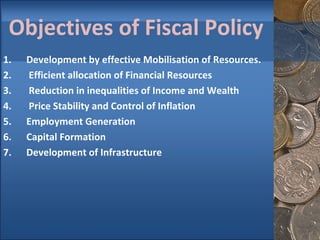

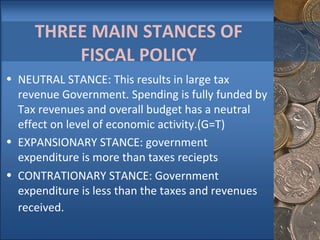

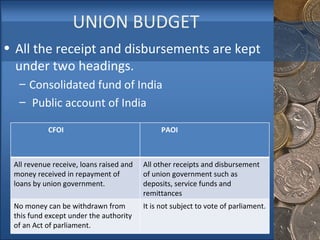

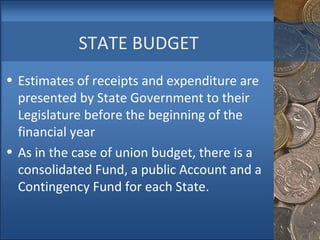

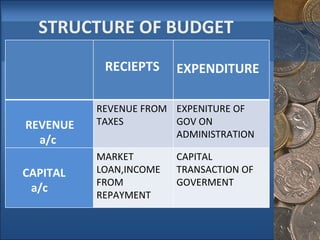

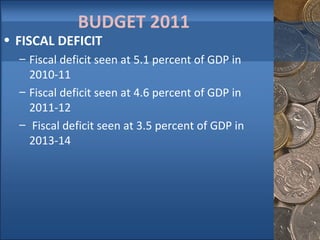

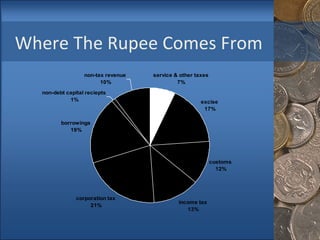

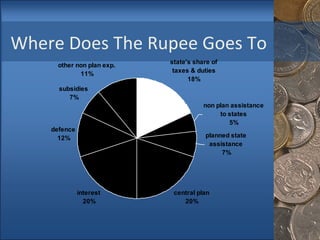

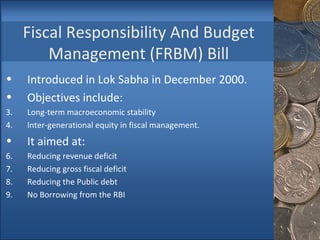

The document summarizes India's fiscal policy. It discusses the objectives of fiscal policy including resource mobilization, efficient allocation of resources, reducing inequality, and price stability. It outlines the different stances a government can take - neutral, expansionary, or contractionary. It also discusses the instruments of fiscal policy including the budget, expenditures, taxation, and public debt. It provides an overview of the union and state budgets in India.