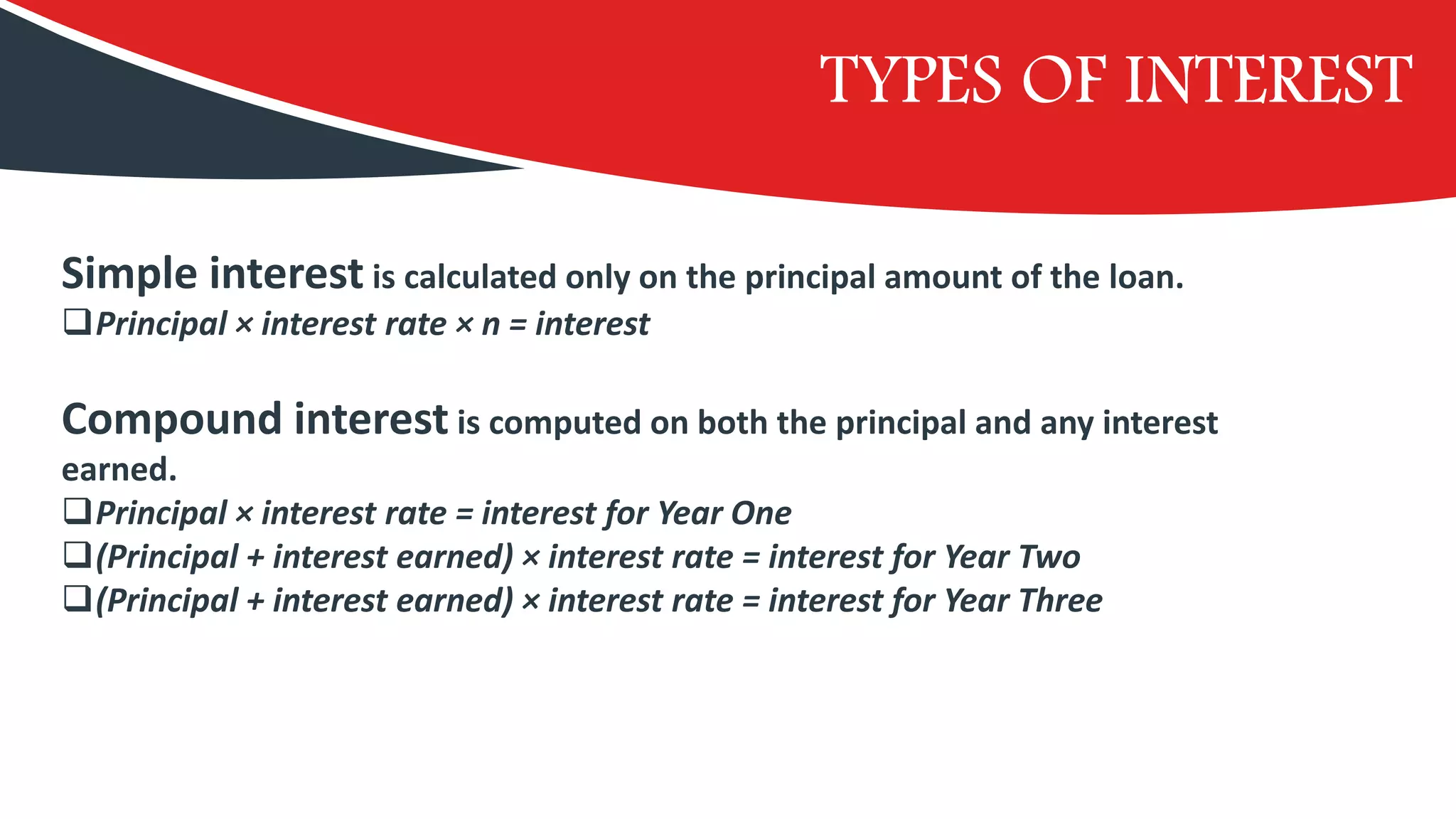

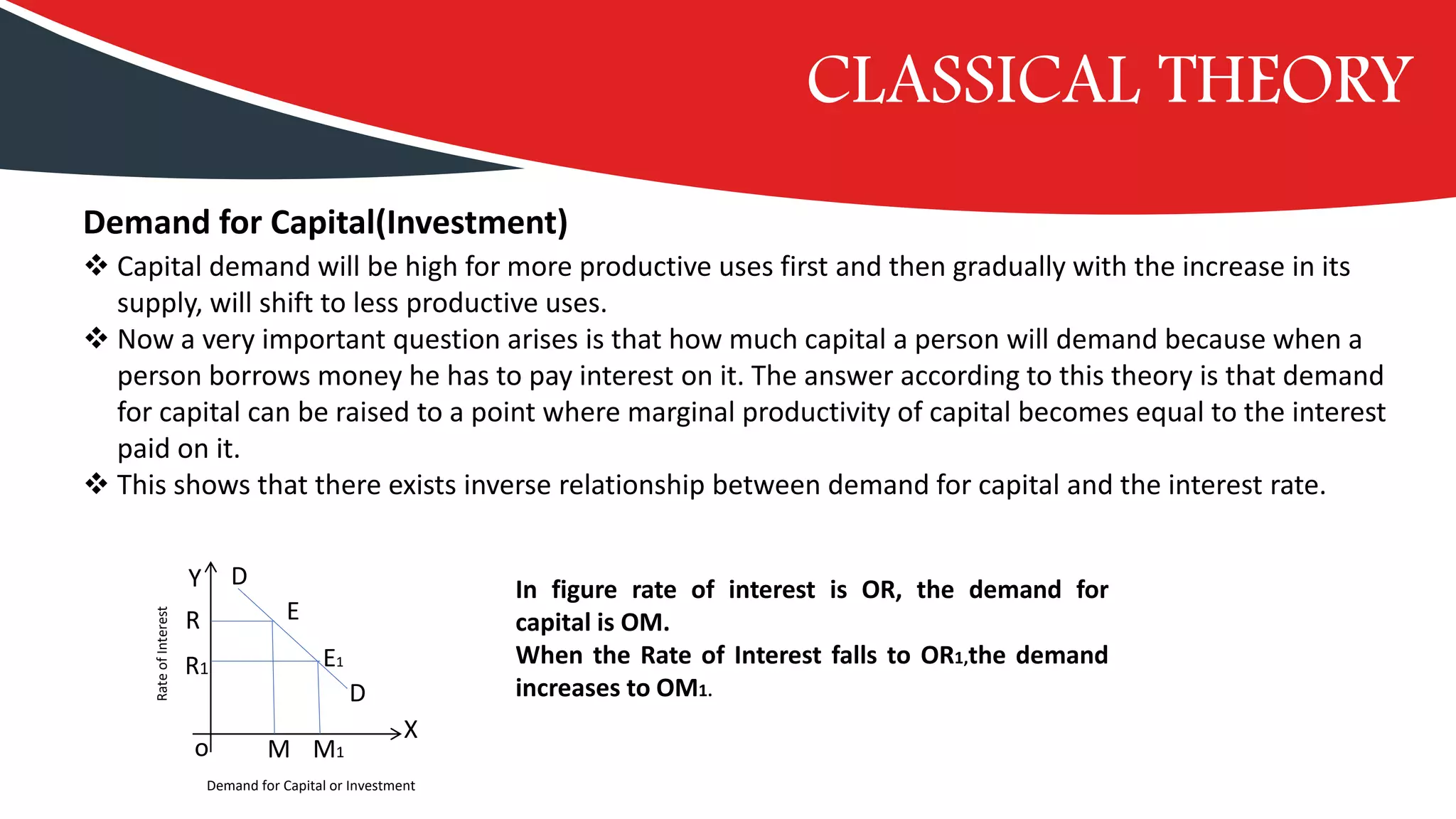

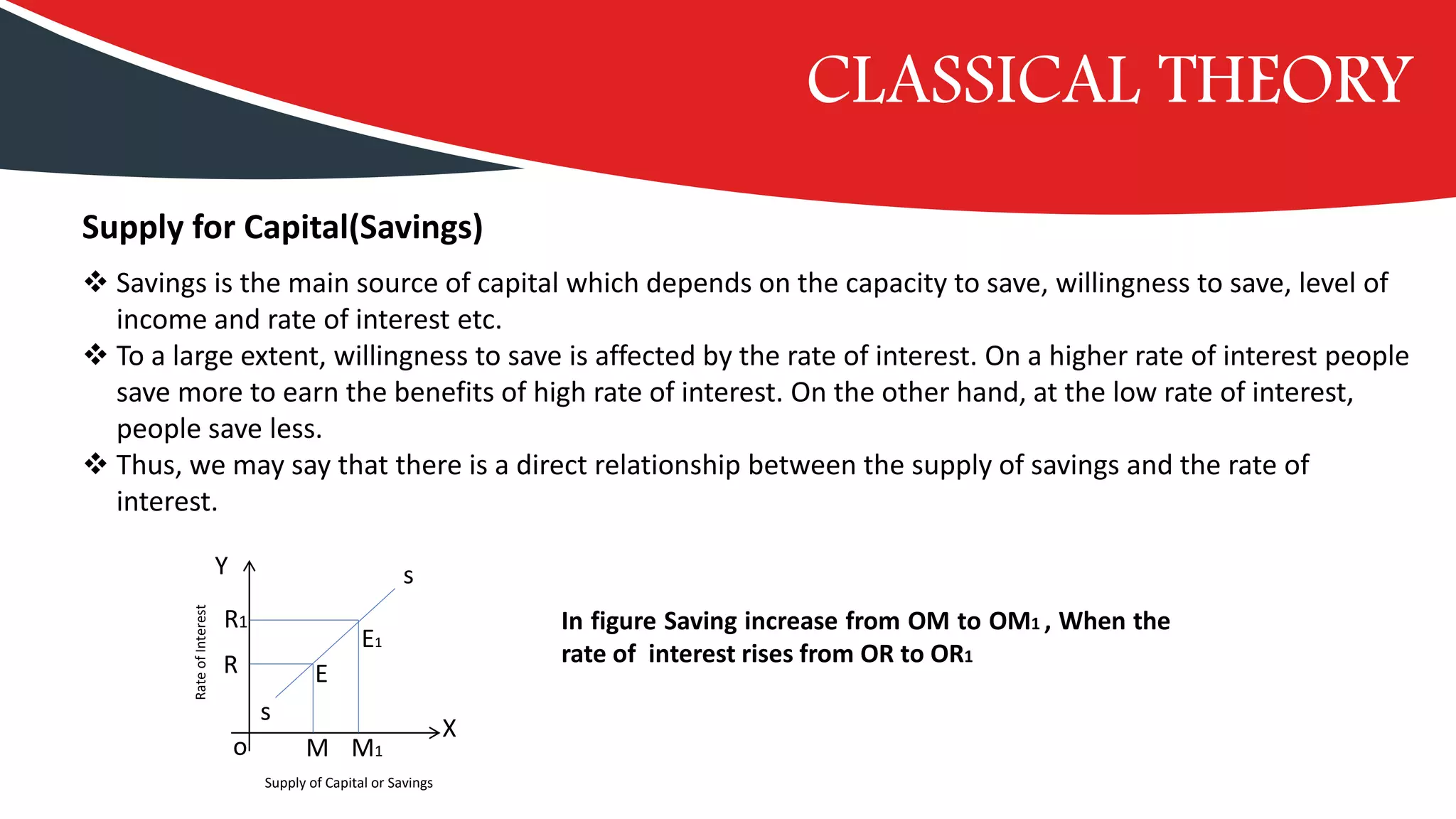

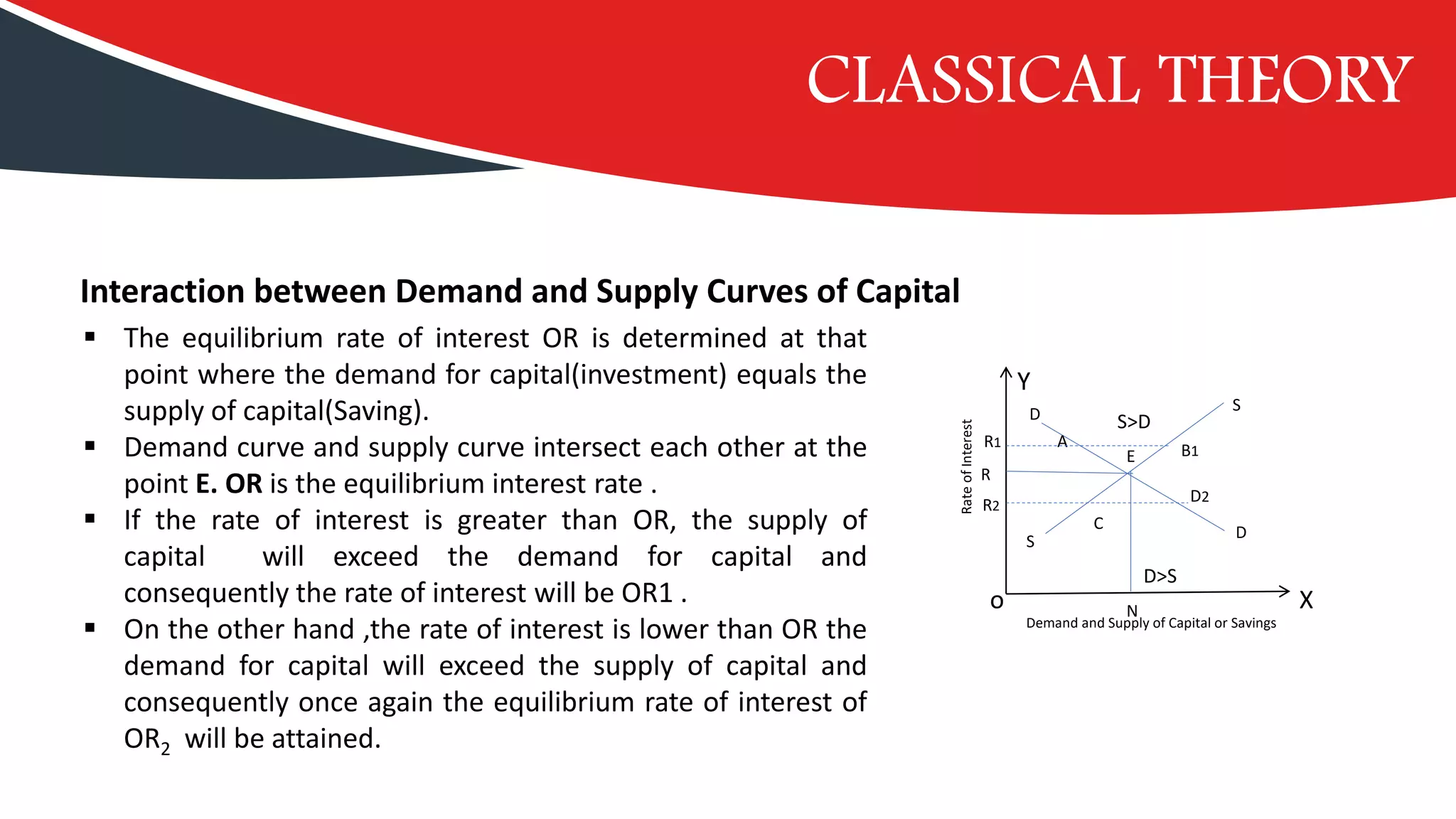

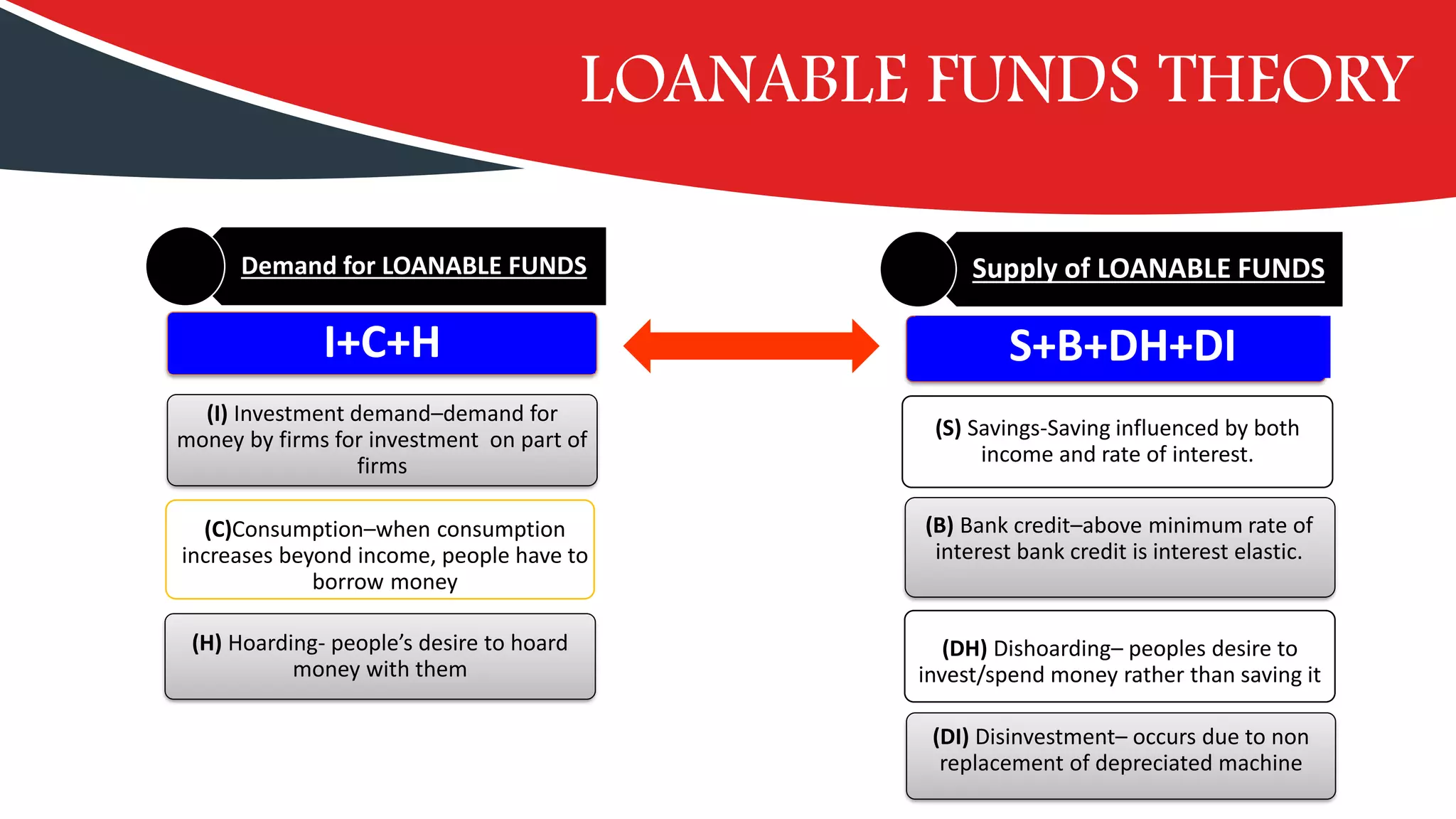

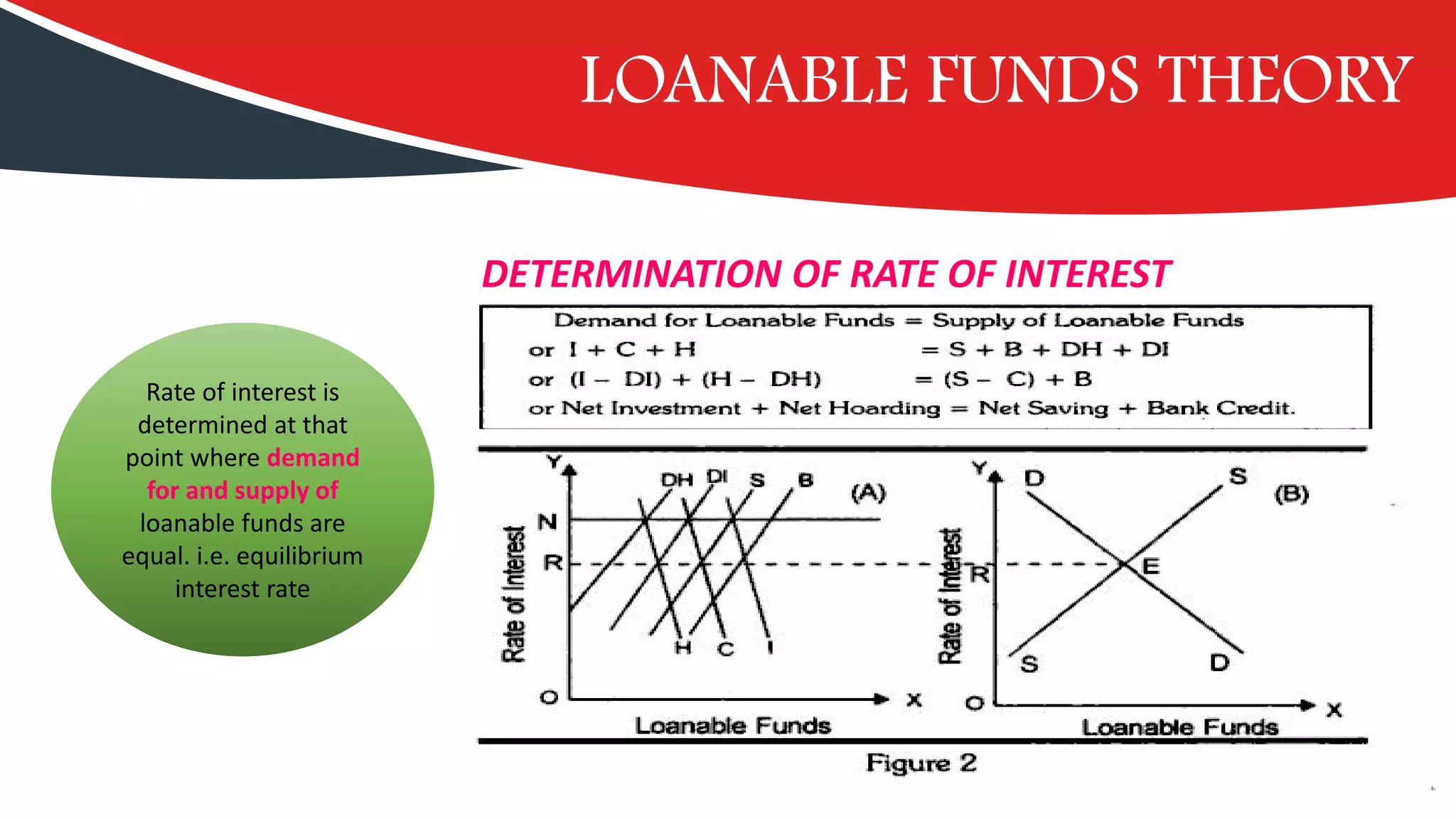

The document discusses the theory of interest rates, explaining both simple and compound interest, and the variations in interest rates due to various economic factors. It presents the classical theory and loanable funds theory, detailing how interest rates are determined through the interaction of demand and supply in capital and highlights the criticisms of these theories. Ultimately, it illustrates the complex relationships between savings, investments, and interest rates in the economy.