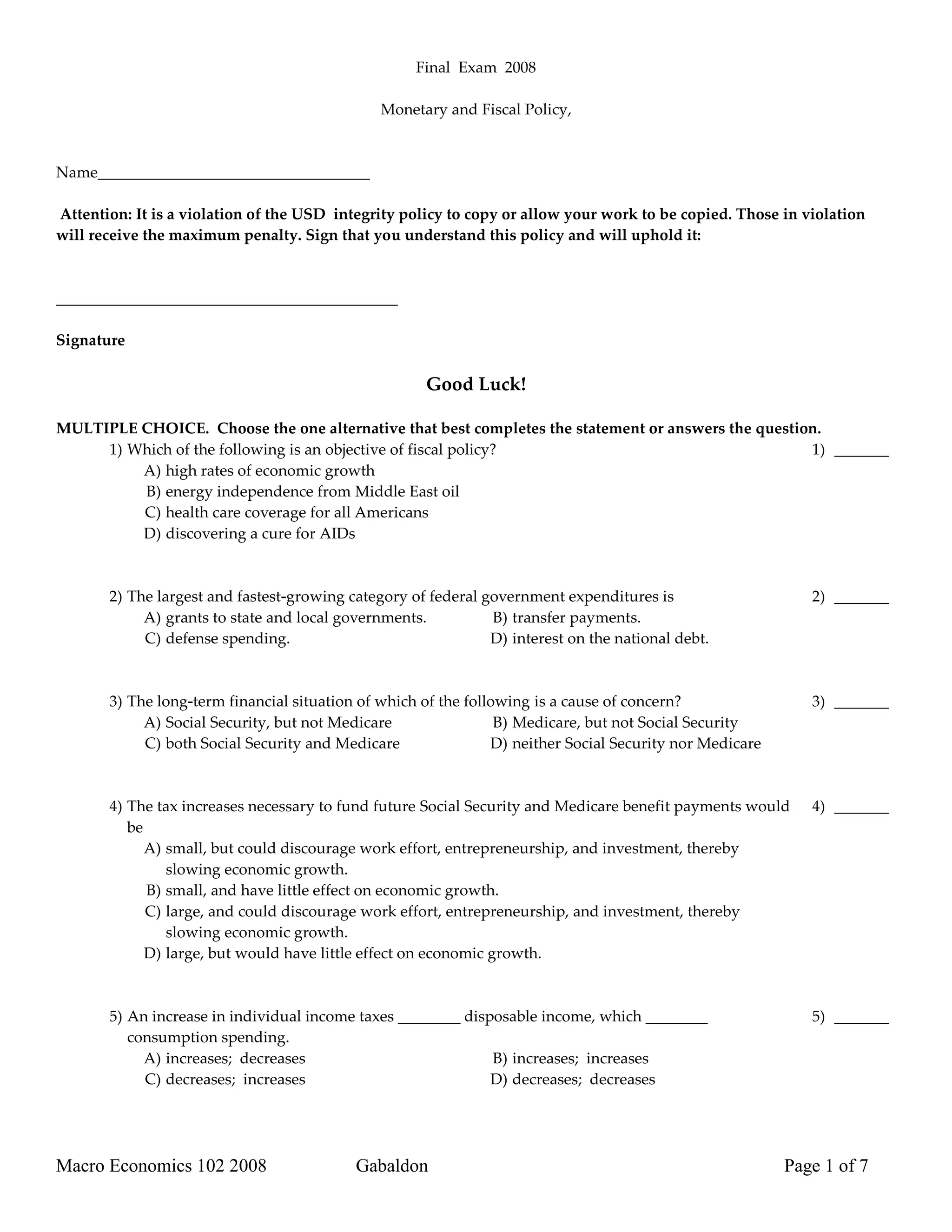

This document is a final exam for a course on Monetary and Fiscal Policy. It contains 25 multiple choice questions testing understanding of concepts related to fiscal and monetary policy tools and their effects on macroeconomic variables like GDP, inflation, interest rates, and the budget deficit. Students are reminded of the integrity policy and warned that copying answers is prohibited. They are asked to sign to acknowledge understanding of this policy. Good luck is wished on the exam.