IS-LM economics theory for undergraduate

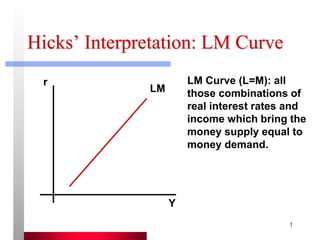

- 1. 1 Hicks’ Interpretation: LM Curve Y r LM LM Curve (L=M): all those combinations of real interest rates and income which bring the money supply equal to money demand.

- 2. 2 IS Curve Y r IS Slopes downward because r I Y

- 3. The IS curve: equilibrium in the goods market The goods market is in equilibrium when savings is equal to investment. The IS curve shows the real interest rate for which the goods market is in equilibrium. The IS curve is so called because at all points on it savings is equal to investment The IS curve slopes downward because if output (income) increases, savings also increases reducing the interest rate and vice versa. For constant output, any change in the economy that changes national savings relative to investment will change the interest rate that clears the market and shift the IS curve. We plot IS curve only by changing savings curve (NOT investment curve), because savings determine the level of investment. 3

- 4. The IS and the LM Relations Together Equilibrium in the goods market (IS). Equilibrium in financial markets (LM). When the IS curve intersects the LM curve, both goods and financial markets are in equilibrium. IS relation: Y C Y T I Y i G ( ) ( , ) LM relation: M P YL i ( ) The IS-LM Model

- 5. Shifts of the LM Curve An increase in money... Shifts of the LM Curve

- 6. Fiscal Policy, the Interest Rate and the IS Curve Fiscal contraction: a fiscal policy that reduces the budget deficit. – Reducing G or increasing T Fiscal expansion: increasing the budget deficit. – Increasing G or decreasing T Taxes (T) and government expenditures (G) affect the IS curve, not the LM curve.

- 7. Fiscal Policy, the Interest Rate and the IS Curve The Effects of an Increase in Taxes

- 8. Monetary Policy, the Interest Rate, and the LM Curve Monetary contraction (tightening) refers to a decrease in the money supply. An increase in the money supply is called monetary expansion. Monetary policy affects only the LM curve, not the IS curve.

- 9. Monetary Policy, the Interest Rate, and the LM Curve The Effects of a Monetary Expansion

- 10. Factors that shift IS curve An increase in Shifts the IS curve Reason Expected future output Up and to the right Consumption rises, savings falls, interest rate rises Wealth Up and to the right Government purchases Up and to the right Expected future MPK Up and to the right Investment increases, interest rate rises Tax No change (Ricardian Equivalence) If the consumers think that in future they will get an equivalent amount of tax-cut Down and to the left If the consumers reduce consumption because of the tax 10

- 11. Factors that shift the LM curve An increase in Shifts the LM curve Reason M Down and to the right Reduces r as M/P increases P Up and to the left Increases r as M/P falls Down and to the right Reduces r as demand for money falls Wealth Up and to the left Demand for money increases and r increases Payment technology Down and to the right Demand for money falls and r falls 11

- 12. Using a Policy Mix The Effects of Fiscal and Monetary Policy. Shift of IS Shift of LM Movement of Output Movement in Interest Rate Increase in taxes left none down down Decrease in taxes right none up up Increase in spending right none up up Decrease in spending left none down down Increase in money none down up down Decrease in money none up down up

- 13. General equilibrium in the IS-LM framework: Classical vs. Keynesian debate We have seen that an increase in the money supply will reduce the interest rate and shift the LM curve to the right to intersect the IS curve in a new point, where a temporary equilibrium only in the goods and asset market will be established. The labor market will not be in this equilibrium and consequently firms will push the price up to return to the general equilibrium state. The question is how fast this adjustment process takes place? According to the Classical view the adjustment process takes place very quickly. On the other hand, the Keynesian view proposes that the adjustment process may take long time and as a result the state out of general equilibrium may persist for a long time. About the monetary neutrality, both agrees. The difference in their view is that- the Classical economists thinks money is always neutral and the Keynesians think that money is neutral but takes a considerable time to be neutral. 13

- 14. 11-14 Use the IS-LM model to show how monetary and fiscal policy work – Fiscal policy has its initial impact in the goods market – Monetary policy has its initial impact mainly in the assets markets Because the goods and assets markets are interconnected, both fiscal and monetary policies have effects on both the level of output and interest rates Expansionary/contractionary monetary policy moves the LM curve to the right/left Expansionary/contractionary fiscal policy

- 15. 11-15 Monetary Policy The Central Bank is responsible for monetary policy Conducted mainly through open market operations: – Buying/selling government bonds CB buys bonds in exchange for money stock of money goes up CB sells bonds in exchange for money paid by purchasers of the [Insert Figure 11-3 here]

- 16. 11-16 Monetary Policy Consider monetary expansion Increase in money supply creates an excess supply of money LM curve shifts out to LM’ Public adjusts by buying other assets Asset prices increase, and yields decrease move to point E1 Money market clears, with lower interest rate Decline in interest rate results in excess demand for goods: goods market out of equilibrium at E1 [Insert Figure 11-3 here, again]

- 17. 11-17 Monetary Policy Note the slope of the LM curve is important Relatively flat LM curve: the shift in LM curve results in small change in interest rate and small change in output Relatively steep LM curve: large effects [Insert Figure 11-3 here, again]

- 18. 11-18 Transition Mechanism Two steps in the transmission mechanism (the process by which changes in monetary policy affect AD): 1. An increase in real balances generates a portfolio disequilibrium • At the prevailing interest rate and level of income, people are holding more money than they want • Portfolio holders attempt to reduce their money holdings by buying other assets asset prices and yields change The change in money supply drives down interest rates

- 19. 11-19 The Liquidity Trap Two extreme cases arise when discussing the effects of monetary policy on the economy the first is the liquidity trap – Liquidity trap = a situation in which the public is prepared, at a given interest rate, to hold whatever amount of money is supplied – Implies the LM curve is horizontal changes in the quantity of money do not shift it • Monetary policy has no impact on either the interest rate or the level of income monetary policy is powerless • Possibility of a liquidity trap at low interest rates is a notion that grew out of the theories of English economist John Maynard Keynes

- 20. 11-20 The Liquidity Trap Japanese interest rates

- 21. 11-21 Banks’ Reluctance to Lend Two extreme cases arise when discussing the effects of monetary policy on the economy the second is the reluctance of banks to lend – Despite lower interest rates and increased demand for investment, banks may be unwilling to make the loans necessary for the investment purchases – This leads to a break down in the transmission mechanism – If banks made prior bad loans that are not repaid, they may become reluctant to make more, despite demand they prefer instead to lend to the government (safer)

- 22. 11-22 The Classical Case The opposite of horizontal LM curve (i.e. monetary policy cannot affect income) is vertical LM curve – If LM is vertical demand for money unresponsive to the interest rate – The equation for the LM curve is (1) • If h is zero there is a unique level of income corresponding to a given real money supply VERTICAL LM CURVE Vertical LM curve corresponds to the classical case – Rewrite equation (1), with h = 0: (2) • Implies that nominal GDP depends only on the quantity of money quantity theory of money hi kY P M ) ( Y P k M

- 23. 11-23 The Classical Case When the LM curve is vertical 1. A given change in the quantity of money has a maximal effect on the level of income 2. Shifts in the IS curve do not affect the level of income Only monetary policy affects income, fiscal policy is ineffective – Requires that the demand for money be irresponsive to i important issue in determining the effectiveness of alternative policies – Evidence suggests that demand for money does depend on the interest rate

- 24. 11-24 Fiscal Policy and Crowding Out If the economy is initially in equilibrium at E, if government expenditures increases, equilibrium moves to E” The goods market is in equilibrium at E”, but the money market is not Y has increased demand for money also increases interest rate increases Firms’ planned investment spending declines at higher interest rates and AD falls off move up the LM curve to E’ [Insert Figure 11-4 here]

- 25. 11-25 Fiscal Policy and Crowding Out Increased government spending increases income and the interest rate Higher interest rates and their impact on AD dampen the expansionary effect of increased G Income increases to Y’0 instead of Y” [Insert Figure 11-4 here] Increase in government expenditures crowds out investment spending.

- 26. 11-26 Fiscal Policy and Crowding Out Note: slopes of IS/LM curves important Flat LM curve: large effect on output, small change in interest rate Flat IS curve: little effect on output or interest rate The larger the multiplier, G, the further the IS curve shifts NB: if economy at full employment, higher G raises P real money supply falls interest rate goes up I falls [Insert Figure 11-4 here]

- 27. 11-27 The Composition of Output and the Policy Mix Table 11-2 summarizes our analysis of the effects of expansionary monetary and fiscal policy on output and the interest rate (assuming not in a liquidity trap or in the classical case) Monetary policy operates by stimulating interest-responsive components of AD Fiscal policy operates through G and t impact depends upon what goods the government buys and what taxes and transfers it changes – Increase in G increases C along with G; reduction in income taxes increases C Accommodating monetary policy: fiscal expansion accompanied by monetary expansion: both curves shift, output increases, interest rate stays the same [Insert Table 11-2 here]

- 28. B. Friedman’s Model C C c Y T c I i i r i Y C I G M m m Y m r m m M M M d d s 0 1 1 0 1 1 0 1 2 2 1 0 1 0 0 ( ), , , and derives: r m c m c i m c T c M m G m c i m 0 1 1 0 0 1 1 1 1 2 1 1 1 1 1 1 ( ) ( ) ( ) ( )

- 29. Result Friedman finds via the total derivative that: dr dG m m c i m 1 2 1 1 1 1 0 ( ) This is positive, but how “important?” Short-run Value Long-run Value Goldfeld (M1) 0.930 0.657 Friedman (M2) 0.849 0.448 Hamburger (M3) 0.876 0.796 These are dY/dG after crowding!

- 30. Variant: Balanced budget multiplier • The government above was free to set G and T however it wished. What if the government had to control the budget deficit, so that G = T at all times? • If we put the G = T requirement into the IS equation, we get the balanced budget multiplier: • IS Equation: Y = C(Y – T) + I + G, where C = c0 + c1 (Y – T) • Re-arranging we have: • Replace G=T, balanced budget • So our new multiplier is 1. G ) I c ( ) c 1 ( 1 Y ) G I G c c ( ) c 1 ( 1 Y 0 1 1 0 1 ) G I T c c ( ) 1 ( 1 Y 1 0 1 c

- 31. Balanced budget multiplier • Intuition: Why is the balanced budget multiplier less than the multiplier without balancing the budget? • Answer: In the balanced budget case, the government has to raise T by $1 when it raises G by $1. Raising T will lower output but by less than G raises output. The net result is a higher level of output, but less than if the government did not have to simultaneously raise taxes.

- 32. Portfolio Crowding Focuses on portfolio effects associated with financing debt. First, he adds wealth effects to “IS”: Y y y G y T y r y W y y y 0 1 1 2 3 3 2 1 1 0 1 ( ) , , Here W is the total real wealth in the private sector. • Assume that the balanced budget multiplier = 1. W = M + B + K Note: This implies that any asset demand is a linear combination of the other two. [There are only two independent asset demands.]

- 33. Portfolio Crowding (2) • Assume that the initial equilibrium of IS and LM is with a balanced budget (G=T) and taxes remain unchanged. Taking differentials: dW = dM + dB Note: The Christ-Silber arguments assume that government bonds represent net wealth. • Assume fixed prices, and fixed capital stock.

- 34. Portfolio Crowding (3) The interest rate variable r in the extended IS curve reflects expected return; it is the expected yield on real capital. So now we have two r’s, rK and rB. The extended model is now: Y y y G y T y r y M K B M m m r m r m Y m M K B B b m b r b r b Y b M K B K B K B K 0 1 1 2 3 0 2 3 4 5 0 2 3 3 4 5 1 ( ) ( ) ( ) ( ) ( )

- 35. Portfolio Crowding (4) dY dG y y y c 1 3 1 1 1 1 , . note that This implies that the goods market reinforces the usual 1/(1-c) multiplier effect. Given m4 > 0, increases in Y imply increases in the transactions demand for money. If the money supply is fixed, then either rB or rK, or both, must rise. (Note: m2,m3 < 0.) Friedman solves the extended model:

- 36. Portfolio Crowding (5) RESULT: As long as assets are all gross substi- tutes, transactions crowding is out. But what about Portfolio Crowding? As money demand rises, M + K + B increases. (Recall m5 > 0.) Therefore the wealth effect reinforces the transactions effect, further increasing money demand. But does rB rise, rK rise, or both?

- 37. Portfolio Crowding (6) Assume that 0 < b5 < 1. This amounts to saying that people don’t want to hold all of their wealth in bonds. If the bond supply changes in the absence of yield changes, either rB rises or rK falls. BUT, the effect of interest rates on the goods market depends on rK. Since we cannot know whether this rate has changed, we cannot know if crowding is “out” or “in”.

- 38. Portfolio Crowding (6) More specifically, we can solve for the partial derivative: r G m b m m b m m m m b m b K 2 5 2 5 3 5 2 3 2 3 3 3 1 This implies that if all three assets are substitutes (m3 , m2 , b3 < 0), then the denominator is positive, and r G m b K 2 3 ,

- 39. Portfolio Crowding (7) RESULT: Whether the crowding is “in” or “out” depends on whether bonds are closer portfolio substitutes for money or for capital. If bonds are closer to capital, then LM shifts leftward and crowding is “out”. If bonds are closer to money, then LM shifts rightward, reinforcing fiscal policy, and crowding is “in”.

- 40. Deficits and Interest Rates: Empirical Evidence (1) Paul Evans. “Do Large Deficits Produce High Interest Rates?” AER 1985. RESULT: No Crowding Method & Assumptions: – G, Deficits, Money Supply: Exogenous – Data 1858-1984, 2SLS Problems: – 1858-69, capital inflows may have financed deficit – Post WWII - 1979, Fed pegged interest rates – prior to 1980s, deficits were typically small – the analysis denies the endogeneity of G, deficits, Ms

- 41. Deficits and Interest Rates: Empirical Evidence (2) Martin Feldstein & Otto Eckstein. “The Fundamental Determinants of the Interest Rate,” REStat 1970. RESULT: Minimal Crowding Out. 10% increase in federal debt increased the interest rate on AAA bonds by 0.28%: 1954Q1 - 1969Q2. Problems – Period of analysis is during the Fed interest rate pegging period, and with fixed exchange rates – Data set is not very rich, and the result (as faithfully reported by the authors) is not very strong at all.

- 42. Deficits and Interest Rates: Empirical Evidence (3) Girola (1984) Updates Feldstein & Epstein interest rate equation. – RESULT: No Crowding(?) – Debt has a positive, but significant effect on the interest rate, but the Durbin-Watson statistic is very low -- this implies autocorrelation in the residuals – After correction for autocorrelation, the coefficient estimate becomes negative and insignificant Plosser (1982, 1987) – RESULT: No Crowding – Changes in privately held gov’t debt have no effect on yields of government securities

- 43. Deficits and Interest Rates: Empirical Evidence (4) Hoelscher (1983) – RESULT: No Crowding – 3-month T-Bill vs. deficit, unemployment, expected inflation, and the monetary base – Positive but insignificant coefficient Barth, Iden, Russek (1984-85) Replicate Hoelscher – Decomposed the deficit into structural and cyclical components – Structural deficit has positive and significant coefficient – RESULT: Crowding Out

- 44. Deficits and Interest Rates: Empirical Evidence (5) Carlson (1983) – RESULT: Crowding out – Aaa corporate bond rate vs. privately-held federal debt, expected inflation, GNP, and monetary base – 1953:2 - 1983:2 – Positive and significant coefficient for debt variable, but first order serial correlation Barth, Iden, Russek (1984-85) Replicate Carlson – Cannot repeat the Carlson result! – Positive coefficient, not significant! – RESULT: No Crowding

- 45. Deficits and Interest Rates: Empirical Evidence (6) Barth, Iden, Russek (1984-1985) – RESULT: Crowding Out – Positive significant relationship between the structural deficit and the interest rate Placone, Ulbrich, Wallace (JPKE) – RESULT: Depends entirely on debt management practices. – Just as easy to get the opposite result as Barth, et al. de Leeuw and Holloway – RESULT: Crowding Out

- 46. Deficits and Interest Rates: Empirical Evidence (7) CBO (1984) – Surveyed 24 studies of interest-rate/deficit relationship – Studies differed widely in terms of • time period • data frequency • statistical method • interest rate variable • deficit or debt variable – Result: • Debt is more significant than the Deficits, • Neither was significant or consistently positive