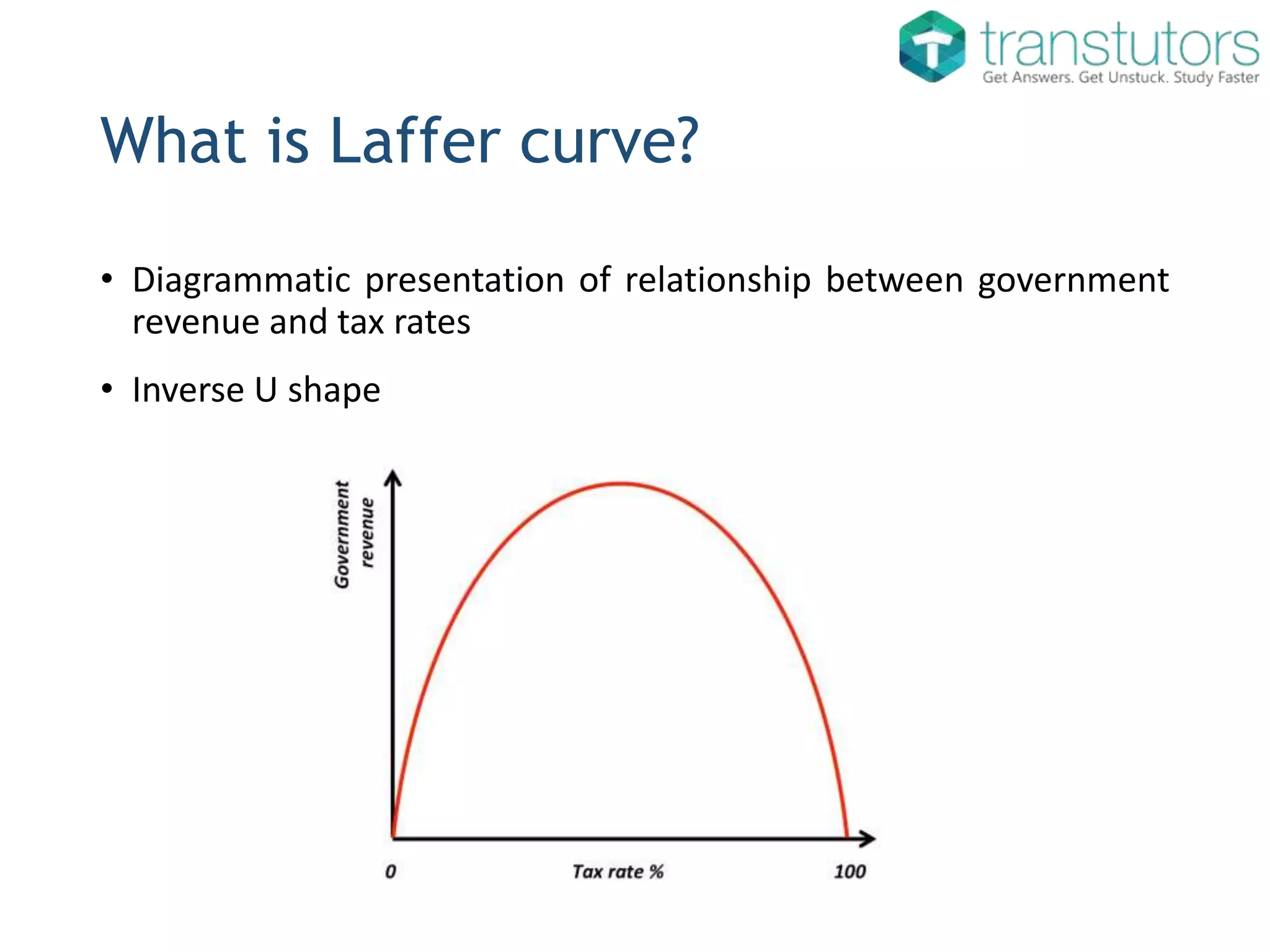

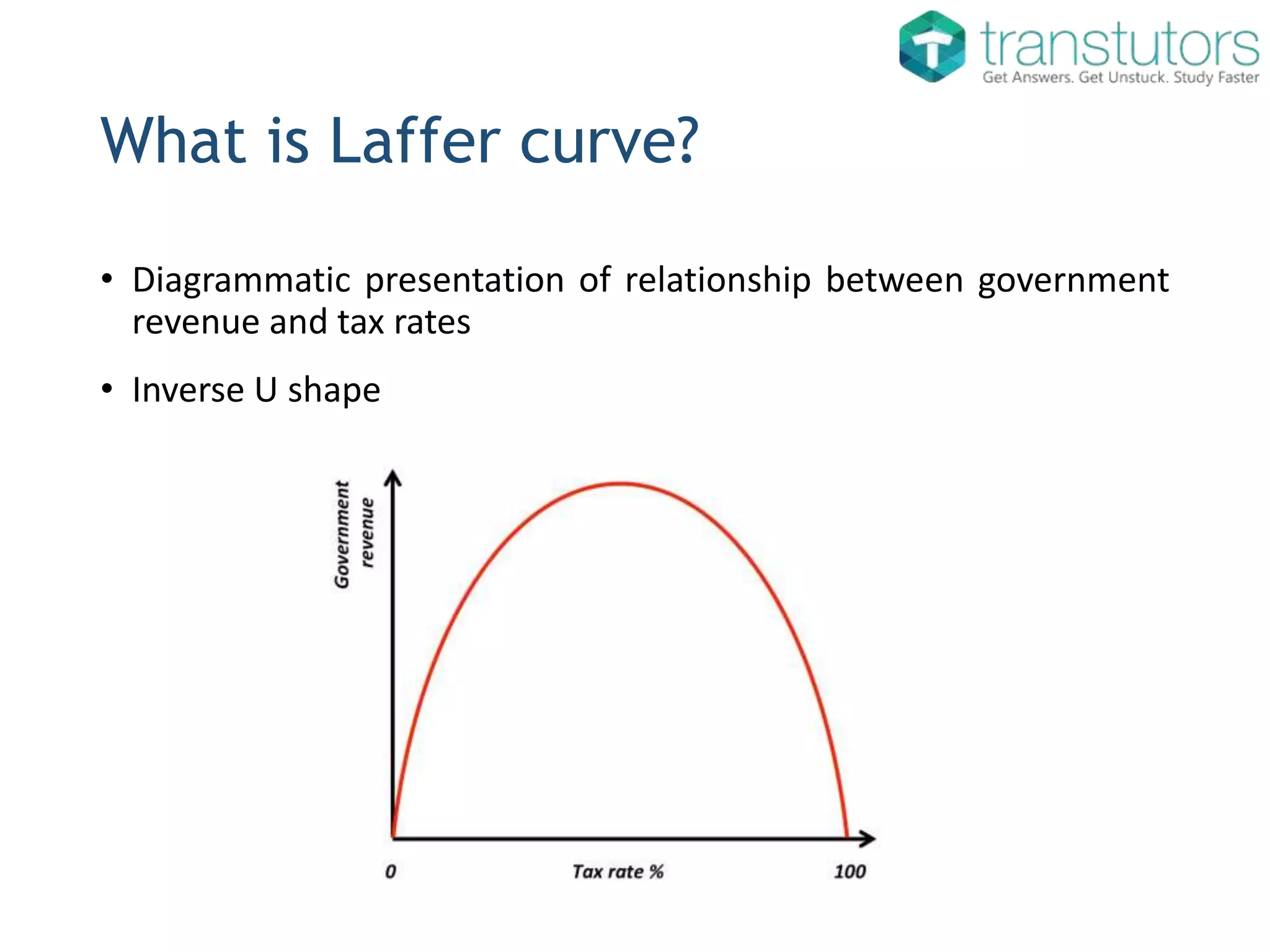

The Laffer Curve illustrates the relationship between government revenue and tax rates, depicting an inverse U-shape where revenue is generated at both 0% and 100% tax rates due to a lack of economic activity. Originating from economist Arthur Laffer in 1974, the theory suggests that there is an optimal tax rate for maximizing revenue, which differs from the optimal tax rate for overall economy efficiency. While tax cuts under President Reagan increased government revenue, economists remain divided on the Laffer Curve's predictive validity, as recent models indicate varying potential outcomes.

Explores the Laffer curve's portrayal of tax rates vs government revenue, its origins, and criticisms based on empirical data.

Provides a summary of the Laffer Curve and directs to a resource link for more information.